false

0001531978

0001531978

2024-07-30

2024-07-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 30, 2024

Paragon 28, Inc.

(Exact

name of Registrant as Specified in its Charter)

| Delaware |

001-40902 |

27-3170186 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| |

14445 Grasslands Drive

Englewood, Colorado |

80112 |

|

| |

(Address of Principal Executive Offices) |

(Zip Code) |

|

Registrant’s Telephone Number, Including

Area Code: (720) 399-3400

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

FNA |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition.

The information appearing below under Item 4.02 regarding our previously

reported fiscal year ended December 31, 2023 and fiscal quarters ended March 31, 2023, June 30, 2023, September 30,

2023, and March 31, 2024, as well as the information with respect to our fiscal quarter ended June 30, 2024 under the heading

“Controls and Procedures”, are incorporated herein by reference.

Item 4.02 Non-Reliance on Previously Issued Financial Statements

or a Related Audit Report or Completed Interim Review.

On July 30, 2024, the Audit Committee of the Board of Directors

(the “Audit Committee”) of Paragon 28, Inc. (the “Company”), in consultation with management, concluded that

the Company's previously issued audited consolidated financial statements for the fiscal year ended December 31, 2023, contained

within the Annual Report on Form 10-K for that year (and the associated audit report of the Company’s independent registered

accounting firm) and the unaudited condensed consolidated financial statements contained within the Quarterly Reports on Form 10-Q

for the quarterly periods ended March 31, 2023, June 30, 2023, September 30, 2023, and March 31, 2024 should no longer

be relied upon due to errors in such financial statements, and therefore a restatement of these prior financial statements is required.

Accordingly, the Company intends to restate the aforementioned financial statements by amending its Annual Report on Form 10-K for

the year ended December 31, 2023 and its quarterly report on Form 10-Q for the quarter ended March 31, 2024 (the “Restated

Filings”) as soon as reasonably practicable.

Subsequent to the issuance of the Company’s condensed consolidated

financial statements as of and for the three months ended March 31, 2024, the Company identified errors in the accounting for inventory

including the calculation of its excess and obsolete inventory reserve which resulted in an overstatement of inventory as of March 31,

2023, June 30, 2023, September 30, 2023, December 31, 2023 and March 31, 2024 and an understatement in cost of goods

sold for the respective interim periods ended on such dates and for the fiscal year ended December 31, 2023. This identification

of errors is preliminary, unaudited and may be subject to change as we complete our procedures and prepare the Restated Filings.

The Audit Committee, along with management, discussed with Deloitte &

Touche LLP, the Company’s independent public accounting firm, the matters disclosed in this filing pursuant to this Item 4.02(a).

We plan to file amendments to the previously issued consolidated financial

statements listed above on Forms 10-K/A and 10-Q/A, respectively, with the SEC. We intend to update at least the following sections within

the respective reports:

| · | Annual Report on Form 10-K for the fiscal year ended December 31, 2023: Special Note Regarding Forward-Looking Statements;

Risk Factors Summary; Part I, Item 1A, Risk Factors; Part II, Item 7, Management’s Discussion and Analysis of

Financial Condition and Results of Operations; Part II, Item 8, Financial Statements and Supplementary Data; Part II, Item

9A, Controls and Procedures; Part IV, Item 15, Exhibit and Financial Statement Schedules |

| · | Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024: Part I, Item 1, Financial Statements;

Part I, Item 2, Management's Discussion and Analysis of Financial Condition and Results of Operations; Part I, Item

4, Controls and Procedure; Part II, Item 1A, Risk Factors; Part II, Item 6, Exhibits |

Summary of Impacts

The following summarizes certain estimated impacts of the restatement:

| · | During the year ended December 31, 2023, cost of goods sold was understated by $8.4 million and inventories, net was overstated

by $8.0 million |

| · | During the three months ended March 31, 2024, cost of goods sold was understated by $1.7 million and inventories, net was overstated

by $9.7 million |

The restatement is not expected to affect reported revenue or net (decrease)

increase in cash. In connection with the restatements in the Restated Filings, the Company expects to also reflect the correction of other

immaterial errors. This summary of impacts is preliminary, unaudited and may be subject to change as we complete our procedures and prepare

the Restated Filings.

