Exhibit 99.1

COOPERATION AGREEMENT

This COOPERATION AGREEMENT (this “Agreement”)

is made and entered into as of January 10, 2025, by and between GrafTech International Ltd., a Delaware corporation (the “Company”),

and Nilesh Undavia (the “Stockholder”). The Company and the Stockholder are each herein referred to as a “Party”

and together, the “Parties.” Following the Company’s 2024 annual meeting of stockholders (the “2024

Annual Meeting”) the Parties have continued discussions regarding, among other things, the composition of the Board of Directors

of the Company (the “Board”), and the Parties have determined to come to an agreement with respect thereto and certain

other matters, as provided in this Agreement. In consideration of the foregoing and the mutual covenants and agreements contained herein,

and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to

be legally bound hereby, agree as follows:

1. Board Composition and Related Matters.

(a) Appointment and Nomination

of New Directors. Immediately following the execution of this Agreement, (i) the Board and all necessary and applicable committees

of the Board shall take all necessary actions to appoint Sachin Shivaram (the “New Class III Director”) to the Board

as a Class III director with a term expiring at the 2027 annual meeting of stockholders of the Company (including any adjournments, postponements,

reschedulings or continuations thereof and any meeting which may be called in lieu thereof, the “2027 Annual Meeting”),

and (ii) the Parties will work in good faith to find a mutually agreeable independent candidate (the “New Class I Director”

and together with the New Class III Director, the “New Directors”) to nominate for election to the Board by stockholders

at the 2025 annual meeting of stockholders of the Company (including any adjournments, postponements, reschedulings or continuations thereof

and any meeting which may be called in lieu thereof, the “2025 Annual Meeting”) as a Class I director with a term expiring

at the 2028 annual meeting of stockholders (including any adjournments, postponements, reschedulings or continuations thereof and any

meeting which may be called in lieu thereof, the “2028 Annual Meeting”), with each of the New Class III Director, and

the New Class I Director if elected at the 2025 Annual Meeting, so serving his or her respective full class term as a director or until

the earlier death, disability, resignation, disqualification or removal of each.

(b) Committees. The

Board and all necessary and applicable committees of the Board shall give each of the New Directors the same due consideration for committee

membership as any other independent director, including, but not limited to, membership on any newly formed Board committee or any other

Board committee formed after the date hereof; provided, however, that so long as each New Director meets all regulatory

requirements and other currently existing and publicly disclosed qualifications for such committees, each of the New Directors shall be

appointed to at least two committees of the Board.

(c) Recommendation of New

Class I Director.

(i)

If the Parties find a mutually agreeable independent candidate for nomination as the New Class I Director in time for inclusion

on the ballot of the 2025 Annual Meeting, the Company agrees that the Board and all necessary and applicable committees of the Board shall

take all necessary actions to nominate the New Class I Director as a Class I director for election to the Board at the 2025 Annual Meeting

with a term expiring at the 2028 Annual Meeting, to include the New Class I Director in the proxy statement and the proxy card prepared,

filed and delivered in connection with the 2025 Annual Meeting and to recommend, support and solicit proxies for the election of the New

Class I Director at the 2025 Annual Meeting in a manner no less rigorous and favorable than the manner in which the Company supports,

and has historically supported, Board nominees for election at any annual or special meetings of the Company’s stockholders or actions

by written consent of the Company’s stockholders (each, a “Stockholder Meeting”), unless the Board has determined

in good faith, after consultation with outside counsel, and in the exercise of its fiduciary duties under applicable law, that it can

no longer recommend the New Class I Director due to facts that occur or circumstances that arise after the date of this Agreement (a “Recommendation

Change”).

(ii)

In the event of a Recommendation Change, the Company shall provide a notice (a “Fiduciary Duty Determination Notice”)

to the Stockholder indicating that the Board has determined in good faith, after consultation with outside counsel, that its obligations

under this Agreement, including this Section 1(c), would violate the Board’s fiduciary duties under applicable law. Upon

the Stockholder’s receipt of such Fiduciary Duty Determination Notice, the Parties will work in good faith to find a mutually agreeable

candidate to replace the New Class I Director as a nominee for election to the Board at the 2025 Annual Meeting with a term expiring at

the 2028 Annual Meeting (any such person, if and when such person is elected to the Board, shall be referred to as the New Class I Director

(and a New Director) for purposes of this Agreement).

