false000182014400018201442024-11-072024-11-070001820144us-gaap:CommonStockMember2024-11-072024-11-070001820144us-gaap:WarrantMember2024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 7, 2024

________________________

Grindr Inc.

(Exact name of registrant as specified in its charter)

________________________

Commission file number 001-39714

________________________

| | | | | | | | |

| Delaware | | 92-1079067 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

| | |

PO Box 69176, 750 N. San Vicente Blvd., Suite RE 1400 West Hollywood, California | | 90069 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(310) 776-6680

Registrant's telephone number, including area code

N/A

(Former name or former address, if changed since last report)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | GRND | New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | GRND.WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On November 7, 2024, Grindr Inc. (the “Company”) issued a press release and posted a shareholder letter to its website announcing its financial results for the third fiscal quarter ended September 30, 2024. Copies of the Company’s press release dated November 7, 2024, and shareholder letter dated November 7, 2024, are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

The information contained herein, and the accompanying Exhibit 99.1 and Exhibit 99.2, is being furnished under “Item 2.02 Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended, nor shall it be deemed incorporated by reference in any filing with the Securities and Exchange Commission made by us, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Press release dated November 7, 2024 |

| | Shareholder Letter dated November 7, 2024 |

| 104 | | Cover Page Interactive Data File, formatted in inline XBRL (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 7, 2024

| | | | | | | | |

| | | GRINDR INC. |

| | | |

| | | By: |

| | | |

| | | /s/ Vandana Mehta-Krantz |

| | | Vandana Mehta-Krantz |

| | | Chief Financial Officer |

Exhibit 99.1

Grindr Inc. Reports Third Quarter 2024 Revenue Growth of 27%,

Raises Revenue Guidance

Third Quarter 2024 Revenue of $89 Million

Net Income of $25 Million, Net Income Margin of 28%

Adjusted EBITDA of $40 Million and Adjusted EBITDA Margin of 45%

Raising FY 2024 Guidance to 29% or Greater Revenue Growth

LOS ANGELES, CA – November 7, 2024 – Grindr Inc. (NYSE: GRND), the Global Gayborhood in Your PocketTM, today posted its financial results for the third fiscal quarter ended September 30, 2024, in a Letter to Shareholders. The Letter to Shareholders can be accessed on Grindr’s Investor Relations website.

“Grindr delivered another quarter of strong performance across all key financial and user metrics, enabling us to again raise our revenue outlook for 2024,” said George Arison, CEO of Grindr. “We have made great progress this year in making our app experience better and introducing compelling products and features that address user intent. By staying focused on our users, we expect to continue our momentum in 2025.”

Earnings Webcast Information

Grindr will host a live webcast today at 2:00 p.m. Pacific Time to discuss the Company’s third quarter 2024 financial results. The webcast of the conference call can be accessed as follows:

Event: Grindr Third Quarter 2024 Earnings Conference Call

Date: Thursday, November 7, 2024

Time: 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time)

Live Webcast Site: https://investors.grindr.com/

An archived webcast of the conference call will also be accessible on Grindr’s Investor Relations page, https://investors.grindr.com

Forward Looking Statements

This press release contains statements that may constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. These forward-looking statements include statements regarding our intentions, beliefs, current expectations or projections concerning, among other things, results of operations, financial condition, liquidity, prospects, growth, strategies and the markets in which we operate. In some cases, you can identify these forward-looking statements by the use of terminology such as “anticipates,” “approximately,” “believes,” “continues,” “could,” “estimates,” “expects,” “goal,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “seeks,” “should,” “upcoming,” “will” or the negative version of these words or other comparable words or phrases.

The forward-looking statements, including statements regarding our strategic priorities; product innovation; improvements and changes in user experience; plans, products, and features, including AI-driven features; our long-term vision; Grindr for Equality initiatives; and our annual revenue growth and adjusted EBITDA guidance for 2024, reflect our current views about our business and future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ materially from those expressed in any forward-looking statement. There are no guarantees that any transactions or events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth in or contemplated by the forward-looking statements:

•our ability to retain existing users and add new users;

•the impact of the regulatory environment and complexities with compliance related to such environment, including maintaining compliance with privacy, data protection, and user safety laws and regulations;

•our ability to address privacy concerns and protect systems and infrastructure from cyber-attacks and prevent unauthorized data access;

•our success in retaining or recruiting directors, officers, key employees, or other key personnel, and our success in managing any changes in such roles;

•our ability to respond to general economic conditions;

•competition in the dating and social networking products and services industry;

•our ability to adapt to changes in technology and user preferences in a timely and cost-effective manner;

•our ability to successfully adopt generative artificial intelligence processes and algorithms into our daily operations, including by deploying generative artificial intelligence and machine learning into our products and services;

•our dependence on the integrity of third-party systems and infrastructure;

•our ability to protect our intellectual property rights from unauthorized use by third parties;

•whether the concentration of our stock ownership and voting power limits our stockholders’ ability to influence corporate matters; and

•the effects of macroeconomic and geopolitical events on our business, such as health epidemics, pandemics, natural disasters, and wars or other regional conflicts.

