Camping World Holdings, Inc. (NYSE: CWH) (the “Company” or

“CWH”), America’s Recreation Dealer, today reported results for the

second quarter ended June 30, 2024.

Marcus Lemonis, Chairman and Chief Executive Officer of Camping

World Holdings, Inc. stated, “Our record new unit market share was

a direct result of listening to the consumer and their mandate for

affordability. We saw year-over-year same store new vehicle unit

growth accelerate into the mid-teens in June and into the

low-twenties in July, positioning our Company for a strong

2025.”

Matt Wagner, President of Camping World Holdings, Inc.

commented, “As we prepare for an improved 2025, our unwavering

philosophy is to remain disciplined around used aging and stocking

levels, regardless of the macro environment. Over the last 30 days,

we have begun to thoughtfully ramp up our used stocking levels,

with year-over-year increases for the first time in over 10 months

and a record volume of consignments. We have proceeded judiciously

on mitigating used inventory risk which will keep pressure on used

vehicle margins and volume in the second half.”

Mr. Lemonis concluded, “We are unbelievably encouraged by our

new vehicle performance over the last several months, but

especially the last 60 days. However, we are not naive about the

macroeconomic environment around us, and we are taking a more

aggressive position around our cost structure and the optimization

of underperforming locations.”

Second Quarter-over-Quarter Operating Highlights

- The total number of our store locations was 215 as of June 30,

2024, a net increase of 12 store locations from June 30, 2023, or

5.9%.

- Revenue was $1.8 billion for the second quarter, a decrease of

$94.2 million, or 5.0%.

- New vehicle revenue was $847.1 million for the second quarter,

an increase of $46.2 million, or 5.8%, and new vehicle unit sales

were 22,084 units, an increase of 3,187 units, or 16.9%. Used

vehicle revenue was $480.8 million for the second quarter, a

decrease of $142.2 million, or 22.8%, and used vehicle unit sales

were 15,700 units, a decrease of 2,074 units, or 11.7%. Combined

new and used vehicle units sales were 37,784, an increase of 1,113

units, or 3.0%.

- Average selling price of new vehicles declined 9.5% during the

second quarter driven primarily by lower cost of 2024 model year

travel trailers and discounting of pre-2024 model year new

vehicles.

- Average selling price of used vehicles declined 12.6% during

the second quarter due to discounting of used vehicles in response

to declines in new vehicle prices to maintain used vehicles as a

lower cost alternative to new vehicles.

- Same store new vehicle unit sales increased 9.7% for the second

quarter and same store used vehicle unit sales decreased

17.0%.

- Products, services and other revenue was $235.9 million, a

decline of $11.8 million, or 4.8%, driven largely by a reduction in

sales activity resulting from our Active Sports Restructuring and

fewer used vehicles sold led to a decline in retail product

attachment to vehicle sales, partially offset by increases in RV

service revenue.

- Gross profit was $547.7 million, a decrease of $23.4 million,

or 4.1%, and total gross margin was 30.3%, an increase of 27 basis

points. The gross profit decline was mainly due to the 5.0%

decrease in revenue discussed above, which was partially offset by

the increase in gross margin. The gross margin increase included a

543 basis point improvement in products, service and other gross

margin, from higher labor billing rates on warranty service, the

sale of our RV furniture business, improvements to the pricing for

aftermarket accessories, and prior year incremental inventory

reserve charges of $2.6 million relating to the Active Sports

Restructuring that were not recurring in 2024. This gross margin

increase was partially offset by a 392 basis point decrease in used

vehicles gross margin, which was driven by the decrease in average

selling price of used vehicles that was partially offset by a

decrease in the average cost of used vehicles sold.

- Selling, general and administrative expenses (“SG&A”) were

$419.7 million, a decrease of $1.2 million, or 0.3%. SG&A

Excluding Equity-based Compensation(1) was relatively unchanged at

$414.4 million, a decrease of $0.2 million, or 0.1%, which was

driven by $6.7 million reduced employee compensation costs and $5.8

million of reduced professional fees and services, which was

partially offset by $11.8 million of additional advertising

expenses.

- Floor plan interest expense was $27.8 million, an increase of

$7.1 million, or 34.5%, and other interest expense, net was $36.2

million, an increase of $2.6 million, or 7.9%. These increases were

primarily as a result of the rise in interest rates and higher

principal balances.

- Net income was $23.4 million for the second quarter of 2024, a

decrease of $41.3 million, or 63.8%.

- Diluted earnings per share of Class A common stock was $0.22

for the second quarter of 2024 versus diluted earnings per share of

Class A common stock of $0.64 for the second quarter of 2023.

Adjusted earnings per share - diluted(1) of Class A common stock

was $0.38 for the second quarter of 2024 versus adjusted earnings

per share – diluted(1) of Class A common stock of $0.73 for the

second quarter of 2023.

- Adjusted EBITDA(1) was $105.6 million, a decrease of $33.7

million, or 24.2%, primarily due to $23.4 million decrease in gross

profit, and the $7.1 million increase in floor plan interest.

(1)

Adjusted earnings per share – diluted,

Adjusted EBITDA, and SG&A Excluding Equity-based Compensation

are non-GAAP measures. For a reconciliation of these non-GAAP

measures to the most directly comparable GAAP measures, see the

“Non-GAAP Financial Measures” section later in this press

release.

Earnings Conference Call and Webcast Information

A conference call to discuss the Company’s second quarter 2024

financial results is scheduled for August 1, 2024, at 7:30 am

Central Time. Investors and analysts can participate on the

conference call by dialing 1-844-826-3035 (international callers

please dial 1-412-317-5195) and using conference ID# 10190122.

Interested parties can also listen to a live webcast or replay of

the conference call by logging on to the Investor Relations section

on the Company’s website at http://investor.campingworld.com. The

replay of the conference call webcast will be available on the

investor relations website for approximately 90 days.

Presentation

This press release presents historical results for the periods

presented for the Company and its subsidiaries, which are presented

in accordance with accounting principles generally accepted in the

United States (“GAAP”), unless noted as a non-GAAP financial

measure. The Company’s initial public offering (“IPO”) and related

reorganization transactions (“Reorganization Transactions”) that

occurred on October 6, 2016 resulted in the Company as the sole

managing member of CWGS Enterprises, LLC (“CWGS, LLC”), with sole

voting power in and control of the management of CWGS, LLC. The

Company’s position as sole managing member of CWGS, LLC includes

periods where the Company has held a minority economic interest in

CWGS, LLC. As of June 30, 2024, the Company owned 53.0% of CWGS,

LLC. Accordingly, the Company consolidates the financial results of

CWGS, LLC and reports a non-controlling interest in its

consolidated financial statements. Unless otherwise indicated, all

financial comparisons in this press release compare our financial

results for the second quarter ended June 30, 2024 to our financial

results from the second quarter ended June 30, 2023.

