UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-21842

First Trust Strategic High Income Fund II

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code: 630-765-8000

Date of fiscal year end: October 31

Date of reporting period: January 31, 2014

Form N-Q is to be used by management investment companies, other than small

business investment companies registered on Form N-5 (ss.ss. 239.24 and 274.5 of

this chapter), to file reports with the Commission, not later than 60 days after

the close of the first and third fiscal quarters, pursuant to rule 30b1-5 under

the Investment Company Act of 1940 (17 CFR 270.30b1-5). The Commission may use

the information provided on Form N-Q in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-Q, and

the Commission will make this information public. A registrant is not required

to respond to the collection of information contained in Form N-Q unless the

Form displays a currently valid Office of Management and Budget ("OMB") control

number. Please direct comments concerning the accuracy of the information

collection burden estimate and any suggestions for reducing the burden to the

Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC

20549. The OMB has reviewed this collection of information under the clearance

requirements of 44 U.S.C. ss. 3507.

ITEM 1. SCHEDULE OF INVESTMENTS. The Schedule of Investments is attached

herewith.

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

PORTFOLIO OF INVESTMENTS

JANUARY 31, 2014 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

---------------- ---------------------------------------------- -------------- --------------- --------------

CORPORATE BONDS AND NOTES - 106.1%

AUTOMOTIVE - 4.0%

$ 1,275,000 American Axle & Manufacturing, Inc............ 6.25% 03/15/21 $ 1,361,063

600,000 American Axle & Manufacturing, Inc............ 6.63% 10/15/22 639,000

1,750,000 Chrysler Group LLC/Chrysler Group Co-Issuer,

Inc. (a)................................... 8.25% 06/15/21 1,970,937

1,500,000 Ford Motor Co. (a)............................ 6.50% 08/01/18 1,752,462

--------------

5,723,462

--------------

BASIC INDUSTRY - 14.5%

1,500,000 AK Steel Corp. (a)............................ 7.63% 05/15/20 1,488,750

2,075,000 Alpha Natural Resources, Inc.................. 6.25% 06/01/21 1,706,688

3,275,000 Arch Coal, Inc. (a)........................... 7.25% 06/15/21 2,497,187

1,750,000 Associated Materials LLC/AMH New Finance,

Inc. (a)................................... 9.13% 11/01/17 1,852,813

500,000 Building Materials Corp. of America (b)....... 6.75% 05/01/21 538,125

1,160,000 Georgia-Pacific LLC (a)....................... 7.38% 12/01/25 1,476,507

415,000 Georgia-Pacific LLC (a)....................... 7.25% 06/01/28 522,335

1,875,000 Hexion US Finance Corp. (a)................... 9.00% 11/15/20 1,889,062

1,100,000 Huntsman International LLC (a)................ 8.63% 03/15/21 1,245,750

500,000 Ply Gem Industries, Inc. (b).................. 6.50% 02/01/22 494,375

1,700,000 Polymer Group, Inc. (a)....................... 7.75% 02/01/19 1,810,500

1,000,000 Steel Dynamics, Inc. (a)...................... 7.63% 03/15/20 1,087,500

2,100,000 USG Corp. (a) (c)............................. 9.75% 01/15/18 2,509,500

1,650,000 Xerium Technologies, Inc. (a)................. 8.88% 06/15/18 1,757,250

--------------

20,876,342

--------------

CAPITAL GOODS - 7.1%

1,750,000 Berry Plastics Corp. (a)...................... 9.50% 05/15/18 1,865,937

1,750,000 Coleman Cable, Inc. (a)....................... 9.00% 02/15/18 1,846,250

1,700,000 Crown Cork & Seal Co., Inc. (a)............... 7.38% 12/15/26 1,887,000

1,755,000 Mueller Water Products, Inc. (a).............. 7.38% 06/01/17 1,812,038

676,000 Tekni-Plex, Inc. (b).......................... 9.75% 06/01/19 777,400

650,000 Terex Corp.................................... 6.50% 04/01/20 700,375

1,350,000 Terex Corp.................................... 6.00% 05/15/21 1,407,375

--------------

10,296,375

--------------

CONSUMER CYCLICAL - 7.2%

2,000,000 Acco Brands Corp.............................. 6.75% 04/30/20 1,992,500

225,000 Ferrellgas Partners L.P./Ferrellgas Partners

Finance Corp............................... 8.63% 06/15/20 238,500

1,775,000 L Brands, Inc. (a)............................ 7.60% 07/15/37 1,801,625

1,750,000 Levi Strauss & Co. (a)........................ 7.63% 05/15/20 1,916,250

1,500,000 Michaels Stores, Inc.......................... 7.75% 11/01/18 1,608,750

550,000 PVH Corp. (a)................................. 7.38% 05/15/20 602,250

2,100,000 Reynolds Group Issuer, Inc. (a)............... 9.00% 04/15/19 2,249,625

--------------

10,409,500

--------------

CONSUMER NON-CYCLICAL - 4.5%

1,350,000 C&S Group Enterprises LLC (b)................. 8.38% 05/01/17 1,422,563

1,000,000 Easton-Bell Sports, Inc. (a).................. 9.75% 12/01/16 1,042,500

1,800,000 New Albertsons, Inc........................... 7.75% 06/15/26 1,467,000

|

See Notes to Quarterly Portfolio of Investments Page 1

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

PORTFOLIO OF INVESTMENTS - (CONTINUED)

JANUARY 31, 2014 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

---------------- ---------------------------------------------- -------------- --------------- --------------

CORPORATE BONDS AND NOTES (CONTINUED)

CONSUMER NON-CYCLICAL (CONTINUED)

$ 1,850,000 Post Holdings, Inc............................ 7.38% 02/15/22 $ 1,977,187

