Today, Block Advisors by H&R Block unveiled its 2024 State of

Women's Small Business Report, which reveals that women

entrepreneurs continue to face significant funding and support

gaps, with these challenges being even more severe for BIPOC women.

These systemic obstacles contribute to a personal confidence gap

among owners themselves. Despite these barriers, many current

business owners feel the outlook for their businesses' future is

positive.

While nearly all applicants (94%) express feeling ‘somewhat’ to

‘very’ positive about 2025, respondents also express being cautious

with finances given the state of today’s economy. Over half of

respondents (56%) claim inflation has affected their prices this

year; and over the next six months to a year, some respondents

believe they may be forced to cut expenses (44%) and raise prices

again due to inflation (39%). Despite cautious optimism, the report

highlights significant challenges in women’s entrepreneurial

journeys. The challenges experienced are even more pronounced for

respondents who are racially diverse.

“Starting a business has its fair share of struggles –

sustaining it brings additional challenges,” said Jamil Khan, Chief

Small Business Officer at H&R Block. “This report sheds light

on the ongoing obstacles, helping us better understand the

resources, guidance, and tools to which women entrepreneurs of all

backgrounds need access. It’s commonly known that 50% of businesses

close within five years of opening – this report helps us

understand how we can work with women founders to beat those

odds.”

The 2024 State of Women's Small Business Report by Block

Advisors offers insights from 6,333 Fund Her Future grant

applicants. The analysis underscores the profile, attitudes, and

behaviors of these applicants, specifically in terms of the

motivations, challenges, and needs of today’s women entrepreneurs.

Block Advisors’ review of survey responses shows women founders'

future confidence is fueled by a spirit of perseverance. The

majority of respondents cited facing substantial funding and

support gaps when starting their business. These barriers may play

into the confidence gap that was noted in over half of

respondents.

Block Advisors believes these findings reinforce the need for

programs like the Fund Her Future grant. “It is clear that women

entrepreneurs are determined to find success on their business

journey. For these underserved business owners, the right support

and guidance in those critical early years can make all the

difference in navigating the challenging road ahead,” said

Khan.

Women Applicants Skew Younger, Diverse, and Seek

Autonomy

The grant applicant pool reveals that today’s woman entrepreneur

in search of funding is a younger, educated, and racially diverse

owner just starting their small business journey. Specifically,

approximately half of respondents to the Fund Her Future grant

survey were women who were Black (50%), college-educated or higher

(63%), millennial (53%), and with two years or less of owning a

business (49%).

Responses indicated that these female founders deeply value

being engaged leaders. Improving communities and the overall need

for autonomy were among the top motivators for starting their

businesses. Almost all (98%) of respondents mentioned improving a

community as a motivator. This is supported by the industries

represented by applicants: nearly one in four (23%) women own a

business in counseling, education, tutoring, or business

consulting.

A preference for business autonomy and work flexibility were

also leading catalysts toward business formation: 92% of those

surveyed cited wanting to be their own boss and 89% cited wanting

to set their own schedule. One in five (21%) women shared that they

were starting a business to escape the traditional 9-to-5 work

environment so that they could tap into the childcare flexibility

of staying home with their kids. Not all aspiring entrepreneurs

leave traditional workplaces right away, however. Exactly half of

all respondents started their business as a side gig. A slower

transition may allow for greater stability during the often-tenuous

early years of a business startup, while still lending the founder

more feelings of autonomy and self-directed purpose.

Funding & Support Gaps Remain Big Barriers to

Business Formation

The report found four of the top five barriers to starting a

business all dealt with funding and support gaps, further

confirming the need to close these gaps through programs like Block

Advisors by H&R Block’s Fund Her Future grant. In fact, a

‘lack of start-up capital’ (80%), ‘needing steady, reliable income’

(76%), and ‘needing a solid business plan’ (56%) round out the top

three barriers, with ‘needing help getting started’ (50%) placing

fifth.

