0001408710FALSE00014087102024-12-192024-12-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

December 19, 2024

______________________

Fabrinet

(Exact name of registrant as specified in its charter)

______________________

| | | | | | | | |

| Cayman Islands | 001-34775 | 98-1228572 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

c/o Intertrust Corporate Services

One Nexus Way, Camana Bay

Grand Cayman

KY1-9005

Cayman Islands

(Address of principal executive offices, including zip code)

+66 2-524-9600

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Ordinary Shares, $0.01 par value | | FN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers.

Amended and Restated Offer Letter

On December 19, 2024, Fabrinet USA, Inc. (the “Company”) and Dr. Harpal Gill, Fabrinet’s President and Chief Operating Officer (“COO”), entered into an amended and restated offer letter of employment (the “Amended Gill Offer Letter”). The Amended Gill Offer Letter confirms Dr. Gill’s current annual base salary of $1,100,000 and his annual cash bonus opportunity of at least 95% of base salary, which will be earned based on evaluation, by the Compensation Committee of Fabrinet’s Board of Directors, of performance objectives established for the applicable year. If Fabrinet appoints another individual as its COO while Dr. Gill is employed with the Company, Dr. Gill will continue in his role as President. Dr. Gill’s additional duties under the Amended Gill Offer Letter will include efforts to recruit and train a successor COO to commence in such role by the earlier of December 31, 2027, or the date six months following the commencement of any notice period (as defined below).

Dr. Gill and the Company are each free to terminate Dr. Gill’s employment with the Company at any time, effective one year after providing written notice (such one-year period, the “notice period”), provided that Dr. Gill’s employment can be terminated at any time for cause without advance written notice. During any notice period or any period following the appointment of a successor COO, the Company in its discretion may reduce Dr. Gill’s authority, duties and responsibilities or his full‑time status, provided that his compensation will continue to include base salary at the level in effect immediately before the notice period or appointment of a successor COO (as applicable), continued eligibility to participate in Fabrinet’s Executive Incentive Plan, and eligibility to receive Fabrinet equity awards to the same extent as similarly situated executives of Fabrinet.

Upon a termination of Dr. Gill’s employment either by the Company without good cause (and other than due to Dr. Gill’s death or disability) or by Dr. Gill for any reason, and provided that Dr. Gill provides the transition services and any required services following appointment of a successor COO (as applicable) specified in the Amended Gill Offer Letter, Dr. Gill will receive (1) a lump sum payment equal to the sum of (a) his one month’s base salary multiplied by the total number of full and fractional years of his employment with the Company; (b) any earned but unpaid bonus; and (c) two times his cost of COBRA coverage for twelve months; (2) any then-outstanding and unvested Fabrinet performance-based equity awards that remain subject to the achievement of any performance goals as of the date of termination of employment (the “Performance Awards”) will remain outstanding and eligible to vest based on the extent that the applicable performance-based or other criteria are satisfied; (3) any then-outstanding and unvested restricted share unit awards that are not Performance Awards (the “RSU Awards”) will accelerate vesting as to 100% of the shares subject thereto; and (4) continued tax equalization benefits under the Company’s expatriate policy, as in effect on the date of termination, for the calendar year in which the termination date occurs, and the following calendar year. In the event Dr. Gill’s employment is terminated on account of his death or disability, Dr. Gill will receive the severance benefits described in the aforementioned clauses (1) through (3).

Dr. Gill’s severance benefits are conditioned upon the parties’ entry into a separation agreement and release of claims in favor of the Company.

The foregoing description of the Amended Gill Offer Letter is a summary and is qualified in its entirety by the terms of the Amended Gill Offer Letter, which is incorporated herein by reference and attached to this Current Report on Form 8-K as Exhibit 10.1.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | FABRINET |

| | |

| By: | /s/ CSABA SVERHA |

| | Csaba Sverha |

| | Executive Vice President, Chief Financial Officer |

| | |

Date: December 20, 2024 | | |

Exhibit 10.1

FABRINET USA, Inc.