About Camping World Holdings, Inc.

Camping World Holdings, Inc., headquartered in Lincolnshire, IL,

(together with its subsidiaries) is the world’s largest retailer of

RVs and related products and services. Our vision is to build a

long-term legacy business that makes RVing fun and easy. Our

Camping World and Good Sam brands have been serving RV consumers

since 1966. We strive to build long-term value for our customers,

employees, and shareholders by combining a unique and comprehensive

assortment of RV products and services with a national network of

RV dealerships, service centers and customer support centers along

with the industry’s most extensive online presence and a highly

trained and knowledgeable team of employees serving our customers,

the RV lifestyle, and the communities in which we operate. We also

believe that our Good Sam organization and family of programs and

services uniquely enable us to connect with our customers as

stewards of the RV enthusiast community and the RV lifestyle. With

RV sales and service locations in 43 states, Camping World has

grown to become the prime destination for everything RV. For more

information, visit www.CampingWorld.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including, without limitation,

statements about our intention with regards to used aging and

stocking levels, our cost management actions, our investments, our

expectations regarding improvements in our business, macroeconomic

and industry trends, business plans and goals, and future financial

results and position, including vehicle margins and volume, in each

case on any specific timeline or at all. These forward-looking

statements are based on management’s current expectations.

These statements are neither promises nor guarantees, but

involve known and unknown risks, uncertainties and other important

factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to, the

following: general economic conditions, including inflation and

interest rates; the availability of financing to us and our

customers; fuel shortages, high prices for fuel or changes in

energy sources; the success of our manufacturers; changes in

consumer preferences; risks related to our strategic review of our

Good Sam business; competition in our industry; risks related to

acquisitions, new store openings and expansion into new markets;

our failure to maintain the strength and value of our brands; our

ability to manage our inventory; fluctuations in our same store

sales; the cyclical and seasonal nature of our business; our

dependence on the availability of adequate capital and risks

related to our debt; risks related to COVID-19; our ability to

execute and achieve the expected benefits of our cost cutting or

restructuring initiatives; our reliance on our fulfillment and

distribution centers; natural disasters, including epidemic

outbreaks; our dependence on our relationships with third party

suppliers and lending institutions; risks associated with selling

goods manufactured abroad; our ability to retain senior executives

and attract and retain other qualified employees; risks associated

with leasing substantial amounts of space; risks associated with

our private brand offerings; we may incur asset impairment charges

for goodwill, intangible assets or other long-lived assets; tax

risks; our private brand offerings exposing us to various risks;

regulatory risks; data privacy and cybersecurity risks; risks

related to our intellectual property; the impact of ongoing or

future lawsuits against us and certain of our officers and

directors; risks related to climate change and other environmental,

social and governance matters; and risks related to our

organizational structure.

These and other important factors discussed under the caption

“Risk Factors” in our Annual Report on Form 10‑K for the year ended

December 31, 2023 and our other reports filed with the SEC could

cause actual results to differ materially from those indicated by

the forward-looking statements made in this press release. Any such

forward-looking statements represent management’s estimates as of

the date of this press release. While we may elect to update such

forward-looking statements at some point in the future, we disclaim

any obligation to do so, even if subsequent events cause our views

to change, except as required under applicable law. These

forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

Future declarations of quarterly dividends, if any, are subject

to the determination and discretion of the Company’s Board of

Directors based on its consideration of various factors, including

the Company’s results of operations, financial condition, level of

indebtedness, anticipated capital requirements, contractual

restrictions, restrictions in its debt agreements, restrictions

under applicable law, receipt of excess tax distributions from CWGS

Enterprises, LLC, its business prospects and other factors that the

Company’s Board of Directors may deem relevant.

We intend to use our official Facebook, X (formerly known as

Twitter), and Instagram accounts, each at the handle @CampingWorld,

as well as the investor page of our website,

investor.campingworld.com, as a distribution channel of material

information about the Company and for complying with our disclosure

obligations under Regulation FD. The information we post through

these social media channels and on our investor webpage may be

deemed material. Accordingly, investors should subscribe to these

accounts and our investor alerts, in addition to following our

press releases, SEC filings, public conference calls and webcasts.

These social media channels may be updated from time to time.

Camping World Holdings, Inc. and

Subsidiaries

Consolidated Statements of Operations

(unaudited)

(In Thousands Except Per Share

Amounts)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Revenue:

Good Sam Services and Plans

$

52,548

$

51,038

$

98,229

$

97,405

RV and Outdoor Retail

New vehicles

847,105

800,903

1,503,191

1,447,655

Used vehicles

480,774

622,962

818,459

1,067,708

Products, service and other

235,947

247,760

413,841

455,421

Finance and insurance, net

179,016

166,934

314,470

296,706

Good Sam Club

11,115

11,124

22,332

22,706

Subtotal

1,753,957

1,849,683

3,072,293

3,290,196

Total revenue

1,806,505

1,900,721

3,170,522

3,387,601

Costs applicable to revenue (exclusive of

depreciation and amortization shown separately below):

Good Sam Services and Plans

17,192

17,671

32,375

33,823

RV and Outdoor Retail

New vehicles

717,650

677,376

1,282,689

1,234,918

Used vehicles

389,601

480,419

668,134

822,366

Products, service and other

132,933

153,043

234,608

282,061

Good Sam Club

1,470

1,110

2,660

2,311

Subtotal

1,241,654

1,311,948

2,188,091

2,341,656

Total costs applicable to revenue

1,258,846

1,329,619

2,220,466

2,375,479

Gross profit (exclusive of depreciation

and amortization shown separately below):

Good Sam Services and Plans

35,356

33,367

65,854

63,582

RV and Outdoor Retail

New vehicles

129,455

123,527

220,502

212,737

Used vehicles

91,173

142,543

150,325

245,342

Products, service and other

103,014

94,717

179,233

173,360

Finance and insurance, net

179,016

166,934

314,470

296,706

Good Sam Club

9,645

10,014

19,672

20,395

Subtotal

512,303

537,735

884,202

948,540

Total gross profit

547,659

571,102

950,056

1,012,122

Operating expenses:

