Equitable, a leading financial services organization and

principal franchise of Equitable Holdings, Inc. (NYSE: EQH), today

announced a new series to its EQUI-VEST line of deferred variable

annuity products, EQUI-VEST® Series 202. This enhanced version is

designed to help educators supplement their retirement savings by

providing additional choices, flexibility and a level of

certainty.

EQUI-VEST® Series 202 is available to employees enrolled in a

403(b) plan at public schools across the United States.1 One

notable enhancement, the Structured Investment Option, allows

participants to capitalize on potential market gains, up to a cap,

while maintaining a level of protection against market losses.

Specifically, it provides buffered indexed options that include

downside protection up to -30%, longer segment periods and the

opportunity to lock in gains. It also provides growth potential

that mirrors the index selected up to a cap. EQUI-VEST is the only

403(b) product in the market that offers a variable annuity with an

index-linked option.

“Nearly six in ten Americans view the current economic

conditions in the U.S. as highly volatile, according to a recent

Equitable survey.2 This has workers increasingly looking for

solutions to help grow and protect their retirement savings,” said

Jim Kais, Head of Group Retirement for Equitable. “Our new

EQUI-VEST series builds on our expertise as the leading provider of

registered index-linked annuities,3 adding an investment option

that helps address these concerns. We hope this makes planning for

the future a bit more reassuring for educators, so they can stay

focused on teaching their students.”

Along with helping to manage market volatility, EQUI-VEST®

Series 202 also addresses longevity risk and decumulation concerns.

At retirement, plan participants have the option of turning their

403(b) account values into guaranteed income for the rest of their

lives. Equitable research shows that nearly two-thirds of Americans

would prefer a steady paycheck rather than having to determine how

much to withdraw from their retirement accounts.4

“While pensions are the primary retirement savings vehicle for

many public-school teachers, we often find this source of income is

not enough on its own to fully replace their income in retirement,”

explained Kais. “Our new EQUI-VEST series provides educators with

additional options and flexibility to help meet their individual

needs, as many depend on their 403(b) plans to supplement their

savings for retirement.”

For nearly five decades, Equitable has served more than 800,000

educators across the country as the leader of retirement plans for

the K-12 educator market.5 Equitable Advisors has more than 1,100

financial professionals dedicated to supporting educators,

providing trusted financial services and strategies to help them

supplement their income and make sound financial decisions.

About Equitable:

Equitable, a principal franchise of Equitable Holdings, Inc.

(NYSE: EQH), has been one of America’s leading financial services

providers since 1859. With the mission to help clients secure their

financial well-being, Equitable provides advice, protection and

retirement strategies to individuals, families and small

businesses. Equitable has more than 8,000 employees and Equitable

Advisors financial professionals and serves 3 million clients

across the country. Please visit equitable.com for more

information.

Reference to the 1859 founding applies specifically and

exclusively to Equitable Financial Life Insurance Company.

Equitable is the brand name of Equitable Holdings, Inc., and its

family of companies, including Equitable Financial Life Insurance

Company (NY, NY) and Equitable Financial Life Insurance Company of

America, an Arizona stock company with an administrative office

located in Charlotte, NC, issuers of annuity and life insurance

products. Equitable Advisors Financial Professionals offer

securities through Equitable Advisors, LLC (NY, NY 212-314-4600),

member FINRA, SIPC (Equitable Financial Advisors in MI & TN)

and offer annuity and insurance products through Equitable Network,

LLC (Equitable Network Insurance Agency of California, LLC;

Equitable Network Insurance Agency of Utah, LLC; Equitable Network

of Puerto Rico, Inc.

Variable annuities are long-term financial products designed for

retirement purposes. In essence, an annuity is a contractual

agreement in which payments are made to an insurance company, which

agrees to pay out an income or a lump-sum amount at a later date.

The variable investment options offered in this contract will

fluctuate in value and are subject to market risk, including loss

of principal.

EQUI-VEST® Series 202 is offered by prospectus, which

contains complete information on investment objectives, fees,

charges and expenses. For a prospectus, contact your financial

professional or Equitable Financial Life Insurance Company of

America (Equitable America). Please read it carefully before

investing or sending money.

Certain types of contracts, features and benefits may not be

available in all jurisdictions or in all 403(b) or 457 plans. All

guarantees are subject to the claims paying ability of Equitable

Financial Life Insurance Company of America. With regard to partial

downside protection, there is a risk of a substantial loss of

principal and previously credited interest because the contract

holder agrees to absorb all losses to the extent that they exceed

the downside protection provided.

Reference to EQUI-VEST being the only 403(b) product in the

market that offers a variable annuity with an index-linked option

is as of as of September 12, 2024. This statement is subject to

change at any time without notice.

The subsidiaries of Equitable Holdings, Inc., do not provide tax

or legal advice. The EQUI-VEST® 202 variable annuity is issued by

Equitable Financial Life Insurance Company of America (Equitable

America) (not in New York), an AZ stock company with an

administrative office located in Charlotte, NC. Co-distributed by

affiliates Equitable Advisors, LLC (member FINRA, SIPC) (Equitable

Financial Advisors in MI & TN) and Equitable Distributors, LLC.

GE-6992492.1(09/24) (exp.09/26).

_______________________________ 1 EQUI-VEST Series 202 is

available when approved in each jurisdiction, with the exception of

New York. The product is available to new 403(b) clients at public

schools, colleges and universities as well as 457(b) clients at

public schools. It is also available to clients in the nonprofit

and 457 governmental markets.

2, 4 The survey was conducted by an independent, global consumer

and B2B panel provider. Respondents include 1,000 U.S. adults (ages

18 and older), with the total survey population representative of

U.S. demographic data. The online survey was fielded from May 22,

2024, through June 1, 2024. Survey participation was anonymous.

3 This information is based solely upon and up to year-end 2023

total sales. This ranking does not reflect or account for

investment performance, product quality or other criteria. Source:

Secure Retirement Institute U.S. Individual Annuities Sales Survey,

2024.

5 LIMRA, Not-for-Profit Survey, Q1 2024 results, based on 403(b)

plan participants and contributions. This applies specifically and

exclusively to Equitable Financial Life Insurance Company

(Equitable Financial).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240912381538/en/

Media:

Monique Freeman (212) 314-2010 mediarelations@equitable.com

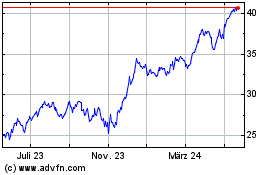

Equitable (NYSE:EQH)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Equitable (NYSE:EQH)

Historical Stock Chart

Von Nov 2023 bis Nov 2024