As filed with the Securities and Exchange Commission on August 18, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FINANCE OF AMERICA COMPANIES INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | | 85-3474065 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

| | | | | | | | |

| 5830 Granite Parkway, Suite 400 | |

| Plano, Texas 75024 | |

(Address of principal executive offices, including zip code)

First Amended Finance of America Companies Inc. Employee Stock Purchase Plan

(Full title of the Plan)

Lauren E. Richmond

Chief Legal Officer, General Counsel & Secretary

Finance of America Companies Inc.

5830 Granite Parkway, Suite 400

Plano, Texas 75024

(877) 202-2666

(Name and address and telephone number, including area code, of agent for service

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | x |

| Non-accelerated filer | ☐ | Smaller reporting company | x |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement on Form S-8 (this “Registration Statement”) filed by Finance of America Companies Inc., a Delaware corporation (the “Company” or the “Registrant”), relates to an additional 2,500,000 shares of the Company’s Class A common stock, par value $0.0001 per share (the “Class A Common Stock”) that may be acquired on the open market for their fair market value pursuant to the terms of the First Amended Finance of America Companies Inc. Employee Stock Purchase Plan (as amended by Amendment No. 1, the “ESPP”) for the benefit of Company employees who voluntarily elect to participate in the ESPP. These shares of Class A Common Stock are additional securities of the same class as other securities for which an original registration statement on Form S-8 (File No. 333-261461) was filed by the Company with the Securities and Exchange Commission (the “Commission”) on December 2, 2021 (the “Prior Registration Statement”) to register 2,500,000 shares of the Class A Common Stock for purchase by eligible employees under the ESPP in effect as of the date thereof, as described below.

No newly-issued shares of the Class A Common Stock are being registered. Shares of the Class A Common Stock may be purchased under the ESPP by a financial institution designated by the Company to act as broker for the ESPP using funds contributed by participants through payroll deductions, up to the lesser of 15% of the participant’s Base Earnings (as defined in the ESPP) or $50,000 per participant in any calendar year (unless otherwise determined by the Compensation Committee (the “Committee”) of the Company’s Board of Directors).

Participation in the ESPP is voluntary and is open to any Company employee who satisfies the eligibility requirements under the ESPP, other than the Company’s “officers” (as defined in Rule 16a-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). The Committee believes offering such employees a means to invest in the Class A Common Stock in a safe and prudent manner builds equity for their future and a personal stake in the success of the Company. Accordingly, to incentivize participation in the ESPP, the ESPP includes a matching component pursuant to which participating employees will be eligible to receive a grant of restricted stock units (“Match RSUs”) pursuant to and in accordance with the Finance of America Companies Inc. 2021 Omnibus Incentive Plan (the “Omnibus Incentive Plan”). The number of Match RSUs to be granted to participants with respect to each offering period will equal to 20% of the shares they purchase under the ESPP with respect to such offering period. The Omnibus Incentive Plan was previously approved by the Company’s stockholders, and shares issuable under the Omnibus Incentive Plan, including the Match RSUs, were previously registered on the Company’s registration statements on Form S-8 filed with the Commission on June 17, 2021 and June 17, 2022.

Pursuant to General Instruction E to Form S-8, the contents of the Prior Registration Statement are incorporated by reference into this Registration Statement, except to the extent such Prior Registration Statement is modified as set forth in this Registration Statement. PART II.

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed with the Commission by the Registrant pursuant to the Securities Act of 1933, as amended and the Exchange Act, are hereby incorporated by reference in this Registration Statement:

(a) The Registrant’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the Commission on March 16, 2023 (the “Annual Report”);

(b) Information specifically incorporated by reference into the Annual Report from the Registrant’s Definitive Proxy Statement on Schedule 14A filed with the Commission on April 26, 2023;

(c) The Registrant’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023, filed with the Commission on May 12, 2023 and August 9, 2023, respectively;

(d) The Registrant’s Current Reports on Form 8-K filed with the Commission on February 2, 2023, February 21, 2023, March 6, 2023, April 3, 2023, June 12, 2023, July 6, 2023 and August 18, 2023 and the Registrant’s Current Report on Form 8-K/A filed with the SEC on June 14, 2023 (excluding any information furnished under Item 2.02 and Item 7.01 and exhibits furnished on such form that relate to such items); and

(e) The description of shares of Class A Common Stock contained in Exhibit 4.4 to the Registrant’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the Commission on March 15, 2022 and any amendment or report filed with the Commission for the purpose of updating such description.

All other reports and other documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold (other than those furnished pursuant to Item 2.02 or Item 7.01 of Form 8-K and exhibits furnished on such form that relate to such items), shall be deemed to be incorporated by reference into this Registration Statement and to be a part of this Registration Statement from the date of the filing of such reports and documents.

For the purposes of this Registration Statement, any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 8. Exhibits

The following exhibits are filed as part of this Registration Statement:

| | | | | |

| Exhibit No. | Document |

| 4.1 | |

| 4.2 | |

| 4.3 | |

| 4.4 | |

| 23.1 | |

| 23.2 | |

| 24 | |

| 107 | |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Park City, State of Utah on this 18th day of August, 2023.

| | | | | | | | | | | |

| | | |

| | FINANCE OF AMERICA COMPANIES INC. |

| | | |

| | By: | /s/ Graham A. Fleming |

| | Name: | Graham A. Fleming |

| | Title: | Chief Executive Officer |

POWER OF ATTORNEY

Each of the undersigned, whose signature appears below, hereby constitutes and appoints Brian L. Libman and Graham A. Fleming, and Lauren E. Richmond and each of them, his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any or all amendments to this Registration Statement and to file the same with all exhibits thereto and other documents in connection therewith, with the Commission, granting unto said attorneys-in-fact and agents full power and authority to do and perform each and every act and thing necessary or appropriate to be done with respect to this Registration Statement or any amendments(including post-effective amendments) hereto in the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or his or their substitute or substitutes, may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement on Form S-8 has been signed by the following persons in the capacities indicated below on August 18, 2023.

