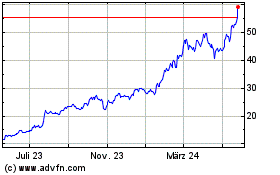

Celestica Inc. (TSX: CLS) (NYSE: CLS), a leader in design,

manufacturing, hardware platform and supply chain solutions for the

world's most innovative companies, today announced financial

results for the quarter ended March 31, 2024 (Q1 2024)†.

“We are pleased with our strong start to the

year, delivering revenue growth of 20% in Q1 2024 compared to the

prior-year period, and continued non-IFRS operating margin*

expansion. Our solid performance was reflected in revenue and

non-IFRS adjusted EPS* each in excess of the high end of our

guidance ranges,” said Rob Mionis, President and CEO, Celestica.

“We continue to see healthy demand across a number of our major

customers, which provides us with the confidence to raise our full

year 2024 outlook. We continue to stay focused on solid execution

for our customers, and delivering on our strategic priorities and

financial targets.”

Q1 2024 Highlights

- Key measures:

- Revenue: $2.21 billion, increased 20% compared to $1.84 billion

for the first quarter of 2023 (Q1 2023).

- Non-IFRS operating margin*: 6.2%, compared to 5.2% for Q1

2023.

- ATS segment revenue decreased 3% compared to Q1 2023; ATS

segment margin was 4.7% compared to 4.4% for Q1 2023.

- CCS segment revenue increased 38% compared to Q1 2023; CCS

segment margin was 7.0% compared to 5.8% for Q1 2023.

- Adjusted earnings per share (EPS) (non-IFRS)*: $0.86, compared

to $0.47 for Q1 2023.

- Adjusted return on invested capital (adjusted ROIC)

(non-IFRS)*: 24.8%, compared to 17.9% for Q1 2023.

- Adjusted free cash flow (non-IFRS)*: $65.2 million,

compared to $9.2 million for Q1 2023.

- Most directly comparable IFRS financial measures to non-IFRS

measures above:

- Earnings from operations as a percentage of revenue: 6.0%

compared to 3.2% for Q1 2023.

- EPS: $0.85 compared to $0.20 for Q1 2023.

- Return on invested capital (IFRS ROIC): 23.8% compared to 11.2%

for Q1 2023.

- Cash provided by operations: $131.1 million compared to

$72.3 million for Q1 2023.

- Repurchased 0.5 million subordinate voting shares (SVS)

for cancellation for $16.5 million.

† Celestica has two operating and reportable

segments: Advanced Technology Solutions (ATS) and Connectivity

& Cloud Solutions (CCS). Our ATS segment consists of our ATS

end market and is comprised of our Aerospace and Defense (A&D),

Industrial, HealthTech and Capital Equipment businesses. Our CCS

segment consists of our Communications and Enterprise (servers and

storage) end markets. Segment performance is evaluated based on

segment revenue, segment income and segment margin (segment income

as a percentage of segment revenue). See note 3 to our

March 31, 2024 unaudited interim condensed consolidated

financial statements (Q1 2024 Interim Financial Statements) for

further detail.* Non-International Financial Reporting Standards

(IFRS) financial measures (including ratios based on non-IFRS

financial measures) do not have any standardized meaning prescribed

by IFRS and therefore may not be comparable to similar financial

measures presented by other public companies that report under IFRS

or U.S. generally accepted accounting principles (GAAP). See

“Non-IFRS Supplementary Information” below for information on our

rationale for the use of non-IFRS financial measures. See Schedule

1 for, among other items, non-IFRS financial measures included in

this press release, their definitions, uses, and a reconciliation

of historical non-IFRS financial measures to the most directly

comparable IFRS financial measures. The most directly comparable

IFRS financial measures to non-IFRS operating margin, non-IFRS

adjusted EPS, non-IFRS adjusted ROIC and non-IFRS adjusted free

cash flow are earnings from operations as a percentage of revenue,

EPS, IFRS ROIC, and cash provided by operations, respectively.

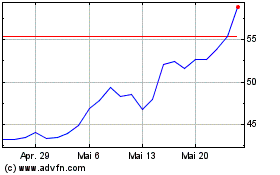

Second Quarter of 2024 (Q2 2024)

Guidance‡

|

|

Q2 2024

Guidance |

| Revenue (in billions) |

$2.175 to $2.325 |

| Non-IFRS operating

margin* |

6.1% at the mid-point of ourrevenue and non-IFRS adjustedEPS

guidance ranges |

| Adjusted SG&A (non-IFRS)*

(in millions) |

$67 to $69 |

| Adjusted EPS (non-IFRS)* |

$0.75 to $0.85 |

For Q2 2024, we expect a negative $0.17 to $0.23

per share (pre-tax) aggregate impact on net earnings on an IFRS

basis for employee stock-based compensation (SBC) expense,

amortization of intangible assets (excluding computer software),

and restructuring charges.

For Q2 2024, we also expect a non-IFRS adjusted

effective tax rate* of approximately 20%, without accounting for

foreign exchange impacts or unanticipated tax settlements. This

rate does assume that our income will be subject to Pillar Two

global minimum tax as currently proposed, as legislation that has

been introduced in Canada may become applicable before the end of

Q2 2024 with possible retroactive impact to January 1,

2024‡. If this legislation is not substantively

enacted in Q2 2024, we expect our Q2 2024 non-IFRS adjusted EPS*

guidance range to shift upwards by approximately $0.05, and our

non-IFRS adjusted effective tax rate* for the quarter to be

approximately 15%. Our Q2 2024 guidance also assumes consummation

in May 2024 of our anticipated acquisition of NCS Global Services

LLC (described below).

2024 Annual Outlook

Update‡

Building on our strong performance in Q1 2024,

we are updating our 2024 outlook to the following:

- revenue of $9.1 billion (our previous outlook was $8.5 billion,

or more);

- non-IFRS operating margin* of 6.1% (our previous outlook was

between 5.5% to 6.0%);

- non-IFRS adjusted EPS* of $3.30 (our previous outlook was $2.70

or more); and

- non-IFRS adjusted free cash flow* of $250 million (our previous

outlook was $200 million, or more).

Our 2024 annual outlook assumes that our income

will be subject to Pillar Two global minimum tax as currently

proposed, as legislation that has been introduced in Canada is

expected to be enacted during 2024 and apply retroactively to

January 1, 2024‡. Our 2024 annual outlook also assumes consummation

in May 2024 of our anticipated acquisition of NCS Global Services

LLC (described below).

For the second through fourth quarters of 2024,

we expect a non-IFRS adjusted effective tax rate* of approximately

20%‡ (which does not account for foreign exchange

impacts or unanticipated tax settlements).

* See Schedule 1 for the definitions of these

non-IFRS financial measures. We do not provide reconciliations for

forward-looking non-IFRS financial measures, as we are unable to

provide a meaningful or accurate calculation or estimation of

reconciling items and the information is not available without

unreasonable effort. This is due to the inherent difficulty of

forecasting the timing or amount of various events that have not

yet occurred, are out of our control and/or cannot be reasonably

predicted, and that would impact the most directly comparable

forward-looking IFRS financial measure. For these same reasons, we

are unable to address the probable significance of the unavailable

information. Forward-looking non-IFRS financial measures may vary

materially from the corresponding IFRS financial measures.

‡ The timing of global minimum tax legislation

effectiveness and its impact on our tax expense cannot currently be

estimated with certainty, and may differ materially from our

expectations.

