InvenTrust Properties Corp. (“InvenTrust” or the “Company”)

(NYSE: IVT) today reported financial and operating results for the

period ended September 30, 2024. For the three months ended

September 30, 2024 and 2023, the Company reported Net Loss of $0.5

million, or $0.01 per diluted share, and Net Loss of $0.8 million,

or $0.01 per diluted share, respectively.

Third Quarter 2024

Highlights:

- Nareit FFO of $0.45 per diluted share

- Core FFO of $0.44 per diluted share

- Same Property Net Operating Income (“NOI”) growth of 6.5%

- Leased Occupancy as of September 30, 2024 of 97.0%

- Executed 59 leases totaling approximately 469,000 square feet

of GLA, of which 403,000 square feet was executed at a blended

comparable lease spread of 9.8%

- Acquired Scottsdale North Marketplace, a 66,000 square foot

neighborhood center anchored by AJ’s Fine Foods, in Scottsdale,

Arizona

- Issued and sold 9.2 million shares of common stock, receiving

$247.3 million in net proceeds

“The InvenTrust team delivered another solid quarter of

financial results," Daniel (DJ) Busch, President and CEO of

InvenTrust announced. “With the continued strength of our portfolio

performance, we are raising our full year Nareit and Core FFO

guidance. In September, we raised approximately $250 million in new

capital through an equity issuance, which will support our

continued cash flow growth over time.”

NET (LOSS) INCOME

- Net Loss for the three months ended September 30, 2024 was $0.5

million, or $0.01 per diluted share, compared to Net Loss of $0.8

million, or $0.01 per diluted share, for the same period in

2023.

- Net Income for the nine months ended September 30, 2024 was

$3.9 million, or $0.06 per diluted share, compared to Net Income of

$2.4 million, or $0.04 per diluted share, for the same period in

2023.

NAREIT FFO

- Nareit FFO for the three months ended September 30, 2024 was

$30.9 million, or $0.45 per diluted share, compared to $27.6

million, or $0.41 per diluted share, for the same period in

2023.

- Nareit FFO for the nine months ended September 30, 2024 was

$91.8 million, or $1.34 per diluted share, compared to $84.7

million, or $1.25 per diluted share, for the same period in

2023.

CORE FFO

- Core FFO for the three months ended September 30, 2024 was

$30.1 million, or $0.44 per diluted share, compared to $27.6

million, or $0.41 per diluted share, for the same period in

2023.

- Core FFO for the nine months ended September 30, 2024 was $89.2

million, or $1.30 per diluted share, compared to $84.1 million, or

$1.24 per diluted share, for the same period in 2023.

SAME PROPERTY NOI

- Same Property NOI for the three months ended September 30, 2024

was $45.5 million, a 6.5% increase, compared to the same period in

2023.

- Same Property NOI for the nine months ended September 30, 2024

was $123.8 million, a 4.2% increase, compared to the same period in

2023.

DIVIDEND

- For the quarter ended September 30, 2024, the Board of

Directors declared a quarterly cash distribution of $0.2263 per

share, paid on October 15, 2024.

PORTFOLIO PERFORMANCE & INVESTMENT ACTIVITY

- As of September 30, 2024, the Company’s Leased Occupancy was

97.0%.

- Anchor Leased Occupancy, which includes spaces greater than or

equal to 10,000 square feet, was 99.8% and Small Shop Leased

Occupancy was 92.0%. Anchor Leased Occupancy increased 70 basis

points, and Small Shop Leased Occupancy increased 30 basis points,

each on a sequential basis compared to the previous quarter.

- Leased to Economic Occupancy spread of 280 basis points, which

equates to approximately $7.2 million of base rent on an annualized

basis.

- Blended re-leasing spreads for comparable new and renewal

leases signed in the third quarter were 9.8%.

- Annualized Base Rent (“ABR”) per square foot (“PSF”) as of

September 30, 2024 was $19.83, an increase of 2.4% compared to the

same period in 2023. Anchor Tenant ABR PSF was $12.67 and Small

Shop ABR PSF was $33.50 for the third quarter.

