By Jacob Bunge And Eyk Henning

The potential merger of DuPont Co. and Dow Chemical Co. could

spur agricultural rivals to forge their own partnerships, further

shrinking the handful of companies that dominate the global seed

and pesticide business.

The two U.S. chemical giants are considering a combination that

would lead to a three-way split of their businesses post merger,

The Wall Street Journal reported this week. Uniting Dow and

DuPont's agricultural units would create a deeper pesticide

portfolio against weeds, bugs and fungi and a stronger franchise in

genetically modified seeds, ratcheting up competition with Monsanto

Co., the top global seller of seeds, and Syngenta AG, the world

leader in pesticides.

Dow and DuPont get most of their revenue from sales of chemicals

and materials, but a combination wouldn't sharply shift the

competitive landscape in that relatively fragmented industry. A

deal would, however, be the first major shake-up in more than a

decade for the seed-and-pesticides business currently led by six

firms including Germany's Bayer AG and BASF SE. Those companies are

contending with weak crop prices world-wide that have pinched

farmers' wallets and forced them to curtail spending on everything

from seeds to fertilizer and tractors.

"It is just the beginning" of consolidation in that area, said

Mark Gulley, principal of New York-based chemicals consultancy

Gulley & Associates LLC. "The industry's overdue."

Monsanto kicked off the current deal making wave last spring

when the biotech seed giant proposed to buy Swiss rival Syngenta.

After unsuccessfully courting Syngenta investors and sweetening its

offer to $46 billion in cash and stock, Monsanto dropped its

pursuit in August, though Monsanto executives have continued to say

the deal would have been a good one.

Syngenta has at least one other suitor--China National Chemical

Corp., or ChemChina--interested in acquiring the company, people

familiar with the discussions said. The state-owned Chinese company

isn't currently a major force in the agriculture sector, but

biotech crops' capacity to simplify pest control and improve yields

has gained prominence in China.

Though China's government has put restrictions on cultivating

GMO crops, the country is investing in plant biotech and pushing to

consolidate its fragmented seed industry in an effort to modernize

its agricultural industry. Chinese firms' expansion has contributed

to overcapacity in some parts of the chemical industry, pressuring

profit margins.

Some Syngenta investors say the company's board should consider

deals since a Dow and DuPont merger would shrink the playing

field.

"If Dow and DuPont are gone. that does reduce the favoured

options for Syngenta," said Folke Rauscher, a Swiss-based investor

relations executive and Syngenta shareholder who in October helped

form a shareholder group to push for changes at the company.

Mr. Rauscher, who met with Syngenta chairman Michel Demaré in

late November to discuss his group's concerns over Syngenta's

stand-alone prospects, said the group would refresh its call for

Syngenta to begin an auction process.

Monsanto has stressed its own independent strengths after

dropping its Syngenta pursuit. But executives have said the company

continues to eye potential deals as a way to expand Monsanto's

chemicals franchise, a business the company had de-emphasized over

the past 15 years as it focused on developing biotech seeds.

"We like where we sit today, both with what we have in hand

right now, as well as the ability to pursue additional options," a

Monsanto spokeswoman said. Acquisitions must fit Monsanto's

strategy, allow for cost reductions and provide new ways to grow.

"There are options out there that can meet those objectives," she

said.

"Despite a lot of noise, we have no pressure to act rashly," she

said.

Industry executives say mergers could help develop new seed and

chemical products faster, and strip out costs in a research-heavy

business. It can cost about $136 million to identify helpful genes,

successfully insert them into crop seeds and secure regulatory

clearances around the world, according to a 2011 study by Phillips

McDougall Ltd.

For BASF and Bayer, a counterbid for Syngenta would be costly

and would likely require significant divestitures to resolve

antitrust concerns, say analysts. A sale of Syngenta to ChemChina,

a relatively minor competitor in the global market for agricultural

chemicals, wouldn't pose the same competitive threat to seed rivals

as a Syngenta-Monsanto combination, bankers say.

Unlike a combination with Monsanto, a tie-up with ChemChina, one

of China's largest state-owned businesses, likely would face fewer

antitrust hurdles, people familiar with the situation said.

Some Syngenta investors prefer Monsanto as a partner. "The

synergies in terms of costs, distribution and R&D would create

huge value for shareholders and establish a dominance that would be

difficult for any competitor, including a Dow/DuPont, to rival,"

said Magnus Spence-Jones, an analyst at fund manager THS Partners

LLP.

Merging Dow and DuPont could provide an opportunity for the

German companies to expand their North American seed franchises,

which lag those of rivals. The combined company might keep DuPont's

highly regarded seed business, which holds 35% of the U.S. corn

market and a third of soybeans, and divest Dow's smaller units to

ensure antitrust clearance, according to analysts.

"If Dow's seed business is going to be up for sale, you can be

sure the Germans are going to bid on it," said Mark Connelly, an

analyst with CLSA Ltd.

A spokeswoman for BASF declined to comment. A spokesman for

Bayer said that agriculture "is a core business of Bayer" but

declined to comment on specific deal possibilities.

John Revill contributed to this article.

(END) Dow Jones Newswires

December 10, 2015 19:59 ET (00:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

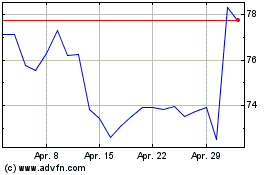

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024