Second highest silver reserve and largest

gold resource in company history

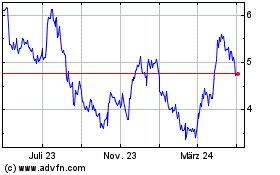

Hecla Mining Company (NYSE:HL) today reported exploration

results and year end reserves. The exploration program has resulted

in the second highest silver reserves and the largest gold resource

in Hecla’s history. Drilling results include very high-grade and

wide intercepts.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240213785221/en/

Figure 1: District geology with 2023

drill target locations. (Graphic: Business Wire)

“Hecla’s silver reserves are the second highest in our 133-year

history at 238 million silver ounces and only 1% less than last

year’s all-time highest reserve, and gold resource is the highest

in our history,” said Phillips S. Baker, Jr., President and CEO.

“The 2023 exploration program successfully expanded our reserves at

Keno Hill and Lucky Friday and expanded mineralization at Greens

Creek.”

Baker continued, “Keno Hill’s 2023 exploration provided an 11%

increase in reserves, now 45% higher since the acquisition, and

does not reflect much of the drilling reported this quarter, so we

expect the reserve to grow. Drilling has intersected wider zones

and higher grades – such as 54 ounces per ton silver over 39 feet –

than are currently in the reserve model and has encountered

high-grade mineralization more than 1,000 feet deeper than any

previous drilling; both are changing the potential size of the

deposit. At Greens Creek, Hecla's exploration efforts spanning 37

years consistently yield remarkable results in both grade and width

across the four key metals: silver, gold, zinc, and lead, and we

still have many potential targets to drill. It’s almost as if we

get a jump in reserves every few years that further extends mine

life.”

Baker concluded, “With the recent acquisition of ATAC and its

massive 700 square mile land package, we now have 20 district-sized

properties with excellent exploration potential to explore and grow

our resource base, primarily in the U.S. and Canada. Hecla produces

almost half of silver in the U.S., and we expect to be Canada’s

largest silver producer in 2024. With half a million ounces of

silver required to produce 1 gigawatt of solar, Hecla is playing a

key role in mining the silver the world needs.”

EXPLORATION HIGHLIGHTS

Select drill highlights from the company’s exploration programs

include the following drill holes, additional drill holes and

details are included later in this release.

KENO HILL

- Footwall Vein: 54.0 oz/ton silver, 4.8% lead, and 2.5% zinc

over 39.5 feet

- Includes: 77.1 oz/ton silver, 8.1% lead, and 3.2% zinc over

11.4 feet; and

- Includes: 122.1 oz/ton silver, 8.0% lead, and 6.5% zinc over

8.9 feet

- Footwall Vein: 58.6 oz/ton silver, 3.6% lead, and 4.3% zinc

over 10.1 feet

- Main Vein: 32.7 oz/ton silver, 1.7% lead, and 1.7% zinc over

15.2 feet

- Includes: 78.9 oz/ton silver, 3.9% lead, and 2.3% zinc over 5.8

feet

- Main Vein: 32.4 oz/ton silver, 8.3% lead, and 4.1% zinc over

9.2 feet

- Includes: 114.9 oz/ton silver, 41.5% lead, and 8.4% zinc over

1.5 feet

GREENS CREEK

West Zone

- 63.4 oz/ton silver, 0.64 oz/ton gold, 8.3% zinc, and 4.3% lead

over 26.04 feet

- 28.3 oz/ton silver, 0.08 oz/ton gold, 8.3% zinc, and 4.7% lead

over 12.8 feet

- 35.2 oz/ton silver, 0.08 oz/ton gold, 10.0% zinc, and 6.3% lead

over 27.3 feet

Upper Plate Zone

- 19.6 oz/ton silver, 0.05 oz/ton gold, 10.9% zinc and 5.4% lead

over 27.9 feet

- 28.3 oz/ton silver, 0.01 oz/ton gold, 2.6% zinc and 1.3% lead

over 23.9 feet

5250 Zone

- 18.7 oz/ton silver, 0.05 oz/ton gold, 11.4% zinc, and 3.6% lead

over 26.8 feet

RESERVES & RESOURCES HIGHLIGHTS

- Silver reserves at 238 million ounces with additions at Keno

Hill and Lucky Friday after depletion.

- Keno Hill reserves increased 10% to 55 million ounces, an

increase of 45% since acquisition.

- Gold reserves decreased by 16% due to the strategic change to

transition to a surface operation only at Casa Berardi.

- Measured and indicated gold reserves increased 21% and inferred

gold resources increased 11% following the acquisition of ATAC

Resources Ltd (“ATAC”).

YEAR-END 2023 RESERVES AND RESOURCES

On a consolidated basis, the Company replaced 11 million ounces

of silver produced during the year. At the Lucky Friday and Keno

Hill, production was replaced, and additional silver reserves were

defined. Greens Creek saw a drop in silver reserves of 10% due to

depletion and other changes not offset by drilling additions. The

Company’s proven and probable gold reserves declined 16% to 2.1

million ounces due to having successfully implemented a strategic

shift at Casa Berardi transitioning the operation to an open pit

only operation.

Reserve metal price assumptions for 2023 were $17/oz silver,

$1,650/oz gold, $1.15/lb zinc, and $0.90/lb lead, unchanged from

2022 except for gold, which was $1600/oz in the prior year.

Measured and indicated silver ounces are unchanged with

increases at Greens Creek and Keno Hill which offset the decrease

at Lucky Friday due to conversion to reserves. Measured and

indicated gold ounces also increased 21% to 4.4 million ounces.

Losses as a result of the current plan to only mine surface

material at Casa Berardi were offset by additions from the

acquisition of ATAC Resources Ltd. (ATAC) at the Osiris and Tiger

projects in the Yukon.

Inferred silver resources decreased less than 1% to 504 million

ounces with decreases at Greens Creek and Lucky Friday almost

offset by additions at Keno Hill. Inferred gold resources increased

11% to 6.3 million ounces with decreases at Casa Berardi offset by

the addition of the ATAC projects in the Yukon.

Resource metal price assumptions for 2023 were $21/oz silver,

$1750/oz gold, $1.35/lb zinc and $1.15/lb lead, and $3.00/lb

copper, unchanged from 2022 except for gold, which was $1700/oz in

the prior year.

A breakdown of the Company’s reserves and resources is set out

in Table A at the end of this news release.

EXPLORATION AND PRE-DEVELOPMENT UPDATE

Keno Hill, Yukon Territory

At Keno Hill, the underground definition and surface exploration

drilling programs continued to be focused on extending

mineralization, resource conversion in the high-grade Bermingham

Bear Zone Veins (Bear, Footwall, and Main Vein Zones), and

discovering and defining new mineral resources. During the fourth

quarter, two underground drills completed over 12,800 feet of

definition and geotechnical drilling, and two surface core drills

completed over 14,400 feet of exploration drilling targeting the

Deep Bermingham, Bermingham Townsite, Inca, and Coral Wigwam target

areas (Figure 1).

Bermingham underground definition and exploration drilling in

the three Bear Zone veins (Bear, Footwall, Main veins) continues to

extend mineralization to the northeast, southeast, and down dip

outside of the current reserve shapes (Figures 2, 3 and 4).

Drilling in the Bear Vein identified strong vein mineralization

between the Ursa and Splay faults where testing at higher

elevations had no significant mineralization; this new drilling

expands higher-grade mineralization between the faults and to the

southwest near the Arctic fault zone. Drilling in the Footwall Vein

intersected substantially wider and higher-grade mineralization

than modeled to the southwest internal to the reserve shape.

