UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT

INVESTMENT COMPANY

Investment Company Act file number 811-21756

FIRST TRUST STRATEGIC HIGH INCOME FUND

(Exact name of registrant as specified in charter)

1001 Warrenville Road, Suite 300

LISLE, IL 60532

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

1001 Warrenville Road, Suite 300

LISLE, IL 60532

(Name and address of agent for service)

Registrant's telephone number, including area code: (630) 241-4141

Date of fiscal year end: OCTOBER 31

Date of reporting period: JULY 31, 2007

Form N-Q is to be used by management investment companies, other than small

business investment companies registered on Form N-5 (ss.ss. 239.24 and 274.5 of

this chapter), to file reports with the Commission, not later than 60 days after

the close of the first and third fiscal quarters, pursuant to rule 30b1-5 under

the Investment Company Act of 1940 (17 CFR 270.30b1-5). The Commission may use

the information provided on Form N-Q in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-Q, and

the Commission will make this information public. A registrant is not required

to respond to the collection of information contained in Form N-Q unless the

Form displays a currently valid Office of Management and Budget ("OMB") control

number. Please direct comments concerning the accuracy of the information

collection burden estimate and any suggestions for reducing the burden to the

Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC

20549. The OMB has reviewed this collection of information under the clearance

requirements of 44 U.S.C. ss. 3507.

ITEM 1. SCHEDULE OF INVESTMENTS.

The Schedule(s) of Investments is attached herewith.

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS

JULY 31, 2007 (UNAUDITED)

PRINCIPAL STATED MARKET

VALUE DESCRIPTION COUPON MATURITY VALUE

------------ ----------------------------------------------- ----------- -------------- --------------

ASSET-BACKED SECURITIES - 80.9%

$ 1,750,000 ABCLO Ltd

Series 2007-1A, Class D (a) (b) ................... 9.27% 04/15/21 $ 1,395,625

504,354 ACE Securities Corp., Home Equity Loan Trust

Series 2003-OP1, Class B (c) ...................... 6.00% 12/25/33 102,104

1,406,893 ACE Securities Corp., Home Equity Loan Trust

Series 2004-HE4, Class M11 (b) .................... 8.82% 12/25/34 908,515

2,000,000 ACE Securities Corp., Home Equity Loan Trust

Series 2005-HE5, Class M10 (b) .................... 8.32% 08/25/35 320,000

2,000,000 ACE Securities Corp., Home Equity Loan Trust

Series 2005-SL1, Class M7 (c) ..................... 6.50% 06/25/35 273,689

3,000,000 ACE Securities Corp., Home Equity Loan Trust

Series 2007-HE4, Class M8 (b) ..................... 7.82% 05/25/37 2,250,000

2,718,136 ACLC Business Loan Receivables Trust

Series 1999-1, Class A3 (a) ....................... 7.39% 08/15/20 2,509,448

2,499,845 ACLC Business Loan Receivables Trust

Series 1999-2, Class B (a) ........................ 8.75% 01/15/21 2,513,464

1,617,579 Aircraft Finance Trust

Series 1999-1A, Class A2 (a) (b) .................. 5.82% 05/15/24 1,570,063

762,678 Atherton Franchisee Loan Funding

Series 1999-A, Class A2 (a) ....................... 7.23% 04/15/12 776,075

4,000,000 Bear Stearns Asset Backed Security Trust

Series 2007-HE3, Class M9 (b) ..................... 7.57% 04/25/37 3,220,000

2,000,000 Bear Stearns Second Lien Trust

Series 2007-1, Class 2B1 (b) ...................... 8.32% 08/25/37 1,246,250

2,878,000 Bear Stearns Second Lien Trust

Series 2007-1, Class 2M6 (b) ...................... 8.32% 08/25/37 2,216,060

3,000,000 BNC Mortgage Loan Trust

Series 2007-2, Class B1 (a) (b) ................... 7.82% 05/25/37 2,340,000

1,766,000 BNC Mortgage Loan Trust

Series 2007-3, Class B2 (a) (b) ................... 7.82% 07/25/37 1,306,840

362,696 Bombardier Capital Mortgage Securitization Corp.

