Trian Comments on Preliminary Results of Disney Annual Meeting

03 April 2024 - 7:25PM

The Trian Group,1 which beneficially owns over $3.5 billion of

common stock in The Walt Disney Company (NYSE: DIS), today

commented on the preliminary results from Disney’s 2024 Annual

Meeting of Shareholders, which indicated that Nelson Peltz and Jay

Rasulo were not elected to Disney’s Board of Directors.

Trian issued the following statement on today’s results:

“While we are disappointed with the outcome of this proxy

contest, Trian greatly appreciates all of the support and dialogue

we have had with Disney stakeholders. We are proud of the impact we

have had in refocusing this Company on value creation and good

governance. Since we re-engaged with the Company in late 2023,

Disney has announced a host of new operating initiatives and

capital improvement plans. The Board has been refreshed with two

new directors. Over the last six months, Disney’s stock is up

approximately 50% and is the Dow Jones Industrial Average’s best

performer year-to-date.

We thank Trian’s investors for the confidence they have placed

in our efforts. And, we wish the best for all of the Company’s

stakeholders, including Disney’s Board and management team. We will

be watching the Company’s performance and be focusing on its

continued success.”

About Trian Fund Management, L.P.

Founded in 2005, Trian Fund Management, L.P. (“Trian”) is a

multi-billion dollar investment management firm. Trian is a highly

engaged shareowner that combines concentrated public equity

ownership with operational expertise. Leveraging the 40+ years’

operating experience of our Founding Partners, Nelson Peltz and

Peter May, Trian seeks to invest in high quality but undervalued

and underperforming public companies and to work collaboratively

with management teams and boards to help companies execute

operational and strategic initiatives designed to drive long-term

sustainable earnings growth for the benefit of all

stakeholders.

Media Contacts:

Anne A. Tarbell(212) 451-3030atarbell@trianpartners.com

Paul Caminiti / Pamela Greene / Jacqueline ZuhseReevemark(212)

433-4600Trian@reevemark.com

Investor Contacts:

Matthew Peltz(212) 451-3060mpeltz@trianpartners.com

Ryan Bunch(212) 451-3176rbunch@trianpartners.com

Bruce Goldfarb / Pat McHughOkapi Partners LLC(212) 297-0720(877)

629-6357info@okapipartners.com

Edward McCarthy / Richard Grubaugh / Thomas GerminarioD.F. King

& Co., Inc. (212) 229-2634 Disney@dfking.com

Disclaimer

Except as otherwise set forth in this press

release, the views expressed in this press release reflect the

opinions of Trian Fund Management, L.P. and its affiliates

(“Trian”), and are based on publicly available information with

respect to The Walt Disney Company (“Disney” or the “Company”).

Trian recognizes that there may be confidential information in the

possession of the Company that could lead it or others to disagree

with Trian’s conclusions. Trian reserves the right to change any of

its opinions expressed herein at any time as it deems appropriate

and disclaims any obligation to notify the market or any other

party of any such change, except as required by law. Trian

disclaims any obligation to update the information or opinions

contained in this press release, except as required by law. For the

avoidance of doubt, this press release is not affiliated with or

endorsed by Disney.

This press release is provided merely as

information and is not intended to be, nor should it be construed

as, an offer to sell or a solicitation of an offer to buy any

security nor as a recommendation to purchase or sell any security.

Funds, investment vehicles, and accounts managed by Trian currently

beneficially own shares of the Company. These funds, investment

vehicles, and accounts are in the business of trading – buying and

selling – securities and intend to continue trading in the

securities of the Company. You should assume such funds may from

time to time sell all or a portion of their holdings of the Company

in open market transactions or otherwise, buy additional shares (in

open market or privately negotiated transactions or otherwise), or

trade in options, puts, calls, swaps or other derivative

instruments relating to such shares.

Some of the materials in this press release

contain forward-looking statements. All statements contained herein

that are not clearly historical in nature or that necessarily

depend on future events are forward-looking, and the words

“anticipate,” “believe,” “expect,” “potential,” “could,”

“opportunity,” “estimate,” “plan,” “once again,” “achieve,” and

similar expressions are generally intended to identify

forward-looking statements. The projected results and statements

contained herein that are not historical facts are based on current

expectations, speak only as of the date of these materials and

involve risks, uncertainties and other factors that may cause

actual results, performances or achievements to be materially

different from any future results, performances or achievements

expressed or implied by such projected results and statements.

Assumptions relating to the foregoing involve judgments with

respect to, among other things, future economic competitive and

market conditions and future business decisions, all of which are

difficult or impossible to predict accurately and many of which are

beyond the control of Trian.

The estimates, projections and potential impact

of the opportunities identified by Trian herein are based on

assumptions that Trian believes to be reasonable as of the date of

this press release, but there can be no assurance or guarantee (i)

that any of the proposed actions set forth in this press release

will be completed, (ii) that the actual results or performance of

the Company will not differ, and such differences may be material,

or (iii) that any of the assumptions provided in this press release

are accurate.

1 Please refer to the definitive proxy statement, filed with the

United States Securities and Exchange Commission by Trian

FundManagement L.P. and certain of its affiliates and other persons

(the “Definitive Proxy Statement”) for information regarding the

members of the “Trian Group.” Nelson Peltz beneficially owns Disney

shares worth approximately $3.5 billion and Jay Rasulo owns Disney

shares worth approximately $800,000, in each case as further

detailed in the Definitive Proxy Statement. Note that ownership

position values are based on Disney’s share price at the close of

business on April 2, 2024.

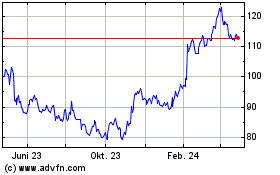

Walt Disney (NYSE:DIS)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

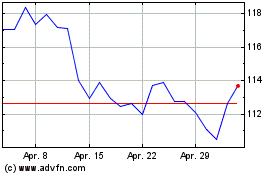

Walt Disney (NYSE:DIS)

Historical Stock Chart

Von Nov 2023 bis Nov 2024