- On August 6, 2024, the Company acquired Scottsdale North

Marketplace, a 66,000 square foot neighborhood center anchored by

AJ’s Fine Foods, in Scottsdale, Arizona, for a gross acquisition

price of $23.0 million. The Company used cash on hand to fund the

acquisition.

LIQUIDITY AND CAPITAL STRUCTURE

- On September 25, 2024, the Company issued and sold 9.2 million

shares of its common stock through an offering, receiving $247.3

million in net proceeds after underwriting discounts and

commissions.

- InvenTrust had $543.2 million of total liquidity, as of

September 30, 2024, comprised of $193.2 million of cash and cash

equivalents and $350.0 million of availability under its Revolving

Credit Facility.

- InvenTrust has no debt maturing in 2024 and $35.9 million of

debt maturing in 2025, as of September 30, 2024. On September 27,

2024, the Company extinguished the $72.5 million cross

collateralized pooled mortgage payable maturing on November 2,

2024.

- The Company's weighted average interest rate on its debt as of

September 30, 2024 was 4.03% and the weighted average remaining

term was 3.6 years.

SUBSEQUENT EVENTS

- On October 9, 2024, the Company acquired Stonehenge Village, a

214,000 square foot community center anchored by Wegman’s in the

Richmond, Virginia market, for a gross acquisition price of $62.1

million. The Company used cash on hand to fund the

acquisition.

- On October 23, 2024, the Company entered into a third amendment

to the Amended Revolving Credit Agreement, which provides for,

among other things, an increase in the revolving commitments

thereunder from $350.0 million to $500.0 million and an extension

of the maturity date to January 15, 2029, with one six-month

extension option.

2024 GUIDANCE

InvenTrust has updated its 2024 guidance, as summarized in the

table below.

(Unaudited, dollars in thousands, except

per share amounts)

Current (1) (2)

Previous

Net Income per diluted share

$0.09

—

$0.12

$0.08

—

$0.12

Nareit FFO per diluted share

$1.74

—

$1.77

$1.73

—

$1.77

Core FFO per diluted share (3)

$1.70

—

$1.73

$1.69

—

$1.73

Same Property NOI (“SPNOI”) Growth

4.25%

—

5.00%

3.50%

—

4.50%

General and administrative

$33,000

—

$34,000

$33,000

—

$34,250

Interest expense, net (4)

$34,500

—

$35,000

$35,750

—

$36,250

Net investment activity (5)

~ $159,000 - $215,000

~ $75,000

(1)

The Company’s guidance excludes

projections related to gains or losses on dispositions, gains or

losses on debt transactions, and depreciation, amortization, and

straight-line rent adjustments related to acquisitions.

(2)

The Company’s guidance includes an

expectation of uncollectibility, reflected as 0-50 basis points of

expected total revenue.

(3)

Core FFO per diluted share excludes

amortization of market-lease intangibles and inducements, debt

extinguishment charges, straight-line rent adjustments,

depreciation and amortization of corporate assets, and

non-operating income and expense.

(4)

Interest expense, net, excludes

amortization of debt discounts and financing costs, and expected

interest income of approximately $3.2 million.

(5)

Net investment activity represents

anticipated acquisition activity less disposition activity.

In addition to the foregoing assumptions, the Company's guidance

incorporates a number of other assumptions that are subject to

change and may be outside the control of the Company. If actual

results vary from these assumptions, the Company's expectations may

change. There can be no assurances that InvenTrust will achieve

these results.

The following table provides a reconciliation of the range of

the Company's 2024 estimated net income per diluted share to

estimated Nareit FFO and Core FFO per diluted share:

(Unaudited)

Low End

High End

Net income per diluted share

$

0.09

$

0.12

Depreciation and amortization of real

estate assets

1.60

1.60

Impairment of real estate assets

0.05

0.05

Nareit FFO per diluted share

1.74

1.77

Amortization of market-lease intangibles

and inducements, net

(0.04

)

(0.04

)

Straight-line rent adjustments, net

(0.03

)

(0.03

)

Amortization of debt discounts and

financing costs

0.03

0.03

Core FFO per diluted share

$

1.70

$

1.73

This press release does not include a reconciliation of

forward-looking SPNOI to forward-looking GAAP Net Income because

the Company is unable, without making unreasonable efforts, to

provide a meaningful or reasonably accurate calculation or

estimation of certain reconciling items which could be significant

to the Company’s results.

