false

0001820872

0001820872

2024-11-06

2024-11-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): November 6, 2024 (November 6, 2024)

Global

Business Travel Group, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware |

|

001-39576 |

|

98-0598290 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

666 3rd Avenue, 4th Floor

New York, New York 10017

(Address of principal executive offices) (Zip Code)

(646) 344-1290

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which

registered |

| Class A common stock, par value of $0.0001 per share |

|

GBTG |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule

12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. |

Regulation FD Disclosure. |

On

November 6, 2024, Global Business Travel Group, Inc. (the “Company”) issued a press release announcing that the U.K. Competition

and Markets Authority (the “CMA”) has published an interim report regarding the Company’s proposed acquisition of CWT

Holdings, LLC, that the Company disagrees with the CMA’s interim assessment that the transaction may result in a substantial lessening

of competition in the U.K. and that the Company continues to expect the transaction to close in the first quarter of 2025. The Company

continues to work cooperatively with the CMA to demonstrate that the transaction should be approved as well as with other regulators,

including the Antitrust Division of the U.S. Department of Justice, in their review of the transaction.

A

copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference into this Item 7.01.

The information in this Item

7.01 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended, or otherwise subject to the liabilities of that Section. The information in this Item 7.01 shall not be incorporated by reference

into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Global

Business Travel Group, Inc. |

| |

|

| |

By: |

/s/

Eric J. Bock |

| |

|

Name: |

Eric J. Bock |

| |

|

Title: |

Chief Legal Officer, Global Head of M&A and

Compliance and Corporate Secretary |

Date: November 6, 2024

Exhibit 99.1

American Express Global Business Travel Notes

U.K. Competition and Markets Authority’s Interim Report Regarding CWT Acquisition

New York – November

6, 2024 – American Express Global Business Travel, which is operated by Global Business Travel Group, Inc. (NYSE: GBTG) (“Amex

GBT” or the “Company”), a leading software and services company for travel, expense and meetings & events, has confirmed

today that the U.K. Competition and Markets Authority (the “CMA”) has published its interim report regarding Amex

GBT’s proposed acquisition of CWT, a global business travel and meeting solutions provider. Amex GBT fundamentally disagrees

with the CMA’s interim assessment that the transaction may result in a substantial lessening of competition in the UK and it will

continue to work collaboratively with the CMA to demonstrate that the transaction should be approved by the CMA.

The Company believes

that the CMA’s interim report does not reflect the evidence presented on the highly competitive and dynamic nature of the business

travel sector. Instead, the CMA has erroneously focused on a narrow segment that makes up a small fraction of business travel spend. The

CMA has ignored multiple sources of evidence that show clearly that Amex GBT consistently competes for all customers, including the largest

global customers, with numerous other travel management companies that operate globally.

Amex GBT will respond

to the interim report to correct several errors and misconceptions about how the business travel sector operates and to demonstrate that

the CWT acquisition will not harm competition in the UK or elsewhere. The acquisition of CWT will create synergies and provide greater

capacity for investment and innovation. It will also create more choice for customers and more efficient distribution for suppliers while

maintaining a highly competitive environment for business travel services.

Amex GBT will in parallel

continue to work collaboratively with other regulators, including the Antitrust Division of the U.S. Department of Justice, in their review

of the transaction. The Company continues to expect the transaction to close in the first quarter of 2025.

Eric J. Bock, Amex GBT’s Chief Legal Officer and Global Head

of M&A, said: “We are disappointed by the CMA’s interim report. The CMA has not appreciated the evidence that reflects

the breadth of the business travel industry and its dynamic and competitive nature. In recent years, numerous travel management companies

have expanded their offerings while other companies have entered the industry and are rapidly growing their businesses. We are reviewing

the interim report closely and will be responding to the CMA’s concerns. We firmly believe that the proposed transaction would result

in many customer and supplier benefits and that the business travel industry would remain highly competitive. We will be engaging further

with the CMA to demonstrate why its concerns are not justified.”

