0001530721false00015307212024-11-262024-11-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 26, 2024

(Exact name of Registrant as Specified in its Charter)

001-35368

(Commission File Number)

| | | | | | | | |

| British Virgin Islands | | N/A |

(State or other jurisdiction

of incorporation) | | (I.R.S. Employer

Identification No.) |

90 Whitfield Street, 2nd Floor

London, United Kingdom

W1T 4EZ

(Address of Principal Executive Offices)

44 207 632 8600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

| Ordinary Shares, no par value | CPRI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

On November 26, 2024, Capri Holdings Limited (the “Company”) announced that Cedric Wilmotte, Chief Executive Officer of Michael Kors, will be leaving the Company effective as of that same date (the “Separation Date”). Mr. Wilmotte is expected to remain on a paid garden leave with benefits from the Separation Date through March 29, 2025 (the “Garden Leave Period”). During the Garden Leave Period, Mr. Wilmotte will be available as needed to answer questions and provide transition services.

In connection with his separation from the Company, and provided that he timely executes (and does not revoke) a separation and release agreement and complies with certain post-employment restrictive covenants, Mr. Wilmotte will receive (i) pursuant to the terms of his employment agreement, continuation of his base salary ($1,000,000) and medical, dental and insurance benefits for a one (1) year period commencing on March 30, 2025, which amounts shall be payable in substantially equal installments in accordance with the normal payroll practices of Michael Kors (USA), Inc., plus his target annual cash incentive payment ($1,000,000) for the fiscal year ending March 29, 2025 (“Fiscal 2025”), which shall be paid in a lump sum at the same time as the Fiscal 2025 annual cash incentive is paid to similarly situated executives in June 2025 and (ii) a cash payment in the amount of $500,000 payable in two lump sum installments, with 50% (or $250,000) to be paid as soon as administratively feasible following the effective date of his separation and release agreement, and 50% (or $250,000) to be paid at the same time the Fiscal 2025 annual cash incentive is paid in June 2025 ((i) and (ii) collectively are hereinafter referred to as, the “Separation Payments”). The Separation Payments will be made less applicable tax withholdings and other payroll deductions.

ITEM 8.01 OTHER EVENTS.

On November 26, 2024, the Company issued a press release concerning the departure of Mr. Wilmotte. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d)Exhibits

| | | | | |

Exhibit Number | Description |

99.1 | |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | | CAPRI HOLDINGS LIMITED

|

Date: December 2, 2024 | | | |

| | By: | /s/ Krista A. McDonough |

| | Name: | Krista A. McDonough |

| | Title: | Senior Vice President, General Counsel & Chief Sustainability Officer |

| | | |

| | | |

| | | |

| | | |

| | | |

Michael Kors Reorganizes Leadership Team

Philippa Newman Promoted to Chief Product Officer

Remains Focused on Returning to Growth

London — November 26, 2024 — Capri Holdings Limited (NYSE:CPRI), a global fashion luxury group, announced today that Michael Kors is reorganizing its leadership team. John D. Idol, Chairman and Chief Executive Officer of Capri Holdings, will assume the role of Chief Executive Officer of Michael Kors. Effective December 2, 2024, Philippa Newman will be promoted to Michael Kors Chief Product Officer. Ms. Newman joined Michael Kors over 14 years ago having most recently served as the President of Accessories and Footwear. In this new role, Ms. Newman will report to Mr. Idol and oversee merchandising, production, licensing and design across all product categories, in partnership with Chief Creative Officer Michael Kors.

“I am excited to continue to partner with Michael, John and the leadership team to achieve our strategic objectives and reinvigorate the Michael Kors brand,” said Philippa Newman. “Michael Kors has strong brand equity and tremendous potential. I am confident that by consolidating design, merchandising, production, and licensing under a unified team we can more effectively execute our strategies, including delivering more targeted product to different consumer cohorts, in order to return Michael Kors to growth.”

Additionally, as part of its reorganization plans and expense reduction initiatives, the company announced that Cedric Wilmotte will leave the organization. John D. Idol, Chairman and Chief Executive Officer of Capri Holdings, said, “I would like to thank Cedric for his significant contributions over the last 16 years. We wish him all the best in his future endeavors.”

Mr. Idol continued, “As I stated on our recent investor call, we are moving quickly to implement strategic initiatives to stabilize revenues and return to growth. This reorganization reinforces Michael Kors’ plans to engage and energize both new and loyal consumers, create exciting fashion and core products with compelling value, improve store productivity and return our wholesale business to growth. Philippa is a dynamic leader with an exceptional breadth of experience developing compelling product for our consumers. I am confident that in her new role as Chief Product Officer for Michael Kors she will successfully lead the execution of our product transformation strategy and drive growth for Michael Kors across all channels.”

About Capri Holdings Limited

Capri Holdings is a global fashion luxury group consisting of iconic, founder-led brands Versace, Jimmy Choo and Michael Kors. Our commitment to glamorous style and craftsmanship is at the heart of each of our luxury brands. We have built our reputation on designing exceptional, innovative products that cover the full spectrum of fashion luxury categories. Our strength lies in the unique DNA and heritage of each of our brands, the diversity and passion of our people and our dedication to the clients and communities we serve. Capri Holdings Limited is publicly listed on the New York Stock Exchange under the ticker CPRI.

Forward-Looking Statements

This press release contains statements which are, or may be deemed to be, “forward-looking statements.” Forward-looking statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections of the management of Capri about future events and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. All statements other than statements of historical facts included herein, may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “plans”, “believes”, “expects”, “intends”, “will”, “should”, “could”, “would”, “may”, “anticipates”, “might” or similar words or phrases, are forward-looking statements. Such forward-looking statements involve known and unknown risks and uncertainties that could significantly affect expected results and are based on certain key assumptions, which could cause actual results to differ materially from those projected or implied in any forward-looking statements. These risks, uncertainties and other factors are identified in the Company's Annual Report on Form 10-K for the fiscal year ended March 30, 2024 filed with the Securities and Exchange Commission. Please consult these documents for a more complete understanding of these risks and uncertainties. Any forward-looking statement in this press release speaks only as of the date made and Capri disclaims any obligation to update or revise any forward-looking or other statements contained herein other than in accordance with legal and regulatory obligations.

CONTACTS:

Investor Relations:

Jennifer Davis

+1 (201) 514-8234

Jennifer.Davis@CapriHoldings.com

Media:

Press@CapriHoldings.com

v3.24.3

Cover Page Cover Page

|

Nov. 26, 2024 |

| Cover [Abstract] |

|

| Document Period End Date |

Nov. 26, 2024

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Ordinary Shares, no par value

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Soliciting Material |

false

|

| Written Communications |

false

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

W1T 4EZ

|

| Entity Incorporation, State or Country Code |

D8

|

| Entity File Number |

001-35368

|

| Document Type |

8-K

|

| Trading Symbol |

CPRI

|

| Security Exchange Name |

NYSE

|

| Entity Address, Address Line One |

90 Whitfield Street, 2nd Floor

|

| Entity Address, City or Town |

London

|

| Entity Address, State or Province |

44

|

| City Area Code |

207

|

| Local Phone Number |

632 8600

|

| Entity Central Index Key |

0001530721

|

| Amendment Flag |

false

|

| Entity Registrant Name |

CAPRI HOLDINGS LTD

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

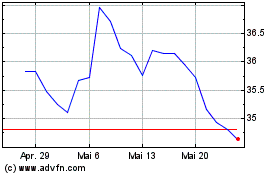

Capri (NYSE:CPRI)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Capri (NYSE:CPRI)

Historical Stock Chart

Von Dez 2023 bis Dez 2024