500,000 Roundy's Supermarkets, Inc. (b)............... 10.25% 12/15/20 530,000

--------------

6,439,250

--------------

ENERGY - 17.8%

2,100,000 Atlas Pipeline Partners L.P./Atlas Pipeline

Finance Corp............................... 5.88% 08/01/23 2,021,250

1,750,000 Breitburn Energy Partners LP/Breitburn

Finance Corp. (a).......................... 8.63% 10/15/20 1,894,375

250,000 Breitburn Energy Partners LP/Breitburn

Finance Corp............................... 7.88% 04/15/22 267,188

1,925,000 Calfrac Holdings LP (a) (b)................... 7.50% 12/01/20 2,006,812

1,875,000 Crosstex Energy LP/Crosstex Energy Finance

Corp. (a).................................. 8.88% 02/15/18 1,969,922

2,060,000 EV Energy Partners LP/EV Energy Finance

Corp. (a).................................. 8.00% 04/15/19 2,108,925

816,163 GMX Resources, Inc. (a) (d) (e)............... 11.00% 12/01/17 734,547

1,700,000 Hilcorp Energy I LP/Hilcorp Finance

Co. (a) (b)................................ 8.00% 02/15/20 1,844,500

1,000,000 ION Geophysical Corp. (b)..................... 8.13% 05/15/18 880,000

1,750,000 Key Energy Services, Inc. (a)................. 6.75% 03/01/21 1,806,875

950,000 Linn Energy LLC/Linn Energy Finance

Corp. (a).................................. 8.63% 04/15/20 1,030,750

800,000 Linn Energy LLC/Linn Energy Finance

Corp....................................... 7.75% 02/01/21 852,000

1,840,000 Niska Gas Storage US LLC/Niska Gas Storage

Canada ULC (a)............................. 8.88% 03/15/18 1,922,800

1,275,000 Pioneer Natural Resources Co. (a)............. 6.65% 03/15/17 1,467,304

1,300,000 RKI Exploration & Production LLC/RKI

Finance Corp. (b).......................... 8.50% 08/01/21 1,384,500

1,000,000 Tesoro Logistics, L.P./Tesoro Logistics

Finance Corp............................... 6.13% 10/15/21 1,032,500

2,100,000 Venoco, Inc. (a).............................. 8.88% 02/15/19 2,058,000

415,000 W&T Offshore, Inc............................. 8.50% 06/15/19 446,125

--------------

25,728,373

--------------

FINANCIAL SERVICES - 1.5%

250,000 Jurassic Holdings III (b)..................... 6.88% 02/15/21 251,875

1,750,000 Level 3 Communications, Inc. (a).............. 8.88% 06/01/19 1,925,000

--------------

2,176,875

--------------

HEALTHCARE - 7.3%

1,925,000 CHS/Community Health Systems, Inc. (a)........ 7.13% 07/15/20 2,052,531

1,375,000 DJO Finance LLC/DJO Finance Corp.............. 9.88% 04/15/18 1,502,188

1,750,000 HCA, Inc. (a)................................. 8.00% 10/01/18 2,078,125

1,045,000 inVentiv Health, Inc. (b)..................... 11.00% 08/15/18 948,338

1,725,000 Jaguar Holdings Co./Merger (a) (b)............ 9.50% 12/01/19 1,944,937

1,925,000 Kindred Healthcare, Inc. (a).................. 8.25% 06/01/19 2,074,187

--------------

10,600,306

--------------

|

Page 2 See Notes to Quarterly Portfolio of Investments

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2014 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

---------------- ---------------------------------------------- -------------- --------------- --------------

CORPORATE BONDS AND NOTES (Continued)

MEDIA - 7.9%

$ 1,850,000 Cablevision Systems Corp. (a)................. 8.63% 09/15/17 $ 2,159,875

1,700,000 CCO Holdings LLC/CCO Holdings

Capital Corp. (a).......................... 8.13% 04/30/20 1,857,250

1,700,000 Clear Channel Communications, Inc. (a)........ 9.00% 03/01/21 1,725,500

1,850,000 Cumulus Media Holdings, Inc. (a).............. 7.75% 05/01/19 1,993,375

1,700,000 Lamar Media Corp. (a)......................... 7.88% 04/15/18 1,787,125

1,750,000 Mediacom LLC/Mediacom Capital

Corp. (a).................................. 9.13% 08/15/19 1,894,375

--------------

11,417,500

--------------

REAL ESTATE - 1.3%

1,750,000 Realogy Corp. (a) (b)......................... 7.88% 02/15/19 1,916,250

--------------

Services - 19.3%

1,650,000 AMC Entertainment, Inc. (a)................... 8.75% 06/01/19 1,761,375

1,000,000 Avis Budget Car Rental Car, LLC............... 5.50% 04/01/23 970,000

1,750,000 Avis Budget Car Rental LLC/Avis Budget

Finance, Inc. (a).......................... 8.25% 01/15/19 1,892,187

2,000,000 Boyd Gaming Corp. (a)......................... 9.00% 07/01/20 2,175,000

2,550,000 Casella Waste Systems, Inc. (a)............... 7.75% 02/15/19 2,626,500

1,975,000 Cenveo Corp. (a).............................. 8.88% 02/01/18 1,965,125

1,950,000 Chester Downs & Marina LLC (a) (b)............ 9.25% 02/01/20 1,925,625

1,550,000 GLP Capital L.P./GLP Financing II,

Inc. (b)................................... 5.38% 11/01/23 1,542,250

1,475,000 Iron Mountain, Inc............................ 6.00% 08/15/23 1,524,781

1,300,000 MGM Resorts International (a)................. 7.63% 01/15/17 1,482,000

1,786,979 MTR Gaming Group, Inc. (a).................... 11.50% 08/01/19 2,019,286

1,250,000 National Cinemedia LLC........................ 6.00% 04/15/22 1,306,250

1,725,000 Palace Entertainment Holdings LLC/Palace

Entertainment Holdings Corp. (a) (b)....... 8.88% 04/15/17 1,789,688

2,100,000 Pulte Group, Inc. (a)......................... 6.38% 05/15/33 1,974,000