About Amex GBT

Amex GBT is a leading software and services company

for travel, expense, and meetings & events. We have built the most valuable marketplace in travel with the most comprehensive and

competitive content. A choice of solutions brought to you through a strong combination of technology and people, delivering the best experiences,

proven at scale. With travel professionals and business partners in more than 140 countries, our solutions deliver savings, flexibility,

and service from a brand you can trust – Amex GBT.

Visit amexglobalbusinesstravel.com for

more information about Amex GBT. Follow @amexgbt on X, LinkedIn and Instagram.

Contacts

Investors:

Jennifer Thorington

Vice President Investor Relations

investor@amexgbt.com

Media:

Martin Ferguson

Vice President Global Communications and Public Affairs

martin.ferguson@amexgbt.com

Forward-Looking Statements

This communication contains statements that are

forward-looking and as such are not historical facts. This includes, without limitation, statements regarding our current expectations

or forecasts of future events. These statements constitute projections, forecasts and forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. The words "anticipate," "believe," "continue," "could,"

"estimate," "expect," "intend," "may," "might," "plan," "possible,"

"potential," "predict," "project," "should," "will," "would" and similar expressions

may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this

communication are based on our current expectations and beliefs concerning future developments and their potential effects on us. There

can be no assurance that future developments affecting us, including as a result of the transaction, will be those that we have anticipated.

These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions

that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

These risks and uncertainties include, but are not limited to, the following risks, uncertainties and other factors: (1) changes to projected

financial information or our ability to achieve our anticipated growth rate and execute on industry opportunities; (2) our ability to

maintain our existing relationships with customers and suppliers and to compete with existing and new competitors; (3) various conflicts

of interest that could arise among us, affiliates and investors; (4) our success in retaining or recruiting, or changes required in, our

officers, key employees or directors; (5) factors relating to our business, operations and financial performance, including market conditions

and global and economic factors beyond our control; (6) the impact of geopolitical conflicts, including the war in Ukraine and the conflicts

in the Middle East, as well as related changes in base interest rates, inflation and significant market volatility on our business, the

travel industry, travel trends and the global economy generally; (7) the sufficiency of our cash, cash equivalents and investments to

meet our liquidity needs; (8) the effect of a prolonged or substantial decrease in global travel on the global travel industry; (9) political,

social and macroeconomic conditions (including the widespread adoption of teleconference and virtual meeting technologies which could

reduce the number of in-person business meetings and demand for travel and our services); (10) the effect of legal, tax and regulatory

changes; (11) the decisions of market data providers, indices and individual investors; (12) the outcome of any legal proceedings that

may be instituted against Amex GBT or CWT in connection with the transaction; (13) the inability to complete the transaction; (14) delays

in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regulatory reviews

required to complete the transaction; (15) the risk that the transaction disrupts current plans and operations as a result of the announcement

and consummation of the transaction; (16) the inability to recognize the anticipated benefits of the transaction, which may be affected

by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships

with customers and suppliers and retain key employees; (17) costs related to the transaction; (18) risks related to the business of CWT

or unexpected liabilities that arise in connection with the transaction or the integration with CWT; (19) the risk that the assumptions,

estimates and estimated adjustments described in this communication may prove to be inaccurate; and (20) other risks and uncertainties

described in the Company's Form 10-K, filed with the SEC on March 13, 2024, and in the Company's other SEC filings. Should one or more

of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects

from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

v3.24.3

Cover

|

Nov. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity File Number |

001-39576

|

| Entity Registrant Name |

Global

Business Travel Group, Inc.

|

| Entity Central Index Key |

0001820872

|

| Entity Tax Identification Number |

98-0598290

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

666 3rd Avenue

|

| Entity Address, Address Line Two |

4th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

646

|

| Local Phone Number |

344-1290

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, par value of $0.0001 per share

|

| Trading Symbol |

GBTG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

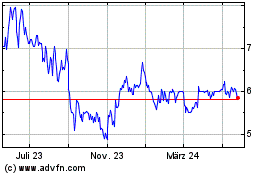

Global Business Travel (NYSE:GBTG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

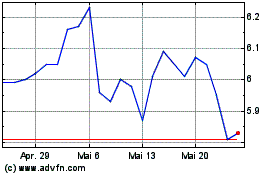

Global Business Travel (NYSE:GBTG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024