First Trust Strategic High Income Fund Declares Monthly Distribution for February of $0.16 Per Share

20 Januar 2006 - 10:47PM

Business Wire

First Trust Strategic High Income Fund (the "Fund") (NYSE:FHI)

today declared the Fund's regularly scheduled monthly distribution,

payable on February 15, 2006 to shareholders of record as of

February 3, 2006. The ex-dividend date is expected to be February

1, 2006. The monthly distribution information for the Fund appears

below. -0- *T First Trust Strategic High Income Fund (FHI):

--------------------------------------------- Distribution per

share: $0.16 Distribution Rate based on the January 19, 2006 NAV of

$18.94: 10.14% Distribution Rate based on the January 19, 2006

closing market price of $18.70: 10.27% *T The Fund is a closed-end

management investment company that seeks to provide a high level of

current income. As a secondary objective, the Fund seeks to provide

capital growth. The Fund pursues these investment objectives by

investing at least 80% of its managed assets in a diversified

portfolio of high income producing securities that the sub-adviser

believes offer attractive yield and capital appreciation potential.

The fund does not employ leverage. First Trust Advisors L.P. acts

as the Fund's investment advisor and currently manages or

supervises approximately $22 billion in assets. Hilliard Lyons

Asset Management ("HLAM") is the Fund's sub-adviser. HLAM is a

division of J.J.B. Hilliard, W.L. Lyons, Inc., which is an indirect

wholly-owned subsidiary of The PNC Financial Services Group, Inc.

("PNC"). PNC, a publicly-held financial holding company, provides

commercial and retail banking and other financial services in the

areas of investment banking, asset management, mutual funds,

trusts, securities brokerage, insurance, leasing, and mortgage

banking. HLAM serves as investment adviser or sub-adviser to

approximately $4.8 billion in assets as of September 30, 2005,

which consists of two mutual funds, one money market fund, and

separately managed accounts and trust assets. HLAM or its

predecessors have been managing assets since 1967. Past performance

is no assurance of future results. Investment return and market

value of an investment in the Fund will fluctuate. Shares, when

sold, may be worth more or less than their original cost. Principal

Risk Factors: Investment in this Fund involves investment and

market risk, management risk, value investing risk,

below-investment grade securities risk, fixed-income securities

risk, mortgage-backed securities risk, asset-backed securities

risk, convertible securities risk, municipal securities risk,

foreign securities risk, foreign government securities risk, equity

securities risk, currency risk, distressed securities risk,

preferred stock risk, inflation/deflation risk, market discount

risk, leverage risk, derivatives risk, market disruption risk,

portfolio turnover risk, and illiquid/restricted securities risk.

The Fund's daily closing New York Stock Exchange price and net

asset value per share as well as other information can be found at

www.ftportfolios.com or by calling 1-800-988-5891.

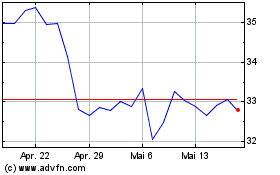

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

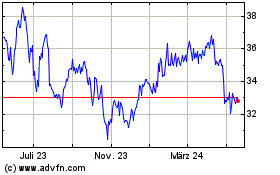

Federated Hermes (NYSE:FHI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024