The Trian Group,1 which beneficially owns over $3.5 billion of

common stock in The Walt Disney Company (NYSE: DIS), today

announced that two respected institutional investors, the

California Public Employees' Retirement System (CalPERS), the

country’s largest public pension fund, and Neuberger Berman, a

global asset manager, have expressed their support for both of

Trian’s nominees, Nelson Peltz and Jay Rasulo, in connection with

Disney’s annual meeting, which is scheduled to be held this

Wednesday, April 3, 2024.

Both CalPERS and Neuberger Berman recognize Disney’s poor track

record of corporate governance – which includes a persistent and

significant lack of alignment between pay and performance2 and a

failure to appropriately manage CEO succession – noting that the

Disney Board would benefit from “a fresh perspective”3 and “[t]wo

new directors who are qualified and capable of leading needed

change. . . .”4

In supporting the election of Nelson Peltz and Jay Rasulo,

CalPERS noted the following:

- "CalPERS believes Walt Disney Co will benefit from fresh eyes

on its board of directors and voted its company shares in favor of

candidates Nelson Peltz and Jay Rasulo.”5

- “[CalPERS’] established voting guidelines focus on the need for

independent corporate boards, a say in setting executive pay, and

increased transparency. Two new directors who are qualified and

capable of leading needed change in corporate governance will serve

the Disney board well."6

Similarly, Neuberger Berman wrote that:

- “We believe there is opportunity to strengthen relevant

policies and practices and that the board may benefit from the

addition of a fresh perspective and more independence. For these

reasons, we intend to support the election of dissident Trian

nominees Nelson Peltz and James Rasulo to the board.”7

- “[W]e believe [Trian’s] nominees are very strong candidates

given Peltz’s large ownership of the company and extensive board

experience and Rasulo’s long-term experience while working as an

executive at Disney.”8

- “[W]e do not believe short-term TSR performance alone is an

adequate indicator of the quality of governance at a company.

Despite recent improvements, in our opinion, the deficiencies of

the board that ultimately led to the failed 2020 succession

endeavor and related consequences remain. As such, we are

unconvinced of the current board’s ability to uphold good

governance practices and fulfill one of its core responsibilities

in finding a CEO successor.9

- “[W]e have concerns regarding the Disney board’s multi-year

efforts to name a successor to CEO Bob Iger. . . . The board has

admitted to not adhering to and executing the process it had in

place for Disney’s 2020 succession plan and that Chapek’s

appointment was a strategic misstep. . . . [W]e believe these

succession planning challenges have impacted business continuity

and distracted from business performance.”10

Other investors and independent proxy advisory firms have also

indicated their support for Nelson Peltz and Trian.

Yacktman Asset Management, a value-focused investment firm,

wrote:

- “Nelson Peltz has been a director, and Trian has been a

significant shareholder, of several companies in our investment

portfolio. As a director, Nelson has brought tremendous energy and

focus to his work, successfully collaborating with management teams

and his fellow directors to improve the companies for the benefit

of all stakeholders.”11

ISS, the largest and most influential proxy advisory firm,

concluded that:

- “[I]ncremental change is needed at the company due to

multi-year underperformance [relative to] the company’s peers and

chosen benchmark, operational challenges, and most critically, a

repeated failure on the part of the board to oversee the

cultivation of a successor to Iger.”

- “[T]he key decision points that led to the company’s challenges

over the past five years, not to mention multiple activist

campaigns, can be traced to the board.”

- “. . . Peltz, as a significant shareholder, could be additive

to the succession process, providing assurance to other investors

that the board is properly engaged this time around. He could also

help evaluate future capital allocation decisions.”

Egan-Jones, another independent proxy advisory firm, also

recommended that shareholders vote for change in the composition of

Disney’s Board. Egan-Jones concluded: “We see very little downside

and a lot of upsides in putting the Trian Nominees on the Board,”12

citing an “apparent lack of a . . . long-term succession plan”13

and “mediocre financial performance and the resultant lower

valuation”14 as reasons for shareholders to vote “For” both of

Trian’s nominees, Nelson Peltz and Jay Rasulo, and “Withhold” on

Maria Elena Lagomasino and Michael B.G. Froman.

Trian commented on the votes and recommendations from these

influential investors and research firms:

While Disney has touted the

endorsements15 of its service providers16 and advisors,17 we are

pleased to have earned the support of independent, respected

institutional investors and proxy advisory firms.

Like CalPERS, Neuberger Berman,

Yacktman, ISS, Egan-Jones, and others, we believe that change is

needed at Disney and that the election of our nominees will help

improve the focus, alignment and accountability of the Board.

