Dun & Bradstreet Global Business Optimism Insights Report Reveals Cautious Economic Outlook for Q1 2025

22 Januar 2025 - 10:10PM

Business Wire

Slow economic growth, rising geopolitical

tensions, and increasing trade uncertainties drive down overall

optimism levels

Dun & Bradstreet (NYSE:DNB), a leading global provider of

business decisioning data and analytics, today released its Q1 2025

Global Business Optimism Insights report. The survey, conducted

during November 2024, revealed a 12.9% quarter-over-quarter decline

in the Global Business Optimism Index for Q1 2025, reflective of

growing concerns over weak economic growth, rising geopolitical

risks, and trade policy uncertainties.

This shift suggests a redirection from previously elevated

optimism levels seen in the latter half of 2024 and indicates a

more cautious approach by businesses, particularly in terms of

supply chain stability and investment strategies. The anticipation

of policy changes from the new U.S. administration may have also

contributed to lower optimism. Despite this quarterly decline, 30

of 32 economies show optimism levels above those seen in Q1 2024,

signaling a correction from previously elevated optimism levels

rather than a bleak outlook.

“Survey respondents have a guarded outlook for the quarter ahead

due to the evolving economic and political landscape that may

impact how the world does business,” said Neeraj Sahai, President

of Dun & Bradstreet International. “Optimism levels for supply

chain risks vary across business size with large businesses

indicating increased optimism and resilience by leveraging their

economies of scale and reliance on alternative sourcing.

Medium-sized businesses experienced the sharpest deterioration with

a 36% decline, indicating that these businesses have not been able

to counter the challenges posed by cross-country trade, while

simultaneously facing insufficient local supplies, further showing

heightened concern on the supply chain continuity front. Small

businesses had a moderate decline of 3.5%.”

Key findings from the Q1 2025 report:

- The Global Business Optimism Index dropped by 12.9%, its

first decline since the series began, with all 32 surveyed

economies seeing a downturn, reflecting heightened economic

uncertainty, geopolitical tensions, and sluggish growth. However,

for over 90% of the economies, the optimism levels remain above Q1

2024, signaling a correction from previously elevated optimism

levels.

- Over 80% of the economies reported a decline in optimism for

new export orders, with almost half of them having more than 10%

trade exposure to either the U.S. or the Chinese Mainland.

- The Global Supply Chain Continuity Index deteriorated by

10.4% after three quarters of improvement. Persistent challenges

such as freight costs, container shortages, and geopolitical

disruptions, as well as payment delays, contributed to this

decline.

- Optimism among large businesses improved 10.7% due to their

economies of scale and reliance on alternative sourcing.

Medium-sized businesses lagged with 66% reporting lower optimism.

Small businesses, despite a 3.5% decline, are optimistic about

delivery times, delivery costs, and supplier concentration due to

their ability to source locally and relocate production bases.

- The Global Business Financial Confidence Index declined

8.9%, for both advanced and emerging economies, with over 90% of

the economies reporting a decline in their financial confidence

index.

- This decline can be attributed to the uncertain macroeconomic

environment, weak demand outlook, increased balance sheet risk, and

declining financial risk appetite, especially among small and

medium-sized businesses. Optimism among large businesses, in

contrast, improved 12.7%.

- The Global Business Investment Confidence Index

decreased by 4.7%, though it is still 12% higher than the 5-quarter

average, reflecting commitments by many central banks to lower

their policy rates.

- Globally, 66% of businesses reported a need to raise long-term

funds, a significant decline from 71% in the previous quarter.

M&A activity remains a bright spot, with 78% of businesses

anticipating a conducive environment.

- The Global Business ESG Index rose 2.4%, highlighting

businesses’ focus on sustainability despite challenging economic

conditions.

- Notably, responses highlighted the differing strategies between

the U.S. and the European Union to increase budgets for

sustainability initiatives in Q1, particularly in automotive

manufacturing spending, likely due to varying expectations of

policy changes that may impact budget allocations.

"Businesses have entered the new year with subdued expectations

for Q1 2025 and are grappling with supplier risk as only 51% of

businesses expressed confidence in managing supplier concentration

risk, compared with 59% in Q4,” said Arun Singh, Global Chief

Economist at Dun & Bradstreet. "Further, central banks globally

are implementing interest rate cuts, yet the cost of capital is

perceived to remain elevated, indicating heightened credit risk.

This is also accentuated by lower optimism for sales and

profitability.”

Descriptions and information about the indices can be found on

page 31 of the report.

About the Global Business Optimism Insights Report

The Global Business Optimism Insights report is a synthesis of

data from a comprehensive survey encompassing 32 economies,

covering approximately 10,000 businesses and 17 sectors, alongside

insights from Dun & Bradstreet, leveraging the firm’s

proprietary data and economic expertise. The report is an

amalgamation of five indices which reflect overall business

optimism and expectations about supply chain continuity, financial

and investment conditions and ESG initiatives. An index reading

above 100 indicates an improvement in optimism relative to the base

year, while an index reading below 100 signifies a deterioration in

optimism.

View the full report here.

About Dun & Bradstreet

Dun & Bradstreet, a leading global provider of business

decisioning data and analytics, enables companies around the world

to improve their business performance. Dun & Bradstreet’s Data

Cloud fuels solutions and delivers insights that empower customers

to accelerate revenue, lower cost, mitigate risk, and transform

their businesses. Since 1841, companies of every size have relied

on Dun & Bradstreet to help them manage risk and reveal

opportunity. For more information on Dun & Bradstreet, please

visit www.dnb.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122979165/en/

Media: Ginny Walthour 904-528-1506 walthourg@dnb.com

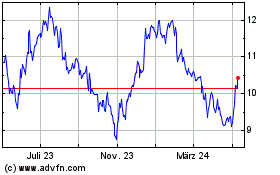

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

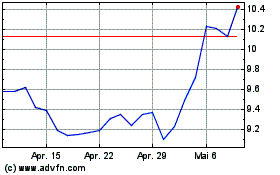

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025