American Express Global Business Travel Announces Private Stock Repurchase

04 September 2024 - 1:45PM

Business Wire

American Express Global Business Travel, which is operated by

Global Business Travel Group, Inc. (NYSE: GBTG) (“Amex GBT” or the

“Company”), a leading B2B software and services company for travel,

expense, and meetings & events, today announced that during the

third quarter of 2024, the Company repurchased 8,000,000 shares of

its Class A common stock from a stockholder of the Company in a

privately negotiated transaction at a purchase price of

approximately $6.85 per share, or approximately $55 million in

aggregate. The stock repurchase was funded by the Company’s cash on

hand and was unanimously approved by the Company’s Board of

Directors. The total number of shares repurchased by the Company

amounted to approximately 1.7% of its shares outstanding as of June

30, 2024.

Karen Williams, Amex GBT’s Chief Financial Officer, stated: “Our

positive and accelerating Free Cash Flow and successful debt

refinancing enable us to return cash to shareholders and

demonstrate our confidence in our longer-term strategy.”

About American Express Global Business Travel

American Express Global Business Travel (Amex GBT) is a leading

B2B travel platform, providing software and services to manage

travel, expenses, and meetings & events for companies of all

sizes. We have built the most valuable marketplace in B2B travel to

deliver unrivalled choice, value and experiences. With travel

professionals and business partners in more than 140 countries, our

solutions deliver savings, flexibility, and service from a brand

you can trust – Amex GBT.

Visit amexglobalbusinesstravel.com for more information about

Amex GBT. Follow @amexgbt on X, LinkedIn and Instagram.

Forward-Looking Statements

This communication contains statements that are forward-looking

and as such are not historical facts. This includes, without

limitation, statements regarding our financial position, business

strategy, and the plans and objectives of management for future

operations and full-year guidance. These statements constitute

projections, forecasts and forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “will,” “would” and

similar expressions may identify forward-looking statements, but

the absence of these words does not mean that a statement is not

forward-looking.

The forward-looking statements contained in this communication

are based on our current expectations and beliefs concerning future

developments and their potential effects on us. There can be no

assurance that future developments affecting us will be those that

we have anticipated. These forward-looking statements involve a

number of risks, uncertainties (some of which are beyond our

control) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by these forward-looking statements. These risks and

uncertainties include, but are not limited to, the following risks,

uncertainties and other factors: (1) changes to projected financial

information or our ability to achieve our anticipated growth rate

and execute on industry opportunities; (2) our ability to maintain

our existing relationships with customers and suppliers and to

compete with existing and new competitors; (3) various conflicts of

interest that could arise among us, affiliates and investors; (4)

our success in retaining or recruiting, or changes required in, our

officers, key employees or directors; (5) factors relating to our

business, operations and financial performance, including market

conditions and global and economic factors beyond our control; (6)

the impact of geopolitical conflicts, including the war in Ukraine

and the conflicts in the Middle East, as well as related changes in

base interest rates, inflation and significant market volatility on

our business, the travel industry, travel trends and the global

economy generally; (7) the sufficiency of our cash, cash

equivalents and investments to meet our liquidity needs; (8) the

effect of a prolonged or substantial decrease in global travel on

the global travel industry; (9) political, social and macroeconomic

conditions (including the widespread adoption of teleconference and

virtual meeting technologies which could reduce the number of

in-person business meetings and demand for travel and our

services); (10) the effect of legal, tax and regulatory changes;

(11) the decisions of market data providers, indices and individual

investors; (12) the impact of any future acquisitions including the

integration of any acquisitions; (13) the risk that the

assumptions, estimates and estimated adjustments described in this

communication may prove to be inaccurate; and (14) other risks and

uncertainties described in the Company’s Form 10-K, filed with the

SEC on March 13, 2024, and in the Company’s other SEC filings.

Should one or more of these risks or uncertainties materialize, or

should any of our assumptions prove incorrect, actual results may

vary in material respects from those projected in these

forward-looking statements. We undertake no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

under applicable securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904757345/en/

Media: Martin Ferguson Vice President Global Communications and

Public Affairs martin.ferguson@amexgbt.com

Investors: Jennifer Thorington Vice President Investor Relations

investor@amexgbt.com

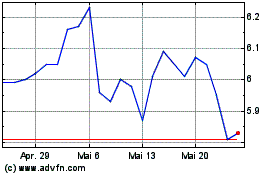

Global Business Travel (NYSE:GBTG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

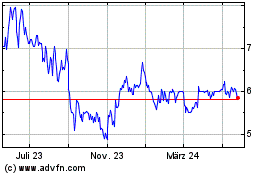

Global Business Travel (NYSE:GBTG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024