Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 November 2023 - 10:02PM

Edgar (US Regulatory)

Nuveen

Multi-Market

Income

Fund

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

LONG-TERM

INVESTMENTS

-

138.6%

(99.2%

of

Total

Investments)

X

–

ASSET-BACKED

AND

MORTGAGE-BACKED

SECURITIES

-

97

.3

%

(

69

.6

%

of

Total

Investments)

X

56,289,347

$

111

321

Henderson

Receivables

VI

LLC,

2010

1A,

144A

9.310%

7/15/61

$

113,527

500

(b)

ACRE

Commercial

Mortgage

Ltd,

(TSFR1M

reference

rate

+

2.714%

spread),

2021

FL4,

144A

8.045%

12/18/37

462,800

500

Adams

Outdoor

Advertising

LP,

2023

1,

144A

6.967%

7/15/53

491,579

500

(b)

AGL

CLO

19

Ltd,

(TSFR3M

reference

rate

+

2.750%

spread),

2022

19A,

144A

8.084%

7/21/35

501,012

400

(b)

AIMCO

CLO

Series

2017-A,

(TSFR3M

reference

rate

+

1.762%

spread),

2017

AA,

144A

7.088%

4/20/34

390,206

34

Alternative

Loan

Trust

2003-J3,

2003

J3

5.250%

11/25/33

28,963

47

Alternative

Loan

Trust

2004-J2,

2004

J2

6.500%

3/25/34

46,381

1,602

American

Homes

4

Rent

2015-SFR2

Trust,

2015

SFR2,

144A

0.000%

10/17/52

16

175

AMSR

Trust,

2019

SFR1,

144A

3.247%

1/19/39

157,990

13

Bayview

Financial

Mortgage

Pass-Through

Trust

2006-C,

2006

C

6.352%

11/28/36

10,620

400

Benchmark

2018-B2

Mortgage

Trust,

2018

B2

4.084%

2/15/51

342,090

1,150

Benchmark

2019-B9

Mortgage

Trust,

2019

B9

3.751%

3/15/52

1,034,836

375

(b)

BX

Trust

2023-DELC,

(TSFR1M

reference

rate

+

3.339%

spread),

2023

DELC,

144A

8.671%

5/15/38

375,942

275

Carmax

Auto

Owner

Trust

2019-4,

2019

4

2.800%

4/15/26

272,315

500

CARS-DB4

LP,

2020

1A,

144A

4.520%

2/15/50

438,927

500

Carvana

Auto

Receivables

Trust

2022-P3,

2022

P3

5.540%

11/10/28

477,384

250

Century

Plaza

Towers

2019-CPT,

2019

CPT,

144A

3.097%

11/13/39

148,377

899

CF

Hippolyta

Issuer

LLC,

2020

1,

144A

2.600%

7/15/60

704,839

400

(b)

CIFC

Funding

2020-II

Ltd,

(3-Month

LIBOR

reference

rate

+

1.862%

spread),

2020

2A,

144A

7.188%

10/20/34

392,844

425

Citigroup

Commercial

Mortgage

Trust,

2015

GC29

4.276%

4/10/48

386,968

150

Citigroup

Commercial

Mortgage

Trust

2014-GC23,

2014

GC23

4.578%

7/10/47

136,006

600

Citigroup

Commercial

Mortgage

Trust

2016-P5,

2016

P5,

144A

3.000%

10/10/49

360,258

450

(b)

Citigroup

Commercial

Mortgage

Trust

2018-TBR,

(TSFR1M

reference

rate

+

2.039%

spread),

2018

TBR,

144A

7.372%

12/15/36

433,567

241

Citigroup

Commercial

Mortgage

Trust

2019-GC41,

2019

GC41

3.502%

8/10/56

171,810

56

Citigroup

Global

Markets

Mortgage

Securities

VII

Inc,

2003

1,

144A

6.000%

9/25/33

35,555

500

COMM

2013-LC13

Mortgage

Trust,

2013

LC13,

144A

5.387%

8/10/46

438,251

450

COMM

2015-CCRE25

Mortgage

Trust,

2015

CR25

4.667%

8/10/48

406,480

108

COMM

Mortgage

Trust,

2015

LC23

4.697%

10/10/48

96,640

540

COMM

Mortgage

Trust,

2015

CR26

4.614%

10/10/48

477,188

775

COMM

Mortgage

Trust,

2015

CR22

4.203%

3/10/48

684,503

35

Commonbond

Student

Loan

Trust

2017-B-GS,

2017

BGS,

144A

4.440%

9/25/42

28,460

200

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

3.750%

spread),

2023

R01,

144A

9.065%

12/25/42

210,262

145

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

3.500%

spread),

2022

R03,

144A

8.815%

3/25/42

149,296

400

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

3.100%

spread),

2022

R04,

144A

8.415%

3/25/42

406,589

560

(b)

Connecticut

Avenue

Securities

Trust,

(SOFR30A

reference

rate

+

6.250%

spread),

2022

R03,

144A

6.349%

3/25/42

616,923

500

(b)

Connecticut

Avenue

Securities

Trust

2022-R01,

(SOFR30A

reference

rate

+

1.900%

spread),

2022

R01,

144A

7.215%

12/25/41

491,512

499

(b)

