United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|X| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended JULY 31, 2008

OR

|_| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission File No. 002-26821

BROWN-FORMAN CORPORATION

(Exact name of Registrant as specified in its Charter)

Delaware 61-0143150

(State or other jurisdiction of (IRS Employer

incorporation or organization) Identification No.)

850 Dixie Highway

Louisville, Kentucky 40210

(Address of principal executive offices) (Zip Code)

(502) 585-1100

(Registrant's telephone number, including area code)

|

N/A

(Former name, former address and former fiscal year,

if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes |X| No |_|

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer |X| Accelerated filer |_|

Non-accelerated filer |_| Smaller reporting company |_|

Indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). Yes | | No |X|

Indicate the number of shares outstanding of each of the issuer's classes of

common stock, as of the latest practicable date: August 31, 2008

Class A Common Stock ($.15 par value, voting) 56,609,413

Class B Common Stock ($.15 par value, nonvoting) 64,089,074

BROWN-FORMAN CORPORATION

Index to Quarterly Report Form 10-Q

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited) Page

Condensed Consolidated Statements of Operations

Three months ended July 31, 2007 and 2008 3

Condensed Consolidated Balance Sheets

April 30, 2008 and July 31, 2008 4

Condensed Consolidated Statements of Cash Flows

Three months ended July 31, 2007 and 2008 5

Notes to the Condensed Consolidated Financial Statements 6 - 11

Item 2. Management's Discussion and Analysis of

Financial Condition and Results of Operations 11 - 18

Item 3. Quantitative and Qualitative Disclosures about Market Risk 18

Item 4. Controls and Procedures 18

PART II - OTHER INFORMATION

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds 19

Item 4. Submission of Matters to a Vote of Security Holders 19

Item 6. Exhibits 19

Signatures 20

|

2

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

BROWN-FORMAN CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(Dollars in millions, except per share amounts)

Three Months Ended

July 31,

2007 2008

------- -------

Net sales $ 739.1 $ 790.0

Excise taxes 152.0 176.2

Cost of sales 196.1 233.0

------- -------

Gross profit 391.0 380.8

Advertising expenses 94.0 97.0

Selling, general, and administrative expenses 143.1 144.3

Amortization expense 1.3 1.3

Other (income), net (2.8) (2.4)

------- -------

Operating income 155.4 140.6

Interest income 2.0 1.7

Interest expense 13.1 9.2

------- -------

Income from continuing operations

before income taxes 144.3 133.1

Income taxes 48.9 44.9

------- -------

Income from continuing operations 95.4 88.2

Loss from discontinued operations,

net of income taxes (0.1) --

------- -------

Net income $ 95.3 $ 88.2

======= =======

Earnings per share(1):

Basic $ 0.77 $ 0.73

Diluted $ 0.77 $ 0.73

Shares (in thousands) used in the

calculation of earnings per share:

Basic 123,217 120,483

Diluted 124,434 121,549

Cash dividends per common share:

Declared $0.6050 $0.6800

Paid $0.3025 $0.3400

|

(1) Earnings per share for Continuing Operations and the total Company are the

same due to the immaterial results of Discontinued Operations.

See notes to the condensed consolidated financial statements.

3

BROWN-FORMAN CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(Dollars in millions)

April 30, July 31,

2008 2008

-------- --------

Assets

------

Cash and cash equivalents $ 118.9 $ 160.2

Accounts receivable, net 453.2 428.8

Inventories:

Barreled whiskey 311.2 317.0

Finished goods 154.2 186.5

Work in process 179.2 150.1

Raw materials and supplies 39.9 55.4

-------- --------

Total inventories 684.5 709.0

Current portion of deferred income taxes 102.3 102.3

Other current assets 97.1 94.1

-------- --------

Total current assets 1,456.0 1,494.4

Property, plant and equipment, net 501.4 505.7

Goodwill 688.0 688.1

Other intangible assets 698.8 697.6

Prepaid pension cost 22.8 25.2

Other assets 38.0 37.9

-------- --------

Total assets $3,405.0 $3,448.9

======== ========

Liabilities

-----------

Accounts payable and accrued expenses $ 379.7 $ 343.0

Accrued income taxes 14.7 61.1

Dividends payable -- 41.0

Short-term borrowings 585.3 576.4

Current portion of long-term debt 4.3 4.3

-------- --------

Total current liabilities 984.0 1,025.8

Long-term debt 417.0 416.7

Deferred income taxes 88.8 81.9

Accrued pension and other postretirement benefits 121.2 115.5

Other liabilities 68.8 58.0

-------- --------

Total liabilities 1,679.8 1,697.9

Stockholders' Equity

--------------------

Common stock:

