AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JULY 17, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

ISSUER TENDER OFFER STATEMENT

UNDER SECTION 13(e)(1) OF THE

SECURITIES EXCHANGE ACT OF 1934

NUVEEN PREFERRED AND INCOME TERM FUND

(Name of Subject Company)

NUVEEN PREFERRED AND INCOME TERM FUND

(Name of Filing Person (Issuer))

COMMON SHARES OF BENEFICIAL INTEREST, PAR VALUE $0.01 PER SHARE

(Title of Class of Securities)

67075A106

(CUSIP Number of

Class of Securities)

Mark L. Winget

Vice President and Secretary

Nuveen Investments

333

West Wacker Drive

Chicago, Illinois 60606

800-257-8787

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Person)

Copies to:

Deborah

Bielicke Eades

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer. |

| |

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

| |

☐ |

third-party tender offer subject to Rule 14d-1. |

| |

☒ |

issuer tender offer subject to Rule 13e-4. |

| |

☐ |

going-private transaction subject to Rule 13e-3. |

| |

☐ |

amendment to Schedule 13D under Rule 13d-2. |

| |

Check the following box if the filing is a final amendment reporting the results of the tender

offer: ☐ |

| |

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

|

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

EXPLANATORY NOTE

Copies of the Offer to Purchase, dated July 17, 2024, and the Letter of Transmittal, among other documents, have been filed by Nuveen Preferred and Income

Term Fund as exhibits to this Schedule TO, Tender Offer Statement (the “Schedule”), pursuant to Section 13(e)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Unless otherwise indicated, all

material incorporated herein by reference in response to items or sub-items of this Schedule is incorporated by reference from the corresponding caption in the Offer to Purchase, including the information

provided under those captions.

ITEM 1. SUMMARY TERM SHEET

Reference is hereby made to the Summary Term Sheet of the Offer to Purchase, which is attached as Exhibit (a)(1)(i) and is incorporated herein by

reference.

ITEM 2. SUBJECT COMPANY INFORMATION

(a) The name of the issuer is Nuveen Preferred and Income Term Fund, a diversified, closed-end management

investment company organized as a Massachusetts business trust (the “Fund”). The principal executive offices of the Fund are located at 333 West Wacker Drive, Chicago, Illinois 60606. The telephone number is

1-800-257-8787.

(b) The title

of the subject class of equity securities described in the offer is common shares of beneficial interest, par value $0.01 per share (the “Shares”). As of January 31, 2024 there were 22,772,419 Shares issued and outstanding.

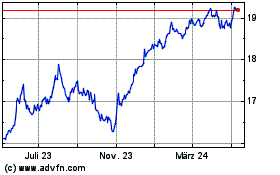

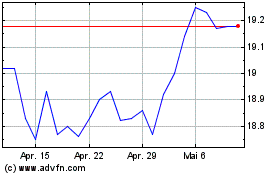

(c) The principal market in which the Shares are traded is the New York Stock Exchange (“NYSE”). For information on the high, low and closing (as

of the close of ordinary trading on the NYSE on the last day of the Fund’s fiscal quarter) net asset values and market prices of the Shares in such principal market for each quarter during the Fund’s past two fiscal years, see

Section 8, “Price Range of Shares,” of the Offer to Purchase, which is incorporated herein by reference.

ITEM 3. IDENTITY AND

BACKGROUND OF FILING PERSON

(a) The name of the filing person is Nuveen Preferred and Income Term Fund (previously defined as the “Fund”), a

diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”) and organized as a Massachusetts business trust. The principal

executive offices of the Fund are located at 333 West Wacker Drive, Chicago, Illinois 60606. The telephone number is

1-800-257-8787. The filing person is the subject company. The members of the Board of Trustees of the Fund are as follows: Thomas

J. Kenny, Amy B. R. Lancellotta, Joanne T. Medero, Albin F. Moschner, John K. Nelson, Loren M. Starr, Matthew Thornton III, Terence J. Toth, Margaret L. Wolff and Robert L. Young.

The principal executive officer of the Fund is David J. Lamb, Chief Administrative Officer. The principal financial officer of the Fund is E. Scott Wickerham,

Vice President and Funds Controller.

Correspondence to the Trustees and executive officers of the Fund should be mailed to the attention of William

Siffermann, Manager of Fund Board Relations, Nuveen, 333 West Wacker Drive, Chicago, Illinois 60606.

ITEM 4. TERMS OF THE TRANSACTION

(a) The Fund’s Board of Trustees has determined to commence an offer to purchase up to 19,265,404 shares of the Fund’s issued and

outstanding Shares. The offer is for cash at a price per share equal to the net asset value per share as of the close of ordinary trading on the NYSE on August 14, 2024, or if the offer is extended, as of the close of ordinary trading on the

NYSE on the new expiration date, upon the terms and subject to the conditions set forth in the enclosed Offer to Purchase and the related Letter of Transmittal (which together constitute the “Offer”).

Copies of the Offer to Purchase and the Letter of Transmittal are attached hereto as Exhibit (a)(1)(i) and Exhibit (a)(1)(ii), respectively, each of

which is incorporated herein by reference. For more information on the type and amount of consideration offered to shareholders, the scheduled expiration date, extending the Offer and the Fund’s intentions in the event of oversubscription, see

Section 1, “Price; Number of Shares,” and Section 15, “Extension of Tender Period; Termination; Amendments,” of the Offer to Purchase. For information on the dates relating to the withdrawal of tendered Shares, the

procedures for tendering Shares and withdrawing Shares tendered, and the manner in which Shares will be accepted for payment, see Section 2, “Procedures for Tendering Shares,” Section 3, “Withdrawal Rights,” and

Section 4, “Payment for Shares,” of the Offer to Purchase. For information on the federal income tax consequences of the Offer, see Section 2, “Procedures for Tendering Shares,” Section 10, “Certain Effects of

the Offer,” and Section 14, “Material Federal Income Tax Consequences,” of the Offer to Purchase.

The information requested by Items

1004(a)(1)(x) and (xi) and Item 1004(a)(2) of Regulation M-A are not applicable.

(b) None of the Trustees

of the Fund, the investment adviser or the investment sub-adviser own any Shares of the Fund. Therefore, the Fund does not intend to purchase Shares from any Trustee, investment adviser or investment sub-adviser of the Fund pursuant to the Offer. For more information, see Section 9 “Interest of Trustees and Executive Officers; Transactions and Arrangements Concerning the Shares,” of the Offer to

Purchase.

ITEM 5. PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS

(e) Reference is hereby made to Section 7, “Plans or Proposals of the Fund,” Section 9, “Interest of Trustees and Executive

Officers; Transactions and Arrangements Concerning the Shares,” Section 12, “Certain Information About the Fund,” and Section 16, “Fees and Expenses,” of the Offer to Purchase, which is incorporated herein by

reference. Except as set forth therein,

the Fund does not know of any agreement, arrangement or understanding, whether or not legally enforceable, between

the Fund (including any of the Fund’s executive officers or Trustees, any person controlling the Fund or any officer or director of any corporation or other person ultimately in control of the Fund) and any other person with respect to any

securities of the Fund. The foregoing includes, but is not limited to: the transfer or the voting of securities, joint ventures, loan or option arrangements, puts or calls, guarantees of loans, guarantees against loss, or the giving or withholding

of proxies, consents or authorizations.

ITEM 6. PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS

(a)–(c) Reference is hereby made to Section 1, “Price; Number of Shares,” Section 6, “Purpose of the Offer,”

Section 7, “Plans or Proposals of the Fund,” Section 10, “Certain Effects of the Offer,” Section 11, “Source and Amount of Funds,” and Section 12, “Certain Information About the Fund,” of

the Offer to Purchase, which is incorporated herein by reference. Except as noted herein and therein, the events listed in Item 1006(c)(1), (3)–(8) and (10) of Regulation M-A are not applicable

to the Fund (including any of the Fund’s executive officers or Trustees, any person controlling the Fund or any officer or director of any corporation or other person ultimately in control of the Fund).

ITEM 7. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

(a)–(b) Reference is hereby made to Section 11, “Source and Amount of Funds,” of the Offer to Purchase, which is incorporated herein by

reference.

