Current Report Filing (8-k)

16 September 2015 - 12:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

September 14, 2015

Date of Report (Date of Earliest Event Reported)

HEWLETT-PACKARD COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| DELAWARE |

|

1-4423 |

|

94-1081436 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

|

| 3000 HANOVER STREET, PALO ALTO, CA |

|

94304 |

| (Address of principal executive offices) |

|

(Zip code) |

(650) 857-1501

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.05 |

Costs Associated with Exit or Disposal Activities |

On

September 14, 2015, the Board of Directors of Hewlett-Packard Company (“HP Co.”) approved a restructuring plan (“the plan”) in connection with the separation of HP Co.’s enterprise technology infrastructure, software,

services and financing businesses, which will do business as Hewlett Packard Enterprise Company (“Hewlett Packard Enterprise”), from HP Co.’s personal systems and printing businesses, which will do business as HP Inc. (the

“separation”). HP Co. expects that the plan will be implemented through fiscal 2018 and will include changes to the company’s workforce as well as cost savings from real estate consolidation of up to approximately $2.7 billion for the

businesses comprising Hewlett Packard Enterprise and up to approximately $300 million for the businesses comprising HP Inc.

As part of the restructuring plan, HP Co. expects up to approximately 33,300 employees to exit by the end of fiscal 2018, with

up to approximately 30,000 employees exiting Hewlett Packard Enterprise and up to approximately 3,300 employees exiting HP Inc. The changes to the workforce will vary by country, based on local legal requirements and consultations with employee

works councils and other employee representatives, as appropriate. HP Co. expects the workforce reduction to result in approximately $2.4 billion in severance costs.

In connection with the plan, HP Co. anticipates both labor and non-labor costs to result in aggregate pre-tax charges between

fiscal 2016 and fiscal 2018 of approximately $2.7 billion to be taken by Hewlett Packard Enterprise and approximately $300 million to be taken by HP Inc. Of these amounts, HP Co. expects Hewlett Packard Enterprise and HP Inc. to incur approximately

$2.2 billion and $171 million in costs, respectively, related to workforce reductions.

| Item 7.01 |

Regulation FD Disclosure. |

On September 15, 2015, HP Co. issued a

press release entitled “HP Announces Fiscal 2016 Financial Outlook for HP Inc.” regarding its 2015 Securities Analyst Meeting, during which HP Co. provided a strategy update and financial outlook for HP Inc.’s 2016 fiscal year. The

text of the press release is furnished herewith as Exhibit 99.1. HP Co. also issued a press release entitled “HP Announces Fiscal 2016 Financial Outlook for Hewlett Packard Enterprise” regarding a strategy update and financial outlook for

Hewlett Packard Enterprise’s 2016 fiscal year provided at the same meeting. The text of the press release is furnished herewith as Exhibit 99.2. The slides presented at the 2015 Securities Analyst Meeting will be available for a period of one

year thereafter at www.hp.com/investor/SAM2015.

The information reported in this report, including the

materials attached as Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference into any filing under the Securities Act of

1933, as amended.

Forward-looking statements

This document contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or

uncertainties ever materialize or the assumptions prove incorrect, the results of HP Co. may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical

fact are statements that could be deemed forward-looking statements, including but not limited to any projections of revenue, margins, expenses, effective tax rates, net earnings, net earnings per share, cash flows, benefit plan funding, deferred

tax assets, share repurchases, currency exchange rates or other financial items; any projections of the amount, timing or impact of cost savings or restructuring charges; any statements of the plans, strategies and objectives of management for

future operations, including the previously announced separation transaction and the future performances of the post-separation companies if the separation is completed, as well as the execution of restructuring plans and any resulting cost savings

or revenue or profitability improvements; any statements concerning the expected development, performance, market share or competitive performance relating to products or services; any statements regarding current or future macroeconomic trends or

events and the impact of those trends and events on HP Co. and its financial performance; any statements regarding pending investigations, claims or disputes; any statements of expectation or belief; and any statements or assumptions underlying any

of the foregoing. Risks, uncertainties and assumptions include the need to address the many challenges facing HP Co.’s businesses; the competitive pressures faced by HP Co.’s businesses; risks associated with executing HP Co.’s

strategy, including the planned separation transaction; the impact of macroeconomic and geopolitical trends and events; the need to manage third-party suppliers and the distribution of HP Co.’s products and the delivery of HP Co.’s

services effectively; the protection of HP Co.’s intellectual property assets, including intellectual property licensed from third parties; risks associated with HP Co.’s international operations; the development and transition of new