Class A, voting

(57,000,000 shares authorized; 56,925,000 and

56,964,000 shares issued at April 30 and

July 31, respectively) 8.5 8.5

Class B, nonvoting

(100,000,000 shares authorized;

69,188,000 shares issued) 10.4 10.4

Additional paid-in capital 73.8 69.7

Retained earnings 1,931.8 1,934.3

Accumulated other comprehensive income 5.0 26.8

Treasury stock

(5,522,000 and 5,462,000 shares

at April 30 and July 31, respectively) (304.3) (298.7)

-------- --------

Total stockholders' equity 1,725.2 1,751.0

-------- --------

Total liabilities and stockholders' equity $3,405.0 $3,448.9

======== ========

|

See notes to the condensed consolidated financial statements.

4

BROWN-FORMAN CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Dollars in millions)

Three Months Ended

July 31,

2007 2008

------- -------

Cash flows from operating activities:

Net income $ 95.3 $ 88.2

Adjustments to reconcile net income to

net cash provided by operations:

Net loss from discontinued operations 0.1 --

Non-cash agave inventory write-down -- 22.4

Depreciation and amortization 12.8 13.3

Stock-based compensation expense 2.4 2.5

Deferred income taxes (4.8) (10.6)

Changes in assets and liabilities, excluding

the effects of businesses acquired or sold:

Accounts receivable 9.9 24.4

Inventories (28.9) (46.9)

Other current assets 51.6 3.0

Accounts payable and accrued expenses (26.8) (36.7)

Accrued income taxes (20.0) 46.4

Noncurrent assets and liabilities 36.9 (1.3)

Net cash used for operating activities

of discontinued operations (0.1) --

------- -------

Cash provided by operating activities 128.4 104.7

Cash flows from investing activities:

Acquisition of business, net of cash acquired 1.5 --

Acquisition of brand name (12.0) --

Sale of short-term investments 85.6 --

Additions to property, plant, and equipment (11.4) (13.2)

Computer software expenditures (3.3) (1.0)

------- -------

Cash provided by (used for)

investing activities 60.4 (14.2)

Cash flows from financing activities:

Net repayment of short-term borrowings (58.9) (10.3)

Net proceeds (payments) from exercise

of stock options 11.3 (3.4)

Excess tax benefits from stock options 3.3 2.7

Acquisition of treasury stock (7.0) (0.3)

Special distribution to stockholders (203.7) --

Dividends paid (37.3) (41.1)

------- -------

Cash used for financing activities (292.3) (52.4)

Effect of exchange rate changes on cash and

cash equivalents 0.5 3.2

------- -------

Net (decrease) increase in cash

and cash equivalents (103.0) 41.3

Cash and cash equivalents, beginning of period 282.8 118.9

------- -------

Cash and cash equivalents, end of period $ 179.8 $ 160.2

======= =======

|

See notes to the condensed consolidated financial statements.

5

BROWN-FORMAN CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

In these notes, "we," "us," and "our" refer to Brown-Forman Corporation.

1. Condensed Consolidated Financial Statements

We prepared these unaudited condensed consolidated statements using our

customary accounting practices as set out in our annual report on Form 10-K for

the year ended April 30, 2008 (the "2008 Annual Report"), except that effective

May 1, 2008, we adopted certain provisions of FASB Statements No. 157 and No.

158 (see Notes 7 and 10). We made all of the adjustments (which include only

normal, recurring adjustments, unless otherwise noted) needed for a fair

statement of this data.

We condensed or omitted some of the information found in financial statements

prepared according to accounting principles generally accepted in the United

States of America ("GAAP"). You should read these financial statements together

with the 2008 Annual Report, which does conform to GAAP.