3637 Fallon Road, Suite 428

Dublin, CA 94568

December 19, 2024

Harpal Gill

[Address]

Dear Harpal,

This letter amends and restates your offer letter with Fabrinet USA, Inc. (“FUSA” or the “Company”), a wholly owned subsidiary of Fabrinet (“Fabrinet”), as last amended (prior to this letter) on May 3, 2023 (the “Prior Amendment Date”).

Title and Duties. Pursuant to this letter, effective as of the date first set forth above (the “Effective Date”), you will continue in your role as President and Chief Operating Officer (“COO”), reporting to Mr. Seamus Grady, Chief Executive Officer of Fabrinet (the “CEO”). Your duties will generally consist of those associated with continuously improving Manufacturing and Operation excellences. Your duties additionally will include using your best efforts to recruit and train a successor that is satisfactory to the CEO and Fabrinet’s Board of Directors (the “Board”) in order to ensure that a successor to the COO position assumes such position no later than the earlier of (1) December 31, 2027, or (2) the date six months following commencement of any Termination Notice Period (as defined below) (such earlier date, the “Successor Deadline Date”). As the President and COO, you will devote substantially all of your business time and efforts to the performance of your duties and use your best efforts in such endeavors. Acceptance of this letter constitutes your representation that your execution of this agreement and performance of the requirements of this position will not be in violation of any other agreement to which you are a party, including but not limited to any current non-solicit agreements.

Salary; Target Bonus. Your annual base salary will be $1,100,000, to be paid on a semi-monthly basis on or about the 15th and 30th of each month in accordance with FUSA’s payroll policy, subject to applicable U.S. tax withholdings. Your base salary will be subject to review and adjustment by the Company from time to time, in its sole discretion. Subject to the approval of the Board, you will be eligible to participate in Fabrinet’s Executive Incentive Plan, with a target bonus of at least 95% of your annual base salary. Any target bonus, or portion thereof, will be paid as soon as practicable after the Compensation Committee of the Board determines that the target bonus (or relevant portion thereof) has been earned, but in no event shall any such target bonus be paid later than sixty (60) days following the end of the applicable target bonus performance period.

Benefits. Additionally, you will be eligible to participate in FUSA’s Employee Benefits Plan, which includes two hundred forty (240) hours paid time off (PTO), health care (medical, dental & vision for you and your eligible dependents), 401(k), and Group Term Life. Reasonable business-related travel and other expenses will be reimbursable via monthly expense reporting pursuant to the Company’s policies and procedures and in accordance with applicable law, but in no event will any reimbursement occur later than the fifteenth (15th) day of the third month

following the later of (i) the close of the Company’s fiscal year in which such expenses are incurred or (ii) the calendar year in which such expenses are incurred. You will be eligible to receive a car allowance of $1,000 per month, provided that you are an employee of FUSA on the date the car allowance is paid to you each month. The Company may modify or terminate its benefits programs and arrangements from time to time as necessary or appropriate. The Company has the right to withhold from any payments or benefits under this letter all applicable federal, state and local taxes required to be withheld and any other required payroll deductions.

Successor COO. If Fabrinet appoints another individual as its COO (a “Successor COO”) while you are employed with FUSA (such employment period, the “Employment Term”), then you no longer will hold the COO role but will continue in your role as President, reporting to the CEO. Upon appointment of such Successor COO (the period during the Employment Term upon and following the appointment of any such Successor COO, the “Post‑COO Period”), your duties will generally consist of (i) support in the transition of the COO position to a Successor COO and such other transition services as may be reasonably requested by the CEO; and (ii) work on such projects as may be reasonably assigned to you by the CEO (the “Post-COO Transition Services”). Your employment during the Post‑COO Period otherwise will remain on a full-time basis. Notwithstanding the foregoing, the Company may reduce your authority, duties and responsibilities, or your full-time status, during the Post‑COO Period or any portion thereof, provided that the Company will continue to pay you, for the duration of the Post‑COO Period, your base salary at the level in effect immediately before the Post COO-Period, in accordance with FUSA’s payroll policy, subject to applicable tax withholdings. During the Post-COO Period, you will remain eligible to receive equity awards covering Fabrinet ordinary shares and participate in Fabrinet’s Executive Incentive Plan (or successor plan, if applicable) to the same extent as the Successor COO and executives similarly situated to the Successor COO. For the avoidance of doubt, any such equity awards granted to you shall be eligible for the Performance Award Severance or RSU Award Severance, as applicable (and as defined below), subject to the applicable terms herein.

