By Jacob Bunge, David Benoit and Chelsey Dulaney

Dow Chemical Co. and DuPont Co. announced a merger that would

fuse two stalwarts of American industry into a giant worth about

$130 billion and would reshape the chemical and agricultural

industries.

The combined company would have $93 billion in total revenue,

based on 2014 numbers, and products ranging from corn seeds to

Kevlar fiber to foam chemicals used in sneaker soles. That behemoth

would serve as a vehicle for cutting some $3 billion in costs

before splitting into three separate businesses 18 to 24 months

after the merger closes. Those companies, each to be publicly

traded, would focus on agriculture, material sciences and specialty

products in nutrition and electronics.

The union, if approved, would mark the end as independent

entities of two of America's oldest corporations: DuPont, founded

in 1802, and Dow, started in 1897. Both are contending with sinking

commodity prices and a strengthening U.S. dollar that have

pressured their revenue. And each has sought separately in recent

years to reinvent itself as a maker of more-profitable products

while facing pressure from major investors agitating for faster,

bolder moves.

Executives billed the deal as a merger of equals. They said it

would spawn a trio of companies that are bigger and more focused,

and therefore better able to navigate current challenges. They also

emphasized that the combination and restructuring would avoid

taxes, adding to the benefit for shareholders.

The deal "was always in front of us to get done, in the right

way," Dow Chief Executive Andrew Liveris, who has long pursued a

tie-up with DuPont, said in an interview. "We believe this is the

right way."

He will be executive chairman of the new company, with DuPont

Chief Executive Edward Breen keeping the CEO title upon

consummation of a deal, anticipated by late next year. The company,

dubbed DowDuPont, will have dual headquarters in Midland, Mich.,

and Wilmington, Del. The leadership and location of the three

eventual companies hasn't been decided.

Some farm groups reacted with concern, fearing that

consolidation among the six global companies that sell crop seeds

and pesticides would leave the industry with too much clout. The

combined company would sell about 41% of U.S. corn seeds and

related genetics, for example.

The National Farmers Union said that having just five major

players "would almost certainly increase the pressure for remaining

companies to merge, resulting in even less competition, reduced

innovation and likely higher costs for farmers."

"It's time for federal regulators to remember that bigger isn't

always better and that the economic power of our nation was built

on the concept of having many players in the marketplace competing

for customers and driving innovation," said the group's president,

Roger Johnson.

The National Corn Growers Association said it would study the

merger's likely impact on agricultural research, grain pricing, and

the cost of seeds and pesticides, and "will do all we can to

protect farmer interests and preserve an open and competitive

marketplace."

"DuPont and Dow are two titans of American industry and the

proposed merger demands serious scrutiny," said Senate Judiciary

Committee Chairman Chuck Grassley, a Republican from the Farm Belt

state of Iowa.

Antitrust specialists also expect the deal to face close

examination. But Dow and DuPont executives said they didn't

anticipate big hurdles. Mr. Breen said in the interview that the

companies plan to divest only minor pieces of their businesses "but

nothing that would move the needle." Mr. Liveris said planned cost

reductions wouldn't "hobble" the companies' research

capabilities.

Friday's announcements will include major job cuts. DuPont on

Friday said that even before the merger, it plans to cut about 10%

of its global workforce. Further reductions are likely as the

combined company streamlines ahead of its planned breakup.

DuPont shares fell 5.1% in New York afternoon trading, as it

also issued downbeat comments on its expected 2016 sales growth.

Dow shares dropped 2%. Shares in both companies had risen since The

Wall Street Journal reported on Tuesday that they were in merger

talks.

A deal would be one of the biggest in a year marked by big

deals. So far, companies have struck some $4.4 trillion of

takeovers in 2015, eclipsing 2007 as the top year on record for

deals, according to Dealogic.

Shareholders of Dow Chemical will get 1 share in the new

DowDuPont for each Dow share, while DuPont shareholders will get

1.282 shares for each DuPont share. The structure will give Dow and

DuPont shareholders equal stakes in the combined company, excluding

the impact of preferred shares.

Mr. Breen, who joined DuPont's board early last year and took

over in October, said in an interview that Mr. Liveris called him

on Mr. Breen's first day running DuPont. Mr. Breen said pursuing a

merger was helped by the companies' almost equal market value.

"That always makes for quicker, easier negotiation," Mr. Breen

said.

He said merging with Dow and then breaking into three units is

far preferable to a split of DuPont by itself, a path proposed in

late 2014 by activist investment firm Trian Fund Management LP.

Friday's deal is "a totally different scenario," Mr. Breen

said.

"We've created three leading, strategic platforms, instead of

splitting DuPont into three small pieces," he said.

Trian, which owns a major stake in DuPont and unsuccessfully

pressed for board seats in a proxy fight earlier this year, said it

"fully supports this transformative transaction and believes that

the combination of DuPont and Dow is a great outcome for all

shareholders."

The New York investment firm said it was approached by the

companies to "assist in negotiations," including on structure and

governance of the combined entity and the planned spinoffs.

DowDuPont's board is to have 16 members, half from each side.

The two companies will choose those directors over the next four to

five months, and will likely hire new directors to serve on

advisory boards set up to help plan the three eventual

spinoffs.

Mr. Breen told analysts that the three-way breakup would likely

be a one-off event, rather than spinning off the units at different

times.

Mr. Liveris said there will "almost certainly" be a new leader

of the materials company, which could keep the Dow name after it is

spun out. "I do want to eventually go to the place where the future

of the company is not just beholden to my presence," he said on the

conference call.

Dow and DuPont said they would reshape their businesses ahead of

the merger. DuPont said it would cut $700 million in costs in 2016,

causing an expected pretax charge of $780 million. DuPont said it

expects sales growth next year to be "challenging."

Dow said it would take full ownership of Dow Corning Corp.,

which it jointly owns with Corning Inc. Dow said it expects that

move to yield more than $1 billion in annual earnings before

interest, taxes, depreciation and amortization. That transaction is

slated to close by the first half of 2016.

Write to Jacob Bunge at jacob.bunge@wsj.com, David Benoit at

david.benoit@wsj.com and Chelsey Dulaney at

Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

December 11, 2015 14:43 ET (19:43 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

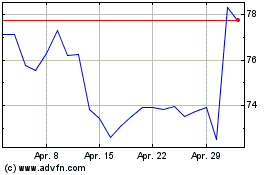

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024