Summary of Selected Q1 2024

Results

| |

Q1 2024

Actual |

|

Q1 2024 Guidance

(2) |

|

Key measures: |

|

|

|

|

Revenue (in billions) |

$ |

2.209 |

|

$2.025 to $2.175 |

|

Non-IFRS operating margin* |

|

6.2% |

|

6.0% at the mid-point of our revenue and non-IFRS adjusted EPS

guidance ranges |

|

Adjusted SG&A (non-IFRS)* (in millions) |

$ |

70.1 |

|

$62 to $64 |

|

Adjusted EPS (non-IFRS)* |

$ |

0.86 |

|

$0.67 to $0.77 |

| |

|

|

|

|

Most directly comparable IFRS financial measures: |

|

|

|

|

Earnings from operations as a % of revenue |

|

6.0% |

|

N/A |

|

SG&A (in millions) |

$ |

65.2 |

|

N/A |

|

EPS (1) |

$ |

0.85 |

|

N/A |

*See Schedule 1 for, among other things, the

definitions of these non-IFRS financial measures, as well as a

reconciliation of these non-IFRS financial measures to the most

directly comparable IFRS financial measures.

(1) IFRS EPS of $0.85 for Q1 2024 included an

aggregate charge of $0.31 (pre-tax) per share for employee SBC

expense, amortization of intangible assets (excluding computer

software), and restructuring charges. See the tables in Schedule 1

and note 8 to the Q1 2024 Interim Financial Statements for per-item

charges. This aggregate charge was within our Q1 2024 guidance

range of between $0.26 to $0.32 per share for these items.

IFRS EPS for Q1 2024 included: (i) a $0.26 per

share positive impact attributable to a fair value gain (TRS Gain)

on our total return swap agreement (TRS Agreement), (ii) a $0.01

per share positive impact attributable to legal recoveries and

(iii) a $0.05 per share favorable tax impact attributable to the

reversals of tax uncertainties relating to one of our Asian

subsidiaries, partially offset by: (x) a $0.04 per share negative

tax impact arising from taxable temporary differences associated

with the anticipated repatriation of undistributed earnings

(Repatriation Expense) from certain of our Asian subsidiaries and

(y) a $0.04 per share negative impact attributable to restructuring

charges. See notes 7, 8 and 9 to the Q1 2024 Interim Financial

Statements.

IFRS EPS of $0.20 for Q1 2023 included a $0.04

per share negative impact attributable to restructuring charges and

a $0.01 per share negative Repatriation Expense from certain of our

Chinese subsidiaries, offset by a $0.05 per share favorable tax

impact attributable to the reversals of tax uncertainties in one of

our Asian subsidiaries. See notes 8 and 9 to the Q1 2024 Interim

Financial Statements.

(2) For Q1 2024, our revenue exceeded the high

end of our guidance range and our non-IFRS operating margin

exceeded the mid-point of our revenue and non-IFRS adjusted EPS

guidance ranges due to higher than anticipated customer demand. Our

Q1 2024 non-IFRS adjusted EPS exceeded the high end of our guidance

range, driven by unanticipated volume leverage and production

efficiencies in our CCS segment, and the lack of enactment of

Pillar Two legislation in Canada (as we assumed a $0.05 per share

Pillar Two legislation impact on our non-IFRS adjusted EPS for the

quarter). Our non-IFRS adjusted SG&A for Q1 2024 exceeded the

high end of our guidance range as a result of higher than expected

variable spend and allowance for doubtful accounts. Our IFRS

effective tax rate for Q1 2024 was 12%. As anticipated, our

non-IFRS adjusted effective tax rate for Q1 2024 was 15%, as Pillar

Two legislation was not substantively enacted in Canada in Q1 2024.

However, if such legislation is enacted as proposed, it would be

retroactive to January 1, 2024.

Acquisition Agreement

In April 2024, we entered into a definitive

agreement to acquire NCS Global Services LLC, a US-based IT

infrastructure and asset management business, for $36 million (and

a possible earnout payment should certain post-closing financial

conditions be met). The transaction is expected to close in May

2024 or earlier, subject to satisfaction of customary closing

conditions.

Q1 2024 Webcast and

2024 Annual and Special Shareholders Meeting/Webcast

Management will host its Q1 2024 results

conference call on April 25, 2024 at 8:00 a.m. Eastern Daylight

Time (EDT). The webcast can be accessed at www.celestica.com.

Celestica's 2024 Annual and Special Meeting of Shareholders

(Meeting) will be held on April 25, 2024 at 9:30 a.m. EDT. As

previously announced, the Meeting will be held in a hybrid format.

Celestica welcomes the participation of shareholders who will be

able to attend the Meeting in-person at Celestica’s head office at

5140 Yonge Street, Suite 1900, Toronto, Ontario. Shareholders may

also attend and participate in the Meeting virtually via a live

audio-only webcast at https://meetnow.global/MUGXJDC. Online access

to the Meeting will begin at 8:30 a.m. EDT.

Non-IFRS Supplementary

Information

In addition to disclosing detailed operating

results in accordance with IFRS, Celestica provides supplementary

non-IFRS financial measures to consider in evaluating the company’s

operating performance. Management uses adjusted net earnings and

other non-IFRS financial measures to assess operating performance

and the effective use and allocation of resources; to provide more

meaningful period-to-period comparisons of operating results; to

enhance investors’ understanding of the core operating results of

Celestica’s business; and to set management incentive targets. We

believe investors use both IFRS and non-IFRS financial measures to

assess management's past, current and future decisions associated

with our priorities and our allocation of capital, as well as to

analyze how our business operates in, or responds to, swings in

economic cycles or to other events that impact our core operations.

See Schedule 1 below.

About Celestica

Celestica enables the world's best brands.

Through our recognized customer-centric approach, we partner with

leading companies in Aerospace and Defense, Communications,

Enterprise, HealthTech, Industrial, and Capital Equipment to

deliver solutions for their most complex challenges. As a leader in

design, manufacturing, hardware platform and supply chain

solutions, Celestica brings global expertise and insight at every

stage of product development — from the drawing board to full-scale

production and after-market services. With talented teams across

North America, Europe and Asia, we imagine, develop and deliver a

better future with our customers. For more information on

Celestica, visit www.celestica.com. Our securities filings can be

accessed at www.sedarplus.ca and www.sec.gov.

Cautionary Note Regarding

Forward-looking Statements

This press release contains forward-looking

statements, including, without limitation, those related to: our

anticipated financial and/or operational results, guidance and

outlook, including statements under the headings "Second Quarter of

2024 (Q2 2024) Guidance", and "2024 Annual Outlook Update"; our

anticipated acquisition of NCS Global Services, LLC; our credit

risk; our liquidity; anticipated charges and expenses, including

restructuring charges; the estimated near-term impact and timing of

international tax reform; the potential impact of tax and

litigation outcomes; and mandatory prepayments under our credit

facility. Such forward-looking statements may, without limitation,

be preceded by, followed by, or include words such as “believes,”

“expects,” “anticipates,” “estimates,” “intends,” “plans,”

“continues,” “project,” "target," "outlook," "goal," "guidance",

“potential,” “possible,” “contemplate,” “seek,” or similar

expressions, or may employ such future or conditional verbs as

“may,” “might,” “will,” “could,” “should,” or “would,” or may

otherwise be indicated as forward-looking statements by grammatical

construction, phrasing or context. For those statements, we claim

the protection of the safe harbor for forward-looking statements

contained in the U.S. Private Securities Litigation Reform Act

of 1995, where applicable, and for forward-looking information

under applicable Canadian securities laws.

