Will Lexmark (LXK) Beat Earnings Estimates? - Analyst Blog

18 April 2014 - 12:00AM

Zacks

Lexmark International Inc. (LXK) is set to

report first-quarter 2014 results on Apr 22. Last quarter, the

company posted a positive earnings surprise of 8.26%. Let’s see how

things are shaping up for this announcement.

Factors This Past Quarter

Lexmark’s fourth-quarter results were impressive as the company

witnessed strong revenue growth across all the business segments

and improved Imaging Solutions and Services (ISS) performance.

However, the first-quarter guidance was disappointing, reflecting

the Inkjet exit and macro uncertainty.

It is encouraging to note that Lexmark’s transition of business

model from low-margin printer sales to high-margin process

management software services, Managed Print Services (MPS) and

Perceptive bodes well. Moreover, its laser printing hardware and

multifunction peripheral (MFP) printer business have yielded

positive results.

Additionally, Lexmark’s dominance in the MPS market is supported

by the large number of deal wins. Though constant pricing pressure

from competitors such as Canon Inc., Xerox Corp.

(XRX) and Hewlett-Packard (HPQ), and a high debt

burden will be concerns, we expect Lexmark to improve its margins

with increased focus on software and services.

Earnings Whispers?

Our proven model does not conclusively show that Lexmark will

beat earnings this quarter. That is because a stock needs to have

both a positive Earnings ESP and a Zacks Rank #1, 2 or 3 for this

to happen. That is not the case here as you will see below.

Zacks ESP: Both the Most Accurate estimate and

the Zacks Consensus Estimate stand at 87 cents. Hence, the

difference is 0.00%.

Zacks Rank: Lexmark’s Zacks Rank #3 (Hold)

which when combined with a 0.00% ESP makes surprise prediction

difficult.

We caution against stocks with Zacks Ranks #4 and 5 (Sell-rated

stocks) going into the earnings announcement, especially when the

company is seeing negative estimate revisions momentum.

Other Stocks to Consider

Another company that you may want to consider as our model shows

that it has the right combination of elements to post an earnings

beat this quarter is:

Amazon.com Inc. (AMZN) has an Earnings ESP of

+4.76% and a Zacks Rank #2 (Buy).

AMAZON.COM INC (AMZN): Free Stock Analysis Report

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

LEXMARK INTL (LXK): Free Stock Analysis Report

XEROX CORP (XRX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

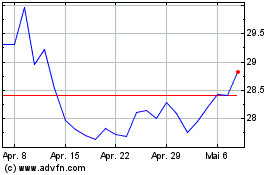

HP (NYSE:HPQ)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

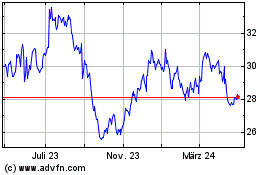

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2023 bis Jul 2024