Transport Sector Signals Problems Ahead for Industrial Stocks

24 Juli 2019 - 10:14PM

Dow Jones News

By Jessica Menton

Caterpillar Inc.'s earnings disappointed on Wednesday, and there

are early indications that there's more pain coming for industrial

stocks.

Often, investors look to transport companies to glean what's

ahead for big industrial firms -- and the sector has had a bumpy

ride recently. Muted results from railroad operators, including CSX

Corp., were the latest dose of gloomy news.

Another worrisome sign for industrials: According to the Cass

Freight Index of North American shipments by truck and rail,

shipments declined 5.3% in June, the seventh consecutive monthly

decline. Cass Information Systems Inc., a processor of freight

payments for companies, points especially to a drop in chemical

shipments.

"We have asserted for years that one of the best predictive

indicators of U.S. domestic industrial activity is the chemical

carload volume moved via railroad," said the index report. "It is

almost impossible to manufacture, even assemble, anything in mass

quantity without chemicals."

The threat of tariffs are also weighing on industrial

companies.

"What's worrisome is that we're seeing high inventories across

the industrial world, perhaps related to trade tensions as

companies buy extra inventories," said Rob Wertheimer, a founding

partner and machinery analyst at Melius Research.

But even as the industrial economy comes under pressure, there

are signs from the transport industry that the consumer economy is

holding up. Packaging giant United Parcel Service Inc. reported a

30% jump in next-day air-shipping volumes for the second quarter

Wednesday, sending shares 8.3% higher -- heading toward their best

day since October 2008. Airliner JetBlue Airways Corp. beat

analysts' earnings estimates Tuesday.

Trucks, which are also closely tied to the retail sector, also

suggest consumer firms may fare better than industrials. Heavy-duty

truck maker Paccar Inc. missed profit estimates Tuesday, but

delivered a better-than-expected outlook for orders next year.

Write to Jessica Menton at Jessica.Menton@wsj.com

(END) Dow Jones Newswires

July 24, 2019 15:59 ET (19:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

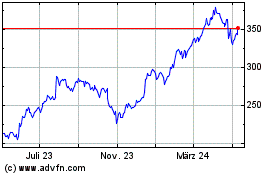

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

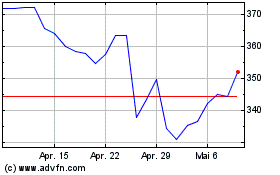

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024