1,000,000 Sotheby's (b)................................. 5.25% 10/01/22 945,000

875,000 United Rentals North America, Inc............. 8.25% 02/01/21 986,563

900,000 United Rentals North America, Inc............. 7.63% 04/15/22 1,017,000

--------------

27,902,630

--------------

TECHNOLOGY & ELECTRONICS - 3.5%

500,000 CyrusOne L.P./CyrusOne Finance Corp........... 6.38% 11/15/22 518,750

2,400,000 First Data Corp. (a) (b)...................... 11.25% 01/15/21 2,658,000

1,775,000 Freescale Semiconductor, Inc. (a)............. 8.05% 02/01/20 1,939,188

--------------

5,115,938

--------------

TELECOMMUNICATIONS - 10.2%

2,000,000 Centurylink, Inc. (a)......................... 7.65% 03/15/42 1,795,000

2,000,000 Cincinnati Bell, Inc. (a)..................... 8.75% 03/15/18 2,102,500

1,200,000 Fairpoint Communications, Inc. (b)............ 8.75% 08/15/19 1,287,000

900,000 Frontier Communications Corp.................. 7.13% 01/15/23 897,750

1,750,000 Frontier Communications Corp. (a)............. 7.13% 03/15/19 1,907,500

475,000 Level 3 Financing, Inc. (b)................... 6.13% 01/15/21 486,875

|

See Notes to Quarterly Portfolio of Investments Page 3

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2014 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

---------------- ---------------------------------------------- -------------- --------------- --------------

CORPORATE BONDS AND NOTES (CONTINUED)

TELECOMMUNICATIONS (CONTINUED)

$ 1,875,000 Metro PCS Wireless, Inc. (a) (b).............. 6.63% 04/01/23 $ 1,952,344

1,700,000 PAETEC Holding Corp. (a)...................... 9.88% 12/01/18 1,887,000

500,000 Qwest Capital Funding, Inc.................... 6.88% 07/15/28 467,500

1,925,000 Windstream Corp............................... 7.50% 06/01/22 1,968,312

--------------

14,751,781

--------------

Total Corporate Bonds and Notes................................................ 153,354,582

(Cost $146,369,251) --------------

PRINCIPAL

VALUE STATED STATED VALUE

(LOCAL CURRENCY) DESCRIPTION COUPON MATURITY (US DOLLARS)

---------------- ---------------------------------------------- -------------- --------------- --------------

FOREIGN CORPORATE BONDS AND NOTES - 15.1%

AUTOMOTIVE - 2.4%

1,300,000 Jaguar Land Rover PLC (USD) (b)............... 8.13% 05/15/21 1,478,750

1,375,000 Servus Luxembourg Holding S.C.A.

(EUR) (b)................................. 7.75% 06/15/18 1,964,853

--------------

3,443,603

--------------

BASIC INDUSTRY - 4.7%

1,540,000 Cascades, Inc. (USD) (a)...................... 7.88% 01/15/20 1,655,500

1,150,000 FMG Resources (August 2006) Pty Ltd.

(USD) (b).................................. 6.88% 04/01/22 1,246,313

1,750,000 Masonite International Corp. (USD) (a) (b).... 8.25% 04/15/21 1,925,000

1,775,000 Tembec Industries, Inc. (USD) (a)............. 11.25% 12/15/18 1,956,937

--------------

6,783,750

--------------

CAPITAL GOODS - 2.1%

352,941 Ardagh Packaging Finance PLC/Ardagh Holdings

USA, Inc. (USD) (b)........................ 7.00% 11/15/20 359,118

800,000 Kraussmaffei Group GMBH (EUR)................. 8.75% 12/15/20 1,206,824

1,425,000 Trinseo Materials Operating S.C.A. (USD)

(b)........................................ 8.75% 02/01/19 1,464,188

--------------

3,030,130

--------------

ENERGY - 0.9%

645,000 Precision Drilling Corp. (USD)................ 6.63% 11/15/20 688,537

700,000 Puma International Financing S.A. (USD) (b)... 6.75% 02/01/21 700,000

--------------

1,388,537

--------------

FINANCIAL SERVICES - 0.9%

812,500 Numericable Finance & Co., S.C.A. (EUR)....... 12.38% 02/15/19 1,333,784

--------------

Real Estate - 0.7%

700,000 RPG Byty, s.r.o. (EUR)........................ 6.75% 05/01/20 964,158

--------------

|

Page 4 See Notes to Quarterly Portfolio of Investments

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2014 (UNAUDITED)

PRINCIPAL

VALUE STATED STATED VALUE

(LOCAL CURRENCY) DESCRIPTION COUPON MATURITY (US DOLLARS)

---------------- ---------------------------------------------- -------------- --------------- --------------

FOREIGN CORPORATE BONDS AND NOTES (CONTINUED)

SERVICES - 0.6%

700,000 Bilbao Luxembourg S.A. (EUR) (f).............. 10.50% 12/01/18 $ 940,556

--------------

TECHNOLOGY & ELECTRONICS - 1.4%

1,500,000 Legrand France S.A. (USD) (a)................. 8.50% 02/15/25 1,979,917

--------------

TELECOMMUNICATIONS - 1.4%

1,900,000 Intelsat Luxembourg S.A. (USD) (b)............ 7.75% 06/01/21 2,044,875

--------------

TOTAL FOREIGN CORPORATE BONDS AND NOTES......................... 21,909,310

(Cost $20,854,007) --------------

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

---------------- ---------------------------------------------- -------------- --------------- --------------

ASSET-BACKED SECURITIES - 7.7%

Ace Securities Corp

$ 1,037,093 Series 2003-MH1, Class A4 (b).............. 6.50% 08/15/30 1,106,717

BankAmerica Manufactured Housing

Contract Trust II

2,300,000 Series 1997-1, Class B1 (g)................ 6.94% 06/10/21 2,517,951

Bombardier Capital Mortgage Securitization

Corp.