Drilling in the Main Vein intercepted strong mineralization at

depth and along strike significantly increasing the strike and

depth of high grade in this zone. Assay highlights include

(reported widths are estimates of true width):

- Bear Vein: 21.4 oz/ton silver, 2.8% lead, and 0.5% zinc over

11.7 feet

- Includes: 129.9 oz/ton silver, 14.8% lead, and 3.1% zinc over

1.6 feet

- Bear Vein: 25.5 oz/ton silver, 3.6% lead, and 1.2% zinc over

5.0 feet

- Footwall Vein: 54.0 oz/ton silver, 4.8% lead, and 2.5% zinc

over 39.5 feet

- Includes: 77.1 oz/ton silver, 8.1% lead, and 3.2% zinc over

11.4 feet; and

- Includes: 122.1 oz/ton silver, 8.0% lead, and 6.5% zinc over

8.9 feet

- Footwall Vein: 58.6 oz/ton silver, 3.6% lead, and 4.3% zinc

over 10.1 feet

- Main Vein: 32.7 oz/ton silver, 1.7% lead, and 1.7% zinc over

15.2 feet

- Includes: 78.9 oz/ton silver, 3.9% lead, and 2.3% zinc over 5.8

feet

- Main Vein: 32.4 oz/ton silver, 8.3% lead, and 4.1% zinc over

9.2 feet

- Includes: 114.9 oz/ton silver, 41.5% lead, and 8.4% zinc over

1.5 feet

Initial surface exploration drilling tested for continuity of

the Bermingham vein system at depth intersected strong

mineralization (87.2 oz/ton silver over 0.6 feet) 1,050 feet below

the existing Deep Bermingham resource. This mineralized intercept

resets and expands exploration potential in the district where

previously high-grade silver mineralization was thought to occur

only in the upper parts of the favorable Basil Quartzite host

stratigraphy.

Surface exploration drilling continued targeting the Bermingham

Townsite Vein and Townsite Vein Splay system intersected strong

mineralization which continues to be open for expansion at depth.

Assay highlights include (reported widths are estimates of true

width):

- Townsite Vein Splay: 73.5 oz/ton silver, 1.4% lead, and 0.2%

zinc over 4.6 feet

Surface exploration drilling targeting the Inca Vein located

east of the Hector Calumet area testing for continuity from

historic drillhole intercepts intersected strong silver

mineralization with significant intercepts associated indium and

zinc mineralization. Limited drilling to date has outlined a

mineralized zone of over 800 feet of strike length and is open for

expansion to the northeast and southwest along strike and up and

down dip.

- Inca Vein 2: 4.7 oz/ton silver, 0.5% lead, 2.7% zinc, and 1.6

oz/ton indium over 22.6 feet

- Includes: 42.9 oz/ton silver, 3.6 oz/ton lead, 21.9% zinc, and

14.9 oz/ton indium over 2.1 feet

- Inca Vein 2: 5.8 oz/ton silver, 0.2% lead, 1.6% zinc, and 0.9

oz/ton indium over 7.4 feet

- Includes: 107.3 oz/ton silver, 4.6 oz/ton lead, 15.7% zinc, and

10.5 oz/ton indium over 0.4 feet

Greens Creek, Alaska

At Greens Creek, four underground drills completed over 38,000

feet of drilling in 79 drillholes focused on resource conversion

and exploration that extends mineralization of known resources.

Drilling was focused in the 9a, 200 South, East, West, Gallagher,

and Gallagher Fault Block zones while assay results were received

from drilling in the 200 South, 5250, East, Upper Plate, West, and

9a zones (Figure 5).

Underground drilling completed 25 drillholes in the 200 South

Zone targeting the upper orebody and the deeper mine contact

portions of the zone covering a strike length of 1,050 feet.

Unexpected zones of mineralized ore lithologies were intersected

early in a few of the drillholes before the targeted contact

expanding mineralization in those areas. Highlights from this

drilling include:

- 17.4 oz/ton silver, 0.02 oz/ton gold, 4.1% zinc, and 3.0% lead

over 21.1 feet

- 11.4 oz/ton silver, 0.06 oz/ton gold, 3.1% zinc, and 1.5% lead

over 7.0 feet

Drilling in the 5250 Zone targeted 150 feet of strike length in

the upper portion of the resources intersected thick sequences of

white baritic and massive sulfide ore lithologies above the modeled

resources expanding mineralization in that area of the zone.

Highlights from this drilling include:

- 18.7 oz/ton silver, 0.05 oz/ton gold, 11.4% zinc, and 3.6% lead

over 26.8 feet

Additional assay results have been received from underground

drilling in the northern, central, and eastern portion of the Upper

Plate zone, targeting mineralization for upgrading and expanding

resources over 900 feet of strike length. Results to date indicate

that drilling is upgrading and expanding mineralization in the

Upper Plate Zone. Highlights from this drilling include:

- 19.6 oz/ton silver, 0.05 oz/ton gold, 10.9% zinc and 5.4% lead

over 27.9 feet

- 28.3 oz/ton silver, 0.01 oz/ton gold, 2.6% zinc and 1.3% lead

over 23.9 feet

Strong assay results received from underground drilling in the

West Zone extend mineralization at the lower mine contact over 400

feet to the west of previous intercepts and infills a 200-foot gap

in drilling in the central ore band (Figure 6). Highlights from

this drilling include:

- 63.4 oz/ton silver, 0.64 oz/ton gold, 8.3% zinc, and 4.3% lead

over 26.04 feet

- 28.3 oz/ton silver, 0.08 oz/ton gold, 8.3% zinc, and 4.7% lead

over 12.8 feet

- 35.2 oz/ton silver, 0.08 oz/ton gold, 10.0% zinc, and 6.3% lead

over 27.3 feet

Detailed complete drill assay highlights can be found in Table B

at the end of the release.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE: HL) is the largest

silver producer in the United States. In addition to operating

mines in Alaska, Idaho, and Quebec, Canada, the Company is

developing a mine in the Yukon, Canada, and owns a number of

exploration and pre-development projects in world-class silver and

gold mining districts throughout North America.

Cautionary Statements Regarding

Estimates and Forward-Looking Statements, Including 2024

Outlook

Statements made or information provided in this news release

that are not historical facts are "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws, and

"forward-looking information" within the meaning of Canadian

securities laws. When a forward-looking statement expresses or

implies an expectation or belief as to future events or results,

such expectation or belief is expressed in good faith and believed

to have a reasonable basis. However, such statements are subject to

risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed,

projected or implied by the forward-looking statements.

Forward-looking statements often address our expected future

business and financial performance and financial condition and

often contain words such as “anticipate,” “intend,” “plan,” “will,”

“could,” “would,” “estimate,” “should,” “expect,” “believe,”

“project,” “target,” “indicative,” “preliminary,” “potential” and

similar expressions. Forward-looking statements in this news

release may include, without limitation: (i) the Company expects

fourth quarter 2023 exploration drilling should grow the reserves

at Keno Hill; (ii) the Company expects to grow its resource base,

primarily in the U.S. and Canada; (iii) the Company expects to be

Canada’s largest silver producer in 2024; and (iv) the Company will

play a key role in mining the silver the world needs for decades to

come. Estimates or expectations of future events or results are

based upon certain assumptions, which may prove to be incorrect,

which could cause actual results to differ from forward-looking

statements. Such assumptions, include, but are not limited to: (i)

there being no significant change to current geotechnical,

metallurgical, hydrological and other physical conditions; (ii)

permitting, development, operations and expansion of the Company’s

projects being consistent with current expectations and mine plans;

(iii) political/regulatory developments in any jurisdiction in

which the Company operates being consistent with its current

expectations; (iv) certain price assumptions for gold, silver, lead

and zinc; (v) prices for key supplies being approximately

consistent with current levels; (vi) the accuracy of our current

mineral reserve and mineral resource estimates; (vii) the Company’s

plans for development and production will proceed as expected and

will not require revision as a result of risks or uncertainties,

whether known, unknown or unanticipated; (viii) sufficient

workforce is available and trained to perform assigned tasks; (ix)

weather patterns and rain/snowfall within normal seasonal ranges so

as not to impact operations; (x) relations with interested parties,

including Native Americans, remain productive; and (xi) factors do

not arise that reduce available cash balances.

In addition, material risks that could cause actual results to

differ from forward-looking statements include, but are not limited

to: (i) gold, silver and other metals price volatility; (ii)

operating risks; (iii) currency fluctuations; (iv) increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans; (v) community relations; (vi)

conflict resolution and outcome of projects or oppositions; (vii)

litigation, political, regulatory, labor and environmental risks;

(viii) exploration risks and results, including that mineral

resources are not mineral reserves, they do not have demonstrated

economic viability and there is no certainty that they can be

upgraded to mineral reserves through continued exploration; (ix)

the failure of counterparties to perform their obligations under

hedging instruments; (x) we take a material impairment charge on

any of our assets; and (xi) inflation causes our costs to rise more

than we currently expect. For a more detailed discussion of such

risks and other factors, see the Company’s 2023 Annual Report on

Form 10-K, to be filed with the Securities and Exchange Commission

(“SEC”) on February 15, 2024. The Company does not undertake any

obligation to release publicly, revisions to any “forward-looking

statement,” including, without limitation, outlook, to reflect

events or circumstances after the date of this presentation, or to

reflect the occurrence of unanticipated events, except as may be

required under applicable securities laws. Investors should not

assume that any lack of update to a previously issued

“forward-looking statement” constitutes a reaffirmation of that

statement. Continued reliance on “forward-looking statements” is at

investors’ own risk.

