0000016058FALSE00000160582023-08-152023-08-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________

FORM 8-K

_________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 20, 2024

_________________________________________

CACI International Inc

(Exact name of Registrant as Specified in Its Charter)

_________________________________________

| | | | | | | | |

| Delaware | 001-31400 | 54-1345888 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

12021 Sunset Hills Road Reston, Virginia | | 20190 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (703) 841-7800

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | CACI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

| | | | | | | | |

| Item 1.01 | | Entry into a Material Definitive Agreement. |

On December 20, 2024, CACI, Inc. – Federal, a wholly-owned subsidiary of CACI International Inc (the “Company”), and certain of its subsidiaries (the “Sellers”) entered into Amendment No. 6 (the “Amendment”) to the Master Accounts Receivable Purchase Agreement (the “Purchase Agreement”), among CACI International Inc, as Seller Representative, the Sellers, the Company, MUFG Bank, Ltd., as administrative agent, and certain purchasers party thereto.

The Amendment amends the Purchase Agreement to, among other things (i) extend the Scheduled Termination Date from December 20, 2024 to December 19, 2025 and (ii) modify certain commercial provisions of the Purchase Agreement.

Capitalized terms not otherwise defined herein have the meanings set forth in the Purchase Agreement and the Amendment.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by the complete text of the Amendment which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

| | | | | | | | |

| Item 2.03 | | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information included in Item 1.01 of this Current Report on Form 8-K is also incorporated by reference into this Item 2.03 of this Current Report on Form 8-K.

| | | | | | | | |

| Item 9.01 | | Financial Statement and Exhibits. |

| | | | | | | | | | | |

| Exhibit Number | | Description | |

| 10.1 | | | |

| | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

| | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| CACI International Inc |

| | |

| Date: December 27, 2024 | By: | s/ J. William Koegel, Jr. |

| | |

| | J. William Koegel, Jr. |

| | Executive Vice President, General Counsel and Secretary |

Exhibit 10.1

AMENDMENT NO. 6, JOINDER AND WAIVER TO MASTER ACCOUNTS RECEIVABLE PURCHASE AGREEMENT

This AMENDMENT NO. 6, JOINDER and WAIVER to the MASTER ACCOUNTS RECEIVABLE PURCHASE AGREEMENT (this “Amendment”), dated as of December 20, 2024, is among CACI INTERNATIONAL INC, a Delaware corporation, as seller representative (in such capacity, the “Seller Representative”), CACI, INC. - FEDERAL, a Delaware corporation (“CACI Federal”), APPLIED INSIGHT, LLC, a Virginia limited liability company (the “New Seller”), certain of CACI Federal’s Subsidiaries party hereto (collectively with the Seller Representative and CACI Federal, the “Existing Sellers” and each, an “Existing Seller” and the Existing Sellers together with the New Seller, the “Sellers” and each, a “Seller”), R.M. VREDENBURG, LLC, a Virginia limited liability company (“R.M.”). LINNDUSTRIES SHIELDING SPECIALTIES INCORPORATED, a New Mexico corporation (“LINNDUSTRIES” and, together with and R.M., the “Removed Sellers”), and MUFG BANK, LTD. (“MUFG”), as a Purchaser and as administrative agent for the Purchasers (the “Administrative Agent”).

W I T N E S S E T H:

WHEREAS, the Sellers, the Seller Representative, the Purchasers and the Administrative Agent have heretofore entered into the Master Accounts Receivables Purchase Agreement, dated as of December 28, 2018 (as amended, restated, supplemented, assigned or otherwise modified from time to time, the “Receivables Purchase Agreement”);

WHEREAS, concurrently herewith, the Administrative Agent, the Purchasers, the Sellers and the Seller Representative are entering into that certain Fee Letter, dated as of the date hereof (the “Fee Letter”);

WHEREAS, each Removed Seller desires to no longer be party to the Receivable Purchase Agreement or any other Purchase Documents as a Seller thereunder effective as of the date hereof;

WHEREAS, as of the date hereof, there are no outstanding Purchased Receivables sold by any Removed Seller under the Receivables Purchase Agreement;

WHEREAS, (i) the New Seller desires to be joined as a party to the Receivables Purchase Agreement and (ii) the parties hereto seek to modify the Receivables Purchase Agreement, in each case, upon the terms hereof;

WHEREAS, prior to the date hereof, (i) SIX3 Intelligence Solutions, LLC changed its name from “SIX3 Intelligence Solutions, LLC” to “CACI Intelligence Solutions, LLC”, (ii) Ticom Geomatics, Inc. changed its name from “Ticom Geomatics, Inc.” to “CACI Geomatics, Inc.”, (iii) SIX3 Systems, LLC changed its name from “SIX3 Systems, LLC” to “CACI Advanced Solutions, LLC”, (iv) LGS INNOVATIONS LLC changed its name from “LGS INNOVATIONS LLC” to “CACI LGS INNOVATIONS LLC”, and (v) AXIOS TECHNOLOGIES, INC. changed its name from “AXIOS TECHNOLOGIES, INC.” to “CACI AXIOS TECHNOLOGIES, INC.” in each case, without complying with the requirements of Section 10.1 (c)(ii) of the Receivables Purchase Agreement (such name changes as described above, each a “Subject Name Change”);