Termination Notice Period. You are free to terminate your employment for any reason at any time, effective one (1) year after written notice is provided to FUSA (such one (1) year period, the “Employee Notice Period”). Similarly, FUSA may terminate the employment relationship, effective one (1) year after providing written notice to you (such period, together with the Employee Notice Period, the “Termination Notice Period”), except in the case of termination with good cause, which may occur without any obligation to provide advance notice to you. During any Termination Notice Period, except as otherwise determined by the Company in its sole discretion and notified to you by the Company in writing, (x) prior to Fabrinet’s appointment of a Successor COO, you shall continue to use your best efforts to recruit and train a successor that is satisfactory to the CEO and the Board in order to ensure that a successor to the COO position assumes such position no later than the Successor Deadline Date, and (y) you will continue to devote substantially all of your business time and efforts (at full-time status) to the performance of your duties and use your best efforts in such endeavors, and continue to perform such other duties and responsibilities as described in this letter (which, for the avoidance of doubt, will include the Post‑COO Transition Services if any Post-COO Period occurs during the Termination Notice Period) (such services with respect to the Termination Notice Period, the “Notice Period Services”). For the avoidance of doubt, the Company may reduce your authority,

duties and responsibilities, or your full‑time status, during the Termination Notice Period, provided that the Company will continue to pay you, for the duration of the Termination Notice Period while you remain employed with FUSA, your base salary at the level in effect immediately before the Termination Notice Period, in accordance with FUSA’s payroll policy, subject to applicable tax withholdings. During the Termination Notice Period while you remain employed with FUSA, you will remain eligible to receive equity awards covering Fabrinet ordinary shares and participate in Fabrinet’s Executive Incentive Plan (or successor plan, if applicable) to the same extent as similarly situated executives of Fabrinet. For the avoidance of doubt, any such equity awards granted to you shall be eligible for the Performance Award Severance or RSU Award Severance, as applicable (and as defined below), subject to the applicable terms herein.

Employment Termination. Upon any termination of your employment, you automatically will be deemed to have resigned from all officer and director positions with the Company, Fabrinet, and any of their respective subsidiaries, and you agree to execute any documents reasonably necessary to reflect such resignations. Upon termination of your employment, you will receive a lump sum cash payment of your accrued but unpaid PTO (if any) which will be paid no later than ten (10) calendar days following the date of termination of your employment (or such earlier date as required by applicable law).

Severance Benefits. In the event your employment is terminated either (A) by FUSA without good cause (and other than due to your death or disability which is addressed further below), or (B) by you for any reason, and provided that (x) during the Termination Notice Period, you have satisfied the Notice Period Services (as defined below) as determined by the Board in good faith in its sole discretion, and (y) during any Post‑COO Period, you have satisfied the Post‑COO Transition Services as determined by the Board in good faith in its sole discretion, you will receive the following (the “Severance Benefits,” and the Severance Benefits described under only clauses (a) through (c) below are referred to as the “Cash and COBRA Severance”):

(a)a lump sum payment payable on the sixtieth (60th) day following your termination date equal to the product of one month of your then‑base salary multiplied by the total number of full and fractional years of your employment with FUSA as of your termination date;

(b) a lump sum payment payable on the sixtieth (60th) day following your termination date equal to any earned but unpaid bonus as of the date of termination of your employment;

(c) a lump sum payment payable on the sixtieth (60th) day following your termination date equal to two times your cost of COBRA coverage for twelve months under the FUSA health plans then in effect for you and your covered dependents;