Forward-looking statements are provided to

assist readers in understanding management’s current expectations

and plans relating to the future. Forward-looking statements

reflect our current estimates, beliefs and assumptions, which are

based on management’s perception of historic trends, current

conditions and expected future developments, as well as other

factors it believes are appropriate in the circumstances, such as

certain assumptions about the economy, our customers, our

suppliers, our ability to achieve our strategic goals, as well as

market, financial and operational assumptions. Readers are

cautioned that such information may not be appropriate for other

purposes. Readers should not place undue reliance on such

forward-looking information.

Forward-looking statements are not guarantees of

future performance and are subject to risks that could cause actual

results to differ materially from those expressed or implied in

such forward-looking statements, including, among others, risks

related to: customer and segment concentration; reduction in

customer revenue; erosion in customer market competitiveness;

changing revenue mix and margins; uncertain market, political and

economic conditions; operational challenges such as inventory

management and materials and supply chain constraints; the cyclical

nature and/or volatility of certain of our businesses; talent

management and inefficient employee utilization; risks related to

the expansion or consolidation of our operations; cash flow,

revenue and operating results variability; technology and IT

disruption; increasing legal, tax and regulatory complexity and

uncertainty; integrating and achieving the anticipated benefits

from acquisitions; and the potential adverse impacts of events

outside of our control.

For more exhaustive information on the foregoing

and other material risks, uncertainties and assumptions readers

should refer to our public filings at www.sedarplus.ca and

www.sec.gov, including in our most recent Management's Discussion

and Analysis of Financial Condition and Results of Operations,

Annual Report on Form 20-F filed with, and subsequent reports on

Form 6-K furnished to, the U.S. Securities and Exchange Commission,

and the Canadian Securities Administrators, as applicable.

Forward-looking statements speak only as of the

date on which they are made, and we disclaim any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable law. All

forward-looking statements attributable to us are expressly

qualified by these cautionary statements.

ContactsCelestica Global Communications

(416) 448-2200

media@celestica.com

Celestica Investor Relations(416)

448-2211clsir@celestica.com

Schedule 1

Supplementary Non-IFRS Financial

Measures

The non-IFRS financial measures (including

ratios based on non-IFRS financial measures) included in this press

release are: adjusted gross profit, adjusted gross margin (adjusted

gross profit as a percentage of revenue), adjusted selling, general

and administrative expenses (SG&A), adjusted SG&A as a

percentage of revenue, non-IFRS operating earnings (or adjusted

EBIAT), non-IFRS operating margin (non-IFRS operating earnings or

adjusted EBIAT as a percentage of revenue), adjusted net earnings,

adjusted EPS, adjusted return on invested capital (adjusted ROIC),

adjusted free cash flow, adjusted tax expense and adjusted

effective tax rate. Adjusted EBIAT, adjusted ROIC, adjusted free

cash flow, adjusted tax expense and adjusted effective tax rate are

further described in the tables below. As used herein, "Q1," "Q2,"

"Q3," and "Q4" followed by a year refers to the first quarter,

second quarter, third quarter and fourth quarter of such year,

respectively.

We believe the non-IFRS financial measures we

present herein are useful to investors, as they enable investors to

evaluate and compare our results from operations in a more

consistent manner (by excluding specific items that we do not

consider to be reflective of our core operations), to evaluate cash

resources that we generate from our business each period, and to

provide an analysis of operating results using the same measures

our chief operating decision makers use to measure performance. In

addition, management believes that the use of a non-IFRS adjusted

tax expense and a non-IFRS adjusted effective tax rate provide

improved insight into the tax effects of our core operations, and

are useful to management and investors for historical comparisons

and forecasting. These non-IFRS financial measures result largely

from management’s determination that the facts and circumstances

surrounding the excluded charges or recoveries are not indicative

of our core operations.

Non-IFRS financial measures do not have any

standardized meaning prescribed by IFRS and therefore may not be

comparable to similar measures presented by other companies that

report under IFRS, or who report under U.S. GAAP and use non-GAAP

financial measures to describe similar financial metrics. Non-IFRS

financial measures are not measures of performance under IFRS and

should not be considered in isolation or as a substitute for any

IFRS financial measure.

The most significant limitation to management’s

use of non-IFRS financial measures is that the charges or credits

excluded from the non-IFRS financial measures are nonetheless

recognized under IFRS and have an economic impact on us. Management

compensates for these limitations primarily by issuing IFRS results

to show a complete picture of our performance, and reconciling

non-IFRS financial measures back to the most directly comparable

financial measures determined under IFRS.

In calculating the following non-IFRS financial

measures: adjusted gross profit, adjusted gross margin, adjusted

SG&A, adjusted SG&A as a percentage of revenue, non-IFRS

operating earnings, non-IFRS operating margin, adjusted net

earnings, adjusted EPS, and adjusted tax expense, management

excludes the following items (where indicated): employee SBC

expense, total return swap (TRS) fair value adjustments (FVAs),

amortization of intangible assets (excluding computer software),

and Other Charges (Recoveries) (defined below), all net of the

associated tax adjustments (quantified in the table below), and any

non-core tax impacts (tax adjustments related to acquisitions, and

certain other tax costs or recoveries related to restructuring

actions or restructured sites). The economic substance of these

exclusions (where applicable to the periods presented) and

management’s rationale for excluding them from non-IFRS financial

measures is provided below. In addition, in calculating adjusted

net earnings and adjusted EPS, management intends to exclude any

one-time prior period portion of cumulative retroactive and

deferred tax adjustments related to Pillar Two legislation when

such legislation is substantively enacted in Canada, as such prior

period adjustments will not be attributable to our operations for

the period when such legislation first becomes applicable or for

subsequent periods. The determination of our non-IFRS adjusted

effective tax rate, adjusted free cash flow, and adjusted ROIC is

described in footnote 2, 3 and 4 to the table below,

respectively.

Employee SBC expense, which represents the

estimated fair value of stock options, restricted share units and

performance share units granted to employees, is excluded because

grant activities vary significantly from quarter-to-quarter in both

quantity and fair value. In addition, excluding this expense allows

us to better compare core operating results with those of our

competitors who also generally exclude employee SBC expense in

assessing operating performance, who may have different granting

patterns and types of equity awards, and who may use different

valuation assumptions than we do.

TRS FVAs represent mark-to-market adjustments to

our TRS, as the TRS is recorded at fair value at each quarter end.

We exclude the impact of these non-cash fair value adjustments

(both positive and negative), as they reflect fluctuations in the

market price of our SVS from period to period, and not our ongoing

operating performance. In addition, we believe that excluding these

non-cash adjustments permits a better comparison of our core

operating results to those of our competitors.

Amortization charges (excluding computer

software) consist of non-cash charges against intangible assets

that are impacted by the timing and magnitude of acquired

businesses. Amortization of intangible assets varies among our

competitors, and we believe that excluding these charges permits a

better comparison of core operating results with those of our

competitors who also generally exclude amortization charges in

assessing operating performance.