(iii)

If the Parties are unable to find a mutually agreeable independent candidate for nomination as the New Class I Director in time

for the inclusion of such candidate on the ballot of the 2025 Annual Meeting, then the Parties will continue to work in good faith to

find a mutually agreeable candidate. Promptly upon the Parties’ agreement with respect to such candidate, the Board and all necessary

and applicable committees of the Board shall take all necessary actions to appoint such candidate as a director on the Board; provided,

however, that such appointment shall not take place prior to the 2025 Annual Meeting.

(d) Additional Agreements.

(i)

The Stockholder shall comply, and shall cause each of its controlled Affiliates and Associates to comply, with the terms of this

Agreement and shall be responsible for any breach of this Agreement by any such controlled Affiliate or Associate. As used in this Agreement,

the terms “Affiliate” and “Associate” shall have the respective meanings set forth in Rule 12b-2

promulgated by the United States Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of

1934, as amended, with the rules and regulations promulgated thereunder (the “Exchange Act”) and shall include all

persons or entities that at any time during the term of this Agreement become Affiliates or Associates of any person or entity referred

to in this Agreement; provided, however, that, for the purposes of this Agreement, the Stockholder shall not be deemed an

Affiliate of the Company and the Company shall not be deemed an Affiliate of the Stockholder; provided, further, that the

term “Associate” shall only refer to associates controlled by the Stockholder and the term “Affiliate” shall not

include any private or publicly-traded portfolio company of the Stockholder to the extent the Stockholder does not have a majority ownership

of the voting securities of such entity and/or the right to appoint a majority of the board or other governing body of such entity.

(ii)

During the Standstill Period, the Stockholder shall appear in person or by proxy at each Stockholder Meeting and vote all shares

of the Company’s common stock, $0.01 par value per share (the “Common Stock”), beneficially owned by the Stockholder

as of each applicable record date in accordance with the Board’s recommendation with respect to any proposal presented at each Stockholder

Meeting. The Stockholder further agrees that it will (A) appear in person or by proxy at any special meeting of the Company’s stockholders

held during the Standstill Period and vote all shares of Common Stock beneficially owned by the Stockholder as of the applicable record

date of such meeting, and (B) execute valid written consents with respect to all shares of Common Stock beneficially owned by the Stockholder

as of the applicable record date for any stockholder action by written consent during the Standstill Period, in the case of each of (A)

and (B) in accordance with the Board’s recommendation on any proposal.

(iii)

The Stockholder acknowledges that all members of the Board are (A) governed by, and required to comply with, all policies, procedures,

codes, rules, standards and guidelines applicable to all members of the Board and (B) required to keep confidential all confidential information

of the Company and, without prior written consent of the Company, not disclose to any third party (including the Stockholder) any discussions,

matters, or materials considered in meetings of the Board or its committees.

2.

Standstill Provisions.

(a) For purposes of this Agreement,

the “Standstill Period” shall be from the date of this Agreement until January 31, 2027; provided, however,

that if the New Class III Director is renominated for election to the Board at the 2027 Annual Meeting by the Company and such final decision

of the Board to so renominate the New Class III Director is shared with the Stockholder in writing at least thirty days prior to the advance

notice deadline (as set forth in the Company’s Amended and Restated By-Laws) in connection with the 2027 Annual Meeting, then the

Standstill Period shall be extended automatically and without further action by any Party until May 31, 2028.

(b) During the Standstill

Period, the Stockholder shall not, and shall cause each of its controlled Affiliates and Associates not to, in each case directly or indirectly,

in any manner:

(i)

engage in any solicitation or become a “participant” in a “solicitation” (as such terms are defined in

Regulation 14A under the Exchange Act) of proxies or consents (including any solicitation of consents that seeks to call a special meeting

of stockholders of the Company), in each case with respect to any securities of the Company;

(ii)

form, join, or in any way participate in any “group” (within the meaning of Section 13(d)(3) of the Exchange Act) with

respect to shares of Common Stock; provided, however, that nothing herein shall limit the ability of an Affiliate or Associate

of the Stockholder to join a “group” with the Stockholder following the execution of this Agreement;