We are confident that Nelson and Jay

will be far more effective in “refocusing the board on CEO

succession planning”18 and “aligning the board with shareholder

interests”19 than the directors we are seeking to replace, Maria

Elena Lagomasino and Michael B.G. Froman. These long-serving

incumbent directors have overseen Disney’s protracted succession

planning failures, persistent underperformance20 and questionable

strategic and capital allocation decisions.

By Disney’s own admission, Ms.

Lagomasino and Mr. Froman – one an advisor to wealthy families and

the other with experience in foreign affairs – possess just one

skill central to the Company’s strategy,21 a skill possessed by

every other incumbent director and by Nelson and Jay. Neither Ms.

Lagomasino nor Mr. Froman is well aligned with shareholders, unlike

Nelson and Jay, because neither owns meaningful amounts of Disney

stock.22

Critically, Ms. Lagomasino has failed

shareholders as the Chair (and previously as a member) of the

Compensation Committee.23 Disney’s executives have been paid more

than $1 billion in the last decade, even as the stock significantly

underperformed the S&P 500.24 Disney’s shareholders have long

expressed displeasure with Disney’s compensation program25 and yet

Ms. Lagomasino remains in her role. Her failure to help align pay

and performance is evident not just at Disney, but also at the

other companies on whose compensation committee she serves or

served, Coca-Cola and Avon Products, over many years.26

As we have said from the beginning,

this election contest is not about Disney’s CEO, it is about

improving the focus, alignment and accountability of Disney’s Board

so that the Company can return to delighting its consumers and

delivering value for its owners. In that context, we do not believe

Ms. Lagomasino or Mr. Froman deserves shareholder support. Change

is needed.

Our nominees, Nelson Peltz and Jay

Rasulo, bring relevant experience and pledge to work constructively

and collaboratively with the Board, as they have done with other

boards many times before. Nelson and Jay will bring a much-needed

shareholder perspective to the boardroom and will ask tough

questions, encourage open discussion and debate and set demanding

goals for the business.

To help ensure a better future for

this great company, we urge shareholders to vote “For” Nelson Peltz

and Jay Rasulo and to withhold support from Ms. Lagomasino and Mr.

Froman today. Together, we can Restore the Magic at Disney.

To ensure the election of Nelson Peltz and Jay Rasulo, it is

essential that shareholders vote “FOR” Nelson

Peltz and Jay Rasulo, and

“WITHHOLD” on Maria Elena Lagomasino,

Michael B.G. Froman, and all three Blackwells

Nominees.

Vote now. The deadline for shareholders to vote by telephone or

electronically is Tuesday, April 2 at 11:59 PM ET.

If you previously voted, you can change that vote by voting again

now.

For more information, including voting instructions, visit our

website: www.RestoreTheMagic.com.

About Trian Fund Management, L.P.

Founded in 2005, Trian Fund Management, L.P. (“Trian”) is a

multi-billion dollar investment management firm. Trian is a highly

engaged shareowner that combines concentrated public equity

ownership with operational expertise. Leveraging the 40+ years’

operating experience of our Founding Partners, Nelson Peltz and

Peter May, Trian seeks to invest in high quality but undervalued

and underperforming public companies and to work collaboratively

with management teams and boards to help companies execute

operational and strategic initiatives designed to drive long-term

sustainable earnings growth for the benefit of all

stakeholders.

Media Contacts:

Anne A. Tarbell(212) 451-3030atarbell@trianpartners.com

Paul Caminiti / Pamela Greene / Jacqueline ZuhseReevemark(212)

433-4600Trian@reevemark.com

Investor Contacts:

Matthew Peltz(212) 451-3060mpeltz@trianpartners.com

Ryan Bunch(212) 451-3176rbunch@trianpartners.com

Bruce Goldfarb / Pat McHughOkapi Partners LLC(212) 297-0720(877)

629-6357info@okapipartners.com

Edward McCarthy / Richard Grubaugh / Thomas GerminarioD.F. King

& Co., Inc. (212) 229-2634 Disney@dfking.com

Disclaimer

Except as otherwise set forth in this press release, the views

expressed in this press release reflect the opinions of Trian Fund

Management, L.P. and its affiliates (“Trian”), and are based on

publicly available information with respect to The Walt Disney

Company (“Disney” or the “Company”). Trian recognizes that there

may be confidential information in the possession of the Company

that could lead it or others to disagree with Trian’s conclusions.

Trian reserves the right to change any of its opinions expressed

herein at any time as it deems appropriate and disclaims any

obligation to notify the market or any other party of any such

change, except as required by law. Trian disclaims any obligation

to update the information or opinions contained in this press

release, except as required by law. For the avoidance of doubt,

this press release is not affiliated with or endorsed by

Disney.