Other Charges (Recoveries) consist of, when

applicable: Restructuring Charges, net of recoveries (defined

below); Transition Costs (Recoveries) (defined below); net

Impairment charges (defined below); consulting, transaction and

integration costs related to potential and completed acquisitions,

and charges or releases related to the subsequent re-measurement of

indemnification assets or the release of indemnification or other

liabilities recorded in connection with acquisitions; legal

settlements (recoveries); specified credit facility-related

charges; post-employment benefit plan losses; in Q2 2023 and Q3

2023, Secondary Offering Costs (defined below) and, commencing in

Q2 2023, related costs pertaining to certain accounting

considerations. We exclude these charges and recoveries because we

believe that they are not directly related to ongoing operating

results and do not reflect expected future operating expenses after

completion of these activities or incurrence of the relevant costs

or recoveries. Our competitors may record similar charges and

recoveries at different times, and we believe these exclusions

permit a better comparison of our core operating results with those

of our competitors who also generally exclude these types of

charges and recoveries in assessing operating performance.

Restructuring Charges, net of recoveries,

consist of costs relating to: employee severance, lease

terminations, site closings and consolidations, accelerated

depreciation of owned property and equipment which are no longer

used and are available for sale and reductions in

infrastructure.

Transition Costs consist of costs recorded in

connection with: (i) the transfer of manufacturing lines from

closed sites to other sites within our global network; (ii) the

sale of real properties unrelated to restructuring actions

(Property Dispositions); and (iii) when applicable, and consistent

with our prior treatment of duplicate costs related to our 2019

Toronto real property sale, the excess of rental expense

attributable to subleased space over anticipated sublease rental

recoveries under a 10-year lease for our then-anticipated corporate

headquarters (Property Lease) executed in connection with such sale

($3.9 million charge in Q3 2023), as we extended (on a long-term

basis) the lease on our current corporate headquarters in November

2022 due to several Property Lease commencement delays. Transition

Costs consist of direct relocation and duplicate costs (such as

rent expense, utility costs, depreciation charges, and personnel

costs) incurred during the transition periods, as well as cease-use

and other costs incurred in connection with idle or vacated

portions of the relevant premises that we would not have incurred

but for these relocations, transfers and dispositions. Transition

Recoveries consist of any gains recorded in connection with

Property Dispositions. We believe that excluding these costs and

recoveries permits a better comparison of our core operating

results from period-to-period, as these costs or recoveries do not

reflect our ongoing operations once these specified events are

complete.

Impairment charges, which consist of non-cash

charges against goodwill, intangible assets, property, plant and

equipment, and right-of-use (ROU) assets, result primarily when the

carrying value of these assets exceeds their recoverable

amount.

Secondary Offering Costs consisted of costs

associated with the conversion and underwritten public sale of our

shares by Onex Corporation (Onex), our then-controlling

shareholder, in Q2 2023 and Q3 2023. We believe that excluding

Secondary Offering Costs permits a better comparison of our core

operating results from period-to-period, as they did not reflect

our ongoing operations, and are no longer applicable as such

conversions and sales are complete.

Non-core tax impacts are excluded, as we believe

that these costs or recoveries do not reflect core operating

performance and vary significantly among those of our competitors

who also generally exclude these costs or recoveries in assessing

operating performance.

The following table (which is unaudited) sets

forth, for the periods indicated, the various non-IFRS financial

measures discussed above, and a reconciliation of such non-IFRS

financial measures to the most directly comparable financial

measures determined under IFRS (in millions, except

percentages and per share amounts):

| |

Three months ended March 31 |

| |

|

2023 |

|

|

|

2024 |

|

| |

|

% of revenue |

|

|

% of revenue |

| IFRS

revenue |

$ |

1,837.8 |

|

|

|

$ |

2,208.9 |

|

|

| |

|

|

|

|

|

|

IFRS gross profit |

$ |

164.0 |

|

8.9 |

% |

|

$ |

228.8 |

|

10.4 |

% |

|

Employee SBC expense |

|

8.5 |

|

|

|

|

8.9 |

|

|

|

TRS FVAs: losses (gains) |

|

0.1 |

|

|

|

|

(12.8 |

) |

|

| Non-IFRS adjusted

gross profit |

$ |

172.6 |

|

9.4 |

% |

|

$ |

224.9 |

|

10.2 |

% |

| |

|

|

|

|

|

| IFRS

SG&A |

$ |

77.9 |

|

4.2 |

% |

|

$ |

65.2 |

|

3.0 |

% |

|

Employee SBC expense |

|

(13.5 |

) |

|

|

|

(13.8 |

) |

|

|

TRS FVAs: (losses) gains |

|

(0.1 |

) |

|

|

|

18.7 |

|

|

| Non-IFRS adjusted

SG&A |

$ |

64.3 |

|

3.5 |

% |

|

$ |

70.1 |

|

3.2 |

% |

| |

|

|

|

|

|

| IFRS earnings from

operations |

$ |

59.4 |

|

3.2 |

% |

|

$ |

132.1 |

|

6.0 |

% |

|

Employee SBC expense |

|

22.0 |

|

|

|

|

22.7 |

|

|

|

TRS FVAs: losses (gains) |

|

0.2 |

|

|

|

|

(31.5 |

) |

|

|

Amortization of intangible assets (excluding computer

software) |

|

9.2 |

|

|

|

|

9.3 |

|

|

|

Other Charges, net of Recoveries |

|

4.6 |

|

|

|

|

4.8 |

|

|

| Non-IFRS operating

earnings (adjusted EBIAT)(1) |

$ |

95.4 |

|

5.2 |

% |

|

$ |

137.4 |

|

6.2 |

% |

| |

|

|

|

|

|

| IFRS net

earnings |

$ |

24.7 |

|

1.3 |

% |

|

$ |

101.7 |

|

4.6 |

% |

|

Employee SBC expense |

|

22.0 |

|

|

|

|

22.7 |

|

|

|

TRS FVAs: losses (gains) |

|

0.2 |

|

|

|

|

(31.5 |

) |

|

|

Amortization of intangible assets (excluding computer

software) |

|

9.2 |

|

|

|

|

9.3 |

|

|

|

Other Charges, net of Recoveries |

|

4.6 |

|

|

|

|

4.8 |

|

|

|

Adjustments for taxes(2) |

|

(3.5 |

) |

|

|

|

(4.7 |

) |

|

| Non-IFRS adjusted net

earnings |

$ |

57.2 |

|

|

|

$ |

102.3 |

|

|

| |

|

|

|

|

|

| Diluted

EPS |

|

|

|

|

|

|

Weighted average # of shares (in millions) |

|

121.6 |

|

|

|

|

119.3 |

|

|

|

IFRS earnings per share |

$ |

0.20 |

|

|

|

$ |

0.85 |

|

|

|

Non-IFRS adjusted earnings per share |

$ |

0.47 |

|

|

|

$ |

0.86 |

|

|

|

# of shares outstanding at period end (in millions) |

|

120.7 |

|

|

|

|

118.8 |

|

|

| |

|

|

|

|

|

| IFRS cash provided by

operations |

$ |

72.3 |

|

|

|

$ |

131.1 |

|

|

|

Purchase of property, plant and equipment |

|

(33.1 |

) |

|

|

|

(40.4 |

) |

|

|

Lease payments |

|

(11.3 |

) |

|

|

|

(11.7 |

) |

|

|

Finance Costs paid |

|

(18.7 |

) |

|

|

|

(13.8 |

) |

|

| Non-IFRS adjusted free

cash flow (3) |

$ |

9.2 |

|

|

|

$ |

65.2 |

|

|

| |

|

|

|

|

|

| IFRS ROIC %

(4) |

|

11.2 |

% |

|

|

|

23.8 |

% |

|

| Non-IFRS adjusted ROIC

% (4) |

|

17.9 |

% |

|

|

|

24.8 |

% |

|

(1) Management uses non-IFRS operating earnings

(adjusted EBIAT) as a measure to assess performance related to our

core operations. Non-IFRS operating earnings is defined as earnings

from operations before employee SBC expense, TRS FVAs (defined

above), amortization of intangible assets (excluding computer

software), and Other Charges (Recoveries) (defined above). See note

8 to our Q1 2024 Interim Financial Statements for separate

quantification and discussion of the components of Other Charges

(Recoveries). Non-IFRS operating margin is non-IFRS operating

earnings as a percentage of revenue.