Series 1999-B , Class A1B ......................... 6.61% 09/15/10 224,836

928,599 Bombardier Capital Mortgage Securitization Corp.

Series 1999-B, Class A3 ........................... 7.18% 12/15/15 608,053

4,267,079 Conseco Finance Securitizations Corp

Series 2000-6, Class M1 ........................... 7.72% 09/01/31 1,593,084

1,415,989 EMAC Owner Trust, LLC

Series 1998-1, Class A3 (a) ....................... 6.63% 01/15/25 1,403,334

1,411,793 EMAC Owner Trust, LLC

Series 2000-1, Class A1 (a) (b) ................... 6.22% 01/15/27 1,087,522

1,808,501 EMAC Owner Trust, LLC

Series 2000-1, Class A2 (a) (b) ................... 6.22% 01/15/27 1,375,026

4,905,000 Falcon Franchise Loan Trust

Series 2000-1, Class E (a) ........................ 6.50% 04/05/16 4,139,261

4,231,000 Falcon Franchise Loan Trust

Series 2003-1, Class E (a) ........................ 6.00% 01/05/25 2,855,781

5,000,000 FFCA Secured Lending Corp.

Series 1998-1, Class D1 (a) ....................... 7.81% 10/18/25 4,627,747

|

See Notes to Quarterly Portfolio of Investments. Page 1

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS - (CONTINUED)

JULY 31, 2007 (UNAUDITED)

PRINCIPAL STATED MARKET

VALUE DESCRIPTION COUPON MATURITY VALUE

------------ ----------------------------------------------- ----------- -------------- --------------

ASSET-BACKED SECURITIES - (CONTINUED)

$ 5,000,000 FFCA Secured Lending Corp

Series 1999-2, Class B1 (a) ....................... 8.27% 05/18/26 $ 2,756,546

1,692,222 FMAC Loan Receivables Trust

Series 1997-B, Class A (a) ........................ 6.85% 09/15/19 1,646,346

6,200,000 FMAC Loan Receivables Trust

Series 1998-CA, Class A3 (a) ...................... 6.99% 09/15/20 5,430,664

422,243 Green Tree Financial Corp.

Series 1997-4, Class B1 ........................... 7.23% 02/15/29 85,710

1,000,000 Green Tree Financial Corp.

Series 1998-4, Class M1 ........................... 6.83% 04/01/30 458,295

5,000,000 Green Tree Financial Corp.

Series 1998-6, Class M1 ........................... 6.63% 06/01/30 3,000,000

3,000,000 Green Tree Financial Corp.

Series 1998-8, Class M1 ........................... 6.98% 09/01/30 1,911,556

7,413,623 Green Tree Financial Corp.

Series 1999-3, Class M1 ........................... 6.96% 02/01/31 1,989,508

10,000,000 GreenPoint Manufactured Housing Contract Trust.

Series 1999-5, Class M2 ........................... 9.23% 12/15/29 5,566,074

1,988,790 GSAMP Trust

Series 2004-AR2, Class B4 (a) (c) ................. 5.00% 08/25/34 1,392,153

3,700,000 Halyard Multi Asset CBO I, Ltd.

Series 1A, Class B (a) (b) ........................ 6.76% 03/24/10 2,849,000

3,000,000 Helios Series I, Multi Asset CBO I, Ltd.

Series 1A, Class B (a) (b) ........................ 6.25% 12/13/36 2,520,000

2,000,000 Home Equity Mortgage Trust

Series 2005-3, Class B2 (c) ....................... 7.00% 11/25/35 800,000

5,000,000 Home Equity Mortgage Trust

Series 2007-2, Class M3 (b) ....................... 7.82% 06/25/37 3,250,000

5,000,000 Independence lll CDO, Ltd.

Series 3A, Class C1 (a) (b) ....................... 7.86% 10/03/37 2,850,000

2,375,000 Indymac Residential Asset Backed Trust

Series 2005-B, Class M10 (b) ...................... 8.82% 08/25/35 1,745,475

2,810,069 Longhorn CDO Ltd.