In addition, statements that “Grindr believes” or “we believe” and similar statements reflect our beliefs and opinions on the relevant subjects as of the date of any such statement. These statements are based upon information available to us as of the date they are made, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. Except to the extent required by applicable law, we are under no obligation (and expressly disclaim any such obligation) to update or revise our forward-looking statements whether as a result of new information, future events, or otherwise. For a further discussion of these and other factors that could cause our future results, performance, or transactions to differ significantly from those expressed in any forward-looking statement, please see the section titled “Risk Factors” in annual reports on Form 10-K and quarterly reports on Form 10-Q that we file with the Securities and Exchange Commission from time to time. Any forward-looking statement speaks only as of the date on which it is made, and you should not place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements).

Non-GAAP Financial Measures

We use Adjusted EBITDA and Adjusted EBITDA margin, free cash flow, and free cash flow conversion, which are non-GAAP measures, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may differ from similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with U.S. GAAP.

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA adjusts for the impact of items that we do not consider indicative of the operational performance of our business. We define Adjusted EBITDA as net income (loss) excluding income tax provision; interest expense, net; depreciation and amortization; stock-based compensation expense; transaction-related costs; gain (loss) in fair value of warrant liability; and severance expense, litigation-related costs, and other items, in each case that are unrelated to our core ongoing business operations. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA for a period by revenue for the same period.

Our management uses this measure internally to evaluate the performance of our business and this measure is one of the primary metrics by which management and other employees are compensated. We exclude the above items as some are non-cash in nature and others may not be representative of normal operating results. While we believe that Adjusted EBITDA and Adjusted EBITDA Margin are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared and presented in accordance with U.S. GAAP.

A reconciliation of net income (loss) and net income (loss) margin to Adjusted EBITDA and Adjusted EBITDA margin for the three and nine months ended September 30, 2024 and 2023, are presented below. We are not able to estimate net income (loss) or net income (loss) margin on a forward-looking basis or reconcile the guidance provided for Adjusted EBITDA margin to net income (loss) margin on a forward-looking basis without unreasonable efforts due to the variability and complexity with respect to the charges excluded from Adjusted EBITDA margin. In particular, the measures and effects of our stock-based compensation related to equity grants and the gain (loss) on changes in fair value of our warrant liability that, in each case, are directly impacted by unpredictable fluctuations in our share price. The variability of the above charges could have a significant and potentially unpredictable impact on our future GAAP financial results.

Free Cash Flow and Free Cash Flow Conversion

We define free cash flow as net cash provided by operating activities less capitalized software, and purchases of property and equipment. Free cash flow is an indicator of liquidity that provides information to our management and investors about the amount of cash generated from operations, after capitalized software development costs and purchases of property and equipment, that can be used to repay debt obligations and/or for strategic initiatives. Free cash flow conversion is calculated by dividing free cash flow for a period by Adjusted EBITDA for the same period. Free cash flow and free cash flow conversion do not represent our residual cash flow available for discretionary purposes and do not reflect our future contractual commitments. A reconciliation of net cash provided by operating activities and operating cash flow conversion to free cash flow and free cash flow conversion, respectively, for the three and nine months ended September 30, 2024 and 2023, are presented below.

The following table reconciles our non-GAAP financial measures to the most comparable GAAP financial measures for the three and nine months ended September 30, 2024 and 2023.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| ($ in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

Reconciliation of net income (loss) to Adjusted EBITDA | | | | | | | |

| Net income (loss) | $ | 24,681 | | | $ | (437) | | | $ | (7,149) | | | $ | (11,005) | |

| Interest expense, net | 6,400 | | | 11,985 | | | 20,254 | | | 35,695 | |

Income tax provision | 5,593 | | | 1,272 | | | 13,238 | | | 2,724 | |

| Depreciation and amortization | 4,241 | | | 5,753 | | | 12,595 | | | 21,845 | |

| | | | | | | |

Litigation-related costs (1) | 396 | | | 414 | | | 1,479 | | | 1,913 | |

| Stock-based compensation expense | 7,052 | | | 3,648 | | | 22,642 | | | 10,594 | |

Severance expense (2) | — | | | 6,744 | | | 58 | | | 8,077 | |

Management fees (3) | — | | | (97) | | | — | | | (97) | |

Change in fair value of warrant liability (4) | (8,219) | | | 3,362 | | | 45,579 | | | 11,581 | |

Other (5) | — | | | (43) | | | — | | | 157 | |

| Adjusted EBITDA | $ | 40,144 | | | $ | 32,601 | | | $ | 108,696 | | | $ | 81,484 | |

| Revenue | $ | 89,325 | | | $ | 70,258 | | | $ | 247,015 | | | $ | 187,605 | |

Net income (loss) margin | 27.6 | % | | (0.6) | % | | (2.9) | % | | (5.9) | % |

| Adjusted EBITDA Margin | 44.9 | % | | 46.4 | % | | 44.0 | % | | 43.4 | % |

| | | | | | | |

Net cash provided by operating activities | $ | 29,125 | | | $ | 8,313 | | | $ | 65,424 | | | $ | 23,116 | |

