Kind of a Draghi - Analyst Blog

06 Juni 2012 - 11:11AM

Zacks

Investors are looking to central banks help ease concerns about

global growth. The European Central Bank (ECB) did not oblige today

by cutting interest rates, but the markets will still be looking

for clues to the central bank’s future course of action in Mario

Draghi’s press conference.

The ECB is no doubt in the spotlight today, but investors are also

pinning hopes on the Fed to do its bit following the recent run of

soft economic readings. Bernanke’s testimony to a congressional

panel on Thursday could potentially provide some clues to his

thinking ahead of the Fed’s meeting on June 19th and 20th.

The ECB’s decision today to keep rates unchanged despite compelling

economic rationale for action otherwise is disappointing. All key

economic indicators are pointing towards a deceleration in activity

levels, with even Germany now showing signs of loss of momentum.

And while Inflation readings remain above the central bank’s 2%

target level, they are trending lower.

Readings of purchasing managers and business confidence across the

region shows a particularly soft start to the second quarter and

retail sales are declining. There is still a pronounced divergence

among the economic profiles of nations such as Spain and Italy on

the one hand and Germany on the other. But the persistent

region-wide air of crisis may be having an impact in Germany as

well.

The tools at the disposal of the ECB include direct interest rate

cuts like the one on the docket today or other indirect but

potentially more beneficial actions like further funding for the

region’s banks or direct purchases of government bonds. The central

bank has not done enough bond purchases given constraints on its

ability to lend directly to member governments, though it has done

some purchases over the past year or so.

The central bank’s LTRO program, where it pumped €1 trillion in the

region’s banks through installments appeared to be the most

beneficial as it helped improve confidence in the financial system

and had a pronounced impact on member countries’ borrowing costs,

but the impact has not proven enduring enough.

But it’s perhaps unfair to expect only the ECB to provide a path

out of the current Euro-zone problems when the region’s leaders

themselves have proven unable to find common ground. The ECB

interest rate decision today could be read as asking the region’s

politicians to take the lead.

With crucial elections in Greece coming up and another

supposedly major summit meeting later this month, the markets are

desperate for direction from the region’s political leadership.

They have been wanting thus far in showing any level of urgency,

but many feel that the window of opportunity may not be available

for long.

In corporate news, Brown Foreman (BF.B), the maker

of Jack Daniels and other alcoholic beverage brands, came short of

earnings expectations. Bob Evans Farms (BOBE) came

out with better-than-expected earnings after the close on Tuesday,

but missed revenue expectations and provide weak guidance. We also

have results from homebuilder Hovnanian

Enterprises (HOV) coming out today.

BROWN FORMAN B (BF.B): Free Stock Analysis Report

BOB EVANS FARMS (BOBE): Free Stock Analysis Report

HOVNANIAN ENTRP (HOV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

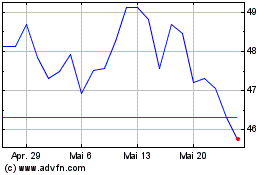

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024