products and services and the enhancement of existing products and services to meet customer needs and respond to emerging technological trends; the execution and performance of contracts by HP Co. and their suppliers, customers and partners; the

hiring and retention of key employees; integration and other risks associated with business combination and investment transactions; the execution, timing and results of the separation transaction or restructuring plans, including estimates and

assumptions related to the cost (including any possible disruption of HP Co.’s business) and the anticipated benefits of implementing the separation transaction and restructuring plans; the resolution of pending investigations, claims and

disputes; and other risks that are described in HP Co.’s Annual Report on Form 10-K for the fiscal year ended October 31, 2014, HP Co.’s other filings with the Securities and Exchange Commission, including HP Co.’s Quarterly

Report on Form 10-Q for the fiscal quarter ended July 31, 2015, and the “Risk Factors” section of the preliminary information statement included in Hewlett Packard Enterprise’s Registration Statement on Form 10. HP Co. assumes no

obligation to update these forward-looking statements.

2

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Hewlett-Packard Company’s press release, dated September 15, 2015, entitled “HP Announces Fiscal 2016 Financial Outlook for HP Inc.” (furnished herewith) |

|

|

| 99.2 |

|

Hewlett-Packard Company’s press release, dated September 15, 2015, entitled “HP Announces Fiscal 2016 Financial Outlook for Hewlett Packard Enterprise” (furnished herewith) |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HEWLETT-PACKARD COMPANY |

|

|

|

|

| DATE: September 15, 2015 |

|

|

|

By: |

|

/s/ RISHI VARMA |

|

|

|

|

Name: |

|

Rishi Varma |

|

|

|

|

Title: |

|

Senior Vice President, Deputy General

Counsel and Assistant Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Hewlett-Packard Company’s press release, dated September 15, 2015, entitled “HP Announces Fiscal 2016 Financial Outlook for HP Inc.” (furnished herewith) |

|

|

| 99.2 |

|

Hewlett-Packard Company’s press release, dated September 15, 2015, entitled “HP Announces Fiscal 2016 Financial Outlook for Hewlett Packard Enterprise” (furnished herewith) |

Exhibit 99.1

|

|

|

|

|

| |

|

Hewlett-Packard Company 3000 Hanover Street

Palo Alto, CA 94304

hp.com |

|

|

|

|

News Release

HP Announces Fiscal 2016 Financial Outlook for HP Inc.

● Estimates non-GAAP diluted EPS outlook for fiscal 2016 of

$1.67 to $1.77 and GAAP diluted EPS for fiscal 2016 of $1.55 to $1.65

● Estimates fiscal 2016 free cash flow of $2.5 to $2.8

billion ● Expects to return up to 75% of fiscal 2016

annual free cash flow to shareholders through dividends and share repurchases |

| |

|

|

|

|

| Editorial contacts

Kait Conetta, HP +1 650 258 6471

corpmediarelations@hp.com

www.hp.com/go/newsroom |

|

SAN JOSE, Calif., Sept 15, 2015 — Today at HP’s 2015 Securities Analysts Meeting, the future HP Inc. leadership team provided

details on the strategy for the company and opportunities for long-term growth, coupled with the financial outlook for the new company.

Dion Weisler, who will become President and CEO for HP Inc. noted, “I am honored to be leading this company at an exciting time. We’re building a company with

the heart and energy of a startup and the brains and muscle of a Fortune 100 corporation.”

Weisler laid out the strategy for how HP Inc. will maintain its leading position in Printing and Personal Systems, and outlined the factors that make the new company a

compelling investment opportunity. In particular, HP Inc. has: |

|

|

|

|

● A

focus on growing profitable share; |

|

|

●

Recurring profit streams and strong cash flows; |

|

|

●

Meticulous focus on cost and operating efficiencies; |

|

|

●

Prudent capital allocation and commitment to shareholder returns; |

|

|

● And,

commitment to investing for the future. |

|

|

|

|

“Executing on our strategy will produce reliable returns and cash flows while also having the opportunity for long-term growth,” Weisler continued. “The separation enables us to focus our company assets

and financial resources on our core businesses, growth opportunities and future while also being very disciplined about delivering long-term, shareholder value.” |