Interestingly, 54% of respondents cited ‘fear of failure,’

making it the fourth most common barrier. This spotlights a

little-talked-about confidence gap for over half of women

entrepreneurs. One respondent stated, “Starting a new business can

be daunting, especially as a first-time entrepreneur. The fear of

failure, coupled with the challenges of securing funding, can be

overwhelming.”

Digging deeper into the support gap, a lack of overall

mentorship was a common theme. This points to a major barrier that

keeps women from taking the leap to start their business.

Additionally, one in four (27%) women business owners said they

hesitated to start a business due to the lack of mentorship during

the process.

Funding gaps and struggles sourcing capital continue to be

prevalent: one in three respondents applied for a bank loan, but

42% of those who applied were never approved. When looked at

through an ethnicity lens, the picture becomes more concerning for

BIPOC and Black women. Among those who applied for a bank loan, 45%

of BIPOC applicants were never approved, compared to 36% of their

white peers. Black women applicants seeking a bank loan

reported being denied bank loans most frequently. 47% of Black

women founders who applied for loans were ultimately denied and

unable to access this type of funding.

What Women Entrepreneurs Need: Money, Marketing Support,

and More Help with Tax Prep

When asked what tops their wish list for achieving business

success, women entrepreneurs confirmed their business would thrive

if they had start-up capital (66%) and marketing and advertising

support (45%).

Furthermore, while starting a business can seem exciting and

glamorous, respondents express owning a business comes with

unexpected responsibilities. While they may have started their

business to follow their passion, there are many administrative

aspects that comprise the less appealing side of their business

to-do lists. Overall, tax preparation (53%) and bookkeeping (40%)

rank as the least favorite tasks for applicants, followed by

website development and social media management (25%), and

marketing & advertising (22%).

On a similar note, amongst a list of eight business tasks,

applicants are least confident in their ability to find all

available tax credits and deductions: more than two-thirds of women

claim they are only ‘somewhat confident’ to ‘very unconfident.’

Because of this – and coupled with the fact that tax preparation

and bookkeeping rank as the two least favorite tasks – today’s

woman small business owner may be at risk of leaving tax deductions

on the table.

“For the upcoming generation of women entrepreneurs, building a

supportive network of trusted experts and advisors will be crucial

in overcoming these challenges and achieving long-term success.

Block Advisors takes pride in helping its small business customers

offload the business tasks—such as tax preparation, bookkeeping,

payroll, business formation, and beneficial owner reporting—to

pursue their passions,” said Khan.

Download the 2024 State of Women’s Small Business Report by

Block Advisors.

To learn more about Block Advisors and the Fund Her Future

grant, visit www.BlockAdvisors.com and

www.BlockAdvisors.com/FundHerFutureGrant.

About H&R Block H&R Block, Inc.

(NYSE: HRB) provides help and inspires confidence in its clients

and communities everywhere through global tax preparation services,

financial products, and small-business solutions. The company

blends digital innovation with human expertise and care as it helps

people get the best outcome at tax time and also be better with

money using its mobile banking app, Spruce. Through Block Advisors

and Wave, the company helps small-business owners thrive with

year-round bookkeeping, payroll, advisory, and payment processing

solutions. For more information, visit H&R Block News.

| Media

Contacts |

|

| Media Relations: |

Erika O’Shea, (816) 585-6058, erika.oshea@hrblock.com |

| Investor Relations: |

Michaella Gallina, (816)

854-3022, michaella.gallina@hrblock.com |

| |

Jordyn Eskijian, (816)

854-5674, jordyn.eskijian@hrblock.com |

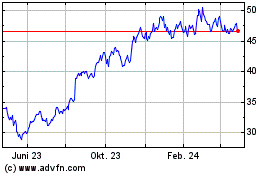

H and R Block (NYSE:HRB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

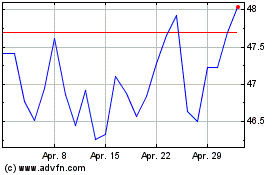

H and R Block (NYSE:HRB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025