The information requested by Item 1007(d) of Regulation M-A is not applicable to the Fund’s

executive officers and Trustees, any person controlling the Fund or any executive officer or director of a corporation or other person ultimately in control of the Fund.

ITEM 8. INTEREST IN SECURITIES OF THE SUBJECT COMPANY

(a)–(b) Reference is hereby made to Section 9, “Interest of Trustees and Executive Officers; Transactions and Arrangements Concerning the

Shares,” of the Offer to Purchase, which is incorporated herein by reference.

ITEM 9. PERSONS/ASSETS RETAINED, EMPLOYED, COMPENSATED OR

USED

(a) No persons have been employed, retained or are to be compensated by or on behalf of the Fund to make solicitations or recommendations in

connection with the Offer.

ITEM 10. FINANCIAL STATEMENTS

Not applicable.

ITEM 11. ADDITIONAL INFORMATION

(a)(1) Reference is hereby made to Section 9, “Interest of Trustees and Executive Officers; Transactions and Arrangements Concerning the

Shares,” of the Offer to Purchase, which is incorporated herein by reference.

(a)(2)-(5) Not applicable.

(c) Reference is hereby made to the Offer to Purchase, which is incorporated herein by reference.

ITEM 12(a). EXHIBITS

| (a)(1)(i) |

Letter to Shareholders from the Chairman of the Board of Trustees of the Fund and Offer to Purchase.

|

| (a)(1)(ii) |

Letter of Transmittal. |

| (a)(1)(iii) |

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(iv) |

Letter to Clients and Client Instruction Form. |

| (a)(1)(v) |

Notice of Guaranteed Delivery. |

| (a)(1)(vi) |

Not applicable. |

| (a)(2)-(4) |

Not applicable. |

| (a)(5)(i) |

Press Release dated July 17, 2024. |

| (d)(1) |

Investment Management Agreement with Nuveen Fund Advisors, LLC (fka Nuveen Fund Advisors, Inc.) dated

June 5, 2012.1 |

| (d)(2) |

Form of Investment Sub-Advisory Agreement by and between Nuveen Fund

Advisors, Inc. and Nuveen Asset Management, LLC.1 |

| (d)(3) |

Transfer Agency and Service Agreement with Computershare Inc. and Computershare Trust Company, N.A. dated

June 15, 2017, (the “Transfer Agency Agreement”).2 |

| (d)(4) |

Amended and Restated Master Custodian Agreement with State Street Bank and Trust Company dated July 15,

2015 (the “Custodian Agreement”).3 |

| (d)(5) |

Appendix A to the Custodian Agreement.3

|

| |

1 |

Previously filed as an exhibit to Pre-Effective Amendment No. 1 to

Nuveen Preferred and Income Term Fund’s Registration Statement on Form N-2/A (File No. 333-181125) via EDGAR on June 22, 2012 and incorporated herein by

reference. |

| |

2 |

Previously filed as an exhibit to Pre-Effective Amendment No. 3 to

Nuveen Variable Rate Preferred & Income Fund’s Registration Statement on Form N-2/A (File No. 333-256744) via EDGAR on December 14, 2021 and

incorporated herein by reference. |

| |

3 |

Previously filed as an exhibit to Pre-Effective Amendment No. 2 to

Nuveen Variable Rate Preferred & Income Fund’s Registration Statement on Form N-2/A (File No. 333-256744) via EDGAR on November 12, 2021 and

incorporated herein by reference. |

ITEM 12(B). FILING FEE EXHIBIT

Filing Fee Exhibit.

ITEM 13. INFORMATION REQUIRED BY SCHEDULE 13E-3

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

| NUVEEN PREFERRED AND INCOME TERM FUND |

|

| /s/ Mark L. Winget |

| Mark L. Winget |

| Vice President and Secretary |

July 17, 2024

Ex-(a)(1)(i)

Nuveen Preferred and Income Term Fund

333 West Wacker Drive

Chicago, Illinois 60606

Dear Shareholder:

Nuveen Preferred and Income Term Fund (the “Fund”) is a term fund that is scheduled to terminate on August 31, 2024. In January 2024, the

Board of Trustees of the Fund approved a series of actions to, among other things, eliminate the term structure of the Fund, so that the Fund may continue with no scheduled termination date. To allow shareholders who do not wish to continue their

investment in the Fund the opportunity to exit their investment at net asset value, the Board of Trustees authorized the Fund to conduct a tender offer for common shares of the Fund if shareholders of the Fund approve the amendment to the

Fund’s Declaration of Trust to eliminate the term structure of the Fund (the “Amendment”). At a special meeting of shareholders held on April 12, 2024, as adjourned to July 17, 2024, shareholders approved the Amendment.

The enclosed materials describe the terms of the tender offer and information you should consider in deciding whether to accept the Fund’s offer to

purchase your common shares (the “Offer”). The Offer provides shareholders the opportunity to tender up to 100% of their shares for cash at a price equal to the Fund’s net asset value per share as of the close of ordinary trading on

the New York Stock Exchange on the expiration date of the Offer. The Fund is making the Offer to allow shareholders who do not wish to continue their investment in the Fund after the Amendment takes effect to exit their investment at net asset

value, which is the same measure used to determine the value that shareholders would receive on the scheduled termination date. You may tender all, a portion or none of your shares.

The completion of the Offer is subject to certain conditions, including that the aggregate net assets of the Fund as of the expiration date of the Offer must

equal or exceed $70 million, taking into account the amounts that would be paid to shareholders who have properly tendered their shares. The Offer will expire on August 14, 2024, or such later date to which the Offer is extended.

If, after carefully evaluating all of the information set forth in the Offer to Purchase and the accompanying Letter of Transmittal, you wish to tender shares

pursuant to the Offer, please follow the instructions contained in the Offer to Purchase and Letter of Transmittal or, if your shares are held of record in the name of a broker, dealer, commercial bank, trust company or other nominee, contact that

firm to effect the tender for you. Shareholders are urged to consult their own investment and tax advisers and make their own decisions whether to tender any shares and, if so, how many shares to tender. Shareholders not interested in tendering

their shares need not take any action.

Questions, requests for assistance and requests for additional copies of this Offer to Purchase may be

directed to Georgeson LLC, the information agent for this Offer, by telephone toll-free at 866-679-9573.

|

| Sincerely,

Mark L. Winget Vice

President and Secretary |

July 17, 2024

NUVEEN PREFERRED AND INCOME TERM FUND

OFFER TO PURCHASE FOR CASH UP TO 19,265,404

ISSUED AND OUTSTANDING COMMON SHARES OF

BENEFICIAL INTEREST AT 100% OF NET ASSET VALUE PER SHARE

THE OFFER PERIOD AND WITHDRAWAL RIGHTS

WILL EXPIRE AT 5:00 P.M. NEW YORK CITY TIME

ON AUGUST 14, 2024, UNLESS THE OFFER IS EXTENDED.

To the holders of Common Shares

of NUVEEN PREFERRED AND INCOME TERM FUND:

Nuveen Preferred and Income Term Fund, a diversified, closed-end

management investment company organized as a Massachusetts business trust (the “Fund”), is offering to purchase up to 19,265,404 of its common shares of beneficial interest, with par value of $0.01 per share (“Shares”), for cash

at a price (the “Purchase Price”) equal to 100% of their net asset value per share (“NAV”) as of the close of ordinary trading on the New York Stock Exchange (the “NYSE”) on August 14, 2024, or if the offer is

extended, as of the close of ordinary trading on the NYSE on the new expiration date. The offer period and withdrawal rights will expire at 5:00 p.m. New York City time on August 14, 2024 (the “Initial Expiration Date”),

unless extended (the Initial Expiration Date or the latest date to which the Offer is extended, the “Expiration Date”), upon the terms and subject to the conditions set forth in this Offer to Purchase and the related Letter of Transmittal

(which together constitute the “Offer”). There will be no proration in the event that more than 19,265,404 Shares are properly tendered and not properly withdrawn in the Offer.

The Shares are currently traded on the NYSE under the ticker symbol “JPI.” The NAV on July 16, 2024 was $19.96 per Share. You can obtain

current NAV quotations from Georgeson LLC, the information agent for the Offer (“Information Agent”) at 866-679-9573. For information on Share price history,

see “The Offer—Section 8—Price Range of Shares.”