EARNINGS CALL INFORMATION

Date:

Wednesday, October 30, 2024

Time:

10:00 a.m. ET

Dial-in:

(833) 470-1428 / Access Code: 861040

Webcast & Replay Link:

https://events.q4inc.com/attendee/437641621

A webcast replay will be available shortly after the conclusion

of the presentation using the webcast link above.

Definitions

NON-GAAP FINANCIAL MEASURES

This Press Release includes certain financial measures and other

terms that are not in accordance with U.S. Generally Accepted

Accounting Principles (“GAAP”) that management believes are helpful

in understanding the Company’s business. These measures should not

be considered as alternatives to, or more meaningful than, net

income (calculated in accordance with GAAP) or other GAAP financial

measures, as an indicator of financial performance and are not

alternatives to, or more meaningful than, cash flow from operating

activities (calculated in accordance with GAAP) as a measure of

liquidity. Non-GAAP performance measures have limitations as they

do not include all items of income and expense that affect

operations, and accordingly, should always be considered as

supplemental financial results to those calculated in accordance

with GAAP. The Company's computation of these non-GAAP performance

measures may differ in certain respects from the methodology

utilized by other REITs and, therefore, may not be comparable to

similarly titled measures presented by such other REITs. Investors

are cautioned that items excluded from these non-GAAP performance

measures are relevant to understanding and addressing financial

performance. A reconciliation of the Company’s non-GAAP measures to

the most directly comparable GAAP financials measures are included

herein.

SAME PROPERTY NOI or SPNOI

Information provided on a same property basis includes the

results of properties that were owned and operated for the entirety

of both periods presented. NOI excludes general and administrative

expenses, depreciation and amortization, other income and expense,

net, impairment of real estate assets, gains (losses) from sales of

properties, gains (losses) on extinguishment of debt, interest

expense, net, equity in earnings (losses) from unconsolidated

entities, lease termination income and expense, and GAAP rent

adjustments such as amortization of market lease intangibles,

amortization of lease incentives, and straight-line rent

adjustments (“GAAP Rent Adjustments”). The Company bifurcates NOI

into Same Property NOI and NOI from other investment properties

based on whether the retail properties meet the Company’s Same

Property criteria. NOI from other investment properties includes

adjustments for the Company’s captive insurance company.

NAREIT FUNDS FROM OPERATIONS (NAREIT FFO) and CORE

FFO

The Company’s non-GAAP measure of Nareit Funds from Operations

("Nareit FFO"), based on the National Association of Real Estate

Investment Trusts ("Nareit") definition, is net income (or loss) in

accordance with GAAP, excluding gains (or losses) resulting from

dispositions of properties, plus depreciation and amortization and

impairment charges on depreciable real property. Adjustments for

the Company’s unconsolidated joint venture are calculated to

reflect the Company’s proportionate share of the joint venture's

Nareit FFO on the same basis. Core Funds From Operations (“Core

FFO”) is an additional supplemental non-GAAP financial measure of

the Company’s operating performance. In particular, Core FFO

provides an additional measure to compare the operating performance

of different REITs without having to account for certain remaining

amortization assumptions within Nareit FFO and other unique revenue

and expense items which some may consider not pertinent to

measuring a particular company’s on-going operating

performance.

ADJUSTED EBITDA

The Company’s non-GAAP measure of Adjusted EBITDA excludes gains

(or losses) resulting from debt extinguishments, straight-line rent

adjustments, amortization of above and below market leases and

lease inducements, and other unique revenue and expense items which

some may consider not pertinent to measuring a particular company’s

on-going operating performance. Adjustments for the Company’s

unconsolidated joint venture are calculated to reflect the

Company’s proportionate share of the joint venture's Adjusted

EBITDA on the same basis.

NET DEBT-TO-ADJUSTED EBITDA

Net Debt-to-Adjusted EBITDA is Net Debt divided by trailing

twelve month Adjusted EBITDA.