This press release is provided merely as information and is not

intended to be, nor should it be construed as, an offer to sell or

a solicitation of an offer to buy any security nor as a

recommendation to purchase or sell any security. Funds, investment

vehicles, and accounts managed by Trian currently beneficially own

shares of the Company. These funds, investment vehicles, and

accounts are in the business of trading – buying and selling –

securities and intend to continue trading in the securities of the

Company. You should assume such funds may from time to time sell

all or a portion of their holdings of the Company in open market

transactions or otherwise, buy additional shares (in open market or

privately negotiated transactions or otherwise), or trade in

options, puts, calls, swaps or other derivative instruments

relating to such shares.

Some of the materials in this press release contain

forward-looking statements. All statements contained herein that

are not clearly historical in nature or that necessarily depend on

future events are forward-looking, and the words “anticipate,”

“believe,” “expect,” “potential,” “could,” “opportunity,”

“estimate,” “plan,” “once again,” “achieve,” and similar

expressions are generally intended to identify forward-looking

statements. The projected results and statements contained herein

that are not historical facts are based on current expectations,

speak only as of the date of these materials and involve risks,

uncertainties and other factors that may cause actual results,

performances or achievements to be materially different from any

future results, performances or achievements expressed or implied

by such projected results and statements. Assumptions relating to

the foregoing involve judgments with respect to, among other

things, future economic competitive and market conditions and

future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond the control of

Trian.

The estimates, projections and potential impact of the

opportunities identified by Trian herein are based on assumptions

that Trian believes to be reasonable as of the date of this press

release, but there can be no assurance or guarantee (i) that any of

the proposed actions set forth in this press release will be

completed, (ii) that the actual results or performance of the

Company will not differ, and such differences may be material, or

(iii) that any of the assumptions provided in this press release

are accurate.

Trian has neither sought nor obtained the consent from any third

party to use any statements or information contained herein that

have been obtained or derived from statements made or published by

such third parties, nor has it paid for any such statements. Any

such statements or information should not be viewed as indicating

the support of such third parties for the views expressed herein.

Trian does not endorse third-party estimates or research which are

used herein solely for illustrative purposes.

Important Information

Trian Fund Management, L.P., together with Nelson Peltz, Peter

W. May, Josh Frank, Matthew Peltz, Isaac Perlmutter, James A.

Rasulo, Trian Fund Management GP, LLC, Trian Partners, L.P., Trian

Partners Parallel Fund I, L.P., Trian Partners Master Fund, L.P.,

Trian Partners Co-Investment Opportunities Fund, Ltd., Trian

Partners Fund (Sub)-G, L.P., Trian Partners Strategic Investment

Fund-N, L.P., Trian Partners Strategic Fund-G II, L.P., Trian

Partners Strategic Fund-K, L.P., The Laura & Isaac Perlmutter

Foundation Inc., Object Trading Corp., Isaac Perlmutter T.A., and

Zib Inc. (collectively, the “Participants”) filed a definitive

proxy statement and accompanying form of blue proxy card (as

supplemented and amended on February 12, 2024, the “Definitive

Proxy Statement”) with the Securities and Exchange Commission (the

“SEC”) on February 1, 2024 to be used in connection with the 2024

annual meeting of shareholders of the Company.

THE PARTICIPANTS STRONGLY ADVISE ALL SHAREHOLDERS OF THE COMPANY

TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER PROXY MATERIALS

BECAUSE THEY CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT

HTTP://WWW.SEC.GOV AND TRIAN’S WEBSITE,

HTTPS://RESTORETHEMAGIC.COM. THE DEFINITIVE PROXY STATEMENT AND

ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE

COMPANY’S SHAREHOLDERS. SHAREHOLDERS MAY ALSO DIRECT A REQUEST TO

EITHER OF TRIAN’S PROXY SOLICITORS, OKAPI PARTNERS LLC, 1212 AVENUE

OF THE AMERICAS, NEW YORK, NY 10036 (SHAREHOLDERS CAN E-MAIL

INFO@OKAPIPARTNERS.COM OR CALL TOLL-FREE: (877) 629-6357), OR D.F.

KING & CO., INC., 48 WALL STREET, NEW YORK, NY 10005

(SHAREHOLDERS CAN E-MAIL DISNEY@DFKING.COM OR CALL TOLL-FREE: (800)

207-3158).

Information about the Participants and a description of their

direct or indirect interests by security holdings or otherwise can

be found in the Definitive Proxy Statement.