2. Inventories

We use the last-in, first-out ("LIFO") method to determine the cost of most of

our inventories. If the LIFO method had not been used, inventories at current

cost would have been $150.1 million higher than reported as of April 30, 2008,

and $159.0 million higher than reported as of July 31, 2008. Changes in the LIFO

valuation reserve for interim periods are based on a proportionate allocation of

the estimated change for the entire fiscal year.

During the three months ended July 31, 2008, a portion of our agave fields

showed signs of abnormally high levels of mortality and disease, which has

significantly reduced the amount of agave we expect to yield from some fields.

As a result, we recorded a provision for inventory losses of $22.4 million,

which is included in cost of sales for the three months ended July 31, 2008.

This amount was based on management's estimates of the extent of the loss in

yield and the effectiveness of the measures we plan to undertake to combat the

crop diseases and other agricultural factors contributing to the lower yield.

Although this provision is based on management's best estimate at this time, it

is at least reasonably possible that actual inventory losses could be

significantly different, which could have a materially adverse effect on our

results of operations and financial condition.

3. Income Taxes

Our consolidated quarterly effective tax rate is based upon our expected annual

operating income, statutory tax rates, and tax laws in the various jurisdictions

in which we operate. Significant or unusual items, including adjustments to

accruals for tax uncertainties, are recognized in the quarter in which the

related event occurs. The effective tax rate of 33.8% for the three months ended

July 31, 2008, is based on an expected effective tax rate of 33.0% on ordinary

income for the full fiscal year, plus additional interest on previously provided

tax contingencies and the tax effect of other events (provision for agave

inventory losses) occurring through July 31, 2008. Our expected tax rate from

operations includes current fiscal year additions for existing tax contingency

items.

6

We believe it is reasonably possible that our gross unrecognized tax benefits

may decrease by approximately $2.5 million in the next 12 months although we do

expect that the statute of limitations on certain gross unrecognized state

income tax benefits of $4.4 million will expire during this period.

We file income tax returns in the U.S., including several state and local

jurisdictions, as well as in various other countries throughout the world in

which we conduct business. The major jurisdictions and their earliest fiscal

years that are currently open for tax examinations are 1998 in the U.S., 2004 in

Ireland and Italy; 2003 in the U.K.; and 2002 in Finland and Poland.

4. Discontinued Operations

Discontinued Operations consisted of Hartmann and Brooks & Bentley, wholly-owned

subsidiaries that we sold in fiscal 2007. Those subsidiaries, along with Lenox,

Inc., the wholly-owned subsidiary that we sold in fiscal 2006, comprised our

former consumer durables business.

5. Earnings Per Share

Basic earnings per share is based upon the weighted average number of all common

shares outstanding during the period. Diluted earnings per share includes the

dilutive effect of stock-based compensation awards, including stock options,

stock-settled stock appreciation rights ("SSARs"), and non-vested restricted

stock. Stock-based awards for approximately 754,000 common shares and 395,000

common shares were excluded from the calculation of diluted earnings per share

for the periods ended July 31, 2007 and 2008, respectively, because the exercise

price of the awards was greater than the average market price of the shares.

The following table presents information concerning basic and diluted earnings

per share:

Three Months Ended

July 31,

2007 2008

------ ------

(Dollars in millions, except per share amounts)

Basic and diluted net income $95.3 $88.2

Share data (in thousands):

Basic average common shares outstanding 123,217 120,483

Dilutive effect of non-vested

restricted stock 80 108

Dilutive effect of stock options and SSARs 1,137 958

------- -------

Diluted average common shares

outstanding 124,434 121,549

======= =======

Basic earnings per share $0.77 $0.73

Diluted earnings per share $0.77 $0.73

|

Earnings per share for Continuing Operations and the total Company are the same

due to the immaterial results of Discontinued Operations.

7

6. Dividends Payable

On July 24, 2008, our Board of Directors approved a regular quarterly cash

dividend of $0.34 per share on Class A and Class B Common Stock. Stockholders of

record on September 8, 2008 will receive the cash dividend on October 1, 2008.