Cautionary Statements to Investors on

Reserves and Resources

This news release uses the terms “mineral resources”, “measured

mineral resources”, “indicated mineral resources” and “inferred

mineral resources”. Mineral resources that are not mineral reserves

do not have demonstrated economic viability. You should not assume

that all or any part of measured or indicated mineral resources

will ever be converted into mineral reserves. Further, inferred

mineral resources have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or

economically, and an inferred mineral resource may not be

considered when assessing the economic viability of a mining

project, and may not be converted to a mineral reserve. We report

reserves and resources under the SEC’s mining disclosure rules

(“S-K 1300”) and Canada’s National Instrument 43-101 – Standards of

Disclosure for Mineral Projects (“NI 43-101”) because we are a

“reporting issuer” under Canadian securities laws. Unless otherwise

indicated, all resource and reserve estimates contained in this

press release have been prepared in accordance with S-K 1300 as

well as NI 43-101.

Qualified Person (QP)

Kurt D. Allen, MSc., CPG, VP - Exploration of Hecla Mining

Company and Keith Blair, MSc., CPG, Chief Geologist of Hecla

Limited, who serve as a Qualified Person under S-K 1300 and NI

43-101, supervised the preparation of the scientific and technical

information concerning Hecla’s mineral projects in this news

release. Technical Report Summaries (each a “TRS”) for each of the

Company’s Greens Creek and Lucky Friday properties are filed as

exhibits 96.1 and 96.2 respectively, to the Company’s Annual Report

on Form 10-K for the year ended December 31, 2022 and are available

at www.sec.gov. A TRS for each of the Company’s Casa Berardi and

Keno Hill properties will be filed as exhibits 96.3 and 96.4,

respectively, to the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023 to be filed on February 15, 2024 and

will then be available at www.sec.gov. Information regarding data

verification, surveys and investigations, quality assurance program

and quality control measures and a summary of analytical or testing

procedures for (i) the Greens Creek Mine are contained in its TRS

and in a NI 43-101 technical report titled “Technical Report for

the Greens Creek Mine” effective date December 31, 2018, (ii) the

Lucky Friday Mine are contained in its TRS and in its technical

report titled “Technical Report for the Lucky Friday Mine Shoshone

County, Idaho, USA” effective date April 2, 2014, (iii) Casa

Berardi will be contained in its TRS titled “Technical Report

Summary on the Casa Berardi Mine, Northwestern Quebec, Canada”

effective date December 31, 2023 and are contained in its NI 43-101

technical report titled “Technical Report on the mineral resource

and mineral reserve estimate for Casa Berardi Mine, Northwestern

Quebec, Canada” effective date December 31, 2018, (iv) Keno Hill

will be contained in its TRS titled “S-K 1300 Technical Report

Summary on the Keno Hill Mine, Yukon, Canada” and are contained its

NI 43-101 technical report titled “Technical Report on Updated

Mineral Resource and Reserve Estimate of the Keno Hill Silver

District” effective date April 1, 2021, and (v) the San Sebastian

Mine, Mexico, are contained in a technical report prepared for

Hecla titled “Technical Report for the San Sebastian Ag-Au

Property, Durango, Mexico” effective date September 8, 2015. Also

included or to be included in each TRS and the four technical

reports is a description of the key assumptions, parameters and

methods used to estimate mineral reserves and resources and a

general discussion of the extent to which the estimates may be

affected by any known environmental, permitting, legal, title,

taxation, socio-political, marketing, or other relevant factors.

Information regarding data verification, surveys and

investigations, quality assurance program and quality control

measures and a summary of sample, analytical or testing procedures

are contained in technical reports prepared for Klondex Mines Ltd.

for (i) the Fire Creek Mine (technical report dated March 31,

2018), (ii) the Hollister Mine (technical report dated May 31,

2017, amended August 9, 2017), and (iii) the Midas Mine (technical

report dated August 31, 2014, amended April 2, 2015). Information

regarding data verification, surveys and investigations, quality

assurance program and quality control measures and a summary of

sample, analytical or testing procedures are contained in technical

reports prepared for ATAC Resources Ltd. for (i) the Osiris Project

(technical report dated July 28, 2022) and (ii) the Tiger Project

(technical report dated February 27, 2020). Copies of these

technical reports are available under the SEDAR profiles of Klondex

Mines Unlimited Liability Company and ATAC Resources Ltd.,

respectively, at www.sedar.com (the Fire Creek technical report is

also available under Hecla’s profile on SEDAR). Mr. Allen and Mr.

Blair reviewed and verified information regarding drill sampling,

data verification of all digitally collected data, drill surveys

and specific gravity determinations relating to all the mines. The

review encompassed quality assurance programs and quality control

measures including analytical or testing practice, chain-of-custody

procedures, sample storage procedures and included independent

sample collection and analysis. This review found the information

and procedures meet industry standards and are adequate for Mineral

Resource and Mineral Reserve estimation and mine planning

purposes.

Table A

Mineral Reserves – 12/31/2023 (1)

Proven Reserves (1)

Asset

Location

Ownership

Tons (000)

Silver (oz/ton)

Gold (oz/ton)

Lead %

Zinc %

Silver (000 oz)

Gold (000 oz)

Lead Tons

Zinc Tons

Greens Creek (2,3)

United States

100.0%

9

11.3

0.08

3.5

8.4

100

1

310

740

Lucky Friday (2,4)

United States

100.0%

5,299

12.8

-

8.0

3.8

67,595

-

424,080

201,280

Casa Berardi Underground (2,5)

Canada

100.0%

55

-

0.12

-

-

-

7

-

-

Casa Berardi Open Pit (2,5)

Canada

100.0%

4,240

-

0.09

-

-

-

379

-

-

Keno Hill (2,6)

Canada

100.0%

-

-

-

-

-

-

-

-

-

Total

9,603

67,695

387

424,390

202,020

Probable Reserves (7)

Asset

Location

Ownership

Tons (000)

Silver (oz/ton)

Gold (oz/ton)

Lead %

Zinc %

Silver (000 oz)

Gold (000 oz)

Lead (Tons)

Zinc (Tons)

Greens Creek (2,3)

United States

100.0%

10,009

10.5

0.09

2.5

6.6

105,122

880

250,270

657,990

Lucky Friday (2,4)

United States

100.0%

966

10.8

-

7.1

2.9

10,411

-

68,320

28,100

Casa Berardi Underground (2,5)

Canada

100.0%

175

-

0.15

-

-

-

26

-

-

Casa Berardi Open Pit (2,5)

Canada

100.0%

11,384

-

0.08

-

-

-

859

-

-

Keno Hill (2,6)

Canada

100.0%

2,069

26.6

0.01

2.8

2.5

55,068

13

58,170

52,380

Total

24,603

170,601

1,778

376,760

738,470

Proven and Probable

Reserves

Asset

Location

Ownership

Tons (000)

Silver (oz/ton)

Gold (oz/ton)

Lead %

Zinc %

Silver (000 oz)

Gold (000 oz)

Lead (Tons)

Zinc (Tons)

Greens Creek (2,3)

United States

100.0%

10,018

10.5

0.09

2.5

6.6

105,222

881

250,580

658,730

Lucky Friday (2,4)

United States

100.0%

6,265

12.5

-

7.9

3.7

78,006

-

492,400

229,380

Casa Berardi Underground (2,5)

Canada

100.0%

230

-

0.14

-

-

-

33

-

-

Casa Berardi Open Pit (2,5)

Canada

100.0%

15,624

-

0.08

-

-

-

1,238

-

-

Keno Hill (2,6)

Canada

100.0%

2,069

26.6

0.01

2.8

2.5

55,068

13

58,170

52,380

Total

34,206

238,296

2,165

801,150

940,490

(1)

The term “reserve” means an estimate of

tonnage and grade or quality of indicated and measured mineral

resources that, in the opinion of the qualified person, can be the

basis of an economically viable project. More specifically, it is

the economically mineable part of a measured or indicated mineral

resource, which includes diluting materials and allowances for

losses that may occur when the material is mined or extracted. The

term “proven reserves” means the economically mineable part of a

measured mineral resource and can only result from conversion of a

measured mineral resource. See footnotes 8 and 9 below.

