DigitalBridge Completes DataBank Recapitalization

14 September 2023 - 3:00PM

Business Wire

Achieves Key 2023 Objective with Successful

Deconsolidation of DataBank

DigitalBridge Group, Inc. (NYSE: DBRG) (“DigitalBridge” or the

“Company”) today announced it has completed the previously

announced recapitalization of its portfolio company DataBank, a

leading nationwide edge data center platform. DigitalBridge

received $219 million in additional commitments in the final

closing, bringing total recapitalization commitments to $2.2

billion. The completion of the recapitalization will result in a

deconsolidation of DataBank from DigitalBridge’s consolidated

financial statements.

Marc Ganzi, CEO of DigitalBridge, said, “The successful

recapitalization and deconsolidation of DataBank – one of our key

2023 priorities – will further simplify our business profile and

result in administrative savings. We are also pleased that

DigitalBridge shareholders, alongside new investors Swiss Life

Asset Management, EDF Invest, and IMCO, will maintain significant

exposure to the next phase of growth and value creation at

DataBank, driven by strong AI-led demand for more data center power

and capacity.”

In connection with the completion of the recapitalization,

DigitalBridge will receive gross cash proceeds of $50 million,

bringing its total gross cash proceeds to $479 million inclusive of

prior closings, and its ownership in DataBank will be reduced to

9.87%. The pricing of the recapitalization, which has remained

constant throughout the recap process, implies a pre-transaction

net equity value of $905 million for DigitalBridge’s ownership,

reflecting a 2.0x multiple of invested capital (MOIC) since

DigitalBridge’s initial balance sheet investment in December 2019.

DigitalBridge plans to continue to hold its 9.87% stake in

DataBank, with a remaining fair market value of $434 million.

DataBank is the largest edge infrastructure operator in the

U.S., enabling the world’s largest enterprises, technology and

content providers to consistently deploy and manage their

mission-critical applications and data across a nationwide

platform. DataBank’s portfolio consists of more than 65 data

centers, 20 interconnection hubs in more than 27 markets, on-ramps

to an ecosystem of cloud providers, and a modular edge data center

platform.

About DigitalBridge

DigitalBridge (NYSE: DBRG) is a leading global alternative asset

manager dedicated to investing in digital infrastructure. With a

heritage of over 25 years investing in and operating businesses

across the digital ecosystem including cell towers, data centers,

fiber, small cells and edge infrastructure, the DigitalBridge team

manages over $70 billion of digital infrastructure assets on behalf

of its limited partners and shareholders. Headquartered in Boca

Raton, Florida, DigitalBridge has key offices in New York, Los

Angeles, London, Luxembourg and Singapore. For more information,

visit: www.digitalbridge.com.

Cautionary Statement Regarding Forward-Looking

Statements

This press release may contain forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements relate to expectations, beliefs, projections, future

plans and strategies, anticipated events or trends and similar

expressions concerning matters that are not historical facts. In

some cases, you can identify forward-looking statements by the use

of forward-looking terminology such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” or “potential” or the negative of these

words and phrases or similar words or phrases which are predictions

of or indicate future events or trends and which do not relate

solely to historical matters. Forward-looking statements involve

known and unknown risks, uncertainties, assumptions and

contingencies, many of which are beyond our control, and may cause

actual results to differ significantly from those expressed in any

forward-looking statement. Factors that might cause such a

difference include the impact of AI on demand for more data center

power and capacity, the accounting impact of the recapitalization

and other risks and uncertainties, including those detailed in

DigitalBridge’s Annual Report on Form 10-K for the year ended

December 31, 2022, Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2023 and June 30, 2023, and its other reports filed

from time to time with the U.S. Securities and Exchange Commission.

All forward-looking statements reflect DigitalBridge’s good faith

beliefs, assumptions and expectations, but they are not guarantees

of future performance. DigitalBridge cautions investors not to

unduly rely on any forward-looking statements. The forward-looking

statements speak only as of the date of this press release.

DigitalBridge is under no duty to update any of these

forward-looking statements after the date of this press release,

nor to conform prior statements to actual results or revised

expectations, and DigitalBridge does not intend to do so.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230914910481/en/

Investors: Severin White Managing Director, Head of Public

Investor Relations (212) 547-2777

severin.white@digitalbridge.com

Media: Joele Frank, Wilkinson Brimmer Katcher Jon Keehner /

Sarah Salky (212) 355-4449 dbrg-jf@joelefrank.com

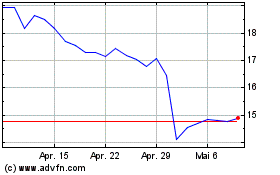

DigitalBridge (NYSE:DBRG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

DigitalBridge (NYSE:DBRG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024