The completion of the Offer is subject to certain conditions, including:

(1) the aggregate net assets of the Fund as of the Expiration Date of the Offer must equal or exceed $70 million after taking into account the amounts that would be paid to shareholders who have properly tendered their Shares,

(2) Shares of the Fund must remain eligible for listing on the NYSE following consummation of the Offer, and (3) the Fund must remain subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, following

consummation of the Offer. If one or more of these conditions are not satisfied, the Offer will not be completed and the Fund will proceed to terminate on August 31, 2024, its scheduled termination date, unless the Fund’s Board of Trustees

extends the term in accordance with the charter documents of the Fund. See “The Offer—Section 5—Certain Conditions of the Offer.”

If, after carefully evaluating all of the information set forth in the Offer, you wish to tender Shares pursuant to the Offer, please either follow the

instructions contained in the Offer and Letter of Transmittal or, if your Shares are held of record in the name of a nominee holder, contact such firm to effect the tender for you. Shareholders not interested in tendering their Shares need not

take any action.

i

THIS OFFER IS BEING MADE TO ALL COMMON SHAREHOLDERS

OF THE FUND AND IS NOT CONDITIONED UPON ANY

MINIMUM NUMBER OF SHARES BEING TENDERED.

THIS OFFER IS SUBJECT TO CERTAIN CONDITIONS, INCLUDING

THE MINIMUM SIZE THRESHOLD.

SEE “THE OFFER—SECTION 5—CERTAIN CONDITIONS OF THE OFFER.”

IMPORTANT

Neither the Fund nor its

Board of Trustees makes any recommendation to any shareholder as to whether to tender any or all of such shareholder’s Shares. Shareholders are urged to carefully evaluate all information in the Offer, consult their own investment and tax

advisers, and make their own decisions whether to tender Shares and, if so, how many Shares to tender.

No person has been authorized to make any

recommendation on behalf of the Fund as to whether shareholders should tender Shares pursuant to the Offer. No person has been authorized to give any information or to make any representations in connection with the Offer other than those contained

herein or in the accompanying Letter of Transmittal. If given or made, such recommendation and such information and representations must not be relied upon as having been authorized by the Fund.

Questions and requests for assistance and requests for additional copies of this Offer to Purchase and Letter of Transmittal should be directed to the

Information Agent at the telephone number set forth below.

The Information Agent for the Offer is:

All Holders Call Toll Free:

866-679-9573

The Depositary for the Offer is:

|

|

|

| By Mail:

Computershare Trust Company, N.A.

c/o Voluntary Corporate Actions

P.O. Box 43011

Providence, RI 02940-3011 |

|

By Registered, Certified, Express Mail or Overnight

Courier:

Computershare Trust Company, N.A.

c/o Voluntary Corporate Actions

150 Royall Street, Suite V

Canton, MA 02021 |

July 17, 2024

ii

SUMMARY TERM SHEET

THE OFFER

|

|

|

|

|

|

|

| 1. |

|

Price; Number of Shares |

|

|

1 |

|

|

|

|

| 2. |

|

Procedures for Tendering Shares |

|

|

1 |

|

|

|

|

| 3. |

|

Withdrawal Rights |

|

|

5 |

|

|

|

|

| 4. |

|

Payment for Shares |

|

|

5 |

|

|

|

|

| 5. |

|

Certain Conditions of the Offer |

|

|

6 |

|

|

|

|

| 6. |

|

Purpose of the Offer |

|

|

7 |

|

|

|

|

| 7. |

|

Plans or Proposals of the Fund |

|

|

8 |

|

|

|

|

| 8. |

|

Price Range of Shares |

|

|

8 |

|

|

|

|

| 9. |

|

Interest of Trustees and Executive Officers; Transactions and Arrangements Concerning the Shares |

|

|

8 |

|

|

|

|

| 10. |

|

Certain Effects of the Offer |

|

|

9 |

|

|

|

|

| 11. |

|

Source and Amount of Funds |

|

|

10 |

|

|

|

|

| 12. |

|

Certain Information About the Fund |

|

|

10 |

|

|

|

|

| 13. |

|

Additional Information |

|

|

12 |

|

|

|

|

| 14. |

|

Material Federal Income Tax Consequences |

|

|

12 |

|

|

|

|

| 15. |

|

Extension of Tender Period; Termination; Amendments |

|

|

16 |

|

|

|

|

| 16. |

|

Fees and Expenses |

|

|

17 |

|

|

|

|

| 17. |

|

Miscellaneous |

|

|

17 |

|

NUVEEN PREFERRED AND INCOME TERM FUND

OFFER TO PURCHASE FOR CASH UP TO 19,265,404

COMMON SHARES OF BENEFICIAL INTEREST AT 100% OF NET ASSET VALUE

SUMMARY TERM SHEET

We are providing this Summary

Term Sheet for your convenience. This Summary Term Sheet highlights the material terms of the Offer but does not describe all of the details of the Offer to the same extent described elsewhere in this Offer to Purchase. We urge you to read the

entire Offer to Purchase, the related Letter of Transmittal and the documents incorporated herein by reference because they contain the full details about the Offer and the Fund. We have included references to sections of this Offer to Purchase

where you will find more information. Except where the context suggests otherwise, the terms “we”, “us”, “our” and the “Fund” refer to Nuveen Preferred and Income Term Fund, a Massachusetts business trust.

Who is offering to purchase my Shares?

Nuveen Preferred and Income Term Fund, a Massachusetts business trust, is offering to purchase up to 19,265,404 of its common shares of beneficial interest

(the “Shares”) on the terms and subject to the conditions described in this Offer to Purchase. We are a registered closed-end management investment company that invests primarily in a portfolio of

preferred securities and other income producing securities, including hybrid securities such as contingent capital securities, with a focus on securities issued by financial and insurance firms. We are a term fund that has a scheduled termination

date on August 31, 2024, subject to the ability of the Fund’s Board of Trustees to extend the term in accordance with the charter documents of the Fund.

What will be the form of payment and purchase price for Shares that are tendered?

We are offering to purchase Shares for cash. The purchase price will equal 100% of the net asset value per share (“NAV”) as of the close of ordinary

trading on the New York Stock Exchange (the “NYSE”) on August 14, 2024 (the “Initial Expiration Date”), unless extended (the Initial Expiration Date or the latest date to which the Offer is extended, the “Expiration

Date”). As of July 16, 2024, the Fund’s NAV was $19.96 per Share. Of course, the NAV can change every business day. You can obtain current NAV quotations from Georgeson LLC, the information agent for the Offer (“Information

Agent”), at 866-679-9573 or on our website at www.nuveen.com. See “The Offer—Section 1—Price; Number of Shares” and “The

Offer—Section 4—Payment for Shares.”

How many shares is the Fund offering to purchase?

Subject to the conditions of the tender offer, we are offering to purchase up to 19,265,404 Shares. There will be no proration if more than 19,265,404

Shares are properly tendered and not properly withdrawn in the Offer. If more than 19,265,404 Shares are properly tendered and not properly withdrawn, the Offer will terminate, subject to the Fund’s right to extend the Offer or to amend the

Offer to increase the maximum number of Shares it may purchase, provided that it would continue to comply with the Minimum Size Threshold condition described below. See “The Offer—Section 1—Price; Number of Shares,”

“The Offer—Section 5—Certain Conditions of the Offer.” and “The Offer—Section 15—Extension of Tender Period; Termination; Amendments.”

What are the conditions of the Offer?

The Fund

will not complete the Offer unless certain conditions are satisfied, including:

| • |

|

Our aggregate net assets must equal or exceed $70 million as of the Expiration Date of the Offer, taking

into account the amounts that would be paid to shareholders who have properly tendered their shares, |

| • |

|

Our common shares must remain eligible for listing on the NYSE following consummation of the Offer, and

|

| • |

|

We must remain subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), following completion of the Offer (collectively, the “Minimum Size Threshold”). |

In addition, the completion of the Offer is subject to the absence of certain adverse developments including but

not limited to the following: (1) the Offer must not be the subject of any material legal action or proceeding instituted or threatened challenging the Offer or otherwise materially adversely affecting the Fund; (2) the completion of the

Offer must not impair our ability to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”), and (3) there must not be any event or condition that would have a material adverse

effect (including any adverse tax effect) on the Fund or its shareholders if Shares were repurchased (collectively, with the Minimum Size Threshold, the “Offer Conditions”).