Credit

Suisse

Mortgage

Capital

Certificates

2019-ICE4,

(TSFR1M

reference

rate

+

1.647%

spread),

2019

ICE4,

144A

6.980%

5/15/36

495,646

250

CSMC

2014-USA

OA

LLC,

2014

USA,

144A

4.373%

9/15/37

134,334

90

CSMC

Mortgage-Backed

Trust

2006-7,

2006

7

6.000%

8/25/36

35,442

Nuveen

Multi-Market

Income

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

ASSET-BACKED

AND

MORTGAGE-BACKED

SECURITIES

(continued)

$

295

DB

Master

Finance

LLC,

2021

1A,

144A

2.493%

11/20/51

$

245,902

1,134

DB

Master

Finance

LLC,

2017

1A,

144A

4.030%

11/20/47

1,030,051

146

Domino's

Pizza

Master

Issuer

LLC,

2017

1A,

144A

4.118%

7/25/47

135,511

1,119

Domino's

Pizza

Master

Issuer

LLC,

2015

1A,

144A

4.474%

10/25/45

1,073,514

1,409

DRIVEN

BRANDS

FUNDING

LLC,

2019

1A,

144A

4.641%

4/20/49

1,327,215

400

(b)

Dryden

49

Senior

Loan

Fund,

(TSFR3M

reference

rate

+

1.862%

spread),

2017

49A,

144A

7.172%

7/18/30

398,525

750

(b)

Fannie

Mae

Connecticut

Avenue

Securities,

(SOFR30A

reference

rate

+

2.000%

spread),

2021

R02,

144A

2.050%

11/25/41

738,990

9

(c)

Fannie

Mae

Pool,

FN

878059

5.500%

3/01/36

8,945

402

Fannie

Mae

Pool,

FN

MA4919

5.500%

2/01/53

388,294

11

(c)

Fannie

Mae

Pool,

FN

882685

6.000%

6/01/36

10,987

23

(c)

Fannie

Mae

Pool,

FN

995018

5.500%

6/01/38

22,741

35

(c)

Fannie

Mae

Pool,

FN

766070

5.500%

2/01/34

33,593

6

(c)

Fannie

Mae

Pool,

FN

709700

5.500%

6/01/33

5,949

301

(c)

Fannie

Mae

Pool,

FN

AW4182

3.500%

2/01/44

266,301

203

(c)

Fannie

Mae

Pool,

FN

BM5839

3.500%

11/01/47

179,357

12

(c)

Fannie

Mae

Pool,

FN

828346

5.000%

7/01/35

11,437

31

(c)

Fannie

Mae

Pool,

FN

745324

6.000%

3/01/34

30,338

2,941

(c)

Fannie

Mae

Pool,

FN

CB3234

3.000%

4/01/52

2,442,002

547

(c)

Fannie

Mae

Pool,

FN

MA4733

4.500%

9/01/52

502,474

2,011

(c)

Fannie

Mae

Pool,

FN

MA4438,

2021

1

2.500%

10/01/51

1,601,979

605

(c)

Fannie

Mae

Pool,

FN

MA4783

4.000%

10/01/52

539,177

464

(c)

Fannie

Mae

Pool,

FN

MA4644,

2022

1

4.000%

5/01/52

413,312

517

(c)

Fannie

Mae

Pool,

FN

MA3305

3.500%

3/01/48

453,086

722

(c)

Fannie

Mae

Pool,

FN

BM5126

3.500%

1/01/48

635,413

47

Fannie

Mae

REMIC

Trust

2002-W1,

2002

W1

4.711%

2/25/42

44,913

254

Fannie

Mae

REMIC

Trust

2003-W1,

2003

W1

2.512%

12/25/42

127,532

613

(c)

Freddie

Mac

Gold

Pool,

FG

Q40841

3.000%

6/01/46

519,122

672

(c)

Freddie

Mac

Gold

Pool,

FG

G60138

3.500%

8/01/45

593,800

411

(c)

Freddie

Mac

Gold

Pool,

FG

Q40718

3.500%

5/01/46

360,853

281

(c)

Freddie

Mac

Gold

Pool,

FG

G08566

3.500%

1/01/44

248,489

407

(c)

Freddie

Mac

Gold

Pool,

FG

G18497

3.000%

1/01/29

386,587

987

(c)

Freddie

Mac

Gold

Pool,

FG

G08528

3.000%

4/01/43

845,094

7

(c)

Freddie

Mac

Gold

Pool,

FG

C00676

6.500%

11/01/28

6,671

403

(c)

Freddie

Mac

Pool,

FR

RA7402

3.500%

5/01/52

346,707

1,761

(c)

Freddie

Mac

Pool,

FR

RA6766

2.500%

2/01/52

1,411,951

500

(b)

Freddie

Mac

STACR

REMIC

Trust,

(SOFR30A

reference

rate

+

2.500%

spread),

2022

DNA1,

144A

7.815%

1/25/42

489,911

410

(b)

Freddie

Mac

STACR

REMIC

Trust,

(SOFR30A

reference

rate

+

2.900%

spread),

2022

DNA3,

144A

8.215%

4/25/42

419,688

750

(b)

Freddie

Mac

STACR

REMIC

Trust,

(SOFR30A

reference

rate

+

2.400%

spread),

2022

DNA2,

144A

7.715%

2/25/42

755,233

275

(b)

Freddie

Mac

STACR

REMIC

Trust

2021-HQA1,

(SOFR30A

reference

rate

+

2.250%

spread),

2021

HQA1,

144A

7.565%

8/25/33

274,220

750

(b)