279,077 Series 1999-B, Class A1B................... 6.61% 12/15/29 156,260

2,301,000 Citigroup Mortgage Loan Trust, Inc.

2,301,000 Series 2003-HE3, Class M4 (h).............. 3.16% 12/25/33 1,040,023

Green Tree Financial Corp.

913,022 Series 1996-6, Class B1.................... 8.00% 09/15/27 305,604

95,777 Series 1997-4, Class B1.................... 7.23% 02/15/29 7,013

701,203 Series 1998-4, Class M1.................... 6.83% 04/01/30 433,423

1,507,484 Series 1999-3, Class M1.................... 6.96% 02/01/31 103,389

GSAMP Trust

2,917,417 Series 2006-S5, Class A1 (h)............... 0.34% 09/25/36 94,991

1,007,499 Series 2007-HE1, Class A2B (h)............. 0.26% 03/25/47 947,856

413,152 Series 2007-NC1, Class A2B (h)............. 0.26% 12/25/46 226,468

2,771,563 Series 2007-NC1, Class A2C (h)............. 0.31% 12/25/46 1,528,137

Home Equity Asset Trust

1,190,000 Series 2006-4, Class 2A4 (h)............... 0.44% 08/25/36 919,638

IMC Home Equity Loan Trust

2,222,357 Series 1997-3, Class B..................... 7.87% 08/20/28 1,122,743

2,348,888 Series 1997-5, Class B (g)................. 7.59% 11/20/28 456,145

Oakwood Mortgage Investors, Inc.

736,511 Series 1999-B, Class M1.................... 7.18% 12/15/26 228,106

--------------

TOTAL ASSET-BACKED SECURITIES.................................................. 11,194,464

(Cost $8,786,212) --------------

|

See Notes to Quarterly Portfolio of Investments Page 5

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2014 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

---------------- ---------------------------------------------- -------------- --------------- --------------

MORTGAGE-BACKED SECURITIES - 4.9%

COLLATERALIZED MORTGAGE OBLIGATIONS - 3.3%

Citicorp Mortgage Securities, Inc.

$ 2,095,984 Series 2007-2, Class 1A3................... 6.00% 02/25/37 $ 2,221,328

Countrywide Alternative Loan Trust

169,299 Series 2007-11T1, Class A37 (h)............ 39.03% 05/25/37 295,057

Countrywide Home Loan Mortgage Pass

Through Trust

234,787 Series 2006-21, Class A8................... 5.75% 02/25/37 218,031

HarborView Mortgage Loan Trust

1,809,794 Series 2005-9, Class B10 (g) (h)........... 1.92% 06/20/35 18

Residential Accredit Loans, Inc.

179,499 Series 2007-Q56, Class A2 (h).............. 54.21% 04/25/37 372,668

Washington Mutual Alternative Mortgage

Pass-Through Certificates

52,877 Series 2007-5, Class A11 (h)............... 38.49% 06/25/37 93,745

Wells Fargo Mortgage Backed Securities

Trust

878,575 Series 2006-8, Class A15................... 6.00% 07/25/36 870,653

308,896 Series 2006-AR1, Class 2A5 (h)............. 5.32% 03/25/36 307,021

343,519 Series 2007-8, Class 2A2................... 6.00% 07/25/37 333,058

--------------

4,711,579

--------------

COMMERCIAL MORTGAGE-BACKED SECURITIES - 1.6%

Banc of America Large Loan, Inc.

1,548,035 Series 2005-MIB1, Class L (g) (h) (i)...... 3.16% 03/15/22 135,623

Greenwich Capital Commercial Funding

Corp.

1,180,000 Series 2007-GG11, Class AJ (h)............. 6.06% 12/10/49 1,179,121

Vornado DP LLC

930,000 Series 2010-VNO, Class D (b)............... 6.36% 09/13/28 1,055,261

--------------

2,370,005

--------------

TOTAL MORTGAGE-BACKED SECURITIES............................................. 7,081,584

(Cost $6,525,597) --------------

SENIOR FLOATING-RATE LOAN INTERESTS - 2.3%

CONSUMER NON-CYCLICAL - 0.5%

671,625 Albertsons, Inc., Term Loan B-1 (h)........... 4.75% 02/27/16 677,502

--------------

HEALTHCARE - 0.7%

1,000,000 inVentiv Health, Inc., Term Loan B (h)........ 7.50% 08/04/16 996,000

--------------

TELECOMMUNICATIONS - 0.7%

992,500 Fairpoint Communications, Inc., Term

Loan (h)................................... 7.50% 02/14/19 1,026,414

--------------

|

Page 6 See Notes to Quarterly Portfolio of Investments

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2014 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

---------------- ---------------------------------------------- -------------- --------------- --------------

SENIOR FLOATING-RATE LOAN INTERESTS (CONTINUED)

UTILITY - 0.4%

$ 834,744 Texas Competitive Electric Holdings Co.,

LLC, Tranche B2 (h)........................ 4.66%-4.74% 10/10/17 $ 580,539

--------------

TOTAL SENIOR FLOATING-RATE LOAN INTERESTS...................................... 3,280,455

(Cost $3,477,367) --------------

SHARES DESCRIPTION VALUE

---------------- ------------------------------------------------------------------------------- --------------

COMMON STOCKS - 1.3%

AUTOMOTIVE - 0.4%

33,500 Ford Motor Co.................................................................. 501,160

--------------

SERVICES - 0.2%

13,250 Iron Mountain, Inc............................................................. 349,932

--------------

TELECOMMUNICATIONS - 0.7%

211,034 Frontier Communications Corp................................................... 991,860

--------------

TOTAL COMMON STOCKS............................................................ 1,842,952

(Cost $1,824,301) --------------

PREFERRED SECURITIES - 0.1%

3,500 Independence III CDO, Ltd., Series 3A, Class PS (i) (j)........................ 3,500

4,000 Soloso CDO, Ltd., Series 2005-1 (i) (j)........................................ 40,000

9,000 White Marlin CDO, Ltd., Series AI (e) (i) (j).................................. 45,000

--------------

TOTAL PREFERRED SECURITIES..................................................... 88,500

(Cost $0) --------------

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

---------------- ---------------------------------------------- -------------- --------------- --------------

STRUCTURED NOTES - 0.0%

$ 5,750,000 Preferred Term Securities XXV, Ltd. (i)....... (j) 06/22/37 575

Preferred Term Securities XXVI, Ltd.