Refer to the section titled “Supplemental Schedules” herein

for a summary of the restatement’s estimated impact on the Company’s consolidated financial statements for each of the periods.

Controls and Procedures

As a result of the errors described above and the related restatement,

the Company has identified one or more material weaknesses in its internal control over financial reporting. As a result, management concluded

that our internal control over financial reporting was not effective as of December 31, 2023, and our disclosure controls and procedures

were not effective at the reasonable assurance level as of December 31, 2023 and March 31, 2024. Accordingly, the Audit Committee

concluded that management’s report on internal control over financial reporting as of December 31, 2023, and Deloitte’s

opinion on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2023, should no

longer be relied upon.

In addition, given that the conclusion to restate occurred subsequent

to June 30, 2024, and related remediation actions were not implemented as of June 30, 2024, we will report in our Quarterly

Report on Form 10-Q for the second quarter of 2024 that our disclosure controls and procedures were not effective at the reasonable

assurance level as of June 30, 2024. The Company will provide management's modified conclusions in the Restated Filings.

Supplemental Schedules

The following tables summarize the previously reported amounts impacted

by the errors described herein (other than certain additional immaterial revisions in prior periods), as well as the preliminary adjustments

and the estimated restated amounts. The restated amounts shown herein are preliminary and unaudited and may be subject to change as we

complete our procedures and prepare the Restated Filings.