Subject to the Fund’s right to waive any of the Offer Conditions (other than the Minimum Size Threshold), if one or more of the Offer Conditions are not

satisfied, the Offer will not be completed and the Fund will proceed to terminate on August 31, 2024, its scheduled termination date, unless the Fund’s Board of Trustees extends the term in accordance with the charter documents of the

Fund. See “The Offer—Section 5—Certain Conditions of the Offer.”

What is the purpose of the Offer?

In light of the upcoming scheduled termination date of the Fund, Nuveen Fund Advisors, LLC (the “Adviser” or “Nuveen Fund Advisors”)

recommended, and the Board of Trustees of the Fund approved, a series of actions to eliminate the term structure of the Fund, so that the Fund could continue as a perpetual fund with no scheduled termination date, while allowing shareholders who do

not wish to continue their investment in the Fund after the term structure is eliminated the opportunity to exit their investment at NAV through a tender offer, which is what shareholders would receive on the scheduled termination of the Fund in

accordance with its current term structure. Specifically, the actions approved by the Board include (1) amending the Fund’s Declaration of Trust to eliminate the term structure of the Fund (the “Amendment”); (2) approving an

agreement with Nuveen Fund Advisors to waive management fees or reimburse expenses in an amount equal to 50% of the Fund’s management fee for the first year following the effectiveness of the Amendment (the “Fee Waiver”); and

(3) authorizing the Offer in order to provide an opportunity for those shareholders who do not wish to continue their investment as a shareholder of the Fund after the term structure is eliminated to exit their investment at NAV. In addition,

if the Amendment takes effect, the Fund will change its name to “Nuveen Preferred Securities & Income Opportunities Fund.”

Shareholders considered and approved the Amendment at a special meeting of shareholders held on April 12, 2024, as adjourned to July 17, 2024. The

Fund is making this Offer in order to allow common shareholders who do not wish to continue their investment in the Fund to exit their investment at NAV, which is the same measure used to determine the value that shareholders would receive if the

Fund terminated on its scheduled termination date. If the Offer is completed, the Amendment and Fee Waiver will take effect as soon as practicable following the completion of the Offer, but no later than August 31, 2024. If the Offer is not

completed, the Amendment and Fee Waiver will not take effect and the Fund will terminate on its scheduled termination date, unless the Fund’s Board of Trustees extends the term in accordance with the charter documents of the Fund. See “The

Offer—Section 6—Purpose of the Offer.”

When does the offer expire? Can the Fund extend the offer, and if so, when will the Fund

announce the extension?

The offer expires on Wednesday, August 14, 2024, at 5:00 p.m., New York City time, unless the Fund extends the

offer. The Fund may extend the offer period at any time. If it does, the Fund will determine the purchase price as of the close of ordinary trading on the NYSE on the new Expiration Date. If the offer period is extended, the Fund will make a public

announcement of the extension not later than 9:30 a.m. New York City time on the next business day following the previously scheduled Expiration Date. See “The Offer—Section 15—Expiration of the Offer; Termination;

Amendments.”

How will the Fund pay for Shares that are properly tendered?

As of July 16, 2024, the Fund had net assets of $454,537,483.24. One of the conditions of the Offer is that the net assets of the Fund, taking into

account the Fund’s purchase of shares properly tendered and not properly withdrawn, must equal or exceed $70 million as of the Expiration Date of the Offer. The Fund intends to fund the purchase price for tendered shares primarily through

cash on hand and sales of portfolio securities. See “The Offer—Section 11—Source and Amount of Funds.”

-ii-

What will be the effects of the Offer?

If we complete the Offer, the Fund’s shares will continue to trade on the NYSE under the ticker symbol “JPI.” However, the purchase of Shares

pursuant to the Offer will have the following effects:

| • |

|

The purchase of Shares pursuant to the Offer will have the effect of decreasing our managed assets, and such

decrease may be significant. Lower managed assets will result in higher annual operating expenses and may limit our investment flexibility and our ability to engage in leverage. Our performance may be adversely affected by these developments.

|

| • |

|

The Fund expects to liquidate its portfolio to the extent necessary to pay for the Shares acquired in the Offer

from tendering shareholders. Such portfolio dispositions may occur at time(s) when market conditions are unfavorable. The Fund will bear the transaction costs associated with such portfolio sales. To the extent that portfolio investments of the Fund

are sold, the Fund may recognize income or gains that will increase the amount of taxable distributions made to shareholders. If the Offer is not completed, the Fund would expect to bear similar risks and costs in connection with the liquidation of

its portfolio prior to its scheduled termination date. |

| • |

|

Purchases of Shares pursuant to the Offer will increase the proportionate interest of shareholders that do not

tender their Shares. |

| • |

|

The purchase of Shares pursuant to the Offer will decrease our outstanding shares, which may impact the trading

discount of our shares. |

We will not purchase Shares pursuant to the Offer if it would result in the delisting of our Shares from the

NYSE or the deregistration of our Shares under the Exchange Act.

See “The Offer—Section 10—Certain Effects of the Offer.”

Will I have to pay any fees or commissions on the Shares I tender?

Shares will be purchased at 100% of the Fund’s NAV. If you are the holder of record of the Shares and you tender your Shares directly, you will not incur

any brokerage fees or commissions or other charges. If you hold your Shares through a broker, dealer, commercial bank, trust company or other nominee and that firm tenders Shares on your behalf, that firm may charge a fee for doing so. We urge you

to consult your broker, dealer, commercial bank, trust company or other nominee to determine whether any such charges will apply. See “The Offer—Section 16—Fees and Expenses.”

How do I tender my Shares?

If your Shares are

registered in the name of a nominee holder, such as a broker, dealer, commercial bank, trust company or other nominee (“Nominee Holder”), you should contact that firm if you wish to tender your Shares.

All other shareholders wishing to participate in the offer must, prior to the date and time the offer expires, EITHER:

| |

• |

|

Complete and execute a Letter of Transmittal, together with any required signature guarantees, and any other

documents required by the Letter of Transmittal. You must send these materials to Computershare Trust Company, N.A. (the “Depositary”) at its address set forth on the inside cover page of this Offer to Purchase. If you hold certificates

for Shares, you must send the certificates to the Depositary at its address set forth on the inside cover page of this Offer to Purchase. If your Shares are held in book-entry form, you must comply with the book-entry delivery procedure set forth

under “The Offer—Section 2—Procedures for Tendering Shares—C. Book-Entry Delivery Procedure.” In all these cases, the Depositary must receive these materials prior to the date and time the offer expires.

|

OR

-iii-

| |

• |

|

Comply with the Guaranteed Delivery Procedure described under “The Offer—Section 2—Procedures

for Tendering Shares—D. Guaranteed Delivery Procedure.” |

The Fund’s transfer agent holds Shares in uncertificated form

for certain shareholders pursuant to the Fund’s dividend reinvestment plan. When a shareholder tenders share certificates, the Depositary will accept any of the shareholder’s uncertificated Shares for tender first and accept the balance of

tendered Shares from the shareholder’s certificated Shares.

See “The Offer—Section 2—Procedures for Tendering Shares.”

Until what time can I withdraw tendered Shares?

You may withdraw your tendered Shares at any time prior to the date and time the Offer expires. You may not withdraw your shares after 5:00 p.m.

New York City time, on August 14, 2024, unless the expiration date is extended. See “The Offer—Section 3—Withdrawal Rights.”

How do I withdraw tendered Shares?

If you desire

to withdraw tendered Shares, you should either:

| |

• |

|

Give proper written notice to the Depositary; or |

| |

• |

|

If your Shares are held of record in the name of a Nominee Holder, contact that firm to withdraw your tendered

Shares. |

See “The Offer—Section 3—Withdrawal Rights.”

Will there be any federal income tax consequences to tendering my Shares?

Yes. If your tendered Shares are purchased, it will be a taxable transaction either as an “exchange” of the tendered Shares or, under certain

circumstances, a “dividend.” See “The Offer—Section 2—Procedures for Tendering Shares—F. Federal Income Tax Withholding” with respect to the application of federal income tax withholding on payments made

to shareholders. Please consult your tax adviser as to the tax consequences of tendering your Shares in this Offer. See “The Offer—Section 14—Material Federal Income Tax Consequences.”