Less: | | | | | | | |

Capitalized development software costs and purchases of property and equipment | $ | (1,243) | | | $ | (914) | | | $ | (4,087) | | | $ | (3,489) | |

Free cash flow | $ | 27,882 | | | $ | 7,399 | | | $ | 61,337 | | | $ | 19,627 | |

Operating cash flow conversion (6) | 118.0 | % | | (1,902.3) | % | | (915.1) | % | | (210.0) | % |

Free cash flow conversion | 69.5 | % | | 22.7 | % | | 56.4 | % | | 24.1 | % |

(1)Litigation-related costs primarily represent external legal fees associated with outstanding litigation or regulatory matters, including fees incurred in connection with the potential Norwegian Data Protection Authority fine and CWA unionization.

(2)Severance expense relates to severance incurred for employees who elected not to relocate or participate in our RTO Plan and other severance arrangements.

(3)Management fees represent administrative costs associated with San Vicente Holdings LLC's ("SVE") administrative role in managing financial relationships and providing directive on strategic and operational decisions, which ceased to continue after the Business Combination. In September 2023, certain management fees previously accrued were forgiven.

(4)Change in fair value of warrant liability relates to the warrants that were remeasured as of September 30, 2024 and 2023.

(5)Other represents other costs that are unrelated to our core ongoing business operations.

(6)Operating cash flow conversion represents net cash provided by operating activities as a percentage of net income (loss).

Trademarks

This press release may contain trademarks of Grindr. Solely for convenience, trademarks referred to in this press release may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that Grindr will not assert, to the fullest extent under applicable law, its rights to these trademarks.

About Grindr Inc.

With more than 14.5 million monthly active users, Grindr has grown to become the Global Gayborhood in Your PocketTM, on a mission to make a world where the lives of our global community are free, equal, and just. Available in 190 countries and territories, Grindr is often the primary way for our users to connect, express themselves, and discover the world around them. Since 2015 Grindr for Equality has advanced human rights, health, and safety for millions of LGBTQ+ people in partnership with organizations in every region of the world. Grindr has offices in West Hollywood, the Bay Area, Chicago, and New York. The Grindr app is available on the App Store and Google Play.

Investors:

IR@grindr.com

Media:

Press@grindr.com

1LETTER TO SHAREHOLDERS Q3 2024 Shareholder Letter Third Quarter 2024 November 7, 2024

2LETTER TO SHAREHOLDERS Q3 2024 Grindr delivered an exceptional third quarter with strong growth across all financial and user metrics. Outstanding performance through the first nine months of the year is allowing us to increase revenue guidance for 2024 to 29% or greater. Our outperformance this quarter has been driven by the success of our weekly Unlimited subscription offering, along with effective merchandising and paywall optimizations. Additionally, indirect revenue exceeded expectations, fueled by increased demand from our third-party advertising partners. Our team has continued to focus on building and testing product innovations that improve the user experience, and over time, create multiple opportunities for monetization. We’ve expanded our testing of Right Now to the Washington, DC metro area and launched a new “feed” feature that allows users who are in the Right Now mode to post their intent to a group of nearby users and then chat directly with each other. We will continue expanding Right Now with more features and across more geographies, with the goal of scaling the product by the end of 2025. Given its strategic nature, during this period, our focus is on achieving a high level of user engagement. Looking ahead, we anticipate significant monetization potential, which we plan to prioritize once we have achieved our scaled engagement goals. Dear Grindr Shareholders, Q3 2024 Achieved 27% year-over- year Revenue growth and an Adjusted EBITDA margin of 45%. Net income was $25 million, representing a net income margin of 28%.

3LETTER TO SHAREHOLDERS Q3 2024 We also launched the new Interest tab, which makes inbounds a core feature by centralizing ‘Viewed Me’ and ‘Taps.’ This change has driven increased user engagement across both features and increased payer conversion. Given its success, we plan to enhance this tab further by introducing additional inbound-related features in the future.1 Roam is now live globally, allowing all our users to move their profile to a different geography prior to their arrival there. With one in four Grindr users traveling in a given week, this feature is designed to meet their needs. Alongside Explore, Roam serves our community’s travel needs, and we’re excited to continue expanding our travel offerings with more features that support our users on the go. In 2025, we expect revenue growth will be driven by features already launched as we continue to execute on effective monetization strategies. We also may realize upside in the latter half of 2025 from new products and features. Concurrently, we remain focused on enhancing user engagement as we build new products, guided by a portfolio strategy, which allows us to experiment with the understanding that some products will be more successful than others, as discussed at Investor Day. Right Now A Dedicated Space Right Off the Main Dance Floor 1. Please note that the Interest tab should not be confused with the Interest add-on discussed at Investor Day; the add-on is a separate offering planned in our product roadmap.