(d) any of your then‑outstanding and unvested performance‑based equity awards covering Fabrinet ordinary shares that remain subject to the achievement of any performance goals as of the date of termination of your employment (the “Performance Awards”) will remain

outstanding and eligible to vest following your termination date (subject to any earlier termination, such as in connection with a change in control of Fabrinet, as set forth in Fabrinet’s 2020 Equity Incentive Plan or any successor plan under which they were granted), and will become vested to the extent that the applicable performance-based or other criteria are satisfied under the Performance Award, with the exception that any requirement to provide further continued service will be deemed to have been met in full as of your termination date (such benefit under this clause (d), the “Performance Award Severance”);

(e) any of your then-outstanding and unvested restricted share unit awards covering Fabrinet ordinary shares that are not Performance Awards will accelerate vesting as to one hundred percent (100%) of the Fabrinet ordinary shares subject thereto (such benefit under this clause (e), the “RSU Award Severance”); and

(f) continued tax equalization benefits under FUSA’s expatriate policy, as in effect on the date of your termination, for the calendar year in which your termination date occurs, and the following calendar year, with such benefits being payable as soon as practicable following the year the compensation subject to the tax equalization payment relates was paid, and in no event later than the end of your second taxable year beginning after your taxable year in which your U.S. Federal income tax return is required to be filed (including any extensions) for the year to which the compensation subject to the tax equalization payment relates, or, if later, your second taxable year beginning after the latest such taxable year in which your foreign tax return or payment is required to be filed or made for the year to which the compensation subject to the tax equalization payment relates.

For the avoidance of doubt, if during any Post‑COO Period or Termination Notice Period, you breach your obligations to perform your Post-COO Transition Services or Notice Period Services, as applicable, as determined by the Board in good faith in its sole discretion, you will forfeit any and all Severance Benefits, and you no longer will have any rights thereto.

Termination due to Death or Disability. In the event your employment is terminated on account of your death or disability, then you will receive the RSU Award Severance, Performance Award Severance, and Cash and COBRA Severance Benefits.

Release. Any payments or benefits due to you under the preceding two sections titled “Severance Benefits” and “Termination due to Death or Disability” shall be conditioned upon the execution of a general separation agreement and release of claims by you (or in the case of your death or disability, the administrator of your estate or your legal representative, as applicable) in such form as provided to you by FUSA within five (5) calendar days following your termination date that becomes effective and irrevocable within sixty (60) days of your termination date. If the foregoing separation agreement and release of claims is executed, delivered, effective, and no longer subject to revocation as provided in the preceding sentence, then such payments or benefits shall be made or commence upon the sixtieth (60th) day following your termination date subject to the requirements under Section 409A (as defined below) as described further below. The first such cash payment shall include payment of all amounts that otherwise would have been due prior thereto under the terms of this letter had such payments commenced immediately

upon your termination date, and any payments made thereafter shall continue as provided herein. The delayed payments or benefits shall in any event expire at the time such benefits would have expired had such benefits commenced immediately following your termination date.

No Mitigation. In the event your employment is terminated for any reason, you shall be under no obligation to seek other employment and there shall be no offset against any amounts due to you under this letter on account of any remuneration attributable to any subsequent employment that you may obtain. Any amounts due under the preceding two sections titled “Severance Benefits” and “Termination due to Death or Disability” are in the nature of severance payments, or liquidated damages, or both, and are not in the nature of a penalty.

Tax Withholdings. Anything in this letter to the contrary notwithstanding, all payments required to be made by FUSA hereunder to you or your estate or beneficiaries shall be subject to the withholding of such amounts relating to taxes as FUSA may reasonably determine it should withhold pursuant to any applicable law or regulation. In lieu of withholding such amounts, in whole or in part, FUSA may, in its sole discretion, accept other provisions for payment of taxes and withholding as required by law, provided it is satisfied that all requirements of law affecting its responsibilities to withhold have been satisfied.