Will I receive the August 2024 dividend distribution, payable in September 2024, on the Shares I tender?

Unless the Expiration Date for the Offer is extended, you will not receive the August 2024 dividend distribution on tendered Shares.

Shareholders tendering Shares are entitled to receive all dividends with an “ex date” on or before the Expiration Date, if they own Shares as of the dividend record date. Shareholders will not receive the August 2024 dividend distribution

on tendered Shares unless the Expiration Date is extended because the record date for the August 2024 dividend distribution will be August 20, 2024, and the “ex date” will be August 20, 2024. See “The

Offer—Section 1—Price; Number of Shares” and “The Offer—Section 8—Price Range of Shares.”

Does the

Board of Trustees have a view with respect to whether shareholders should participate in the Offer?

Neither the Fund nor the Board of Trustees

makes any recommendation to shareholders as to whether to tender their Shares. Our intention is to complete this Offer and eliminate the term structure. The Adviser recommended the elimination of the term structure because it believes that preferred

securities and other income producing securities remains an attractive asset class. The Fund’s Board of Trustees has (1) determined that the elimination of the Fund’s term structure via the Amendment is in the best interest of the

Fund; (2) approved the Amendment; (3) recommended that shareholders approve the Amendment; and (4) approved making this Offer in order to provide shareholders who do not wish to remain in the Fund following the effectiveness of the

Amendment the option to exit at NAV, which is the same measure used to determine what shareholders would receive if the Fund terminates on its scheduled termination date. You, however, must make your own decision as to whether to tender your Shares

and, if so, how many Shares to tender. In making this decision, you should carefully read the information in this Offer to Purchase and in the Letter of Transmittal. You should discuss whether to tender your Shares with your broker or financial

advisor.

-iv-

Whom do I contact if I have questions about the tender offer?

For additional information or assistance, you may call the Information Agent toll-free at

866-679-9573.

-v-

THE OFFER

| 1. |

PRICE; NUMBER OF SHARES |

Upon the terms and subject to the conditions of the Offer, the Fund will accept for payment (and thereby purchase) up to 19,265,404 of its issued and

outstanding Shares, or such lesser number as are properly tendered (and not withdrawn in accordance with Section 3, “Withdrawal Rights”), subject to the satisfaction of the Offer Conditions. The purchase price of the Shares will be

equal to 100% of the Fund’s NAV as of the close of ordinary trading on the NYSE on the Expiration Date. There will be no proration if more than 19,265,404 Shares are properly tendered and not properly withdrawn in the

Offer. You can obtain current NAV quotations from the Information Agent by calling (866) 679-9573 or by visiting our website at www.nuveen.com.

The

completion of the Offer is subject to certain conditions. Subject to the Fund’s right to waive any of the Offer Conditions (other than the Minimum Size Threshold), if one or more of these conditions are not satisfied, the Offer will not be

completed and the Fund will proceed to terminate on August 31, 2024, its scheduled termination date, unless the Fund’s Board of Trustees extends the term in accordance with the charter documents of the Fund. See “The

Offer—Section 5—Certain Conditions of the Offer.”

The Fund reserves the right, in its sole discretion, at any time or from time to

time, to extend the period of time during which the Offer is open by giving notice of such extension to the Depositary and making a public announcement thereof. The Fund makes no assurance that it will extend the Offer. See “The

Offer—Section 15—Extension of Tender Period; Termination; Amendments.”

Shareholders tendering Shares are entitled to receive all

dividends with an “ex date” on or before the Expiration Date, if they own Shares as of the record date. The record date for the August 2024 dividend distribution will be August 20, 2024, and the “ex date” will be August 20, 2024.

Accordingly, it is anticipated that shareholders who tender Shares will not receive the August 2024 dividend distribution on tendered Shares unless the Expiration Date is extended past the ex date for the August 2024 dividend.

| 2. |

PROCEDURES FOR TENDERING SHARES |

| A. |

Proper Tender of Shares |

Holders of Shares that are registered in the name of a Nominee Holder, such as a broker, dealer, commercial bank, trust company or other nominee, should

contact such firm if they desire to tender their Shares.

For Shares to be properly tendered pursuant to the Offer, the following must occur prior to

5:00 p.m. New York City time on the Expiration Date:

| (i) |

A properly completed and duly executed Letter of Transmittal, together with any required signature guarantees,

or an Agent’s Message in the case of a book-entry transfer, as described below under “C. Book-Entry Delivery Procedure”, and any other documents required by the Letter of Transmittal must be received by the Depositary at its address

set forth on the inside cover page of this Offer to Purchase; and |

| (ii) |

Either the certificates for the Shares must be received by the Depositary at its address set forth on the

inside cover page of this Offer to Purchase, or the tendering shareholder must comply with the book-entry delivery procedure described below under “C. Book-Entry Delivery Procedure”; or |

| (iii) |

Shareholders must comply with the Guaranteed Delivery Procedure described below under “D. Guaranteed

Delivery Procedure.” |

If the Letter of Transmittal or any certificates or stock powers are signed by trustees, executors,

administrators, guardians, agents, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity, such persons should so

indicate when signing and must submit proper evidence satisfactory to the Fund of their authority to so act.

1

Letters of Transmittal and certificates representing Shares should be sent to the Depositary; they should not be

sent or delivered to the Fund.

The Fund’s transfer agent holds Shares in uncertificated form for certain shareholders pursuant to the Fund’s

dividend reinvestment plan. When a shareholder tenders certificated Shares, the Depositary will accept any of the shareholder’s uncertificated Shares for tender first and accept the balance of tendered Shares from the shareholder’s

certificated Shares, and any remaining Shares will be issued in book-entry and will be electronically held in your account in lieu of a certificate.

Section 14(e) of the Exchange Act and Rule 14e-4 promulgated thereunder make it unlawful for any person, acting

alone or in concert with others, to tender shares in a partial tender offer for such person’s own account unless at the time of tender, and at the time the shares are accepted for payment, the person tendering has a net long position equal to

or greater than the amount tendered in (i) shares, and will deliver or cause to be delivered such shares for the purpose of tender to the person making the offer within the period specified in the offer, or (ii) an equivalent security and,

upon acceptance of his or her tender, will acquire shares by conversion, exchange, or exercise of such equivalent security to the extent required by the terms of the offer, and will deliver or cause to be delivered the shares so acquired for the

purpose of tender to the person conducting the tender offer prior to or on the expiration date. Section 14(e) and Rule 14e-4 provide a similar restriction applicable to the tender or guarantee of a

tender on behalf of another person.

The acceptance of Shares by the Fund for payment will constitute a binding agreement between the tendering

shareholder and the Fund upon the terms and subject to the conditions of the Offer, including the tendering shareholder’s representation that (i) such shareholder has a net long position in the Shares being tendered within the meaning of

Rule 14e-4 promulgated under the Exchange Act and (ii) the tender of such Shares complies with Rule 14e-4.

By submitting the Letter of Transmittal (or an Agent’s Message as described in “C. Book-Entry Deliver Procedure” below), a tendering

shareholder shall, subject to and effective upon acceptance for payment of the Shares tendered, be deemed in consideration of such acceptance to sell, assign and transfer to, or upon the order of, the Fund all right, title and interest in and to all

the Shares that are being tendered (and any and all dividends, distributions, other Shares or other securities or rights declared or issuable in respect of such Shares after the Expiration Date) and irrevocably constitute and appoint the Fund the

true and lawful agent and attorney-in-fact of the tendering shareholder with respect to such Shares (and any such dividends, distributions, other Shares or securities or

rights), with full power of substitution (such power of attorney being deemed to be an irrevocable power coupled with an interest) to (a) deliver certificates, as applicable, for such Shares (and any such other dividends, distributions,

other Shares or securities or rights) or transfer ownership of such Shares (and any such other dividends, distributions, other Shares or securities or rights), together, in either such case, with all accompanying evidences of transfer and

authenticity to or upon the order of the Fund, upon receipt by the Depositary of the purchase price, (b) present such Shares (and any such other dividends, distributions, other Shares or securities or rights) for transfer on the books of the

Fund, and (c) receive all benefits and otherwise exercise all rights of beneficial ownership of such Shares (and any such other dividends, distributions, other Shares or securities or rights), all in accordance with the terms of the Offer. Upon

such acceptance for payment, all prior powers of attorney given by the tendering shareholder with respect to such Shares (and any such dividends, distributions, other shares or securities or rights) will, without further action, be revoked and no

subsequent powers of attorney may be given by the tendering shareholder with respect to the tendered Shares (and, if given, will be null and void).

