UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o Filed

by a Party other than the Registrant x

Check the appropriate box:

| o |

Preliminary Proxy Statement |

| |

|

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| o |

Definitive Proxy Statement |

| |

|

| x |

Definitive Additional Materials |

| |

|

| o |

Soliciting Material under §240.14a-12 |

E. I. du Pont de Nemours and Company

(Name of Registrant as Specified In Its

Charter)

Trian Fund

Management, L.P.

Trian Fund Management GP, LLC

Trian Partners, L.P.

Trian Partners Strategic Investment Fund, L.P.

Trian Partners Strategic Investment Fund II, L.P.

Trian Partners Master Fund, L.P.

Trian Partners Parallel Fund I, L.P.

Trian Partners Master Fund (ERISA), L.P.

Trian Partners Strategic Investment Fund-A, L.P.

Trian Partners Strategic Investment Fund-D, L.P.

Trian Partners Strategic Investment Fund-N, L.P.

Trian SPV (SUB) VIII, L.P.

Trian Partners Fund (Sub)-G, L.P.

Trian Partners Fund (Sub)-G II, L.P.

Nelson Peltz

Peter W. May

Edward P. Garden

John H. Myers

Arthur B. Winkleblack

Robert J. Zatta

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

| x |

No fee required |

| |

|

| o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| |

|

|

| o |

Fee paid previously with preliminary materials. |

| |

|

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

4) |

Date Filed: |

| |

|

|

Trian Fund Management, L.P. (“Trian”)

has provided, and may from time to time in the future provide, the materials attached as Exhibit 1 to stockholders of E.I. du

Pont de Nemours and Company and/or certain other persons. These materials are being filed by Trian in HTML

and PDF formats as a convenience for readers.

###

Exhibit 1

Additional Information

Trian Fund Management, L.P. (“Trian”) and the investment

funds that it manages that hold shares of E.I. du Pont de Nemours and Company (collectively, Trian with such funds, “Trian

Partners”) together with other Participants (as defined below), filed a definitive proxy statement and an accompanying proxy

card with the Securities and Exchange Commission (the “SEC”) on March 25, 2015 to be used to solicit proxies in connection

with the 2015 Annual Meeting of Stockholders of E.I. du Pont de Nemours and Company (the “Company”), including any

adjournments or postponements thereof or any special meeting that may be called in lieu thereof (the “2015 Annual Meeting”).

Information relating to the participants in such proxy solicitation (the “Participants”) has been included in that

definitive proxy statement and in any other amendments to that definitive proxy statement. Stockholders are advised to read the

definitive proxy statement and any other documents related to the solicitation of stockholders of the Company in connection with

the 2015 Annual Meeting because they contain important information, including additional information relating to the Participants.

Trian Partners’ definitive proxy statement and a form of proxy have been mailed to stockholders of the Company. These materials

and other materials filed by Trian Partners in connection with the solicitation of proxies are available at no charge at the SEC’s

website at www.sec.gov. The definitive proxy statement and other relevant documents filed by Trian Partners with the SEC are also

available, without charge, by directing a request to Trian’s proxy solicitor, MacKenzie Partners, Inc. 105 Madison Avenue,

New York, New York 10016 (call collect: 212-929-5500; call toll free: 800-322-2885) or email: proxy@mackenziepartners.com

General Considerations

This presentation is for general informational purposes only,

is not complete and does not constitute an agreement, offer, a solicitation of an offer, or any advice or recommendation to enter

into or conclude any transaction or confirmation thereof (whether on the terms shown herein or otherwise). This presentation should

not be construed as legal, tax, investment, financial or other advice. The views expressed in this presentation represent the opinions

of Trian Partners, and are based on publicly available information with respect to the Company and the other companies referred

to herein. Trian Partners recognizes that there may be confidential information in the possession of the companies discussed in

this presentation that could lead such companies to disagree with Trian Partners’ conclusions. Certain financial information

and data used herein have been derived or obtained from filings made with the SEC or other regulatory authorities and from other

third party reports. Trian Partners currently beneficially owns shares of the Company.

Trian Partners has not sought or obtained consent from any third

party to use any statements or information indicated herein as having been obtained or derived from statements made or published

by third parties. Any such statements or information should not be viewed as indicating the support of such third party for the

views expressed herein. Trian Partners does not endorse third-party estimates or research which are used in this presentation solely

for illustrative purposes. No warranty is made that data or information, whether derived or obtained from filings made with the

SEC or any other regulatory agency or from any third party, are accurate. Past performance is not an indication of future results.

Neither the Participants nor any of their affiliates shall be

responsible or have any liability for any misinformation contained in any third party, SEC or other regulatory filing or third

party report. Unless otherwise indicated, the figures presented in this presentation, including return on invested capital (“ROIC”)

and investment values have not been calculated using generally accepted accounting principles (“GAAP”) and have not

been audited by independent accountants. Such figures may vary from GAAP accounting in material respects and there can be no assurance

that the unrealized values reflected in this presentation will be realized. This is not meant to be, nor is it, a prediction of

the future trading price or market value of securities of the Company. There is no assurance or guarantee with respect to the prices

at which any securities of the Company will trade, and such securities may not trade at prices that may be implied herein. The

estimates, projections, pro forma information and potential impact of the opportunities identified by Trian Partners herein are

based on assumptions that Trian Partners believes to be reasonable as of the date of this presentation, but there can be no assurance

or guarantee that actual results or performance of the Company will not differ, and such differences may be material. This presentation

does not recommend the purchase or sale of any security.

Trian Partners reserves the right to change any of its opinions

expressed herein at any time as it deems appropriate. Trian Partners disclaims any obligation to update the data, information or

opinions contained in this presentation.

Forward-Looking Statements

This presentation contains forward-looking statements. All statements

contained in this presentation that are not clearly historical in nature or that necessarily depend on future events are forward-looking,

and the words “anticipate,” “believe,” “expect,” “potential,” “opportunity,”

“estimate,” “plan,” and similar expressions are generally intended to identify forward-looking statements.

The projected results and statements contained in this presentation that are not historical facts are based on current expectations,

speak only as of the date of this presentation and involve risks, uncertainties and other factors that may cause actual results,

performance or achievements to be materially different from any future results, performance or achievements expressed or implied

by such projected results and statements. Assumptions relating to the foregoing involve judgments with respect to, among other

things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond the control of Trian Partners. Although Trian Partners believes that the assumptions

underlying the projected results or forward-looking statements are reasonable as of the date of this presentation, any of the assumptions

could be inaccurate and, therefore, there can be no assurance that the projected results or forward-looking statements included

in this presentation will prove to be accurate. In light of the significant uncertainties inherent in the projected results and

forward-looking statements included in this presentation, the inclusion of such information should not be regarded as a representation

as to future results or that the objectives and initiatives expressed or implied by such projected results and forward-looking

statements will be achieved. Trian Partners will not undertake and specifically declines any obligation to disclose the results

of any revisions that may be made to any projected results or forward-looking statements in this presentation to reflect events

or circumstances after the date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated

events.

Not An Offer to Sell or a Solicitation of an Offer to Buy

Under no circumstances is this presentation intended to be, nor

should it be construed as, an offer to sell or a solicitation of an offer to buy any security. Funds managed by Trian are in the

business of trading -- buying and selling -- securities. It is possible that there will be developments in the future that cause

one or more of such funds from time to time to sell all or a portion of their holdings in open market transactions or otherwise

(including via short sales), buy additional shares (in open market or privately negotiated transactions or otherwise), or trade

in options, puts, calls or other derivative instruments relating to such shares. Consequently, Trian Partners’ beneficial

ownership of shares of, and/or economic interest in, the Company’s common stock may vary over time depending on various factors,

with or without regard to Trian Partners’ views of the Company’s business, prospects or valuation (including the market

price of the Company’s common stock), including without limitation, other investment opportunities available to Trian Partners,

concentration of positions in the portfolios managed by Trian, conditions in the securities markets and general economic and industry

conditions. Trian Partners also reserves the right to change its intentions with respect to its investments in the Company and

take any actions with respect to investments in the Company as it may deem appropriate.