2,500,000 Subordinated Note (i)...................... (j) 09/22/37 250

--------------

TOTAL STRUCTURED NOTES......................................................... 825

(Cost $0) --------------

TOTAL INVESTMENTS - 137.5%..................................................... 198,752,672

(Cost $187,836,735) (k)

OUTSTANDING LOAN - (38.6%)..................................................... (55,800,000)

NET OTHER ASSETS AND LIABILITIES - 1.1%........................................ 1,613,577

--------------

NET ASSETS - 100.0%............................................................ $ 144,566,249

==============

|

(a) All or a portion of this security serves as collateral on the outstanding

loan.

See Notes to Quarterly Portfolio of Investments Page 7

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2014 (UNAUDITED)

(b) This security, sold within the terms of a private placement memorandum, is

exempt from registration upon resale under Rule 144A under the Securities

Act of 1933, as amended (the "1933 Act"), and may be resold in

transactions exempt from registration, normally to qualified institutional

buyers. Pursuant to procedures adopted by the Fund's Board of Trustees,

this security has been determined to be liquid by Brookfield Investment

Management Inc., the Fund's sub-advisor. Although market instability can

result in periods of increased overall market illiquidity, liquidity for

each security is determined based on security specific factors and

assumptions, which require subjective judgment. At January 31, 2014,

securities noted as such amounted to $40,871,532 or 28.27% of net assets.

(c) Multi-Step Coupon Bond - Coupon steps up or down based upon ratings

changes by Standard & Poor's Ratings Group or Moody's Investors Service,

Inc. The interest rate shown reflects the rate in effect at January 31,

2014.

(d) The issuer filed for bankruptcy on April 1, 2013.

(e) The issuer is in default. Income is not being accrued.

(f) This security is a Payment-in-kind ("PIK")Toggle Note whereby the issuer

may, at its option, elect to pay interest in cash at the stated coupon or

in PIK at 11.25%.

(g) Security missed one or more of its interest payments.

(h) Floating rate security. The interest rate shown reflects the rate in

effect at January 31, 2014.

(i) This security, sold within the terms of a private placement memorandum, is

exempt from registration upon resale under Rule 144A under the 1933 Act,

and may be resold in transactions exempt from registration, normally to

qualified institutional buyers (see Note 2C - Restricted Securities in the

Notes to Quarterly Portfolio of Investments).

(j) Zero coupon security.

(k) Aggregate cost for financial reporting purposes, which approximates the

aggregate cost for federal income tax purposes. As of January 31, 2014,

the aggregate gross unrealized appreciation for all securities in which

there was an excess of value over tax cost was $17,856,261 and the

aggregate gross unrealized depreciation for all securities in which there

was an excess of tax cost over value was $6,940,324.

CDO Collateralized Debt Obligation

EUR Euro

USD United States Dollar

Page 8 See Notes to Quarterly Portfolio of Investments

|

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2014 (UNAUDITED)

VALUATION INPUTS

A summary of the inputs used to value the Fund's investments as of January 31,

2014 is as follows (see Note 2A - Portfolio Valuation in the Notes to Quarterly

Portfolio of Investments):

LEVEL 2 LEVEL 3

TOTAL LEVEL 1 SIGNIFICANT SIGNIFICANT

VALUE AT QUOTED OBSERVABLE UNOBSERVABLE

INVESTMENTS 1/31/2014 PRICES INPUTS INPUTS

---------------------------------------------- --------------- ------------- --------------- --------------

Corporate Bonds and Notes*.................... $ 153,354,582 $ -- $ 153,354,582 $ --

Foreign Corporate Bonds and Notes*............ 21,909,310 -- 21,909,310 --

Asset-Backed Securities....................... 11,194,464 -- 11,194,464 --

Mortgage-Backed Securities:

Collateralized Mortgage Obligations........ 4,711,579 -- 4,711,579 --

Commercial Mortgage-Backed Securities...... 2,370,005 -- 2,370,005 --

Senior Floating-Rate Loan Interests*.......... 3,280,455 -- 3,280,455 --

Common Stocks* ............................... 1,842,952 1,842,952 -- --

Preferred Securities ......................... 88,500 -- -- 88,500

Structured Notes ............................. 825 -- 825 --

--------------- ------------- --------------- --------------

Total Investments ............................ 198,752,672 1,842,952 196,821,220 88,500

Forward Foreign Currency Contracts**.......... 55,474 -- 55,474 --

--------------- ------------- --------------- --------------

Total $ 198,808,146 $ 1,842,952 $ 196,876,694 $ 88,500

=============== ============= =============== ==============

|

* See Portfolio of Investments for industry breakout.

** See the Schedule of Forward Foreign Currency Contracts for contract and

currency detail.

All transfers in and out of the Levels during the period are assumed to be

transferred on the last day of the period at their current value. There were no

transfers between Levels at January 31, 2014.

The following table presents the activity of the Fund's investments measured at

fair value on a recurring basis using significant unobservable inputs (Level 3)

for the period presented.

BEGINNING BALANCE AT OCTOBER 31, 2013

Preferred Securities $ 88,500

Net Realized Gain (Loss) --

Net Change in Unrealized Appreciation/Depreciation --

Purchases --

Sales --

Transfers In --

Transfers Out --

ENDING BALANCE AT JANUARY 31, 2014

Preferred Securities 88,500

---------

Total Level 3 holdings $ 88,500

=========

|

There was no net change in unrealized appreciation (depreciation) from Level 3

investments held as of January 31, 2014.