WHEREAS, the failure to comply with the requirements of Section 10.1 (c)(ii) of the Receivables Purchase Agreement with respect to each Subject Name Change constituted and/or resulted in certain Servicer Replacement Events and Facility Suspension Events under the Receivables Purchase Agreement (such Servicer Replacement Events and Facility Suspension Events, collectively, but solely to the extent (a) occurring on or prior to the date hereof and (b) resulting solely from any Subject Name Change or any failure by the Sellers or the Seller Representative to notify the Purchaser or any other party hereto of the occurrence thereof prior to the date hereof, the “Subject Events”);

WHEREAS, the Sellers and the Seller Representative have requested that the Purchaser waive the occurrence of the Subject Events on the terms and subject to the conditions set forth herein;

WHEREAS, the Purchaser wishes to waive the occurrence of the Subject Events; and

NOW, THEREFORE, in exchange for good and valuable consideration (the receipt and sufficiency of which are hereby acknowledged and confirmed), the parties hereto agree as follows:

A G R E E M E N T:

1.Definitions. Unless otherwise defined or provided herein, capitalized terms used herein have the meanings attributed thereto in (or by reference in) the Receivables Purchase Agreement.

2.Joinder. The New Seller acknowledges and agrees that it is a “Seller” under the Receivables Purchase Agreement, effective upon the date of the New Seller’s execution of this Amendment. All references in the Receivables Purchase Agreement to the term “Seller” or “Sellers” shall be deemed to include the New Seller. Without limiting the generality of the foregoing, the New Seller hereby repeats and reaffirms all covenants, agreements, representations and warranties made or given by a Seller contained in the Receivables Purchase Agreement, and appoints the Seller Representative as its agent, attorney-in-fact and representative in accordance with Section 2.5 of the Receivables Purchase Agreement. Against the possibility that, contrary to the mutual intent of the parties, the purchase of any Receivable is not characterized as a sale by any applicable court, the New Seller hereby grants to the Administrative Agent (for the benefit of the Purchasers) a security interest in, and right of setoff with respect to, all of the Purchased Receivables to secure the payment and performance of the New Seller’s payment and performance obligations under the Receivables Purchase Agreement and under each other Purchase Document. In addition, the New Seller hereby grants to the Administrative Agent, for the benefit of the Purchasers, a security interest in, and right of setoff with respect to, all of the Seller Account Collateral related to such New Seller and all proceeds thereof to secure the payment and performance of the New Seller’s payment and performance obligations under the Receivables Purchase Agreement and under each other Purchase Document.

3.New Seller’s Account. For purposes of the Receivables Purchase Agreement, “Seller Account” with respect to the New Seller means the account of the Seller Representative located at Bank of America, N.A. (ABA No. 051-000-017 (ACH) and 026-009-593 (wires)) with account number 11211189, which account is located at a depository bank reasonably satisfactory to the Administrative Agent and which account is subject to an Account Control Agreement.

4.Waiver; Limitations.

(a)On the terms and subject to the conditions set forth herein, the Purchaser hereby waives the occurrence of each of the Subject Events.

(b)Notwithstanding anything to the contrary herein or in the Purchase Documents, by executing this Amendment, the Purchaser is not now waiving, nor has it agreed to waive in the future (i) the breach of any provision of the Purchase Documents (whether presently or subsequently existing or arising), other than as expressly set forth in clause (a) above, (ii) any Servicer Replacement Events and Facility Suspension Events under the Receivables Purchase Agreement (whether presently or subsequently existing or arising), other than as expressly set forth in clause (a) above or (iii) any rights, powers, privileges or remedies presently or subsequently available to the Purchaser or any other Person against the Sellers or Seller Representative and/or any other Person under the Receivables Purchase Agreement, any of the other Purchase Documents, applicable Law or otherwise, relating to any matter other than solely to the extent expressly waived herein, each of which rights, powers, privileges or remedies is hereby specifically and expressly reserved and continue.

(c)Without limiting the generality of the foregoing and for the avoidance of doubt, the Purchaser is not hereby waiving or releasing, nor has it agreed to waive or release in the future, any right or claim to indemnification or reimbursement by, or damages from, any Seller or the Seller Representative or any other Person under any Purchase Document, including without limitation, for any liability, obligation, loss, damage, penalty, judgment, settlement, cost, expense or disbursement resulting or arising directly or indirectly from any Subject Event or otherwise.

5.Amendments to Receivables Purchase Agreement. The Receivables Purchase Agreement is amended as follows:

(a)As of the date hereof, the Receivables Purchase Agreement is hereby amended to incorporate the changes shown on the marked pages of the Receivables Purchase Agreement attached hereto as Exhibit A.

6.Release of Removed Sellers. The parties hereto hereby agree that upon the effectiveness of this Amendment, (a) each Removed Seller shall no longer be a party to the Receivable Purchase Agreement or any other Purchase Documents and shall no longer have any obligations or rights thereunder and (b) each Removed Seller shall no longer sell any Receivables to Buyer pursuant to the Receivables Purchase Agreement.

7.Authorization to File Financing Statements.

(a)Upon the effectiveness of this Amendment, the Administrative Agent authorizes the Seller Representative or its designees to file (at the expense of the Seller Representative) the UCC-3 financing statement terminations in the forms attached as Exhibit B hereto with respect to each Removed Seller.

(b)Upon the effectiveness of this Amendment, the Administrative Agent authorizes the Seller Representative or its designees to file (at the expense of the Seller Representative) the UCC-1 financing statement in the form attached as Exhibit C hereto.