(2)

Mineral reserves are based on $17/oz

silver, $1,650/oz gold, $0.90/lb lead, $1.15/lb zinc, unless

otherwise stated. All Mineral Reserves are reported in-situ with

estimates of mining dilution and mining loss.

(3)

The reserve NSR cut-off values for Greens

Creek are $230/ton for all zones except the Gallagher Zone at

$235/ton; metallurgical recoveries (actual 2023): 80% for silver,

74% for gold, 82% for lead, and 89% for zinc.

(4)

The reserve NSR cut-off values for Lucky

Friday are $241.34/ton for the 30 Vein and $268.67/ton for the

Intermediate Veins; metallurgical recoveries (actual 2023): 96% for

silver, 95% for lead, and 85% for zinc

(5)

The average reserve cut-off grades at Casa

Berardi are 0.11 oz/ton gold underground and 0.03 oz/ton gold for

open pit. Metallurgical recovery (actual 2023): 85% for gold;

US$/CAN$ exchange rate: 1:1.3. Underground mineral reserves at Casa

Berardi were based on a gold price of $1,850/oz.

(6)

The reserve NSR cut-off value at Keno Hill

is $244.24/ton (CAN$350/tonne), Metallurgical recovery (actual

2023): 96% for silver, 93% for lead, 81% for zinc; US$/CAN$

exchange rate: 1:1.3

(7)

The term “probable reserves” means the

economically mineable part of an indicated and, in some cases, a

measured mineral resource. See footnotes 9 and 10 below.

Totals may not represent the sum of parts due to rounding

Mineral Resources - 12/31/2023 (8)

Measured Resources (9)

Asset

Location

Ownership

Tons (000)

Silver (oz/ton)

Gold (oz/ton)

Lead %

Zinc %

Copper %

Silver (000 oz)

Gold (000 oz)

Lead (Tons)

Zinc (Tons)

Copper (Tons)

Greens Creek (12,13)

United States

100.0%

-

-

-

-

-

-

-

-

-

-

-

Lucky Friday (12,14)

United States

100.0%

5,326

8.6

-

5.6

2.7

-

45,785

-

299,360

146,420

-

Casa Berardi Underground(12,15)

Canada

100.0%

1,099

-

0.21

-

-

-

-

234

-

-

-

Casa Berardi Open Pit (12,15)

Canada

100.0%

67

-

0.03

-

-

-

-

2

-

-

-

Keno Hill (12,16)

Canada

100.0%

-

-

-

-

-

-

-

-

-

-

-

San Sebastian - Oxide (17)

Mexico

100.0%

-

-

-

-

-

-

-

-

-

-

-

San Sebastian - Sulfide (17)

Mexico

100.0%

-

-

-

-

-

-

-

-

-

-

-

Fire Creek (18,19)

United States

100.0%

-

-

-

-

-

-

-

-

-

-

-

Hollister (18,20)

United States

100.0%

18

4.9

0.59

-

-

-

87

10

-

-

-

Midas (18,21)

United States

100.0%

2

7.6

0.68

-

-

-

14

1

-

-

-

Heva (22)

Canada

100.0%

-

-

-

-

-

-

-

-

-

-

-

Hosco (22)

Canada

100.0%

-

-

-

-

-

-

-

-

-

-

-

Star (12,23)

United States

100.0%

-

-

-

-

-

-

-

-

-

-

-

Rackla - Tiger Underground (29)

Canada

100.0%

881

-

0.09

-

-

-

-

75

-

-

-

Rackla - Tiger Open Pit (29)

Canada

100.0%

32

-

0.06

-

-

-

-

2

-

-

-

Rackla - Osiris Underground (30)

Canada

100.0%

-

-

-

-

-

-

-

-

-

-

-

Rackla - Osiris Open Pit (30)

Canada

100.0%

-

-

-

-

-

-

-

-

-

-

-

Total

7,425

45,886

324

299,360

146,420

-

Indicated Resources

(10)

Asset

Location

Ownership

Tons (000)

Silver (oz/ton)

Gold (oz/ton)

Lead %

Zinc %

Copper %

Silver (000 oz)

Gold (000 oz)

Lead (Tons)

Zinc (Tons)

Copper (Tons)

Greens Creek (12,13)

United States

100.0%

8,040

13.9

0.10

3.0

8.0

-

111,526

800

239,250

643,950

-

Lucky Friday (12,14)

United States

100.0%

1,011

8.0

-

6.0

2.7

-

8,136

-

60,200

26,910

-

Casa Berardi Underground (12,15)

Canada

100.0%

3,154

-

0.19

-

-

-

-

603

-

-

-

Casa Berardi Open Pit (12,15)

Canada

100.0%

205

-

0.03

-

-

-

-

5

-

-

-

Keno Hill (12,16)

Canada

100.0%

4,504

7.5

0.006

0.9

3.5

-

33,926

26

41,120

157,350

-

San Sebastian - Oxide (17)

Mexico

100.0%

1,453

6.5

0.09

-

-

-

9,430

135

-

-

-

San Sebastian - Sulfide (17)

Mexico

100.0%

1,187

5.5

0.01

1.9

2.9

1.2

6,579

16

22,420

34,100

14,650

Fire Creek (18,19)

United States

100.0%

114

1.0

0.46

-

-

-

113

53

-

-

-

Hollister (18,20)

United States

100.0%

70

1.9

0.58

-

-

-

130

40

-

-

-

Midas (18,21)

United States

100.0%

76

5.7

0.42

-

-

-

430

32

-

-

-

Heva (22)

Canada

100.0%

1,266

-

0.06

-

-

-

-

76

-

-

-

Hosco (22)

Canada

100.0%

29,287

-

0.04

-

-

-

-

1,202

-

-

-

Star (12,23)

United States

100.0%

1,068

3.0

-

6.4

7.7

-

3,177

-

67,970

82,040

-

Rackla - Tiger Underground (29)

Canada

100.0%

3,116

-

0.10

-

-

-

-

311

-

-

-

Rackla - Tiger Open Pit (29)

Canada

100.0%

960

-

0.08

-

-

-

-

76

-

-

-

Rackla - Osiris Underground (30)

Canada

100.0%

5,135

-

0.12

-

-

-

-

604

-

-

-

Rackla - Osiris Open Pit (30)

Canada

100.0%

960

-

0.13

-

-

-

-

128

-

-

-

Total

61,606

173,447

4,107

430,960

944,350

14,650

Measured & Indicated

Resources

Asset

Location

Ownership

Tons (000)

Silver (oz/ton)

Gold (oz/ton)

Lead %

Zinc %

Copper %

Silver (000 oz)

Gold (000 oz)

Lead (Tons)

Zinc (Tons)

Copper (Tons)

Greens Creek (12,13)

United States

100.0%

8,040

13.9

0.10

3.0

8.0

-

111,526

800

239,250

643,950

-

Lucky Friday (12,14)

United States

100.0%

6,337

8.3

-

5.8

2.7

-

53,921

-

359,560

173,330

-

Casa Berardi Underground (12,15)

Canada

100.0%

4,253

-

0.20

-

-

-

-

837

-

-

-

Casa Berardi Open Pit (12,15)

Canada

100.0%

272

-

0.03

-

-

-

-

7

-

-

-

Keno Hill (12,16)

Canada

100.0%

4,504

7.5

0.006

0.9

3.5

-

33,926

26

41,120

157,350

-

San Sebastian - Oxide (17)

Mexico

100.0%

1,453

6.5

0.09

-

-

-

9,430

135

-

-

-

San Sebastian - Sulfide (17)

Mexico

100.0%

1,187

5.5

0.01

1.9

2.9

1.2

6,579

16

22,420

34,100

14,650

Fire Creek (18,19)

United States

100.0%

114

1.0

0.46

-

-

-

113

53

-

-

-

Hollister (18,20)

United States

100.0%

88

2.5

0.58

-

-

-

217

50

-

-

-

Midas (18,21)

United States

100.0%

78

5.7

0.43

-

-

-

444

33

-

-

-

Heva (22)

Canada

100.0%

1,266

-

0.06

-

-

-

-

76

-

-

-

Hosco (22)

Canada

100.0%

29,287

-

0.04

-

-

-

-

1,202

-

-

-

Star (12,23)