See Notes to Quarterly Portfolio of Investments Page 9

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2014 (UNAUDITED)

SCHEDULE OF FORWARD FOREIGN CURRENCY CONTRACTS (see Note 2F - Forward Foreign

Currency Contracts in the Notes to Quarterly Portfolio of Investments):

FORWARD FOREIGN CURRENCY CONTRACTS

---------------------------------------------------------

PURCHASE SALE UNREALIZED

SETTLEMENT AMOUNT AMOUNT VALUE AS OF VALUE AS OF APPRECIATION/

DATE COUNTERPARTY PURCHASED (a) SOLD (a) JANUARY 31, 2014 JANUARY 31, 2014 (DEPRECIATION)

---------- -------------- -------------------- ----------------- ---------------- ---------------- --------------

02/10/14 BNYM USD 6,117,919 EUR 4,495,000 $ 6,117,919 $ 6,062,445 $ 55,474

------------

Net unrealized appreciation (depreciation).............................................................. $ 55,474

============

|

(a) Please see Portfolio of Investments for currency descriptions.

Counterparty Abbreviations:

BNYM Bank of New York Mellon

Page 10 See Notes to Quarterly Portfolio of Investments

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

JANUARY 31, 2014 (UNAUDITED)

1. ORGANIZATION

First Trust Strategic High Income Fund II (the "Fund") is a diversified,

closed-end management investment company organized as a Massachusetts business

trust on January 18, 2006, and is registered with the Securities and Exchange

Commission ("SEC") under the Investment Company Act of 1940, as amended (the

"1940 Act"). The Fund trades under the ticker symbol FHY on the New York Stock

Exchange ("NYSE").

2. VALUATION AND INVESTMENT PRACTICES

A. PORTFOLIO VALUATION:

The net asset value ("NAV") of the Common Shares of the Fund is determined

daily, as of the close of regular trading on the NYSE, normally 4:00 p.m.

Eastern time, on each day the NYSE is open for trading. If the NYSE closes early

on a valuation day, the NAV is determined as of that time. Domestic debt

securities and foreign securities are priced using data reflecting the earlier

closing of the principal markets for those securities. The NAV per Common Share

is calculated by dividing the value of all assets of the Fund (including accrued

interest and dividends), less all liabilities (including accrued expenses,

dividends declared but unpaid and any borrowings of the Fund), by the total

number of Common Shares outstanding.

The Fund's investments are valued daily in accordance with valuation procedures

adopted by the Fund's Board of Trustees and in accordance with provisions of the

1940 Act. Market quotations and prices used to value the Fund's investments are

primarily obtained from third party pricing services. The Fund's investments are

valued as follows:

Corporate bonds, notes, U.S. government securities, mortgage-backed

securities, asset-backed securities and other debt securities are valued

on the basis of valuations provided by dealers who make markets in such

securities or by an independent pricing service approved by the Fund's

Board of Trustees, which may use the following valuation inputs when

available:

1) benchmark yields;

2) reported trades;

3) broker/dealer quotes;

4) issuer spreads;

5) benchmark securities;

6) bids and offers; and

7) reference data including market research publications.

Common stocks and other equity securities listed on any national or

foreign exchange (excluding the NASDAQ(R) Stock Market LLC ("NASDAQ") and

the London Stock Exchange Alternative Investment Market ("AIM")) are

valued at the last sale price on the exchange on which they are

principally traded or, for NASDAQ and AIM securities, the official closing

price. Securities traded on more than one securities exchange are valued

at the last sale price or official closing price, as applicable, at the

close of the securities exchange representing the principal market for

such securities.

Securities traded in an over-the-counter market are valued at the mean of

the bid and the asked prices, if available, and otherwise at their closing

bid price.

The loan assignments, participations and commitments ("Senior Loans")(1)

held in the Fund are not listed on any securities exchange or board of

trade. Senior Loans are typically bought and sold by institutional

investors in individually negotiated private transactions that function in

many respects like an over-the-counter secondary market, although

typically no formal market-makers exist. This market, while having grown

substantially since its inception, generally has fewer trades and less

liquidity than the secondary market for other types of securities. Some

Senior Loans have few or no trades, or trade infrequently, and information

regarding a specific Senior Loan may not be widely available or may be

incomplete. Accordingly, determinations of the market value of Senior

Loans may be based on infrequent and dated information. Because there is

less reliable, objective data available, elements of judgment may play a

greater role in valuation of Senior Loans than for other types of

securities. Typically, Senior Loans are valued using information provided

by a third party pricing service. The third party pricing service

primarily uses over-the-counter pricing from dealer runs and broker quotes

from indicative sheets to value the Senior Loans.

Forward foreign currency contracts are valued at the current day's

interpolated foreign exchange rate, as calculated using the current day's

spot rate, and the thirty, sixty, ninety, and one-hundred eighty day

forward rates provided by an independent pricing service.

Debt securities having a remaining maturity of sixty days or less when

purchased are valued at cost adjusted for amortization of premiums and

accretion of discounts.

1 The terms "security" and "securities" used throughout the Notes to

Quarterly Portfolio of Investments include Senior Loans.

Page 11

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS (CONTINUED)

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

JANUARY 31, 2014 (UNAUDITED)

Certain securities may not be able to be priced by pre-established pricing

methods. Such securities may be valued by the Fund's Board of Trustees or its

delegate at fair value. These securities generally include, but are not limited

to, restricted securities (securities which may not be publicly sold without

registration under the Securities Act of 1933, as amended (the "1933 Act")) for

which a pricing service is unable to provide a market price; securities whose

trading has been formally suspended; a security whose market price is not

available from a pre-established pricing source; a security with respect to

which an event has occurred that is likely to materially affect the value of the

security after the market has closed but before the calculation of the Fund's

NAV or make it difficult or impossible to obtain a reliable market quotation;

and a security whose price, as provided by the pricing service, does not reflect

the security's "fair value." As a general principle, the current "fair value" of

a security would appear to be the amount which the owner might reasonably expect

to receive for the security upon its current sale. The use of fair value prices

by the Fund generally results in prices used by the Fund that may differ from

current market quotations or official closing prices on the applicable exchange.