8.Conditions to Effectiveness. This Amendment shall be effective subject to the satisfaction of the following conditions, each to the satisfaction of the Administrative Agent in its sole discretion and, as to any agreement, document or instrument specified below, each in form and substance satisfactory to the Administrative Agent in its sole discretion:

(a)the Administrative Agent shall have received an executed counterpart of this Amendment;

(b)the Administrative Agent shall have received counterparts of the Fee Letter (whether by facsimile or otherwise) executed by each of the respective parties thereto along with confirmation of receipt of all fees owing under the Fee Letter;

(c)the Sellers shall have either, in the discretion of the Seller Representative, (i) deposited or (ii) authorized the Administrative Agent to withhold and deposit, and the Administrative Agent shall have so withheld and deposited, from the initial purchase of Receivables to occur on or after the date hereof, if any, in each case, in an amount equal to 1.25% of the Aggregate Discretionary Amounts (as defined in the Receivables Purchase Agreement as amended hereby) into the Refundable Discount Advance Account to serve as additional Refundable Discount Advance (such amount, the “Sixth Amendment Discretionary Reserve”);

(d)the Administrative Agent shall have received either (i) certified copies of resolutions of CACI and each Existing Seller authorizing this Amendment and the Fee Letter and authorizing a person or persons to sign those documents including any subsequent notices and acknowledgements to be executed or delivered pursuant to this Amendment, the Fee Letter, the other Purchase Documents and any other documents to be executed or delivered by CACI and each Existing Seller pursuant hereto or thereto or (ii) certifications from each of CACI and each Existing Seller that the respective resolutions previously delivered by such Person to the Administrative Agent in connection with the Receivables Purchase Agreement are still in full force and effect;

(e)the Administrative Agent shall have received either (i) an officer incumbency and specimen signature certificate for CACI and each Seller or (ii) certifications from each of CACI and each Seller that the respective incumbency and specimen signature certificate previously delivered by such Person to the Administrative Agent in connection with the Receivables Purchase Agreement is still in full force and effect; and

(f)the Administrative Agent shall have received either (i) organizational documents of CACI and each Seller certified by the applicable governmental authority (as applicable), and evidence of good standing (as applicable) or (ii) certifications from each of CACI and each Seller that (x) the respective organizational

documents previously delivered by such Person to the Administrative Agent in connection with the Receivables Purchase Agreement have not been amended since such date and (y) such Person is in good standing in its respective jurisdiction of organization;

(g)the Administrative Agent shall have received (i) organizational documents of the New Seller certified by the applicable governmental authority (as applicable), and evidence of good standing (as applicable), (ii) an officer incumbency and specimen signature certificate for the New Seller, and (iii) certified copies of resolutions of the New Seller authorizing this Amendment and the other Purchase Documents and authorizing a person or persons to sign those documents including any subsequent notices and acknowledgements to be executed or delivered pursuant to this Amendment, the other Purchase Documents and any other documents to be executed or delivered by the New Seller pursuant hereto or thereto;

(h)the Administrative Agent shall have received proof of payment of all fees due and payable to the Purchaser on the date hereof pursuant to the Fee Letter and, to the extent invoiced at least three (3) Business Days’ prior to the Sixth Amendment Date (as defined in the Receivables Purchase Agreement) all reasonable and documented attorneys’ fees and disbursements incurred by the Purchaser to the extent required to be reimbursed pursuant to the Receivables Purchase Agreement; and

(i)the Administrative Agent shall have received acknowledgment copies (or evidence of filing satisfactory to the Administrative Agent) of proper financing statement amendments (Form UCC-3) necessary to evidence the release of all security interests, ownership and other rights of JPMorgan Chase Bank, N.A previously granted by each Seller in the Purchased Receivables (it being agreed that a written confirmation from JPMorgan Chase Bank, N.A. or its counsel that such UCC-3s have been submitted for filing shall satisfy this clause).

9.Certain Representations, Warranties and Covenants. Each Seller hereby represents and warrants to the Administrative Agent, as of the date hereof, that:

(a)the representations and warranties made by it in the Receivables Purchase Agreement are true and correct in all material respects (unless such representation or warranty contains a materiality qualification and, in such case, such representation and warranty shall be true and correct as made) as of (i) the date hereof and (ii) immediately after giving effect to this Amendment to the same extent as though made on and as of the date hereof, except to the extent such representations and warranties specifically relate to an earlier date, in which case such representations and warranties shall have been true and correct in all material respects (unless such representation or warranty contains a materiality qualification and, in such case, such representation and warranty shall be true and correct as made) on and as of such earlier date;

(b)no Servicer Replacement Event or Facility Suspension Event exists as of the date hereof, other than with respect to the Subject Events, and immediately after giving effect to this Amendment; and

(c)the execution and delivery by it of this Amendment, and the performance of its obligations under this Amendment, the Receivables Purchase Agreement (as amended hereby) and the other Purchase Documents to which it is a party are within its organizational powers and have been duly authorized by all necessary organizational action on its part, and this Amendment, the Receivables Purchase Agreement (as amended hereby) and the other Purchase Documents to which it is a party are its valid and legally binding obligations, enforceable in accordance with its terms, subject to the effect of bankruptcy, insolvency, reorganization or other similar laws affecting the enforcement of creditors’ rights generally.