Concerning Intellectual Property

All registered or unregistered service marks, trademarks and trade

names referred to in this presentation are the property of their respective owners, and Trian Partners’ use herein does not

imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and trade names.

Questions on Trian’s Strategy

| 1. | What is Trian’s overall investment strategy, and how will that strategy benefit DuPont? |

| · | Trian’s investment strategy is to buy large stakes in high-quality but underperforming

public companies and then work collaboratively with management teams and boards to improve operating performance and drive earnings

growth. |

| · | Trian’s core competency is our ability to be a catalyst for significant operating improvements

and increased stockholder value at the companies in which we invest. |

| · | As our Principals’ 40-plus year track record demonstrates, Trian directors succeed because

of our deep operational experience, our focus on enhancing stockholder value and our success in cutting through management rhetoric

and ensuring clear financial, strategic and operational analysis in the boardroom. |

| · | If elected as a minority to the DuPont Board, the Trian nominees will seek to work constructively

with the other Board members and management to assess DuPont’s corporate structure, determine why many of DuPont’s

businesses underperform their competitors, eliminate excess corporate costs and bureaucracy, improve capital allocation, enhance

overall accountability and improve corporate governance, including aligning compensation with performance. |

| · | Trian has a long track record of driving operational improvements and growth of its portfolio

companies. |

| 1. | EPS growth of Trian’s investments, core and other, has more than doubled to 8.3% after

Trian’s involvement1, and |

| 2. | Shareholder returns of Trian’s core and other positions have outperformed the S&P 500

Index by over 670 basis points, annualized, after Trian’s involvement; furthermore, Trian portfolio companies on which Nelson

Peltz has held a board seat have outperformed the S&P 500 Index by an average of over 830 basis points, annualized.2

|

| 2. | Does Trian advocate breaking up DuPont? |

| · | Despite DuPont’s allegations, with an investment of approximately $1.7 billion in DuPont,3

Trian is not wedded to any specific strategic and operating initiatives – other than achieving best-in-class operating performance

(organic revenue growth and margins) – much less initiatives that are high-risk and value destructive. |

| · | Our focus is on enhancing the long-term value of DuPont for the benefit of all stockholders by

improving operating performance and capital allocation. If DuPont management can implement a plan that would retain DuPont’s

conglomerate structure and provide better stockholder returns than would be generated if certain DuPont businesses were operated

independently, Trian would be supportive of such a plan. |

| · | Trian put forth the idea of splitting up the Company because we believe the Company is hampered

by $2 to $4 billion of excess costs and stifling bureaucracy and as a result has consistently failed to meet its growth targets.4

|

| 3. | Will Trian try to replace Ellen Kullman as CEO if elected to the Board? |

| · | Trian is not seeking to replace Ellen Kullman. |

| · | If elected, Trian’s four nominees will seek to work collaboratively with the Board and

management and will provide the oversight necessary to help DuPont achieve best-in-class operating performance, earnings growth,

returns on invested capital and corporate governance. |

| · | Our nominees will seek to help DuPont grow sales and profitability, which should allow DuPont’s

dividend to grow. |

| · | Trian has a track record of working collaboratively with existing management teams at our portfolio

companies. The best example of this was after our only other proxy fight at H.J. Heinz, where we worked closely with Bill Johnson

(the CEO at the time) and Arthur Winkleblack (the CFO at the time). Today, Bill Johnson serves as a Trian Advisory Partner and

Arthur Winkleblack is one of Trian’s four highly-qualified nominees for the DuPont Board. |

| 4. | How will DuPont’s dividend be affected if Trian’s nominees are elected to the

Board? |

| · | DuPont’s dividend growth has been meager during current management’s tenure, growing

at approximately 12% (vs 66% for its proxy peers and 117% for diversified chemical and industrial peers).5

|

| · | We note that dividends can only grow if earnings grow! |

| · | If elected to the DuPont Board, Trian’s nominees will seek to grow sales, profitability

and cash flow at a best-in-class pace, which should allow DuPont’s dividend to grow. Trian’s financial model forecasts

10% annual growth in DuPont’s dividend.6 |

| 5. | How will Trian’s involvement on the DuPont Board be beneficial to DuPont employees and

its local communities? |

| · | As one of DuPont’s largest stockholders, Trian has a clear interest in the long-term success

of the Company — our interests are fully aligned with those of DuPont’s employees, customers, stockholders and the

communities it serves. |

| · | We invested in DuPont in 2013 because we believe DuPont can be best-in-class in every aspect

of its business – operations, research and development, capital allocation and corporate governance. |

| · | Trian’s objective is to help DuPont be in a position to honor its obligations to current

and former employees. |

| · | We believe the best way to protect employees is to ensure DuPont’s long-term viability

by holding management accountable for best-in-class performance in every aspect of DuPont’s business. |

| · | If elected, Trian’s nominees will seek to grow sales, profitability and cash flow at a

best-in-class pace, which should result in job growth. We are also committed to increasing the dividend and maintaining DuPont’s

investment grade credit rating. |

| · | We are highly motivated to see DuPont grow and innovate once again, and we believe Trian’s

nominees will offer fresh perspectives and new ideas. |

| 6. | I am a DuPont employee. How will my pension be affected if Trian’s nominees are elected

to the Board? Could I possibly lose my benefits or job? |

| · | Trian’s objective is to help DuPont be in a position to honor its obligations to current

and former employees. |

| · | We believe the best way to protect jobs is to ensure DuPont’s long-term viability by holding

management accountable for best-in-class performance in every aspect of DuPont’s business. If elected to the DuPont Board,

Trian’s nominees will seek to grow sales, profitability and cash flow at a best-in-class pace, which should benefit DuPont’s

employees and other stakeholders. |

| 7. | Does Trian intend to cut DuPont’s R&D spending? Won’t that hurt innovation? |

| · | No. Trian is committed to investment in R&D – but like other investments, we believe

it must be well managed and directed towards projects that are expected to produce the best results. |

| · | If elected, Trian’s nominees, in concert with the other directors and management, will

seek to ensure that those who run the businesses will also make appropriate R&D decisions. Trian helps build businesses, as

we believe that a company cannot “cost cut” its way to prosperity. In fact, almost all of the companies in which we

have invested have increased capital spending, often significantly. |

| 8. | Does Trian have concerns about the strategic decision that resulted in the sale of Performance

Coatings? |

| · | While we are not opposed to prudent, strategic M&A, Trian does not support dilutive capital

allocation decisions (M&A or otherwise). |

| · | Despite DuPont’s claims that Performance Coatings was a “commoditized, cyclical business”

7, we and others believe that this business is extremely

high quality. The standalone Coatings business today, renamed Axalta, is viewed as a specialty business that is highly cash generative

and a leader in a steady industry with barriers to entry.8

As a result, the business currently trades at a premium valuation of 29.6x forward earnings, a multiple that is approximately 12x

higher than DuPont’s current trading multiple of 17.7x.9

Berkshire Hathaway also recently acknowledged the quality and value of this business when it bought approximately 9% of the company

in early April 2015.10 We believe that DuPont clearly

failed to recognize this business’ transformation opportunity and, as a result, transferred over $6bn of DuPont stockholder

wealth to private equity owners.11 |

| · | In defending the divestiture of Performance Coatings, DuPont’s management has stated, “In

order to get that price in a tough market, we gave a clear roadmap to potential investors on how to grow the profitability of the

business in a short number of years, and this is what the buyer has done in return for taking on the risk.”12

We disagree with DuPont’s approach because DuPont stockholders were not able to participate in this significant value creation.