Series 1, Class C (a) (b) ......................... 11.60% 05/10/12 2,472,861

5,349,096 Merit Securities Corp.

Series 13, Class B1 (c) (d) ....................... 8.65% 12/28/33 359,406

2,602,000 Merit Securities Corp.

Series 13, Class M2 (c) ........................... 8.65% 12/28/33 1,014,780

2,500,000 Merrill Lynch Mortgage Investors Trust

Series 2006-SL1, Class B4 (a) (c) ................. 7.50% 09/25/36 625,000

4,500,000 North Street Referenced Linked Notes

Series 2000-1A, Class C (a) (b) ................... 7.11% 04/28/11 3,150,000

7,000,000 North Street Referenced Linked Notes

Series 2000-1A, Class D1 (a) (b) .................. 7.96% 04/28/11 3,504,375

8,000,000 Oakwood Mortgage Investors, Inc.

Series 2002-B, Class M1 ........................... 7.62% 06/15/32 3,396,953

4,000,000 Park Place Securities, Inc.

Series 2004-WCW1, Class M8 (b) .................... 8.82% 09/25/34 3,115,592

|

Page 2 See Notes to Quarterly Portfolio of Investments.

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS - (CONTINUED)

JULY 31, 2007 (UNAUDITED)

PRINCIPAL STATED MARKET

VALUE DESCRIPTION COUPON MATURITY VALUE

------------ ----------------------------------------------- ----------- -------------- --------------

ASSET-BACKED SECURITIES - (CONTINUED)

$ 3,000,000 Park Place Securities, Inc.

Series 2004-WCW2, Class M10 (b) ................... 8.07% 10/25/34 $ 2,502,910

3,000,000 Park Place Securities, Inc.

Series 2005-WHQ4, Class M10 (a) (b) ............... 7.82% 09/25/35 1,800,000

2,000,000 Pebble Creek LCDO Ltd.

Series 2007-2A, Class E (a) (b) ................... 8.61% 06/22/14 1,537,980

2,656,636 Pegasus Aviation Lease Securitization III

Series 2001-1A, Class A3 (a) (b) .................. 6.00% 03/10/14 2,259,801

3,500,000 Rosedale CLO Ltd.

Series I-A, Class II (a) .......................... 0.00% 07/24/21 2,625,000

1,000,000 Signature 5 Ltd.

Series 5A, Class C (a) ............................ 12.56% 10/27/12 980,000

6,000,000 Soundview Home Equity Loan Trust

Series 2005-A, Class B2 (a) (b) ................... 8.32% 04/25/35 229,222

1,634,000 Soundview Home Equity Loan Trust

Series 2007-OPT3, Class M10 (a) (b) ............... 7.82% 08/25/37 1,338,093

2,651,000 Structured Asset Investment Loan Trust

Series 2004-8, Class B2 (c) ....................... 5.00% 09/25/34 2,294,311

3,000,000 Structured Asset Securities Corp.

Series 2007-BC3, Class B1 (a) (b) ................. 7.82% 05/25/47 2,402,811

2,000,000 Structured Asset Securities Corp.

Series 2007-OSI, Class M10 (b) .................... 7.82% 06/25/37 1,644,375

5,000,000 Summit CBO I, Ltd.

Series 1A, Class B (a) (b) ........................ 6.38% 05/23/11 1,003,125

10,000,000 UCFC Manufactured Housing Contract

Series 1998-3, Class M1 ........................... 6.51% 01/15/30 4,200,000

3,947,000 Wells Fargo Home Equity Trust

Series 2007-2, Class B2 (a) (b) ................... 7.82% 04/25/37 2,850,472

5,000,000 Wilbraham CBO Ltd.

