Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

26 November 2024 - 6:19PM

Edgar (US Regulatory)

Portfolio

of

Investments

September

30,

2024

DIAX

(Unaudited)

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

100.7%

X

606,195,871

COMMON

STOCKS

-

99.2%

X

606,195,871

BANKS

-

3.2%

94,081

JPMorgan

Chase

&

Co

$

19,837,920

TOTAL

BANKS

19,837,920

CAPITAL

GOODS

-

13.7%

94,081

3M

Co

12,860,873

94,081

(a)

Boeing

Co/The

14,304,075

94,081

(b)

Caterpillar

Inc

36,796,961

94,081

Honeywell

International

Inc

19,447,483

TOTAL

CAPITAL

GOODS

83,409,392

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

-

9.1%

94,081

(a),(b)

Amazon.com

Inc

17,530,113

94,081

Home

Depot

Inc/The

38,121,621

TOTAL

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

55,651,734

CONSUMER

DURABLES

&

APPAREL

-

1.4%

94,081

NIKE

Inc,

Class

B

8,316,761

TOTAL

CONSUMER

DURABLES

&

APPAREL

8,316,761

CONSUMER

SERVICES

-

4.7%

94,081

McDonald's

Corp

28,648,605

TOTAL

CONSUMER

SERVICES

28,648,605

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

-

1.2%

94,081

Walmart

Inc

7,597,041

TOTAL

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

7,597,041

ENERGY

-

2.3%

94,081

Chevron

Corp

13,855,309

TOTAL

ENERGY

13,855,309

FINANCIAL

SERVICES

-

16.0%

94,081

(b)

American

Express

Co

25,514,767

94,081

(b)

Goldman

Sachs

Group

Inc/The

46,580,444

94,081

Visa

Inc,

Class

A

25,867,571

TOTAL

FINANCIAL

SERVICES

97,962,782

FOOD,

BEVERAGE

&

TOBACCO

-

1.1%

94,081

Coca-Cola

Co/The

6,760,661

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

6,760,661

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

9.0%

94,081

UnitedHealth

Group

Inc

55,007,279

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

55,007,279

HOUSEHOLD

&

PERSONAL

PRODUCTS

-

2.7%

94,081

Procter

&

Gamble

Co/The

16,294,829

TOTAL

HOUSEHOLD

&

PERSONAL

PRODUCTS

16,294,829

INSURANCE

-

3.6%

94,081

Travelers

Cos

Inc/The

22,026,244

TOTAL

INSURANCE

22,026,244

MATERIALS

-

0.8%

94,081

Dow

Inc

5,139,645

TOTAL

MATERIALS

5,139,645

MEDIA

&

ENTERTAINMENT

-

1.5%

94,081

Walt

Disney

Co/The

9,049,651

TOTAL

MEDIA

&

ENTERTAINMENT

9,049,651

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

-

9.2%

94,081

(b)

Amgen

Inc

30,313,839

94,081

Johnson

&

Johnson

15,246,767

94,081

Merck

&

Co

Inc

10,683,838

TOTAL

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

56,244,444

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

-

0.4%

94,081

Intel

Corp

2,207,140

TOTAL

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

2,207,140

Portfolio

of

Investments

September

30,

2024

(continued)

DIAX

Investments

in

Derivatives

SHARES

DESCRIPTION

VALUE

SOFTWARE

&

SERVICES

-

14.2%

94,081

International

Business

Machines

Corp

$

20,799,427

94,081

Microsoft

Corp

40,483,054

94,081

Salesforce

Inc

25,750,911

TOTAL

SOFTWARE

&

SERVICES

87,033,392

TECHNOLOGY

HARDWARE

&

EQUIPMENT

-

4.4%

94,081

(b)

Apple

Inc

21,920,873

94,081

Cisco

Systems

Inc

5,006,991

TOTAL

TECHNOLOGY

HARDWARE

&

EQUIPMENT

26,927,864

TELECOMMUNICATION

SERVICES

-

0.7%

94,081

Verizon

Communications

Inc

4,225,178

TOTAL

TELECOMMUNICATION

SERVICES

4,225,178

TOTAL

COMMON

STOCKS

(Cost

$198,863,490)