(iii)

deposit any shares of Common Stock in any voting trust or subject any shares of Common Stock to any arrangement or agreement with

respect to the voting of any shares of Common Stock, other than any such voting trust, arrangement or agreement solely among the members

of the Stockholder and otherwise in accordance with this Agreement;

(iv)

seek or submit, or encourage any person or entity to seek or submit, nomination(s) in furtherance of a “contested solicitation”

for the appointment, election or removal of directors with respect to the Company or seek, or knowingly encourage or take any other action

with respect to the appointment, election or removal of any directors, in each case in opposition to the recommendation of the Board;

(v)

(A) make any proposal for consideration by stockholders at a Stockholder Meeting, (B) make any offer or proposal (with or

without conditions) with respect to any merger, takeover offer, tender (or exchange) offer, acquisition, recapitalization, restructuring,

disposition or other business combination involving the Company or any of its subsidiaries (provided that nothing in this clause

(B) shall prohibit the Stockholder from making any confidential proposal to the Board), (C) solicit a third party to make an offer or

proposal (with or without conditions) with respect to any merger, takeover offer, tender (or exchange) offer, acquisition, recapitalization,

restructuring, disposition or other business combination involving the Company or any of its subsidiaries, or publicly encourage, initiate

or support any third party in making such an offer or proposal, (D) publicly comment on any third party proposal regarding any merger,

takeover offer, tender (or exchange) offer, acquisition, recapitalization, restructuring, disposition, or other business combination involving

the Company or any of its subsidiaries by such third party (provided that this clause (D) shall not prevent such public comment

after such proposal has become generally known to the public other than as a result of a disclosure by the Stockholder), (E) initiate,

encourage or participate in any “vote no,” “withhold” or similar campaign with respect to any Stockholder Meeting

or (F) call or seek to call a special meeting of stockholders, or initiate or participate in any stockholder action by written consent;

(vi)

acquire (or propose or agree to acquire), of record or beneficially, by purchase or otherwise, any securities of the Company that

represent or are convertible or otherwise exchangeable for securities in excess of 9.9% of Common Stock (the “Ownership Cap”);

provided that to the extent the Stockholder (together with its Affiliates) exceeds the Ownership Cap solely by reason of any decrease

in the number of the Company’s total outstanding equity securities, stock repurchases, reclassifications, stock combinations or

stock cancellations by the Company and the Stockholder does not purchase or otherwise acquire, or offer, seek, propose, or agree to acquire,

any additional ownership (including beneficial ownership as defined in Rule 13d-3 under the Exchange Act) of any Common Stock, then such

increase in the Stockholder’s beneficial ownership shall not be deemed to breach or otherwise violate this Section 2(b)(vi);

(vii)

seek, alone or in concert with others, representation on the Board, except as specifically provided in Section 1 (provided

that nothing in this Section 2(b)(vii) shall prohibit the Stockholder from privately seeking representation on the Board as long

as such private communications would not reasonably be expected to require public disclosure of such communications by the Company or

the Stockholder);

(viii)

advise, encourage, support or influence any person or entity with respect to the voting or disposition of any securities of the

Company at any Stockholder Meeting, except as specifically provided in Section 1; or

(ix)

make any request or submit any proposal to amend the terms of this Agreement other than through non-public communications with

the Company or the Board that would not be reasonably determined to trigger public disclosure obligations for any Party.

(c) Nothing in Section

2(b) shall be deemed to limit the exercise in good faith by each of the New Directors of such person’s fiduciary duties solely

in such person’s capacity as a director of the Company.

3.