4LETTER TO SHAREHOLDERS Q3 2024 I am bullish about our ambitious product agenda. To enhance our ability to execute on it, in September, we brought together our Engineering, Product, and Design teams under the leadership of our Chief Product Officer, AJ Balance. This streamlines decision-making and enables faster iteration as part of an accountability culture that allows each employee to unleash their full potential in service of audacious goals. I am grateful for our team’s hard work in making this happen and to AJ, whose founder mindset and user-centric approach will drive strong execution as we work toward our goals. As part of the technical debt from Grindr’s past, the app historically had a number of bugs and stability issues well known to our users. We have been aggressively tackling these. Since 2020, we’ve made significant investments in enhancing product stability, including paying down this technical debt and transitioning to a new chat infrastructure. In September, as the latest step in this effort, we conducted a two-week “bug bash,” addressing nearly 75% of known bugs and further improving the Grindr user experience. While we’ve made progress, further architectural investments in our iOS and Android code bases will remain a priority. As we look ahead to 2025, we have a lot of momentum. We’re executing on our strategic priorities and making great improvements to the user experience. We’re well- positioned to execute on our ambitious goals and create value for users, shareholders and the community we serve. All my best, George George Arison, CEO

5LETTER TO SHAREHOLDERS Q3 2024 Grindr Wingman is an all-purpose AI assistant aimed at enhancing the user experience on the app. As part of our product portfolio, Wingman embodies our portfolio strategy as we test, iterate, and refine to drive long-term success. Early testing of the AI bot is focused on understanding the type of queries users wish to ask Wingman. As shared in our product roadmap at Investor Day, we expect Wingman to have a longer test and iteration period compared to other products, allowing us to gather deeper insights. The insights gained will help us better understand how users interact with AI and guide our broader AI initiatives over time. Currently, three versions of Wingman are being tested by a small group of users under NDAs, with plans to expand testing to a larger group by year-end. In Q3, we continued to refine the way premium features are presented and merchandised within the app. In September, we launched Interest, which centralizes inbound interest, making it easier for users to see and respond to engagement from other users. Additionally, we are starting to make progress in creating areas in the product where we can offer users useful recommendations about each other or profiles that may be interesting to them, something that is new to Grindr. As part of this effort, for the first time in Grindr’s history, we leveraged machine learning to display profiles in a way that goes beyond distance-based sorting, showing the most relevant profiles to users once they hit their profile limit on the app. This strategic adjustment to the grid gives users a view into a more diverse grid while driving conversion to subscription tiers in a seamless way if users wish to unlock these profiles. These updates reflect our ongoing focus on ensuring a high-quality, engaging experience for everyone on Grindr while delivering value to paid users. Introducing Wingman Enhancing User Experience Q3 Business Highlights The Interest Tab: a centralized space where users can view inbound interest, with a fun animation for each interaction. This feature has driven higher engagement, increasing views of ‘Viewed Me’ by over 150%. Premium Features

6LETTER TO SHAREHOLDERS Q3 2024 In September, we premiered season 2 of Who’s the A**hole, our award-winning podcast series, across all major platforms. This series exemplifies how we’re delivering engaging and fun experiences that elevate our brand, reaching both existing and new audiences and driving positive media coverage and social engagement. In addition, in July, we launched Host or Travel, an online series that guides viewers through global gayborhoods, exploring local culture, nightlife, and cuisine. This series showcases Roam and Explore, reinforcing Grindr’s association with travel—a large opportunity, as one in four Grindr users is traveling in any given week. Looking forward, we’re excited to continue bringing ‘out of the app’ experiences to life, linking back to in-app activity, as we build our brand equity by engaging with users and bringing the global gayborhood to life. Building on our mission of making a world where the lives of our global community are free, equal and just, through Grindr for Equality we strive to expand our users’ access to HIV prevention, testing, and treatment. In August, we expanded our at-home HIV self-test kit distribution program, which has helped deliver hundreds of thousands of free test kits to date, to Namibia. We also welcomed our new Managing Director of Grindr for Equality, Owen Ryan, who brings extensive experience in advancing gay community health and human rights, including as the former Executive Director of the International AIDS Society. Steering our Brand Host or Travel NEW SERIES Serving the LGBTQ+ Community

7LETTER TO SHAREHOLDERS Q3 2024 Q3 Financial & Operating Performance We delivered an outstanding third quarter, with solid performance across our financial and user metrics. Outperformance in our advertising business was driven by strengthening demand of our third-party advertising (TPA) partners. On the subscription side, our continued success in improved merchandising of premium features contributed to higher conversion rates during the quarter. Total revenue for the third quarter increased by 27% year-over-year to $89 million. Net income was $25 million in the third quarter, and Adjusted EBITDA was $40 million, representing a net income margin and Adjusted EBITDA margin of 28% and of 45%, respectively. Average Monthly Active Users (MAU) for the quarter grew 8% year-over- year with Average Paying Users reaching 1.11 million, a 15% increase year-over-year, and Average Direct Revenue per Average Paying User (ARPPU) reached $23.07, up 8% year-over-year. AVG MAUs 14.6M +8% YOY GROWTH 1.11M +15% YOY GROWTH AVG PAYING USERS ARPPU $23.07 +8% YOY GROWTH Q3 2024 Operational Highlights