FORMER JOINT VENTURE

On January 18, 2023, the Company acquired the four remaining

retail properties from its unconsolidated joint venture, IAGM

Retail Fund I, LLC (“IAGM” or “JV”), a joint venture partnership

between the Company and PGGM Private Real Estate Fund (“PGGM”), in

which it held a 55% ownership share. In connection with the

foregoing, IAGM adopted a liquidation plan on January 11, 2023. On

December 15, 2023, IAGM was fully liquidated.

Financial Statements

Condensed Consolidated Balance

Sheets

In thousands, except share amounts

As of Sept. 30

As of December 31

2024

2023

Assets

(unaudited)

Investment properties

Land

$

710,160

$

694,668

Building and other improvements

2,013,459

1,956,117

Construction in progress

11,716

5,889

Total

2,735,335

2,656,674

Less accumulated depreciation

(496,559

)

(461,352

)

Net investment properties

2,238,776

2,195,322

Cash, cash equivalents and restricted

cash

202,758

99,763

Intangible assets, net

107,004

114,485

Accounts and rents receivable

34,797

35,353

Deferred costs and other assets, net

37,146

42,408

Total assets

$

2,620,481

$

2,487,331

Liabilities

Debt, net

$

740,109

$

814,568

Accounts payable and accrued expenses

48,683

44,583

Distributions payable

17,455

14,594

Intangible liabilities, net

30,369

30,344

Other liabilities

28,660

29,198

Total liabilities

865,276

933,287

Commitments and contingencies

Stockholders' Equity

Preferred stock, $0.001 par value,

40,000,000 shares authorized, none outstanding

—

—

Common stock, $0.001 par value,

146,000,000 shares authorized, 77,130,431 shares issued and

outstanding as of September 30, 2024 and 67,807,831 shares issued

and outstanding as of December 31, 2023

77

68

Additional paid-in capital

5,721,592

5,468,728

Distributions in excess of accumulated net

income

(3,977,152

)

(3,932,826

)

Accumulated comprehensive income

10,688

18,074

Total stockholders' equity

1,755,205

1,554,044

Total liabilities and stockholders'

equity

$

2,620,481

$

2,487,331

Financial Statements, continued

Condensed Consolidated Statements of Operations and

Comprehensive (Loss) Income

In thousands, except share and per share

amounts, unaudited

Three Months Ended Sept. 30

Nine Months Ended Sept. 30

2024

2023

2024

2023

Income

Lease income, net

$

68,132

$

63,716

$

201,681

$

192,814

Other property income

389

346

1,061

1,060

Other fee income

—

—

—

80

Total income

68,521

64,062

202,742

193,954

Operating expenses

Depreciation and amortization

28,134

30,318

85,092

85,339

Property operating

10,795

11,070

31,037

31,056

Real estate taxes

9,205

8,781

27,232

27,361

General and administrative

8,133

7,610

24,768

23,389

Total operating expenses

56,267

57,779

168,129

167,145

Other (expense) income

Interest expense, net

(9,470

)

(9,555

)

(28,744

)

(28,441

)

Impairment of real estate assets

(3,854

)

—

(3,854

)

—

Gain on sale of investment properties

334

1,707

334

2,691

Equity in earnings (losses) of

unconsolidated entities

—

67

—

(447

)

Other income and expense, net

197

676

1,510

1,767

Total other (expense) income, net

(12,793

)

(7,105

)

(30,754

)

(24,430

)

Net (loss) income

$

(539

)

$

(822

)

$

3,859

$

2,379

Weighted-average common shares outstanding

- basic

68,526,238

67,531,335

68,101,901

67,521,110

Weighted-average common shares outstanding

- diluted

68,526,238

67,531,335

68,659,319

67,720,485

Net (loss) income per common share -

basic

$

(0.01

)

$

(0.01

)

$

0.06

$

0.04

Net (loss) income per common share -

diluted

$

(0.01

)

$

(0.01

)

$

0.06

$

0.04

Distributions declared per common

share

$

0.23

$

0.22

$

0.68

$

0.65

Distributions paid per common share

$

0.23

$

0.22

$

0.67

$

0.64

Comprehensive (loss) income

Net (loss) income

$

(539

)

$

(822

)

$

3,859

$

2,379

Unrealized (loss) gain on derivatives,

net

(7,145

)

5,978

2,560

13,496

Reclassification to net (loss) income

(3,315

)