Series 1A, Class A2 (a) (b) ....................... 6.05% 07/13/12 4,500,000

--------------

TOTAL ASSET-BACKED SECURITIES.................................................. 128,921,171

--------------

(Cost $140,205,934)

COLLATERALIZED MORTGAGE OBLIGATIONS - 10.1%

1,930,000 Adjustable Rate Mortgage Trust

Series 2005-10, Class 5M5 (b) ..................... 7.52% 01/25/36 1,351,000

3,985,835 Countrywide Alternative Loan Trust

Series 2005-56, Class B4 (a) (b) .................. 6.57% 11/25/35 2,560,899

3,137,516 Countrywide Alternative Loan Trust

Series 2006-OA2, Class B2 (b) ..................... 7.57% 05/20/46 1,955,065

2,437,856 Credit Suisse Mortgage Capital

Series 2006-1, Class DB5 (b) ...................... 5.74% 02/25/36 1,346,503

2,349,491 Credit Suisse Mortgage Capital

Series 2006-2, Class DB5 (b) ...................... 5.87% 03/25/36 1,369,619

1,099,080 CS First Boston Mortgage Securities

Series 2005-11, Class DB6 (b) ..................... 6.19% 12/25/35 629,815

|

See Notes to Quarterly Portfolio of Investments. Page 3

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS - (CONTINUED)

JULY 31, 2007 (UNAUDITED)

PRINCIPAL STATED MARKET

VALUE DESCRIPTION COUPON MATURITY VALUE

------------ ----------------------------------------------- ----------- -------------- --------------

COLLATERALIZED MORTGAGE OBLIGATIONS - (CONTINUED)

$ 3,690,000 Deutsche Securities ALT-A Securities, Inc.

Mortgage Loan Trust

Series 2007-OA4, Class M10 (b) .................... 8.32% 08/25/47 $ 2,854,178

4,596,668 HarborView Mortgage Loan Trust

Series 2005-9, Class B10 (b) ...................... 7.07% 06/20/35 4,003,410

--------------

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS...................................... 16,070,489

--------------

(Cost $17,102,706)

COMMERCIAL MORTGAGE-BACKED SECURITIES - 17.5%

1,171,422 Banc of America Commercial Mortgage Inc.

Series 2000-1, Class M (d) ........................ 6.00% 11/15/31 969,505

2,000,000 Banc of America Large Loan, Inc.

Series 2005-MIB1, Class L (a) (b) ................. 8.32% 03/15/22 1,948,037

2,878,166 Banc of America Structured Securities Trust

Series 2002-X1, Class O (a) ....................... 7.00% 10/11/33 2,510,645

2,878,166 Banc of America Structured Securities Trust

Series 2002-X1, Class P (a) ....................... 7.00% 10/11/33 2,160,449

1,776,400 Bear Stearns Commercial Mortgage Securities

Series 2000-WF1, Class K .......................... 6.50% 02/15/32 1,096,769

14,938,142 FannieMae-ACES

Series 1998-M7, Class N, IO (b) (e) (f)............ 0.74% 05/25/36 305,978

700,000 GE Capital Commercial Mortgage Corp.

Series 2000-1, Class G (a) ........................ 6.13% 01/15/33 633,754

1,000,000 GMAC Commercial Mortgage Securities, Inc.

Series 1999-C3, Class G (a) ....................... 6.97% 08/15/36 934,470

111,642,092 Government National Mortgage Association

Series 2003-47, Class XA, IO (b) (f) .............. 0.56% 06/16/43 6,834,785

26,237,543 Government National Mortgage Association

Series 2003-59, Class XA, IO (b) (f) ............. 1.69% 06/16/34 2,293,833

7,000,000 GS Mortgage Securities Corp. II

Series 1998-C1, Class H (a) ....................... 6.00% 10/18/30 3,282,674

3,025,000 LB-UBS Commercial Mortgage Trust

Series 2001-C7, Class Q (d) ....................... 5.87% 11/15/33 2,280,158

2,084,042 LB-UBS Commercial Mortgage Trust

Series 2001-C7, Class S (a) ....................... 5.87% 11/15/33 1,000,541

968,400 Morgan Stanley Capital I Inc.

Series 1999-WF1, Class M (d) ...................... 5.91% 11/15/31 636,582

2,787,919 Morgan Stanley Capital I Inc.