|

| · | Management had three options with Performance Coatings: |

| 1. | Fix the business internally and eliminate the inefficiencies, |

| 2. | Spin it off to shareholders and let the new entity eliminate legacy inefficiencies, or |

| 3. | Sell the business for cash, pay ~$1 billion of tax leakage,13

and let a new owner eliminate the inefficiencies, grow the business and reap the rewards. |

| · | In our view, management chose the worst option, #3. In addition, management only used 25% of

the proceeds to offset the dilution from the divestiture.14

As a result, we estimate this transaction was $0.27 more dilutive to DuPont EPS than it needed to be (had the Company returned

the other $3bn of proceeds to stockholders.)15 |

Questions on DuPont’s Financial Performance

| 9. | Are DuPont’s new products revenues generating real innovation or simply cannibalizing

existing product sales? |

| · | We believe DuPont’s “new” products are, for the most part, cannibalizing the

existing business. |

| · | In 2006, the Company reported that 63% of new products introduced in the last 5 years cannibalized

existing product sales.16 In 2007, the Company ceased

reporting new products sales cannibalization. Consequently, we believe that DuPont’s “new” products are not driving

innovation or growth. |

| · | If new product sales were truly innovative, DuPont would be delivering organic growth at least

in-line with peers and its own targets. On the contrary, five of DuPont’s seven business segments generate lower organic

growth than peers and DuPont’s own long-term growth targets.17 |

| · | Many of DuPont’s listed “new” products appear to be iterations of existing

products that were invented decades ago (e.g., Kevlar XP, Tyvek Fire Curb and Nomex XF).18 |

| · | Even DuPont’s claimed “break-through innovations” have not moved the needle: |

| 1. | Rynaxypyr, an insecticide introduced in 2006, is cited by management as evidence of its integrated

science strategy. However, the reality is that Rynaxypyr generated only 3% of DuPont’s revenues in 201419

and did not help DuPont’s overall crop chemicals business outperform as revenue growth trailed peers by 240 basis points

annually from 2008-2014.20 |

| 2. | Sorona, a biomaterials business, is also referenced as a key example of the Company’s “successful”

integrated science strategy. However, this business accounted for less than 1% of sales in 2013.21

We believe this business is not profitable. |

| 10. | If DuPont is underperforming peer margins in five reported segments, is DuPont’s claim

that it improved margins by 740 basis points since 2008 true? |

| · | Over the years, Trian has found that underperforming companies often rely on rhetoric to obfuscate

their performance issues. In our view, DuPont is no exception. |

| · | Firstly, DuPont’s claim that operating margins have expanded significantly since 2008 ignores

the fact that EBITDA margins continue to underperform peers in five of seven segments.22

|

| · | Secondly, we believe that DuPont’s claim that operating margins expanded by 740 basis points23

since 2008 is flawed because: |

| 1. | Using 2008 as a starting point to measure the change in margins is misleading because it does

not take into account the significant decline in margins from 2007 to 2008 as a result of the recession. We think it is more appropriate

to use 2007 as a base year to compare margin performance over time; we also note that Ellen Kullman was CEO for 86% of this time

period (January 2009-present) and held a role in the Office of the Chief Executive for the entire time period. |

| 2. | DuPont attempts to take

credit for the margin benefits related to positive commodity price dislocations and M&A,

rather than from true operational initiatives. We estimate that the ethylene cycle alone

drove 91 basis points of margin improvement from 2008-2014.24 We also note

that the Danisco business, which DuPont acquired in 2011, had margins of 25% at the time

of the acquisition, pro forma for synergies, significantly above DuPont’s 2008

margins of 14.9%.25 |

| · | The chart below shows each business segment’s EBITDA margin performance in 2007 and during the last twelve months (LTM)

ended Q1 2015. The chart excludes the Industrial Biosciences and Nutrition & Health segments, which are predominately comprised

of businesses acquired in DuPont’s 2011 acquisition of Danisco. Overall, the blended margin of the businesses that DuPont

has managed throughout the period has not improved materially. |

| Adjusted

EBITDA Margins of DuPont’s Reported Business Segments (a) |

| | |

| 2007 | | |

| LTM

(Q1’15) | | |

| Annual

Change | |

| Agriculture(b) | |

| 20.4 | % | |

| 22.9 | % | |

| 35 | bps |

| Performance Chemicals | |

| 20.0 | % | |

| 17.6 | % | |

| -33 | bps |

| Performance

Materials ex Ethylene(c) | |

| 13.8 | % | |

| 17.6 | % | |

| 52 | bps |

| Safety & Protection | |

| 31.0 | % | |

| 25.7 | % | |

| -74 | bps |

| Electronics & Communications | |

| 18.6 | % | |

| 19.8 | % | |

| 17 | bps |

| Unallocated Corp % of Total (Corporate + Other) | |

| -2.2 | % | |

| -2.5 | % | |

| -5 | bps |

| | |

| | | |

| | | |

| | |

| Blended

(Of Businesses Shown Above)(c) | |

| 17.0 | % | |

| 17.5 | % | |

| 8 | bps |

Source: DuPont

SEC filings, Bloomberg, and Nomura research model (December 26, 2014).

Notes:

(a) “Adjusted

EBITDA Margins Of DuPont’s Reported Business Segments” is calculated as adjusted pre-tax operating income (as reported)

plus depreciation and amortization divided by segment sales. Other and Corporate are listed as a percentage of total net sales.

(b) For Agriculture,

DuPont used to list the business with Nutrition in the “Agriculture and Nutrition” segment in 2007. At the time,

the business accounted for 83% of sales. Trian assumes Nutrition & Health had the same margin in 2007 as it did on average

from 2008-2010 to extrapolate the historical Agriculture margin.

(c) Using Bloomberg

and Nomura research model, estimates revenue and EBITDA for DuPont’s ethylene cracker assuming 95% nameplate utilization

and removes it from Performance Materials.

| · | The businesses that management did not own for the entire time period (since 2007), Axalta and Danisco, exhibit the inefficiencies

of DuPont’s corporate structure. Axalta’s EBITDA margins improved from 8% in 2011 to 20% in 2014 after DuPont sold

the business - demonstrating that Axalta is being run more efficiently outside of DuPont’s corporate structure.26

Danisco’s operating margins, on the other hand, have fallen 33% since the business was acquired by DuPont.27 |

| 11. | Is Trian’s 2011 EPS metric intellectually honest? Is Trian including or excluding the earnings contribution from discontinued

operations? |

| · | We believe that Trian’s 2011 EPS metric of $4.32 is intellectually honest. It uses DuPont’s originally reported

2011 EPS, excluding significant items, on which management was compensated and adds back non-operating pension and other post-employment

benefits (OPEB) expenses to conform to DuPont’s current “Operating EPS” methodology.28 |

| · | Trian’s 2011 EPS includes earnings from the Performance Coatings business, sold in 2013, for the following reasons: |

| 1. | Trian believes all management teams, including DuPont, should be held accountable for the accretion/dilution related to their

M&A decisions. DuPont made the strategic decision to sell Performance Coatings for approximately $4bn of after-tax cash proceeds29

and had the responsibility to invest those proceeds efficiently (e.g., share buybacks and/or capital investments.) |

| 2. | Today’s 2014 EPS reflects many of the benefits of the Performance Coatings proceeds as the Company used $1bn of the net

proceeds to reduce share count.30

Accordingly, 2011 EPS should reflect the income from that business to make the two earnings figures comparable (“apples to

apples”). |

| · | Trian’s 2011 EPS also includes the earnings contribution from Performance Chemicals which is not yet considered a discontinued

operation (and is still included in the Company’s 2015 EPS guidance). |

| 12. | How much of the decline in earnings between 2011 and 2014 is attributable to currency? |

| · | Based on disclosure from DuPont’s transcripts and SEC filings, Trian estimates that underlying earnings (excluding the

impact of foreign currency movements) would have grown at a 3% CAGR from 2011 to 2014.31 |

| · | We note that an EPS CAGR of 3% from 2011 to 2014 is still in the bottom-third of both DuPont’s proxy peers and Trian’s

selected diversified chemical and industrial peers (which Trian believes provide a more appropriate comparison), even if one does

not adjust either set of peers for similar currency headwinds.32 |

| · | DuPont has also

increased prices during this time frame, which has somewhat offset the impact of currency headwinds (local pricing contributed