10.Reference to, and Effect on, the Receivables Purchase Agreement and the Purchase Documents.

(a)The Receivables Purchase Agreement (except as specifically amended herein) and the other Purchase Documents shall remain in full force and effect and the Receivables Purchase Agreement and such other Purchase Documents are hereby ratified and confirmed in all respects by each of the parties hereto.

(b)The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of the Administrative Agent, nor constitute a waiver of any provision of, the Receivables Purchase Agreement or any other Purchase Document.

(c)After this Amendment becomes effective, all references in the Receivables Purchase Agreement or in any other Purchase Document to “the Master Accounts Receivable Purchase Agreement,” “this Agreement,” “hereof,” “herein” or words of similar effect, in each case referring to the Receivables Purchase Agreement, shall be deemed to be references to the Receivables Purchase Agreement as amended by this Amendment.

11.Further Assurances. The Sellers agree to do all such things and execute all such documents and instruments as the Administrative Agent may reasonably consider necessary or desirable to give full effect to the transaction contemplated by this Amendment and the documents, instruments and agreements executed in connection herewith.

12.Expenses. The Sellers agree, jointly and severally, to pay on demand all actual and reasonable costs and expenses incurred by the Administrative Agent in connection with the preparation, negotiation, documentation and delivery of this Amendment.

13.Purchase Document. This Amendment is a Purchase Document.

14.Assignments and Transfers. This Amendment shall be binding upon and inure to the benefit of the Sellers and the Administrative Agent and each Purchaser, and their respective successors and assigns.

15.Counterparts. This Amendment may be executed in any number of counterparts, and by the different parties hereto on separate counterparts; each such counterpart shall be deemed an original and all of such counterparts taken together shall be deemed to constitute one and the same instrument. A facsimile or electronic copy of an executed counterpart of this Amendment shall be effective as an original for all purposes.

16.Governing Law. THIS AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO THE PRINCIPLES OF CONFLICTS OF LAW THEREOF (OTHER THAN SECTIONS 5-1401 AND 5-1402 OF THE NEW YORK GENERAL OBLIGATIONS LAW).

17.Section Headings. Section headings in this Amendment are for convenience of reference only and shall not limit or otherwise affect the meaning hereof.

18.Invalidity. If at any time any provision of this Amendment shall be adjudged by any court or other competent tribunal to be illegal, invalid or unenforceable, the validity, legality, and enforceability of the remaining provisions hereof shall not in any way be affected or impaired, and the parties hereto will use their best efforts to revise the invalid provision so as to render it enforceable in accordance with the intention expressed in this Amendment.

[THE REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by their respective officers thereunto duly authorized, as of the date first above written.

| | | | | |

| SELLER REPRESENTATIVE: | CACI INTERNATIONAL INC |

| |

| By: Jeffrey D. MacLauchlan Name: Jeffrey D. MacLauchlan Title: Executive Vice President, Chief Financial Officer and Treasurer |

| |

| SELLERS: | CACI TECHNOLOGIES, LLC

CACI NSS, LLC

CACI, INC. - FEDERAL

CACI PREMIER TECHNOLOGY, LLC

CACI-ISS, LLC

CACI INTELLIGENCE SOLUTIONS, LLC (f/k/a SIX3 INTELLIGENCE SOLUTIONS, LLC)

CACI ENTERPRISE SOLUTIONS, LLC

CACI, LLC - COMMERCIAL

CACI PRODUCTS COMPANY CALIFORNIA

SIX3 ADVANCED SYSTEMS, INC.

CACI GEOMATICS, INC. (f/k/a TICOM GEOMATICS, INC.)

CACI-ATHENA, LLC

CACI-CMS INFORMATION SYSTEMS, LLC

CACI DYNAMIC SYSTEMS, LLC

CACI SECURED TRANSFORMATIONS, LLC

CACI-WGI, LLC

CACI ADVANCED SOLUTIONS, LLC (f/k/a SIX3 SYSTEMS, LLC)

CACI LGS INNOVATIONS LLC (f/k/a LGS INNOVATIONS LLC)

NEXT CENTURY CORPORATION

CACI AXIOS TECHNOLOGIES, INC. (f/k/a AXIOS TECHNOLOGIES, INC.)

|

|

|

| By: Jeffrey D. MacLauchlan Name:Jeffrey D. MacLauchlan Title: Executive Vice President, Chief Financial Officer and Treasurer |

| |

| NEW SELLER: | APPLIED INSIGHT, LLC |

| |

| By: Jeffrey D. MacLauchlan Name:Jeffrey D. MacLauchlan Title: Executive Vice President, Chief Financial Officer and Treasurer |

| |

| | | | | |

| REMOVED SELLERS: | R.M. VREDENBURG, LLC |

| |

| By: Jeffrey D. MacLauchlan Name:Jeffrey D. MacLauchlan Title: Executive Vice President, Chief Financial Officer and Treasurer |

| |

| LINNDUSTRIES SHIELDING SPECIALTIES INCORPORATED |

| |

| By: Jeffrey D. MacLauchlan Name:Jeffrey D. MacLauchlan Title: Executive Vice President, Chief Financial Officer and Treasurer |

| | | | | |

| ADMINISTRATIVE AGENT: | MUFG BANK, LTD. |

| |

| By: Richard Gregory Hurst Name: Richard Gregory Hurst Title: Managing Director |

| |

| PURCHASER: | MUFG BANK, LTD. |

| By: Richard Gregory Hurst Name: Richard Gregory Hurst Title: Managing Director |