A variety of factors may be considered in determining the fair value of such

securities, including, but not limited to, the following:

1) the fundamental business data relating to the issuer;

2) an evaluation of the forces which influence the market in which

these securities are purchased and sold;

3) the type, size and cost of a security;

4) the financial statements of the issuer;

5) the credit quality and cash flow of the issuer, based on the

sub-advisor's or external analysis;

6) the information as to any transactions in or offers for the

security;

7) the price and extent of public trading in similar securities (or

equity securities) of the issuer/borrower, or comparable companies;

8) the coupon payments;

9) the quality, value and salability of collateral, if any, securing

the security;

10) the business prospects of the issuer, including any ability to

obtain money or resources from a parent or affiliate and an

assessment of the issuer's management;

11) the prospects for the issuer's industry, and multiples (of earnings

and/or cash flows) being paid for similar businesses in that

industry; and

12) other relevant factors.

The Fund invests a significant portion of its assets in below-investment grade

debt securities, including structured finance securities and corporate bonds.

Structured finance securities include: asset-backed securities, including home

equity, manufactured housing, etc.; commercial mortgage-backed securities;

residential mortgage-backed or private-label collateralized mortgage

obligations; and collateralized debt obligations. The value and related income

of these securities is sensitive to changes in economic conditions, including

delinquencies and/or defaults.

The Fund is subject to fair value accounting standards that define fair value,

establish the framework for measuring fair value and provide a three-level

hierarchy for fair valuation based upon the inputs to the valuation as of the

measurement date. The three levels of the fair value hierarchy are as follows:

o Level 1 - Level 1 inputs are quoted prices in active markets for

identical investments. An active market is a market in which

transactions for the investment occur with sufficient frequency and

volume to provide pricing information on an ongoing basis.

o Level 2 - Level 2 inputs are observable inputs, either directly or

indirectly, and include the following:

o Quoted prices for similar investments in active markets.

o Quoted prices for identical or similar investments in markets

that are non-active. A non-active market is a market where

there are few transactions for the investment, the prices are

not current, or price quotations vary substantially either

over time or among market makers, or in which little

information is released publicly.

o Inputs other than quoted prices that are observable for the

investment (for example, interest rates and yield curves

observable at commonly quoted intervals, volatilities,

prepayment speeds, loss severities, credit risks, and default

rates).

o Inputs that are derived principally from or corroborated by

observable market data by correlation or other means.

o Level 3 - Level 3 inputs are unobservable inputs. Unobservable

inputs may reflect the reporting entity's own assumptions about the

assumptions that market participants would use in pricing the

investment.

The inputs or methodology used for valuing investments are not necessarily an

indication of the risk associated with investing in those investments. A summary

of the inputs used to value the Fund's investments as of January 31, 2014, is

included with the Fund's Portfolio of Investments.

Page 12

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS (CONTINUED)

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

JANUARY 31, 2014 (UNAUDITED)

B. SECURITIES TRANSACTIONS AND INVESTMENT INCOME:

Securities transactions are recorded as of the trade date. Realized gains and

losses from securities transactions are recorded on the identified cost basis.

The Fund invests in certain lower credit quality securitized assets (for

example, asset-backed securities, collateralized mortgage obligations and

commercial mortgage-backed securities), as well as interest-only securities,

that have contractual cash flows. For these securities, if there is a change in

the estimated cash flows, based on an evaluation of current information, then

the estimated yield is adjusted. Additionally, if the evaluation of current

information indicates a permanent impairment of the security, the cost basis of

the security is written down and a loss is recognized. Debt obligations may be

placed on non-accrual status, and related interest income may be reduced by

ceasing current accruals and amortization/accretion and writing off interest

receivables when the collection of all or a portion of interest has become

doubtful based on consistently applied procedures. A debt obligation is removed

from non-accrual status when the issuer resumes interest payments or when

collectability of interest is reasonably assured.

Securities purchased on a when-issued, delayed-delivery or forward purchase

commitment basis may have extended settlement periods. The value of the security

so purchased is subject to market fluctuations during this period. The Fund

maintains liquid assets with a current value at least equal to the amount of its

when-issued, delayed-delivery or forward purchase commitments until payment is

made. At January 31, 2014, the Fund had no when-issued, delayed-delivery or

forward purchase commitments.

C. RESTRICTED SECURITIES:

The Fund invests in restricted securities, which are securities that may not be

offered for public sale without first being registered under the 1933 Act. Prior

to registration, restricted securities may only be resold in transactions exempt

from registration under Rule 144A under the 1933 Act, normally to qualified

institutional buyers. As of January 31, 2014, the Fund held restricted

securities as shown in the following table that Brookfield Investment Management

Inc., the sub-advisor, has deemed illiquid pursuant to procedures adopted by the

Fund's Board of Trustees. Although market instability can result in periods of

increased overall market illiquidity, liquidity for each security is determined

based on security-specific factors and assumptions, which require subjective

judgment. The Fund does not have the right to demand that such securities be

registered. These securities are valued according to the valuation procedures as

stated in the Portfolio Valuation note (Note 2A) and are not expressed as a

discount to the carrying value of a comparable unrestricted security. There are

no unrestricted securities with the same maturity dates and yields for these

issuers.

% OF

ACQUISITION PRINCIPAL CARRYING NET

SECURITY DATE VALUE/SHARES PRICE COST VALUE ASSETS

------------------------------------------- ----------- ------------ --------- ------------ ------------ ------------

Banc of America Large Loan, Inc.

Series 2005-MIB1, Class L, 3.16%,

03/15/22 06/26/06 $ 1,548,035 $ 8.76 $ 278,984 $ 135,623 0.10%

Independence III CDO, Ltd.

Series 3A, Class PS 04/11/06 3,500 1.00 -- 3,500 0.00**

Preferred Term Securities XXV, Ltd.

