Farmers Have Qualms About DuPont, Dow Chemical Merger

12 Dezember 2015 - 12:09AM

Dow Jones News

By Jacob Bunge

Farming leaders reacted with concern to the planned merger

between Dow Chemical Co. and DuPont Co ., calling for regulators to

scrutinize a deal that could give the companies broader clout in

the markets for seeds and pesticides.

The deal, announced Friday, would create a combined company

called DowDuPont worth about $120 billion at current valuations

that would later split into three publicly traded businesses

focused on agriculture, material sciences and specialty products in

nutrition and electronics.

DowDuPont's revenue from its chemicals and materials businesses

would be far larger, but the markets for those products tend to be

more fragmented. The agriculture business would boast major market

share: to about 41% of sales of U.S. corn seeds and related

genetics versus DuPont's current 35% and Dow's 6%, for example.

What's more, analysts expect the tie-up could fuel further deal

making among the six companies that currently dominate the global

market for seed and crop chemicals, a group that also includes

Monsanto Co., Syngenta AG, Bayer AG and BASF SE.

Analysts expect the DuPont-Dow deal to face close

examination--in the U.S. and the European Union as well as other

major markets like Brazil. The "global nature of the antitrust

hurdles are...likely to be significant," analysts at Piper Jaffray

& Co. wrote.

Dow and DuPont executives said they didn't anticipate problems.

DuPont Chief Executive Ed Breen said in an interview that they plan

to divest only minor pieces of their businesses--"nothing that

would move the needle," he said.

The National Farmers Union said that having just five major

players "would almost certainly increase the pressure for remaining

companies to merge, resulting in even less competition, reduced

innovation and likely higher costs for farmers."

"It's time for federal regulators to remember that bigger isn't

always better," said the group's president, Roger Johnson.

The National Corn Growers Association said it would study the

merger's likely impact on research, grain pricing, and costs for

seeds and pesticides and "will do all we can to protect farmer

interests and preserve an open and competitive marketplace."

"DuPont and Dow are two titans of American industry and the

proposed merger demands serious scrutiny," said Senate Judiciary

Committee Chairman Chuck Grassley, an Iowa Republican.

Dave Nelson, who farms near Fort Dodge, Iowa, said he has

concerns that consolidation could blunt the competitive drive among

big seed and chemical companies to create new products and bring

them to market quickly. But he said it wouldn't much alter how he

chooses seeds and sprays.

"In this type of [poor] ag economy you're going to see more

consolidation," Mr. Nelson said. "It's a sign of the times."

Write to Jacob Bunge at jacob.bunge@wsj.com

(END) Dow Jones Newswires

December 11, 2015 17:54 ET (22:54 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

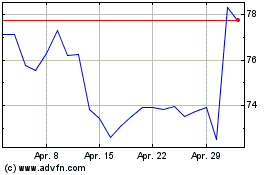

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024