(FROM THE WALL STREET JOURNAL 1/6/16)

By Bob Tita and Joann S. Lublin

To gauge the future of the planned chemical titan DowDuPont, it

helps to look back at the dismantling of another industrial giant:

Tyco International PLC.

DuPont Co. Chief Executive Edward Breen spent a decade as CEO of

Tyco, pulling apart what was once among the largest U.S.

conglomerates. He transformed Tyco from a company with $41 billion

a year in revenue to one that now has about $10 billion in annual

sales, mostly from security and fire-suppression systems for

commercial buildings.

Mr. Breen and Dow Chemical Co. CEO Andrew Liveris plan to

similarly disassemble their two companies after first merging them

into one with about $90 billion a year in combined sales. Mr. Breen

will be the CEO of the resulting enterprise, DowDuPont, which the

companies hope regulators will approveby the end of 2016.

Executives plan to eliminate about $3 billion in annual costs,

then split DowDuPont by 2018 into separate companies focused on

agriculture,industrial materials and specialty products.

Mr. Liveris, who will be chairman of the combined company,

brings some experience in separating businesses as well. Dow last

year split off much of its chlorine business in a $5 billion deal

with smaller rival Olin Corp. Dow also has committed to reducing

costs without sacrificing growth.

"You always have productivity as your focus," Mr. Liveris said

in an interview, adding that the company has figured out how to

stay lean while it grows.

Mr. Breen, in an interview, said his Tyco experience offers a

guide to how to select and prepare executives for the changes.

Several people who know him agreed that his Tyco work showed an

ability to assess how executives and business units can slide

effectively into new companies.

"He likes stepping into situations that have a lot of moving

parts," said Deane Dray, a longtime analyst covering industrial

conglomerates at RBC Capital Markets. "It's easier for CEOs to be

acquisitive and empire builders than to be diplomatic and ruthless

about making decisions to create viable spin outs. He's not shy

about controversy."

During Mr. Breen's tenure as Tyco's CEO, which ended in 2012,

the company sold about 100 businesses, hived off three public

spinoffs, and made Tyco shareholders majority owners of a fourth

through a merger.

Some of the resulting stocks became hits, particularly

medical-equipment company CovidienPLC. Othershave faredless well,

particularly home-security service ADT Corp.

Unlike DuPont or Dow, Tyco was in perilous financial shape when

Mr. Breen arrived in 2002 after serving as president of Motorola

Inc.

Following years of acquisitions by his predecessor, L. Dennis

Kozlowski, Tyco was saddled with debt and dozens of incompatible

businesses that made it unwieldy to manage.

Still, fellow directors were surprised when Mr. Breen in late

2005 proposed spinning off Tyco's medical products and electronics

businesses, recalled a former Tyco executive.

The medical business, which would become Covidien, was Tyco's

most profitable unit. Tyco Electronics, a components manufacturer

that became TE Connectivity Ltd., generated the most revenue.

Mr. Breen argued at the time that separation would help the

businesses thrive. For example, Covidien, which manufactured

pharmaceuticals, sutures, surgical instruments, and other items for

operating rooms, needed independence to invest in research and

development, and to attract specialized employees wary of joining a

manufacturing conglomerate.

The spinoffs began trading in 2007. Covidien's stock price

soared more than 170% through early 2015, when it was acquired by

medical-device maker Medtronic Inc.for $42.9 billion in cash and

stock.

Thomas Lynch, TE Connectivity's CEO since its split, credits Mr.

Breen with identifying executives and board members for the new

companies early on and involving them in decisions.

Mr. Breen created trust among the future CEOs, and avoided

surprises. "It was very seamless when the split occurred," Mr.

Lynch said.

Connectivity's stock languished following the move, owing partly

to the auto industry's collapse, but is up 71% since the start of

2013.

Four years after the initial spinoff, Tyco said it planned to

split off ADT security and its business selling valves and

pipes.

To groom executives to run them, Mr. Breen devised a six-month

training program, emphasizing compliance with regulatory

requirements and managing relations with investors and board

members, recalled Laurie Siegel, Tyco's then senior vice president

of human resources. "We even went into things like how to do

succession planning with a board,"shesaid.

Mr. Breen says he tried to be clear with employees about their

aspirations and prospects, and stepped back while senior managers

handled portions of earnings calls to explain plans for their

proposed new units. "People were nervous," Mr. Breen said in the

interview, but "that process worked very well for us."

Tycoended up merging the pipes-and-valves business with Pentair

Ltd.in 2012, giving Tyco shareholders 52.5% of the resulting

company. Pentair's stock rose in the two years after the merger,

but fell in 2015 amid weaker sales, particularly in energy, leaving

it up 15% since the merger.

ADT has an industry-leading 25% share of the home security

market in the U.S. and Canada, but has faltered since its 2012

spinoff, owing partly to high costs to acquire customers and new

competition from cable TV and phone service providers. Its shares

are down 13% since their debut.

ADT recently entered the commercial-building security market,

competing with Tyco, its former parent. ADT declined to

comment.

Tyco performed well immediately after the last breakup, its

stock beating the broader market during its first two years of

trading. But its shares fell 27% in 2015 amid slowing revenue

growth. Its 2016 sales and profit guidance lagged behind analysts'

expectations.

Despite more challenging business conditions, corporate breakups

such as Tyco's that create focused companies remain popular with

investors.

Jack Krol, a retired DuPont CEO who was Tyco's lead independent

director during much of the Breen era, expects Mr. Breen to follow

the same breakup playbook at DowDuPont.

"He will send [the companies] out with strong balance sheets and

the right kind of people to run them," Mr. Krol said. In that way,

"they don't run into trouble."

---

Jacob Bunge and Rachel Feintzeig contributed to this

article.

(END) Dow Jones Newswires

January 06, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

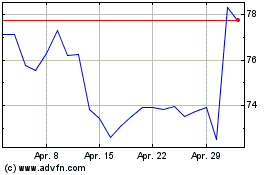

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024