By

submitting a Letter of Transmittal (or an Agent’s Message as described in “C. Book-Entry Deliver Procedure” below), and in accordance with the terms and conditions of the Offer, a tendering shareholder shall be deemed to represent and

warrant that: (a) the tendering shareholder has full power and authority to tender, sell, assign and transfer the tendered Shares (and any and all dividends, distributions, other Shares or other securities or rights declared or issuable in

respect of such Shares after the Expiration Date); (b) when and to the extent the Fund accepts the Shares for purchase, the Fund will acquire good, marketable and unencumbered title thereto, free and clear of all liens, restrictions, charges,

proxies, encumbrances or other obligations relating to their sale or transfer, and not subject to any adverse claim; (c) on request, the tendering shareholder will execute and deliver any additional documents deemed by the Depositary or the

Fund to be necessary or desirable to complete the sale, assignment and transfer of the tendered Shares (and any and all dividends, distributions, other Shares or securities or rights declared

2

or issuable in respect of such Shares after the Expiration Date); and (d) the tendering shareholder has read and agreed to all of the terms of the Offer, including this Offer to Purchase and

the Letter of Transmittal.

| B. |

Signature Guarantees and Method of Delivery |

Signatures on the Letter of Transmittal are required to be guaranteed if the tendered stock certificates are registered in a name other than that of the

tendering shareholder or if a check for cash is to be issued in a name other than that of the registered owner of such Shares. In those instances, all signatures on the Letter of Transmittal must be guaranteed by an eligible guarantor acceptable to

the Depositary (an “Eligible Guarantor”). An eligible guarantor includes a bank, broker, dealer, credit union, savings association or other entity that is a member in good standing of the Securities Transfer Agents Medallion Program

(“STAMP”), or a bank, broker, dealer, credit union, savings association or other entity that is an “Eligible Guarantor Institution” as such term is defined in Rule 17Ad-15 under the

Exchange Act. If Shares are tendered for the account of an institution that qualifies as an Eligible Guarantor, signatures on the Letter of Transmittal are not required to be guaranteed. If the Letter of Transmittal is signed by a person or persons

authorized to sign on behalf of the registered owner(s), then the Letter of Transmittal must be accompanied by documents evidencing such authority to sign to the satisfaction of the Fund.

THE METHOD OF DELIVERY OF ANY DOCUMENTS, INCLUDING CERTIFICATES FOR SHARES, IS AT THE ELECTION AND RISK OF THE PARTY TENDERING SHARES. IF DOCUMENTS ARE

SENT BY MAIL, IT IS RECOMMENDED THAT THEY BE SENT BY REGISTERED MAIL, PROPERLY INSURED, WITH RETURN RECEIPT REQUESTED.

| C. |

Book-Entry Delivery Procedure |

The Depositary will establish accounts with respect to the Shares at The Depository Trust Company (“DTC”) for purposes of the Offer by July 22,

2024. Any financial institution that is a participant in any of DTC’s systems may make delivery of tendered Shares by (i) causing DTC to transfer such Shares into the Depositary’s account in accordance with DTC’s procedure for

such transfer; and (ii) causing a confirmation of receipt of such delivery to be received by the Depositary. DTC may charge the account of such financial institution for tendering Shares on behalf of shareholders. Notwithstanding that delivery

of Shares may be properly effected in accordance with this book-entry delivery procedure, the Letter of Transmittal, with signature guarantee, if required, or, in lieu of the Letter of Transmittal, an Agent’s Message (as defined below) in

connection with a book-entry transfer, must be transmitted to and received by the Depositary at the appropriate address set forth on the inside cover page of this Offer to Purchase before 5:00 p.m. New York City time on the Expiration

Date.

The term “Agent’s Message” means a message from DTC transmitted to, and received by, the Depositary forming a part of a timely

confirmation of a book-entry transfer (a “Book-Entry Confirmation”), which states that DTC has received an express acknowledgment from the DTC participant (“DTC Participant”) tendering the Shares that are the subject of the

Book-Entry Confirmation that (i) the DTC Participant has received and agrees to be bound by the terms of the Letter of Transmittal; and (ii) the Fund may enforce such agreement against the DTC Participant.

DELIVERY OF DOCUMENTS TO DTC IN ACCORDANCE WITH DTC’S PROCEDURES DOES NOT CONSTITUTE DELIVERY TO THE DEPOSITARY FOR PURPOSES OF THIS OFFER.

| D. |

Guaranteed Delivery Procedure |

Any shareholder who desires to tender Shares but cannot comply with the procedures set forth herein for a tender on a timely basis or whose Shares are not

immediately available may properly tender Shares if the following three conditions are met:

| (i) |

You make such tenders by or through an Eligible Guarantor; |

| (ii) |

The Depositary receives, prior to 5:00 p.m. New York City time on the Expiration Date, a properly completed and

duly executed Notice of Guaranteed Delivery substantially in the form provided by the Fund (delivered by mail, or email transmission); and |

3

| (iii) |

The certificates for all tendered Shares, or a Book-Entry Confirmation, together with a properly completed and

duly executed Letter of Transmittal (or, in the case of a book-entry transfer, an Agent’s Message in lieu of the Letter of Transmittal), and any other documents required by the Letter of Transmittal, are received by the Depositary within one

NYSE trading day after the execution date of the Notice of Guaranteed Delivery. |

| E. |

Determination of Validity |

All questions as to the validity, form, eligibility (including time of receipt) and acceptance of tenders will be determined by the Fund, in its sole

discretion, whose determination shall be final and binding. The Fund reserves the absolute right to reject any or all tenders determined by it not to be in appropriate form or good order, or the acceptance of or payment for which may, in the opinion

of the Fund’s counsel, be unlawful. The Fund also reserves the absolute right to waive any of the conditions of the Offer, other than the Minimum Size Threshold, or any defect in any tender with respect to any particular Shares or any

particular shareholder, and the Fund’s interpretations of the terms and conditions of the Offer will be final and binding. Unless waived, any defects or irregularities in connection with tenders must be cured within such times as the Fund shall

determine. Tendered Shares will not be accepted for payment unless any defects or irregularities have been cured or waived within such time. Neither the Fund, the Depositary nor any other person shall be obligated to give notice of any defects or

irregularities in tenders, nor shall any of them incur any liability for failure to give such notice.

| F. |

Federal Income Tax Withholding |

Backup Withholding. To prevent backup federal income tax withholding equal to 24% of the gross payments made pursuant to the Offer, each shareholder

must notify the Depositary of such shareholder’s correct taxpayer identification number (or certify that such taxpayer is awaiting a taxpayer identification number) and provide certain other information by completing the Internal Revenue

Service (“IRS”) Form W-9, which is included with the Letter of Transmittal. Gross proceeds paid to a shareholder may also be subject to backup withholding if the IRS notifies the Fund or

Depositary that the shareholder is subject to backup withholding. Non-U.S. Shareholders (as that term is defined in the next paragraph) who have not previously submitted an IRS Form W-8 (W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, or W-8IMY) to the Fund must do so to avoid backup withholding. Such form (and additional IRS forms) may be obtained from the Depository or from the IRS at www.irs.gov.

Additionally, an IRS Form W-8 is generally valid from the date signed until the last day of the third succeeding calendar year. If you submitted an IRS

Form W-8 prior to this three-year period, or any information on the IRS Form W-8 that you submitted has changed, you generally must submit a new IRS Form W-8 to avoid backup withholding.