Exhibit A

(attached)

EXHIBIT A to

Amendment No. 56, dated December 20, 202322024

MASTER ACCOUNTS RECEIVABLE PURCHASE AGREEMENT

among

CACI INTERNATIONAL INC

as Seller Representative and

CACI, INC. - FEDERAL

and certain of its Subsidiaries as Sellers

the PURCHASERS party hereto and

MUFG BANK, LTD.,

as the Administrative Agent

Dated as of December 28, 2018

| | | | | |

“NFV” equals | Net Face Value of such Purchased Receivable as of the first day of such Settlement Period |

“DR” equals | Adjusted Discount Rate applicable to such Purchased Receivable |

“Days” equals | Number of days in such Settlement Period |

“Adjusted Discount Rate” means, with respect to any Purchased Receivable during any Settlement Period, a rate per annum equal to the sum of (i) the Base Rate as determined by the Administrative Agent for an assumed interest period of one month commencing two (2) Business Days prior to the first day of such Settlement Period, plus (ii) the Applicable Margin.

“Adjusted Purchase Price” as defined in Section 2.3. “Administration Fee” as defined in Section 3.5.

“Administration Fee Letter” means a fee letter between the Seller Representative and MUFG as Administrative Agent regarding any fees to be paid by MUFG in its role as Administrative Agent.

“Administrative Agent’s Account” means the account of the Administrative Agent located at MUFG with account number [xxx], or such other account as notified to the Seller Representative from time to time by the Administrative Agent in writing.

“Adverse Claim” means any mortgage, assignment, security interest, pledge, lien or other encumbrance securing any obligation of any Person or any other type of adverse claim or preferential arrangement having a similar effect (including any agreement to give any of the foregoing, any conditional sale or other title retention agreement, and any lease in the nature thereof), in each case other than as arising under this Agreement.

“Affiliate” means, as to any Person, any other present or future Person controlling, controlled by or under common control with, such Person.

“Aggregate Commitments” means the sum of the Commitments of the Purchasers.

“Aggregate Discretionary Amounts” means the sum of the Discretionary Amounts of the Purchasers; provided, however, any Purchaser may, in its sole discretion, cancel and reduce to $0 its Discretionary Amount upon five (5) Business Days’ prior written notice to the Administrative Agent, the other Purchasers and the Seller Representative. As of the FifthSixth Amendment Date, the Aggregate Discretionary Amounts are equal to $50,000,000100,000,000.

“Aggregate Unreimbursed Purchase Discount” means, as of any Reconciliation Date, with respect to all outstanding Purchased Receivables for which the Administrative Agent elected, in accordance with Section 2.3, not to deduct the Purchase Discount from the Net Face Value when calculating the Purchase Price or Adjusted Purchase Price of such Purchased Receivables, an amount equal to the aggregate of all Adjusted Discounts for such Purchased Receivables for the Settlement Period ending on such Reconciliation Date, which Adjusted Discounts otherwise have not been paid by the Seller Representative or any Seller to the Administrative Agent by deposit into the Administrative Agent’s Account.

2

Administrative Agent, or any Purchaser in writing that it does not intend to comply with its funding obligations hereunder, or has made a public statement to the effect that it does not intend to comply with any of its funding obligations under this Agreement (unless such writing or public statement indicates that such position is based on such Purchaser’s good faith determination that a condition precedent to funding (specifically identified and including the particular default, if any) cannot be satisfied) or generally under other agreements in which it commits to extend credit, (c) has failed, within three Business Days after written request by the Administrative Agent or the Seller Representative, to confirm in writing to the Administrative Agent and the Seller Representative that it will comply with its prospective funding obligations hereunder (provided that such Purchaser shall cease to be a Defaulting Purchaser pursuant to this clause (c) upon receipt of such written confirmation by the Administrative Agent and the Seller Representative) or (d) has, or has a direct or indirect parent company that has, (i)become the subject of an Insolvency Event; provided that a Purchaser shall not be a Defaulting Purchaser solely by virtue of the ownership or acquisition of any equity interest in that Purchaser or any direct or indirect parent company thereof by a Governmental Authority so long as such ownership interest does not result in or provide such Purchaser with immunity from the jurisdiction of courts within the United States or from the enforcement of judgments or writs of attachment on its assets or permit such Purchaser (or such Governmental Authority) to reject, repudiate, disavow or disaffirm any contracts or agreements made with such Purchaser. Any determination by the Administrative Agent that a Purchaser is a Defaulting Purchaser under any one or more of clauses (a) through (d) above shall be conclusive and binding absent manifest error, and such Purchaser shall be deemed to be a Defaulting Purchaser (subject to Section 2.11(c)) upon delivery of written notice of such determination to the Seller Representative and each Purchaser.

“Designated Project” means each project with respect to an Approved Obligor and listed on Schedule A-2, with each such project to be identified by a specific project number on the applicable Seller’s accounts receivable platform and, as the same may be updated by the Seller Representative from time to time in accordance with Sections 14.23.