Freddie

Mac

STACR

REMIC

Trust

2022-DNA4,

(SOFR30A

reference

rate

+

3.350%

spread),

2022

DNA4,

144A

8.665%

5/25/42

779,015

500

FREMF

2017-K724

Mortgage

Trust,

2017

K724,

144A

3.583%

12/25/49

496,300

500

Frontier

Issuer

LLC,

2023

1,

144A

6.600%

8/20/53

477,069

37

(c)

Ginnie

Mae

I

Pool,

GN

631574

6.000%

7/15/34

38,046

69

(c)

Ginnie

Mae

I

Pool,

GN

604567

5.500%

8/15/33

67,481

642

(b)

GS

Mortgage

Securities

Corp

Trust

2018-TWR,

(TSFR1M

reference

rate

+

1.197%

spread),

2018

TWR,

144A

6.530%

7/15/31

541,366

185

GS

Mortgage

Securities

Trust

2013-GC16,

2013

GC16

5.161%

11/10/46

183,409

25

GS

Mortgage

Securities

Trust

2013-GCJ14,

2013

GC14,

144A

4.399%

8/10/46

23,712

45

GSMPS

Mortgage

Loan

Trust

2001-2,

2001

2,

144A

7.500%

6/19/32

41,184

318

GSMPS

Mortgage

Loan

Trust

2003-3,

2003

3,

144A

7.000%

6/25/43

312,076

249

GSMPS

Mortgage

Loan

Trust

2005-RP1,

2005

RP1,

144A

8.500%

1/25/35

245,004

353

GSMPS

Mortgage

Loan

Trust

2005-RP2,

2005

RP2,

144A

7.500%

3/25/35

334,432

322

GSMPS

Mortgage

Loan

Trust

2005-RP3,

2005

RP3,

144A

7.500%

9/25/35

311,455

205

GSMPS

Mortgage

Loan

Trust

2005-RP3,

2005

RP3,

144A

8.000%

9/25/35

195,038

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

ASSET-BACKED

AND

MORTGAGE-BACKED

SECURITIES

(continued)

$

486

Hardee's

Funding

LLC,

2020

1A,

144A

3.981%

12/20/50

$

409,099

600

Hertz

Vehicle

Financing

III

LP,

2021

2A,

144A

1.680%

12/27/27

526,366

500

Hudson

Yards

2019-55HY

Mortgage

Trust,

2019

55HY,

144A

3.041%

12/10/41

382,540

109

Impac

Secured

Assets

CMN

Owner

Trust,

2000

3

8.000%

10/25/30

95,626

381

J.G.

Wentworth

XXXVII

LLC,

2016

1A,

144A

5.190%

6/17/69

330,610

430

J.P.

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2018-AON,

2018

AON,

144A

4.767%

7/05/31

247,781

636

JGWPT

XXV

LLC,

2012

1A,

144A

7.140%

2/15/67

613,948

263

JGWPT

XXVI

LLC,

2012

2A,

144A

6.770%

10/17/61

249,233

189

JP

Morgan

Alternative

Loan

Trust

2006-S1,

2006

S1

6.500%

3/25/36

104,604

500

JP

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2016-JP4,

2016

JP4,

144A

3.516%

12/15/49

326,190

368

JP

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2019-ICON

UES,

2019

UES,

144A

4.343%

5/05/32

351,947

500

JP

Morgan

Chase

Commercial

Mortgage

Securities

Trust

2020-NNN,

2020

NNN,

144A

3.620%

1/16/37

411,285

697

JPMDB

Commercial

Mortgage

Securities

Trust

2016-C4,

2016

C4

3.187%

12/15/49

482,512

500

JPMDB

Commercial

Mortgage

Securities

Trust

2017-C7,

2017

C7,

144A

3.000%

10/15/50

247,237

400

Manhattan

West

2020-1MW

Mortgage

Trust,

2020

1MW,

144A

2.413%

9/10/39

324,397

206

MASTR

Alternative

Loan

Trust

2004-1,

2004

1

7.000%

1/25/34

195,511

140

MASTR

Alternative

Loan

Trust

2004-5,

2004

5

7.000%

6/25/34

136,409

102

MASTR

Asset

Securitization

Trust

2003-11,

2003

11

5.250%

12/25/33

96,845

268

Mid-State

Capital

Corp

2005-1

Trust,

2005

1

5.745%

1/15/40

261,779

94

Mid-State

Trust

XI,

2003

11

5.598%

7/15/38

91,723

530

Morgan

Stanley

Bank

of

America

Merrill

Lynch

Trust

2014-C14,

2014

C14

5.032%

2/15/47

525,029

250

Morgan

Stanley

Bank

of

America

Merrill

Lynch

Trust

2015-C20,

2015

C20

4.603%

2/15/48

224,454

500

Morgan

Stanley

Bank

of

America

Merrill

Lynch

Trust

2016-C28,

2016

C28

4.756%

1/15/49

407,905

33

Morgan

Stanley

Mortgage

Loan

Trust

2006-2,

2006

2

5.750%

2/25/36

28,883

500

MSCG

Trust,

2015

ALDR,

144A

3.577%

6/07/35

424,554

334

MVW

2022-1

LLC,

2022

1A,

144A

4.150%

11/21/39

317,747

98

MVW

Owner

Trust

2017-1,

2017

1A,

144A

2.420%

12/20/34

95,533

1,000

(b)

Natixis

Commercial

Mortgage

Securities

Trust

2019-MILE,

(TSFR1M

reference

rate

+

2.829%

spread),

2019

MILE,

144A

8.162%

7/15/36

766,461

400

(b)