Page 1 of 6

|

|

|

|

|

Weisler then went on to acknowledge the challenging market environment and currency headwinds, but emphasized that HP Inc. business fundamentals are strong, and the team has a proven track record of execution. He outlined pockets of

growth and new markets that HP Inc. will pursue to drive growth, including graphics, the A3 copier market, commercial mobility, and 3D printing. |

|

|

|

|

Fiscal 2016 outlook |

|

|

Cathie Lesjak, who will become the Chief Financial Officer of HP Inc. provided the financial outlook for the new company in fiscal 2016. Lesjak acknowledged that markets are likely to remain tough for the next several quarters with

continued competitive pricing in printing and soft demand in PCs. To offset these challenges, HP Inc.’s strategy will be to protect the core while focusing on accelerating in key areas, including: business printing, graphics, commercial

mobility, and services. |

|

|

|

|

For fiscal 2016, the new company estimates non-GAAP diluted EPS to be in the range of $1.67 to $1.77 and estimates GAAP diluted EPS to be in the range of $1.55 to $1.65. Fiscal 2016 non-GAAP diluted EPS estimates exclude after-tax

costs primarily related to restructuring and separation. |

|

|

|

|

Based on the current environment, HP Inc. anticipates generating cash flow from operations of approximately $3.0 to $3.3 billion in fiscal 2016. With about $0.5 billion in net capital expenditures, free cash flow outlook is in the

range of $2.5 to $2.8 billion for fiscal 2016. |

|

|

|

|

HP Inc. expects to return 50%-75% of annual free cash flow to shareholders through a combination of a robust dividend and regular share buy backs. In fiscal 2016, the company indicated that it expects to be at the higher end of that

range, with approximately $865 million returned through dividends, and the balance returned to shareholders through share repurchases |

|

|

|

|

HP Inc. will trade under the ticker symbol HPQ on the New York Stock Exchange. |

|

|

|

|

Business segment strategies |

|

|

Over the course of the day, the future HP Inc. management team laid out the strategy for the company’s individual business segments, including: |

|

|

|

|

Printing Business |

|

|

● Enrique Lores, who will

become President of the Printing Business, provided details on the strategy that will ensure HP maintains its role as the world’s leader in printing. Acknowledging market and competitive headwinds, Lores emphasized that printing remains a

massive market, currently $234 billion and growing. Echoing Weisler’s earlier comments, Lores is optimistic that as a separate company, the Printing Business in particular will successfully drive all-important supplies revenue. |

Page 2 of 6

|

|

|

|

|

● Lores emphasized that the

objective of the printing strategy is to drive value for customers by engineering the best printing experience. Lores highlighted several initiatives, including: |

|

|

¡ Ink in the Office

– one of the fastest growing web based services; |

|

|

¡ Expansion into the

A3 copier market where HP Inc. has an opportunity to significantly grow its market share; |

|

|

¡ Graphics, which

has been a leading growth business for HP overall; and |

|

|

¡ Managed Print

Services, where the shift in customer behavior from transactional to contractual presents HP with an opportunity to increase penetration in supplies. |

|

|

● Stephen Nigro, who will lead

the 3D Printing Business, outlined the opportunity the company sees in 3D printing with its MultiJet Fusion technology. The company plans to launch its first product in the market during 2016 focused on addressing customer challenges around speed,

quality and cost. Nigro outlined how the company plans to leverage its existing PageWide technology to disrupt the traditional manufacturing market. |

|

|

|

|

Personal Systems |

|

|

● Ron Coughlin, who will be

President of the Personal Systems Business, gave an overview of how Personal Systems plans to deliver profitable growth moving forward. Leveraging HP’s leading market position, powerful pipeline of innovation and ability to execute regardless

of the market environment, the new HP Inc. will focus on the commercial PC market and attractive segments of consumer. |

|

|

● The addressable market for

Personal Systems is approximately $340 billion, and while Coughlin acknowledged near-term market headwinds are expected to last several quarters, he identified several opportunities that will propel the Personal Systems Business,

including: |

|

|

¡ Clear and

systematic market segmentation to identify areas where HP Inc. is under-penetrated; |

|

|

¡ A cost focus

coupled with great design and innovation to address the Commercial market; |

|

|

¡ New form factors,

such as convertibles, that complement our existing line-up; |

|

|

¡ Expanding into

Commercial Mobility solutions and services such as “PC-as-a-Service”; |

|

|

¡ And exciting new

category creation such as Immersive Computing, where the company’s new Sprout product has already generated significant interest. |