(4,213

)

(9,946

)

(11,089

)

Comprehensive (loss) income

$

(10,999

)

$

943

$

(3,527

)

$

4,786

Reconciliation of Non-GAAP

Measures

In thousands

Same Property NOI

Three Months Ended Sept. 30

Nine Months Ended Sept. 30

2024

2023

2024

2023

Income

Minimum base rent

$

42,809

$

41,481

$

116,321

$

113,761

Real estate tax recoveries

8,214

7,798

22,886

22,749

Common area maintenance, insurance, and

other recoveries

8,212

7,885

21,924

20,746

Ground rent income

4,715

4,762

11,634

11,735

Short-term and other lease income

799

691

2,706

2,575

Reversal of (provision for) uncollectible

billed rent and recoveries, net

162

(491

)

(55

)

(366

)

Other property income

374

346

936

978

Total income

65,285

62,472

176,352

172,178

Operating Expenses

Property operating

10,691

10,981

27,518

28,072

Real estate taxes

9,083

8,771

25,046

25,342

Total operating expenses

19,774

19,752

52,564

53,414

Same Property NOI

$

45,511

$

42,720

$

123,788

$

118,764

Net (Loss) Income to Same Property

NOI

Three Months Ended Sept. 30

Nine Months Ended Sept. 30

2024

2023

2024

2023

Net (loss) income

$

(539

)

$

(822

)

$

3,859

$

2,379

Adjustments to reconcile to non-GAAP

metrics:

Other income and expense, net

(197

)

(676

)

(1,510

)

(1,767

)

Equity in (earnings) losses of

unconsolidated entities

—

(67

)

—

447

Interest expense, net

9,470

9,555

28,744

28,441

Gain on sale of investment properties

(334

)

(1,707

)

(334

)

(2,691

)

Impairment of real estate assets

3,854

—

3,854

—

Depreciation and amortization

28,134

30,318

85,092

85,339

General and administrative

8,133

7,610

24,768

23,389

Other fee income

—

—

—

(80

)

Adjustments to NOI (a)

(1,626

)

(1,434

)

(6,056

)

(6,028

)

NOI

46,895

42,777

138,417

129,429

NOI from other investment properties

(1,384

)

(57

)

(14,629

)

(10,665

)

Same Property NOI

$

45,511

$

42,720

$

123,788

$

118,764

(a)

Adjustments to NOI include lease

termination income and expense and GAAP Rent Adjustments.

Reconciliation of Non-GAAP Measures,

continued

in thousands, except share and per share amounts

Nareit FFO and

Core FFO

The following table presents a

reconciliation of Net Income to Nareit FFO and Core FFO Applicable

to Common Shares and Dilutive Securities, and provides additional

information related to its operations:

Three Months Ended Sept. 30

Nine Months Ended Sept. 30

2024

2023

2024

2023

Net (loss) income

$

(539

)

$

(822

)

$

3,859

$

2,379

Depreciation and amortization of real

estate assets

27,923

30,094

84,439

84,714

Impairment of real estate assets

3,854

—

3,854

—

Gain on sale of investment properties

(334

)

(1,707

)

(334

)

(2,691

)

Unconsolidated joint venture adjustments

(a)

—

—

—

342

Nareit FFO Applicable to Common Shares and

Dilutive Securities

30,904

27,565

91,818

84,744

Amortization of market lease intangibles

and inducements, net

(831

)

(629

)

(2,064

)

(2,717

)

Straight-line rent adjustments, net

(765

)

(730

)

(2,652

)

(2,492

)

Amortization of debt discounts and

financing costs

567

1,167

1,742

3,286

Depreciation and amortization of corporate

assets

211

224

653

625

Non-operating income and expense, net

(b)

21

55

(275

)

791

Unconsolidated joint venture adjustments

(c)

—

(10

)

—

(172

)

Core FFO Applicable to Common Shares and

Dilutive Securities

$

30,107

$

27,642

$

89,222

$

84,065

Weighted average common shares outstanding

- basic

68,526,238

67,531,335

68,101,901

67,521,110

Dilutive effect of unvested restricted

shares (d)

—

—

557,418

199,375

Weighted average common shares outstanding

- diluted

68,526,238

67,531,335

68,659,319

67,720,485

Net (loss) income per diluted share

$

(0.01

)

$

(0.01

)

$

0.06

$

0.04

Nareit FFO per diluted share

$

0.45

$

0.41

$

1.34

$

1.25

Core FFO per diluted share

$

0.44

$

0.41

$

1.30

$

1.24

(a)

Reflects the Company’s share of

adjustments for IAGM's Nareit FFO on the same basis as

InvenTrust.