(2) The adjustments for taxes, as applicable,

represent the tax effects of our non-IFRS adjustments (see

below).

The following table sets forth a reconciliation

of our non-IFRS adjusted tax expense and our non-IFRS adjusted

effective tax rate to our IFRS tax expense and IFRS effective tax

rate, respectively, for the periods indicated, in each case

determined by excluding the tax benefits or costs associated with

the listed items (in millions, except percentages) from our IFRS

tax expense for such periods. Our IFRS effective tax rate is

determined by dividing (i) IFRS tax expense by (ii) earnings from

operations minus Finance Costs (defined in footnote (3) below); our

non-IFRS adjusted effective tax rate is determined by dividing (i)

non-IFRS adjusted tax expense by (ii) non-IFRS operating earnings

minus Finance Costs.

| |

Three months ended March 31 |

|

|

|

2023 |

|

|

|

2024 |

|

| IFRS tax expense |

$ |

13.0 |

|

|

$ |

13.9 |

|

| |

|

|

|

| Tax costs (benefits) of the

following items excluded from IFRS tax expense: |

|

|

|

|

Employee SBC expense and TRS FVAs |

|

2.3 |

|

|

|

3.6 |

|

|

Amortization of intangible assets (excluding computer

software) |

|

0.8 |

|

|

|

0.8 |

|

|

Other Charges, net of Recoveries |

|

0.4 |

|

|

|

0.3 |

|

| Non-IFRS adjusted tax

expense |

$ |

16.5 |

|

|

$ |

18.6 |

|

| |

|

|

|

| IFRS tax expense |

$ |

13.0 |

|

|

$ |

13.9 |

|

| |

|

|

|

| Earnings from operations |

$ |

59.4 |

|

|

$ |

132.1 |

|

| Finance Costs |

|

(21.7 |

) |

|

|

(16.5 |

) |

| |

$ |

37.7 |

|

|

$ |

115.6 |

|

| |

|

|

|

| IFRS effective tax rate |

|

34 |

% |

|

|

12 |

% |

| |

|

|

|

| Non-IFRS adjusted tax

expense |

$ |

16.5 |

|

|

$ |

18.6 |

|

| |

|

|

|

| Non-IFRS operating

earnings |

$ |

95.4 |

|

|

$ |

137.4 |

|

| Finance Costs |

|

(21.7 |

) |

|

|

(16.5 |

) |

| |

$ |

73.7 |

|

|

$ |

120.9 |

|

| |

|

|

|

| Non-IFRS adjusted effective

tax rate |

|

22 |

% |

|

|

15 |

% |

(3) Management uses non-IFRS adjusted free cash

flow as a measure, in addition to IFRS cash provided by (used in)

operations, to assess our operational cash flow performance. We

believe non-IFRS adjusted free cash flow provides another level of

transparency to our liquidity. Non-IFRS adjusted free cash flow is

defined as cash provided by (used in) operations after the purchase

of property, plant and equipment (net of proceeds from the sale of

certain surplus equipment and property, when applicable), lease

payments, and Finance Costs (defined below) paid (excluding,

when applicable, any debt issuance costs and credit facility waiver

fees paid). Finance Costs consist of interest expense and fees

related to our credit facility (including debt issuance and related

amortization costs), our interest rate swap agreements, our TRS

Agreement, our accounts receivable sales program and customers'

supplier financing programs, and interest expense on our lease

obligations, net of interest income earned. We do not consider debt

issuance costs paid or credit facility waiver fees paid (when

applicable) to be part of our ongoing financing expenses. As a

result, these costs are excluded from total Finance Costs paid in

our determination of non-IFRS adjusted free cash flow (no such

costs were applicable to the periods presented in this table). We

believe that excluding Finance Costs paid (other than debt issuance

costs and credit-agreement-related waiver fees paid) from cash

provided by operations in the determination of non-IFRS adjusted

free cash flow provides useful insight for assessing the

performance of our core operations. Note, however, that non-IFRS

adjusted free cash flow does not represent residual cash flow

available to Celestica for discretionary expenditures.

(4) Management uses non-IFRS adjusted ROIC as a

measure to assess the effectiveness of the invested capital we use

to build products or provide services to our customers, by

quantifying how well we generate earnings relative to the capital

we have invested in our business. Non-IFRS adjusted ROIC is

calculated by dividing annualized non-IFRS adjusted EBIAT by

average net invested capital for the period. Net invested capital

(calculated in the tables below) is derived from IFRS financial

measures, and is defined as total assets less: cash, ROU assets,

accounts payable, accrued and other current liabilities,

provisions, and income taxes payable. We use a two-point average to

calculate average net invested capital for the quarter. Average net

invested capital for Q1 2024 is the average of net invested capital

as at March 31, 2024 and December 31, 2023. A comparable financial

measure to non-IFRS adjusted ROIC determined using IFRS measures

would be calculated by dividing annualized IFRS earnings from

operations by average net invested capital for the period.

The following table sets forth, for the periods

indicated, our calculation of IFRS ROIC % and non-IFRS adjusted

ROIC % (in millions, except IFRS ROIC % and non-IFRS adjusted ROIC

%).

| |

Three months ended |

| |

March 31 |

|

|

|

2023 |

|

|

|

2024 |

|

| |

|

|

|

| IFRS earnings from

operations |

$ |

59.4 |

|

|

$ |

132.1 |

|

| Multiplier to annualize

earnings |

|

4 |

|

|

|

4 |

|

| Annualized IFRS earnings from

operations |

$ |

237.6 |

|

|

$ |

528.4 |

|

| |

|

|

|

| Average net invested capital

for the period |

$ |

2,127.1 |

|

|

$ |

2,217.4 |

|

| |

|

|

|

| IFRS ROIC % (1) |

|

11.2 |

% |

|

|

23.8 |

% |

| |

|

|

|

| |

Three months ended |

| |

March 31 |

| |

|

2023 |

|

|

|

2024 |

|

| |

|

|

|

| Non-IFRS operating earnings

(adjusted EBIAT) |

$ |

95.4 |

|

|

$ |

137.4 |

|

| Multiplier to annualize

earnings |

|

4 |

|

|

|

4 |

|

| Annualized non-IFRS adjusted

EBIAT |

$ |

381.6 |

|

|

$ |

549.6 |

|

| |

|

|

|

| Average net invested capital

for the period |

$ |

2,127.1 |

|

|

$ |

2,217.4 |

|

| |

|

|

|

| Non-IFRS adjusted ROIC %

(1) |

|

17.9 |

% |

|

|

24.8 |

% |

| |

December 312023 |

|

March 312024 |

| Net invested capital consists

of: |

|

|

|

|

Total assets |

$ |

5,890.7 |

|

|

$ |

5,717.1 |

|

| Less: cash |

|

370.4 |

|

|

|

308.1 |

|

| Less: ROU assets |

|

154.0 |

|

|

|

180.1 |

|

| Less: accounts payable,

accrued and other current liabilities, provisions and income taxes

payable |

|

3,167.9 |

|

|

|

2,992.6 |

|

| Net invested capital at period

end (1) |

$ |

2,198.4 |

|

|

$ |

2,236.3 |

|

| |

|

|

|

|

|

December 312022 |

|

March 312023 |

| Net invested capital consists

of: |

|

|

|

| Total assets |

$ |

5,628.0 |

|

|

$ |

5,468.1 |

|

| Less: cash |

|

374.5 |

|

|

|

318.7 |

|

| Less: ROU assets |

|

138.8 |

|

|

|

133.1 |

|

| Less: accounts payable,

accrued and other current liabilities, provisions and income taxes

payable |

|

3,003.0 |

|

|

|

2,873.9 |

|

| Net invested capital at period

end (1) |

$ |

2,111.7 |

|

|

$ |

2,142.4 |

|

(1) See footnote 4 on the previous

page.