Page 3 of 6

|

|

|

|

|

Webcast details |

|

|

A webcast of today’s event, along with management presentations and other materials, is available at www.hp.com/investor/SAM2015. This press release contains only a summary of some of the information being presented at

today’s event and should be read in conjunction with the management presentations and other materials made available on that website. |

|

|

|

|

About HP |

|

|

HP creates new possibilities for technology to have a meaningful impact on people, businesses, governments and society. With the broadest technology portfolio spanning printing, personal systems, software, services and IT

infrastructure, HP delivers solutions for customers’ most complex challenges in every region of the world. More information about HP ( NYSE : HPQ ) is available at http://www.hp.com. |

|

|

|

|

Use of non-GAAP financial information |

|

|

HP has included non-GAAP financial measures in this press release. Definitions of these non-GAAP financial measures and reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures

are included in the slides presented at the 2015 Securities Analyst Meeting, which will be available for a period of one year thereafter at www.hp.com/investor/SAM2015. |

|

|

|

|

HP’s management uses net revenue on a constant currency basis, non-GAAP operating profit, non-GAAP operating expense, non-GAAP operating income and earnings, net debt, net cash, non-GAAP net earnings, non-GAAP diluted net

earnings per share, and HP’s non-GAAP tax rate to evaluate and forecast HP’s performance before gains, losses or other charges that are considered by HP’s management to be outside of HP’s core business segment operating results.

HP also provides forecasts of non-GAAP diluted net earnings per share. Free cash flow, as defined below, is a liquidity measure that provides useful information to management about the amount of cash available for investment in HP’s businesses,

funding strategic acquisitions, repurchasing stock and other purposes. |

|

|

|

|

These non-GAAP financial measures may have limitations as analytical tools, and these measures should not be considered in isolation or as a substitute for analysis of HP’s results as reported under GAAP. Items such as

separation costs and restructuring charges that are excluded from non-GAAP operating expense, non-GAAP operating profit, non-GAAP net earnings, non-GAAP diluted net earnings per share and HP’s non-GAAP tax rate can have a material impact on

cash flows and net earnings per share. In addition, items such as impairment of goodwill and intangible assets and amortization of intangible assets, though not directly affecting HP’s cash position, represent the loss in value of intangible

assets over time. The expense associated with this loss in value is not included in non-GAAP operating profit, non-GAAP net earnings, non-GAAP diluted net earnings per share and HP’s non-GAAP tax rate and therefore does not reflect the full

economic effect of the loss in value of those intangible assets. Free cash flow does not represent the total increase or decrease in the cash balance for the period. The non-GAAP financial information that we provide also may differ from the

non-GAAP information provided by other companies. |

Page 4 of 6

|

|

|

|

|

We compensate for the limitations on our use of these non-GAAP financial measures by relying primarily on our GAAP financial statements and using non-GAAP financial measures only supplementally. We also provide robust and

detailed reconciliations of each non-GAAP financial measure to the most directly comparable GAAP measure, and we encourage investors to review carefully those reconciliations. |

|

|

|

|

We believe that providing these non-GAAP financial measures in addition to the related GAAP measures provides investors with greater transparency to the information used by HP’s management in its financial and operational

decision-making and allows investors to see HP’s results “through the eyes” of management. We further believe that providing this information better enables investors to understand HP’s operating performance and to evaluate the

efficacy of the methodology and information used by management to evaluate and measure such performance. |

|

|

|

|

Free cash flow is defined as cash flow from operations less net capital expenditures. Net capital expenditures is defined as investments in property, plant and equipment less proceeds from the sale of property, plant and

equipment. HP’s management uses free cash flow for the purpose of determining the amount of cash available for investment in HP’s businesses, funding acquisitions, repurchasing stock and other purposes. HP’s management also uses free

cash flow to evaluate HP’s historical and prospective liquidity. Because net capital expenditures includes proceeds from the sale of property, plant and equipment, HP believes that net capital expenditures provides a more accurate and complete

assessment of HP’s liquidity. Because free cash flow includes the effect of net capital expenditures that are not reflected in GAAP cash flow from operations, HP believes that free cash flow provides a more accurate and complete assessment of

HP’s liquidity and capital resources. Total company net debt consists of total debt (including the effects of hedging) less gross cash, which includes cash and cash equivalents, short-term investments, and certain liquid long-term investments.