United States

100.0%

1,068

3.0

-

6.4

7.7

-

3,177

-

67,970

82,040

-

Rackla - Tiger Underground (29)

Canada

100.0%

3,997

-

0.10

-

-

-

-

386

-

-

-

Rackla - Tiger Open Pit (29)

Canada

100.0%

992

-

0.08

-

-

-

-

78

-

-

-

Rackla - Osiris Underground (30)

Canada

100.0%

5,135

-

0.12

-

-

-

-

604

-

-

-

Rackla - Osiris Open Pit (30)

Canada

100.0%

960

-

0.13

-

-

-

-

128

-

-

-

Total

69,031

219,333

4,431

730,320

1,090,770

14,650

Inferred Resources

(11)

Asset

Location

Ownership

Tons (000)

Silver (oz/ton)

Gold (oz/ton)

Lead %

Zinc %

Copper %

Silver (000 oz)

Gold (000 oz)

Lead (Tons)

Zinc (Tons)

Copper (Tons)

Greens Creek (12,13)

United States

100.0%

1,930

13.4

0.08

2.9

6.9

-

25,891

154

55,890

133,260

-

Lucky Friday (12,14)

United States

100.0%

3,600

7.8

-

5.9

2.8

-

27,934

-

211,340

100,630

-

Casa Berardi Underground (12,15)

Canada

100.0%

1,475

-

0.22

-

-

-

-

332

-

-

-

Casa Berardi Open Pit (12,15)

Canada

100.0%

828

-

0.08

-

-

-

-

64

-

-

-

Keno Hill (12,16)

Canada

100.0%

2,836

11.2

0.003

1.1

1.8

-

31,791

9

32,040

51,870

-

San Sebastian - Oxide (17)

Mexico

100.0%

3,490

6.4

0.05

-

-

-

22,353

182

-

-

-

San Sebastian - Sulfide (17)

Mexico

100.0%

385

4.2

0.01

1.6

2.3

0.9

1,606

5

6,070

8,830

3,330

Fire Creek (18,19)

United States

100.0%

764

0.5

0.51

-

-

-

393

392

-

-

-

Fire Creek - Open Pit (24)

United States

100.0%

74,584

0.1

0.03

-

-

-

5,232

2,178

-

-

-

Hollister (18,20)

United States

100.0%

642

3.0

0.42

-

-

-

1,916

273

-

-

-

Midas (18,21)

United States

100.0%

1,232

6.3

0.50

-

-

-

7,723

615

-

-

-

Heva (22)

Canada

100.0%

2,787

-

0.08

-

-

-

-

216

-

-

-

Hosco (22)

Canada

100.0%

17,726

-

0.04

-

-

-

-

663

-

-

-

Star (12,23)

United States

100.0%

2,851

3.1

-

5.9

5.9

-

8,795

-

168,180

166,930

-

San Juan Silver (12,25)

United States

100.0%

2,570

14.9

0.01

1.4

1.1

-

38,203

34

49,400

39,850

-

Monte Cristo (26)

United States

100.0%

913

0.3

0.14

-

-

-

271

131

-

-

-

Rock Creek (12,27)

United States

100.0%

100,086

1.5

-

-

-

0.7

148,736

-

-

-

658,680

Libby Exploration Project (12,28)

United States

100.0%

112,185

1.6

-

-

-

0.7

183,346

-

-

-

759,420

Rackla - Tiger Underground (29)

Canada

100.0%

30

-

0.05

-

-

-

-

2

-

-

-

Rackla - Tiger Open Pit (29)

Canada

100.0%

152

-

0.07

-

-

-

-

10

-

-

-

Rackla - Osiris Underground (30)

Canada

100.0%

5,919

-

0.09

-

-

-

-

530

-

-

-

Rackla - Osiris Open Pit (30)

Canada

100.0%

4,398

-

0.12

-

-

-

-

514

-

-

-

Total

341,383

504,190

6,304

522,920

501,370

1,421,430

Note: All estimates are in-situ except for the proven reserves

at Greens Creek which are in surface stockpiles. Mineral resources

are exclusive of reserves.

(8)

The term "mineral resources" means a

concentration or occurrence of material of economic interest in or

on the Earth's crust in such form, grade or quality, and quantity

that there are reasonable prospects for economic extraction. A

mineral resource is a reasonable estimate of mineralization, taking

into account relevant factors such as cut-off grade, likely mining

dimensions, location or continuity, that, with the assumed and

justifiable technical and economic conditions, is likely to, in

whole or in part, become economically extractable. It is not merely

an inventory of all mineralization drilled or sampled.

(9)

The term "measured resources" means that

part of a mineral resource for which quantity and grade or quality

are estimated on the basis of conclusive geological evidence and

sampling. The level of geological certainty associated with a

measured mineral resource is sufficient to allow a qualified person

to apply modifying factors in sufficient detail to support detailed

mine planning and final evaluation of the economic viability of the

deposit. Because a measured mineral resource has a higher level of

confidence than the level of confidence of either an indicated

mineral resource or an inferred mineral resource, a measured

mineral resource may be converted to a proven mineral reserve or to

a probable mineral reserve.

(10)

The term "indicated resources" means that

part of a mineral resource for which quantity and grade or quality

are estimated on the basis of adequate geological evidence and

sampling. The level of geological certainty associated with an

indicated mineral resource is sufficient to allow a qualified

person to apply modifying factors in sufficient detail to support

mine planning and evaluation of the economic viability of the

deposit. Because an indicated mineral resource has a lower level of

confidence than the level of confidence of a measured mineral

resource, an indicated mineral resource may only be converted to a

probable mineral reserve.

(11)

The term "inferred resources" means that

part of a mineral resource for which quantity and grade or quality

are estimated on the basis of limited geological evidence and

sampling. The level of geological uncertainty associated with an

inferred mineral resource is too high to apply relevant technical

and economic factors likely to influence the prospects of economic

extraction in a manner useful for evaluation of economic viability.

Because an inferred mineral resource has the lowest level of

geological confidence of all mineral resources, which prevents the

application of the modifying factors in a manner useful for

evaluation of economic viability, an inferred mineral resource may

not be considered when assessing the economic viability of a mining

project, and may not be converted to a mineral reserve.

(12)

Mineral resources for operating properties

are based on $1,750/oz gold, $21/oz silver, $1.15/lb lead, $1.35/lb

zinc and $3.00/lb copper, unless otherwise stated. Mineral

resources for non-operating resource projects are based on

$1,700/oz for gold, $21.00/oz for silver, $1.15/lb for lead,

$1.35/lb for zinc and $3.00/lb for copper, unless otherwise

stated.

(13)

The resource NSR cut-off values for Greens

Creek are $230/ton for all zones except the Gallagher Zone at

$235/ton; metallurgical recoveries (actual 2023): 80% for silver,

74% for gold, 82% for lead, and 89% for zinc.

(14)

The resource NSR cut-off values for Lucky

Friday are $200.57/ton for the 30 Vein, $227.90/ton for the

Intermediate Veins and $198.48/ton for the Lucky Friday Veins;

metallurgical recoveries (actual 2023): 96% for silver, 95% for

lead, and 85% for zinc

(15)

The average resource cut-off grades at

Casa Berardi are 0.12 oz/ton gold for underground and 0.03 oz/ton

gold for open pit; metallurgical recovery (actual 2023): 85% for

gold; US$/CAN$ exchange rate: 1:1.3.

(16)

The resource NSR cut-off value at Keno

Hill is $129.10/ton (CAN$185/tonne); using minimum width of 4.9

feet (1.5m); metallurgical recovery (actual 2023): 96% for silver,

93% for lead, 81% for zinc; US$/CAN$ exchange rate: 1:1.3

(17)

Indicated resources for most zones at San

Sebastian based on $1,500/oz gold, $21/oz silver, $1.15/lb lead,

$1.35/lb zinc and $3.00/lb copper using a cut-off grade of

$90.72/ton ($100/tonne); $1700/oz gold used for Toro, Bronco, and

Tigre zones. Metallurgical recoveries based on grade dependent

recovery curves: recoveries at the mean resource grade average 89%

for silver and 84% for gold for oxide material and 85% for silver,

83% for gold, 81% for lead, 86% for zinc, and 83% for copper for

sulfide material. Resources reported at a minimum mining width of

8.2 feet (2.5m) for Middle Vein, North Vein, and East Francine,

6.5ft (1.98m) for El Toro, El Bronco, and El Tigre, and 4.9 feet

(1.5 m) for Hugh Zone and Andrea.

