Will Hewlett-Packard (HPQ) Surprise This Earnings Season? - Analyst Blog

19 Mai 2014 - 4:00PM

Zacks

Hewlett-Packard Company (HPQ) is set to report

the second-quarter fiscal 2014 results on May 22. Last quarter, the

company posted positive earnings surprise of 5.88%. Let us see how

things are shaping up for this announcement.

Factors this Past Quarter

Hewlett-Packard reported better-than-expected first-quarter

results on the back of higher IP sales and cost cutting initiatives

which aided margins. The share buybacks also supported

earnings.

Going forward, we believe that Hewlett-Packard’s strategic focus

on the software business will help it to diversify its revenue

source which is predominantly dependent on PCs. Additionally, the

company’s traction in the cloud, security and big data segments are

the positives. Hewlett-Packard’s probable entry into the 3D

printing market should be another growth catalyst given the rapid

adoption of 3D technology across industries.

Nonetheless, macroeconomic challenges, shrinking PC industry and

tepid IT spending are the challenges in the near term. Competition

from International Business Machines and Oracle remain the

headwinds, going forward.

Earnings Whispers?

Our proven model does not conclusively show that Hewlett-Packard

will beat earnings this quarter. That is because a stock needs to

have both a positive Earnings ESP and a Zacks Rank #1, 2 or 3 for

this to happen. That is not the case here as you will see

below.

Zacks ESP: Both the Most Accurate estimate and

the Zacks Consensus Estimate stand at 88 cents. Hence, the

difference is 0.00%.

Zacks Rank: Hewlett-Packard’s Zacks Rank #2

(Buy) when combined with a 0.00% ESP makes surprise prediction

difficult.

We caution against stocks with Zacks Rank #4 and 5 (Sell-rated

stocks) going into the earnings announcement, especially when the

company is seeing negative estimate revisions momentum.

Other Stocks to Consider

Here are some other companies you may want to consider as our

model shows they have the right combination of elements to post an

earnings beat this quarter:

Intuit Inc. (INTU), with Earnings ESP of +1.18%

and a Zacks Rank #2.

Best Buy Co., Inc. (BBY), with Earnings ESP of

+5.00% and a Zacks Rank #2.

Nimble Storage, Inc. (NMBL), with Earnings ESP

of +6.25% and a Zacks Rank #3 (Hold).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

BEST BUY (BBY): Free Stock Analysis Report

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

INTUIT INC (INTU): Free Stock Analysis Report

NIMBLE STORAGE (NMBL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

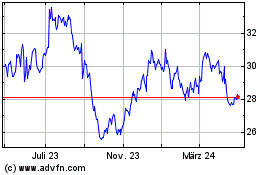

HP (NYSE:HPQ)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

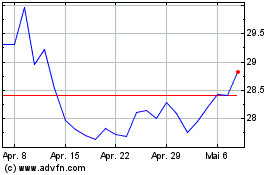

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2023 bis Jul 2024