Total company net cash consists of gross cash less total debt. Gross cash is defined as cash and cash equivalents plus short-term investments and certain long-term investments that may be liquidated within 90 days pursuant to the terms of existing

put options or similar rights. Total company net debt and total company net cash provide useful information to HP’s management about the state of HP’s consolidated condensed balance sheets. |

|

|

|

|

Forward looking statements |

|

|

This press release contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the results of Hewlett-Packard Company

and HP Inc. (collectively, “HP”) may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are statements that could be deemed

forward-looking statements, including but not limited to any projections of revenue, margins, expenses, effective tax rates, net earnings, net earnings per share, cash flows, benefit plan funding, share repurchases, currency exchange rates

or |

Page 5 of 6

|

|

|

|

|

other financial items; any projections of the amount, timing or impact of cost savings or restructuring charges; any statements of the plans, strategies and objectives of management for future operations, including the previously

announced separation transaction and the future performances of the post-separation companies if the separation is completed, as well as the execution of restructuring plans and any resulting cost savings or revenue or profitability improvements;

any statements concerning the expected development, performance, market share or competitive performance relating to products or services; any statements regarding current or future macroeconomic trends or events and the impact of those trends and

events on HP and its financial performance; any statements regarding pending investigations, claims or disputes; any statements of expectation or belief; and any statements or assumptions underlying any of the foregoing. Risks, uncertainties and

assumptions include the need to address the many challenges facing HP’s businesses; the competitive pressures faced by HP’s businesses; risks associated with executing HP’s strategy, including the planned separation transaction; the

impact of macroeconomic and geopolitical trends and events; the need to manage third-party suppliers and the distribution of HP’s products and the delivery of HP’s services effectively; the protection of HP’s intellectual property

assets, including intellectual property licensed from third parties; risks associated with HP’s international operations; the development and transition of new products and services and the enhancement of existing products and services to meet

customer needs and respond to emerging technological trends; the execution and performance of contracts by HP and its suppliers, customers and partners; the hiring and retention of key employees; integration and other risks associated with business

combination and investment transactions; the execution, timing and results of the separation transaction or restructuring plans, including estimates and assumptions related to the cost (including any possible disruption of HP’s business) and

the anticipated benefits of implementing the separation transaction and restructuring plans; the resolution of pending investigations, claims and disputes; and other risks that are described in HP’s Annual Report on Form 10-K for the fiscal

year ended October 31, 2014, and HP’s other filings with the Securities and Exchange Commission, including HP’s Quarterly Report on Form 10-Q for the fiscal quarter ended July 31, 2015. HP assumes no obligation and does not

intend to update these forward-looking statements. |

Page 6 of 6

Exhibit 99.2

|

|

|

|

|

| |

|

Hewlett-Packard Company 3000 Hanover Street

Palo Alto, CA 94304

hp.com |

|

|

|

|

News Release

HP Announces Fiscal 2016 Financial Outlook for Hewlett Packard Enterprise

● Estimates non-GAAP diluted net EPS for fiscal 2016 of $1.85

to $1.95 and GAAP diluted net EPS for fiscal 2016 of $0.75 to $0.85 ●

Estimates free cash flow of $2.0 to $2.2 billion in fiscal 2016 or normalized free cash flow of $3.7 billion before separation and restructuring cash payments

● Expects to return at least 50% of free cash flow in fiscal

2016 to shareholders through dividends and share repurchases |

| |

|

|

|

|

| Editorial contacts

Kait Conetta, HP +1 650 258 6471

corpmediarelations@hp.com

www.hp.com/go/newsroom |

|

SAN JOSE, Calif., Sept 15, 2015 — Today at HP’s 2015 Securities Analysts Meeting, the future Hewlett Packard Enterprise Company

leadership team provided a strategy update and financial outlook for the new company. Meg

Whitman, current Chairman, President and Chief Executive Officer of HP, who will become President and Chief Executive Officer of Hewlett Packard Enterprise, gave an overview of how the new company will build on its leading position in

infrastructure, software, services and cloud to help enterprise customers address their four most pressing challenges: |

|

|

|

|

●

Transforming to a hybrid infrastructure that gives greater flexibility and agility, while ensuring that there is no disruption to legacy systems. |

|

|

●

Protecting the digital enterprise from external risk. |

|

|

●

Empowering the organization to use data to give the insights needed to anticipate risk and opportunity. |

|

|

●

Enabling workplace productivity by delivering the right tools that are optimized for business critical tasks at the right economics. |

|

|

|

|

The new Hewlett Packard Enterprise will have more than $50 billion in annual revenue and will be focused on delivering unrivaled integrated technology solutions to a market that has the potential to exceed $1 trillion

over the next three years. Hewlett Packard Enterprise will trade under the ticker symbol “HPE”. |

|

|

|

|

“Hewlett Packard Enterprise will be smaller and more focused than HP is today, and we will have a broad and deep portfolio of businesses that will help enterprises transition to the new style of business,” said

Whitman. “As a separate company, we are better positioned than ever to meet the evolving needs of our customers around the world.” |