Selling, general, and administrative

419,676

420,887

791,149

786,613

Depreciation and amortization

20,032

17,206

39,322

31,843

Long-lived asset impairment

4,584

477

10,411

7,522

Lease termination

40

—

40

—

Loss (gain) on sale or disposal of

assets

7,945

(145

)

9,530

(5,132

)

Total operating expenses

452,277

438,425

850,452

820,846

Income from operations

95,382

132,677

99,604

191,276

Other expense

Floor plan interest expense

(27,799

)

(20,672

)

(55,681

)

(41,482

)

Other interest expense, net

(36,153

)

(33,518

)

(72,247

)

(64,631

)

Other expense, net

(81

)

(183

)

(175

)

(1,683

)

Total other expense

(64,033

)

(54,373

)

(128,103

)

(107,796

)

Income (loss) before income taxes

31,349

78,304

(28,499

)

83,480

Income tax (expense) benefit

(7,935

)

(13,581

)

1,107

(13,854

)

Net income (loss)

23,414

64,723

(27,392

)

69,626

Less: net income (loss) attributable to

non-controlling interests

(13,643

)

(36,020

)

14,856

(37,754

)

Net income (loss) attributable to Camping

World Holdings, Inc.

$

9,771

$

28,703

$

(12,536

)

$

31,872

Earnings (loss) per share of Class A

common stock:

Basic

$

0.22

$

0.65

$

(0.28

)

$

0.72

Diluted

$

0.22

$

0.64

$

(0.28

)

$

0.71

Weighted average shares of Class A common

stock outstanding:

Basic

45,093

44,490

45,070

44,473

Diluted

45,244

44,804

45,070

84,783

Camping World Holdings, Inc. and

Subsidiaries

Supplemental Data (unaudited)

Three Months Ended June

30,

Increase

Percent

2024

2023

(decrease)

Change

Unit

sales

New vehicles

22,084

18,897

3,187

16.9

%

Used vehicles

15,700

17,774

(2,074

)

(11.7

%)

Total

37,784

36,671

1,113

3.0

%

Average selling

price

New vehicles

$

38,358

$

42,383

$

(4,025

)

(9.5

%)

Used vehicles

30,623

35,049

(4,426

)

(12.6

%)

Same store unit

sales(1)

New vehicles

19,824

18,065

1,759

9.7

%

Used vehicles

14,269

17,195

(2,926

)

(17.0

%)

Total

34,093

35,260

(1,167

)

(3.3

%)

Same store

revenue(1) ($ in 000s)

New vehicles

$

761,528

$

767,728

$

(6,200

)

(0.8

%)

Used vehicles

436,111

603,063

(166,952

)

(27.7

%)

Products, service and other

184,785

198,381

(13,596

)

(6.9

%)

Finance and insurance, net

160,923

161,210

(287

)

(0.2

%)

Total

$

1,543,347

$

1,730,382

$

(187,035

)

(10.8

%)

Average gross profit

per unit

New vehicles

$

5,862

$

6,537

$

(675

)

(10.3

%)

Used vehicles

5,807

8,020

(2,213

)

(27.6

%)

Finance and insurance, net per vehicle

unit

4,738

4,552

186

4.1

%

Total vehicle front-end yield(2)

10,577

11,808

(1,231

)

(10.4

%)

Gross

margin

Good Sam Services and Plans

67.3

%

65.4

%

191

bps

New vehicles

15.3

%

15.4

%

(14

)

bps

Used vehicles

19.0

%

22.9

%

(392

)

bps

Products, service and other

43.7

%

38.2

%

543

bps

Finance and insurance, net

100.0

%

100.0

%

unch.

Good Sam Club

86.8

%

90.0

%

(325

)

bps

Subtotal RV and Outdoor Retail

29.2

%

29.1

%

14

bps

Total gross margin

30.3

%

30.0

%

27

bps

Retail

locations

RV dealerships

211

196

15

7.7

%

RV service & retail centers

4

7

(3

)

(42.9

%)

Total

215

203

12

5.9

%

RV and Outdoor

Retail inventories ($ in 000s)

New vehicles

$

1,477,510

$

1,206,493

$

271,017

22.5

%

Used vehicles

349,843

651,396

(301,553

)

(46.3

%)

Products, parts, accessories and misc.

186,758

218,570

(31,812

)

(14.6

%)

Total RV and Outdoor Retail

inventories

$

2,014,111

$

2,076,459

$

(62,348

)

(3.0

%)

Vehicle inventory

per location ($ in 000s)

New vehicle inventory per dealer

location

$

7,002

$

6,156

$

847

13.8

%

Used vehicle inventory per dealer

location

1,658

3,323

(1,665

)

(50.1

%)

Vehicle inventory

turnover(3)

New vehicle inventory turnover

2.0

1.8

0.2

10.8

%

Used vehicle inventory turnover

3.9

3.0

0.9

31.6

%

Other

data

Active Customers(4)

4,762,376

5,218,340

(455,964

)

(8.7

%)

Good Sam Club members (5)

1,880,126

2,036,119

(155,993

)

(7.7

%)

Service bays (6)

2,877

2,720

157

5.8

%

Finance and insurance gross profit as a %

of total vehicle revenue

13.5

%

11.7

%

176

bps

n/a

Same store locations

182

n/a

n/a

n/a

Six Months Ended June

30,

Increase

Percent

2024

2023

(decrease)

Change

Unit

sales

New vehicles

38,966

32,809

6,157

18.8

%

Used vehicles

26,394

30,206

(3,812

)

(12.6

%)

Total

65,360

63,015

2,345

3.7

%

Average selling

price

New vehicles

$

38,577

$

44,124

$

(5,547

)

(12.6

%)

Used vehicles

31,009

35,348

(4,338

)

(12.3

%)

Same store unit

sales(1)

New vehicles

35,447

31,591

3,856

12.2

%

Used vehicles

24,299

29,321

(5,022

)

(17.1

%)

Total

59,746

60,912

(1,166

)

(1.9

%)

Same store

revenue(1) ($ in 000s)

New vehicles

$

1,368,241

$

1,398,018

$

(29,777

)

(2.1

%)

Used vehicles

748,589

1,037,534

(288,945

)

(27.8

%)

Products, service and other

329,200

356,855

(27,655

)

(7.7

%)

Finance and insurance, net

287,914

288,022

(108

)

(0.0

%)

Total

$

2,733,944

$

3,080,429

$

(346,485

)

(11.2

%)

Average gross profit

per unit

New vehicles

$

5,659

$

6,484

$

(825

)

(12.7

%)

Used vehicles

5,695

8,122

(2,427

)

(29.9

%)