Neuberger

Berman

Loan

Advisers

CLO

31

Ltd,

(TSFR3M

reference

rate

+

1.812%

spread),

2019

31A,

144A

7.138%

4/20/31

396,610

500

(b)

Neuberger

Berman

Loan

Advisers

CLO

48

Ltd,

(TSFR3M

reference

rate

+

1.800%

spread),

2022

48A,

144A

7.151%

4/25/36

489,937

502

New

Residential

Mortgage

Loan

Trust,

2015

2A,

144A

5.364%

8/25/55

471,373

267

New

Residential

Mortgage

Loan

Trust

2014-1,

2014

1A,

144A

6.004%

1/25/54

254,986

475

Planet

Fitness

Master

Issuer

LLC,

2018

1A,

144A

4.666%

9/05/48

455,296

236

Planet

Fitness

Master

Issuer

LLC,

2022

1A,

144A

3.251%

12/05/51

211,383

1,250

(b)

PNMAC

GMSR

ISSUER

TRUST,

(1-Month

LIBOR

reference

rate

+

3.850%

spread),

2018

GT1,

144A

9.284%

2/25/25

1,252,022

1,250

(b)

PNMAC

GMSR

ISSUER

TRUST,

(1-Month

LIBOR

reference

rate

+

2.650%

spread),

2018

GT2,

144A

8.084%

8/25/25

1,251,169

485

RBS

Commercial

Funding

Inc

2013-SMV

Trust,

2013

SMV,

144A

3.704%

3/11/31

421,733

489

SERVPRO

Master

Issuer

LLC,

2021

1A,

144A

2.394%

4/25/51

403,444

269

Sesac

Finance

LLC,

2019

1,

144A

5.216%

7/25/49

252,911

165

Sierra

Timeshare

2020-2

Receivables

Funding

LLC,

2020

2A,

144A

3.510%

7/20/37

156,334

44

Sierra

Timeshare

Receivables

Funding

LLC,

2019

3A,

144A

4.180%

8/20/36

41,676

135

SLG

Office

Trust

2021-OVA,

2021

OVA,

144A

2.851%

7/15/41

97,487

373

Sonic

Capital

LLC,

2020

1A,

144A

3.845%

1/20/50

337,632

350

Stack

Infrastructure

Issuer

LLC,

2020

1A,

144A

1.893%

8/25/45

317,709

226

Start

II

LTD,

2019

1,

144A

5.095%

3/15/44

178,186

Nuveen

Multi-Market

Income

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X–

ASSET-BACKED

AND

MORTGAGE-BACKED

SECURITIES

(continued)

$

64

Structured

Receivables

Finance

2010-A

LLC,

2010

A,

144A

5.218%

1/16/46

$

62,384

586

Taco

Bell

Funding

LLC,

2016

1A,

144A

4.970%

5/25/46

564,710

648

Taco

Bell

Funding

LLC,

2021

1A,

144A

2.294%

8/25/51

529,679

295

Taco

Bell

Funding

LLC,

2021

1A,

144A

1.946%

8/25/51

254,861

250

VB-S1

Issuer

LLC

-

VBTEL,

2022

1A,

144A

4.288%

2/15/52

217,750

250

VNDO

Trust

2016-350P,

2016

350P,

144A

4.033%

1/10/35

225,154

8

Washington

Mutual

MSC

Mortgage

Pass-Through

Certificates

Series

2004-RA3

Trust

5.721%

8/25/38

7,474

195

Wells

Fargo

Commercial

Mortgage

Trust

2016-C33,

2016

C33

3.896%

3/15/59

161,360

500

Wells

Fargo

Commercial

Mortgage

Trust

2017-C38,

2017

C38

3.903%

7/15/50

409,731

567

Wendy's

Funding

LLC,

2021

1A,

144A

2.370%

6/15/51

465,498

451

Wendy's

Funding

LLC,

2019

1A,

144A

3.783%

6/15/49

418,016

391

Wendy's

Funding

LLC,

2018

1A,

144A

3.884%

3/15/48

350,198

985

Wingstop

Funding

LLC,

2020

1A,

144A

2.841%

12/05/50

852,206

176

Zaxby's

Funding

LLC,

2021

1A,

144A

3.238%

7/30/51

146,441

Total

Asset-Backed

and

Mortgage-Backed

Securities

(cost

$62,877,576)

56,289,347

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X

–

CORPORATE

BONDS

-

36

.7

%

(

26

.3

%

of

Total

Investments)

X

21,242,935

Automobiles

&

Components

-

1.4%

$

50

Dana

Inc

4.250%

9/01/30

$

40,130

175

(c)

Ford

Motor

Co

3.250%

2/12/32

134,866

200

(c)

Ford

Motor

Credit

Co

LLC

6.950%

3/06/26

199,670

400

(c)

General

Motors

Financial

Co

Inc

3.600%

6/21/30

334,779

100

(c)

Goodyear

Tire

&

Rubber

Co/The

5.250%

4/30/31

84,255

Total

Automobiles

&

Components

793,700

Banks

-

4.8%

400

Banco

Santander

SA

2.749%

12/03/30

298,060

775

(c)

Bank

of

America

Corp

1.898%

7/23/31

588,889

60

Citigroup

Inc

6.174%

5/25/34

57,338

200

Intesa

Sanpaolo

SpA,

144A

6.625%

6/20/33

187,946

400

(c)

JPMorgan

Chase

&

Co

2.580%

4/22/32

315,530

300

JPMorgan

Chase

&

Co

3.650%

9/01/72

261,851

295

M&T

Bank

Corp

3.500%

3/01/72

207,456

250

(b)