Page 1 of 6

|

|

|

|

|

2016 outlook |

|

|

Tim Stonesifer, who will become Chief Financial Officer of Hewlett Packard Enterprise, provided a financial outlook for Hewlett Packard Enterprise in fiscal 2016. As a standalone company, Hewlett Packard Enterprise expects fiscal

2016 revenue to grow year-over-year in constant currency driven by continued strength in servers, storage and networking, and stabilization in services and software. The company anticipates currency impact to be a three point headwind to revenue

growth in fiscal 2016. |

|

|

|

|

Hewlett Packard Enterprise anticipates operating profit dollars to grow year-over-year in fiscal 2016, due to the continued focus on supply chain productivity, disciplined approach to discretionary spending and efforts to reshape

the workforce. The new company estimates fiscal 2016 non-GAAP diluted net EPS to be in the range of $1.85 to $1.95, and estimated GAAP diluted net EPS to be in the range of $0.75 to $0.85. |

|

|

|

|

Fiscal 2016 non-GAAP diluted net EPS estimates exclude after-tax costs of $1.10 primarily related to restructuring charges, separation costs and amortization of intangible assets. |

|

|

|

|

Information about HP’s use of non-GAAP financial information is provided under “Use of non-GAAP financial information” below. |

|

|

|

|

Cash Flow |

|

|

Hewlett Packard Enterprise expects to generate approximately $5.0-$5.2 billion in cash flow from operations and $2.0-$2.2 billion in free cash flow in fiscal 2016. This includes separation cash payments of $0.4 billion and

restructuring cash payments of $1.2 billion. |

|

|

Excluding these separation and restructuring payments, HP expects Hewlett Packard Enterprise’s normalized free cash flow to be approximately $3.7 billion in fiscal 2016. |

|

|

|

|

Capital Allocation Approach |

|

|

Stonesifer stressed that Hewlett Packard Enterprise will maintain a disciplined capital allocation framework to drive shareholder value, and expects at least 50% of free cash flow in fiscal 2016 to be returned to shareholders

through approximately $400 million in dividends and the remaining in share repurchases. |

|

|

|

|

Restructuring Related Activities |

|

|

Stonesifer presented a clear plan to deliver $2.7 billion in ongoing annual cost reductions both associated with the separation and specific to the Enterprise Services (“ES”) business. |

|

|

|

|

These new activities will enable Hewlett Packard Enterprise to achieve $0.7 billion of ongoing cost savings associated with the separation, including adjustments to real estate strategy and other reorganizations across the

portfolio. |

Page 2 of 6

|

|

|

|

|

In addition, it will enable ES to achieve $2.0 billion of gross annualized cost reductions, helping ES achieve a long-term, sustainable 7-9% operating profit margin. |

|

|

|

|

To achieve these savings, Hewlett Packard Enterprise expects 25,000 to 30,000 people to leave the company, primarily associated with the ES transformation. |

|

|

|

|

This will result in a GAAP-only charge of approximately $2.7 billion, beginning in the fourth quarter fiscal 2015. The cash impact will be approximately $2.6 billion over the next three years, beginning in fiscal 2016. |

|

|

|

|

“These restructuring activities will enable a more competitive, sustainable cost structure for the new Hewlett Packard Enterprise,” said Whitman. “We’ve done a significant amount of work over the past few years

to take costs out and simplify processes and these final actions will eliminate the need for any future corporate restructuring.”. |

|

|

|

|

Cloud Strategy Update |

|

|

|

|

Whitman provided an overview of Hewlett Packard Enterprise’s cloud strategy, and how the company is uniquely positioned to help customers migrate more of their applications and services to a hybrid cloud environment. |

|

|

|

|

HPE Helion ensures that customers’ applications are deployed to the right IT environment - based on business requirements like security levels, service availability and regulatory compliance – making it easier to build,

manage and consume workloads in a hybrid IT environment. |

|

|

|

|

Hewlett Packard Enterprise’s hybrid infrastructure strategy is consistent with market data that shows that a combination of traditional IT and private clouds will dominate the market for the foreseeable future. Nearly 90% of IT

spend over the next three years will be in traditional IT and private cloud. |

|

|

|

|

The company expects cloud revenue in fiscal 2015 to be approximately $3 billion, growing over 20% annually for the next several years. This estimate includes revenue from our enterprise group, software and enterprise services

segments which support customers’ cloud build and consume. |

|

|

|

|

Business Updates |

|

|

Over the course of the day, the future Hewlett Packard Enterprise management team provided updates on business segments, including: |

|

|

|

|

Enterprise Services |

|

|

|

|

● Mike Nefkens, Executive Vice

President and General Manager of Enterprise Services (“ES”), gave an overview of the progress ES has made over the past three years and the opportunity ahead. ES, which will be critical to Hewlett Packard Enterprise’s solution-based

approach, is delivering accelerated profit growth and revenue stabilization in constant currency |