Finance and insurance, net per vehicle

unit

4,811

4,708

103

2.2

%

Total vehicle front-end yield(2)

10,485

11,978

(1,493

)

(12.5

%)

Gross

margin

Good Sam Services and Plans

67.0

%

65.3

%

177

bps

New vehicles

14.7

%

14.7

%

(3

)

bps

Used vehicles

18.4

%

23.0

%

(461

)

bps

Products, service and other

43.3

%

38.1

%

524

bps

Finance and insurance, net

100.0

%

100.0

%

unch.

bps

Good Sam Club

88.1

%

89.8

%

(173

)

bps

Subtotal RV and Outdoor Retail

28.8

%

28.8

%

(5

)

bps

Total gross margin

30.0

%

29.9

%

9

bps

Other

data

Finance and insurance gross profit as a %

of total vehicle revenue

13.5

%

11.8

%

175

bps

n/a

Same store locations

182

n/a

n/a

n/a

unch – unchanged

bps – basis points

n/a – not applicable

(1)

Our same store revenue and units

calculations for a given period include only those stores that were

open both at the end of the corresponding period and at the

beginning of the preceding fiscal year.

(2)

Front end yield is calculated as gross

profit from new vehicles, used vehicles and finance and insurance

(net), divided by combined new and used vehicle unit sales.

(3)

Inventory turnover is calculated as

vehicle costs applicable to revenue over the last twelve months

divided by the average quarterly ending vehicle inventory over the

last twelve months.

(4)

An Active Customer is a customer who has

transacted with us in any of the eight most recently completed

fiscal quarters prior to the date of measurement.

(5)

Excludes Good Sam Club members under the

free basic plan, which was introduced in November 2023 and provides

for limited participation in the loyalty point program without

access to the remaining member benefits.

(6)

A service bay is a fully-constructed bay

dedicated to service, installation, and collision offerings.

Camping World Holdings, Inc. and

Subsidiaries

Consolidated Balance Sheets

(unaudited)

(In Thousands Except Per Share

Amounts)

June 30,

December 31,

June 30,

2024

2023

2023

Assets

Current assets:

Cash and cash equivalents

$

23,743

$

39,647

$

54,458

Contracts in transit

165,033

60,229

132,466

Accounts receivable, net

128,938

128,070

119,247

Inventories

2,014,444

2,042,949

2,077,024

Prepaid expenses and other assets

68,220

48,353

56,063

Assets held for sale

8,418

29,864

4,635

Total current assets

2,408,796

2,349,112

2,443,893

Property and equipment, net

856,308

834,426

785,003

Operating lease assets

760,143

740,052

730,460

Deferred tax assets, net

150,105

157,326

141,233

Intangible assets, net

21,354

13,717

15,028

Goodwill

731,015

711,222

655,744

Other assets

34,387

39,829

31,732

Total assets

$

4,962,108

$

4,845,684

$

4,803,093

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable

$

260,390

$

133,516

$

200,516

Accrued liabilities

187,120

149,096

192,639

Deferred revenues

99,045

92,366

96,850

Current portion of operating lease

liabilities

62,795

63,695

61,808

Current portion of finance lease

liabilities

7,335

17,133

5,337

Current portion of Tax Receivable

Agreement liability

12,277

12,943

13,999

Current portion of long-term debt

24,082

22,121

26,766

Notes payable – floor plan, net

1,296,352

1,371,145

1,155,356

Other current liabilities

80,343

68,536

84,552

Liabilities related to assets held for

sale

—

17,288

4,125

Total current liabilities

2,029,739

1,947,839

1,841,948

Operating lease liabilities, net of

current portion

788,613

763,958

753,999

Finance lease liabilities, net of current

portion

134,538

97,751

99,341

Tax Receivable Agreement liability, net of

current portion

137,589

149,866

151,053

Revolving line of credit

31,885

20,885

20,885

Long-term debt, net of current portion

1,513,986

1,498,958

1,521,629

Deferred revenues

66,981

66,780

69,809

Other long-term liabilities

92,140

85,440

86,186

Total liabilities

4,795,471

4,631,477

4,544,850

Commitments and contingencies

Stockholders' equity:

Preferred stock, par value $0.01 per share

– 20,000 shares authorized; none issued and outstanding

—

—

—

Class A common stock, par value $0.01 per

share – 250,000 shares authorized; 49,571, 49,571 and 49,571 shares

issued, respectively; 45,115, 45,020 and 44,525 shares outstanding,

respectively

496

496

496

Class B common stock, par value $0.0001

per share – 75,000 shares authorized; 39,466, 39,466 and 39,466

shares issued, respectively; 39,466, 39,466 and 39,466 shares

outstanding, respectively

4

4

4

Class C common stock, par value $0.0001

per share – 0.001 share authorized, issued and outstanding

—

—

—

Additional paid-in capital

100,076

98,280

115,844

Treasury stock, at cost; 4,456, 4,551, and

5,046 shares, respectively

(156,116

)

(159,440

)

(176,783

)

Retained earnings

161,434

185,244

197,293

Total stockholders' equity attributable to

Camping World Holdings, Inc.

105,894

124,584

136,854

Non-controlling interests

60,743

89,623

121,389

Total stockholders' equity

166,637

214,207

258,243

Total liabilities and stockholders'

equity

$

4,962,108

$

4,845,684

$

4,803,093

Camping World Holdings, Inc. and

Subsidiaries

Summary of Consolidated Statements of

Cash Flows (unaudited)

(In Thousands)

Six Months Ended June

30,

2024

2023

Net cash provided by operating

activities

$

84,341

$

227,964

Investing activities

Purchases of property and equipment

(48,553

)

(53,053

)

Proceeds from sale of property and

equipment

3,583

2,034

Purchases of real property

(1,243

)

(36,981

)

Proceeds from the sale of real

property

31,195

35,603

Purchases of businesses, net of cash

acquired

(62,323

)

(74,414

)

Proceeds from divestiture of business

19,957

—

Purchases of and loans to other

investments

—

(3,444

)

Purchases of intangible assets

(142

)

(1,652

)

Proceeds from sale of intangible

assets

2,595

—

Net cash used in investing activities

(54,931

)

(131,907

)

Financing activities

Proceeds from long-term debt

55,624

59,227

Payments on long-term debt

(57,351

)

(22,776

)

Net payments on notes payable – floor

plan, net

(19,160

)

(131,462

)

Borrowings on revolving line of credit

43,000

—

Payments on revolving line of credit

(32,000

)

—

Payments on finance leases

(3,682

)

(2,847

)

Payments on sale-leaseback arrangement

(97

)