8LETTER TO SHAREHOLDERS Q3 2024 Revenue Direct revenue increased by 25% year-over-year to $77 million. Growth in direct revenue was driven by the success of our weekly Unlimited subscription offerings and better merchandising and paywall optimizations resulting in higher conversion of free to paid users. Indirect revenue grew 43% year-over-year to $12 million, with both TPA and direct brand sales driving the growth. In the third quarter, TPA benefited from strengthened demand and the introduction of new advertising formats, including native ads, which we began testing in inboxes this quarter. Operating Expenses Operating expenses for Q3 2024, excluding cost of revenue, were $38 million, representing an increase of 7% versus $35 million in Q3 2023. As a percentage of revenue, operating expenses, excluding cost of revenue, were approximately 43%, an improvement of nearly 8 percentage points versus Q3 2023. Operating income in the third quarter totaled $28 million. Net Income Net income for Q3 2024 was $25 million, representing a net income margin of 28% versus the prior year’s net loss margin of 0.6%. The improvement in net income versus the prior year reflects outperformance of revenue expectations as well as a favorable impact due to the fair value of our warrant liability. Revenue ($ in millions) *The graphs presented above are for illustrative purposes and are not to scale. $70M $72M $75M $82M $89M Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024

9LETTER TO SHAREHOLDERS Q3 2024 Adjusted EBITDA Adjusted EBITDA was $40 million, or 45% of total revenue, in Q3 2024. Relative to Q3 of last year, Adjusted EBITDA grew by approximately $8 million, or 23%, as we benefited from robust revenue growth driven by the exceptional performance of our advertising business alongside continued momentum in our subscription offerings. Free Cash Flow Net cash generated from operating activities was $29 million in Q3, up 250% year-over-year. Free cash flow for the third quarter was $28 million. Outlook With our exceptional performance through the first nine months of the year, we are raising our revenue guidance. We now expect revenue growth in 2024 to be 29% or greater and expect our Adjusted EBITDA margin to remain at 42% or greater. 29%+ Revenue Growth Adjusted EBITDA Margin 42%+ 2024 Guidance $33M $29M $32M $37M $40M 46% 40% 42% 45% 45% Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Adj. EBITDA Adj. EBITDA margin Adjusted EBITDA ($ in millions) *The graphs presented above are for illustrative purposes and are not to scale.

10LETTER TO SHAREHOLDERS Q3 2024 Conference Call Grindr will host a conference call to discuss these results at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time), November 7, 2024. The live audio webcast, along with the press release, will be accessible at https://investors.grindr.com/. A recording of the webcast will also be available on our website following the conference call. Average Paying Users 1.11M Q3 2024 Average Paying User Penetration 7.6% Average MAUs 14.6M ARPPU $23.07 Performance Metrics

11LETTER TO SHAREHOLDERS Q3 2024 Condensed Consolidated Balance Sheets (unaudited) (in thousands, except share data) Grindr Inc. and subsidiaries Condensed Consolidated Balance Sheets (unaudited) (in thousands, except share data) September 30, December 31, 2024 2023 Assets Current Assets Cash and cash equivalents ..................................................................................... $ 39,120 $ 27,606 Accounts receivable, net of allowance of $114 and $757, at September 30, 2024, and December 31, 2023, respectively ................................................... 43,984 33,906 Prepaid expenses ................................................................................................... 5,188 4,190 Deferred charges .................................................................................................... 3,773 3,635 Other current assets ............................................................................................... 605 2,413 Total current assets .................................................................................................. 92,670 71,750 Restricted cash ....................................................................................................... 605 1,392 Property and equipment, net ................................................................................. 1,652 1,576 Capitalized software development costs, net ........................................................ 8,665 7,433 Intangible assets, net ............................................................................................. 72,987 82,332 Goodwill.................................................................................................................. 275,703 275,703 Right-of-use assets ................................................................................................ 2,922 3,362 Other assets ........................................................................................................... 1,141 1,047 Total assets ................................................................................................ $ 456,345 $ 444,595 Liabilities and Stockholders’ Equity Current liabilities Accounts payable ................................................................................................... $ 2,082 $ 3,526 Accrued expenses and other current liabilities ..................................................... 26,371 22,934 Current maturities of long-term debt, net .............................................................. 15,000 15,000 Deferred revenue ................................................................................................... 19,895 19,181 Total current liabilities.............................................................................................. 63,348 60,641 Long-term debt, net ............................................................................................... 279,136 325,600 Warrant liability ...................................................................................................... 113,200 67,622 Lease liability .......................................................................................................... 1,030 2,241 Deferred tax liability ............................................................................................... 3,422 4,665 Other non-current liabilities ................................................................................... 9,612 2,118 Total liabilities ............................................................................................ $ 469,748 $ 462,887 Stockholders’ Deficit Preferred stock, par value $0.0001; 100,000,000 shares authorized; none issued and outstanding at September 30, 2024, and December 31, 2023, respectively ... — — Common stock, par value $0.0001; 1,000,000,000 shares authorized; 177,085,154 and 175,377,711 shares issued at September 30, 2024, and December 31, 2023, respectively; 176,188,289 and 175,020,471 outstanding at September 30, 2024, and December 31, 2023, respectively ............................... 18 18 Treasury Stock ........................................................................................................ (7,776) (2,154) Additional paid-in capital ....................................................................................... 62,315 44,655 Accumulated deficit ............................................................................................... (67,960) (60,811) Total stockholders’ deficit ........................................................................... $ (13,403) $ (18,292) Total liabilities and stockholders’ deficit ...................................................... $ 456,345 $ 444,595