|

|

|

CELESTICA INC. CONDENSED

CONSOLIDATED BALANCE SHEET(in millions of

U.S. dollars)(unaudited) |

| |

|

|

|

|

| |

Note |

December 312023 |

|

March 312024 |

| |

|

|

|

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

370.4 |

|

|

$ |

308.1 |

|

|

Accounts receivable |

4 |

|

1,795.7 |

|

|

|

1,815.2 |

|

|

Inventories |

5 |

|

2,106.1 |

|

|

|

1,959.2 |

|

|

Income taxes receivable |

|

|

11.9 |

|

|

|

11.8 |

|

|

Other current assets |

10 |

|

228.5 |

|

|

|

232.5 |

|

| Total current assets |

|

|

4,512.6 |

|

|

|

4,326.8 |

|

| |

|

|

|

|

| Property, plant and

equipment |

|

|

472.7 |

|

|

|

467.9 |

|

| Right-of-use assets |

|

|

154.0 |

|

|

|

180.1 |

|

| Goodwill |

|

|

321.7 |

|

|

|

321.5 |

|

| Intangible assets |

|

|

318.3 |

|

|

|

309.2 |

|

| Deferred income taxes |

|

|

62.5 |

|

|

|

65.5 |

|

| Other non-current assets |

10 |

|

48.9 |

|

|

|

46.1 |

|

| Total assets |

|

$ |

5,890.7 |

|

|

$ |

5,717.1 |

|

| |

|

|

|

|

| Liabilities and

Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Current portion of borrowings under credit facility and lease

obligations |

6 |

$ |

51.6 |

|

|

$ |

54.3 |

|

|

Accounts payable |

|

|

1,298.2 |

|

|

|

1,388.1 |

|

|

Accrued and other current liabilities |

5&10 |

|

1,781.3 |

|

|

|

1,516.2 |

|

|

Income taxes payable |

|

|

64.8 |

|

|

|

65.7 |

|

|

Current portion of provisions |

|

|

23.6 |

|

|

|

22.6 |

|

| Total current liabilities |

|

|

3,219.5 |

|

|

|

3,046.9 |

|

| |

|

|

|

|

| Long-term portion of borrowings

under credit facility and lease obligations |

6 |

|

731.2 |

|

|

|

778.4 |

|

| Pension and non-pension

post-employment benefit obligations |

|

|

88.1 |

|

|

|

86.1 |

|

| Provisions and other non-current

liabilities |

|

|

41.2 |

|

|

|

47.2 |

|

| Deferred income taxes |

|

|

42.2 |

|

|

|

47.0 |

|

| Total liabilities |

|

|

4,122.2 |

|

|

|

4,005.6 |

|

| |

|

|

|

|

| Equity: |

|

|

|

|

|

Capital stock |

7 |

|

1,672.5 |

|

|

|

1,671.5 |

|

|

Treasury stock |

7 |

|

(80.1 |

) |

|

|

(95.0 |

) |

|

Contributed surplus |

|

|

1,030.6 |

|

|

|

896.8 |

|

|

Deficit |

|

|

(839.6 |

) |

|

|

(737.9 |

) |

|

Accumulated other comprehensive loss |

|

|

(14.9 |

) |

|

|

(23.9 |

) |

| Total equity |

|

|

1,768.5 |

|

|

|

1,711.5 |

|

| Total liabilities and equity |

|

$ |

5,890.7 |

|

|

$ |

5,717.1 |

|

| |

|

|

|

|

Commitments

and Contingencies (note 11). Subsequent event (note 11).

The accompanying notes are an integral part of

these unaudited interim condensed consolidated financial

statements.

| |

|

|

|

CELESTICA INC. CONDENSED

CONSOLIDATED STATEMENT OF

OPERATIONS(in millions of U.S. dollars,

except per share amounts)(unaudited) |

| |

|

|

| |

|

Three months ended |

| |

|

March 31 |

|

|

Note |

|

2023 |

|

|

|

2024 |

|

| |

|

|

|

|

| Revenue |

3 |

$ |

1,837.8 |

|

|

$ |

2,208.9 |

|

| Cost of sales |

5 |

|

1,673.8 |

|

|

|

1,980.1 |

|

| Gross profit |

|

|

164.0 |

|

|

|

228.8 |

|

| Selling, general and

administrative expenses |

|

|

77.9 |

|

|

|

65.2 |

|

| Research and development |

|

|

12.1 |

|

|

|

16.5 |

|

| Amortization of intangible

assets |

|

|

10.0 |

|

|

|

10.2 |

|

| Other charges, net of

recoveries |

8 |

|

4.6 |

|

|

|

4.8 |

|

| Earnings from operations |

|

|

59.4 |

|

|

|

132.1 |

|

| Finance costs |

6 |

|

21.7 |

|

|

|

16.5 |

|

| Earnings before income

taxes |

|

|

37.7 |

|

|

|

115.6 |

|

| Income tax expense

(recovery) |

9 |

|

|

|

|

Current |

|

|

17.9 |

|

|

|

11.3 |

|

|

Deferred |

|

|

(4.9 |

) |

|

|

2.6 |

|

|

|

|

|

13.0 |

|

|

|

13.9 |

|

| Net earnings for the

period |

|

$ |

24.7 |

|

|

$ |

101.7 |

|

| |

|

|

|

|

| Basic earnings per share |

|

$ |

0.20 |

|

|

$ |

0.85 |

|

| Diluted earnings per

share |

|

$ |

0.20 |

|

|

$ |

0.85 |

|

| |

|

|

|

|

| Shares used in computing per

share amounts (in millions): |

|

|

|

|

|

Basic |

|

|

121.5 |

|

|

|

119.0 |

|

|

Diluted |

|

|

121.6 |

|

|

|

119.3 |

|

The accompanying notes are an integral part of

these unaudited interim condensed consolidated financial

statements.

| |

|

|

CELESTICA INC.CONDENSED CONSOLIDATED

STATEMENT OF COMPREHENSIVE INCOME(in millions

of U.S. dollars)(unaudited) |

|

|

|

| |

Three months ended |

| |

March 31 |

|

|

|

2023 |

|

|

|

2024 |

|

| |

|

|

|

| Net earnings for the

period |

$ |

24.7 |

|

|

$ |

101.7 |

|

| Other comprehensive income

(loss), net of tax: |

|

|

|

|

Items that may be reclassified to net earnings: |

|

|

|

|

Currency translation differences for foreign operations |

|

(1.5 |

) |

|

|

(3.3 |

) |

|

Changes from currency forward derivative hedges |

|

1.1 |

|

|

|

(6.7 |

) |

|

Changes from interest rate swap derivative hedges |

|

(3.6 |

) |

|

|

1.0 |

|

| Total comprehensive income for

the period |

$ |

20.7 |

|

|

$ |

92.7 |

|

The accompanying notes are an integral part of

these unaudited interim condensed consolidated financial

statements.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

CELESTICA INC. CONDENSED CONSOLIDATED

STATEMENT OF CHANGES IN EQUITY(in millions of U.S.