“Dilution” means, with respect to any Receivable, (a) any discount, adjustment, deduction, or reduction (including, without limitation, as a result of any rate variance under the related Contract or as a result of any set-off whatsoever effected by the Approved Obligor, whether in relation to a payment obligation, tax or other amount payable by a Seller to such Approved Obligor (or any other branch or agency of the U.S. Government)), in each case, that would have the effect of reducing the amount of part or all of such Receivable and (b) the Conversion Date Adjustment Amount (if any) with respect to such Receivable.

“Discount Period” means, with respect to any Receivable the number of days from (and including) the applicable Purchase Date of such Receivable to (but not including) the date which is the last day of the Approved Obligor Buffer Period for the Approved Obligor of such Receivable following the Maturity Date of such Receivable.

“Discount Rate” means, with respect to any Receivable, a rate per annum equal to the sum of (i) the one-month Base Rate, plus (ii) the Applicable Margin.

“Discounted Purchase Price” as defined in Section 2.3.

“Discretionary Amount” means, as to each Purchaser, its commitment to purchase Asset Interests in Purchased Receivables pursuant to Section 2.1(b), in an aggregate amount at any one time outstanding not to exceed its Pro Rata Share of $50,000,000100,000,000, as such amount may be adjusted from time to time in accordance with this Agreement.

7

“Executive Order” means Executive Order No. 13224 on Terrorist Financings: Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten To Commit, or Support Terrorism issued on September 23, 2001.

“FACA” means the Federal Assignment of Claims Act, 41 U.S.C. § 15, as supplemented by the Federal Acquisition Regulations, 48 C.F.R.

“Facility Activation Date” means, subject to Section 8.2, the date of the initial purchase of Receivables under this Agreement.

“Facility Suspension Event” means (i) the occurrence of a Servicer Replacement Event, (ii) any disclaimer of its obligations by the guarantor under the CACI Performance Undertaking or failure of the CACI Performance Undertaking to be in full force and effect or (iii) any disclaimer of its obligations by the Revolver Agent under the Intercreditor Agreement or failure of the Intercreditor Agreement to be in full force and effect.

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement, any current or future regulations or official interpretations thereof and any agreement entered into pursuant to Section 1471(b)(1) of the Code.

“Fee Letter” means that certain amended and restated fee letter agreement, dated as of the FifthSixth Amendment Date, by and among the Administrative Agent, the Purchasers, the Seller Representative and the Sellers.

“Fifth Amendment” means that certain Amendment No. 5 to the Master Accounts Receivable Purchase Agreement, dated as of the Fifth Amendment Date, by and among the Seller Representative, the other Sellers party thereto and the Administrative Agent.

“Fifth Amendment Date” means December 20, 2023.

“Fifth Amendment Discretionary Reserve” as defined in the Fifth Amendment.

“Final Collection Date” means the Business Day following the termination of purchases under this Agreement on which all amounts to which the Purchasers shall be entitled in respect of Purchased Receivables and all other amounts owing to the Administrative Agent and the Purchasers hereunder and under the other Purchase Documents are paid in full.

“Final Maturity Date” means the Maturity Date of the last outstanding Purchased Receivable.

“Funded Amount” means, as of any date of determination, the difference between (a) the sum of all Purchase Prices paid hereunder and (b) the sum of all Collections actually received by the Administrative Agent by deposit into the Administrative Agent’s Account.

“GAAP” means United States generally accepted accounting principles in effect as of the date of determination thereof.

9

“Sanctioned Country” means a country or territory which is the subject or target of any Sanctions (currently, Cuba, Iran, North Korea, Syria, and the Crimea, the so-called Donetsk People’s Republic, and the so-called Luhansk People’s Republic regions of Ukraine).

“Sanctioned Person” means any Person: (a) listed on, and/or targeted by, any Sanctions; (b) resident, operating, or organized under the laws of, a comprehensively Sanctioned Country; or (c) who is, directly or indirectly, fifty-percent or more owned or controlled by any such Person or Persons.

“Sanctions” means any financial, economic or trade sanctions laws, regulations, rules, decisions, embargoes and/or restrictive measures imposed, administered or enforced by, as applicable, the Government of Japan, the Government of the United States, the United Nations Security Council, the European Union, His Majesty’s Treasury of the United Kingdom or by other relevant sanctions authorities to the extent compliance with the sanctions imposed by such other authorities would not entail a violation of applicable Law.

“Scheduled Termination Date” means December 2019, 20242025.

“Seller” and “Sellers” as defined in the preamble hereto. “Seller Account” means, with respect to:

(i)the Initial Sellers, the deposit account of the Seller Representative located at Bank of America, N.A. (ABA No. 051-000-017 (ACH) and 026-009-593 (wires)) with account number 11211189;

(ii)each Additional Seller, each deposit account of such Additional Seller specified as such in the applicable Joinder Agreement; and

(iii)any other deposit account designated by the Seller Representative as an “Seller Account” hereunder and located at a depository bank satisfactory to the Administrative Agent;

each of which accounts is subject to an Account Control Agreement.

“Seller Account Collateral” means collectively, (i) each Seller Account, and (ii) all checks, drafts, instruments, cash and other items at any time received for deposit into a Seller Account, wire transfers of funds, automated clearing house entries, credits from merchant card transactions and other electronic funds transfers or other funds deposited into, credited to, or held for deposit into or credit to, a Seller Account, but only to the extent that any such items referred to in this clause (ii) are Collections; provided that Seller Account Collateral shall not include Seller Funds.