7. Pension and Other Postretirement Benefits

On April 30, 2007, we adopted FASB Statement No. 158, "Employer's Accounting for

Defined Benefit Pension and Other Postretirement Plans" (FAS 158). FAS 158

requires that, beginning in 2009, the assumptions used to measure our annual

pension and other postretirement benefit expenses be determined as of the

balance sheet date, and all plan assets and liabilities be reported as of that

date. Accordingly, as of the beginning of our 2009 fiscal year, we changed the

measurement date for our annual pension and other postretirement benefit

expenses and all plan assets and liabilities from January 31 to April 30. As a

result of this change in measurement date, we recorded an increase of $5.6

million (net of tax of $3.7 million) to stockholders' equity as of May 1, 2008,

as follows:

Pension Other Total

(Dollars in millions) Benefits Benefits Benefits

Retained earnings $(2.8) $(0.8) $(3.6)

Accumulated other comprehensive income 8.4 0.8 9.2

----- ----- -----

Total $ 5.6 $ -- $ 5.6

===== ===== =====

|

The following table shows the components of the pension and other postretirement

benefit expense recognized during the three months ended July 31:

Pension Benefits Other Benefits

(Dollars in millions) 2007 2008 2007 2008

---- ---- ---- ----

Service cost $ 3.4 $3.4 $0.2 $0.3

Interest cost 6.6 7.5 0.8 0.9

Expected return on plan assets (8.0) (8.7) -- --

Amortization of:

Prior service cost 0.2 0.2 -- --

Net actuarial loss 3.0 1.6 0.1 --

----- ---- ---- ----

Net expense $ 5.2 $4.0 $1.1 $1.2

===== ==== ==== ====

|

8. Contingencies

We operate in a litigious environment, and we are sued in the normal course of

business. Sometimes plaintiffs seek substantial damages. Significant judgment is

required in predicting the outcome of these suits and claims, many of which take

years to adjudicate. We accrue estimated costs for a contingency when we believe

that a loss is probable and we can make a reasonable estimate of the loss, and

adjust the accrual as appropriate to reflect changes in facts and circumstances.

8

9. Comprehensive Income

Comprehensive income is a broad measure of the effects of all transactions and

events (other than investments by or distributions to stockholders) that are

recognized in stockholders' equity, regardless of whether those transactions and

events are included in net income. The following table adjusts the Company's net

income for the other items included in the determination of comprehensive

income:

(Dollars in millions) Three Months Ended

July 31,

2007 2008

------ ------

Net income $ 95.3 $ 88.2

Other comprehensive income (loss):

Net (loss) gain on cash flow hedges (0.4) 2.0

Net loss on securities (0.1) --

Postretirement benefits adjustment 2.0 10.1

Foreign currency translation adjustment 1.4 9.7

------ ------

2.9 21.8

------ ------

Comprehensive income $ 98.2 $110.0

====== ======

|

Accumulated other comprehensive income (loss) consisted of the following:

(Dollars in millions) April 30, July 31,

2008 2008

------ ------

Postretirement benefits adjustment $(87.8) $(77.7)

Cumulative translation adjustment 99.1 108.8

Unrealized loss on cash flow hedge contracts (6.3) (4.3)

------ ------

$ 5.0 $ 26.8

====== ======

|

9

10. Fair Value Measurements

In September 2006, the FASB issued Statement No. 157, "Fair Value Measurements"

(FAS 157), which defines fair value, establishes a framework for measuring fair

value, and expands disclosures about fair value measurements. FAS 157 defines

fair value as the exchange price that would be received for an asset or paid to

transfer a liability in the principal or most advantageous market for the asset

or liability in an orderly transaction between market participants at the

measurement date. FAS 157 establishes a three-level hierarchy based upon the

assumptions (inputs) used to determine fair value. Level 1 provides the most

reliable measure of fair value, while Level 3 generally requires significant

management judgment. The three levels are:

- Level 1: Quoted prices (unadjusted) in active markets for identical assets

or liabilities.

- Level 2: Observable inputs other than those included in Level 1, such as

quoted prices for similar assets and liabilities in active markets; quoted

prices for identical or similar assets and liabilities in markets that are

not active; or other inputs that are observable or can be derived from or

corroborated by observable market data.

- Level 3: Unobservable inputs that are supported by little or no market

activity.

In February 2008, the FASB issued FSP 157-2, "Effective Date of FASB Statement

No. 157," which permits a one-year deferral for the implementation of FAS 157 as

it relates to nonfinancial assets and liabilities that are not recognized or

disclosed at fair value in the financial statements on a recurring basis (at

least annually), such as goodwill and other indefinite-lived intangible assets.