2% to sales growth during the period versus a -4% foreign currency headwind).33 |

| 13. | Can you explain why DuPont needs to grow underlying earnings at a 29% growth rate in the last three quarters of 2015 just

to achieve the low end of its guidance this year?34 |

| · | The 29% growth rate reflects the constant currency “core growth” needed to achieve $4.00 of EPS (the low-end of

the range of the Company’s 2014 guidance of $4.00-$4.20) after accounting for the additional benefits from the targeted cost

savings and accretion from share repurchases. |

| 1. | For this calculation, we adjust Q2-Q4 2014 earnings to exclude one-time benefits/losses such as $100mm of gains on sales, a

lower tax rate than guided in 2015, the one-time reduction in performance-based compensation and net exchange losses. As a result,

the normalized Q2-Q4 2014 EPS we use in our calculation is $2.23, 20 cents lower than the reported operating EPS of $2.43. |

| 2. | We also adjust Q2-Q4 2015 earnings to exclude FX headwinds and to include the benefits of cost-savings and share repurchases

(which are somewhat offset by the higher interest expense resulting from new Chemours debt). We arrive at Q2-Q4 15 Core EPS of

$2.88 – 22 cents higher than the implied guidance for Q2-Q4 2015 EPS, which includes those benefits/headwinds. |

Corporate Governance Questions

| 14. | Why is Trian seeking four seats on the DuPont Board? |

| · | Trian wants to see DuPont become great again by achieving best-in-class operating performance, earnings growth, returns on

invested capital and corporate governance. Unfortunately, DuPont is not best-in-class in any of those metrics today. EPS figures

for 2012, 2013, and 2014 were all below 2011 levels. And even if DuPont achieves its earnings guidance, EPS

in 2015 will also be below 2011 levels.35

Furthermore, DuPont has continually missed its rolling long-term targets of 7% revenue growth and 12% EPS growth.36

Trian was patient for 18 months before sharing its views on value creation publicly. We tried repeatedly to reach a compromise

– we would have preferred to avoid a proxy contest; we take pride in our reputation as long-term stockholders who work constructively

with boards and management teams. |

| · | If elected to the DuPont Board, Trian’s nominees will seek to hold management accountable for DuPont’s continuing

underperformance and will work collaboratively with the Board and management to assess the corporate structure, eliminate excess

corporate costs, ensure productivity initiatives hit the bottom line, review capital allocation and improve corporate governance. |

| 15. | What do Trian’s nominees bring to the DuPont Board that it does not already have? |

| · | Trian’s nominees have the experience, skill-sets and passion to address the underperformance at DuPont. |

| · | Attributes of Trian’s nominees:37 |

| 1. | Oversaw high performance cultures |

| 2. | Diverse industry backgrounds |

| 3. | Relevant chemicals and industrials experience |

| 5. | Independence in the boardroom |

| 6. | Ownership mentality in the boardroom |

| 7. | Wendy’s, where Nelson Peltz serves as Non-Executive Chairman of the Board, was an early adopter of proxy access |

| 8. | 3 of 4 nominees have served as a public company CEO or CFO |

| 9. | Our 4 nominees have held a cumulative total of 20 public company board seats |

| 10. | Exceptional track records driven by operational improvements |

| · | Nelson Peltz: CEO and a founding partner of Trian; has served as CEO of six public companies, including a Fortune 100 industrial

company with 24,000 employees and 115 manufacturing facilities worldwide. |

| · | John Myers: Former President and CEO of GE Asset Management – grew assets under management from $58 billion to $200 billion;

currently serves on the board of Legg Mason (Nominating and Corporate Governance Committee) and previously served as a director

of Hilton, DoubleTree, Callaway Golf and Promus Hotel. Mr. Myers spent the first half of his 35+ year career at General Electric

in various managerial roles on the industrial side of GE’s business, where he gained valuable operational skills. |

| · | Arthur Winkleblack: Former CFO of Heinz who also held various positions over multiple decades at PepsiCo and Allied Signal,

as well as private equity portfolio companies; currently serves on the boards of Church & Dwight and RTI International Metals;

strong regulatory/safety credentials running global manufacturing footprint at past companies. |

| · | Robert Zatta: Former Acting CEO and long-time CFO of Rockwood, a chemicals conglomerate; oversaw best-in-class capital allocation

execution and successful strategic investments; extensive international regulatory experience in TiO2/lithium businesses. |

| · | Trian has a long track record of driving operational improvements and growth of its portfolio companies. |

| 1. | EPS growth of Trian’s investments, core and other, has more than doubled to 8.3% after Trian’s involvement, and38 |

| 2. | Shareholder returns of Trian’s core and other positions have outperformed the S&P 500 Index by over 670 basis points,

annualized, after Trian’s involvement; furthermore, Trian portfolio companies on which Nelson Peltz has held a board seat

have outperformed the S&P 500 Index by an average of over 830 basis points, annualized.39 |

| 16. | Why does Trian believe a Trian Principal needs to be elected to the DuPont Board? |

| · | As a member of the board, a Trian Principal seeks to: |

| 1. | Eliminate management’s rhetoric. The Trian team works with the Trian Principal to ensure that he is fully prepared for

every board meeting so that he can help stimulate a robust discussion in the boardroom. This allows the right questions to be asked

which helps ensure that the board makes its decisions based on analysis grounded in reality and free from “spin”. |

| 2. | Eliminate management’s “information advantage.” We question whether the Board

was aware of: 1) the significant growth of Axalta’s EBITDA after its acquisition; 2) that the CEO sold over half of her stock

since Trian’s investment; 3) the fact that management suggested that changes in pension

accounting led to lowered margin targets at the 2013 Investor Day; 4) the release of 9 different EPS figures for 2011; and 5) the

lack of transparency when reporting financial and operating metrics.40 |

| 3. | Trian believes it already has had a significant impact at DuPont, but there is more value to be unlocked. For instance, the

Company announced a $925mm “Fresh Start” cost savings initiative;41

however, it has not committed to flow through the savings to the bottom line. Moreover, revenue growth and margins still trail

peers in five of seven segments.42 |

| 4. | Trian has a track record of adding value in the boardroom, improving both operating results and share price performance.

43

The Trian approach makes the boardroom a place of constructive debate. Trian’s Principals seek to “raise the bar”

for fellow board members and management in the companies in which we invest, which directly benefits all stockholders. |

| · | Trian Principals bring an “ownership mentality” to the boardroom. |

| 17. | Does Trian create a “shadow management team” to work with the board? |

| · | DuPont suggests that Trian creates a “shadow management team” when a Trian Principal joins a board – this

is just rhetoric: Trian simply strives to eliminate the “information advantage” that management teams have over the

board. |

| · | It is not unusual for board and committee members to receive a thousand pages of material just a few days before a meeting;

as a result it is difficult, if not impossible, for any director without a team of analysts to thoroughly review all of the information. |

| · | Trian shares all of its findings with senior management and the rest of the board to ensure that the dialogue in the boardroom

is robust, dispassionate and focused on the key issues at hand. |

| · | We encourage you

to review the testimonials

on our website (www.DuPontCanBeGreat.com)

from board members

with whom Trian Principals

have worked. |

| 18. | How will Trian’s nominees help DuPont improve performance? |

| · | Trian believes that it has already been driving constructive and meaningful change at DuPont. Since we first invested in March

2013, DuPont has announced the planned spin-off of Performance Chemicals (Chemours), a commitment to return more capital to stockholders,

the Fresh Start cost-reduction initiatives, the appointment of new independent directors and the amendment to its key performance

indicators for management’s 2015 compensation plan. |

| · | However, we believe that there is still much more value to created. Trian’s nominees, if elected as a minority of the

