Hewlett-Packard Expects Up To 30,000 More Job Cuts--2nd Update

16 September 2015 - 12:36AM

Dow Jones News

By Robert McMillan

Hewlett-Packard Co. said Tuesday that it plans to cut another

25,000 to 30,000 jobs as it whittles down its services group and

restructures the company into separate entities.

The layoffs are part of a plan to cut $2.7 billion in annual

costs, the company said. They amount to approximately 10% of the

company's workforce of 300,000 and will primarily affect the

company's enterprise services group, which has struggled to expand

profit margins in the face of a changing services business.

"These restructuring activities will enable a more competitive,

sustainable cost structure for the new Hewlett Packard Enterprise,"

Chief Executive Meg Whitman said in a news release. "We've done a

significant amount of work over the past few years to take costs

out and simplify processes, and these final actions will eliminate

the need for any future corporate restructuring."

The cuts will be part of a $2.7 billion charge that will start

to show up in the earnings for the company's fourth quarter, which

ends in October. In addition to the layoffs, this charge includes

$700 million in cost reductions from things such as site reductions

and other cuts as the company splits in two.

The layoffs are in addition to a 55,000 head count reduction

that the company previously announced.

Observers had been expecting tens of thousands of layoffs since

May, when H-P had warned that it expected to incur $2 billion in

restructuring charges, but today was the first time that the

company spelled out the exact number of layoffs it expects. H-P

didn't say when these layoffs will occur.

Hewlett Packard Enterprise, which is expected to split from the

current Hewlett-Packard on Nov. 1, will primarily sell servers and

software that corporations use to run their operations. That

business is threatened by big companies renting computing power

from Amazon.com Inc., Microsoft Corp. and International Business

Machines Corp., among others.

The new enterprise company, set to trade under the stock symbol

"HPE", is expected to have more than $50 billion in annual

revenue.

"Hewlett Packard Enterprise will be smaller and more focused

than H-P is today," said Ms. Whitman, who will be president and CEO

of the new company.

The remaining company, HP Inc., will push personal computers and

printers.

H-P said it expects the new enterprise company to report

per-share earnings between 75 cents and 85 cents in the fiscal year

ending around October 2016. Excluding per-share costs of about

$1.10 from the company's restructuring and the separation, Hewlett

Packard Enterprise projects per-share earnings between $1.85 and

$1.95.

The enterprise company expects to generate cash flow from

operations of between $5 billion and $5.2 billion in the next

fiscal year and free cash flow between $2 billion and $2.2 billion.

Hewlett Packard Enterprise plans to return at least 50% of that

free cash flow to shareholders through dividends and share

repurchases.

Hewlett Packard Enterprise said it sees revenue from

itscloud-related businesses growing more than 20% annually for the

next several years.

Write to Robert McMillan at Robert.Mcmillan@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 15, 2015 18:21 ET (22:21 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

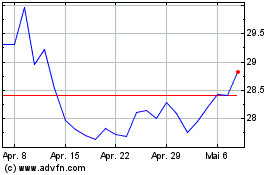

HP (NYSE:HPQ)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

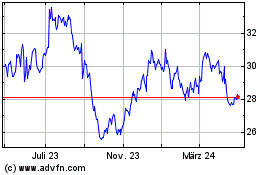

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2023 bis Jul 2024