We elected to defer adoption of the provisions of FAS 157 that relate to such

items until the beginning of our 2010 fiscal year. We do not expect our adoption

to have a material impact on our financial statements. We adopted the other

provisions of FAS 157 on May 1, 2008, with no material impact on our financial

statements.

As of July 31, 2008, the fair values of our financial assets and liabilities are

as follows:

(Dollars in millions) Total Level 1 Level 2 Level 3

Assets:

Commodity contracts $7.4 $7.4 -- --

Liabilities:

Foreign currency contracts $8.6 -- $8.6 --

|

The fair value of commodity contracts is based on quoted prices in active

markets. The fair value of foreign exchange contracts is determined through

pricing from brokers who develop values based on inputs observable in active

markets.

In February 2007, the FASB issued Statement No. 159, "The Fair Value Option for

Financial Assets and Financial Liabilities" (FAS 159). FAS 159, which became

effective as of May 1, 2008, provides the option to measure at fair value many

financial instruments and certain other items for which fair value measurement

is not required. We have currently chosen not to elect this option.

10

11. Recent Accounting Pronouncements

In December 2007, the FASB issued Statement No. 141(R), "Business Combinations"

(FAS 141(R)), which establishes accounting principles and disclosure

requirements for all transactions in which a company obtains control over

another business.

In December 2007, the FASB issued Statement No. 160, "Noncontrolling Interests

in Consolidated Financial Statements" (FAS 160), which prescribes the accounting

by a parent company for minority interests held by other parties in a subsidiary

of the parent company.

In March 2008, the FASB issued Statement No. 161, "Disclosures about Derivative

Instruments and Hedging Activities" (FAS 161), which requires qualitative

disclosures about objectives and strategies for using derivatives, quantitative

disclosures about fair value amounts of and gains and losses on derivative

instruments, and disclosures about credit-risk-related contingent features in

derivative agreements.

FAS 141(R) and FAS 160 become effective as of the beginning of our 2010 fiscal

year, while FAS 161 becomes effective as of the end of our 2009 fiscal year. We

do not expect our adoption of these pronouncements will have a material impact

on our financial statements.

Item 2. Management's Discussion and Analysis of Financial Condition

and Results of Operations

You should read the following discussion and analysis along with our 2008 Annual

Report. Note that the results of operations for the three months ended July 31,

2008, do not necessarily indicate what our operating results for the full fiscal

year will be. In this Item, "we," "us," and "our" refer to Brown-Forman

Corporation.

Important Note on Forward-Looking Statements:

This report contains statements, estimates, or projections that constitute

"forward-looking statements" as defined under U.S. federal securities laws.

Generally, the words "expect," "believe," "intend," "estimate," "will,"

"anticipate," and "project," and similar expressions identify a forward-looking

statement, which speaks only as of the date the statement is made. Except as

required by law, we do not intend to update or revise any forward-looking

statements, whether as a result of new information, future events, or otherwise.

We believe that the expectations and assumptions with respect to our

forward-looking statements are reasonable. But by their nature, forward-looking

statements involve known and unknown risks, uncertainties and other factors that

in some cases are out of our control. These factors could cause our actual

results to differ materially from Brown-Forman's historical experience or our

present expectations or projections. Here is a non-exclusive list of such risks

and uncertainties:

- continuation of the deterioration in general economic conditions

(particularly in the United States where we earn about half of our profits,

and other markets where we do significant business), including higher energy

prices, declining home prices, deterioration of the sub-prime lending market,

interest rate fluctuations, inflation, decreased discretionary income or

other factors;

11

- pricing, marketing and other competitive activity focused against our major

brands;

- lower consumer confidence or purchasing related to economic conditions,

major natural disasters, terrorist attacks or widespread outbreak of

infectious diseases;

- tax increases and/or tariff barriers or other restrictions affecting

beverage alcohol, whether at the federal or state level in the U.S. or

in other major markets around the world, and the unpredictability or

suddenness with which they can occur;

- limitations and restrictions on distribution of products and alcohol

marketing, including advertising and promotion, as a result of stricter

governmental policies adopted either in the United States or in our other

major markets;

- fluctuations in the U.S. Dollar against foreign currencies, especially the

British Pound, Euro, Australian Dollar, Polish Zloty and the South African

Rand;