(92

)

Payment of debt issuance costs

(876

)

(858

)

Dividends on Class A common stock

(11,274

)

(55,610

)

Proceeds from exercise of stock

options

51

143

RSU shares withheld for tax

(754

)

(625

)

Distributions to holders of LLC common

units

(18,795

)

(16,830

)

Net cash used in financing activities

(45,314

)

(171,730

)

Decrease in cash and cash equivalents

(15,904

)

(75,673

)

Cash and cash equivalents at beginning of

the period

39,647

130,131

Cash and cash equivalents at end of the

period

$

23,743

$

54,458

Comparison of Certain Trends to Pre-COVID-19 Pandemic

Periods

New vehicle gross margins in the second quarter of 2024 were

relatively similar to second quarter of 2023 and slightly above the

range of gross margins for the pre-COVID-19 pandemic periods

presented in the table below. Additionally, used vehicle gross

margins were negatively impacted in the second quarter of 2024 from

the discounting necessary to maintain used vehicles as a lower cost

alternative for our customers. Beginning primarily in the fourth

quarter of 2023, we adjusted our acceptable procurement cost of

used vehicles to reflect the lower average market price of RVs that

was driven by the lower cost 2024 models.

The following table presents vehicle gross margin and unit sales

mix for the three months ended June 30, 2024 and pre-COVID-19

pandemic periods for the three months ended June 30, 2019, 2018,

2017, and 2016 (unaudited):

Three Months Ended June

30,

2024

2019(1)

2018(1)

2017(1)

2016(1)

Gross margin:

New vehicles

15.3

%

12.5

%

13.6

%

15.1

%

14.9

%

Used vehicles

19.0

%

21.6

%

22.9

%

25.9

%

20.4

%

Unit sales mix:

New vehicles

58.4

%

67.9

%

72.7

%

70.7

%

61.6

%

Used vehicles

41.6

%

32.1

%

27.3

%

29.3

%

38.4

%

(1)

These periods were prior to the COVID-19

pandemic.

Earnings (Loss) Per Share

Basic earnings (loss) per share of Class A common stock is

computed by dividing net income (loss) attributable to Camping

World Holdings, Inc. by the weighted-average number of shares of

Class A common stock outstanding during the period. Diluted

earnings (loss) per share of Class A common stock is computed by

dividing net income (loss) attributable to Camping World Holdings,

Inc. by the weighted-average number of shares of Class A common

stock outstanding adjusted to give effect to potentially dilutive

securities.

The following table sets forth reconciliations of the numerators

and denominators used to compute basic and diluted earnings (loss)

per share of Class A common stock (unaudited):

Three Months Ended June

30,

Six Months Ended June

30,

(In thousands except per share

amounts)

2024

2023

2024

2023

Numerator:

Net income (loss)

$

23,414

$

64,723

$

(27,392

)

$

69,626

Less: net income (loss) attributable to

non-controlling interests

(13,643

)

(36,020

)

14,856

(37,754

)

Net income (loss) attributable to Camping

World Holdings, Inc. — basic

$

9,771

$

28,703

$

(12,536

)

$

31,872

Add: reallocation of net income

attributable to non-controlling interests from the assumed dilutive

effect of stock options and RSUs

19

101

—

—

Add: reallocation of net income

attributable to non-controlling interests from the assumed

redemption of common units of CWGS, LLC for Class A common

stock

—

—

—

28,569

Net income (loss) attributable to Camping

World Holdings, Inc. — diluted

$

9,790

$

28,804

$

(12,536

)

$

60,441

Denominator:

Weighted-average shares of Class A common

stock outstanding — basic

45,093

44,490

45,070

44,473

Dilutive options to purchase Class A

common stock

—

29

—

22

Dilutive restricted stock units

151

285

—

243

Dilutive common units of CWGS, LLC that

are convertible into Class A common stock

—

—

—

40,045

Weighted-average shares of Class A common

stock outstanding — diluted

45,244

44,804

45,070

84,783

Earnings (loss) per share of Class A

common stock — basic

$

0.22

$

0.65

$

(0.28

)

$

0.72

Earnings (loss) per share of Class A

common stock — diluted

$

0.22

$

0.64

$

(0.28

)

$

0.71

Weighted-average anti-dilutive securities

excluded from the computation of diluted earnings (loss) per share

of Class A common stock:

Stock options to purchase Class A common

stock

186

—

188

—

Restricted stock units

1,037

1,099

1,980

1,608

Common units of CWGS, LLC that are

convertible into Class A common stock

40,045

40,045

40,045

—

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with accounting principles

generally accepted in the United States (“GAAP”), we use the

following non-GAAP financial measures: EBITDA; Adjusted EBITDA;

Adjusted EBITDA Margin; trailing twelve-month (“TTM”) Adjusted

EBITDA; Adjusted Net Income (Loss) Attributable to Camping World

Holdings, Inc. – Basic; Adjusted Net Income (Loss) Attributable to

Camping World Holdings, Inc. – Diluted; Adjusted Earnings (Loss)

Per Share – Basic; Adjusted Earnings (Loss) Per Share – Diluted;

and SG&A Excluding Equity-based Compensation (collectively the

"Non-GAAP Financial Measures"). We believe that these Non-GAAP

Financial Measures, when used in conjunction with GAAP financial

measures, provide useful information about operating results,

enhance the overall understanding of past financial performance and

future prospects, and allow for greater transparency with respect

to the key metrics we use in our financial and operational decision

making. Certain of these Non-GAAP Financial Measures are also

frequently used by analysts, investors and other interested parties

to evaluate companies in the Company’s industry and are used by

management to evaluate our operating performance, to evaluate the

effectiveness of strategic initiatives and for planning purposes.

By providing these Non-GAAP Financial Measures, together with

reconciliations, we believe we are enhancing investors’

understanding of our business and our results of operations, as

well as assisting investors in evaluating how well we are executing

our strategic initiatives. In addition, our Senior Secured Credit

Facilities use Adjusted EBITDA, as calculated for our subsidiary

CWGS Group, LLC, to measure our compliance with covenants such as

the consolidated leverage ratio. The Non-GAAP Financial Measures

have limitations as analytical tools, and the presentation of this

financial information is not intended to be considered in isolation

or as a substitute for, or superior to, the financial information

prepared and presented in accordance with GAAP. They should not be

construed as an inference that the Company’s future results will be

unaffected by any items adjusted for in these Non-GAAP Financial

Measures. In evaluating these Non-GAAP Financial Measures, it is

reasonable to expect that certain of these items will occur in

future periods. However, we believe these adjustments are

appropriate because the amounts recognized can vary significantly

from period to period, do not directly relate to the ongoing

operations of our business and complicate comparisons of our

internal operating results and operating results of other companies

over time. Each of the normal recurring adjustments and other

adjustments described in this section and in the reconciliation

tables below help management with a measure of our core operating

performance over time by removing items that are not related to

day-to-day operations.