dollars)(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Note |

Capital stock(note

7) |

|

Treasury

stock (note 7) |

|

Contributedsurplus |

|

Deficit |

|

Accumulated other

comprehensiveloss

(a) |

|

Total equity |

|

Balance -- January 1, 2023 |

|

$ |

1,714.9 |

|

|

$ |

(18.5 |

) |

|

$ |

1,063.6 |

|

|

$ |

(1,076.6 |

) |

|

$ |

(5.7 |

) |

|

$ |

1,677.7 |

|

| Capital

transactions: |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of capital stock |

|

|

0.1 |

|

|

|

— |

|

|

|

(0.1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Repurchase of capital stock for cancellation(b) |

|

|

(15.5 |

) |

|

|

1.8 |

|

|

|

(1.9 |

) |

|

|

— |

|

|

|

— |

|

|

|

(15.6 |

) |

|

Stock-based compensation (SBC) cash settlement |

7 |

|

— |

|

|

|

— |

|

|

|

(49.8 |

) |

|

|

— |

|

|

|

— |

|

|

|

(49.8 |

) |

|

Equity-settled SBC |

|

|

— |

|

|

|

6.4 |

|

|

|

16.1 |

|

|

|

— |

|

|

|

— |

|

|

|

22.5 |

|

| Total comprehensive

income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

24.7 |

|

|

|

— |

|

|

|

24.7 |

|

|

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency translation differences for foreign operations |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.5 |

) |

|

|

(1.5 |

) |

|

Changes from currency forward derivative hedges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1.1 |

|

|

|

1.1 |

|

|

Changes from interest rate swap derivative hedges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3.6 |

) |

|

|

(3.6 |

) |

| Balance -- March 31, 2023 |

|

$ |

1,699.5 |

|

|

$ |

(10.3 |

) |

|

$ |

1,027.9 |

|

|

$ |

(1,051.9 |

) |

|

$ |

(9.7 |

) |

|

$ |

1,655.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Balance -- January 1,

2024 |

|

$ |

1,672.5 |

|

|

$ |

(80.1 |

) |

|

$ |

1,030.6 |

|

|

$ |

(839.6 |

) |

|

$ |

(14.9 |

) |

|

$ |

1,768.5 |

|

| Capital

transactions: |

7 |

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of capital stock |

|

|

5.4 |

|

|

|

— |

|

|

|

(1.5 |

) |

|

|

— |

|

|

|

— |

|

|

|

3.9 |

|

|

Repurchase of capital stock for cancellation(c) |

|

|

(6.4 |

) |

|

|

— |

|

|

|

(7.4 |

) |

|

|

— |

|

|

|

— |

|

|

|

(13.8 |

) |

|

Purchase of treasury stock for SBC plans (d) |

|

|

— |

|

|

|

(94.1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(94.1 |

) |

|

SBC cash settlement |

|

|

— |

|

|

|

— |

|

|

|

(69.0 |

) |

|

|

— |

|

|

|

— |

|

|

|

(69.0 |

) |

|

Equity-settled SBC |

|

|

— |

|

|

|

79.2 |

|

|

|

(55.9 |

) |

|

|

— |

|

|

|

— |

|

|

|

23.3 |

|

| Total comprehensive

income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

101.7 |

|

|

|

— |

|

|

|

101.7 |

|

|

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency translation differences for foreign operations |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3.3 |

) |

|

|

(3.3 |

) |

|

Changes from currency forward derivative hedges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6.7 |

) |

|

|

(6.7 |

) |

|

Changes from interest rate swap derivative hedges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1.0 |

|

|

|

1.0 |

|

| Balance -- March 31, 2024 |

|

$ |

1,671.5 |

|

|

$ |

(95.0 |

) |

|

$ |

896.8 |

|

|

$ |

(737.9 |

) |

|

$ |

(23.9 |

) |

|

$ |

1,711.5 |

|

(a) Accumulated other comprehensive loss is net of tax.(b)

Consists of $10.6 paid to repurchase subordinate voting shares

(SVS) for cancellation during the first quarter of 2023 and $5.0

accrued at March 31, 2023 for the contractual maximum spend

for SVS repurchases for cancellation under an automatic share

purchase plan (ASPP) executed in February 2023 for such purpose

(see note 7).(c) Consists of $16.5 paid to repurchase SVS for

cancellation during the first quarter of 2024, offset in part by

the reversal of $2.7 accrued at December 31, 2023 for the

estimated contractual maximum quantity of permitted SVS repurchases

(Contractual Maximum Quantity) under an ASPP executed in December

2023 for such purpose (see note 7).(d) Consists of $101.6 paid to

repurchase SVS for delivery obligations under our SBC plans during

the first quarter of 2024, offset in part by the reversal of $7.5

accrued at December 31, 2023 for the estimated Contractual

Maximum Quantity under an ASPP executed in September 2023 for such

purpose (see note 7).

The accompanying notes are an integral part of

these unaudited interim condensed consolidated financial

statements.

| |

|

|

|

CELESTICA INC.CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS(in millions of U.S.