Series 2003-IQ5, Class O (a) ...................... 5.24% 04/15/38 1,091,925

--------------

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES.................................... 27,980,105

--------------

(Cost $29,692,131)

CORPORATE BONDS AND NOTES - 17.7%

3,500,000 Americast Technologies (a)............................ 11.00% 12/01/14 3,465,000

1,000,000 Broadview Networks Holdings, Inc. (a)................. 11.38% 09/01/12 1,015,000

1,500,000 Broadview Networks Holdings, Inc. (a)................. 11.38% 09/01/12 1,522,500

2,000,000 Coleman Cable Inc..................................... 9.88% 10/01/12 2,090,000

3,500,000 Dayton Superior Corp.................................. 13.00% 06/15/09 3,508,750

2,500,000 Interdent Service Corp. .............................. 10.75% 12/15/11 2,312,500

|

Page 4 See Notes to Quarterly Portfolio of Investments.

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS - (CONTINUED)

JULY 31, 2007 (UNAUDITED)

PRINCIPAL STATED MARKET

VALUE DESCRIPTION COUPON MATURITY VALUE

------------ ----------------------------------------------- ----------- -------------- --------------

CORPORATE BONDS AND NOTES - (CONTINUED)

$ 2,000,000 International Coal Group Inc. ........................ 10.25% 07/15/14 $ 1,750,000

1,500,000 Lexington Precision Corp. Units (g)................... 12.00% 08/01/09 1,200,000

3,000,000 MSX International UK, MXS International

Business Service FR/MXS International

GmBH (a) .......................................... 2.50% 04/01/12 2,985,000

3,341,000 Rafealla Apparel Group, Inc........................... 11.25% 06/15/11 3,224,065

2,000,000 Sheridan Group, Inc. ................................. 10.25% 08/15/11 2,030,000

3,500,000 The Restaurant Company................................ 10.00% 10/01/13 3,062,500

--------------

TOTAL CORPORATE BONDS AND NOTES ............................................... 28,165,315

--------------

(Cost $29,243,315)

STRUCTURED NOTES - 1.3%

1,225,000 Bacchus Ltd.

Series 2006-1I, Subordinated Note (a) ............. N/A 01/20/19 992,250

2,000,000 InCaps Funding II Ltd./InCaps Funding II Corp.

Subordinated Note (a) ............................. N/A 01/15/34 1,020,000

--------------

TOTAL STRUCTURED NOTES......................................................... 2,012,250

--------------

(Cost $2,050,281)

MARKET

SHARES DESCRIPTION VALUE

------------ ---------------------------------------------------------------------------- --------------

C

PREFERRED SECURITIES - 8.4%

1,450,000 Ajax Ltd., Series 2A (a) (b)................................................ 754,000

2,000,000 Ajax Ltd., Series 2X (a) (b)................................................ 1,040,000

3,750,000 Preferred Term Securities XXV, Ltd. (a)..................................... 3,698,438

4,000,000 Pro Rata Funding Ltd., Inc. (a) (b)......................................... 3,200,000

2,000,000 Soloso CDO Ltd., Series 2005-1 (a) (b)...................................... 1,712,500

3,000,000 White Marlin CDO Ltd., Series AI (a)........................................ 3,000,000

--------------

TOTAL PREFERRED SECURITIES.................................................. 13,404,938

--------------

(Cost $13,891,474)

TOTAL INVESTMENTS - 135.9%.................................................. 216,554,268

(Cost $232,185,841) (h)

LOAN OUTSTANDING - (45.2)%.................................................. (72,000,000)

NET OTHER ASSETS AND LIABILITIES - 9.3%..................................... 14,793,024

--------------

NET ASSETS - 100.0%......................................................... $ 159,347,292

==============

-------------------------------------------

(a) Securities sold within the terms of a private placement

memorandum, exempt from registration under Rule 144A of the

Securities Act of 1933, as amended, and may be resold in

transactions exempt from registration normally to qualified

institutional buyers. Pursuant to procedures adopted by the

Fund's Board of Trustees, these securities have been determined

to be liquid by Valhalla Capital Partners, LLC, the Fund's

sub-advisor. At July 31, 2007, these securities amounted to

$119,788,299 or 75.2% of net assets.

(b) Variable rate security. The interest rate shown reflects the rate

in effect at July 31, 2007.