12LETTER TO SHAREHOLDERS Q3 2024 Grindr Inc. and Subsidiaries Consolidated Statements of Operations and Comprehensive Income (Loss) (unaudited) (in thousands, except per share and share data) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Revenue...................................................... $ 89,325 $ 70,258 $ 247,015 $ 187,605 Operating costs and expenses Cost of revenue (exclusive of depreciation and amortization shown separately below) ... 22,915 18,243 63,534 49,168 Selling, general and administrative expense .... 24,976 16,420 76,387 52,523 Product development expense ......................... 8,806 13,270 22,301 24,976 Depreciation and amortization .......................... 4,241 5,753 12,595 21,845 Total operating expenses ............................. 60,938 53,686 174,817 148,512 Income from operations .............................. 28,387 16,572 72,198 39,093 Other income (expense) Interest expense, net ........................................ (6,400) (11,985) (20,254) (35,695) Other income (expense), net ............................. 68 (390) (276) (98) Gain (loss) in fair value of warrant liability ........ 8,219 (3,362) (45,579) (11,581) Total other income (loss), net ....................... 1,887 (15,737) (66,109) (47,374) Net income (loss) before income tax ............. 30,274 835 6,089 (8,281) Income tax provision ................................... 5,593 1,272 13,238 2,724 Net income (loss) and comprehensive income (loss) ............................................... $ 24,681 $ (437) $ (7,149) $ (11,005) Net income (loss) per share Basic ................................................................ $ 0.14 $ — $ (0.04) $ (0.06) Diluted ............................................................. $ 0.09 $ — $ (0.04) $ (0.06) Weighted-average shares outstanding: Basic ................................................................ 176,034,571 174,113,605 175,610,399 173,871,888 Diluted ............................................................. 179,961,828 174,113,605 175,610,399 173,871,888 Consolidated Statements of Operations and Comprehensive (Loss) Inco e (unaudited) (in thousands, except per share and share ata)

13LETTER TO SHAREHOLDERS Q3 2024 Condensed Consolidated Statements of Cash Flows (unaudited) (in thousands) Grindr Inc. and subsidiaries Condensed Consolidated Statements of Cash Flows (unaudited) Nine Months Ended September 30, 2024 2023 Operating activities Net loss and comprehensive loss ............................................................................................................. (7,149) (11,005) Adjustments to reconcile net loss to net cash provided by operating activities: ................................... Stock-based compensation ...................................................................................................................... 22,642 10,594 Loss in fair value of warrant liability ......................................................................................................... 45,579 11,581 Amortization of debt discount and issuance costs .................................................................................. 683 1,452 Interest income on promissory note from member ................................................................................. — (282) Depreciation and amortization .................................................................................................................. 12,595 21,845 Provision for expected credit losses ......................................................................................................... (642) 540 Deferred income taxes .............................................................................................................................. (1,243) (7,221) Non-cash lease expense ........................................................................................................................... 1,237 867 Changes in operating assets and liabilities: ............................................................................................. Accounts receivable .......................................................................................................................... (9,436) (10,416) Prepaid expenses and deferred charges .......................................................................................... (1,136) 1,621 Other current assets ......................................................................................................................... 1,808 538 Other assets ...................................................................................................................................... (191) (175) Accounts payable .............................................................................................................................. (1,660) (2,883) Accrued expenses and other current liabilities ............................................................................... 3,619 6,542 Deferred revenue .............................................................................................................................. 714 561 Lease liability ..................................................................................................................................... (2,008) (1,043) Other liabilities .................................................................................................................................. 12 — Net cash provided by operating activities ................................................................................ 65,424 23,116 Investing activities Purchases of property and equipment ............................................................................................. (699) (241) Additions to capitalized software ..................................................................................................... (3,388) (3,248) Net cash used in investing activities........................................................................................ (4,087) (3,489) Financing activities Proceeds from the exercise of stock options ................................................................................... 2,031 2,142 Proceeds from the exercise of warrants .......................................................................................... 1 — Principal payments on debt .............................................................................................................. (47,050) (18,703) Withholding taxes paid on stock-based compensation................................................................... (5,592) — Transaction costs paid in connection with the Business Combination ........................................... — (1,196) Proceeds from the repayment of promissory note to a member including interest ...................... — 19,353 Net cash (used in) provided by financing activities ................................................................... (50,610) 1,596 Net increase in cash, cash equivalents and restricted cash ....................................................... 10,727 21,223 Cash, cash equivalents and restricted cash, beginning of the period ......................................... 28,998 10,117 Cash, cash equivalents and restricted cash, end of the period .................................................. 39,725 31,340 Reconciliation of cash, cash equivalents and restricted cash Cash and cash equivalents ............................................................................................................... 39,120 29,948 Restricted cash .................................................................................................................................. 605 1,392 Cash, cash equivalents and restricted cash ............................................................................. 39,725 31,340 Supplemental disclosure of cash flow information: Cash interest paid ............................................................................................................................. $ 20,291 $ 34,973 Income taxes paid ............................................................................................................................. $ 9,959 $ 5,494 Supplemental disclosure of non-cash investing activities: Capitalized software development costs accrued but not paid ...................................................... $ 292 $ — Supplemental disclosure of non-cash financing activities: Repurchase of common stock for net settlement of equity awards ............................................... $ 51 $ —