PNC

Financial

Services

Group

Inc/The

(TSFR3M

reference

rate

+

3.940%

spread)

3.804%

2/01/72

250,245

300

Truist

Financial

Corp

4.800%

3/01/72

257,168

400

Wells

Fargo

&

Co

3.900%

3/15/72

349,339

Total

Banks

2,773,822

Capital

Goods

-

2.3%

455

(c)

Albion

Financing

2SARL,

144A

8.750%

4/15/27

422,013

350

(c)

Boeing

Co/The

3.250%

2/01/28

315,624

200

(c)

Boeing

Co/The

3.625%

2/01/31

172,758

65

Chart

Industries

Inc,

144A

9.500%

1/01/31

69,082

60

Chart

Industries

Inc,

144A

7.500%

1/01/30

60,329

100

H&E

Equipment

Services

Inc,

144A

3.875%

12/15/28

85,389

50

WESCO

Distribution

Inc,

144A

7.250%

6/15/28

50,243

135

(c)

Windsor

Holdings

III

LLC,

144A

8.500%

6/15/30

133,177

Total

Capital

Goods

1,308,615

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

Commercial

&

Professional

Services

-

0.9%

$

100

(c)

GFL

Environmental

Inc,

144A

4.250%

6/01/25

$

96,100

150

(c)

MPH

Acquisition

Holdings

LLC,

144A

5.500%

9/01/28

127,387

200

(c)

Prime

Security

Services

Borrower

LLC

/

Prime

Finance

Inc,

144A

5.750%

4/15/26

194,034

100

Prime

Security

Services

Borrower

LLC

/

Prime

Finance

Inc,

144A

6.250%

1/15/28

92,617

Total

Commercial

&

Professional

Services

510,138

Consumer

Discretionary

Distribution

&

Retail

-

1.8%

365

(c)

Asbury

Automotive

Group

Inc,

144A

4.625%

11/15/29

313,491

325

(c)

Asbury

Automotive

Group

Inc,

144A

5.000%

2/15/32

269,275

50

Bath

&

Body

Works

Inc,

144A

6.625%

10/01/30

46,876

75

LCM

Investments

Holdings

II

LLC,

144A

4.875%

5/01/29

63,766

500

Michaels

Cos

Inc/The,

144A

7.875%

5/01/29

326,423

50

Michaels

Cos

Inc/The,

144A

5.250%

5/01/28

39,905

Total

Consumer

Discretionary

Distribution

&

Retail

1,059,736

Consumer

Services

-

0.1%

55

Marriott

Ownership

Resorts

Inc,

144A

4.500%

6/15/29

46,084

Total

Consumer

Services

46,084

Energy

-

3.8%

250

(c)

Archrock

Partners

LP

/

Archrock

Partners

Finance

Corp,

144A

6.875%

4/01/27

241,835

90

Civitas

Resources

Inc,

144A

8.375%

7/01/28

91,575

55

Civitas

Resources

Inc,

144A

8.750%

7/01/31

56,181

35

DT

Midstream

Inc,

144A

4.125%

6/15/29

30,276

30

DT

Midstream

Inc,

144A

4.375%

6/15/31

25,227

100

(c)

EnLink

Midstream

LLC

5.375%

6/01/29

92,500

250

EQM

Midstream

Partners

LP

6.500%

7/15/48

219,852

200

(c)

Genesis

Energy

LP

/

Genesis

Energy

Finance

Corp

6.250%

5/15/26

191,719

200

(c)

MEG

Energy

Corp,

144A

5.875%

2/01/29

186,775

400

(c)

MPLX

LP

4.800%

2/15/29

379,505

125

(c)

Parkland

Corp,

144A

4.500%

10/01/29

107,041

315

(c)

Parkland

Corp/Canada,

144A

4.625%

5/01/30

268,531

200

USA

Compression

Partners

LP

/

USA

Compression

Finance

Corp

6.875%

4/01/26

195,909

110

(c)

Venture

Global

LNG

Inc,

144A

8.125%

6/01/28

108,916

Total

Energy

2,195,842

Equity

Real

Estate

Investment

Trusts

(Reits)

-

3.4%

650

(c)

Brixmor

Operating

Partnership

LP

4.050%

7/01/30

567,452

200

(c)

Essential

Properties

LP

2.950%

7/15/31

145,807

500

(c)

GLP

Capital

LP

/

GLP

Financing

II

Inc

4.000%

1/15/30

424,027

250

(c)

Iron

Mountain

Inc,

144A

5.250%

3/15/28

231,119

75

Iron

Mountain

Inc,

144A

4.500%

2/15/31

61,685

100

(c)

Kite

Realty

Group

Trust

4.750%

9/15/30

89,035

325

(c)

MPT

Operating

Partnership

LP

/

MPT

Finance

Corp

3.500%

3/15/31

202,953

250

(c)

SITE

Centers

Corp

4.250%

2/01/26

234,060

Total

Equity

Real

Estate

Investment

Trusts

(Reits)

1,956,138

Financial

Services

-

2.3%

300

American

Express

Co

3.550%

9/15/72

238,197

300

Bank

of

New

York

Mellon

Corp/The

4.700%

9/20/72

288,768

250

(c)

Compass

Group

Diversified

Holdings

LLC,

144A

5.250%

4/15/29

218,572

300

(c)

Goldman

Sachs

Group

Inc/The

1.992%

1/27/32

224,887

250

(c)