“Seller Funds” means all checks, drafts, instruments, cash and other items that, in each case, are not Collections, and that at any time are received for deposit into a Seller Account.

“Seller Representative” as defined in Section 2.5.

“Servicer Replacement Event” means any of the following:

(a) the failure by the Seller Representative to issue an Invoice for an Eligible Unbilled Receivable in accordance with the terms of Section 2.9;

15

consecutive days during which a stay of enforcement of such judgment or order, by reason of a pending appeal or otherwise, shall not be in effect; provided that any such judgment or order shall not be a Servicer Replacement Event as defined herein if and to the extent that (i) the amount of such judgment or order is covered by a valid and binding policy of insurance covering payment thereof and (ii) such insurer has been notified of, and does not dispute the claim made for payment of, the amount of such judgment or order;

(l)CACI, at any time, ceasing to own at least 51% of the equity securities of any Seller and, in each case, to control any Seller. For the purposes of this definition, “control” of a Person means the possession, directly or indirectly, of the power to direct or cause the direction of such Peron’s management and policies, whether through the ownership of voting securities, by contract or otherwise; or

(m)the acquisition by any “person” or “group” (within the meaning of Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended, but excluding any employee benefit plan of such person or its subsidiaries, and any person or entity acting in its capacity as trustee, agent or other fiduciary or administrator of any such plan) becomes the “beneficial owner” (within the meaning of Rule 13d-3 of the SEC under the Securities Exchange Act of 1934, as amended), directly or indirectly, of securities of CACI (or other securities convertible into such securities) representing 50% or more of the combined voting power of all securities of CACI entitled to vote in the election of directors, other than securities having such power only by reason of the happening of a contingency; provided that if CACI shall become a wholly owned Subsidiary of a publicly owned Person whose beneficial ownership is, immediately after CACI shall become such a wholly owned subsidiary of such Person, substantially identical to that of CACI immediately prior to such circumstance (a “Holding Company”), such circumstance shall not be a Servicer Replacement Event as defined herein unless the beneficial ownership of such Holding Company shall be acquired as set forth in this clause (m).

“Servicing Fee” as defined in Section 5.1.

“Settlement Date” means each Thursday; provided, however, that (x) if a Settlement Date falls on a day that is not a Business Day, then the Settlement Date shall be the next following Business Day and (y) the final Settlement Date shall occur on the Business Day immediately preceding the Termination Date.

“Settlement Period” means the period from (but excluding) one Reconciliation Date to (and including) the immediately following Reconciliation Date.

“Shutdown of the U.S. Government” means the creation of a “funding gap” caused by the failure of the United States Congress to pass legislation funding U.S. Government operations in whole or in part affecting any or all Approved Obligors, or the failure of any such legislation passed by the United States Congress to become law (thereby preventing any such Approved Obligor(s) from making payments to the applicable Seller or the Administrative Agent (for the ratable benefit of the Purchasers)).

“Significant Subsidiary” means, with respect to any Person at any time, any Subsidiary of such Person which accounts for more than 5% of consolidated total assets or 5% of consolidated revenue of such Person determined in accordance with GAAP.

“Sixth Amendment” means that certain Amendment No. 6 to the Master Accounts Receivable Purchase Agreement, dated as of the Sixth Amendment Date, by and among the Seller Representative, the other Sellers party thereto and the Administrative Agent.

17

“Sixth Amendment Date” means December 20, 2024.

“Sixth Amendment Discretionary Reserve” as defined in the Sixth Amendment.“SOFR Administrator” means the Federal Reserve Bank of New York (or a successor administrator of the secured overnight financing rate).

“SOFR” means a rate equal to the secured overnight financing rate, as such rate is published by the SOFR Administrator two (2) Business Days prior to the first day of the relevant period (or if SOFR is not published on such Business Day, then SOFR as most recently published by the SOFR Administrator).

“SOFR Administrator” means the Federal Reserve Bank of New York (or a successor administrator of the secured overnight financing rate).

“Subsidiary” means, with respect to any Person, any corporation, partnership, limited liability company, association, joint venture or other business entity of which more than 50% of the total voting power of shares of stock or other ownership interests entitled (without regard to the occurrence of any contingency) to vote in the election of the Person or Persons (whether directors, managers, trustees or other Persons performing similar functions) having the power to direct or cause the direction of the management and policies thereof is at the time owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof; provided, in determining the percentage of ownership interests of any Person controlled by another Person, no ownership interest in the nature of a “qualifying share” of the former Person shall be deemed to be outstanding.

“Taxes” means all present and future income and other taxes, levies, imposts, deductions, charges, duties and withholdings and any charges of a similar nature imposed by any fiscal authority, together with any interest thereon and any penalties with respect thereto and any payments made on or in respect thereof; and “Taxation” and “Tax” shall be construed accordingly.

“Term SOFR” means, for any Purchased Receivable, an interest rate per annum equal to the Term SOFR Reference Rate for a tenor comparable to the number of days in the relevant period, as such rate is published by the Term SOFR Administrator two (2) Business Days prior to the first day of such period (such day, the “Term SOFR Determination Day”); provided, that if on any Term SOFR Determination Day the Term SOFR Reference Rate for the applicable tenor is not published by the Term SOFR Administrator and a Benchmark Replacement Date with respect to the Term SOFR Reference Rate has not occurred, then Term SOFR shall be the Term SOFR Reference Rate for the applicable tenor as most recently published by the Term SOFR Administrator. Notwithstanding the foregoing, if the number of days in the relevant period does not correspond to any available published tenor, then the relevant rate shall be an Interpolated Rate.