1 Source: Please refer to the definitive proxy statement, filed

with the United States Securities and Exchange Commission by Trian

Fund Management L.P. and certain of its affiliates and other

persons (as supplemented and amended, the “Definitive Proxy

Statement”) for information regarding the members of the “Trian

Group.” Nelson Peltz beneficially owns Disney shares worth

approximately $3.5 billion and Jay Rasulo owns Disney shares worth

approximately $800,000, in each case, as further detailed in the

Definitive Proxy Statement. Note that ownership position values are

based on Disney’s share price at the close of business on

3/29/2024.2 Since Ms. Lagomasino became Chair of Disney’s

Compensation Committee, Disney’s say-on-pay votes have averaged

just 73%, which ranks in the bottom 10% of all S&P 500

companies and Disney’s say-on-pay approval percentages have been

below the S&P 500 median every year. Say-on-pay has also been

below the average of all of the S&P 500 companies since 2018,

which is when Mr. Froman joined the Board. Source: SEC filings,

FactSet.3 NB Votes, available at:

https://www.nb.com/en/global/esg/nb-votes.4 Source: Svea

Herbst-Bayliss, Reuters, “US pension fund CalPERS backs Peltz,

Rasulo in Disney board battle,” published on 03/29/24.5 Source:

Svea Herbst-Bayliss, Reuters, “US pension fund CalPERS backs Peltz,

Rasulo in Disney board battle,” published on 03/29/24.6 Id.7 NB

Votes, available at: https://www.nb.com/en/global/esg/nb-votes.8

Id.9 Id.10 Id.11 Source: restorethemagic.com.12 Egan-Jones Proxy

Research Report, published on 03/26/24.13 Id.14 Id.15 See Disney

Investor Presentations and Letters to Shareholders filed on

02/12/24, 03/04/24, 03/11/24, 03/12/24 and 03/25/24, which

referenced endorsements from ValueAct Capital Management and J.P.

Morgan CEO Jamie Dimon.16 Blackwells Capital Investor Presentation,

03/11/24 (estimating that ValueAct has earned more than $90 million

in fees from managing assets for Disney’s pension funds).17 Source:

Anna Nicolaou, James Fontanella-Khan and Joshua Franklin, Financial

Times, “Jamie Dimon Backs Disney’s Bob Iger in Proxy Fight with

Nelson Peltz”, published on 03/13/24.18 NB Votes, available at:

https://www.nb.com/en/global/esg/nb-votes.19 Id.20 Disney has

underperformed its Media Industry Peers and the S&P 500 over

one, two, three, four and five years and during the tenures of each

of the incumbent directors. Source: FactSet. Note: Disney

performance measures total shareholder return (“TSR”) through

03/29/24, defined as the total return an investor would have

received if they purchased one share of stock on the first day of

the measured period, inclusive of share price appreciation and

dividends paid. “Media Industry Peers” represents the simple

average and consists of Alphabet, Amazon, Apple, Comcast, Meta,

Netflix, Paramount, and Warner Bros. Discovery. We highlight the

S&P 500 here only as a widely recognized index; however, for

various reasons, the performance of the index and that of the

securities mentioned above may not be comparable. One cannot invest

directly in an index. Note: James Gorman and D. Jeremy Darroch

excluded due to less than one year of tenure on the Board.21 Per

Disney’s 2024 Proxy Statement, Mr. Froman and Ms. Lagomasino

possess just one skill that Disney defines as “Central to Disney’s

Strategy”: “360 Degree Brand Activation,” which is a skill that is

also possessed by every other director on Disney’s Board.22 Mr.

Froman and Ms. Lagomasino beneficially own Disney shares worth

approximately $5 million. By comparison, the Trian Group

beneficially owns over $3.5 billion in Disney shares. Note that

ownership position values are based on Disney’s share price at the

close of business on 3/29/2024.23 Ms. Lagomasino has served as

Chair of the Compensation Committee since 2019 and a member of the

Committee since 2016.24 Source: SEC filings, FactSet. TSR measured

from Disney’s fiscal year 2013 ended 09/28/13 through 09/30/23.25

Since Ms. Lagomasino became Chair of Disney’s Compensation

Committee, Disney’s say-on-pay votes have averaged just 73%, which

ranks in the bottom 10% of all S&P 500 companies, and Disney’s

say-on-pay approval percentages have been below the S&P 500

median every year. Say-on-pay has also been below the average of

all of the S&P 500 companies since 2018, which is when Mr.

Froman joined the Board. Source: SEC filings, FactSet.26 Coca-Cola

received just 50% support for its say-on-pay proposal in 2022,

while Avon Products received 56%, 56% and 71% support in 2013, 2014

and 2015, respectively, earning an “F” Pay-for-Performance Grade

from Glass Lewis in each such year.

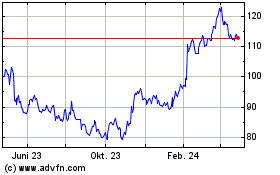

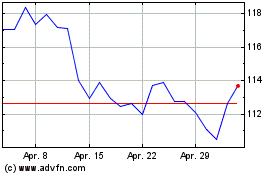

Walt Disney (NYSE:DIS)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Walt Disney (NYSE:DIS)

Historical Stock Chart

Von Nov 2023 bis Nov 2024