DuPont Board, will seek to work collaboratively with the Board and management to: |

| 1. | Assess the corporate structure and determine whether management is capable of achieving best-in-class revenue growth

and margins with the existing portfolio or whether there is a need to separate the portfolio – our nominees are open-minded

as to the best path forward. |

| 2. | Eliminate excess corporate costs and ensure that productivity initiatives hit the bottom line. |

| 3. | Assess capital allocation including organic investments (e.g., research and development, capital expenditures, industrial

biosciences initiatives), M&A, balance sheet efficiency and capital return policies (increasing dividends). |

| 4. | Improve corporate governance including increasing transparency of business performance, aligning compensation programs

with performance and fostering overall accountability for promised performance. |

| 19. | DuPont says having Trian on the Board is “risky” and “value-destructive” – why is this not

the case? |

| · | We believe DuPont is attempting to distract and mislead stockholders from the real issue at the Company – its consistently

subpar performance. 2015 is projected by the Company to be the fourth year in a row that DuPont’s earnings will be below

its earnings from 2011. 44 |

| · | Trian is not wedded to any specific agenda, much less a high-risk agenda. Our focus is on enhancing the long-term value of

DuPont for the benefit of all stockholders. |

| · | Trian’s initiatives for DuPont have never included aggressively leveraging the Company. We believe a prudent capital

structure with a strong credit rating (investment grade) is a powerful tool to help improve stockholder returns over time. Trian’s

suggestion was always to keep Chemours investment grade, while management has chosen to put the company’s credit rating into

“junk” territory,45

utilizing approximately twice the balance sheet leverage that Trian proposed.46 |

| · | Trian believes DuPont has tremendous potential, and if elected to the DuPont Board, Trian’s nominees will seek to help

DuPont make needed improvements for the benefit of all DuPont stockholders. |

| · | Trian’s nominees will seek to work collaboratively with the Board and management and provide the oversight necessary

to help DuPont achieve best-in-class operating performance, earnings growth, returns on invested capital and corporate governance. |

| 20. | Based on DuPont’s stock price performance, is Trian’s involvement really necessary? |

| · | Yes, Trian believes much of DuPont’s share price appreciation over the last two years has not been driven by fundamentals. |

| · | DuPont’s stock price has risen over 40% since the date of Trian’s initial investment47,

yet DuPont’s 2014 EPS and its guided 2015 EPS are below 2011 levels.48 |

| · | Since January 1,

2009 (when Ellen Kullman became CEO), DuPont’s two largest one-day stock price increases on a percentage basis relative

to the S&P 500 Index occurred on July 17, 2013, the day it was first reported Trian had invested in DuPont, and on September

17, 2014, the day we publicly released a letter to the DuPont Board outlining proposed strategic and operating initiatives.49 |

| · | DuPont’s stock price has declined an aggregate of $12 on the trading day following all 32 announcements of earnings or

guidance since April 2009.50 |

| · | Other boards seem to recognize that stockholders do not want entrenched directors and poor corporate governance at spin-offs;

recently announced or completed spinoffs (e.g., Time Inc., Gannett’s publishing business, and PayPal) have corporate governance

provisions that are much more shareholder-friendly than those proposed for Chemours.51 |

| 21. | Why is Trian concerned that DuPont is spinning off Chemours to stockholders with a poor corporate governance structure?

Do you think it will have an impact on shareholder value? |

| o | DuPont has announced that Chemours will have a staggered board at least until 2017 (with each director serving a three-year

term).52

Because stockholders will not be allowed to elect directors annually, we believe that this staggered board structure will drastically

limit the ability of stockholders to hold the board accountable. |

| o | Stockholders will not be allowed to amend Chemours’ bylaws and various provisions of its certificate of incorporation

unless 80% of the outstanding shares vote in favor of the amendment. 53

By setting the supermajority threshold so high, DuPont has made it almost impossible for stockholders to amend most provisions

contained in Chemours’ organizational documents. |

| o | DuPont established a 35% threshold for stockholders to call a special meeting (later reduced to 25% in March 2015 after Trian

made note of it), and Chemours’ stockholders will be prohibited from taking action by written consent. 54 |

| o | After the spin-off, Chemours will not be permitted to engage in various business activities relating to fluoropolymers for

a period of five years. In addition, any third party that purchases Chemours during this period will in most cases become subject

to the same restrictions, and hence could be impeded from completing the purchase unless it divests all of its business units (or

those of its affiliates) relating to such activities. 55

We believe this type of provision is inappropriate and has the ability to negatively impact stockholder value. By requiring Chemours

to agree to such a broad non-compete provision, we believe that DuPont may be deterring certain strategic and financial buyers

from acquiring Chemours in a transaction that could otherwise maximize value for Chemours’ stockholders. |

| o | After the spin-off, Chemours will enter into a Transition Services Agreement with DuPont whereby

DuPont will provide certain functional services to Chemours and certain of its subsidiaries for up to 24 months. However, if any

of those subsidiaries undergoes a change of control, DuPont has the right to immediately terminate the Transition Services Agreement

and potentially cut off services that are vital to Chemours. 56

Again, we believe that this type of provision is inappropriate, and it could impede Chemours from entering into certain sale transactions

or divestitures that would be otherwise beneficial to stockholders. |

| 22. | Why is DuPont spinning off Chemours with such a poor corporate governance profile? |

| o | DuPont has provided little explanation in its public filings as to why it believes that the corporate governance provisions

described above are necessary. 57

Trian is concerned that DuPont is employing an “entrenchment” tactic—in our view, DuPont is spinning off Chemours

with a poor governance package, in part, to preserve the status quo and impede certain acquirers from purchasing the business. |

| o | Rather than focusing on maximizing stockholder value, it appears to us that DuPont is more concerned about proving to stockholders

that the “status quo” at Chemours is best. Chemours has appointed two former DuPont directors to its Board, 58

will move in to the old company headquarters in Wilmington and will be burdened by what management believes are the “right”

corporate costs. Moreover, because of Chemours’ poor corporate governance framework, stockholders will have much less ability

to influence the future direction of the business. |

| o | DuPont

recently stated that the “Board prioritizes reviewing emerging best practices in corporate governance…[and] believes

that the proposed governance structure of Chemours...is in the best interest of stockholders,” but in our view, the Board

is ignoring the fact that other boards seem to have recognized that stockholders do not want entrenched directors and poor corporate

governance at spin-offs; recently announced or completed spinoffs (e.g., Time Inc., Gannett’s publishing business,

and PayPal) have corporate governance provisions that are much more shareholder-friendly than those proposed for Chemours.59 |

| 23. | What is the maximum number of boards a DuPont director can serve on? |

| · | DuPont’s policy is that no DuPont director who is also an executive officer of a public company may serve on more than

three public company boards, including the DuPont Board.60 Because

none of the Trian nominees or its alternate nominee is an executive officer of a public company, this policy is not applicable. |

| · | DuPont’s policy is that if a director is not an executive officer of a public company,

he or she may serve on a maximum of four public company boards, including DuPont’s Board. 61

None of Trian’s nominees or its alternate nominee currently serves on the boards of more than three other public companies

and if elected to the DuPont Board would therefore not serve on more than four public company boards, including the DuPont Board. |

| 24. | Was Trian’s request to present its investment thesis to the full Board turned down? If so, why? |

| · | On various occasions,

Trian made it clear that it was interested in meeting with DuPont’s Board of Directors.

For example, in a letter dated November 5, 2013 to Alexander M. Cutler, DuPont’s

Lead Director, Trian and CALSTRS wrote: “[D]espite repeated attempts to engage

in constructive dialogue over the past four months, Trian has had only two meetings with

senior management and/or DuPont’s advisors, and only one which included DuPont’s

Chair and CEO Ellen Kullman. We are disturbed by this lack of interaction. Of all the

investments Trian has made over the years, Trian has never experienced a management team

so reluctant to engage in a dialogue…[B]ased on the lack of interaction with management,

Trian and CalSTRS are now requesting a meeting with you (and perhaps other directors).

As Lead Director, we understand that one of your responsibilities, if requested by major

shareholders, is to ensure that you are available for consultation and direct communication.