606,195,871

SHARES

DESCRIPTION

VALUE

X

9,050,072

EXCHANGE-TRADED

FUNDS

-

1.5%

X

9,050,072

2,450

SPDR

Dow

Jones

Industrial

Average

ETF

Trust

$

1,036,644

28,300

Vanguard

Total

Stock

Market

ETF

8,013,428

TOTAL

EXCHANGE-TRADED

FUNDS

(Cost

$7,784,196)

9,050,072

TYPE

DESCRIPTION(c)

NUMBER

OF

CONTRACTS

NOTIONAL

AMOUNT(d)

EXERCISE

PRICE

EXPIRATION

DATE

VALUE

OPTIONS

PURCHASED

-

0.0%

Call

Chicago

Board

Options

Exchange

SPX

Volatility

Index

150

$

600,000

$

40

12/18/24

11,175

Put

Chicago

Board

Options

Exchange

SPX

Volatility

Index

300

420,000

14

10/16/24

600

TOTAL

OPTIONS

PURCHASED

(Cost

$15,937)

450

$

1,020,000

11,775

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$206,663,623)

615,257,718

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

1.9%

11,670,225

REPURCHASE

AGREEMENTS

-

1.9%

X

11,670,225

$

11,670,225

(e)

Fixed

Income

Clearing

Corporation

1.520

%

10/01/24

$

11,670,225

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$11,670,225)

11,670,225

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$11,670,225)

11,670,225

TOTAL

INVESTMENTS

-

102.6%

(Cost

$218,333,848

)

626,927,943

OTHER

ASSETS

&

LIABILITIES,

NET

- (2.6)%

(16,061,400)

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

610,866,543

Options

Written

Type

Description(c)

Number

of

Contracts

Notional

Amount

(d)

Exercise

Price

Expiration

Date

Value

Call

S&P

500

Index

(55)

$

(31,075,000)

$

5,650

10/18/24

$

(816,475)

Call

S&P

500

Index

(380)

(216,600,000)

5,700

10/18/24

(4,161,000)

Call

S&P

500

Index

(55)

(31,900,000)

5,800

10/18/24

(257,400)

Call

S&P

500

Index

(110)

(64,900,000)

5,900

10/31/24

(298,650)

Total

Options

Written

(premiums

received

$2,565,656)

(600)

$(344,475,000)

$(5,533,525)

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Common

Stocks

$

606,195,871

$

–

$

–

$

606,195,871

Exchange-Traded

Funds

9,050,072

–

–

9,050,072

Options

Purchased

11,775

–

–

11,775

Short-Term

Investments:

Repurchase

Agreements

–

11,670,225

–

11,670,225

Investments

in

Derivatives:

Options

Written

(5,533,525)

–

–

(5,533,525)

Total

$

609,724,193

$

11,670,225

$

–

$

621,394,418

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(a)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(b)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

derivatives.

(c)

Exchange-traded,

unless

otherwise

noted.

(d)

For

disclosure

purposes,

Notional

Amount

is

calculated

by

multiplying

the

Number

of

Contracts

by

the

Exercise

Price

by

100.

(e)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.520%

dated

9/30/24

to

be

repurchased

at

$11,670,718

on

10/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.500%

and

maturity

date

9/30/26,

valued

at

$11,903,770.

ETF

Exchange-Traded

Fund

SPDR

Standard

&

Poor's

Depositary

Receipt

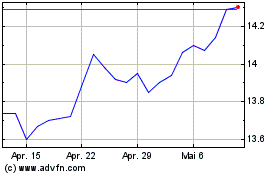

Nuveen Dow 30SM Dynamic ... (NYSE:DIAX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Nuveen Dow 30SM Dynamic ... (NYSE:DIAX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024