Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

05 Januar 2022 - 12:01PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of January, 2022

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

ANNOUNCEMENT OF TRANSACTION WITH RELATED PARTY

CENTRAIS

ELÉTRICAS BRASILEIRAS S/A CNPJ: 00.001.180/0001-26 | NIRE: 533.0000085-9 OPEN COMPANY

Centrais Elétricas

Brasileiras S/A (“Company” or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR & EBR.B; LATIBEX:

XELT.O & XELT.B) hereby in compliance with Annex 30-XXXIII of CVM Instruction No. 552, dated October 9, 2014, informs its shareholders

and the market in general of the following related party transaction:

|

Related Party Names

|

Companhia Hidro Elétrica do São Francisco (“Chesf”) and Fundação Chesf de Assistência e Seguridade Social (“Fachesf”).

|

|

Issuer Relationships

|

Chesf is a subsidiary of Eletrobras; Chesf is a sponsor of Fachesf.

|

|

Date of the transaction

|

December 26, 2021

|

|

Object of the Agreement

|

Term of Update of the Actuarial Commitment for Settlement of Closed Plan (in extinction regime), as established in Clause Two of the Twelfth Amendment to the Contract 01.1.266-017, aims to determine that the value of the actuarial commitment assumed in the original contract by Sponsor is now R$ 1,594,264,982.17 (one billion, five hundred and ninety-four million, two hundred and sixty-four thousand, nine hundred and eighty-two reais and seventeen cents), at prices on December 31, 2020, relating to the portion of the Reserve for Granted Benefits, not covered by equity, pursuant to item 101 and its sub-items of the Fachesf Defined Benefit Plan (BD) Regulation. The recognition of this commitment meets the terms of Clause Five of the original contract and was based on the Actuarial Opinion issued by the consulting firm PREVUE Consultoria Ltda, official actuary of Fachesf, dated 01/28/2021, which integrates this Amendment for all purposes of right.

|

|

Main Terms and Conditions

|

The total amount of the commitment is BRL 1,594,264,982.17 (one billion, five hundred and ninety-four million, two hundred and sixty-four thousand, nine hundred and eighty-two reais and seventeen cents), being the monthly amount to be paid by the Sponsor, as of April 2021, of BRL 13,091,222.30 (thirteen million, ninety-one thousand, two hundred and twenty-two reais and thirty cents), monetarily restated by the Plan's index (currently the IGPM), between 12/31/2020 and the date of each maturity, with the first installment on the third to last business day of April 2021, and the other installments on the third to last business day of subsequent months. The debt will be settled in 158 (one hundred and fifty-eight) months, within a period of one and a half times the duration of the Plan's liabilities, thus complying with article 34 of CNPC Resolution No. 30/2018.

|

This document may contain estimates

and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute

future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

|

Detailed reasons why the Company's Management considers that the transaction observed commutative conditions or provides for adequate compensatory payment

|

Coverage of the Actuarial Debt Agreement (01.1.266-017) already signed between Chesf and Fachesf, as provided for in items 101.1 and 101.2 of the Defined Benefit Plan Regulation – BD.

|

|

Eventual participation of the counterparty, its partners or administrators in the decision process of the issuer's subsidiary regarding the transaction or the negotiation of the transaction as representatives of the Company, describing these interests.

|

The transaction was evaluated in December 2021 by the Audit and Statutory Risks Committee of Eletrobras and its Controlled Companies, in advising to the Board of Directors of Chesf, which expressed itself in favor of the proposal for approval of the eighteenth amendment to the Actuarial Debt Agreement (01.1 .266-017) of the BD Plan.

|

Rio de Janeiro, January 04,

2022.

Elvira Cavalcanti Presta

CFO and Investor Relations Officer

This document may contain estimates

and forecasts that are not statements of fact that occurred in the past but reflect our management beliefs and expectations and may constitute

future events' forecasts and estimates under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

and Exchange Act of 1934, as amended. The words "believe", "may", "estimate", "continue", "anticipate",

"intend", "expect" and related words are intended to identify estimates that necessarily involve risks and uncertainties,

known or unknown . Known risks and uncertainties include, but are not limited to: general economic, regulatory, political and commercial

conditions in Brazil and abroad, changes in interest rates, inflation and value of the Real, changes in volumes and the pattern of use

of electricity by consumer, competitive conditions, our level of indebtedness, the possibility of receiving payments related to our receivables,

changes in rainfall and water levels in the reservoirs used to operate our hydroelectric plants, our financing and capital investment

plans, existing and future government regulations , and other risks described in our annual report and other documents filed with CVM

and SEC. Estimates and forecasts refer only to the date they were expressed and we assume no obligation to update any of these estimates

or forecasts due to the occurrence of new information or future events. Future results of the Company's operations and initiatives may

differ from current expectations and the investor should not rely solely on the information contained herein. This material contains calculations

that may not reflect accurate results due to rounding.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: January 4, 2022

|

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

|

|

|

|

|

|

By:

|

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

|

|

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

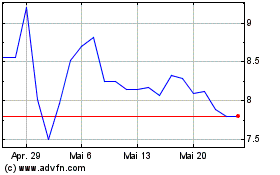

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

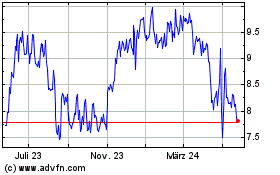

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024