For periods beginning after December 31, 2022 for the 2019

Strategic Shift and for periods beginning after December 31, 2023

for the Active Sports Restructuring, we are no longer including the

other associated costs category of expenses relating to those

restructuring activities as restructuring costs for purposes of our

Non-GAAP Financial Measures, since these costs are not expected to

be significant in future periods.

Our earnings call on August 1, 2024 may present guidance that

includes Adjusted EBITDA. A full reconciliation of the forecasted

Adjusted EBITDA to its most-directly comparable GAAP metric cannot

be provided without unreasonable efforts due to the inherent

difficulty in forecasting and quantifying with reasonable accuracy

significant items required for the reconciliations.

The Non-GAAP Financial Measures that we use are not necessarily

comparable to similarly titled measures used by other companies due

to different methods of calculation.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin

We define “EBITDA” as net income (loss) before other interest

expense, net (excluding floor plan interest expense), provision for

income tax (expense) benefit and depreciation and amortization. We

define “Adjusted EBITDA” as EBITDA further adjusted for the impact

of certain noncash and other items that we do not consider in our

evaluation of ongoing operating performance. These items include,

among other things, long-lived asset impairment, lease termination,

gains and losses on sale or disposal of assets, net, equity-based

compensation, loss and impairment on investments in equity

securities, Tax Receivable Agreement liability adjustment,

restructuring costs related to the Active Sports Restructuring, and

other unusual or one-time items. We define “Adjusted EBITDA Margin”

as Adjusted EBITDA as a percentage of total revenue. We caution

investors that amounts presented in accordance with our definitions

of EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin may not be

comparable to similar measures disclosed by our competitors,

because not all companies and analysts calculate EBITDA, Adjusted

EBITDA, and Adjusted EBITDA Margin in the same manner. We present

EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin because we

consider them to be important supplemental measures of our

performance and believe they are frequently used by securities

analysts, investors and other interested parties in the evaluation

of companies in our industry. Management believes that investors’

understanding of our performance is enhanced by including these

Non-GAAP Financial Measures as a reasonable basis for comparing our

ongoing results of operations.

The following table reconciles EBITDA, Adjusted EBITDA and

Adjusted EBITDA Margin to the most directly comparable GAAP

financial performance measures (unaudited):

Three Months Ended June

30,

Six Months Ended June

30,

($ in thousands)

2024

2023

2024

2023

EBITDA and Adjusted EBITDA:

Net income (loss)

$

23,414

$

64,723

$

(27,392

)

$

69,626

Other interest expense, net

36,153

33,518

72,247

64,631

Depreciation and amortization

20,032

17,206

39,322

31,843

Income tax expense (benefit)

7,935

13,581

(1,107

)

13,854

Subtotal EBITDA

87,534

129,028

83,070

179,954

Long-lived asset impairment (a)

4,584

477

10,411

7,522

Lease termination (b)

40

—

40

—

Loss (gain) on sale or disposal of assets,

net (c)

7,945

(145

)

9,530

(5,132

)

Equity-based compensation (d)

5,397

6,492

10,594

12,850

Restructuring costs (e)

—

3,259

—

3,259

Loss and impairment on investments in

equity securities (f)

81

184

175

1,683

Adjusted EBITDA

$

105,581

$

139,295

$

113,820

$

200,136

Three Months Ended June

30,

Six Months Ended June

30,

(as percentage of total revenue)

2024

2023

2024

2023

Adjusted EBITDA margin:

Net income (loss) margin

1.3

%

3.4

%

(0.9

%)

2.1

%

Other interest expense, net

2.0

%

1.8

%

2.3

%

1.9

%

Depreciation and amortization

1.1

%

0.9

%

1.2

%

0.9

%

Income tax expense (benefit)

0.4

%

0.7

%

(0.0

%)

0.4

%

Subtotal EBITDA margin

4.8

%

6.8

%

2.6

%

5.3

%

Long-lived asset impairment (a)

0.3

%

0.0

%

0.3

%

0.2

%

Lease termination (b)

0.0

%

—

0.0

%

—

Loss (gain) on sale or disposal of assets,

net (c)

0.4

%

(0.0

%)

0.3

%

(0.2

%)

Equity-based compensation (d)

0.3

%

0.3

%

0.3

%

0.4

%

Restructuring costs (e)

—

0.2

%

—

0.1

%

Loss and impairment on investments in

equity securities (f)

0.0

%

0.0

%

0.0

%

0.0

%

Adjusted EBITDA margin

5.8

%

7.3

%

3.6

%

5.9

%

Three Months Ended

TTM Ended

June 30,

March 31,

December 31,

September 30,

June 30,

($ in thousands)

2024

2024

2023

2023

2024

Adjusted EBITDA:

Net income (loss)

$

23,414

$

(50,806

)

$

(49,918

)

$

30,893

$

(46,417

)

Other interest expense, net

36,153

36,094

35,397

35,242

142,886

Depreciation and amortization

20,032

19,290

19,181

17,619

76,122

Income tax expense (benefit)

7,935

(9,042

)

(18,732

)

3,679

(16,160

)

Subtotal EBITDA

87,534

(4,464

)

(14,072

)

87,433

156,431

Long-lived asset impairment (a)

4,584

5,827

—

1,747

12,158

Lease termination (b)

40

—

(478

)

375

(63

)

Loss (gain) on sale or disposal of assets,

net (c)

7,945

1,585

(221

)

131

9,440

Equity-based compensation (d)

5,397

5,197

5,770

5,466

21,830

Restructuring costs (e)

—

—

732

1,549

2,281

Loss and impairment on investments in

equity securities (f)

81

94

110

(23

)

262

Tax Receivable Agreement liability

adjustment (g)

—

—

(762

)

(1,680

)

(2,442

)

Adjusted EBITDA

$

105,581

$

8,239

$

(8,921

)

$

94,998

$

199,897

(a)

Represents long-lived asset impairment

charges related to the RV and Outdoor Retail segment.

(b)

Represents the loss on the termination of

operating leases resulting from lease termination fees and the

derecognition of the operating lease assets and liabilities.

(c)

Represents an adjustment to eliminate the

gains and losses on disposals and sales of various assets.