(18)

Mineral resources for Fire Creek,

Hollister and Midas are reported using $1,500/oz gold and $21/oz

silver prices, unless otherwise noted. A minimum mining width is

defined as four feet or the vein true thickness plus two feet,

whichever is greater.

(19)

Fire Creek mineral resources are reported

at a gold equivalent cut-off grade of 0.283 oz/ton. Metallurgical

recoveries: 90% for gold and 70% for silver.

(20)

Hollister mineral resources, including the

Hatter Graben are reported at a gold equivalent cut-off grade of

0.238 oz/ton. Metallurgical recoveries: 88% for gold and 66% for

silver

(21)

Midas mineral resources are reported at a

gold equivalent cut-off grade of 0.237 oz/ton. Metallurgical

recoveries: 90% for gold and 70% for silver. A gold-equivalent

cut-off grade of 0.1 oz/ton and a gold price of $1,700/oz used for

Sinter Zone with resources undiluted.

(22)

Measured, indicated and inferred resources

at Heva and Hosco are based on $1,500/oz gold. Resources are

without dilution or material loss at a gold cut-off grade of 0.01

oz/ton for open pit and 0.088 oz/ton for underground. Metallurgical

recovery: Heva: 95% for gold, Hosco: 88% for gold.

(23)

Indicated and Inferred resources at the

Star property are reported using a minimum mining width of 4.3 feet

and an NSR cut-off value of $150/ton; Metallurgical recovery: 93%

for silver, 93% for lead, and 87% for zinc.

(24)

Inferred open-pit resources for Fire Creek

calculated November 30, 2017 using gold and silver recoveries of

65% and 30% for oxide material and 60% and 25% for mixed

oxide-sulfide material. Indicated Resources reclassified as

Inferred in 2019. Open pit resources are calculated at $1,400 gold

and $19.83 silver and cut-off grade of 0.01 Au Equivalent oz/ton

and is inclusive of 10% mining dilution and 5% ore loss. Open pit

mineral resources exclusive of underground mineral resources.

NI43-101 Technical Report for the Fire Creek Project, Lander

County, Nevada; Effective Date March 31, 2018; prepared by

Practical Mining LLC, Mark Odell, P.E. for Hecla Mining Company,

June28, 2018.

(25)

Inferred resources reported at a minimum

mining width of 6.0 feet for Bulldog and an NSR cut-off value of

$175/ton and 5.0 feet for Equity and North Amethyst veins at an NSR

cut-off value of $100/ton; Metallurgical recoveries based on grade

dependent recovery curves; metal recoveries at the mean resource

grade average 89% silver, 74% lead, and 81% zinc for the Bulldog

and a constant 85% gold and 85% silver for North Amethyst and

Equity.

(26)

Inferred resource at Monte Cristo reported

at a minimum mining width of 5.0 feet; resources based on $1,400

Au, $26.50 Ag using a 0.06 oz/ton gold cut-off grade. Metallurgical

recovery: 90% for gold and 90% silver.

(27)

Inferred resource at Rock Creek reported

at a minimum thickness of 15 feet and an NSR cut-off value of

$24.50/ton; Metallurgical recoveries: 88% for silver and 92% for

copper. Resources adjusted based on mining restrictions as defined

by U.S. Forest Service, Kootenai National Forest in the June 2003

'Record of Decision, Rock Creek Project'.

(28)

Inferred resource at the Libby Exploration

Project reported at a minimum thickness of 15 feet and an NSR

cut-off value of $24.50/ton NSR; Metallurgical recoveries: 88% for

silver and 92% copper. Resources adjusted based on mining

restrictions as defined by U.S. Forest Service, Kootenai National

Forest, Montana DEQ in December 2015 'Joint Final EIS, Montanore

Project' and the February 2016 U.S Forest Service - Kootenai

National Forest 'Record of Decision, Montanore Project'.

(29)

Mineral resources at the Rackla-Tiger

Project are based on a gold price of $1650/oz, metallurgical

recovery of 95% for gold, and cut-off grades of 0.02 oz/ton gold

for the open pit portion of the resources and 0.04 oz/ton gold for

the underground portions of the resources; US$/CAN$ exchange rate:

1:1.3.

(30)

Mineral resources at the Rackla-Osiris

Project are based on a gold price of $1,850/oz, metallurgical

recovery of 83% for gold, and cut-off grades of 0.03 oz/ton gold

for the open pit portion of the resources and 0.06 oz/ton gold for

the underground portions of the resources; US$/CAN$ exchange rate:

1:1.3.

Totals may not represent the sum of parts due to rounding

Table B

Assay Results – Q4 2022

Keno Hill

Zone

Drillhole Number

Drillhole Azm/Dip

Sample From (feet)

Sample To (feet)

True Width (feet)

Silver (oz/ton)

Gold (oz/ton)

Lead (%)

Zinc (%)

Indium (oz/ton)

Depth From Surface

(feet)