Navient

Corp

6.125%

3/25/24

248,664

170

(c)

OneMain

Finance

Corp

3.500%

1/15/27

145,562

Total

Financial

Services

1,364,650

Nuveen

Multi-Market

Income

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

Food,

Beverage

&

Tobacco

-

1.0%

$

400

(c)

BAT

Capital

Corp

2.726%

3/25/31

$

308,655

250

(c)

Chobani

LLC

/

Chobani

Finance

Corp

Inc,

144A

4.625%

11/15/28

220,495

75

Primo

Water

Holdings

Inc,

144A

4.375%

4/30/29

64,125

Total

Food,

Beverage

&

Tobacco

593,275

Health

Care

Equipment

&

Services

-

0.7%

50

CHS/Community

Health

Systems

Inc,

144A

5.625%

3/15/27

42,886

100

(c)

DaVita

Inc,

144A

4.625%

6/01/30

82,112

300

(c)

Tenet

Healthcare

Corp

4.375%

1/15/30

258,037

Total

Health

Care

Equipment

&

Services

383,035

Household

&

Personal

Products

-

0.1%

50

Kronos

Acquisition

Holdings

Inc

/

KIK

Custom

Products

Inc,

144A

5.000%

12/31/26

45,556

Total

Household

&

Personal

Products

45,556

Insurance

-

0.6%

25

AmWINS

Group

Inc,

144A

4.875%

6/30/29

21,906

300

(b)

Vitality

Re

XIV

Ltd

(3-Month

U.S.

Treasury

Bill

reference

rate

+

3.500%

spread),

144A

8.935%

1/05/27

306,660

Total

Insurance

328,566

Materials

-

2.6%

200

(c)

Ardagh

Metal

Packaging

Finance

USA

LLC

/

Ardagh

Metal

Packaging

Finance

PLC,

144A

3.250%

9/01/28

166,758

250

(c)

Constellium

SE,

144A

3.750%

4/15/29

209,479

240

(c)

EverArc

Escrow

Sarl,

144A

5.000%

10/30/29

192,343

375

(c)

NOVA

Chemicals

Corp,

144A

5.000%

5/01/25

353,269

60

Owens-Brockway

Glass

Container

Inc,

144A

7.250%

5/15/31

58,650

500

(c)

SunCoke

Energy

Inc,

144A

4.875%

6/30/29

424,862

120

(c)

Tronox

Inc,

144A

4.625%

3/15/29

96,841

Total

Materials

1,502,202

Media

&

Entertainment

-

2.2%

50

Arches

Buyer

Inc,

144A

4.250%

6/01/28

42,630

42

Cinemark

USA

Inc,

144A

8.750%

5/01/25

42,261

200

(c)

CSC

Holdings

LLC,

144A

11.250%

5/15/28

199,217

50

Directv

Financing

LLC

/

Directv

Financing

Co-Obligor

Inc,

144A

5.875%

8/15/27

44,209

325

(c)

Gray

Television

Inc,

144A

4.750%

10/15/30

215,303

200

(c)

LCPR

Senior

Secured

Financing

DAC,

144A

5.125%

7/15/29

160,879

135

(c)

Sirius

XM

Radio

Inc,

144A

4.000%

7/15/28

115,232

30

Sirius

XM

Radio

Inc,

144A

3.125%

9/01/26

26,738

75

Univision

Communications

Inc,

144A

4.500%

5/01/29

61,068

200

VZ

Secured

Financing

BV,

144A

5.000%

1/15/32

157,111

235

(c)

Warnermedia

Holdings

Inc

4.279%

3/15/32

199,472

Total

Media

&

Entertainment

1,264,120

Pharmaceuticals,

Biotechnology

&

Life

Sciences

-

1.3%

340

(c)

Avantor

Funding

Inc,

144A

3.875%

11/01/29

290,588

75

Avantor

Funding

Inc,

144A

4.625%

7/15/28

68,376

200

(c)

Organon

&

Co

/

Organon

Foreign

Debt

Co-Issuer

BV,

144A

5.125%

4/30/31

160,271

220

(c)

Teva

Pharmaceutical

Finance

Netherlands

III

BV

6.750%

3/01/28

216,039

Total

Pharmaceuticals,

Biotechnology

&

Life

Sciences

735,274

Real

Estate

Management

&

Development

-

0.5%

325

(c)

Kennedy-Wilson

Inc

5.000%

3/01/31

237,083

75

Kennedy-Wilson

Inc

4.750%

3/01/29

57,563

Total

Real

Estate

Management

&

Development

294,646

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

Semiconductors

&

Semiconductor

Equipment

-

0.4%

$

300

(c)

Broadcom

Inc,

144A

2.450%

2/15/31

$

234,481

Total

Semiconductors

&

Semiconductor

Equipment

234,481

Software

&

Services

-

1.5%

500

Ahead

DB

Holdings

LLC,

144A

6.625%

5/01/28

422,340

250

CA

Magnum

Holdings,

144A

5.375%

10/31/26

221,277

285

(c)

Open

Text

Corp,

144A

3.875%

12/01/29

234,275

Total

Software

&

Services

877,892

Technology

Hardware

&

Equipment

-

0.8%

200

(c)

Imola

Merger

Corp,

144A

4.750%

5/15/29

175,280

400

(c)

T-Mobile

USA

Inc

2.250%

11/15/31

304,813

Total

Technology

Hardware

&

Equipment

480,093

Telecommunication

Services

-

1.4%

600

(c)