With deadlines for shareholder proposals and director nominees fast approaching, time

is of the essence.” On November 15, 2013, Trian and CALSTRS wrote a follow-up letter

to Mr. Cutler concerning an upcoming December 2013 meeting. That letter concluded with

the following statement: “We believe it is healthy to challenge management and

the status quo. We hope that our meeting with you and perhaps other members of the Board

will be a first step in building a constructive and mutually beneficial long-term relationship.”

On December 10, 2013, representatives of Trian, including our Chief Investment Officer

and Principal, Ed Garden, met with Mr. Cutler and Company management. No other independent

members of the DuPont Board attended that meeting. Both of the letters referred to above

are available at: www.DuPontCanBeGreat.com. |

| · | On September

16, 2014, Trian sent its summary White Paper to the entire DuPont Board and described

the lack of open dialogue between the Company’s management and Trian. Trian wrote,

“In order to assist you in discerning rhetoric from reality, we are attaching a

summary of our White Paper… We remain willing to engage in discussions with you

[i.e., the DuPont Board of Directors] at any time.” Trian’s summary White

Paper and letter to the Board are available at: www.DuPontCanBeGreat.com. |

| · | On January 14, 2015, Trian and DuPont communicated about the scheduling of meetings for Trian’s nominees with the four

members of DuPont’s Corporate Governance Committee. As noted on page 24 of Trian’s definitive proxy statement dated

March 25, 2015, Trian expressed disappointment that the Committee did not want to interview one of our Nominees, our CEO and Principal,

Nelson Peltz. Trian advised the Company that Mr. Peltz had never met members of the Committee and Trian believed it was appropriate

for the entire Committee to meet with Mr. Peltz in order to gain additional insight into his qualifications. In late January, each

of the nominees met with the Chair of the Committee and Mr. Cutler. However, the other two members of the Committee never met any

of the nominees, nor did they participate in those Committee meetings by phone or video conference. |

| 25. | One targeted nominee, Lois Juliber, was a Trian appointee at Kraft in 2007. Did she ever get the benefit of the Trian resources

for Kraft board meetings? If so, did she ever make a public statement on the helpfulness/disruptiveness of Trian’s engagement

with Kraft? |

| · | Lois Juliber

was not a Trian appointee or a Trian nominee to the Kraft board. On November 7, 2007, Kraft issued a press release that stated

that Kraft had named two new directors, including Ms. Juliber, “who have been selected by the company and supported for

nomination by Trian.” Trian never received any Kraft board materials as result of Ms. Juliber joining the Kraft board. In

January 2014, Mr. Peltz joined the Mondelēz board, of which Ms. Juliber is a member. When Mr. Peltz joined the Mondelēz board, Trian signed a |

| | | confidentiality agreement and representatives of Trian have been afforded access to

materials provided by Mondelēz to Mr. Peltz. Irene Rosenfeld, Chairman and CEO of

Mondelēz, has said: “Since joining our board in January 2014, Nelson has been

a constructive participant in our board processes. His knowledge and experience in the

food industry has added good value to our discussions.” (See www.DuPontCanBeGreat.com.)

We are unaware of any public statement by Ms. Juliber about Mr. Peltz’s involvement

on the Mondelēz board or our engagement with Kraft. |

End Notes

1 See Appendix

A below.

2 See Appendix

B below.

3 Source: Bloomberg

as of 4/23/15.

4

For additional information, please refer to pages 85 and 86 of the Trian Discussion Points, which were filed with the SEC on April

21, 2015 and are available at www.DuPontCanBeGreat.com.

5 Source: SEC

filings. All calculations represent 2008-2014 dividend growth. Calculated based on dividends declared in a given calendar year.

“Proxy peers” refer to the proxy peers disclosed in DuPont’s proxy statement. “Diversified chemical and

industrial peers” refers to the set of companies which Trian believes is more comparable to DuPont and includes FMC, Eastman,

Danaher, BASF, Dover, Eaton, Emerson Electric, United Technologies, Honeywell, Dow, 3M, Ingersoll-Rand, General Electric, Huntsman,

and Celanese.

6

For additional information, please refer to page 9 of the Trian Discussion Points, which were filed with the SEC on April 21,

2015 and are available at www.DuPontCanBeGreat.com. Also see “Trian Implied Target Value for DuPont Stock,”

which was filed with the SEC on April 17, 2015.

7 DuPont letter

to shareholders, which was filed with the SEC on March 23, 2015.

8 Source: Nomura

Securities 12/22/14.

9 Source: Bloomberg

as of 4/23/15.

10 Source:

“Berkshire Hathaway to Buy 8.7% Stake in Axalta Coating From Carlyle”, By Ryan Dezember and Chelsey Dulaney, Wall Street

Journal as of 4/7/15.

11 Source:

DuPont 2013 Form 10-K and Bloomberg as of 4/23/15.

12 “In

Making Its Case, Trian Attacks Two Big DuPont Deals”, by David Benoit, Wall Street Journal as of 9/17/14.

13

Source: DuPont 2013 Form 10-K and “The Carlyle Group Completes Acquisition of DuPont Performance Coatings”, February

3, 2013, http://www.carlyle.com/news-room/news-release-archive/carlyle-group-completes-acquisition-dupont-performance-coatings.

14 Source:

2013 Guidance/Update Call transcript, December 11, 2012.

15 Trian calculates

that the sale of Performance Coatings would have resulted in $0.27/share less dilution if DuPont had used the additional $3bn in

sale proceeds to repurchase stock at the average 2012 share price.

16 Source:

Trian estimates based on DuPont’s 2006 Data Book.

17

For additional information, please refer to pages 19 and 20 of the Trian Discussion Points, which were filed with the SEC on April

21, 2015 and are available at www.DuPontCanBeGreat.com.

18 Source:

DuPont’s 2014 Data Book.

19 Source:

DuPont 2014 Form 10-K and DuPont Bank of America Merrill Lynch Global Agriculture Conference 2015 transcript, February 26, 2015.

20

For additional information, please refer to page 19 of the Trian Discussion Points, which were filed with the SEC on April 21,

2015 and are available at www.DuPontCanBeGreat.com.

21 Source:

12/3/13 Citi Basic Materials conference transcript.

22

For additional information, please refer to page 20 of the Trian Discussion Points, which were filed with the SEC on April 21,

2015 and are available www.DuPontCanBeGreat.com.

23

Source: “DuPont Issues Letter to Shareholders”, 2/17/15, http://investors.dupont.com/investor-relations/investor-news/investor-news-details/2015/DuPont-Issues-Letter-to-Shareholders/default.aspx.

24 Source:

DuPont SEC filings, Bloomberg and Nomura research model (December 26, 2014). Estimates revenue and EBITDA for DuPont’s ethylene

cracker assuming 95% nameplate utilization for both 2008 and 2014.

25 Company

SEC filings and transcripts, Danisco annual and quarterly financial reports and transcripts. Makes pro forma adjustments to Danisco’s

EBITDA for CY 2010 for DuPont’s claimed synergies of $130 million. DuPont’s 2008 EBITDA is adjusted for significant

items (as described in its SEC filings) and DuPont’s non-operating pension & other post-employment benefits (OPEB) expenses.

26 Source:

Axalta Form S-1 filed on 8/20/14, Trian estimates, and SEC filings. Compares 2011 EBITDA margin reported by DuPont and 2014 EBITDA

margin reported by Axalta. DuPont EBITDA adjusted for unallocated corporate expense (2% of sales), and adds back non-cash items

and certain pension expense to make it comparable to Axalta figures. Axalta EBITDA is Axalta’s Adjusted Operating Income

plus D&A. This figure differs slightly from Axalta’s Adjusted EBITDA (as reported) as it excludes other expense (income)

and dividend to non-controlling interest to make it comparable to DuPont figures.

27

For additional information, please refer to page 25 of the Trian Discussion Points, which were filed with the SEC on April 21,

2015 and are available at www.DuPontCanBeGreat.com.