(d)

Represents non-cash equity-based

compensation expense relating to employees, directors, and

consultants of the Company.

(e)

Represents restructuring costs relating to

the Active Sports Restructuring. These restructuring costs include

one-time termination benefits, incremental inventory reserve

charges, and other associated costs. These costs exclude lease

termination costs, which are presented separately above.

(f)

Represents gain and loss and impairment on

investments in equity securities and interest income relating to

any notes receivables with those investments. These amounts are

included in other expense, net in the consolidated statements of

operations. During the six months ended June 30, 2023, this amount

included a $1.3 million impairment on an equity method

investment.

(g)

Represents an adjustment to eliminate the

gains on remeasurement of the Tax Receivable Agreement primarily

due to changes in the Company’s blended statutory income tax

rate.

Adjusted Net Income (Loss) Attributable to Camping World

Holdings, Inc. and Adjusted Earnings (Loss) Per Share

We define “Adjusted Net Income (Loss) Attributable to Camping

World Holdings, Inc. – Basic” as net income (loss) attributable to

Camping World Holdings, Inc. adjusted for the impact of certain

non-cash and other items that we do not consider in our evaluation

of ongoing operating performance. These items include, among other

things, long-lived asset impairment, lease termination costs, gains

and losses on sale or disposal of assets, net, equity-based

compensation, loss and impairment on investments in equity

securities, other unusual or one-time items, the income tax

(expense) benefit effect of these adjustments, and the effect of

net income (loss) attributable to non-controlling interests from

these adjustments.

We define “Adjusted Net Income (Loss) Attributable to Camping

World Holdings, Inc. – Diluted” as Adjusted Net Income (Loss)

Attributable to Camping World Holdings, Inc. – Basic adjusted for

the reallocation of net income (loss) attributable to

non-controlling interests from stock options and restricted stock

units, if dilutive, or the assumed redemption, if dilutive, of all

outstanding common units in CWGS, LLC for shares of newly-issued

Class A common stock of Camping World Holdings, Inc.

We define “Adjusted Earnings (Loss) Per Share – Basic” as

Adjusted Net Income (Loss) Attributable to Camping World Holdings,

Inc. - Basic divided by the weighted-average shares of Class A

common stock outstanding. We define “Adjusted Earnings (Loss) Per

Share – Diluted” as Adjusted Net Income (Loss) Attributable to

Camping World Holdings, Inc. – Diluted divided by the

weighted-average shares of Class A common stock outstanding,

assuming (i) the redemption of all outstanding common units in

CWGS, LLC for newly-issued shares of Class A common stock of

Camping World Holdings, Inc., if dilutive, and (ii) the dilutive

effect of stock options and restricted stock units, if any. We

present Adjusted Net Income (Loss) Attributable to Camping World

Holdings, Inc. – Basic, Adjusted Net Income (Loss) Attributable to

Camping World Holdings, Inc. – Diluted, Adjusted Earnings (Loss)

Per Share – Basic, and Adjusted Earnings (Loss) Per Share – Diluted

because we consider them to be important supplemental measures of

our performance and we believe that investors’ understanding of our

performance is enhanced by including these Non-GAAP financial

measures as a reasonable basis for comparing our ongoing results of

operations.

The following table reconciles Adjusted Net Income (Loss)

Attributable to Camping World Holdings, Inc. – Basic, Adjusted Net

Income (Loss) Attributable to Camping World Holdings, Inc. –

Diluted, Adjusted Earnings (Loss) Per Share – Basic, and Adjusted

Earnings (Loss) Per Share – Diluted to the most directly comparable

GAAP financial performance measure:

Three Months Ended June

30,

Six Months Ended June

30,

(In thousands except per share

amounts)

2024

2023

2024

2023

Numerator:

Net income (loss) attributable to Camping

World Holdings, Inc.

$

9,771

$

28,703

$

(12,536

)

$

31,872

Adjustments related to basic

calculation:

Long-lived asset impairment (a):

Gross adjustment

4,584

477

10,411

7,522

Income tax expense for above adjustment

(b)

(607

)

(64

)

(1,378

)

(1,002

)

Lease termination (c):

Gross adjustment

40

—

40

—

Income tax expense for above adjustment

(b)

(5

)

—

(5

)

—

Loss (gain) on sale or disposal of assets

(d):

Gross adjustment

7,945

(145

)

9,530

(5,132

)

Income tax (expense) benefit for above

adjustment (b)

(1,052

)

19

(1,262

)

684

Equity-based compensation (e):

Gross adjustment

5,397

6,492

10,594

12,850

Income tax expense for above adjustment

(b)

(722

)

(872

)

(1,417

)

(1,729

)

Restructuring costs (f):

Gross adjustment

—

3,259

—

3,259

Income tax expense for above adjustment

(b)

—

(434

)

—

(434

)

Loss and impairment on investments in

equity securities (g):

Gross adjustment

81

184

175

1,683

Income tax expense for above adjustment

(b)

(11

)

(25

)

(23

)

(225

)

Adjustment to net income (loss)

attributable to non-controlling interests resulting from the above

adjustments (h)

(8,481

)

(4,855

)

(14,452

)

(9,543

)

Adjusted net income (loss) attributable to

Camping World Holdings, Inc. – basic

16,940

32,739

(323

)

39,805

Adjustments related to diluted

calculation:

Reallocation of net income (loss)

attributable to non-controlling interests from the dilutive effect

of stock options and restricted stock units (i)

39

151

(38

)

—

Income tax on reallocation of net income

(loss) attributable to non-controlling interests from the dilutive

effect of stock options and restricted stock units (j)

(9

)

(37

)

10

—

Reallocation of net income (loss)

attributable to non-controlling interests from the dilutive

redemption of common units in CWGS, LLC (i)

—

—

—

47,298

Income tax on reallocation of net income

(loss) attributable to non-controlling interests from the dilutive

redemption of common units in CWGS, LLC (j)

—

—

—

(11,586

)

Adjusted net income (loss) attributable to

Camping World Holdings, Inc. – diluted

$

16,970

$

32,853

$

(351

)

$

75,517

Denominator:

Weighted-average Class A common shares

outstanding – basic

45,093

44,490

45,070

44,473

Adjustments related to diluted

calculation:

Dilutive redemption of common units in

CWGS, LLC for shares of Class A common stock (k)

—

—

—

40,045

Dilutive options to purchase Class A

common stock (k)

—

29

14

22

Dilutive restricted stock units (k)

