Constellation Brands Inc. (STZ), the largest

wine company in the world, posted its fourth-quarter 2012 results

last week on Thursday. Therefore, the covering analysts have had

roughly a week to ponder the results. In the subsequent paragraphs,

we will cover the recent earnings announcement, analysts’ estimate

revisions as well as the Zacks Rank and long-term recommendation on

the stock.

Earnings Review

Constellation Brands delivered adjusted EPS of 69 cents per

share in the fourth quarter of fiscal 2012, surpassing the Zacks

Consensus Estimate of 38 cents and surged nearly two-folds from the

prior-year earnings of 35 cents. The year-over-year increase in the

bottom line was primarily driven by benefits from negative tax

rates and improved margins.

Sales in the quarter dropped 12.2% to $628.1 million from the

year-ago quarter. The fall was due to the divestitures of the

Australian and U.K. wine businesses, partially offset by improved

sales in the North American business. Sales also missed the Zacks

Consensus forecast of $633 million. The company’s North American

organic constant currency net sales increased 5% driven by improved

volume and favorable product mix.

Management Guidance for Fiscal

2013

The company expects fiscal 2013 adjusted EPS in the band of

$1.93 to $2.03 per share compared with $2.34 in fiscal 2012. The

guidance factors in an interest expense expectation in the range of

approximately $210–$220 million, an approximate tax rate of 34% and

weighted average diluted shares outstanding of approximately

185-190 million.

On a reported basis, the company expects earnings in the range

of $1.89-$1.99 per share compared with $2.13 in fiscal 2012.

Moreover, the company anticipates generating free cash flow in

the range of $425 million to $475 million.

(Read our full coverage on this earnings report: STZ’s

EPS Up, Posts Record FCF)

Agreement of Analysts

The estimate revision trend for the first and second quarters of

fiscal 2013 portrays negative sentiment among the analysts covering

the stock. Over the last 7 days, 6 out of 8 analysts lowered their

estimates for the first quarter with no movement in the opposite

direction. Similarly, for the second quarter, 6 analysts lowered

their estimates over the last 7 days.

For fiscal 2013, estimate revision trends show a negative

sentiment among the analysts covering the stock. Over the last 7

days, 9 analysts cut their estimates for fiscal 2013. For fiscal

2014, estimate revision trend portrays a mixed sentiment as 2

analysts raised their estimates while 1 analyst lowered its

estimate over the last 7days.

Magnitude of Estimate Revisions

As a result of the bearish sentiment of most of the analysts

over the past week, the Zacks Consensus Estimate for first-quarter

2013 moved down by 10 cents to 39 cents per share. For

second-quarter 2013, earnings per share as projected by the Zacks

Consensus are down by 5 cents to 58 cents.

Similarly, the Zacks Consensus Estimate for fiscal 2013 and

fiscal 2014 earnings per share are down by 24 cents and 3 cents, to

$2.00 and $2.30, respectively.

Constellation Brands is expecting a lower year-over-year EPS in

fiscal 2013 compared with fiscal 2012. The company expects its

fiscal 2013 adjusted EPS in the band of $1.93 to $2.03 per share

compared with $2.34 in fiscal 2012. The lower guidance range

provided by Constellation Brands is in anticipation of a higher tax

rate of 34% in fiscal 2013 compared with 17% in fiscal 2012 along

with increased expenses due to investments in brand building.

Moreover, the company also expects higher cost of goods sold,

which may lead to lower operating income growth compared to sales

growth. We believe the analysts covering the stock adjusted their

estimates according to the company’s guidance range.

Our Recommendation

We believe that the company’s strategic initiative of expanding

its foothold in the U.S wine industry along with focus on brand

building and promotion will accelerate its growth opportunities

while strengthening its market position. Moreover, in an effort to

generate strong margins, Constellation Brands is also focusing on

higher priced segments across all key categories.

Moreover, the company’s recent stake sale in the Australian and

U.K. businesses will help it to focus on organic growth of its

brand portfolio, margin improvement, return on invested capital and

free cash flow. During the last two years, the Australian and U.K.

businesses were facing challenging market conditions, which were no

longer consistent with Constellation Brands’ business strategy.

However, distilled spirits are subject to excise tax in various

countries. Rising fiscal pressure in the U.S., European and many

emerging markets may lead to increasing risk of a potential excise

tax on spirits by governments of respective countries. We believe

any excise tax increase in future may have an adverse effect on

Constellation Brands’ financial performance.

Above all, the company faces intense competition from other

well-established players in the industry, including Beam

Inc. (BEAM), Brown-Forman Corporation

(BF.B) and Diageo plc (DEO). Moreover,

Constellation Brands also encounters competition from local and

regional players in the respective countries. Consequently, this

may dent the company’s future operating performance.

Currently, Constellation Brands holds a Zacks #3 Rank, implying

a short-term Hold rating on the stock. Moreover, in the long term,

we have a Neutral recommendation on the stock.

BEAM INC (BEAM): Free Stock Analysis Report

BROWN FORMAN B (BF.B): Free Stock Analysis Report

DIAGEO PLC-ADR (DEO): Free Stock Analysis Report

CONSTELLATN BRD (STZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

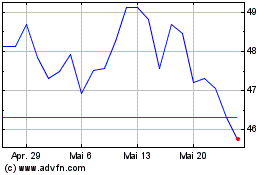

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024