Amended Statement of Beneficial Ownership (sc 13d/a)

04 April 2023 - 11:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

EAGLE POINT

CREDIT COMPANY INC.

(Name of Issuer)

common stock, par value $0.001 per share

(Title of Class of Securities)

269808101

(CUSIP Number)

Jacqueline Giammarco

Stone Point Capital LLC

20 Horseneck Lane

Greenwich, CT 06830

(203) 862-2900

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 31, 2023

(Date of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

| CUSIP No. 269808101 |

|

13D/A |

|

Page

2

of 8 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Trident V, L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (See Instructions) (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (See

Instructions) N/A |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman

Islands |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 0% |

| 14 |

|

TYPE OF REPORTING PERSON

(See Instructions) PN |

|

|

|

|

|

| CUSIP No. 269808101 |

|

13D/A |

|

Page

3

of 8 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Trident Capital V, L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (See Instructions) (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (See

Instructions) N/A |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman

Islands |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 0% |

| 14 |

|

TYPE OF REPORTING PERSON

(See Instructions) PN |

|

|

|

|

|

| CUSIP No. 269808101 |

|

13D/A |

|

Page

4

of 8 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Trident V Parallel Fund, L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (See Instructions) (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (See

Instructions) N/A |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman

Islands |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 0% |

| 14 |

|

TYPE OF REPORTING PERSON

(See Instructions) PN |

|

|

|

|

|

| CUSIP No. 269808101 |

|

13D/A |

|

Page

5

of 8 |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Trident Capital V-PF, L.P. |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (See Instructions) (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (See

Instructions) N/A |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION Cayman

Islands |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

0 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11) 0% |

| 14 |

|

TYPE OF REPORTING PERSON

(See Instructions) PN |

|

|

|

|

|

| CUSIP No. 269808101 |

|

13D/A |

|

Page

6

of 8 |

Explanatory Note

This Schedule 13D/A is filed jointly on behalf of Trident V, L.P. (“Trident V”), Trident Capital V, L.P. (“Trident V GP”), Trident V

Parallel Fund, L.P. (“Trident V Parallel”) and Trident Capital V-PF, L.P. (“Trident V Parallel GP”) (collectively, the “Reporting Persons”) with respect to common stock, par value

$0.001 per share (the “Common Shares”), of Eagle Point Credit Company Inc. (the “Issuer”), having its principal executive offices at 600 Steamboat Road, Suite 202, Greenwich, CT 06830.

This filing constitutes Amendment No. 2 to that certain Schedule 13D filed on October 16, 2014 (the “Initial Schedule 13D”), as amended

and supplemented by Amendment No. 1, filed on May 15, 2018. The Initial Schedule 13D, as modified by Amendment No. 1 and this filing, is referenced herein as the “Schedule 13D,” which remains unchanged, except as

specifically amended. Capitalized terms used but not defined herein shall have the respective meanings defined in the Initial Schedule 13D, as previously amended. As set forth below, as a result of the transaction described herein, on

March 31, 2023 each of the Reporting Persons ceased to be the beneficial owner of more than five percent of the Common Shares. The filing of this Amendment No. 2 represents the final amendment to the Schedule 13D and constitutes an exit

filing for the Reporting Persons.

| Item 1. |

Security and Issuer |

Item 1 is hereby amended and supplemented by adding the following information:

The address of the principal executive offices of the Issuer is 600 Steamboat Road, Suite 202, Greenwich, CT 06830.

| Item 4. |

Purpose of Transaction. |

Item 4 is hereby amended and supplemented by adding the following information:

On March 31, 2023, pursuant to and subject to the terms and conditions of the contribution agreement entered into on such date (the

“Contribution Agreement”), and in connection with the transfer of substantially all of the Reporting Persons’ economic interest in the Common Shares to certain investment funds affiliated with Trident Capital IX, L.P., the Reporting

Persons contributed an aggregate of 5,676,339 Common Shares to Trident ECC Aggregator LP consisting of: (i) 3,336,438 Common Shares from Trident V and (ii) 2,339,901 Common Shares from Trident V Parallel.