Cause. For purposes of this letter, “good cause” means (i) an act of dishonesty made by you in connection with your responsibilities as an employee; (ii) your conviction of or plea of nolo contendere to a felony, or any crime involving fraud, embezzlement or any other act of moral turpitude; (iii) your gross misconduct; (iv) your unauthorized use or disclosure of any proprietary information or trade secrets of the Company or any other party to whom you owe an obligation of nondisclosure as a result of your relationship with the Company; (v) your willful breach of any obligations under any written agreement or covenant with the Company; or (vi) your continued failure to perform your employment duties after you have received a written demand of performance from the Company which specifically sets forth the factual basis for the Company’s belief that you have not substantially performed your duties and have failed to cure such nonperformance to the Company’s satisfaction within thirty (30) days after receipt of such notice.

Section 409A. Notwithstanding anything to the contrary in this letter, no Deferred Compensation Separation Benefits (as defined below) will be considered due or payable until you have incurred a “separation from service” within the meaning of Section 409A of the Internal Revenue Code of 1986, as amended, and the final regulations and any guidance promulgated thereunder (together, “Section 409A”).

In addition, if FUSA, Fabrinet or affiliates of either continues to be a public company with its securities listed on a stock exchange at the time of termination of your employment, and at the time of such termination it is determined that you are a “specified employee” within the meaning of Section 409A, the amounts payable to you, pursuant to this letter, when considered together with any other severance payments or separation benefits that are considered deferred compensation under Section 409A (together, the “Deferred Compensation Separation Benefits”) that are payable within the first six (6) months following termination of your employment, will

become payable on the first regularly scheduled payroll date that occurs on or after the date six (6) months and one (1) day following the date of termination of your employment (the “Separation Delay”). Any amount paid under this letter that satisfies the requirements of the “short-term deferral” rule set forth in Section 1.409A-1(b)(4) of the Treasury Regulations will not constitute Deferred Compensation Separation Benefits for purposes of this paragraph. In addition, any amount paid under this letter that qualifies as a payment made as a result of an involuntary separation from service pursuant to Section 1.409A-1(b)(9)(iii) of the Treasury Regulations that does not exceed the specified limit in Section 1.409A-1(b)(9)(iii)(A) of the Treasury Regulations will not constitute Deferred Compensation Separation Benefits for purposes of this paragraph. Each payment and benefit payable under this letter is intended to constitute a separate payment for purposes of Section 1.409A-2(b)(2) of the Treasury Regulations. To the extent necessary or appropriate to be exempt from or to comply with Section 409A, your employment termination, termination of your employment, or similar terms in this letter will be references to your separation from service within the meaning of Section 409A.

The foregoing provisions are intended to comply with the requirements of Section 409A so that none of the payments and benefits to be provided hereunder will be subject to the additional tax imposed under Section 409A, and any ambiguities or ambiguous terms herein will be interpreted to so comply. In no event will the Company have any liability, responsibility or obligation to reimburse you for any taxes or other costs (including without limitation any interest and penalties) that may be imposed on you under Section 409A or any other provision of the Code with respect to any payments or benefits you may receive from the Company under this letter or under any other agreement or arrangement. The parties to this letter agree to work together in good faith to consider amendments to this letter, if required, and to take such reasonable actions, which are necessary, appropriate or desirable to avoid imposition of any additional tax or income recognition prior to actual payment to you under Section 409A.

Certain Obligations. During the term of your employment, you shall not, without FUSA’s prior written consent:

(i) solicit or encourage to leave the employment or other service of FUSA, Fabrinet or the affiliates of either, any employee or independent contractor thereof or conduct activities that conflict with your duties to FUSA, Fabrinet, or the affiliates of either, such as providing services to any person or entity in the business of developing, commercializing, and/or selling products or services competitive to the products or services of FUSA, Fabrinet, or the affiliates of either; or

(ii) whether for your own account or for the account of any other person, firm, corporation or other business organization, intentionally interfere with FUSA’s, Fabrinet’s or any of their affiliates’ relationship with, or endeavor to entice away from FUSA, Fabrinet or the affiliates of either, any person who during the term of your employment is a customer or client of FUSA, Fabrinet or the affiliates of either.