28

For more information on how Trian calculates 2011 EPS (and DuPont’s nine different “versions” of 2011 EPS),

please see pages 5 and 7 of our presentation entitled, “Shining a Light on DuPont’s Rhetoric,” filed with the

SEC on March 12, 2015 and available at www.DuPontCanBeGreat.com.

29 Source:

DuPont 2013 Form 10-K.

30 Source:

2013 guidance/update call transcript, December 11, 2012 and Company 2014 Form 10-K.

31 Source:

DuPont Q4 2014 earnings call transcript and press release dated January 27, 2015, DuPont Q4 2013 earnings call transcript and press

release dated January 28, 2014, DuPont Q4 2012 earnings call transcript and press release dated January 22, 2013 and Trian calculations.

Removes the impact of exchange gains/losses from currency headwinds quoted in the transcript as it is unclear whether these gains/losses

are one-time in nature.

32

For additional information, please refer to page 15 of the Trian Discussion Points, which were filed with the SEC on April 21,

2015 and are available at www.DuPontCanBeGreat.com. “Diversified chemical and industrial peers” refers to the

set of companies which Trian believes is more comparable to DuPont and includes FMC, Eastman, Danaher, BASF, Dover, Eaton, Emerson

Electric, United Technologies, Honeywell, Dow, 3M, Ingersoll-Rand, General Electric, Huntsman, and Celanese.

33 Source:

DuPont’s 2012, 2013 and 2014 Form 10-Ks.

34

For additional information, please refer to page 14 of the Trian Discussion Points, which were filed with the SEC on April 21,

2015 and are available at www.DuPontCanBeGreat.com.

35 Source:

DuPont SEC filings, earnings transcripts. 2011 EPS (after adjusting for changes in reporting methodology that DuPont applied to

subsequent EPS figures) was $4.32. Operating EPS in 2012, 2013, and 2014 was $3.77, $3.88, and $4.01, respectively. As per April

21, 2015 earning conference call, Operating EPS expected “to be at the low end of [DuPont’s] previously communicated

range of $4.00 to $4.20.”

36 Source:

DuPont’s 2011 and 2013 Investor Day transcripts dated December 13, 2011 and May 2, 2013, respectively.

37

For additional information, please refer to pages 8 and 44-59 of the Trian Discussion Points, which were filed with the SEC on

April 21, 2015 and are available at www.DuPontCanBeGreat.com.

38 See Appendix

A below.

39 See Appendix

B below.

40

For additional information, please refer to pages 34-37 of the Trian Discussion Points, which were filed with the SEC on April

21, 2015 and are available at www.DuPontCanBeGreat.com.

41 Source:

Company SEC filings, transcripts and press releases. Represents announcement of Fresh Start Initiative in which $1.3bn cost saving

plan includes $375m of costs transferred to Performance Chemicals (according to Q4 2014 earnings call). Please refer to page 74

of Trian’s White Paper, which was filed with the SEC on February 17, 2015 for further details.

42

For additional information, please refer to pages 19 and 20 of the Trian Discussion Points, which were filed with the SEC on April

21, 2015 and are available at www.DuPontCanBeGreat.com.

43 See Appendices

A and B below.

44 Source:

DuPont SEC filings, earnings transcripts. 2011 EPS (after adjusting for changes in reporting methodology that DuPont applied to

subsequent EPS figures) was $4.32. Operating EPS in 2012, 2013, and 2014 was $3.77, $3.88, and $4.01, respectively. As per April

21, 2015 earning conference call, Operating EPS expected “to be at the low end of [DuPont’s] previously communicated

range of $4.00 to $4.20.”

45

Source: “Ratings Action: Moody’s Assigns Chemours Ba3 Corporate Family Rating” 4/24/15

https://www.moodys.com/research/Moodys-Assigns-Chemours-Ba3-Corporate-Family-Rating--

PR_323305?WT.mc_id=AM~RmluYW56ZW4ubmV0X1JTQl9SYXRpbmdzX05ld3NfTm9fVHJhbnNsYXRpb25z~20150424_PR_323305.

46

Source: SEC filings and The Open Letter to the DuPont Board (Trian Summary White Paper) dated September 16, 2014, which was filed

with the SEC on January 9, 2015 and is available at www.DuPontCanBeGreat.com. Page 22 of Trian’s Summary White Paper

proposes a Net Debt/EBITDA ratio of approximately 2x for Chemours. Chemours’ Form 10 that was filed with the SEC on April

21, 2015 indicates a post-spin Net Debt / EBITDA of approximately 4x at Chemours. Both leverage ratios exclude unfunded pension

liabilities.

47 Source:

Bloomberg as of 4/23/15.

48 Source:

DuPont SEC filings, earnings transcripts. 2011 EPS (after adjusting for changes in reporting methodology that DuPont applied to

subsequent EPS figures) was $4.32. Operating EPS in 2012, 2013, and 2014 was $3.77, $3.88, and $4.01, respectively. As

per April

21, 2015 earning conference call, Operating EPS expected “to be at the low end of [DuPont’s] previously communicated

range of $4.00 to $4.20.”

49

For additional information, please refer to page 61 of the Trian Discussion Points, which were filed with the SEC on April 21,

2015 and are available at www.DuPontCanBeGreat.com.

50

For additional information, please refer to pages 62 and 63 of the Trian Discussion Points, which were filed with the SEC on April

21, 2015 and are available at www.DuPontCanBeGreat.com. These pages detail a $10 share decline on the trading day following

all earnings events from January 2009 through January 2015, excluding the Q4 2008 announcement as the CEO did not oversee that

period. In addition to the events detailed on these pages, the DuPont share price declined by $2.15 on April 21, 2015 (the trading

day following the release of DuPont’s Q1 2015 earnings), thereby making the total share price decline equal to more than

$12 on the trading day following each of the 32 identified earnings events.

51 Source:

Company SEC filings.

52 Source:

DuPont SEC filings. On March 30, 2015, in response to requests for improvements of Chemours’ corporate governance by Trian

and following a stockholder lawsuit, DuPont announced that Chemours’ classified board structure will be put to a stockholder

vote at Chemours’ first annual meeting in 2016. However, even if stockholders vote to remove Chemours’ classified board,

it will remain in place until at least 2017.

53 Source:

Second Amendment to the Chemours Form 10 that was filed with the SEC on April 21, 2015.

54 Source:

Supplement to DuPont’s Proxy Statement dated April 23, 2015 and the Second Amendment to the Chemours Form 10 that was filed

with the SEC on April 21, 2015.

55 Source:

Section 5.4 of the Separation Agreement between DuPont and Chemours, attached as Exhibit 2.1 to the Second Amendment to the Chemours

Form 10 that was filed with the SEC on April 21, 2015.

56 Source:

Section 5.03 of the First Amended and Restated Transition Services Agreement between DuPont and Chemours, attached as Exhibit 10.1

to the Second Amendment to the Chemours Form 10 that was filed with the SEC on April 21, 2015.

57 For example,

the Supplement to DuPont’s Proxy Statement dated April 23, 2015 simply states that “[f]ollowing its careful evaluation...your

Board believes that the proposed governance structure of Chemours, reflecting the changes described herein, is in the best interest

of its stockholders.”

58 Source:

Company SEC filings.

59 Source:

SEC filings, press releases.

60 Source:

DuPont Board of Directors Corporate Governance Guidelines dated December 2014.

61 Source:

DuPont Board of Directors Corporate Governance Guidelines dated December 2014.