14LETTER TO SHAREHOLDERS Q3 2024 Adjusted EBITDA and Free Cash Flow (in thousands) Grindr Inc. and subsidiaries Adjusted EBITDA and Free Cash Flow (in thousands) Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Reconciliation of net income (loss) to Adjusted EBITDA Net income (loss) ............................................................ $ 24,681 $ (437) $ (7,149) $ (11,005) Interest expense, net ..................................................... 6,400 11,985 20,254 35,695 Income tax provision ...................................................... 5,593 1,272 13,238 2,724 Depreciation and amortization ....................................... 4,241 5,753 12,595 21,845 Litigation-related costs (1) ............................................... 396 414 1,479 1,913 Stock-based compensation expense ............................. 7,052 3,648 22,642 10,594 Severance expense (2) ..................................................... — 6,744 58 8,077 Management fees (3) ....................................................... — (97) — (97) Change in fair value of warrant liability (4) ...................... (8,219) 3,362 45,579 11,581 Other (5) ........................................................................... — (43) — 157 Adjusted EBITDA ........................................................... $ 40,144 $ 32,601 $ 108,696 $ 81,484 Revenue .......................................................................... $ 89,325 $ 70,258 $ 247,015 $ 187,605 Net income (loss) margin ............................................... 27.6% (0.6)% (2.9)% (5.9)% Adjusted EBITDA Margin ................................................ 44.9 % 46.4 % 44.0 % 43.4 % Net cash provided by operating activities ...................... $ 29,125 $ 8,313 $ 65,424 $ 23,116 Less: Capitalized development software costs and purchases of property and equipment ........................ (1,243) (914) (4,087) (3,489) Free cash flow ................................................................ $ 27,882 $ 7,399 $ 61,337 $ 19,627 (1) Litigation-related costs primarily represent external legal fees associated with outstanding litigation or regulatory matters, including fees incurred in connection with the potential Norwegian Data Protection Authority fine and CWA unionization. (2) Severance expense relates to severance incurred for employees who elected not to relocate or participate in our RTO Plan and other severance arrangements. (3) Management fees represent administrative costs associated with San Vicente Holdings LLC's ("SVE") administrative role in managing financial relationships and providing directive on strategic and operational decisions, which ceased to continue after the Business Combination. In September 2023, certain management fees previously accrued were forgiven. (4) Change in fair value of warrant liability relates to the Warrants that were remeasured as of September 30, 2024 and 2023. (5) Other represents other costs that are unrelated to our core ongoing business operations.

15LETTER TO SHAREHOLDERS Q3 2024 Forward Looking Statements This letter contains “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 regarding Grindr’s current views with respect to our industry, operations, and future business plans, expectations and performance. These forward-looking statements can generally be identified by the use of forward-looking terminology, such as “anticipates,” “approximately,” “believes,” “continues,” “could,” “estimates,” “expects,” “goal,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts, “seeks,” “should,” “upcoming,” “will” or the negative version of these words or other comparable words or phrases, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, among others, statements regarding our strategic priorities; product innovation; improvements and changes in user experience for paid and other users; new plans, products, and features, including plans for Wingman and other AI-driven features; our long-term vision; G4E initiatives; and our annual revenue growth and adjusted EBITDA guidance for 2024. Forward-looking statements, including guidance related to revenue growth and adjusted EBITDA margin, are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are not guarantees of future performance and are subject to risks and uncertainties that may cause actual results to differ materially from our expectations discussed in the forward-looking statements. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) our ability to retain existing users and add new users; (ii) the impact of the regulatory environment and complexities with compliance related to such environment, including maintaining compliance with privacy, data protection, and user safety laws and regulations; (iii) our ability to address privacy concerns and protect systems and infrastructure from cyber-attacks and prevent unauthorized data access; (iv) our success in retaining or recruiting directors, officers, key employees, or other key personnel, and our success in managing any changes in such roles; (v) our ability to respond to general economic conditions; (vi) competition in the dating and social networking products and services industry; (vii) our ability to adapt to changes in technology and user preferences in a timely and cost-effective manner; (viii) our ability to successfully adopt generative AI processes and algorithms into our daily operations, including by deploying generative AI and machine learning into our products and services; (ix) our dependence on the integrity of third-party systems and infrastructure; (x) our ability to protect our intellectual property rights from unauthorized use by third parties; (xi) whether the concentration of our stock ownership and voting power limits our stockholders’ ability to influence corporate matters; and (xii) the effects of macroeconomic and geopolitical events on our business, such as health epidemics, pandemics, natural disasters and wars or other regional conflicts. The foregoing list of factors is not exhaustive. Further information on these and additional risks, uncertainties and other factors that could cause actual outcomes and results to differ materially from those included in or contemplated by the forward-looking statements contained in this press release are included in the section titled “Risk Factors’’ included under Part I, Item 1A in our Annual Report on Form 10-K, as amended, for the year ended December 31, 2023, as amended, and updated in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024. Any forward-looking statement speaks only as of the date on which it is made, and you should not place undue reliance on forward-looking statements. Except as required by law, Grindr assumes no obligation, and does not intend, to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