U.S. Withholding at the Source. Because the Fund cannot determine

whether a payment made pursuant to the Offer should be characterized as an “exchange” or a “dividend” for federal income tax purposes at the time of the payment, any payment to a tendering shareholder who is a beneficial owner of

the Shares and is a nonresident alien individual, a foreign trust or estate or a foreign corporation, as such terms are defined in the Code (a “Non-U.S. Shareholder”), that does not hold its Shares

in connection with a trade or business conducted in the United States (a “U.S. trade or business”) generally will be treated by the Fund as a dividend for federal income tax purposes and generally will be subject to federal income

withholding tax at the rate of 30%. This 30% U.S. withholding tax will apply even if a Non-U.S. Shareholder has provided the required certification to avoid backup withholding (unless a reduced rate under an

applicable tax treaty or exemption applies). A tendering Non-U.S. Shareholder who is not engaged in a U.S. trade or business and who realizes a capital gain on a tender of Shares will not be subject to federal

income tax on such gain, unless the Shareholder is an individual who is physically present in the United States for 183 days or more during the taxable year and certain other conditions are satisfied. A tendering

Non-U.S. Shareholder who realizes a capital gain may be eligible to claim a refund of the withheld federal income tax by filing a U.S. federal income tax return if the shareholder can demonstrate that the

proceeds were not dividends. Special rules may also apply in the case of Non-U.S. Shareholders that are: (i) former citizens or residents of the United States; or (ii) subject to special rules such

as “controlled foreign corporations.” Non-U.S. Shareholders are advised to consult their own tax advisers.

Foreign Account Tax Compliance Act (“FATCA”) Withholding. Because the Fund cannot determine whether a payment made pursuant to the Offer

should be characterized as an “exchange” or a “dividend” for federal income tax purposes at the time of the payment, the Fund will withhold a 30% tax on any payment to a tendering

4

shareholder that is a foreign financial institution or non-financial foreign entity that fails to comply (or be deemed compliant) with extensive reporting

and withholding requirements under FATCA designed to inform the U.S. Department of the Treasury of U.S.-owned foreign investment accounts. The Fund may disclose the information that it receives from its shareholders to the IRS, non-U.S. taxing authorities or other parties as necessary to comply with FATCA or similar laws. Withholding also may be required if a foreign entity that is a shareholder of the Fund fails to provide the Fund with

appropriate certifications or other documentation concerning its status under FATCA.

Additional Information. For an additional discussion of

federal income tax withholding as well as a discussion of certain other federal income tax consequences to tendering shareholders, see “The Offer—Section 14—Material Federal Income Tax Consequences.”

Except as otherwise provided in this Section 3, tenders of Shares made pursuant to the Offer will be irrevocable. If you desire to withdraw Shares

tendered on your behalf by a Nominee Holder, you may withdraw by contacting that firm and instructing them to withdraw such Shares. You have the right to withdraw tendered Shares at any time prior to 5:00 p.m. New York City time on the

Expiration Date. Upon terms and subject to the conditions of the Offer, the Fund expects to accept for payment properly tendered Shares promptly after the Expiration Date. You may not withdraw your shares after 5:00 p.m. New York City

time, on August 14, 2024, unless the Expiration Date is extended.

To be effective, a written notice of withdrawal must be timely received by the

Depositary at the address set forth on the inside cover page of this Offer to Purchase. Any notice of withdrawal must specify the name of the person who deposited the Shares to be withdrawn, the number of Shares to be withdrawn, and the names in

which the Shares to be withdrawn are registered. Shareholders should contact the Information Agent for instructions if they wish to submit a notice of withdrawal.

If certificates have been delivered to the Depositary, the name of the registered holder and the serial numbers of the particular certificates evidencing the

Shares withdrawn must also be furnished to the Depositary and the signature on the notice of withdrawal must be guaranteed by an Eligible Guarantor.

If

Shares have been delivered pursuant to the book-entry delivery procedure (set forth in “The Offer—Section 2—Procedures for Tendering Shares”), any notice of withdrawal must specify the name and number of the account at the

book-entry transfer facility to be credited with the withdrawn Shares (which must be the same name, number, and book-entry transfer facility from which the Shares were tendered), and must comply with the procedures of DTC.

All questions as to the form and validity (including time of receipt) of notices of withdrawal will be determined by the Depositary, in its sole discretion,

whose determination shall be final and binding. Neither the Fund, the Depositary nor any other person is or will be obligated to give any notice of any defects or irregularities in any notice of withdrawal, and none of them will incur any liability

for failure to give any such notice. Shares properly withdrawn shall not thereafter be deemed to be tendered for purposes of the Offer. However, withdrawn Shares may be retendered by following the procedures described in “The

Offer—Section 2—Procedures for Tendering Shares,” prior to 5:00 p.m. New York City time on the Expiration Date.

For purposes of the Offer, the Fund will be deemed to have accepted for payment (and thereby purchased) Shares that are properly tendered and not properly

withdrawn when, as and if, it gives oral or written notice to the Depositary of its acceptance of such Shares for payment pursuant to the Offer. Upon the terms and subject to the conditions of the Offer, the Fund will, promptly after the Expiration

Date, accept for payment (and thereby purchase) Shares properly tendered prior to 5:00 p.m. New York City time on the Expiration Date.

Payment for Shares accepted for payment pursuant to the Offer will be made by the Depositary out of funds made available to it by the Fund. The Depositary

will act as agent for the Fund for the purpose of effecting payment to the tendering shareholders. In all cases, payment for Shares tendered and accepted for payment pursuant to the Offer will be made only after timely receipt by the Depositary of

(i) Share certificates evidencing such Shares or a Book-

5

Entry Confirmation of the delivery of such Shares, (ii) a properly completed and duly executed Letter of Transmittal or, in the case of a book-entry transfer, an Agent’s Message in lieu

of the Letter of Transmittal, and (iii) any other documents required by the Letter of Transmittal. Accordingly, payment may not be made to all tendering shareholders at the same time and will depend upon when Share certificates are received by

the Depositary or Book-Entry Confirmations of tendered Shares are received in the Depositary’s account at DTC.

If any tendered Shares are not

accepted for payment or are not paid because of an invalid tender, if certificates are submitted for more Shares than are tendered, or if a shareholder withdraws tendered Shares, (i) the shares will be issued in book-entry form and will be

electronically held in your account for such unpurchased Shares, as soon as practicable following the expiration, termination or withdrawal of the Offer, (ii) Shares delivered pursuant to the book-entry delivery procedures will be credited to

the account from which they were delivered, and (iii) uncertificated Shares held by the Fund’s transfer agent pursuant to the Fund’s dividend reinvestment plan will be returned to the dividend reinvestment plan account maintained by

the transfer agent.

The Fund will pay all transfer taxes, if any, payable on the transfer to it of Shares purchased pursuant to the Offer. If, however,

payment of the purchase price is to be made to, or if unpurchased Shares were registered in the name of, any person other than the tendering holder, or if any tendered Shares are registered or held in the name of any person other than the person

signing the Letter of Transmittal, the amount of any transfer taxes (whether imposed on the registered holder or such other person) payable on account of such transfer will be the responsibility of the transferor and satisfactory evidence of the

payment of such taxes, or exemption therefrom, is submitted to the Depository. In addition, if certain events occur, the Fund may not be obligated to purchase Shares pursuant to the Offer. See “The Offer—Section 5—Certain

Conditions of the Offer.”

Any tendering shareholder or other payee who fails to complete fully and sign the IRS Form

W-9, which is included with the Letter of Transmittal, may be subject to federal income tax withholding of 24% of the gross proceeds paid to such shareholder or other payee pursuant to the Offer. Non-U.S. Shareholders should provide the Depositary with a completed IRS Form W-8 to avoid 24% backup withholding. A copy of IRS Form

W-8 will be provided upon request from the Depositary. See “The Offer—Section 2—Procedures for Tendering Shares” and “The Offer—Section 14—Material Federal Income

Tax Consequences.”

| 5. |

CERTAIN CONDITIONS OF THE OFFER |

The completion of the Offer is subject to certain conditions, including:

| (i) |

The aggregate net assets of the Fund as of the Expiration Date of the Offer must equal or exceed

$70 million after taking into account the amounts that would be paid to shareholders who have properly tendered their Shares; |

| (ii) |

Shares of the Fund must remain eligible for listing on the NYSE following consummation of the Offer (the NYSE

Listed Company Manual provides that the NYSE would promptly initiate suspension and delisting procedures with respect to closed-end funds if the total market value of publicly held shares and net assets of the

entity over 60 consecutive calendar days are each below $5,000,000), and |

| (iii) |

The Fund must remain subject to the reporting requirements of the Exchange Act following consummation of the

Offer. |

If one or more of these conditions are not satisfied, the Offer will not be completed and the Fund will proceed to terminate on

August 31, 2024, its scheduled termination date, unless the Fund’s Board of Trustees extends the term in accordance with the charter documents of the Fund.