Representations and Warranties of the Company. The Company hereby represents and warrants that:

(a)

it has the power and authority to execute, deliver, and carry out the terms and provisions of this Agreement and to consummate

the transactions contemplated hereby;

(b)

this Agreement has been duly and validly authorized, executed, and delivered by the Company and assuming due execution by the other

Party, constitutes a valid and binding obligation and agreement of the Company, enforceable against the Company in accordance with its

terms, except as enforcement thereof may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance,

or similar laws generally affecting the rights of creditors and subject to general equity principles;

(c)

the execution of this Agreement, the consummation of any of the transactions contemplated hereby, and the fulfillment of the terms

hereof, in each case in accordance with the terms hereof, will not conflict with, or result in a breach or violation of the organizational

documents of the Company as currently in effect; and

(d)

the execution, delivery and performance of this Agreement by the Company does not and will not (i) violate or conflict with any

law, rule, regulation, order, judgment, or decree applicable to the Company or (ii) result in any breach or violation of or constitute

a default under or pursuant to (or an event which with notice or lapse of time or both could constitute such a breach, violation, or default),

or result in the loss of a material benefit under, or give any right of termination, amendment, acceleration, or cancellation of, any

organizational document, agreement, contract, commitment, understanding, or arrangement to which the Company is a party or by which it

is bound.

4.

Representations and Warranties of the Stockholder. The Stockholder hereby represents and warrants that:

(a)

this Agreement has been duly and validly authorized, executed and delivered by the Stockholder, and assuming due execution by the

other Party is a valid and binding obligation and agreement of the Stockholder, enforceable against the Stockholder in accordance with

its terms;

(b)

the execution, delivery and performance of this Agreement by the Stockholder does not and will not (i) violate or conflict with

any law, rule, regulation, order, judgment or decree applicable to the Stockholder, or (ii) result in any breach or violation of or constitute

a default under or pursuant to (or an event which with notice or lapse of time or both would constitute such a breach, violation or default),

or result in the loss of a material benefit under, or give any right of termination, amendment, acceleration or cancellation of, any agreement,

contract, commitment, understanding or arrangement to which such member is a party or by which it is bound;

(c)

as of the date of this Agreement, the Stockholder beneficially owns (as determined under Rule 13d-3 promulgated under the Exchange

Act) 17,308,942 shares of Common Stock;

(d)

as of the date of this Agreement, and except as set forth in clause (c) above, the Stockholder does not currently have, and does

not currently have any right to acquire, any interest in any securities or assets of the Company or its subsidiaries (or any rights, options

or other securities convertible into or exercisable or exchangeable (whether or not convertible, exercisable or exchangeable immediately

or only after the passage of time or the occurrence of a specified event) for such securities or assets or any obligations measured by

the price or value of any securities of the Company or any of its controlled Affiliates, including any swaps or other derivative arrangements

designed to produce economic benefits and risks that correspond to the ownership of shares of Common Stock or any other securities of

the Company, whether or not any of the foregoing would give rise to beneficial ownership (as determined under Rule 13d-3 promulgated under

the Exchange Act), and whether or not to be settled by delivery of shares of Common Stock or any other class or series of the Company’s

stock, payment of cash or by other consideration, and without regard to any short position under any such contract or arrangement); and

(e)

the Stockholder has not agreed to, directly or indirectly, compensate or agree to compensate, and will not, directly or indirectly,

compensate or agree to compensate, any New Director for serving as a nominee or director, with any cash, securities (including any rights

or options convertible into or exercisable for or exchangeable into securities or any profit sharing agreement or arrangement), or other

form of compensation directly or indirectly related to the Company or its securities. For the avoidance of doubt, nothing herein shall

prohibit the Stockholder from compensating or agreeing to compensate any person for his or her respective service as a nominee or director

of any other company.

5.

Press Release; Public Announcements.

(a)

Promptly following the execution of this Agreement, the Company shall issue a mutually agreeable press release (the “Press

Release”) announcing certain terms of this Agreement substantially in the form attached hereto as Exhibit A. Prior to

the issuance of the Press Release and subject to the terms of this Agreement, neither the Company (including, but not limited to, the

Board and any committee thereof) nor the Stockholder shall issue any press release or make any public announcement regarding this Agreement

or the matters contemplated hereby without the prior written consent of the other Party, except as required by law or applicable stock

exchange listing rules.

(b)

The Company shall provide the Stockholder a reasonable opportunity to review and provide any reasonable comments to the Company’s

filing on Form 8-K regarding this Agreement prior to making such filing with the SEC, and the Company shall consider in good faith any

changes to the Form 8-K proposed by the Stockholder.