- reduced bar, restaurant, hotel and other on-premise business, including

consumer shifts to discount stores and other price sensitive purchases and

venues;

- longer-term, a change in consumer preferences, societal attitudes or cultural

trends that results in the reduced consumption of our products;

- changes in distribution arrangements in major markets that limit our ability

to market or sell our products;

- adverse impacts relating to our acquisition strategies or our integration of

acquired businesses and conforming them to the company's trade practice

standards, financial controls environment and U.S. public company

requirements;

- price increases in energy or raw materials, including grapes, grain, agave,

wood, glass, and plastic;

- changes in climate conditions, agricultural uncertainties or other supply

limitations that adversely affect the price, availability, quality, or health

of grapes, agave, grain, glass, closures or wood;

- termination of our rights to distribute and market agency brands in our

portfolio;

- press articles or other public media related to our company, brands,

personnel, operations, business performance or prospects;

- counterfeit production, tampering, or contamination of our products and any

resulting negative effect on our sales, intellectual property rights, or

brand equity;

- adverse developments stemming from state or federal investigations of

beverage alcohol industry marketing or trade practices of suppliers,

distributors or retailers; and

- impairment in the recorded value of inventory, fixed assets, goodwill

or other acquired intangibles.

12

Results of Operations:

First Quarter Fiscal 2009 Compared to First Quarter Fiscal 2008

A summary of our operating performance (dollars expressed in millions, except

per share amounts) is presented below. Continuing Operations consist of our

beverage business. Discontinued Operations consisted of Hartmann and Brooks &

Bentley, wholly-owned subsidiaries that we sold in fiscal 2007. Those

subsidiaries, along with Lenox, Inc., the wholly-owned subsidiary that we sold

in fiscal 2006, comprised our former consumer durables business.

Three Months Ended

July 31,

CONTINUING OPERATIONS 2007 2008 Change

------ ------ ------

Net sales $739.1 $790.0 7%

Gross profit 391.0 380.8 (3%)

Advertising expenses 94.0 97.0 3%

Selling, general, and

administrative expenses 143.1 144.3 1%

Amortization expense 1.3 1.3

Other (income), net (2.8) (2.4)

Operating income 155.4 140.6 (10%)

Interest expense, net 11.1 7.5

Income before income taxes 144.3 133.1 (8%)

Income taxes 48.9 44.9

Net income 95.4 88.2 (8%)

Gross margin 52.9% 48.2%

Effective tax rate 33.9% 33.8%

Earnings per share:

Basic $0.77 $0.73 (5%)

Diluted 0.77 0.73 (5%)

|

13

Net sales for the three months ended July 31, 2008 were $790.0 million, up $50.9

million or 7% over the prior-year period. Sales outside the U.S. constituted

slightly more than half of our total sales in the quarter. The major factors

driving the increase in net sales were:

Growth vs.

Prior Period

Foreign exchange(1) 5%

Estimated net change in trade inventories(2) (1%)

Discontinued agency brands(3) (1%)

Underlying net sales growth 4%

-----

Reported net sales growth 7%

=====

|

The following discussion highlights net sales and depletion(4) results for

several brands:

- Jack Daniel's Tennessee Whiskey first quarter reported net sales increased in

the mid-single digits, or in the low single digits on a constant currency

basis(5), reflecting the benefit of price increases. Global depletions

declined 1% for the period as gains in Eastern Europe, including countries

such as Romania, Poland, Bulgaria, and Russia, Latin America, and Southeast

Asia were offset by declines in markets with softening economies,

particularly Germany, the U.K., and South Africa. Depletions were flat for

the period in the U.S.

- Finlandia net sales increased by double digits on both a reported and a

constant currency basis in the period, reflecting higher volumes and pricing

gains. Global depletions grew in the high single digits, led by continued

double-digit growth in Eastern Europe, which represents over 1.5 million of

Finlandia's 2.9 million cases sold for the 12 months ended July 31, 2008.

Several markets within this region of the world grew at double digits,

including Poland, the Czech Republic, Romania, Hungary and Russia.

(1) Refers to net gains and losses incurred by the company relating to sales

and purchases in currencies other than the U.S. dollar. We use the measure

to understand the growth of the business on a constant dollar basis as

fluctuations in exchange rates can distort the underlying growth of our

business (both positively and negatively). To neutralize the effect of

foreign exchange fluctuations, we have historically translated current year

results at prior year rates. While we recognize that foreign exchange

volatility is a reality for a global company, we routinely review our

company performance on a constant dollar basis. We believe this allows both

management and our investors to understand better our company's growth

trends.