Following the consummation of the foregoing transaction, the Reporting Persons no longer beneficially own any Common Shares.

| Item 5. |

Interest in Securities of the Issuer. |

Item 5 is hereby amended and restated in its entirety to read as follows:

As a result of the transaction described in Item 4, the Reporting Persons no longer beneficially own any Common Shares.

Other than the transactions reported in Item 4, each of the Reporting Persons reports that neither it, nor to its knowledge, any person named

in Item 2 of this Schedule 13D, has effected any transactions in Common Shares during the past 60 days.

The Reporting Persons have each

ceased to be the beneficial owner of more than five percent (5%) of the Common Shares, effective as of March 31, 2023. The filing of this Amendment No. 2 constitutes an exit filing for the Reporting Persons.

| Item 6. |

Contracts, Arrangement, Understanding or Relationships with Respect to Securities of the Issuer.

|

Item 6 is hereby amended and restated in its entirety to read as follows:

The description of the Contribution Agreement set forth in Item 4 of this Amendment No. 2 is hereby incorporated herein by reference.

|

|

|

|

|

| CUSIP No. 269808101 |

|

13D/A |

|

Page

7

of 8 |

The foregoing description is qualified in its entirety by reference to the complete text of

the Contribution Agreement, which is attached hereto as Exhibit B and is incorporated herein by reference.

| Item 7. |

Material to be Filed as Exhibits. |

|

|

|

| Exhibit |

|

Description |

|

|

| A |

|

Joint Filing Agreement, dated October 16, 2014 (incorporated by reference to Exhibit B to Schedule 13D filed October 16, 2014).

|

|

|

| B |

|

Contribution Agreement, dated March 31, 2023, by and among Trident V, L.P., Trident V Parallel Fund, L.P., Trident V Professionals Fund, L.P. and Trident ECC Aggregator LP. |

|

|

|

|

|

| CUSIP No. 269808101 |

|

13D/A |

|

Page

8

of 8 |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Date: April 4, 2023

|

|

|

|

|

| TRIDENT V, L.P. |

|

|

| By: |

|

Trident Capital V, L.P., its general partner |

| By: |

|

DW Trident V, LLC, a general partner |

|

|

| By: |

|

/s/ Jacqueline Giammarco |

|

|

Name: |

|

Jacqueline Giammarco |

|

|

Title: |

|

Vice President |

|

| TRIDENT CAPITAL V, L.P. |

|

|

| By: |

|

DW Trident V, LLC, a general partner |

|

|

| By: |

|

/s/ Jacqueline Giammarco |

|

|

Name: |

|

Jacqueline Giammarco |

|

|

Title: |

|

Vice President |

|

| TRIDENT V PARALLEL, L.P. |

|

|

| By: |

|

Trident Capital V-PF, L.P., its general partner |

| By: |

|

DW Trident V, LLC, a general partner |

|

|

| By: |

|

/s/ Jacqueline Giammarco |

|

|

Name: |

|

Jacqueline Giammarco |

|

|

Title: |

|

Vice President |

|

| TRIDENT CAPITAL V-PF, L.P. |

|

|

| By: |

|

DW Trident V, LLC, a general partner |

|

|

| By: |

|

/s/ Jacqueline Giammarco |

|

|

Name: |

|

Jacqueline Giammarco |

|

|

Title: |

|

Vice President |

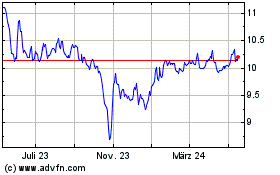

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

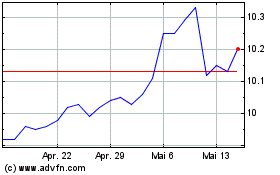

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024