(c)

The Stockholder shall provide the Company a reasonable opportunity to review and provide any reasonable comments to the Stockholder’s

amendment to its Schedule 13D regarding this Agreement prior to making such filing with the SEC, and the Stockholder shall consider in

good faith any changes to such Schedule 13D amendment proposed by the Company.

(d)

During the Standstill Period, neither the Company nor the Stockholder shall make any public announcement or statement that is inconsistent

with or contrary to the terms of this Agreement, except as required by law or applicable stock exchange listing rules or with the prior

written consent of the other Party.

(e)

Until such time as the Press Release is issued and the Form 8-K regarding this Agreement is filed with the SEC, the Stockholder

shall, and shall cause its representatives to, keep confidential the information contained in the Press Release and Form 8-K. Notwithstanding

the foregoing, nothing in this Section 5(e) shall prevent the Stockholder from complying with its obligations under Regulation

13D of the Exchange Act.

6.

Specific Performance. Each of the Stockholder, on the one hand, and the Company, on the other hand, acknowledges

and agrees that irreparable harm to the other Party would occur in the event any of the provisions of this Agreement were not performed

in accordance with their specific terms or were otherwise breached and that such harm would not be adequately compensable by the remedies

available at law (including, but not limited to, the payment of money damages). It is accordingly agreed that the Stockholder, on the

one hand, and the Company, on the other hand (the “Moving Party”), shall each be entitled to specific enforcement of,

and injunctive relief to prevent any violation of the terms hereof, and the other Party shall not take action, directly or indirectly,

in opposition to the Moving Party seeking such relief on the grounds that any other remedy or relief is available at law or in equity.

This Section 6 is not the exclusive remedy for any violation of this Agreement.

7.

Expenses. The Company shall pay the Stockholder’s legal counsel (on behalf of the Stockholder) directly for

the Stockholder’s reasonable, documented out-of-pocket legal expenses incurred solely in connection with the Stockholder’s

negotiation and execution of this Agreement; provided, however, that such reimbursement shall not exceed $40,000 in the

aggregate. For the avoidance of doubt, in no event shall the Company pay or reimburse the Stockholder or its legal counsel for fees and

expenses the Stockholder incurred in connection with its proxy contest at the 2024 Annual Meeting.

8.

Severability. If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction

to be invalid, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions of this Agreement shall remain

in full force and effect and shall in no way be affected, impaired or invalidated. It is hereby stipulated and declared to be the intention

of the Parties that the Parties would have executed the remaining terms, provisions, covenants and restrictions without including any

of such provisions which may be hereafter declared invalid, void or unenforceable. In addition, the Parties agree to use their reasonable

efforts to agree upon and substitute a valid and enforceable term, provision, covenant or restriction for any of such that is held invalid,

void or enforceable by a court of competent jurisdiction.

9.

Notices. Any notices, consents, determinations, waivers or other communications required or permitted to be given

under the terms of this Agreement must be in writing and will be deemed to have been delivered: (a) upon receipt, when delivered personally;

(b) upon confirmation of receipt, when sent by email (provided such confirmation is not automatically generated); or (c) two business

days after deposit with a nationally recognized overnight delivery service, in each case properly addressed to the Party to receive the

same. The addresses for such communications shall be:

If to the Company:

GrafTech International Ltd.

982 Keynote Circle

Brooklyn Heights, Ohio 44131

Attn: Chief Legal Officer and

Corporate Secretary

with a copy to (which shall not constitute notice):

Jones Day

901 Lakeside Ave.

Cleveland, Ohio 44114

Attn: Kimberly J. Pustulka,

Benjamin L. Stulberg

If to the Stockholder:

Nilesh Undavia

474 NE 3rd St.

Boca Raton, Florida 33432

with a copy to (which copy

shall not constitute notice):

Vinson & Elkins L.L.P.

1114 Avenue of the Americas,

32nd Floor

New York, New York 10036

Attn: Lawrence S. Elbaum and

C. Patrick Gadson

10.