(c) Step-up security. A security where the coupon increases or steps

up at a predetermined date. The interest rate shown reflects the

rate in effect at July 31, 2007.

|

(d) Securities sold within the terms of a private placement

memorandum, exempt from registration under Rule 144A under the

Securities Act of 1933, as amended, and may be resold in

transactions exempt from registration, normally to qualified

institutional buyers (See Note 1C - Restricted Securities).

(e) ACES - Alternative Credit Enhancement Securities

(f) IO - Interest only

(g) The issuer is in default. Income is not being accrued.

(h) Aggregate cost for federal income tax and financial reporting

purposes.

N/A Not applicable

Page 6 See Notes to Quarterly Portfolio of Investments.

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS

FIRST TRUST STRATEGIC HIGH INCOME FUNDJULY 31, 2007 (UNAUDITED)

1. VALUATION AND INVESTMENT PRACTICES

A. PORTFOLIO VALUATION:

The net asset value ("NAV") of the Common Shares of First Trust Strategic High

Income Fund (the "Fund") is determined daily as of the close of regular session

trading on the New York Stock Exchange ("NYSE"), normally 4:00 p.m. Eastern

time, on each day the NYSE is open for trading. Domestic debt securities and

foreign securities are priced using data reflecting the earlier closing of the

principal markets for those securities. The NAV per Common Share is calculated

by subtracting the Fund's liabilities (including accrued expenses, dividends

payable and any borrowings of the Fund) from the Fund's Total Assets (the value

of the securities and other investments the Fund holds plus cash or other

assets, including interest accrued but not yet received) and dividing the result

by the total number of Common Shares outstanding.

The Fund's investments are valued daily at market value or, in the absence of

market value with respect to any portfolio securities, at fair value according

to procedures adopted by the Fund's Board of Trustees. A majority of the Fund's

assets are valued using market information supplied by third parties. In the

event that market quotations are not readily available, the pricing service does

not provide a valuation for a particular asset, or the valuations are deemed

unreliable, or if events occurring after the close of the principal markets for

particular securities (e.g., domestic debt and foreign securities), but before

the Fund values its assets, would materially affect NAV, First Trust Advisors

L.P. ("First Trust") may use a fair value method to value the Fund's securities

and investments. The use of fair value pricing by the Fund is governed by

valuation procedures adopted by the Fund's Board of Trustees, and in accordance

with the provisions of the Investment Company Act of 1940, as amended.

Portfolio securities listed on any exchange other than the NASDAQ National

Market ("NASDAQ") are valued at the last sale price on the business day as of

which such value is being determined. If there has been no sale on such day, the

securities are valued at the mean of the most recent bid and asked prices on

such day. Securities traded on the NASDAQ are valued at the NASDAQ Official

Closing Price as determined by NASDAQ. Portfolio securities traded on more than

one securities exchange are valued at the last sale price on the business day as

of which such value is being determined at the close of the exchange

representing the principal market for such securities. Portfolio securities

traded in the over-the-counter market, but excluding securities traded on the

NASDAQ, are valued at the closing bid prices. Short-term investments that mature

in less than 60 days are valued at amortized cost.

B. SECURITIES TRANSACTIONS:

Securities transactions are recorded as of the trade date. Realized gains and

losses from securities transactions are recorded on an identified cost basis.

Securities purchased or sold on a when-issued or delayed-delivery basis may be

settled a month or more after the trade date; interest income on such securities

is not accrued until settlement date. The Fund maintains liquid assets of the

Fund with a current value at least equal to the amount of its when-issued or

delayed-delivery purchase commitments. As of July 31, 2007, the Fund held no

when-issued or delayed-delivery purchase commitments.

C. RESTRICTED SECURITIES:

The Fund invests in restricted securities, which are securities that may not be

offered for public sale without first being registered under the Securities Act

of 1933, as amended (the "Securities Act"). Prior to registration, restricted

securities may only be resold in transactions exempt from registration under

Rule 144A of the Securities Act, normally to qualified institutional buyers. As

of July 31, 2007, the Fund held restricted securities as shown in the table on

the following page that the Sub-Advisor has deemed illiquid pursuant to

procedures adopted by the Fund's Board of Trustees. The Fund does not have the

right to demand that such securities be registered. These securities are valued

according to the valuation procedures as stated in the Portfolio Valuation

footnote (Note 1A) and are not expressed as a discount to the carrying value of

a comparable unrestricted security. There are no unrestricted securities with

the same maturity dates and yields for these issuers.