(b)

Reflects items which are not pertinent to

measuring on-going operating performance, such as miscellaneous and

settlement income, and basis difference recognition arising from

acquiring the four remaining properties of IAGM in 2023.

(c)

Reflects the Company’s share of

adjustments for IAGM's Core FFO on the same basis as

InvenTrust.

(d)

For purposes of calculating non-GAAP per

share metrics, the Company applies the same denominator used in

calculating diluted earnings per share in accordance with GAAP.

Reconciliation of Non-GAAP Measures,

continued

In thousands

EBITDA and Adjusted EBITDA

The following table presents a

reconciliation of Net Income to EBITDA and Adjusted EBITDA, and

provides additional information related to its operations:

Three Months Ended Sept. 30

Nine Months Ended Sept. 30

2024

2023

2024

2023

Net (loss) income

$

(539

)

$

(822

)

$

3,859

$

2,379

Interest expense, net

9,470

9,555

28,744

28,441

Income tax expense

138

128

403

388

Depreciation and amortization

28,134

30,318

85,092

85,339

Unconsolidated joint venture adjustments

(a)

—

(6

)

—

417

EBITDA

37,203

39,173

118,098

116,964

Impairment of real estate assets

3,854

—

3,854

—

Gain on sale of investment properties

(334

)

(1,707

)

(334

)

(2,691

)

Amortization of market-lease intangibles

and inducements, net

(831

)

(629

)

(2,064

)

(2,717

)

Straight-line rent adjustments, net

(765

)

(730

)

(2,652

)

(2,492

)

Non-operating income and expense, net

(b)

21

55

(275

)

791

Unconsolidated joint venture adjustments

(c)

—

(10

)

—

(188

)

Adjusted EBITDA

$

39,148

$

36,152

$

116,627

$

109,667

(a)

Reflects the Company's share of

adjustments for IAGM's EBITDA on the same basis as InvenTrust.

(b)

Reflects items which are not pertinent to

measuring on-going operating performance, such as miscellaneous and

settlement income, and basis difference recognition arising from

acquiring the four remaining properties of IAGM in 2023.

(c)

Reflects the Company's share of

adjustments for IAGM's Adjusted EBITDA on the same basis as

InvenTrust.

Financial Leverage Ratios

Dollars in thousands

The following table presents the

calculation of net debt and Net Debt-to-Adjusted EBITDA:

As of Sept. 30

As of December 31

2024

2023

Net Debt:

Outstanding Debt, net

$

740,109

$

814,568

Less: Cash and cash equivalents

(193,187

)

(96,385

)

Net Debt

$

546,922

$

718,183

Net Debt-to-Adjusted EBITDA (trailing 12

months):

Net Debt

$

546,922

$

718,183

Adjusted EBITDA (trailing 12 months)

153,419

146,459

Net Debt-to-Adjusted EBITDA

3.6x

4.9x

About InvenTrust Properties Corp.

InvenTrust Properties Corp. (the “Company,” "IVT," or

"InvenTrust") is a premier Sun Belt, multi-tenant essential retail

REIT that owns, leases, redevelops, acquires and manages

grocery-anchored neighborhood and community centers as well as

high-quality power centers that often have a grocery component.

Management pursues the Company's business strategy by acquiring

retail properties in Sun Belt markets, opportunistically disposing

of retail properties, maintaining a flexible capital structure, and

enhancing environmental, social and governance ("ESG") practices

and standards. A trusted, local operator bringing real estate

expertise to its tenant relationships, IVT has built a strong

reputation with market participants across its portfolio. IVT is

committed to leadership in ESG practices and has been a Global Real

Estate Sustainability Benchmark (“GRESB”) member since 2013. For

more information, please visit www.inventrustproperties.com.