Governing Law; Jurisdiction. This Agreement shall be governed by and construed and enforced in accordance with the

laws of the State of Delaware without reference to the conflict of laws principles thereof that would result in the application of the

law of another jurisdiction. Each of the Parties irrevocably agrees that any legal action or proceeding with respect to this Agreement

and the rights and obligations arising hereunder, or for recognition and enforcement of any judgment in respect of this Agreement and

the rights and obligations arising hereunder brought by the other Party or its successors or assigns, shall be brought and determined

exclusively in the Delaware Court of Chancery and any state appellate court therefrom within the State of Delaware (or, if the Delaware

Court of Chancery declines to accept jurisdiction over a particular matter, any federal court within the State of Delaware). Each of the

Parties hereby irrevocably submits with regard to any such action or proceeding for itself and in respect of its property, generally and

unconditionally, to the personal jurisdiction of the aforesaid courts and agrees that it will not bring any action relating to this Agreement

in any court other than the aforesaid courts. Each of the Parties hereby irrevocably waives, and agrees not to assert in any action or

proceeding with respect to this Agreement, (a) any claim that it is not personally subject to the jurisdiction of the above-named courts

for any reason, (b) any claim that it or its property is exempt or immune from jurisdiction of any such court or from any legal process

commenced in such courts (whether through service of notice, attachment prior to judgment, attachment in aid of execution of judgment,

execution of judgment or otherwise) and (c) to the fullest extent permitted by applicable legal requirements, any claim that (i) the suit,

action or proceeding in such court is brought in an inconvenient forum, (ii) the venue of such suit, action or proceeding is improper

or (iii) this Agreement, or the subject matter hereof, may not be enforced in or by such courts. EACH PARTY HEREBY IRREVOCABLY WAIVES

ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT.

11.

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be considered one and

the same agreement and shall become effective when counterparts have been signed by each of the Parties and delivered to the other Party

(including, but not limited to, by means of electronic delivery or facsimile).

12.

Mutual Non-Disparagement. Subject to applicable law, each of the Parties covenants and agrees that, during the Standstill

Period, or if earlier, until such time as the other Party or any of its subsidiaries, successors, assigns, officers or directors, in each

case in their capacity as such, shall have breached this Section 12, neither it nor any of its respective subsidiaries, successors,

assigns, officers or directors, in each case in their capacity as such, shall in any way publicly criticize, disparage, call into disrepute,

or otherwise defame or slander the other Party or such other Party’s subsidiaries, successors, officers (including, but not limited

to, any current officer of a Party or a Party’s subsidiaries who no longer serves in such capacity following the execution of this

Agreement), directors (including, but not limited to, any current officer or director of a Party or a Party’s subsidiaries who no

longer serves in such capacity following the execution of this Agreement), employees, stockholders, agents, attorneys or representatives,

or any of their businesses, products or services, in any manner that would reasonably be expected to damage the business or reputation

of such other Party, their businesses, products or services or their subsidiaries, successors, assigns, officers (or former officers),

directors (or former directors), employees, stockholders, agents, attorneys or representatives. The restrictions in this Section 12

shall not (a) apply (i) to any compelled testimony or production of information, whether by legal process, subpoena, or as part of a response

to a request for information from any governmental or regulatory authority with jurisdiction over the party from whom information is sought,

in each case to the extent required, or (ii) to any disclosure that such party reasonably believes, after consultation with outside counsel,

to be legally required by applicable law, rules or regulations, in each case of clause (i) or (ii), solely to the extent that such restrictions

would require a violation of the applicable requirement; or (b) prohibit any party from reporting what it reasonably believes, after consultation

with outside counsel, to be violations of federal law or regulation to any governmental authority pursuant to Section 21F of the Exchange

Act or Rule 21F promulgated thereunder.

13.

Entire Agreement; Amendment and Waiver; Successors and Assigns; Third Party Beneficiaries; Term. This Agreement contains

the entire understanding of the Parties with respect to its subject matter. There are no restrictions, agreements, promises, representations,

warranties, covenants or undertakings between the Parties other than those expressly set forth herein. No amendments, modifications or

waivers of this Agreement can be made except in writing signed by an authorized representative of the Company and the Stockholder. No

failure on the part of any Party to exercise, and no delay in exercising, any right, power, privilege or remedy hereunder shall operate

as a waiver thereof, nor shall any single or partial exercise of such right, power, privilege or remedy by such Party preclude any other

or further exercise thereof or the exercise of any other right, power or remedy. All remedies hereunder are cumulative and are not exclusive