dollars)(unaudited) |

| |

|

|

| |

|

Three months ended |

| |

|

March 31 |

|

|

Note |

|

2023 |

|

|

|

2024 |

|

| |

|

|

|

|

| Cash provided by (used

in): |

|

|

|

|

| Operating

activities: |

|

|

|

|

| Net earnings for the

period |

|

$ |

24.7 |

|

|

$ |

101.7 |

|

| Adjustments to net earnings

for items not affecting cash: |

|

|

|

|

|

Depreciation and amortization |

|

|

38.3 |

|

|

|

43.6 |

|

|

Equity-settled employee SBC expense |

7 |

|

22.0 |

|

|

|

22.7 |

|

|

Total return swap fair value adjustments: losses (gains) |

|

|

0.2 |

|

|

|

(31.5 |

) |

|

Other charges |

8 |

|

— |

|

|

|

0.7 |

|

|

Finance costs |

|

|

21.7 |

|

|

|

16.5 |

|

|

Income tax expense |

|

|

13.0 |

|

|

|

13.9 |

|

| Other |

|

|

3.3 |

|

|

|

2.0 |

|

| Changes in non-cash working

capital items: |

|

|

|

|

|

Accounts receivable |

|

|

133.5 |

|

|

|

(16.8 |

) |

|

Inventories |

|

|

(53.0 |

) |

|

|

146.9 |

|

|

Other current assets |

|

|

8.6 |

|

|

|

(10.1 |

) |

|

Accounts payable, accrued and other current liabilities and

provisions |

|

|

(129.2 |

) |

|

|

(139.6 |

) |

| Non-cash working capital

changes |

|

|

(40.1 |

) |

|

|

(19.6 |

) |

| Net income tax paid |

|

|

(10.8 |

) |

|

|

(18.9 |

) |

| Net cash provided by operating

activities |

|

|

72.3 |

|

|

|

131.1 |

|

| |

|

|

|

|

| Investing

activities: |

|

|

|

|

| Purchase of computer software

and property, plant and equipment |

|

|

(33.1 |

) |

|

|

(40.4 |

) |

| Net cash used in investing

activities |

|

|

(33.1 |

) |

|

|

(40.4 |

) |

| |

|

|

|

|

| Financing

activities: |

|

|

|

|

| Revolving loan borrowings |

6 |

|

— |

|

|

|

285.0 |

|

| Revolving loan repayments |

6 |

|

— |

|

|

|

(257.0 |

) |

| Term loan repayments |

6 |

|

(4.6 |

) |

|

|

(4.6 |

) |

| Lease payments |

|

|

(11.3 |

) |

|

|

(11.7 |

) |

| Issuance of capital stock |

7 |

|

— |

|

|

|

3.9 |

|

| Repurchase of capital stock

for cancellation |

7 |

|

(10.6 |

) |

|

|

(16.5 |

) |

| Purchase of treasury stock for

stock-based plans |

7 |

|

— |

|

|

|

(101.6 |

) |

|

Proceeds from partial total return swap settlement |

10 |

|

— |

|

|

|

32.3 |

|

|

SBC cash settlement |

7 |

|

(49.8 |

) |

|

|

(69.0 |

) |

|

Finance costs paid |

6 |

|

(18.7 |

) |

|

|

(13.8 |

) |

| Net cash used in financing

activities |

|

|

(95.0 |

) |

|

|

(153.0 |

) |

| |

|

|

|

|

|

Net decrease in cash and cash equivalents |

|

|

(55.8 |

) |

|

|

(62.3 |

) |

|

Cash and cash equivalents, beginning of period |

|

|

374.5 |

|

|

|

370.4 |

|

|

Cash and cash equivalents, end of period |

|

$ |

318.7 |

|

|

$ |

308.1 |

|

The accompanying notes are an integral part of

these unaudited interim condensed consolidated financial

statements.

1. REPORTING

ENTITY

Celestica Inc. (referred to herein as Celestica,

the Company, we, us, or our) is incorporated in Ontario with its

corporate headquarters located in Toronto, Ontario, Canada.

Celestica’s subordinate voting shares (SVS) are listed on the

Toronto Stock Exchange (TSX) and the New York Stock Exchange

(NYSE).

2. BASIS OF PREPARATION

AND MATERIAL ACCOUNTING POLICIES

Statement of compliance:

These unaudited interim condensed consolidated

financial statements for the quarter ended March 31, 2024 (Q1

2024 Interim Financial Statements) have been prepared in accordance

with International Accounting Standard (IAS) 34, Interim Financial

Reporting, and the accounting policies we have adopted in

accordance with International Financial Reporting Standards (IFRS),

in each case as issued by the International Accounting Standards

Board (IASB), and reflect all adjustments that are, in the opinion

of management, necessary to present fairly our financial position

as of March 31, 2024 and our financial performance,

comprehensive income and cash flows for the three months ended

March 31, 2024 (referred to herein as Q1 2024). The Q1 2024

Interim Financial Statements should be read in conjunction with our

2023 audited consolidated financial statements (2023 AFS), which

are included in our Annual Report on Form 20-F for the year ended

December 31, 2023. The Q1 2024 Interim Financial Statements are

presented in United States (U.S.) dollars, which is also

Celestica's functional currency. Unless otherwise noted, all

financial information is presented in millions of U.S. dollars

(except percentages and per share/per unit amounts).

The Q1 2024 Interim Financial Statements were

authorized for issuance by our Board of Directors on April 24,

2024.

Use of estimates and

judgments:

The preparation of financial statements in

conformity with IFRS requires management to make judgments,

estimates and assumptions that affect the application of accounting

policies, the reported amounts of assets, liabilities, revenue and

expenses, and related disclosures with respect to contingent assets

and liabilities. We base our judgments, estimates and assumptions

on current facts (including, in recent periods, the prolonged

impact of global supply chain constraints), historical experience

and various other factors that we believe are reasonable under the

circumstances. The economic environment also impacts certain

estimates and discount rates necessary to prepare our consolidated

financial statements, including significant estimates and discount

rates applicable to the determination of the recoverable amounts

used in the impairment testing of our non-financial assets. Our

assessment of these factors forms the basis for our judgments on

the carrying values of our assets and liabilities, and the accrual

of our costs and expenses. Actual results could differ materially

from our estimates and assumptions. We review our estimates and

underlying assumptions on an ongoing basis and make revisions as

determined necessary by management. Revisions are recognized in the

period in which the estimates are revised and may also impact

future periods.

Our review of the estimates, judgments and

assumptions used in the preparation of the Q1 2024 Interim

Financial Statements included those relating to, among others: our

determination of the timing of revenue recognition, the

determination of whether indicators of impairment existed for our

assets and cash generating units (CGUs1), our measurement of

deferred tax assets and liabilities, our estimated inventory

write-downs and expected credit losses, and customer

creditworthiness. Any revisions to estimates, judgments or

assumptions may result in, among other things, write-downs,

accelerated depreciation or amortization, or impairments to our

assets or CGUs, and/or adjustments to the carrying amount of our

accounts receivable and/or inventories, or to the valuation of our

deferred tax assets, any of which could have a material impact on

our financial performance and financial condition.

Accounting policies:

Except for Amendments to IAS 1, adopted as of

January 1, 2024 as described below, the Q1 2024 Interim Financial

Statements are based on accounting policies consistent with those

described in note 2 to our 2023 AFS.

Recently adopted accounting standards

and amendments:

Classification of liabilities as current or

non-current (Amendments to IAS 1)

In January 2020, the IASB issued Classification

of liabilities as current or non-current (Amendments to IAS 1) to

clarify how to classify debt and other liabilities as current or

non-current. The amendments are effective for reporting periods

beginning on or after January 1, 2024. This standard, which we

adopted as of January 1, 2024, did not have a material impact on

our consolidated financial statements.

Recently issued but not yet effective

standards:

IFRS 18 Presentation and Disclosure in Financial

Statements

In April 2024, the IASB issued IFRS 18

Presentation and Disclosure in Financial Statements. IFRS 18

replaces IAS 1 Presentation of Financial Statements and sets out

requirements for the presentation and disclosure of information in

general purpose financial statements. The standard applies to

annual reporting periods beginning on or after January 1, 2027 and

is to be applied retrospectively, with early adoption permitted. We

have not yet adopted such standard and are currently assessing the

impact on our consolidated financial statements.

3.

SEGMENT AND CUSTOMER REPORTING

Segments:

Celestica delivers innovative supply chain

solutions globally to customers in two operating and reportable

segments: Advanced Technology Solutions (ATS) and Connectivity

& Cloud Solutions (CCS). Our ATS segment consists of our ATS

end market, and is comprised of our Aerospace and Defense

(A&D), Industrial, HealthTech and Capital Equipment businesses.

Our CCS segment consists of our Communications and Enterprise

(servers and storage) end markets. Segment performance is evaluated

based on segment revenue, segment income and segment margin

(segment income as a percentage of segment revenue). See note 25 to

our 2023 AFS for a description of the businesses that comprise our

segments, how segment revenue is attributed, how costs are

allocated to our segments, and how segment income and segment

margin are determined.

Information regarding the performance of our

reportable segments is set forth below:

| Revenue by

segment: |

Three months ended March 31 |

| |

|

2023 |

|

|

|

2024 |

|

| |

|

% of total |

|

|

% of total |

|

ATS |

$ |

792.2 |

43 |

% |

|

$ |

767.9 |

35 |

% |

| CCS |

|

1,045.6 |

57 |

% |

|

|

1,441.0 |

65 |

% |

|

Communications end market revenue as a % of total revenue |

|

36 |

% |

|

|

34 |

% |

|

Enterprise end market revenue as a % of total revenue |

|

21 |

% |