Separately, notwithstanding any other provision of the Offer, it is the announced policy of the Board of Trustees of the Fund, which may be changed by the

Board of Trustees, that the Fund cannot accept tenders or effect repurchases if: (1) such transactions, if consummated, would (a) result in the delisting of the Shares from the NYSE or elsewhere, or (b) impair the Fund’s status

as a regulated investment company under the Code (which would make the Fund a taxable entity, causing the Fund’s income to be taxed at the corporate level in addition to the taxation of common shareholders who receive dividends from the Fund)

or as a registered closed-end investment company

6

under the Investment Company Act of 1940, as amended (the “1940 Act”); (2) the Fund would not be able to liquidate portfolio securities in an orderly manner and consistent with the

Fund’s investment objectives and policies in order to repurchase Shares; or (3) there is, in the Board of Trustees’ judgment, any (a) material legal action or proceeding instituted or threatened challenging such transactions or

otherwise materially adversely affecting the Fund, (b) general suspension of or limitation on prices for trading securities on the NYSE, (c) declaration of a banking moratorium by federal or state authorities or any suspension of payment

by United States or state banks in which the Fund invests, (d) material limitation affecting the Fund or the issuers of its portfolio securities by federal or state authorities on the extension of credit by lending institutions or on the

exchange of foreign currency, (e) commencement of war, armed hostilities or other international or national calamity directly or indirectly involving the United States, or (f) other event or condition that would have a material adverse

effect (including any adverse tax effect) on the Fund or its shareholders if Shares were repurchased. The Board of Trustees of the Fund may in the future modify these conditions in light of experience.

The Fund reserves the right, at any time during the pendency of the Offer, to terminate, extend or amend the Offer in any respect. If the Fund determines to

terminate or amend the Offer or to postpone the acceptance for payment of or payment for Shares tendered, it will, to the extent necessary, extend the period during which the Offer is open as provided in “The

Offer—Section 15—Extension of Tender Period; Termination; Amendments.” In the event any of the foregoing conditions are modified or waived in whole or in part at any time, the Fund will promptly make a public announcement of such

waiver and may, depending on the materiality of the modification or waiver, extend the Offer period as provided in “The Offer—Section 15—Extension of Tender Period; Termination; Amendments.”

In light of the upcoming scheduled termination date of the Fund, the Adviser recommended, and the Board of Trustees of the Fund approved, a series of actions

to eliminate the term structure of the Fund, so that the Fund could continue as a perpetual fund with no scheduled termination date, while allowing shareholders who do not wish to continue their investment in the Fund after the term structure is

eliminated the opportunity to exit their investment through a tender offer. Specifically, the actions approved by the Board included (1) amending the Fund’s Declaration of Trust to eliminate the term structure of the Fund (the

“Amendment”); (2) approving an agreement with Nuveen Fund Advisors to waive management fees or reimburse expenses in an amount equal to 50% of the Fund’s management fee for the first year following the effectiveness of the Amendment

(the “Fee Waiver”); and (3) authorizing the Offer in order to provide an opportunity for those shareholders who do not wish to continue their investment as a shareholder of the Fund after the term structure is eliminated to exit their

investment at NAV, which is what shareholders would receive on the scheduled termination of the Fund in accordance with its current term structure. In addition, if the Amendment takes effect, the Fund will change its name to “Nuveen Preferred

Securities & Income Opportunities Fund.”

The Fund is making this Offer to allow common shareholders who do not wish to continue their

investment in the Fund to exit their investment at NAV, which is the same measure used to determine the value that shareholders would receive if the Fund terminated on its scheduled termination date. If the Offer is completed, the Amendment and Fee

Waiver will take effect as soon as practicable thereafter, but no later than August 31, 2024. The Amendment will take effect only if the Offer Conditions described above are satisfied and the Offer is completed. If the Offer is not completed,

the Amendment and Fee Waiver will not be effected and the Fund will terminate on its scheduled termination date, unless the Fund’s Board of Trustees extends the term in accordance with the charter documents of the Fund.

NEITHER THE FUND NOR ITS BOARD OF TRUSTEES MAKES ANY RECOMMENDATION TO ANY SHAREHOLDER AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING ANY OR ALL OF SUCH

SHAREHOLDER’S SHARES AND HAS NOT AUTHORIZED ANY PERSON TO MAKE ANY SUCH RECOMMENDATION. SHAREHOLDERS ARE URGED TO EVALUATE CAREFULLY ALL INFORMATION IN THE OFFER, CONSULT THEIR OWN INVESTMENT AND TAX ADVISERS, AND MAKE THEIR OWN DECISIONS

WHETHER TO TENDER SHARES AND, IF SO, HOW MANY SHARES TO TENDER.

7

| 7. |

PLANS OR PROPOSALS OF THE FUND |

Other than the proposed Amendment and the scheduled termination of the Fund on August 31, 2024 if the Amendment is not effected, the Fund has no current

plans or proposals, and is not engaged in any negotiations, that relate to or would result in: any extraordinary corporate transaction, such as a merger, reorganization or liquidation involving the Fund; any purchase, sale or transfer of a material

amount of assets of the Fund (other than in its ordinary course of business and in connection with the Offer); any material changes in the Fund’s present capitalization (except as resulting from the Offer or otherwise set forth herein); or any

other material changes in the Fund’s structure or business.

In January 2024, the Fund’s Board of Trustees approved a series of actions to,

among other things, eliminate the term structure of the Fund. Shareholders considered and approved the proposal to amend the Fund’s Declaration of Trust to eliminate the term structure of the Fund at a special meeting of shareholders held on

April 12, 2024, as adjourned to July 17, 2024. See “The Offer—Section 12—Certain Information About the Fund.”

As of July 16, 2024, there were 22,772,419 Shares issued and outstanding. The Shares are traded on the NYSE. During each completed fiscal quarter of the Fund

during the past two fiscal years the highest and lowest NAV and market price per Share were as follows:

|

|

|

|

|

|

|

|

|

| |

|

NAV (s) |

|

Market Price ($) |

| Fiscal Quarter Ended |

|

High |

|

Low |

|

High |

|

Low |

| April 2024 |

|

$19.75 |

|

$19.21 |

|

$19.24 |

|

$18.52 |

| January 2024 |

|

$19.48 |

|

$17.66 |

|

$18.90 |

|

$16.71 |

| October 2023 |

|

$18.42 |

|

$17.48 |

|

$17.88 |

|

$16.28 |

| July 2023 |

|

$18.44 |

|

$17.21 |

|

$17.63 |

|

$16.10 |

| April 2023 |

|

$21.13 |

|

$16.59 |

|

$20.62 |

|

$16.18 |

| January 2023 |

|

$20.91 |

|

$18.91 |

|

$20.37 |

|

$17.92 |

| October 2022 |

|

$21.47 |

|

$18.68 |

|

$21.21 |

|

$17.58 |

| July 2022 |

|

$21.90 |

|

$20.10 |

|

$20.95 |

|

$18.82 |

| April 2022 |

|

$24.24 |

|

$21.90 |

|

$24.54 |

|

$20.90 |

The Fund pays dividends monthly. Shareholders tendering Shares are entitled to receive all dividends with an “ex

date” on or before the Expiration Date, provided that they own shares as of the dividend record date. The record date for the August 2024 dividend distribution will be August 20, 2024, and the “ex date” will be August 20, 2024.

Accordingly, shareholders will not receive the August 2024 dividend distribution on tendered Shares unless the Expiration Date is extended past the ex date for the August 2024 dividend. The amount and frequency of any dividends in the future

will depend on circumstances existing at the time.

| 9. |

INTEREST OF TRUSTEES AND EXECUTIVE OFFICERS; TRANSACTIONS AND ARRANGEMENTS CONCERNING THE SHARES

|

The members of the Board of Trustees of the Fund are: Thomas J. Kenny, Amy B. R. Lancellotta, Joanne T. Medero, Albin F. Moschner,

John K. Nelson, Loren M. Starr, Matthew Thornton III, Terence J. Toth, Margaret L. Wolff and Robert L. Young.

The principal executive officer of the Fund