Page 3 of 6

|

|

|

|

|

● The cost reduction program,

including the $2 billion restructuring program, is driving operating profit improvement and will result in a long-term, sustainable, market competitive cost structure with a 7-9% operating margin by fiscal 2018. |

|

|

● Given the importance of Enterprise

Services to the overall turnaround strategy, HP provided an outlook for ES for fiscal 2016. Revenue is expected to be flat to down 2% year-over-year in constant currency, however, with continued focus on cost management and operational improvements,

operating margin is expected to further improve to be in the range of 6-7% for fiscal 2016. |

|

|

● Approximately 37% of Hewlett

Packard Enterprise’s revenue will come from ES. |

|

|

|

|

Software |

|

|

|

|

● Robert Youngjohns, Executive Vice

President and General Manager of Software, discussed the performance of the business and the essential role of Software in the go-forward strategy of Hewlett Packard Enterprise. |

|

|

● HPE Software is margin accretive

with good cash flow, and serves as an intellectual property anchor in the new style of business. |

|

|

● Youngjohns discussed the growth

products and areas of investment of Software, and outlined a clear strategy to position Software for long-term growth, including continuing to focus the portfolio around key growth areas. |

|

|

● Approximately 7% of Hewlett

Packard Enterprise’s revenue will come from Software. |

|

|

|

|

Enterprise Group |

|

|

|

|

● Antonio Neri, Executive Vice

President and General Manager of Enterprise Group (“EG”), gave an overview of the strategy, performance and key areas of the portfolio that are driving the future of EG. |

|

|

● EG financial performance has been

strong in fiscal 2015, driven by cost reductions, innovative product introductions, a new leadership team and a stronger go-to-market strategy. |

|

|

● Hewlett Packard Enterprise

anticipates the overall market for EG to grow at a 3% CAGR, and certain markets such as converged infrastructure, Cloud Hardware and Network Functions Virtualization, to grow at an even faster pace. |

|

|

● Approximately 50% of Hewlett

Packard Enterprise’s revenue will come from EG, spread across servers, storage, networking, and technology services. |

|

|

|

|

Webcast details |

|

|

A webcast of today’s event, along with management presentations and other materials, is available on the Investor Relations website. This press release contains only a summary of some of the information being presented

at today’s event and should be read in conjunction with the management presentations and other materials made available on that website. |

Page 4 of 6

|

|

|

|

|

About HP |

|

|

HP creates new possibilities for technology to have a meaningful impact on people, businesses, governments and society. With the broadest technology portfolio spanning printing, personal systems, software, services and IT

infrastructure, HP delivers solutions for customers’ most complex challenges in every region of the world. More information about HP (NYSE: HPQ) is available at http://www.hp.com. |

|

|

|

|

Use of non-GAAP financial information |

|

|

HP has included non-GAAP financial measures in this press release. Definitions of these non-GAAP financial measures and reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are

included in the slides presented at the 2015 Securities Analyst Meeting, which will be available for a period of one year thereafter at www.hp.com/investor/SAM2015. |

|

|

HP’s management uses revenue on a constant currency basis, non-GAAP operating profit, non-GAAP operating expense, non-GAAP operating income and earnings, net debt, net cash, operating company net debt and operating company net

cash, non-GAAP net earnings, non-GAAP diluted earnings per share, and HP’s non-GAAP tax rate to evaluate and forecast HP’s performance before gains, losses or other charges that are considered by HP’s management to be outside of