AT&T

Inc

2.750%

6/01/31

480,001

200

Iliad

Holding

SASU,

144A

6.500%

10/15/26

187,903

200

(c)

Vmed

O2

UK

Financing

I

PLC,

144A

4.750%

7/15/31

161,575

Total

Telecommunication

Services

829,479

Transportation

-

0.1%

100

(c)

Cargo

Aircraft

Management

Inc,

144A

4.750%

2/01/28

89,277

Total

Transportation

89,277

Utilities

-

2.7%

100

Ferrellgas

LP

/

Ferrellgas

Finance

Corp,

144A

5.875%

4/01/29

89,933

75

Ferrellgas

LP

/

Ferrellgas

Finance

Corp,

144A

5.375%

4/01/26

70,297

300

(c)

Georgia

Power

Co

4.650%

5/16/28

289,420

200

(c)

Suburban

Propane

Partners

LP/Suburban

Energy

Finance

Corp

5.875%

3/01/27

191,000

475

(c)

Superior

Plus

LP

/

Superior

General

Partner

Inc,

144A

4.500%

3/15/29

412,780

190

(c)

Talen

Energy

Supply

LLC,

144A

8.625%

6/01/30

194,769

350

(c)

Virginia

Electric

and

Power

Co

5.000%

4/01/33

328,115

Total

Utilities

1,576,314

Total

Corporate

Bonds

(cost

$25,000,779)

21,242,935

Principal

Amount

(000)

Description

(a)

,(d)

Coupon

Maturity

Value

X

–

CONTINGENT

CAPITAL

SECURITIES

-

2

.0

%

(

1

.4

%

of

Total

Investments)

X

1,171,979

Banks

-

1.7%

$

200

Banco

Bilbao

Vizcaya

Argentaria

SA

9.375%

N/A

(e)

$

198,450

200

Banco

Santander

SA

4.750%

N/A

(e)

148,372

200

Lloyds

Banking

Group

PLC

7.500%

N/A

(e)

186,855

200

Societe

Generale

SA,

144A

8.000%

N/A

(e)

195,289

250

UniCredit

SpA

,

Reg

S

8.000%

N/A

(e)

245,937

Total

Banks

974,903

Financial

Services

-

0.3%

200

UBS

Group

AG,

144A

7.000%

N/A

(e)

197,076

Total

Financial

Services

197,076

Total

Contingent

Capital

Securities

(cost

$1,283,197)

1,171,979

Nuveen

Multi-Market

Income

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

X

–

SOVEREIGN

DEBT

-

1

.5

%

(

1

.1

%

of

Total

Investments)

X

880,553

Bahrain

-

0.4%

$

250

Bahrain

Government

International

Bond

,

144A

7.000%

10/12/28

$

253,084

Total

Bahrain

253,084

Egypt

-

0.6%

400

Egypt

Government

International

Bond

,

144A

5.875%

6/11/25

324,772

Total

Egypt

324,772

El

Salvador

-

0.1%

100

El

Salvador

Government

International

Bond

,

144A

5.875%

1/30/25

90,510

Total

El

Salvador

90,510

Turkey

-

0.4%

250

Turkey

Government

International

Bond

5.950%

1/15/31

212,187

Total

Turkey

212,187

Total

Sovereign

Debt

(cost

$1,008,821)

880,553

Principal

Amount

(000)

Description

(a)

Coupon

(f)

Reference

Rate

(f)

Spread

(f)

Maturity

(g)

Value

X

–

VARIABLE

RATE

SENIOR

LOAN

INTERESTS

-

1

.1

%

(

0

.8

%

of

Total

Investments)

(f)

X

635,638

Capital

Goods

-

0.4%

$

244

Core

&

Main

LP,

Term

Loan

B

7.804%

SOFR30A

+

SOFR90A

2.500%

6/10/28

$

244,703

Total

Capital

Goods

244,703

Insurance

-

0.4%

196

Alliant

Holdings

Intermediate,

LLC,

Term

Loan

B4

8.931%

1-Month

LIBOR

3.500%

11/06/27

195,826

Total

Insurance

195,826

Investments

in

Derivatives

kya

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Principal

Amount

(000)

Description

(a)

Coupon

(f)

Reference

Rate

(f)

Spread

(f)

Maturity

(g)

Value

Materials

-

0.3%

$

196

INEOS

Styrolution

US

Holding

LLC,

Term

Loan

B

8.181%

SOFR30A

2.750%

1/29/26

$

195,109

Total

Materials

195,109

Total

Variable

Rate

Senior

Loan

Interests

(cost

$635,212)

635,638

Total

Long-Term

Investments

(cost

$90,805,585)

80,220,452

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

1.2% (0.8%

of

Total

Investments)

X

–

REPURCHASE

AGREEMENTS

-

1

.2

%

(

0

.8

%

of

Total

Investments)

X

680,000

$

680

Repurchase

Agreement

with

Fixed

Income

Clearing

Corporation,

dated

9/29/23,

repurchase

price

$680,000,

collateralized

by

$870,700

U.S.

Treasury

Bonds,

3.375%,

due

11/15/48,

value

$693,657

1.600%

10/02/23

$

680,000

Total

Repurchase

Agreements

(cost

$680,000)

680,000

Total

Short-Term

Investments

(cost

$680,000)

680,000

Total

Investments

(cost

$

91,485,585

)

-

139

.8

%

80,900,452

Reverse

Repurchase

Agreements,

including

accrued

interest

-

(41.5)%(h)

(

24,044,238

)

Other

Assets

&

Liabilities,

Net

- 1.7%

1,025,811

Net

Assets

Applicable

to

Common

Shares

-

100%

$

57,882,025

Futures

Contracts

-

Long

Description

Number

of

Contracts

Expiration

Date

Notional

Amount

Value

Unrealized

Appreciation

(Depreciation)

U.S.