| | | | | | | | |

| /s/ Brian L. Libman | | /s/ Graham A. Fleming |

| Brian L. Libman | | Graham A. Fleming |

| Chairman of the Board of Directors | | Chief Executive Officer |

| | (Principal Executive Officer) |

| | |

| /s/ Johan Gericke | | /s/ Tai A. Thornock |

| Johan Gericke | | Tai A. Thornock |

| Chief Financial Officer | | Chief Accounting Officer |

| (Principal Financial Officer) | | (Principal Accounting Officer) |

| | |

| /s/ Norma C. Corio | | /s/ Robert W. Lord |

| Norma C. Corio | | Robert W. Lord |

| Director | | Director |

| | |

| /s/ Tyson A. Pratcher | | /s/ Lance N. West |

| Tyson A. Pratcher | | Lance N. West |

| Director | | Director |

Exhibit 107

Calculation of Filing Fee Tables

S-8

(Form Type)

Finance of America Companies Inc.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered(1) | Proposed Maximum Offering Price Per Unit(2) | Maximum Aggregate Offering Price(2) | Fee Rate | Amount of Registration Fee |

| Equity | Class A Common Stock, par value $0.0001 per share | Other | 2,500,000 | | $ | 1.69 | | $ | 4,225,000 | | 0.0001102 | $ | 465.56 | |

| Total Offering Amounts | | $ | 4,225,000 | | | $ | 465.56 | |

| Total Fee Offsets | | | | N/A |

| Net Fee Due | | | | $ | 465.56 | |

(1) Represents an additional 2,500,000 shares of Class A common stock, par value $0.0001 per share (the “Class A Common Stock”), registered for purchase by eligible employees under the First Amended Finance of America Companies Inc. Employee Stock Purchase Plan (the “ESPP”). Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), the Registration Statement on Form S-8 (the “Registration Statement”) to which this exhibit relates also covers an indeterminate number of additional shares that may be issued to prevent dilution resulting from stock splits, stock dividends or similar transactions.

(2) Estimated solely for the purpose of calculating the registration fee in accordance with Rules 457(c) and 457(h) of the Securities Act. The amount of the registration fee is based on a price of $1.69 per share of the Class A Common Stock, which is the average of the high and low prices of the Registrant’s Class A Common Stock as reported by the New York Stock Exchange on August 14, 2023.

AMENDMENT NO. 1 TO First Amended Finance of America Companies Inc. EMPLOYEE STOCK PURCHASE PLAN

Finance of America Companies, Inc., a Delaware corporation (the “Company”), hereby adopts, as of August 10, 2023, this Amendment No. 1 (this “Amendment”) to the First Amended Finance of America Companies Inc. Employee Stock Purchase Plan, dated August 15, 2022 (the “Plan”). Capitalized terms used but not otherwise defined in this Amendment shall have the respective meanings set forth in the Plan.

Pursuant to authority granted by the Board of Directors of the Company, the Company hereby amends the Plan as follows:

1. Amendment to the Plan.

Section 9.1 of the Plan is revised in its entirety as follows:

“9.1 OPEN MARKET PURCHASES; SHARES UNDER OMNIBUS INCENTIVE PLAN.

All ESPP Shares shall be purchased on the open market, and the maximum number of shares of Company Stock that may be purchased under the Plan as ESPP Shares pursuant to Participant Contributions is 5,000,000 shares. All Match RSUs shall be issued under, and in accordance with, the Omnibus Incentive Plan and shall, accordingly, count against the Absolute Share Limit (as defined in the Omnibus Incentive Plan) in accordance with Section 5(b) and Section 5(c) of the Omnibus Incentive Plan.”

2. No Other Amendments. Except as expressly amended hereby, the provisions of the Plan are and will remain in full force and effect and, except as expressly provided herein, nothing in this Amendment will be construed as a waiver of any of the rights or obligations of the Company and eligible employees under the Plan.

3. This Amendment shall be, and is hereby incorporated in and forms, a part of the Plan.

IN WITNESS WHEREOF, the Company has executed this Amendment as of the date first written above.

Name: /s/ Lauren E. Richmond

Date: August 10, 2023

Title: Chief Legal Officer, General Counsel and Secretary

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

Finance of America Companies Inc.

Plano, Texas

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated March 16, 2023, except for Notes 30 and 38, and the effects of the discontinued operations as discussed in Note 3, for which the date is August 18, 2023, relating to the consolidated financial statements of Finance of America Companies Inc. (the “Company”) and our report dated March 16, 2023 relating to the effectiveness of internal control over financial reporting of Finance of America Companies Inc. appearing in the Current Report on Form 8-K filed on August 18, 2023.

/s/ BDO USA, P.A.

Philadelphia, Pennsylvania

August 18, 2023

Exhibit 23.2

CONSENT OF INDEPENDENT AUDITOR

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of Finance of America Companies Inc. of our report dated March 31, 2023 relating to the consolidated financial statements of American Advisors Group, which appears in the Current Report on Form 8-K/A of Finance of America Companies Inc., dated June 14, 2023.

/s/ RSM US LLP

Las Vegas, Nevada

August 18, 2023

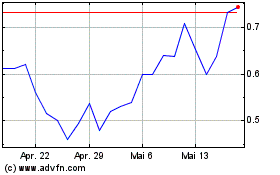

Finance of America Compa... (NYSE:FOA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Finance of America Compa... (NYSE:FOA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024