of any other remedies provided by law. The terms and conditions of this Agreement shall be binding upon, inure to the benefit of, and

be enforceable by the Parties and their respective successors, heirs, executors, legal representatives, and permitted assigns. No Party

shall assign this Agreement or any rights or obligations hereunder without, with respect to the Stockholder, the prior written consent

of the Company, and with respect to the Company, the prior written consent of the Stockholder. This Agreement is solely for the benefit

of the Parties and is not enforceable by any other persons or entities. This Agreement shall terminate at the end of the Standstill Period,

except that (a) the provisions of Section 6, Sections 8 through 11 and Sections 13 and 14 shall survive

termination and (b) no termination shall relieve either Party from liability for any breach of this Agreement prior to such termination.

14.

Interpretation. Each Party acknowledges that it has been represented by counsel of its choice throughout all negotiations

that have preceded the execution of this Agreement and that it has executed the same with the advice of said counsel. Each Party and its

respective counsel cooperated and participated in the drafting and preparation of this Agreement and the documents referred to herein,

and any and all drafts relating thereto exchanged among the parties shall be deemed the work product of all Parties and may not be construed

against any Party by reason of its drafting or preparation. Accordingly, any rule of law or any legal decision that would require interpretation

of any ambiguities in this Agreement against any Party that drafted or prepared it is of no application and is expressly waived by each

of the Parties hereto, and any controversy over interpretations of this Agreement shall be decided without regard to events of drafting

or preparation. The headings set forth in this Agreement are for convenience of reference purposes only and shall not affect or be deemed

to affect in any way the meaning or interpretation of this Agreement or any term or provision of this Agreement. In this Agreement, unless

a clear contrary intention appears, (a) the words “hereunder,” “hereof,” “hereto” and words of similar

import are references in this Agreement as a whole and not to any particular provision of this Agreement; (b) the word “or”

is not exclusive; (c) references to “Sections” in this Agreement are references to Sections of this Agreement unless otherwise

indicated; and (d) whenever the context requires, the masculine gender shall include the feminine and neuter genders.

15.

Securities Laws. The Stockholder acknowledges that it is aware, and will advise each of its representatives who are

informed as to the matters that are the subject of this Agreement, that the United States securities laws may prohibit any person who

directly or indirectly has received from an issuer material, non-public information from purchasing or selling securities of such issuer

or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person

is likely to purchase or sell such securities.

[Signature Page Follows]

IN WITNESS WHEREOF,

the Parties have caused this Agreement to be executed as of the date first written above.

| |

GRAFTECH INTERNATIONAL LTD. |

| |

|

| |

|

| |

/s/ Timothy K. Flanagan |

|

| |

Name: |

Timothy K. Flanagan |

| |

Title: |

Chief Executive Officer and President |

| |

NILESH UNDAVIA |

| |

|

| |

|

| |

/s/ Nilesh Undavia |

|

| |

Nilesh Undavia |

[Signature Page to Cooperation Agreement]

Exhibit A

Press Release

[See attached.]

GrafTech Announces Cooperation Agreement with

Stockholder Nilesh Undavia

BROOKLYN HEIGHTS, Ohio – (BUSINESS WIRE)

– January 10, 2025 – GrafTech International Ltd. (NYSE: EAF) (“GrafTech” or the “Company”) today announced

that it has entered into a cooperation agreement (the “Cooperation Agreement”) with one of the Company’s largest stockholders,

Mr. Nilesh Undavia, who owns approximately 6.7% of the Company’s outstanding common stock.

Pursuant to the Cooperation Agreement, GrafTech

has appointed Sachin Shivaram to the Board of Directors of the Company (the “Board”), effective immediately. Additionally,

GrafTech and Mr. Undavia will work together to identify a mutually agreed upon independent candidate to nominate for election to the

Board at the 2025 annual meeting of stockholders of the Company (the “2025 Annual Meeting”), although if the parties are unable

to find a mutually agreeable candidate in time for inclusion on the ballot of the 2025 Annual Meeting, they will continue to work together

to find a mutually agreeable candidate to be appointed as a director on the Board.