Treasury

Ultra

Bond

49

12/23

$

6,268,795

$

5,815,688

$

(

453,107

)

Interest

Rate

Swaps

-

OTC

Uncleared

Counterparty

Notional

Amount

Fund

Pay/Receive

Floating

Rate

Floating

Rate

Index

Fixed

Rate

(Annualized)

Fixed

Rate

Payment

Frequency

Effective

Date

(i)

Optional

Termination

Date

Maturity

Date

Value

Unrealized

Appreciation

(Depreciation)

Morgan

Stanley

Capital

Services

LLC

$

17,000,000

Receive

1-Month

LIBOR

1.994%

Monthly

6/01/18

7/01/25

7/01/27

$

914,768

$

914,768

Nuveen

Multi-Market

Income

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Asset-Backed

and

Mortgage-Backed

Securities

$

–

$

56,289,347

$

–

$

56,289,347

Corporate

Bonds

–

21,242,935

–

21,242,935

Contingent

Capital

Securities

–

1,171,979

–

1,171,979

Sovereign

Debt

–

880,553

–

880,553

Variable

Rate

Senior

Loan

Interests

–

635,638

–

635,638

Short-Term

Investments:

Repurchase

Agreements

–

680,000

–

680,000

Investments

in

Derivatives:

Futures

Contracts*

(453,107)

–

–

(453,107)

Interest

Rate

Swaps*

–

914,768

–

914,768

Total

$

(453,107)

$

81,815,220

$

–

$

81,362,113

*

Represents

net

unrealized

appreciation

(depreciation).

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Variable

rate

security.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(c)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

reverse

repurchase

agreements.

As

of

the

end

of

the

reporting

period,

investments

with

a

value

of

$26,643,716

have

been

pledged

as

collateral

for

reverse

repurchase

agreements.

(d)

Contingent

Capital

Securities

(“CoCos”)

are

hybrid

securities

with

loss

absorption

characteristics

built

into

the

terms

of

the

security

for

the

benefit

of

the

issuer.

For

example,

the

terms

may

specify

an

automatic

write-down

of

principal

or

a

mandatory

conversion

into

the

issuer’s

common

stock

under

certain

adverse

circumstances,

such

as

the

issuer’s

capital

ratio

falling

below

a

specified

level.

(e)

Perpetual

security.

Maturity

date

is

not

applicable.

(f)

Senior

loans

generally

pay

interest

at

rates

which

are

periodically

adjusted

by

reference

to

a

base

short-term,

floating

lending

rate

(Reference

Rate)

plus

an

assigned

fixed

rate

(Spread).

These

floating

lending

rates

are

generally

(i)

the

lending

rate

referenced

by

the

London

Inter-Bank

Offered

Rate

("LIBOR"),

or

(ii)

the

prime

rate

offered

by

one

or

more

major

United

States

banks.

Senior

loans

may

be

considered

restricted

in

that

the

Fund

ordinarily

is

contractually

obligated

to

receive

approval

from

the

agent

bank

and/or

borrower

prior

to

the

disposition

of

a

senior

loan.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(g)

Senior

loans

generally

are

subject

to

mandatory

and/or

optional

prepayment.

Because

of

these

mandatory

prepayment

conditions

and

because

there

may

be

significant

economic

incentives

for

a

borrower

to

prepay,

prepayments

of

senior

loans

may

occur.

As

a

result,

the

actual

remaining

maturity

of

senior

loans

held

may

be

substantially

less

than

the

stated

maturities

shown.

(h)

Reverse

Repurchase

Agreements,

including

accrued

interest

as

a

percentage

of

Total

investments

is

29.7%.

(i)

Effective

date

represents

the

date

on

which

both

the

Fund

and

counterparty

commence

interest

payment

accruals

on

each

contract.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

LIBOR

London

Inter-Bank

Offered

Rate

Reg

S

Regulation

S

allows

U.S.

companies

to

sell

securities

to

persons

or

entities

located

outside

of

the

United

States

without

registering

those

securities

with

the

Securities

and

Exchange

Commission.

Specifically,

Regulation

S

provides

a

safe

harbor

from

the

registration

requirements

of

the

Securities

Act

for

the

offers

and

sales

of

securities

by

both

foreign

and

domestic

issuers

that

are

made

outside

the

United

States.

REIT

Real

Estate

Investment

Trust

SOFR

30A

30

Day

Average

Secured

Overnight

Financing

Rate

SOFR

90A

90

Day

Average

Secured

Overnight

Financing

Rate

TSFR

1M

CME

Term

SOFR

1

Month

TSFR

3M

CME

Term

SOFR

3

Month

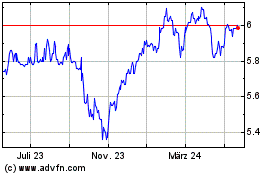

Nuveen Multi Market Income (NYSE:JMM)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

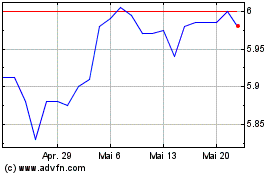

Nuveen Multi Market Income (NYSE:JMM)

Historical Stock Chart

Von Nov 2023 bis Nov 2024