Policies. You were previously provided additional information about general employment conditions including Company policies and benefits programs. Also, please be advised that it is the policy of FUSA to maintain a workplace that is free of drugs and alcohol.

Protected Activity. You understand that nothing in this letter or other non‑disclosure agreements you entered into with the Company shall in any way limit or prohibit you from engaging for a lawful purpose in any Protected Activity. For purposes of this letter and any other such applicable agreements, “Protected Activity” means filing and/or pursuing a charge or complaint with, or otherwise communicating or cooperating with or participating in any investigation or proceeding that may be conducted by, any federal, state or local government agency or commission, including the Securities and Exchange Commission, the Equal Employment Opportunity Commission, the Occupational Safety and Health Administration, and the National Labor Relations Board (“Government Agencies”), including disclosing documents or other information as permitted by law, without giving notice to, or receiving authorization from, the Company. In addition, nothing in this letter or other non-disclosure agreements, including a definition of Company confidential information set forth therein, is intended to limit employees’ rights to discuss the terms, wages, and working conditions of their employment, nor to deny employees the right to discuss or disclose information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that you have reason to believe is unlawful. You further understand that you are not permitted to disclose the Company’s attorney-client privileged communications or attorney work product. In addition, you acknowledge that the Company has provided you with notice in compliance with the Defend Trade Secrets Act of 2016 regarding immunity from liability for limited disclosures of trade secrets. The full text of the notice is the following: “ . . . An individual shall not be held criminally or civilly liable under any Federal or State trade secret law for the disclosure of a trade secret that—(A) is made—(i) in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. . . . An individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law may disclose the trade secret to the attorney of the individual and use the trade secret information in the court proceeding, if the individual—(A) files any document containing the trade secret under seal; and (B) does not disclose the trade secret, except pursuant to court order.”

Should you have questions or require additional information about any benefits, terms or conditions of your employment, please do not hesitate to contact our General Counsel, Colin R. Campbell.

If you are in agreement with the provisions of this letter detailing the terms of your employment with FUSA, please indicate your acceptance by signing below.

We look forward to your continuing with our organization.

Sincerely,

Fabrinet USA, Inc.

/s/ Seamus Grady

Seamus Grady, Chief Executive Officer

I accept the offer of continued employment with FUSA under the terms described in this letter. I acknowledge that this letter is the complete agreement concerning my employment and supersedes all prior or concurrent agreements and representations and may not be modified in any way except in a writing executed by an authorized agent of FUSA.

/s/ Harpal Gill

Harpal Gill

December 19, 2024

Date

v3.24.4

Cover

|

Dec. 19, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 19, 2024

|

| Entity Registrant Name |

Fabrinet

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity File Number |

001-34775

|

| Entity Tax Identification Number |

98-1228572

|

| Entity Address, Address Line One |

c/o Intertrust Corporate Services

|

| Entity Address, City or Town |

Grand Cayman

|

| Entity Address, Postal Zip Code |

KY1-9005

|

| Entity Address, Country |

KY

|

| City Area Code |

66 2

|

| Local Phone Number |

524-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary Shares, $0.01 par value

|

| Trading Symbol |

FN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001408710

|

| Entity Addresses [Line Items] |

|

| Entity Address, City or Town |

Grand Cayman

|

| Entity Address, Country |

KY

|

| Entity Address, Address Line Two |

One Nexus Way, Camana Bay

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

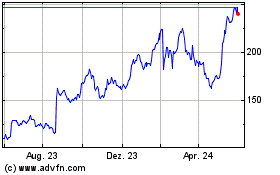

Fabrinet (NYSE:FN)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

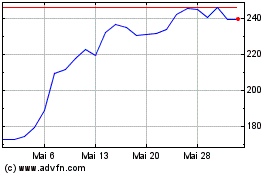

Fabrinet (NYSE:FN)

Historical Stock Chart

Von Dez 2023 bis Dez 2024