“We appreciate the constructive dialogue

we have had with Mr. Undavia over the course of the past year and believe that the appointment of Mr. Shivaram is in the best interests

of the Company and our stockholders given Mr. Shivaram’s vast experience in the steel industry,” said Henry R. Keizer, Chair

of the Board of GrafTech.

“I want to express gratitude for the collaborative

engagement I have had with the Company over the past year, culminating in the selection and acceptance of a highly qualified, independent

Board candidate, Mr. Shivaram. Stockholders will benefit from the expertise of Mr. Shivaram, who is highly accomplished in the global

metals industry,” said Mr. Undavia.

Mr. Shivaram has served as the Chief Executive

Officer of Wisconsin Aluminum Foundry Company, Inc., a century-old, family-owned manufacturer of aluminum and copper-based alloy castings,

since 2019. Mr. Shivaram began his career at ArcelorMittal S.A., one of the world’s largest steel and mining companies, rising to

the head of strategy and marketing for a business unit with production facilities across North and South America. Mr. Shivaram serves

on the board of directors of Lodge Manufacturing Company, Broadwind, Inc., Vollrath Company, LLC and the Green Bay Packers, Inc. He also

serves on the board of the Wisconsin Council on Workforce Investment and is a trustee of Lawrence University. He earned a Bachelor of

Arts in history and literature from Harvard University, a Masters in social and political sciences from the University of Cambridge and

a Juris Doctor from Yale Law School. He is a bar-certified attorney.

In connection with the appointment of Mr. Shivaram,

Mr. Undavia has agreed to customary standstill provisions and voting commitments during the term of the Cooperation Agreement. The Company

will file the Cooperation Agreement as an exhibit to a Current Report on Form 8-K with the United States Securities and Exchange Commission

(“SEC”).

Jones Day is serving as legal advisor to the Company.

Vinson & Elkins L.L.P. is serving as legal advisor to Mr. Undavia.

About GrafTech

GrafTech International Ltd. is a leading manufacturer

of high-quality graphite electrode products essential to the production of electric arc furnace steel and other ferrous and non-ferrous

metals. The Company has a competitive portfolio of low-cost, ultra-high power graphite electrode manufacturing facilities, with some of

the highest capacity facilities in the world. We are the only large-scale graphite electrode producer that is substantially vertically

integrated into petroleum needle coke, our key raw material for graphite electrode manufacturing. This unique position provides us with

competitive advantages in product quality and cost.

Cautionary Note Regarding Forward-Looking Statements

This press release may contain forward-looking

statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking

statements reflect our current views with respect to, among other things, financial projections, plans and objectives of management for

future operations, and future economic performance. Examples of forward-looking statements include, among others, statements we make regarding

future estimated volume, pricing and revenue, anticipated levels of capital expenditures and cost of goods sold, and guidance relating

to adjusted EBITDA and free cash flow. You can identify these forward-looking statements by the use of forward-looking words such as “will,”

“may,” “plan,” “estimate,” “project,” “believe,” “anticipate,”

“expect,” “foresee,” “intend,” “should,” “would,” “could,” “target,”

“goal,” “continue to,” “positioned to,” “are confident,” or the negative versions of those

words or other comparable words. Any forward-looking statements contained in this press release are based upon our historical performance

and on our current plans, estimates and expectations considering information currently available to us. The inclusion of this forward-looking

information should not be regarded as a representation by us that the future plans, estimates, or expectations contemplated by us will

be achieved. Our expectations and targets are not predictions of actual performance and historically our performance has deviated, often

significantly, from our expectations and targets. These forward-looking statements are subject to various risks and uncertainties and

assumptions relating to our operations, financial results, financial condition, business, prospects, growth strategy and liquidity. Accordingly,

there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements.

Additional factors are described in the “Cautionary

Note Regarding Forward-Looking Statements” and “Risk Factors” sections in reports and statements filed by the Company

with the SEC. The forward-looking statements made in this press release relate only to events as of the date on which the statements

are made. Except as required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether

as a result of new information, future developments or otherwise.

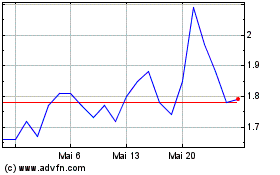

GrafTech (NYSE:EAF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

GrafTech (NYSE:EAF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025