Statement of Changes in Beneficial Ownership (4)

27 Februar 2023 - 11:09PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Isaacman Jared |

2. Issuer Name and Ticker or Trading Symbol

Shift4 Payments, Inc.

[

FOUR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chairman & CEO |

|

(Last)

(First)

(Middle)

2202 N. IRVING ST |

3. Date of Earliest Transaction

(MM/DD/YYYY)

2/27/2023 |

|

(Street)

ALLENTOWN, PA 18109

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 2/27/2023 | | C(1) | | 2000000 | A | $0.00 | 2000000 | I | See footnotes (2)(3) |

| Class B Common Stock | 2/27/2023 | | J(4) | | 2000000 | D | $0.00 | 23829016 | I | See footnotes (2)(3) |

| Class A Common Stock | 2/27/2023 | | J(5) | | 2000000 | D | (5)(6) | 0 | I | See footnotes (2)(3) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Forward Contract Sale (obligation to sell) | (5)(6) | 2/27/2023 | | J (5)(6) | | | 2000000 | (5)(6) | (5)(6) | Class A Common Stock | 2000000 | (5)(6) | 0 | I | See footnote (2)(3) |

| LLC Interests | (7) | 2/27/2023 | | C | | | 2000000 | (7) | (7) | Class A Common Stock | 2000000 | $0.00 | 23829016 | I | See footnote (2)(3) |

| Explanation of Responses: |

| (1) | All entries and transactions on this Form 4 arise from a previously executed variable prepaid transaction (the "Transaction") with an unaffiliated third party (the "Counterparty"), which Transaction was entered into two years ago on March 16, 2021, and previously reported on March 18, 2021. |

| (2) | Represents securities held of record by Rook SPV 1, LLC ("Rook SPV"). |

| (3) | Rook SPV is a wholly owned subsidiary of Rook Holdings Inc. Mr. Isaacman is the sole stockholder of Rook Holdings Inc. and therefore may be deemed to beneficially own the securities held of record by Rook SPV and Rook Holdings Inc. |

| (4) | Reflects the cancellation for no consideration of Class B Common Stock in connection with the conversion of the LLC Interests in to Class A Common Stock. |

| (5) | From February 27, 2023 to April 7, 2023 (the "Settlement Period"), Rook SPV is scheduled to settle the Transaction with the Counterparty, relating to 2,000,000 shares of Shift4 Payments, Inc.'s Class A common stock (the "Class A Common Stock") in accordance with the following Transaction terms previously agreed upon as of March 16, 2021 and reported on March 18, 2021. The Transaction is divided into 30 individual components (each comprising 66,667 shares (or 66,666 in the case of the first 10 valuation dates) (the "Component Shares") of Class A Common Stock) over the 30 scheduled trading days up to, and including, April 5, 2023 (the "Valuation Period"). The number of Class A Common Stock to be delivered to the Counterparty with respect to each component during each day of the Settlement Period will be based on the volume weighted average price per share of the Class A Common Stock for each trading day during the Valuation Period (the "Settlement Price") as follows: |

| (6) | (Continued from footnote 5) (A) if the Settlement Price for any component is less than or equal to $73.1920 (the "Floor Price"), Rook SPV will deliver for that component the Component Shares; (B) if the Settlement Price for any component is less than or equal to $137.2350 (the "Cap Price"), but greater than the Floor Price, Rook SPV will deliver for that component a number of Class A Common Stock equal to (i) the Component Shares, multiplied by a fraction, the numerator of which is the Floor Price and the denominator of which is the Settlement Price; and (C) if the Settlement Price for any component is greater than the Cap Price, Rook SPV will deliver for that component a number of shares equal to (i) the Component Shares, multiplied by (ii) a fraction, the numerator of which is the sum of (x) the Floor Price and (y) the Settlement Price minus the Cap Price, and the denominator of which is the Settlement Price, in each case rounded up to the nearest whole share. |

| (7) | The LLC Interests generally may be redeemed by Rook SPV at any time for shares of the Issuer's Class A Common Stock on a 1-to-1 basis. Upon redemption of any LLC Interests, a corresponding number of shares of Class B Common Stock will be cancelled for no consideration. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Isaacman Jared

2202 N. IRVING ST

ALLENTOWN, PA 18109 | X | X | Chairman & CEO |

|

Signatures

|

| /s/ Jordan Frankel, Attorney-in-Fact for Jared Isaacman | | 2/27/2023 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

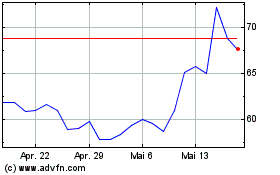

Shift4 Payments (NYSE:FOUR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Shift4 Payments (NYSE:FOUR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024