Underground

Bermingham Bear Vein

BMUG23-086

153/-13

268.7

272.7

2.6

49.7

0.01

12.8

4.3

897

Bermingham Bear Vein

BMUG23-087

153/-20

304.8

308.2

1.4

50.0

0.01

0.9

1.0

948

Bermingham Bear Vein

BMUG23-088

145/-17

255.4

255.9

0.3

39.7

0.00

18.5

0.1

910

Bermingham Bear Vein

BMUG23-089

145/-25

338.7

345.6

3.9

0.1

0.00

0.0

0.0

991

Bermingham Bear Vein

BMUG23-090

136/-14

228.1

240.1

9.0

10.8

0.00

0.4

0.4

886

Bermingham Bear Vein

Including

230.2

231.3

0.8

83.7

0.01

1.4

1.4

887

Bermingham Bear Vein

BMUG23-091

136/-21

278.9

279.5

0.3

0.4

0.00

0.0

0.0

932

Bermingham Bear Vein

BMUG23-092

136/-26

347.9

350.7

1.0

0.1

0.00

0.0

0.0

1001

Bermingham Bear Vein

BMUG23-093

130/-14

221.1

225.1

2.8

82.5

0.01

7.2

1.5

889

Bermingham Bear Vein

Including

222.0

223.1

0.8

278.5

0.00

25.0

5.0

889

Bermingham Bear Vein

BMUG23-094

130/-20

254.0

259.5

3.7

2.7

0.00

0.1

0.5

925

Bermingham Bear Vein

BMUG23-095

115/-7

351.5

354.6

2.7

10.8

0.00

1.6

0.4

925

Bermingham Bear Vein

BMUG23-096

130/-26

352.0

355.6

1.3

0.1

0.00

0.0

0.0

1007

Bermingham Bear Vein

BMUG23-097

145/06

373.1

379.7

5.0

25.5

0.02

3.6

1.2

847

Bermingham Bear Vein

BMUG23-098A

120/-15

212.9

213.9

0.7

0.6

0.00

0.3

0.5

877

Bermingham Bear Vein

BMUG23-105

140/-08

388.8

404.6

11.7

21.4

0.00

2.8

0.5

947

Bermingham Bear Vein

Including

396.6

398.8

1.6

129.9

0.01

14.8

3.1

949

Bermingham Bear Vein

Including

404.3

404.6

0.2

84.3

0.01

22.8

3.0

950

Bermingham Bear Vein

BMUG23-106

110/-22

249.5

252.1

1.4

0.1

0.00

0.0

0.0

926

Bermingham Bear Vein

BMUG23-107

100/-16

348.9

357.0

3.4

0.2

0.00

0.0

0.0

928

Bermingham Footwall Vein

BMUG23-087

153/-20

611.4

614.3

2.2

8.8

0.01

0.7

0.9

1096

Bermingham Footwall Vein

BMUG23-088

145/-17

548.9

561.5

10.1

58.6

0.01

3.6

4.3

1010

Bermingham Footwall Vein

BMUG23-090

136/-14

497.7

509.2

10.1

13.9

0.00

0.9

2.9

966

Bermingham Footwall Vein

Including

497.7

498.8

1.0

121.0

0.02

6.4

24.4

965

Bermingham Footwall Vein

BMUG23-093

130/-14

483.9

487.4

3.0

17.7

0.00

0.2

1.8

968

Bermingham Footwall Vein

Including

483.9

485.8

1.7

31.4

0.00

0.3

2.9

968

Bermingham Footwall Vein

BMUG23-094

130/-20

510.7

513.0

2.0

6.9

0.00

0.2

1.8

1001

Bermingham Footwall Vein

BMUG23-098A

120/-15

471.5

485.9

12.2

8.3

0.01

1.1

3.1

958

Bermingham Footwall Vein

Including

473.4

474.3

0.8

21.8

0.01

7.3

13.1

958

Bermingham Footwall Vein

Including

484.6

485.9

1.1

47.7

0.02

4.7

1.4

961

Bermingham Footwall Vein

BMUG23-105

140/-08

553.9

598.2

39.5

54.0

0.01

4.8

2.5

980

Bermingham Footwall Vein

Including

554.7

567.4

11.4

77.1

0.02

8.1

3.2

981

Bermingham Footwall Vein

Including

574.5

575.1

0.6

137.7

0.01

44.5

6.2

984

Bermingham Footwall Vein

Including

583.3

593.3

8.9

122.1

0.01

8.0

6.5

985

Bermingham Main Vein

BMUG23-086

153/-13

615.8

631.1

10.3

28.3

0.00

0.9

0.1

974

Bermingham Main Vein

Including

615.8

617.8

1.4

117.0

0.01

2.0

0.1

974

Bermingham Main Vein

Including

628.5

631.1

1.8

47.6

0.01

2.1

0.4

974

Bermingham Main Vein

BMUG23-087

153/-20

766.1

783.9

9.2

32.4

0.01

8.3

4.1

1152

Bermingham Main Vein

Including

770.0

772.9

1.5

114.9

0.02

41.5

8.4

1152

Bermingham Main Vein

Including

779.8

783.9

2.1

35.7

0.01

1.6

3.5

1152

Bermingham Main Vein

BMUG23-088

145/-17

604.2

608.1

2.8

1.2

0.00

0.1

0.0

1028

Bermingham Main Vein

BMUG23-090

136/-14

528.2

547.3

15.2

32.7

0.01

1.7

1.7

978

Bermingham Main Vein

Including

531.8

539.1

5.8

78.9

0.01

3.9

2.3

978

Bermingham Main Vein

BMUG23-093

130/-14

494.1

507.5

10.1

19.8

0.01

1.0

3.9

971

Bermingham Main Vein

Including

494.1

499.5

4.1

46.3

0.02

2.2

9.2

971

Bermingham Main Vein

BMUG23-094

130/-20

535.1

539.0

3.0

15.4

0.01

0.9

1.1

1014

Bermingham Main Vein

Including

535.1

535.9

0.6

70.6

0.01

3.2

3.6

1014

Bermingham Main Vein

BMUG23-105

140/-08

674.0

680.1

4.4

0.2

0.00

0.0

0.1

1001

Stockwork Mineralization

BMUG23-086

153/-13

137.2

137.8

0.4

12.6

0.00

5.7

6.7

863

Stockwork Mineralization

BMUG23-087

153/-20

635.2

636.2

0.7

89.5

0.02

1.7

4.6

1096

Stockwork Mineralization

BMUG23-092

136/-26

407.4

417.3

3.6

0.9

0.00

0.4

0.2

1024

Stockwork Mineralization

BMUG23-104

110/-15

403.9

407.3

2.4

5.4

0.00

0.0

3.7

944

Stockwork Mineralization

Including

403.9

404.6

0.5

22.7

0.00

0.1

15.4

944

Surface Exploration

Bermingham Footwall Vein

K-23-0855

278/-63

3138.9

3139.8

0.6

87.2

0.03

0.0

0.0

2719

Bermingham Footwall Vein

K-23-0869

285/-54

2632.0

2634.1

1.8

0.2

0.00

0.0

0.0

1995

Bermingham Main Vein

K-23-0855

278/-63

2438.9

2457.7

16.9

0.1

0.00

0.0

0.0

2186

Bermingham Main Vein

K-23-0869

285/-54

2223.7

2224.6

0.9

2.7

0.00

1.0

0.4

1729

Bermingham Main Vein

K-23-0869

285/-54

2317.6

2318.4

0.8

1.1

0.00

0.5

1.4

1831

Bermingham Ruby Vein

K-23-0860

330/-60

540.0

543.1

2.8

0.4

0.00

0.0

0.1

394

Bermingham Ruby Vein

K-23-0870

300/-66.5

757.9

762.3

3.5

33.2

0.00

0.0

0.0

636

Bermingham Townsite Vein

K-23-0860

330/-60

1013.6

1014.3

0.6

0.4

0.00

0.0

0.0

720

Bermingham Townsite Vein

K-23-0860

330/-60

1073.1

1075.9

2.4

0.1

0.00

0.0

0.4

762

Bermingham Townsite Vein

TSUG23-001

030/-55

451.7

455.9

2.7

0.3

0.00

0.0

0.0

1031

Bermingham Townsite Vein

K-23-0861

315/-60

1018.4

1023.1

4.3

1.7

0.00

0.4

0.7

770

Bermingham Townsite Vein

K-23-0862

309/-65

1082.2

1084.5

2.0

6.1

0.00

0.5

0.1

969

Bermingham Townsite Vein

K-23-0863

338/-53

596.1

609.5

12.5

3.2

0.00

0.1

1.6

427

Bermingham Townsite Vein

K-23-0864

308/-59

592.8

594.7

1.7

0.2

0.01

0.0

0.2

463

Bermingham Townsite Vein

K-23-0865

308/-70

665.5

667.5

1.7

1.2

0.00

0.1

0.7

587

Bermingham Townsite Vein

K-23-0867

305/-67

1070.5

1079.6

8.0

5.4

0.00

0.3

0.1

889

Bermingham Townsite Vein

Including

1070.5

1070.9

0.3

30.6

0.01

4.2

1.5

889

Bermingham Townsite Vein

Including

1078.8

1079.6

0.6

51.6

0.01

2.1

0.1

889

Bermingham Townsite Vein

K-23-0868

271/-75

803.5

804.5

0.7

0.1

0.00

0.0

0.1

755

Bermingham Townsite Vein

K-23-0870

300/-66.5

1166.5

1168.8

2.0

8.1

0.00

0.0

3.6

997

Bermingham Townsite Vein

TSUG23-002

023/-74

487.0

489.6

1.8

0.2

0.00

0.0

0.0

1159

Bermingham Townsite Vein

splay

K-23-0862

309/-65

1195.0

1200.5

4.6

73.5

0.01

1.4

0.2

1029

Bermingham Townsite Vein

splay

Including

1195.8

1200.5

3.9

85.7

0.02

1.6

0.2

1029

Bermingham Townsite Vein

splay

K-23-0865

308/-70

693.9

698.7

4.0

0.3

0.00

0.2

0.4

612

Bermingham Townsite Vein

splay

K-23-0870

300/-66.5

1186.9

1196.7

8.4

2.4

0.00

0.5

0.1

1007

Bermingham Townsite Vein

Stockwork

K-23-0867

305/-67

1053.6

1054.0

0.4

7.7

0.01

0.8

4.8

840

Coral Wigwam Walleye Vein

K-23-0857

260/-73

1603.0

1608.7

3.2

0.1

0.00

0.1

0.0

1512

Coral Wigwam Walleye Vein

K-23-0858

297/-73

1488.7

1492.1

2.3

24.9

0.00

0.0

0.1

1353

Inca Vein 1

K-23-0871

314/-65

585.4

595.2

8.6

6.9

0.00

0.3

2.7

0.3

571

Inca Vein 1

K-23-0872

336/-58

610.2

612.5

1.9

6.4

0.00

0.2

8.6

4.5

548

Inca Vein 1

K-23-0873

355/-56

587.2

590.1

2.5

14.6

0.00

1.0

4.3

1.7

467

Inca Vein 1

K-23-0874

007/-67

713.4

714.2

0.6

1.4

0.00

0.0

3.0

1.7

605

Inca Vein 2

K-23-0873

355/-56

671.4

702.1

22.6

4.7

0.00

0.5

2.7

1.6

545

Inca Vein 2

Including

696.0

698.8

2.1

42.9

0.02

3.6

21.9

14.9

567

Inca Vein 2

K-23-0874

007/-67

757.1

759.0

1.3

4.2

0.02

0.9

13.8

9.6

646

Inca Vein 2

K-23-0874

007/-67

767.7

778.5

7.4

5.8

0.00

0.2

1.6

0.9

656

Inca Vein 2

Including

767.7

768.2

0.4

107.3

0.03

4.6

15.7

10.5

656

Inca Vein 2

K-23-0874

007/-67

800.4

806.9

4.4

3.0

0.01

3.5

12.1

10.1

687

Greens Creek (Alaska)