16LETTER TO SHAREHOLDERS Q3 2024 Non-GAAP Financial Measures Grindr uses Adjusted EBITDA, Adjusted EBITDA margin, and free cash flow, which are non-GAAP measures, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may differ from similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of Grindr’s financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Adjusted EBITDA adjusts for the impact of items that Grindr does not consider indicative of the operational performance of its business. Grindr defines Adjusted EBITDA as net income (loss) excluding income tax provision; interest expense, net; depreciation and amortization; stock-based compensation expense; transaction-related costs; gain (loss) in fair value of warrant liability; and severance expense, litigation-related costs, and other items, in each case that are unrelated to Grindr’s core ongoing business operations. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA for a period by revenue for the same period. Free cash flow is an indicator of liquidity that provides information to our management and investors about the amount of cash generated from operations, after capitalized software, and purchases of property and equipment, that can be used to repay debt obligations and/or for strategic initiatives. Grindr defines free cash flow as net cash provided by (used in) operating activities, less capitalized software, and purchases of property and equipment. Grindr excludes the above items as some are non-cash in nature, and others may not be representative of normal operating results. While Grindr believes that Adjusted EBITDA, Adjusted EBITDA Margin, and free cash flow are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared and presented in accordance with GAAP. A reconciliation of (1) net income (loss) and net income (loss) margin to Adjusted EBITDA and Adjusted EBITDA margin, respectively, and (2) net cash provided by (used in) operating activities to free cash flow, in each case for the three and nine months ended September 30, 2024 and 2023 are presented above. We are not able to estimate net income (loss) or net income (loss) margin on a forward-looking basis or reconcile the guidance provided for Adjusted EBITDA margin to net income (loss) margin on a forward-looking basis without unreasonable efforts due to the variability and complexity with respect to the charges excluded from Adjusted EBITDA margin. In particular, the measures and effects of our stock-based compensation related to equity grants and the gain (loss) on changes in fair value of our warrant liability that, in each case, are directly impacted by unpredictable fluctuations in our share price. The variability of the above charges could have a significant and potentially unpredictable impact on our future GAAP financial results.

17LETTER TO SHAREHOLDERS Q3 2024 Key Operating Measures Our key operating measures include Average Paying Users, Average Monthly Active Users (Average MAUs), Average Paying User Penetration, Average Direct Revenue per Average Paying User (ARPPU) , and Average Total Revenue Per User (ARPU). We define our key operating measures and how we calculate them in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Operating and Financial Metrics” included under Part I, Item 2 in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024. Trademarks This letter may contain trademarks of Grindr. Solely for convenience, trademarks referred to in this letter may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that Grindr will not assert, to the fullest extent under applicable law, its rights to these trademarks. About Grindr With more than 14.5 million monthly active users, Grindr has grown to become the Global Gayborhood in Your PocketTM, on a mission to make a world where the lives of our global community are free, equal, and just. Available in 190 countries and territories, Grindr is often the primary way for our users to connect, express themselves, and discover the world around them. Since 2015 Grindr for Equality has advanced human rights, health, and safety for millions of LGBTQ+ people in partnership with organizations in every region of the world. Grindr has offices in West Hollywood, the Bay Area, Chicago, and New York. The Grindr app is available on the App Store and Google Play.

v3.24.3

Cover

|

Nov. 07, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity Registrant Name |

Grindr Inc.

|

| Entity File Number |

001-39714

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

92-1079067

|

| Entity Address, Address Line One |

PO Box 69176

|

| Entity Address, Address Line Two |

750 N. San Vicente Blvd.

|

| Entity Address, Address Line Three |

Suite RE 1400

|

| Entity Address, City or Town |

West Hollywood

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90069

|

| City Area Code |

310

|

| Local Phone Number |

776-6680

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001820144

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

GRND

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

GRND.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

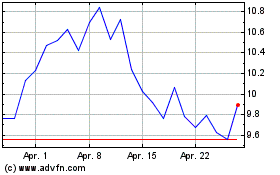

Grindr (NYSE:GRND)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Grindr (NYSE:GRND)

Historical Stock Chart

Von Dez 2023 bis Dez 2024