Zero Coupon, 06/22/37 03/27/07 $ 5,750,000 0.00* -- 575 0.00**

Preferred Term Securities XXVI, Ltd.

Subordinated Note, Zero Coupon, 09/22/37 06/06/07 $ 2,500,000 0.00* -- 250 0.00**

Soloso CDO, Ltd., Series 2005-1 04/24/06 4,000 10.00 -- 40,000 0.03

White Marlin CDO, Ltd., Series AI 06/01/07 9,000 5.00 -- 45,000 0.03

------------ ------------ ------------

$ 278,984 224,948 0.16%

============ ============ ============

|

* Amount is less than $0.01.

** Amount is less than 0.01%.

Page 13

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS (CONTINUED)

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

JANUARY 31, 2014 (UNAUDITED)

D. INTEREST-ONLY SECURITIES:

An interest-only security ("IO Security") is the interest-only portion of a

mortgage-backed security that receives some or all of the interest portion of

the underlying mortgage-backed security and little or no principal. A reference

principal value called a notional value is used to calculate the amount of

interest due to the IO Security. IO Securities are sold at a deep discount to

their notional principal amount. Generally speaking, when interest rates are

falling and prepayment rates are increasing, the value of an IO Security will

fall. Conversely, when interest rates are rising and prepayment rates are

decreasing, generally the value of an IO Security will rise. These securities,

if any, are identified on the Portfolio of Investments.

E. COLLATERALIZED DEBT OBLIGATIONS:

A collateralized debt obligation ("CDO") is an asset-backed security whose

underlying collateral is typically a portfolio of bonds or bank loans. Where the

underlying collateral is a portfolio of bonds, a CDO is referred to as a

collateralized bond obligation ("CBO"). Where the underlying collateral is a

portfolio of bank loans, a CDO is referred to as a collateralized loan

obligation ("CLO"). Investors in CDOs bear the credit risk of the underlying

collateral. Multiple tranches of securities are issued by the CDO, offering

investors various maturity and credit risk characteristics. Tranches are

categorized as senior, mezzanine, and subordinated/equity, according to their

degree of risk. If there are defaults or the CDO's collateral otherwise

underperforms, scheduled payments to senior tranches take precedence over those

of mezzanine tranches, and scheduled payments to mezzanine tranches take

precedence over those to subordinated/equity tranches. CDOs, similar to other

asset-backed securities, are subject to prepayment risk.

F. FORWARD FOREIGN CURRENCY CONTRACTS:

The Fund is subject to foreign currency risk in the normal course of pursuing

its investment objectives. Forward foreign currency contracts are agreements to

exchange one currency for another at a future date and at a specified price. The

Fund uses forward foreign currency contracts to facilitate transactions in

foreign securities and to manage the Fund's foreign currency exposure. These

contracts are valued daily, and the Fund's net equity therein, representing

unrealized gain or loss on the contracts as measured by the difference between

the forward foreign exchange rates at the dates of entry into the contracts and

the forward rates at the reporting date, is included on the Schedule of Forward

Foreign Currency Contracts. Risks arise from the possible inability of

counterparties to meet the terms of their contracts and from movement in

currency and securities values and interest rates. Due to the risks, the Fund

could incur losses in excess of the net unrealized value shown on the Schedule

of Forward Foreign Currency Contracts.

For the fiscal year to date period (November 1, 2013 through January 31, 2014),

the amount of notional values of forward foreign currency contracts opened and

closed were $28,084,819 and $7,395,443, respectively.

G. FOREIGN CURRENCY:

The books and records of the Fund are maintained in U.S. dollars. Foreign

currencies, investments and other assets and liabilities are translated into

U.S. dollars at the exchange rates prevailing at the end of the period.

Purchases and sales of investments and items of income and expense are

translated on the respective dates of such transactions.

3. LITIGATION

The Fund has entered into a settlement of the previously-reported class action

lawsuit filed by Lehman Brothers Special Finance, Inc. in the United States

Bankruptcy Court for the Southern District of New York (the "Class Litigation").

The settlement fully disposes of all outstanding claims asserted against the

Fund and the Fund is no longer a party to the Class Litigation.

Page 14

ITEM 2. CONTROLS AND PROCEDURES.

(a) The registrant's principal executive and principal financial officers, or

persons performing similar functions, have concluded that the

registrant's disclosure controls and procedures (as defined in Rule

30a-3(c) under the Investment Company Act of 1940, as amended (the "1940

Act") (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days

of the filing date of the report that includes the disclosure required by

this paragraph, based on their evaluation of these controls and

procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR

270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities

Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

(b) There were no changes in the registrant's internal control over financial

reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR

270.30a-3(d)) that occurred during the registrant's last fiscal quarter

that have materially affected, or are reasonably likely to materially

affect, the registrant's internal control over financial reporting.

ITEM 3. EXHIBITS.

Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of

the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) First Trust Strategic High Income Fund II

By (Signature and Title)* /s/ Mark R. Bradley

----------------------------------------

Mark R. Bradley, President and

Chief Executive Officer

(principal executive officer)

Date: March 20, 2014

-------------------

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

By (Signature and Title)* /s/ Mark R. Bradley

----------------------------------------

Mark R. Bradley, President and

Chief Executive Officer

(principal executive officer)

Date: March 20, 2014

-------------------

By (Signature and Title)* /s/ James M. Dykas

----------------------------------------

James M. Dykas, Treasurer,

Chief Financial Officer and

Chief Accounting Officer

(principal financial officer)

Date: March 20, 2014

-------------------

|

* Print the name and title of each signing officer under his or her signature.

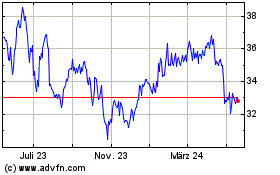

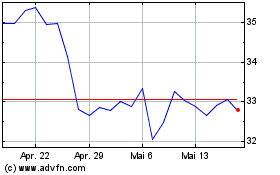

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024