HP’s core business segment operating results. HP also provides forecasts of non-GAAP diluted net earnings per share. Free cash flow and normalized free cash flow are liquidity measure that provides useful information to management about the

amount of cash available for investment in HP’s businesses, funding strategic acquisitions, repurchasing stock and other purposes. |

|

|

These non-GAAP financial measures may have limitations as analytical tools, and these measures should not be considered in isolation or as a substitute for analysis of HP’s results as reported under GAAP. Items such as

impairment of goodwill and intangible assets and amortization of intangible assets, though not directly affecting HP’s cash position, represent the loss in value of intangible assets over time. The expense associated with this loss in value is

not included in non-GAAP operating profit, non-GAAP net earnings, non-GAAP diluted earnings per share and HP’s non-GAAP tax rate and therefore does not reflect the full economic effect of the loss in value of those intangible assets. In

addition, items such as separation and restructuring charges that are excluded from non-GAAP operating expense, non-GAAP operating profit, non-GAAP net earnings, non-GAAP diluted earnings per share and HP’s non-GAAP tax rate can have a material

impact on cash flows and earnings per share. Free cash flow and normalized free cash flow do not represent the total increase or decrease in the cash balance for the period. The non-GAAP financial information that we provide also may differ from the

non-GAAP information provided by other companies. |

|

|

We compensate for the limitations on our use of these non-GAAP financial measures by relying primarily on our GAAP financial statements and using non-GAAP financial measures only supplementally. We also provide robust and detailed

reconciliations of each non-GAAP financial measure to the most directly comparable GAAP measure, and we encourage investors to review carefully those reconciliations. |

|

|

We believe that providing these non-GAAP financial measures in addition to the related GAAP measures provides investors with greater transparency to the information used by HP’s management in its financial and operational

decision-making and allows investors to see HP’s results “through the eyes” of management. We further believe that providing this information better enables investors to understand HP’s operating performance and to evaluate the

efficacy of the methodology and information used by management to evaluate and measure such performance. |

Page 5 of 6

|

|

|

|

|

Forward-Looking Statements |

|

|

This press release contains forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the assumptions prove incorrect, the results of Hewlett-Packard Company

(“HP”) and Hewlett Packard Enterprise Company (“HPE”) may differ materially from those expressed or implied by such forward-looking statements and assumptions. All statements other than statements of historical fact are

statements that could be deemed forward-looking statements, including but not limited to any projections of revenue, margins, expenses, effective tax rates, net earnings, net earnings per share, cash flows, benefit plan funding, deferred tax assets,

share repurchases, currency exchange rates or other financial items; any projections of the amount, timing or impact of cost savings or restructuring charges; any statements of the plans, strategies and objectives of management for future

operations, including the previously announced separation transaction and the future performances of the post-separation companies if the separation is completed, as well as the execution of restructuring plans and any resulting cost savings or

revenue or profitability improvements; any statements concerning the expected development, performance, market share or competitive performance relating to products or services; any statements regarding current or future macroeconomic trends or

events and the impact of those trends and events on HP or HPE and their financial performance; any statements regarding pending investigations, claims or disputes; any statements of expectation or belief; and any statements or assumptions underlying

any of the foregoing. Risks, uncertainties and assumptions include the need to address the many challenges facing HP’s or HPE’s businesses; the competitive pressures faced by HP’s or HPE’s businesses; risks associated with

executing HP’s or HPE’s strategy, including the planned separation transaction; the impact of macroeconomic and geopolitical trends and events; the need to manage third-party suppliers and the distribution of HP’s or HPE’s

products and the delivery of HP’s or HPE’s services effectively; the protection of HP’s or HPE’s intellectual property assets, including intellectual property licensed from third parties; risks associated with HP’s or

HPE’s international operations; the development and transition of new products and services and the enhancement of existing products and services to meet customer needs and respond to emerging technological trends; the execution and performance

of contracts by HP or HPE and their suppliers, customers and partners; the hiring and retention of key employees; integration and other risks associated with business combination and investment transactions; the execution, timing and results of the

separation transaction or restructuring plans, including estimates and assumptions related to the cost (including any possible disruption of HP’s or HPE’s business) and the anticipated benefits of implementing the separation transaction

and restructuring plans; the resolution of pending investigations, claims and disputes; and other risks that are described in HP’s Annual Report on Form 10-K for the fiscal year ended October 31, 2014, HP’s other filings with the

Securities and Exchange Commission, including HP’s Quarterly Report on Form 10-Q for the fiscal quarter ended July 31, 2015 and the “Risk Factors” section of the preliminary information statement included in HPE’s

Registration Statement on Form 10 as amended August 10, 2015 and September 4, 2015. HP assumes no obligation to update these forward-looking statements. |

Page 6 of 6

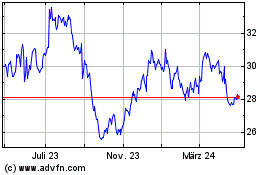

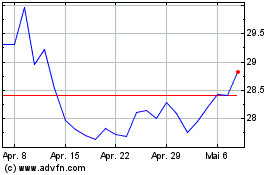

HP (NYSE:HPQ)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2023 bis Jul 2024