SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of September, 2022

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

NOTICE TO SHAREHOLDERS

CENTRAIS

ELÉTRICAS BRASILEIRAS S/A CNPJ: 00.001.180/0001-26 | NIRE: 533.0000085-9 PUBLIC COMPANY

Centrais Elétricas Brasileiras S/A

(“Company” or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE:

EBR & EBR.B; LATIBEX: XELT.O & XELT.B)

hereby informs its shareholders, in compliance to the resolution of the 62nd Annual General Meeting ("AGM")

of April 22, 2022, the payment of Dividends for the year 2021 will be made on September 09, 2022, to individuals and legal entities registered

as owners or beneficial owners of class “A” and “B” common and preferred shares (“ON”, “PNA”

and “PNB”, respectively) on the base date of April 22, 2022.

As also approved at the AGM, Dividends are subject

to monetary restatement based on the variation of the Reference Rate of the Settlement and Custody System - Selic, published by the Central

Bank of Brazil, pro rata temporis from December 31, 2021. The values per share updated by the Selic Rate, published by the Central Bank

of Brazil, until today, are as follows:

|

Class of Share |

12.31.2021 |

09.09.2022* |

| ON |

0.71578248571496 |

0.77350548242684 |

| PNA |

1.99153557854615 |

2.15213939876563 |

| PNB |

1.49365168208243 |

1.61410454709969 |

*Gross dividends amounts,

per class, updated by Selic rate.

Regarding the amounts to be paid, as monetary

restatement at the Selic rate, in accordance with current legislation, Income Tax will be charged, to be withheld at source. The withholding

of Income Tax mentioned above will not be applied to immune or exempt persons who have proven this condition, through the “Term

of Declaration of Commitment”, which can be found on the Company's website (https://ri.eletrobras.com/informacoes/convocacoes-e-atas/)

and must be delivered to any branch of Banco Bradesco. For exempt shareholders who are in B3, the holders or their representatives must

file the statement with their brokers/custodian agents. Such payment will be made by deposit in the shareholders' checking account, as

informed by each of them to Banco Bradesco S.A., responsible for the bookkeeping of shares issued by the Company. Dividends related to

shares held in the stock exchange environment via the B3 Assets Depository Center will be paid to this entity, which will transfer them

to shareholders through the depositing brokers.

Rio de Janeiro, September 01, 2022.

Elvira Cavalcanti Presta

CFO and Investor Relations Officer

This document may contain estimates

and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute

future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: September 1, 2022

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

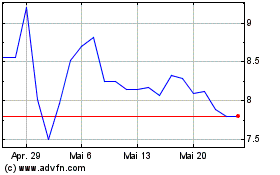

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

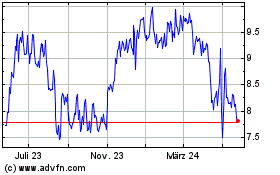

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024