Zone

Drill Hole Number

Drill Hole Azm/Dip

Sample From (feet)

Sample To (feet)

Est. True Width (feet)

Silver (oz/ton)

Gold (oz/ton)

Zinc (%)

Lead (%)

Depth From Mine Portal

(feet)

Underground

200 South

GC6069

216.7/-81.4

603.0

604.7

1.2

10.8

0.07

5.9

3.3

-1907

200 South

GC6120

131.8/-83.5

301.5

306.5

2.5

20.0

0.01

1.9

1.1

-1620

200 South

GC6120

131.8/-83.5

589.4

592.4

2.8

8.6

0.13

0.2

0.1

-1909

200 South

GC6120

131.8/-83.5

638.6

641.6

1.8

12.2

0.05

1.0

0.4

-1959

200 South

GC6162

243.4/63.7

13.5

14.5

0.9

11.5

0.05

6.0

4.4

-1266

200 South

GC6162

243.4/63.7

32.0

41.0

8.1

6.1

0.04

6.8

3.3

-1244

200 South

GC6162

243.4/63.7

64.0

65.7

1.5

5.3

0.02

12.0

4.2

-1219

200 South

GC6170

63.4/52.9

104.0

106.9

2.4

8.1

0.09

2.3

1.8

-1195

200 South

GC6192

243.4/-44.1

65.5

67.0

1.4

10.6

0.02

4.8

2.2

-1344

200 South

GC6192

243.4/-44.1

71.0

73.0

1.9

8.9

0.02

6.6

3.3

-1347

200 South

GC6192

243.4/-44.1

81.0

83.6

2.4

9.1

0.03

4.3

2.3

-1353

200 South

GC6192

243.4/-44.1

120.0

160.0

21.1

17.4

0.02

4.1

3.0

-1389

200 South

GC6195

243.4/-23.6

37.5

45.3

7.0

11.4

0.06

3.1

1.5

-1313

200 South

GC6196

243.4/-13.1

36.1

40.8

3.2

4.2

0.01

9.0

4.4

-1299

200 South

GC6200

63.4/47.5

49.0

57.6

3.7

5.7

0.03

6.1

3.2

-1243

200 South

GC6200

63.4/47.5

87.6

93.0

4.4

3.6

0.06

2.7

1.2

-1216

200 South

GC6200

63.4/47.5

104.4

105.6

0.8

6.9

0.05

6.5

3.1

-1205

5250

GC6151

36.5/27

0.0

30.5

10.6

20.0

0.14

11.8

3.9

266

5250

GC6151

36.5/27

61.8

92.0

30.0

14.2

0.07

8.4

2.4

287

5250

GC6151

36.5/27

104.0

131.6

26.8

18.7

0.05

11.4

3.6

310

East

GC6152

23.1/59.6

188.6

189.7

1.0

8.4

0.01

9.2

6.7

76

East

GC6160

63.4/48.6

204.0

205.6

1.5

6.5

0.01

10.1

6.1

68

East

GC6165

63.4/31.6

247.8

259.0

7.4

12.7

0.02

5.8

3.3

44

East

GC6165

63.4/31.6

267.0

271.0

2.7

9.7

0.07

2.3

1.4

38

East

GC6207

63.4/50.7

164.5

176.0

11.0

14.3

0.04

2.4

2.0

45

East

GC6207

63.4/50.7

193.4

194.7

1.1

4.0

0.02

9.5

4.5

50

East

GC6207

63.4/50.7

203.3

204.6

0.7

21.5

0.01

3.7

2.0

75

Upper Plate

GC6127

351.2/76

77.9

106.2

27.9

19.6

0.05

10.9

5.4

93

Upper Plate

GC6127

351.2/76

130.7

132.3

1.6

16.3

0.05

15.1

7.5

113

Upper Plate

GC6127

351.2/76

141.8

143.3

1.5

2.2

0.01

14.0

6.3

142

Upper Plate

GC6127

351.2/76

167.0

183.0

15.0

15.0

0.07

12.9

4.8

246

Upper Plate

GC6141

222.3/56.3

222.4

227.0

3.9

17.9

0.01

6.6

3.4

200

Upper Plate

GC6149

14/70.2

465.5

466.7

1.1

11.7

0.01

1.9

1.1

288

Upper Plate

GC6164

54.5/73.6

348.0

372.0

23.9

28.3

0.01

2.6

1.3

198

Upper Plate

GC6164

54.5/73.6

461.5

466.2

4.6

13.9

0.01

1.9

0.7

299

Upper Plate

GC6191

253.9/74.1

506.9

526.4

14.9

13.0

0.02

2.7

1.1

352

Upper Plate

GC6191

253.9/74.1

557.6

561.7

3.5

11.4

0.01

10.1

3.7

388

Upper Plate

GC6201

254.8/48.6

726.2

732.9

4.8

24.3

0.02

18.5

8.5

380

Upper Plate

GC6206

5.3/73.9

226.0

247.0

18.4

11.1

0.04

5.3

3.3

288

Upper Plate

GC6209

15.3/69.4

146.0

159.0

7.4

12.3

0.01

1.4

0.7

223

Upper Plate

GC6209

15.3/69.4

242.0

250.0

7.9

14.2

0.05

5.7

3.9

313

Upper Plate

GC6219

225.9/64.8

154.0

161.2

6.8

38.3

0.03

9.3

4.4

223

Upper Plate

GC6219

225.9/64.8

178.5

194.0

14.0

8.7

0.02

7.6

3.4

249

Upper Plate

GC6219

225.9/64.8

241.0

244.0

3.0

16.0

0.06

0.2

0.1

298

Upper Plate

GC6220

259.2/76.2

124.1

129.2

5.1

13.1

0.01

5.1

2.0

205

Upper Plate

GC6220

259.2/76.2

239.5

259.4

19.9

21.5

0.03

12.9

6.4

326

West

GC6179

16.1/-40.8

21.4

28.1

6.4

8.8

0.01

5.4

2.4

-116

West

GC6179

16.1/-40.8

50.0

59.4

9.0

7.3

0.04

11.5

4.6

-134

West

GC6179

16.1/-40.8

63.0

66.2

3.1

3.5

0.05

15.2

7.5

-139

West

GC6179

16.1/-40.8

92.5

107.0

12.7

8.4

0.02

19.6

9.6

-164

West

GC6183

243.4/-82.6

120.3

128.8

8.5

10.4

0.07

20.0

8.9

-221

West

GC6212

63.4/-9.5

110.5

112.4

0.9

0.6

0.01

10.3

8.9

-111

West

GC6212

63.4/-9.5

126.3

136.2

4.8

8.2

0.00

8.0

4.0

-113

West

GC6214

63.4/-35.9

57.0

90.5

26.0

63.4

0.64

8.3

4.3

-147

West

GC6214

63.4/-35.9

282.0

307.6

12.8

28.3

0.08

8.3

4.7

-273

West

GC6221

63.4/-71.2

48.1

59.0

10.8

40.6

0.07

8.4

5.0

-148

West

GC6221

63.4/-71.2

102.0

110.2

8.0

7.7

0.03

12.4

5.1

-202

West

GC6221

63.4/-71.2

116.0

125.0

9.0

6.3

0.02

9.3

3.7

-215

West

GC6223

10.5/-49.7

49.6

53.8

3.3

7.8

0.02

9.5

5.5

-140

West

GC6223

10.5/-49.7

90.1

92.4

2.1

2.0

0.01

26.4

7.8

-167

West

GC6223

10.5/-49.7

116.0

121.4

5.4

77.5

0.42

9.6

4.3

-189

West

GC6226

243.4/-63.6

72.9

74.5

1.6

4.2

0.02

9.0

6.9

-162

West

GC6226

243.4/-63.6

83.7

88.7

4.3

2.5

0.01

11.0

5.9

-175

West

GC6226

243.4/-63.6

196.5

199.0

1.9

15.1

0.01

10.4

5.0

-274

West

GC6228

243.4/-81.6

62.6

73.0

10.3

2.2

0.01

10.4

8.6

-255

West

GC6228

243.4/-81.6

150.6

158.0

7.4

9.5

0.02

13.8

7.2

-170

West

GC6232

95.6/-26.3

145.3

159.1

9.3

6.7

0.01

9.6

4.3

-166

West