Appendix A:

| Annual

Adjusted EPS(1) Growth for Core and Other Trian Investments(2) |

| Time Period: From the Date of Trian’s First Purchase Through the Present (or last day of trading on exchange) |

| Compared

to Prior 5-Year Period |

|

Source: Company filings, Bloomberg.

| (1) | Adjusted earnings per share (“EPS”) is defined as net income excluding specifically

identified items divided by the weighted average number of diluted shares outstanding during the fiscal year. Trian believes that

using EPS on an adjusted basis for this analysis provides a more accurate representation of a company’s operating performance

across time periods. Adjustments to net income include, but are not limited to, certain non-cash items (e.g., impairments, intangibles

amortization, non-cash interest), non-recurring items (e.g., one-time gains and/or losses, restructuring costs, extraordinary items)

and non-operational items (e.g., acquisition costs, legal settlements, hedges). |

| (2) | “Core and Other Trian Investments” refers to the same population of Trian investments

used for the Total Shareholder Return (TSR) analysis described on Appendix B of this presentation. Please refer to the summary

chart on Appendix B for the names of the “Core Trian Investments” and “Other Trian Investments” used in

the TSR analysis and the criteria used to select such investments. Such investments do not represent all of the investments purchased

or sold for Trian’s clients. |

| (3) | The Annual Adjusted EPS Growth during the “Prior 5-Year Period” represents the compound

annual growth rate (“CAGR”) calculated using the company’s Adjusted EPS on the “pre-investment date”

versus the Adjusted EPS five years prior to such date. For purposes of this analysis, the “pre-investment date” for

each Trian portfolio company was established as the portfolio company’s (forward or backward-looking) fiscal year-end that

was closest to Trian’s initial investment date. |

| (4) | The Annual Adjusted EPS Growth during the Time Period represents the CAGR calculated using the

company’s Adjusted EPS on the “pre-investment date” versus the Adjusted EPS through either calendar year 2014

or the last full fiscal year prior to the last day of public trading of the company’s stock. |

Note: While Trian may believe that earnings per share growth during

the Time Period is attributable in large part to the cumulative effects of the implementation of operational and strategic initiatives

during the period of Trian’s active involvement and beyond, there is no objective method to confirm what portion of such

growth was attributable to Trian’s efforts and what may have been attributable to other factors. The EPS Growth figures on

this page should not be construed as an indication of the performance of the funds managed by Trian and it should not be assumed

that any or all of the investments included in this analysis were or will be profitable in any of the funds managed by Trian. Past

performance is not an indication of future results.

Appendix B:

| | |

| |

| | |

| | |

Cumulative | |

| |

| | |

| |

| | |

| | |

Total Shareholder | |

Annual Bps of |

| | |

| |

Highest % of Total | |

Time | |

Return (TSR) (3) | |

Outperformance |

| | |

| |

Company Owned | |

Horizon | |

Over Time Horizon |

| Over Time Horizon |

| | |

Company | |

by Trian (1) | |

(Years) (2) | |

Stock | |

S&P 500 (4) | |

vs. S&P 500 |

Core Trian

Investments (5) | |

*Wendy’s / Tim Hortons | |

| 20.3 | % | |

| 9.4 | | |

| 314 | % | |

| 110 | % | |

| 805 | bps |

| |

Cadbury / Dr Pepper Snapple | |

| 4.4 | % | |

| 8.3 | | |

| 261 | % | |

| 78 | % | |

| 944 | |

| |

Tiffany & Co. | |

| 8.7 | % | |

| 8.2 | | |

| 147 | % | |

| 76 | % | |

| 448 | |

| |

*Mondelez / Kraft Foods | |

| 3.1 | % | |

| 8.0 | | |

| 167 | % | |

| 74 | % | |

| 590 | |

| |

*H.J. Heinz | |

| 4.3 | % | |

| 7.3 | | |

| 177 | % | |

| 53 | % | |

| 890 | |

| |

*Legg Mason | |

| 11.4 | % | |

| 6.2 | | |

| 227 | % | |

| 175 | % | |

| 333 | |

| |

Family Dollar | |

| 8.5 | % | |

| 5.3 | | |

| 183 | % | |

| 105 | % | |

| 720 | |

| |

Domino’s Pizza | |

| 9.9 | % | |

| 4.0 | | |

| 518 | % | |

| 72 | % | |

| 4,275 | |

| |

State Street | |

| 3.3 | % | |

| 4.1 | | |

| 90 | % | |

| 77 | % | |

| 201 | |

| |

*Ingersoll-Rand / Allegion | |

| 7.1 | % | |

| 3.2 | | |

| 154 | % | |

| 70 | % | |

| 1,575 | |

| |

Lazard | |

| 6.0 | % | |

| 3.2 | | |

| 128 | % | |

| 68 | % | |

| 1,194 | |

| |

InterContinental Hotels Group | |

| 4.0 | % | |

| 3.1 | | |

| 107 | % | |

| 65 | % | |

| 880 | |

| |

PepsiCo | |

| 1.3 | % | |

| 2.5 | | |

| 50 | % | |

| 57 | % | |

| (211 | ) |

| |

Danone | |

| 1.0 | % | |

| 2.5 | | |

| 51 | % | |

| 57 | % | |

| (185 | ) |

| |

DuPont | |

| 2.7 | % | |

| 2.1 | | |

| 54 | % | |

| 42 | % | |

| 485 | |

| |

The Bank of New York Mellon | |

| 2.7 | % | |

| 1.1 | | |

| 33 | % | |

| 17 | % | |

| 1,393 | |

Other Trian

Investments

(at or above

4.2%) (6) | |

Cracker Barrel Old Country Store | |

| 4.9 | % | |

| 9.5 | | |

| 410 | % | |

| 112 | % | |

| 1,054 | |

| |

Cheesecake Factory | |

| 14.0 | % | |

| 7.5 | | |

| 124 | % | |

| 64 | % | |

| 459 | |

| |

Chemtura | |

| 4.3 | % | |

| 4.0 | | |

| (96 | %) | |

| (7 | %) | |

| (5,320 | ) |

| |

Peet’s Coffee & Tea | |

| 4.8 | % | |

| 1.8 | | |

| 81 | % | |

| 15 | % | |

| 3,008 | |

| Average Outperformance |

| 677 | bps |

| Average Outperformance for Companies on which Nelson Peltz

Serves or has Served on the Board |

| 839 | bps |

Notes

*Denotes a board on which Nelson Peltz serves or has served

| (1) | Represents the highest percentage of the company’s outstanding shares held across all of Trian’s

equity investment vehicles at any point during the life of the investment. |

| (2) | Time horizon is defined as from the date of Trian’s first purchase through the earlier of

4/16/2015 or last day of public trading. |

| (3) | The TSR figures in the column titled “Stock” reflect the change in the stock price

of each company referenced plus the effect of dividends received over the relevant time period. The TSR figures in the Stock column

should not be construed as an indication of the performance of the funds managed by Trian and it should not be assumed that any

or all of these investments were or will be profitable in any of the funds managed by Trian. |

| (4) | We highlight the S&P 500 Index (the “Index”) here only as widely recognized index,

however, for various reasons the performance of the Index and that of the individual companies included in this chart may not be

comparable. Reference to the S&P 500 used in this chart shall mean the S&P 500 Total Return Index, which includes the price

changes of all underlying stocks and all dividends reinvested. S&P data is obtained from Bloomberg using the SPX ticker with

the inclusion of dividend re-investment. |

| (5) | This category includes all of the investments made by Trian since Trian’s inception in November

2005 (through March 2015): (i) for which Trian has filed a Schedule 13D or 13G or made a similar non-U.S. filing or other notification

with respect to its investment in the company or (ii) that were or are a publicly disclosed activist position in which funds managed

by Trian invested at least $700 million of capital (the representative size of Trian’s current activist investments) and

where Trian (x) had a designee or nominee on the Board and/or (y) wrote a white paper” and met with management. The companies

shown on this page do not represent all of the investments purchased or sold for Trian’s clients. |

| (6) | This category includes all other investments made by Trian since Trian’s inception in November

2005 (through March 2015) in which funds managed by Trian held 4.2% or more of the company’s outstanding shares, the percentage

that Trian held in chemical company Chemtura. |

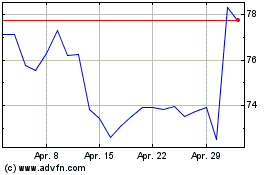

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024