“Term SOFR” means the forward-looking term rate based on SOFR that has been selected or recommended by the Relevant Governmental Body. Administrator” means CME Group Benchmark Administration Limited (CBA) (or a successor administrator of Term SOFR selected by the Administrative Agent in its discretion).

“Term SOFR Reference Rate” means the forward-looking term rate based on SOFR. Each such determination by the Administrative Agent shall be conclusive absent manifest error. The Administrative Agent does not accept responsibility for or have any liability with respect to the administration, determination, publication or other matters related to Term SOFR.

“Termination Date” means the earlier to occur of (i) the Scheduled Termination Date or (ii) such time as the Commitments are terminated by the Administrative Agent or the Seller Representative in accordance with the terms of this Agreement.

“Termination Payment Amount” means, as of any given Termination Settlement Date, the sum of (a) the Funded Amount, (b) to the extent that the Aggregate Unreimbursed Purchase Discount has not

18

(on behalf of the Sellers) by deposit into the Remittance Account; provided, however, that if the Seller Representative (on behalf of the Sellers) has not paid the Aggregate Unreimbursed Purchase Discount in full as of the Final Maturity Date (or any such earlier date as required by Section 2.8(a)), the Administrative Agent may set-off the Refundable Discount Advance against the unpaid balance of the Aggregate Unreimbursed Purchase Discount, and upon doing so, the Administrative Agent will promptly repay the excess Refundable Discount Advance (if any) to the Seller Representative (on behalf of the Sellers) by deposit into the Remittance Account. For the avoidance of doubt, it is understood and agreed that, to the extent there remains any deficiency in the Aggregate Unreimbursed Purchase Discount after any such set-off and application, such deficiency shall remain the obligation of the Sellers.

(c) On and following the FifthSixth Amendment Date, in the event any Purchaser elects to terminate all or a portion of its Discretionary Amount pursuant to the definition of “Aggregate Discretionary Amounts”, then the Administrative Agent shall, as promptly as operationally possible after the relevant date of termination, remit such terminated Discretionary Amount in cash to the Seller Representative.

Section 2.9. Eligible Unbilled Receivables. The Seller Representative shall procure that each Eligible Unbilled Receivable sold, transferred and assigned to the Administrative Agent hereunder will be the subject of an Invoice as soon as reasonably practicable, and in any event within ten (10) Business Days following the Seller Representative’s receipt of a written request to issue such Invoice from the Administrative Agent; provided, however, that if any Approved Obligor becomes insolvent or is unable to pay its debts or fails or admits in writing its inability generally to pay its debts as they become due, the Seller Representative shall promptly (and in any event, within five (5) Business Days) issue an Invoice for each Purchased Receivable that is an Eligible Unbilled Receivable payable by such Approved Obligor, and shall provide the Administrative Agent with a copy of each such Invoice. In the event of the occurrence of the Termination Date or a revocation of the Purchasers’ approval of any Approved Obligor pursuant to Section 14.21, the Administrative Agent shall have the option to (i) retain ownership of any Eligible Unbilled Receivable and/or (ii) at any time following such termination or revocation, but solely to the extent that an Approved Obligor Termination Event has not occurred with respect to the Approved Obligor of the applicable Eligible Unbilled Receivable, cause the applicable Seller to repurchase such Eligible Unbilled Receivable from the Administrative Agent pursuant to Section 11. The Administrative Agent shall promptly inform the Seller Representative following any such termination or revocation of its decision to either retain ownership or cause a Repurchase Event with respect to any such Eligible Unbilled Receivable. In the event that the Administrative Agent elects to retain ownership of any Eligible Unbilled Receivable after the Termination Date or the revocation of the Purchasers’ approval of any Approved Obligor pursuant to Section 14.22, the Seller Representative shall promptly (and in any event, within five (5) Business Days) issue an Invoice for any such retained Eligible Unbilled Receivable. Upon issuance by the relevant Seller of an Invoice for a Purchased Receivable that is an Eligible Unbilled Receivable, such Purchased Receivable shall immediately become a Billed Receivable for purposes hereof (the date upon which such Purchased Receivable becomes a Billed Receivable, the “Conversion Date”).

Section 2.10. Increase in Aggregate Commitments.

(a)Request for Increase. Provided there exists no Facility Suspension Event, upon notice to the Administrative Agent (which shall promptly notify the Purchasers), the Seller Representative may from time to time request an increase in the Aggregate Commitments by an amount (for all such requests) not exceeding $50,000,000; provided that (i) any such request for an increase shall be in a minimum amount of $25,000,000, (ii) the Seller Representative may make a maximum of two (2) such requests. At the time of sending such notice, the Seller Representative (in consultation with the Administrative Agent)

24

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

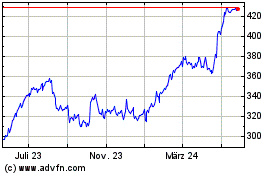

CACI (NYSE:CACI)

Historical Stock Chart

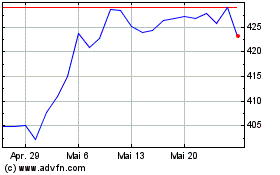

Von Dez 2024 bis Jan 2025

CACI (NYSE:CACI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025