Page 7

NOTES TO QUARTERLY PORTFOLIO OF INVESTMENTS - (CONTINUED)

CARRYING

VALUE 07/31/07

ACQUISITION PRINCIPAL PER SHARE CURRENT MARKET % OF

SECURITY DATE VALUE 07/31/07 CARRYING COST VALUE NET ASSETS

------------------------------------------------------------------------------------------------------------------------------------

Banc of America Commercial

Mortgage Inc.,

Series 2000-1, Class M,

6.00%, 11/15/31 08/02/05 $ 1,171,422 $82.76 $ 937,130 $ 969,505 0.61%

LB-UBS Commercial Mortgage Trust

Series 2001-C7, Class Q,

5.87%, 11/15/33 09/19/05 3,025,000 75.38 2,435,514 2,280,158 1.43

Merit Securities Corp.

Series 13, Class B1,

8.65%,12/28/33 02/20/07 5,349,096 6.72 351,578 359,406 0.23

Morgan Stanley Capital I Inc.,

Series 1999-WF1, Class M,

5.91%, 11/15/31 08/03/05 968,400 65.74 620,312 636,582 0.40

------------- ------------ ------------

$ 10,513,918 $ 4,344,534 $ 4,245,651 2.67%

============= ============ ============

|

2. UNREALIZED APPRECIATION (DEPRECIATION)

As of July 31, 2007, the aggregate gross unrealized appreciation for all

securities in which there was an excess of value over tax cost was $7,340,882,

and the aggregate gross unrealized depreciation for all securities in which

there was an excess of tax cost over value was $22,972,455.

Page 8

ITEM 2. CONTROLS AND PROCEDURES.

(a) The registrant's principal executive and principal financial officers,

or persons performing similar functions, have concluded that the

registrant's disclosure controls and procedures (as defined in Rule

30a-3(c) under the Investment Company Act of 1940, as amended (the

"1940 Act") (17 CFR 270.30a-3(c))) are effective, as of a date within

90 days of the filing date of the report that includes the disclosure

required by this paragraph, based on their evaluation of these controls

and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR

270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities

Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or

240.15d-15(b)).

(b) There were no changes in the registrant's internal control over

financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17

CFR 270.30a-3(d)) that occurred during the registrant's last fiscal

quarter that have materially affected, or are reasonably likely to

materially affect, the registrant's internal control over financial

reporting.

ITEM 3. EXHIBITS.

Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of

the Sarbanes-Oxley Act of 2002 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) FIRST TRUST STRATEGIC HIGH INCOME FUND

By (Signature and Title)* /S/ JAMES A. BOWEN

-------------------------------------------------------

James A. Bowen, Chairman of the Board, President and

Chief Executive Officer

(principal executive officer)

|

Date SEPTEMBER 24, 2007

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

By (Signature and Title)* /S/ JAMES A. BOWEN

-------------------------------------------------------

James A. Bowen, Chairman of the Board, President and

Chief Executive Officer

(principal executive officer)

|

Date SEPTEMBER 24, 2007

By (Signature and Title)* /S/ MARK R. BRADLEY

-------------------------------------------------------

Mark R. Bradley, Treasurer, Controller, Chief Financial

Officer and Chief Accounting Officer

(principal financial officer)

|

Date SEPTEMBER 24, 2007

* Print the name and title of each signing officer under his or her signature.

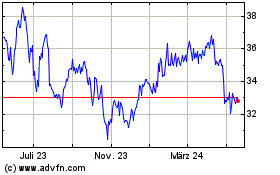

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

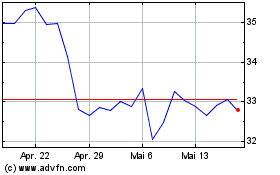

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024