151

285

207

243

Adjusted weighted average Class A common

shares outstanding – diluted

45,244

44,804

45,291

84,783

Adjusted earnings (loss) per share -

basic

$

0.38

$

0.74

$

(0.01

)

$

0.90

Adjusted earnings (loss) per share -

diluted

$

0.38

$

0.73

$

(0.01

)

$

0.89

Anti-dilutive amounts (l):

Numerator:

Reallocation of net income (loss)

attributable to non-controlling interests from the anti-dilutive

redemption of common units in CWGS, LLC (i)

$

22,085

$

40,724

$

(366

)

$

—

Income tax on reallocation of net income

(loss) attributable to non-controlling interests from the

anti-dilutive redemption of common units in CWGS, LLC (j)

$

(5,126

)

$

(9,934

)

$

592

$

—

Denominator:

Anti-dilutive redemption of common units

in CWGS, LLC for shares of Class A common stock (k)

40,045

40,045

40,045

—

Reconciliation of per share

amounts:

Earnings (loss) per share of Class A

common stock — basic

$

0.22

$

0.65

$

(0.28

)

$

0.72

Non-GAAP Adjustments (m)

0.16

0.09

0.27

0.18

Adjusted earnings (loss) per share -

basic

$

0.38

$

0.74

$

(0.01

)

$

0.90

Earnings (loss) per share of Class A

common stock — diluted

$

0.22

$

0.64

$

(0.28

)

$

0.71

Non-GAAP Adjustments (m)

0.16

0.09

0.27

0.18

Adjusted earnings (loss) per share -

diluted

$

0.38

$

0.73

$

(0.01

)

$

0.89

(a)

Represents long-lived asset impairment

charges related to the RV and Outdoor Retail segment.

(b)

Represents the current and deferred income

tax expense or benefit effect of the above adjustments. This

assumption uses effective tax rates of 25.0% and 25.3% for the

adjustments for the 2024 and 2023 periods, which represent the

estimated tax rates that would apply had the above adjustments been

included in the determination of our non-GAAP metric.

(c)

Represents the loss on the termination of

operating leases resulting from lease termination fees and the

derecognition of the operating lease assets and liabilities.

(d)

Represents an adjustment to eliminate the

gains and losses on disposals and sales of various assets.

(e)

Represents non-cash equity-based

compensation expense relating to employees, directors, and

consultants of the Company.

(f)

Represents restructuring costs relating to

Active Sports Restructuring during the three and six months ended

June 30, 2023. These restructuring costs include one-time

termination benefits, incremental inventory reserve charges, and

other associated costs. These costs exclude lease termination

costs.

(g)

Represents loss and impairment on

investments in equity securities and interest income relating to

any notes receivables with those investments. During the six months

ended June 30, 2023, this amount included a $1.3 million impairment

on an equity method investment.

(h)

Represents the adjustment to net income

(loss) attributable to non-controlling interests resulting from the

above adjustments that impact the net income (loss) of CWGS, LLC.

This adjustment uses the non-controlling interest’s weighted

average ownership of CWGS, LLC of 47.0% and 47.4% for the three

months ended June 30, 2024 and 2023, respectively, and 47.0% and

47.4% for the six months ended June 30, 2024 and 2023,

respectively.

(i)

Represents the reallocation of net income

(loss) attributable to non-controlling interests from the impact of

the assumed change in ownership of CWGS, LLC from stock options,

restricted stock units, and/or common units of CWGS, LLC.

(j)

Represents the income tax expense effect

of the above adjustment for reallocation of net income (loss)

attributable to non-controlling interests. This assumption uses

effective tax rates of 25.0% and 25.3% for the adjustments for 2024

and 2023 periods.

(k)

Represents the impact to the denominator

for stock options, restricted stock units, and/or common units of

CWGS, LLC.

(l)

The below amounts have not been considered

in our adjusted earnings (loss) per share – diluted amounts as the

effect of these items are anti-dilutive.

(m)

Represents the per share impact of the

Non-GAAP adjustments to net income (loss) detailed above (see (a)

through (h) above).

Our “Up-C” corporate structure may make it difficult to compare

our results with those of companies with a more traditional

corporate structure. There can be a significant fluctuation in the

numerator and denominator for the calculation of our adjusted

earnings (loss) per share – diluted depending on if the common

units in CWGS, LLC are considered dilutive or anti-dilutive for a

given period. To improve comparability of our financial results,

users of our financial statements may find it useful to review our

earnings (loss) per share assuming the full redemption of common

units in CWGS, LLC for all periods, even when those common units

would be anti-dilutive. The relevant numerator and denominator

adjustments have been provided under “Anti-dilutive amounts” in the

table above (see (l) above).

SG&A Excluding Equity-based Compensation

We define “SG&A Excluding Equity-based Compensation” as

SG&A before Equity-based Compensation relating to SG&A. We

caution investors that amounts presented in accordance with our

definition of SG&A Excluding Equity-based Compensation may not

be comparable to similar measures disclosed by our competitors,

because not all companies and analysts calculate SG&A Excluding

Equity-based Compensation in the same manner. We present SG&A

Excluding Equity-based Compensation because we believe that

investors’ understanding of our performance and drivers of our

other Non-GAAP Financial Measures, such as Adjusted EBITDA, is

enhanced by including this Non-GAAP Financial Measure as a

reasonable basis for comparing our ongoing results of

operations.

The following table reconciles SG&A Excluding Equity-based

Compensation to the most directly comparable GAAP financial

performance measure:

Three Months Ended June

30,

Six Months Ended June

30,

($ in thousands)

2024

2023

2024

2023

SG&A Excluding Equity-based

Compensation:

SG&A

$

419,676

$

420,887

$

791,149

$

786,613

Equity-based Compensation - SG&A

(5,308

)

(6,270

)

(10,413

)

(12,497

)

SG&A Excluding Equity-based

Compensation

$

414,368

$

414,617

$

780,736

$

774,116

As a percentage of gross profit

75.7

%

72.6

%

82.2

%

76.5

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731920408/en/

Investors: Brett Andress InvestorRelations@campingworld.com

Media Outlets: PR-CWGS@CampingWorld.com

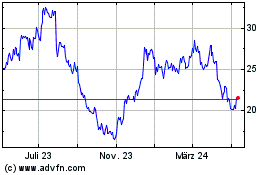

Camping World (NYSE:CWH)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

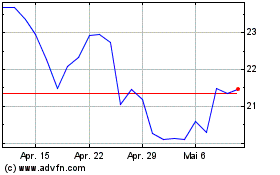

Camping World (NYSE:CWH)

Historical Stock Chart

Von Nov 2023 bis Nov 2024