DuPont, Dow Chem Formally Announce Megamerger Plan

11 Dezember 2015 - 1:40PM

Dow Jones News

Dow Chemical Co. and DuPont Co. announced Friday that they have

agreed to merge, fusing two of the U.S.'s oldest companies into a

chemical giant currently worth about $130 billion.

Under the terms of the deal, shareholders of Dow Chemical will

get 1 share in the new company called DowDuPont for each Dow share,

while DuPont shareholders will get 1.282 shares for each DuPont

share.

Dow's Chief Executive Andrew Liveris will be executive chairman

of the new company, with DuPont Chief Executive Edward Breen

keeping the CEO title.

The companies expect the merger, which must be approved by

regulators and both companies' shareholders, to be completed by the

second half of 2016.

The deal will be followed by a three-way breakup of the combined

company, a common approach to mergers and acquisitions of late. The

three resulting companies, which would be publicly-traded, would be

focused on agriculture, material sciences and specialty

products.

Dow's shares rose 1.6% in premarket trading, while DuPont shares

fell 4%.

Still, there is no guarantee antitrust regulators would bless

the union or that a breakup plan would address any such concerns.

The merger would combine two top suppliers of industrial and

agricultural chemicals and crop seeds, but it comes as sinking

commodity prices and a strengthening U.S. dollar have hurt revenue

across the companies' business lines.

Should the deal come to fruition, a combination of the

companies, each more than a century old, would be one of the

biggest in a year marked by big deals. So far, companies have

struck some $4.35 trillion of takeovers in 2015, eclipsing 2007 as

the top year on record for deals, according to Dealogic.

Both Dow and DuPont have been restructuring their businesses as

they've come under pressure from shareholders to slim themselves

and focus on faster-growing business lines—sometimes by shedding

products that made them famous.

DuPont has exited performance paints and coatings, including the

business that invented Teflon nonstick pan coating. Dow, meanwhile,

has gotten out of selling materials like chlorine and the epoxy

used in everything from space travel to Ziploc bags.

The deal comes shortly after DuPont named Mr. Breen, a

turnaround expert, as the company's chief executive after a stint

as interim CEO. Prior CEO Ellen Kullman retired after fending off

Nelson Peltz and Trian Fund Management LP, which sought board seats

and criticized the company—and its leadership—for bloated corporate

spending and a continued failure to hit earnings forecasts.

Soon after Mr. Breen stepped in to run DuPont in October, Mr.

Liveris called him to propose a deal. For more than a decade, Mr.

Liveris had sought to merge with DuPont, and he pitched a deal as a

way to find synergies before breaking up the businesses into more

focused operations, the people said.

For its part, Dow also has had an activist investor. Last year,

the company added two directors nominated by Daniel Loeb's Third

Point LLC after Mr. Loeb sought a breakup of the company and

threatened a proxy fight.

Talks of consolidation in the agricultural-sciences industry

have heated up recently, with companies scrambling to adjust to

pressure on lower prices for their commodities.

Last month, The Wall Street Journal reported that DuPont was

discussing a potential combination of its agriculture division with

seed giant Syngenta AG, and separately exploring a potential

agriculture deal with Dow. Monsanto Co. earlier this year abandoned

a $46 billion bid for Syngenta amid resistance from the Swiss

company.

Separately, Dow Chemical said it had restructured the ownership

of Dow Corning Corp. Under the pact, Dow will become the 100% owner

of Dow Corning, currently a joint venture between Dow and

Corning.

Dana Cimilluca and Dana Mattioli contributed to this

article.

Write to David Benoit at david.benoit@wsj.com, Jacob Bunge at

jacob.bunge@wsj.com and Chelsey Dulaney at

Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

December 11, 2015 07:25 ET (12:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

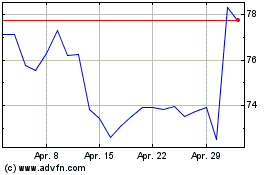

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024