| | |

Year Ended December 31, 2023 | | |

Three Months Ended March 31, 2024 | |

| | |

As

Reported | | |

Adjustments | | |

As

Restated | | |

As

Reported | | |

Adjustments | | |

As

Restated | |

| Cost of goods sold | |

| 43,598 | | |

| 8,356 | | |

| 51,954 | | |

| 12,186 | | |

| 1,656 | | |

| 13,842 | |

| Gross profit | |

| 172,791 | | |

| (8,356 | ) | |

| 164,435 | | |

| 48,896 | | |

| (1,656 | ) | |

| 47,240 | |

| Selling, general, and administrative | |

| 180,022 | | |

| - | | |

| 180,022 | | |

| 54,215 | | |

| 567 | | |

| 54,782 | |

| Total operating expenses | |

| 210,100 | | |

| - | | |

| 210,100 | | |

| 61,799 | | |

| 567 | | |

| 62,366 | |

| Operating income / (loss) | |

| (37,309 | ) | |

| (8,356 | ) | |

| (45,655 | ) | |

| (12,903 | ) | |

| (2,223 | ) | |

| (15,126 | ) |

| Other income (expenses), net | |

| 154 | | |

| (1,337 | ) | |

| (1,183 | ) | |

| 515 | | |

| - | | |

| 515 | |

| Total other expenses, net | |

| (10,319 | ) | |

| (1,337 | ) | |

| (11,656 | ) | |

| (2,107 | ) | |

| - | | |

| (2,107 | ) |

| Income / (loss) before income taxes | |

| (47,628 | ) | |

| (9,693 | ) | |

| (57,321 | ) | |

| (15,010 | ) | |

| (2,223 | ) | |

| (17,233 | ) |

| Net income / (loss) | |

| (47,841 | ) | |

| (9,693 | ) | |

| (57,534 | ) | |

| (15,234 | ) | |

| (2,165 | ) | |

| (17,399 | ) |

| Comprehensive income / (loss) | |

| (47,676 | ) | |

| (9,693 | ) | |

| (57,369 | ) | |

| (16,331 | ) | |

| (2,165 | ) | |

| (18,496 | ) |

| | |

As of December 31, 2023 | | |

As of March 31, 2024 | |

| | |

As

Reported | | |

Adjustments | | |

As

Restated | | |

As

Reported | | |

Adjustments | | |

As

Restated | |

| Inventories, net | |

| 98,062 | | |

| (8,016 | ) | |

| 90,046 | | |

| 104,298 | | |

| (9,672 | ) | |

| 94,626 | |

| Total current assets | |

| 215,815 | | |

| (8,016 | ) | |

| 207,799 | | |

| 207,392 | | |

| (10,239 | ) | |

| 197,153 | |

| Total assets | |

| 340,699 | | |

| (8,016 | ) | |

| 332,683 | | |

| 334,594 | | |

| (10,227 | ) | |

| 324,367 | |

| Accumulated deficit | |

| (115,630 | ) | |

| (8,016 | ) | |

| (123,646 | ) | |

| (130,864 | ) | |

| (10,181 | ) | |

| (141,045 | ) |

| Total stockholders' equity | |

| 177,741 | | |

| (8,016 | ) | |

| 169,725 | | |

| 164,476 | | |

| (10,181 | ) | |

| 154,295 | |

| Total liabilities and stockholders' equity | |

| 340,699 | | |

| (8,016 | ) | |

| 332,683 | | |

| 334,594 | | |

| (10,227 | ) | |

| 324,367 | |

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains certain “forward-looking”

statements as that term is defined by Section 27A of the Securities Act and Section 21E of the Exchange Act. Statements that

are predictive in nature, that depend on or relate to future events or conditions, or that include words such as “believes”,

“anticipates”, “expects”, “may”, “will”, “would,” “should”, “estimates”,

“could”, “intends”, “plans” or other similar expressions are forward-looking statements. These forward-looking

statements include, among others, the anticipated timing of the filing of the Restated Filings; the financial statements to be restated

and the filings in which such restated financial statements will appear; and the Company's intent to report one or more material weaknesses

in its internal control over financial reporting. These forward-looking statements are based on the Company’s current assumptions,

expectations and beliefs and are subject to numerous risks, including, among other things, risks related to the timely and correct completion

of the restatement and Restated Filings; the risk that additional information may become known prior to the expected filing with the SEC

of the Restated Filings or that other subsequent events may occur that would require the Company to make additional adjustments to its

financial statements, which could be material, or delay the filing of the corrected or future periodic reports with the SEC; risks related

to the timing and results of the Company’s review of the effectiveness of internal control over financial reporting and related

disclosure controls and procedures, remediation of the control deficiencies identified and our ability to implement and maintain effective

internal control over financial reporting in the future, which may adversely affect the accuracy and timeliness of our financial reporting;

identification of errors in our financial reporting in the future that require us to restate previously issued financial statements, which

may subject us to unanticipated costs or regulatory penalties and could cause investors to lose confidence in the accuracy and completeness

of our financial statements; and those set forth under the caption “Risk Factors” in the Company’s most recent filings

with the Securities and Exchange Commission, uncertainties, assumptions and changes in circumstances that may cause the Company’s

actual results, performance or achievements to differ materially from those expressed or implied in any forward-looking statement. The

Company cautions investors not to place undue reliance on the forward-looking statements contained in this Current Report on Form 8-K.

Further information on these and other factors that could affect the

Company’s financial results and the forward-looking statements in this Current Report on Form 8-K is included in the Company’s

filings with the Securities and Exchange Commission, including, among others, the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023, particularly under the captions “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations.”

The Company undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events, or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

PARAGON 28, INC. |

| |

|

| Date: July 30, 2024 |

By: |

/s/ Robert S. McCormack |

| |

|

General Counsel & Corporate Secretary |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

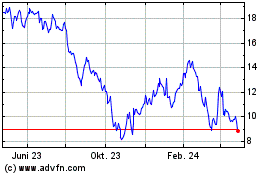

Paragon 28 (NYSE:FNA)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

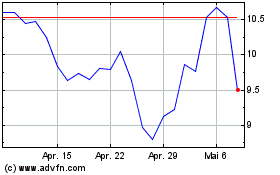

Paragon 28 (NYSE:FNA)

Historical Stock Chart

Von Jan 2024 bis Jan 2025