The enclosed information should be read in conjunction with the

Company's filings with the U.S. Securities and Exchange Commission

(“SEC”), including, but not limited to, the Company's Form 10-Qs

filed quarterly and Form 10-Ks filed annually. Additionally, the

enclosed information does not purport to disclose all items

required under GAAP. The information provided in this press release

is unaudited and includes non-GAAP measures (as discussed below),

and there can be no assurance that the information will not vary

from the final information in the Company's Form 10-Q for the

quarter ended September 30, 2024. The Company may, but assumes no

obligation to, update information in this press release.

Forward-Looking Statements Disclaimer

Forward-Looking Statements in this press release, or made during

the earnings call, which are not historical facts, are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are

based on the current beliefs and expectations of InvenTrust's

management and are subject to significant risks and uncertainties.

Actual results may differ materially from those described in the

forward-looking statements. Any statements made in this press

release that are not statements of historical fact, including

statements about our beliefs and expectations, are forward-looking

statements. Forward-looking statements include information

concerning possible or assumed future results of operations,

including our guidance and descriptions of our business plans and

strategies. These statements often include words such as "may,"

"should," “could,” "would," "expect," "intend," "plan," "seek,"

"anticipate," "believe," "estimate," "target," "project,"

"predict," "potential," "continue," "likely," "will," "forecast,"

"outlook," "guidance," "suggest," and variations of these terms and

similar expressions, or the negative of these terms or similar

expressions.

The following factors, among others, could cause actual results,

financial position and timing of certain events to differ

materially from those described in the forward-looking statements:

interest rate movements; local, regional, national and global

economic performance; the impact of inflation on the Company and on

its tenants; competitive factors; the impact of e-commerce on the

retail industry; future retailer store closings; retailer

consolidation; retailers reducing store size; retailer

bankruptcies; government policy changes; and any material market

changes and trends that could affect the Company’s business

strategy. For further discussion of factors that could materially

affect the outcome of management's forward-looking statements and

IVT's future results and financial condition, see the Risk Factors

included in the Company's most recent Annual Report on Form 10-K,

as updated by any subsequent Quarterly Report on Form 10-Q, in each

case as filed with the SEC. InvenTrust intends that such

forward-looking statements be subject to the safe harbors created

by Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended,

except as may be required by applicable law.

IVT cautions you not to place undue reliance on any

forward-looking statements, which are made as of the date of this

press release. IVT undertakes no obligation to update publicly any

of these forward-looking statements to reflect actual results, new

information or future events, changes in assumptions or changes in

other factors affecting forward-looking statements, except to the

extent required by applicable laws. If IVT updates one or more

forward-looking statements, no inference should be drawn that IVT

will make additional updates with respect to those or other

forward-looking statements.

Availability of Information on InvenTrust Properties Corp.'s

Website and Social Media Channels

Investors and others should note that InvenTrust routinely

announces material information to investors and the marketplace

using U.S. Securities and Exchange Commission filings, press

releases, public conference calls, webcasts and the InvenTrust

investor relations website. The Company uses these channels as well

as social media channels (e.g., the InvenTrust X account

(twitter.com/inventrustprop); and the InvenTrust LinkedIn account

(linkedin.com/company/inventrustproperties)), as a means of

disclosing information about the Company's business to colleagues,

investors, and the public. While not all of the information that

the Company posts to the InvenTrust investor relations website or

on the Company’s social media channels is of a material nature,

some information could be deemed to be material. Accordingly, the

Company encourages investors, the media and others interested in

InvenTrust to review the information that it shares on

www.inventrustproperties.com/investor-relations and on the

Company’s social media channels.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029744608/en/

Dan Lombardo Vice President of Investor Relations 630-570-0605

dan.lombardo@inventrustproperties.com

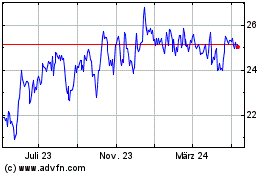

InvenTrust Properties (NYSE:IVT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

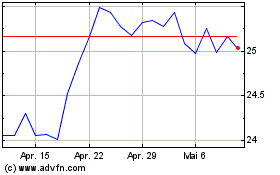

InvenTrust Properties (NYSE:IVT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024