IBM Buys Daeja Image Systems - Analyst Blog

25 September 2013 - 1:05AM

Zacks

International Business Machines (IBM) recently

announced its acquisition of privately-held Daeja Image Systems

Ltd. The flagship product of Daeja’s “ViewONE Pro” has the

capability to display documents in different formats, consisting of

TIF, BMP, JPG, GIF, PDF, Excel and PNG. Moreover, ViewONE’s caching

capabilities can ensure exceptionally large files can be easily

viewed.

By using Daeja’s flagship solution ViewOne Pro, users can open

and view documents and images in different file formats, even if

the native application is not present on their devices, Daeja’s

software also enables viewing of large documents such as medical

X-rays, CAD files or photos of automobile accidents offered in

various formats.

This acquisition would be especially helpful for IBM, as ViewONE

Pro has often been used in combination with IBM FileNet, OpenText

and OpenText Vignette, EMC Documentum, as well as Oracle

Stellent.

IBM has resorted to acquisitions time and again to gain access

to new technology. This strategy has helped IBM to enhance its

product portfolio, which ultimately helps in generating incremental

revenues, strengthening its technology leadership and resulting in

a more favorable mix of business.

In Aug 2013, IBM strengthened its position in the IT security

market with the acquisition of Trusteer. The acquisition cost IBM

around $700.0 million to $1.0 billion. With this acquisition the

company strengthened its solutions offering capability related to

financial frauds and other cyber attacks. The takeover helped the

company strengthen its technical capability of IBM’s security labs

well.

IBM’s strategy of acquiring companies that can be easily

integrated into its current business has helped it to expand its

product portfolio to higher-growth segments, such as business

analytics, IT security, cloud computing and software. The

acquisitions have also increased its scale of operations

globally.

In fiscal 2012, IBM completed 11 acquisitions for an aggregate

cost of $3.96 billion. IBM plans to spend approximately $20.0

billion on acquisitions though 2015, which is expected to boost

top-line growth by approximately 2.0%. We believe that IBM will

continue to pursue strategic acquisitions to boost its product

portfolio, going forward.

However, IBM is expected to face tough competition from the

likes of Oracle Corp. (ORCL),

Hewlett-Packard Co. (HPQ) and Microsoft

Corp. (MSFT), in the near term.

Currently, IBM has a Zacks Rank #3 (Hold).

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

INTL BUS MACH (IBM): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

ORACLE CORP (ORCL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

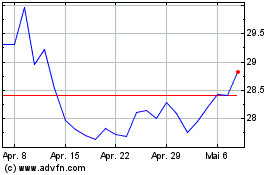

HP (NYSE:HPQ)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

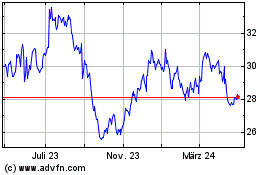

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2023 bis Jul 2024