(2) Refers to the estimated financial impact of changes in wholesale trade

inventories for the company's brands. We compute this effect using our

estimated depletion trends and separately identify trade inventory changes

in the variance analysis for our key measures. Based on the estimated

depletions and the fluctuations in trade inventory levels, we then adjust

the percentage variances from prior to current periods for our key measures.

We believe it is important to make this adjustment in order for management

and investors to understand the results of our business without distortions

that can arise from varying levels of wholesale inventories.

(3) Refers to the impact of certain agency brands, primarily Appleton, Amarula,

Durbanville Hills, and Red Bull, which exited Brown-Forman's portfolio

during fiscal 2008.

(4) Depletions are shipments from wholesaler distributors to retail customers,

and are commonly regarded in the industry as an approximate measure of

consumer demand.

(5) Constant currency represents reported net sales with the cost/benefit of

currency movements removed. Management uses the measure to understand the

growth of the business on a constant dollar basis, as fluctuations in

exchange rates can distort the underlying growth of the business both

positively and negatively.

14

- Southern Comfort net sales, both reported and in constant currency, declined

in the mid-single digits during the quarter. Volume declines, due in part to

softness of the on-premise channel in the brand's major markets, the U.S. and

the U.K, were offset only partially by the benefit of price increases.

- Gentleman Jack net sales increased over 40%. The brand's volume crossed

the 200 thousand case milestone in the U.S. for the twelve months ended

July 31, 2008. Jack Daniel's Single Barrel net sales grew in the high single

digits. Jack Daniel's & Cola brand experienced significant volume declines

in the quarter due to a substantial (70%) increase in ready-to-drink excise

taxes in Australia. However, the brand's global reported net sales grew in

the mid-single digits, reflecting the benefit of a weaker U.S. dollar and the

increase in excise taxes in Australia.

- Sonoma-Cutrer, Bonterra, Chambord, Tuaca, and Woodford Reserve all grew net

sales at double-digit rates for the quarter on both a reported and constant

currency basis. Together these five brands are now approaching 1 million

cases in depletions on a 12 month basis ended July 31, 2008.

- The Casa Herradura portfolio, which includes el Jimador, Herradura, New Mix

tequila based ready-to-drink, Antiguo, and Suave 35, grew net sales by double

digits on a reported basis and in the mid-single digits on a constant

currency basis.

Our gross profit decreased $10.2 million, or 3%, largely reflecting a $22.4

million non-cash inventory write-down included in cost of sales related to agave

plants identified during the quarter as dead or dying. During the three months

ended July 31, 2008, a portion of our agave fields showed signs of abnormally

high levels of mortality and disease, which has significantly reduced the amount

of agave we expect to yield from some fields. The $22.4 million provision was

based on management's estimates of the extent of the loss in yield and the

effectiveness of the measures we plan to undertake to combat the crop diseases

and other agricultural factors contributing to the lower yield. Although this

provision is based on management's best estimate at this time, it is at least

reasonably possible that actual inventory losses could be significantly

different, which could have a materially adverse effect on our results of

operations and financial condition.

The following table shows the major factors influencing the changes in gross

profit for the quarter:

Growth vs.

Prior Period

Non-cash agave inventory write-down (6%)

Discontinued agency brands (1%)

Estimated net change in trade inventories (1%)

Foreign exchange 4%

Underlying gross profit growth 1%

-----

Reported gross profit growth (3%)

=====

|

15

Underlying gross profit growth for the quarter was driven by continued expansion

of Finlandia and Jack Daniel's in Eastern Europe, gains in Latin America and

Southeast Asia, double digit consumer demand for several of our super premium

brands including Gentleman Jack, Sonoma-Cutrer, and Bonterra and higher overall

gross profit for the Casa Herradura portfolio of brands. Slowing volume growth

trends in some of our most developed markets in Western Europe, due in part to

deteriorating economic conditions and shifts in consumer purchasing patterns to

the off-premise in the U.K., and trade resistance to a price increase and a weak

economy in Europe, partially offset these gains. In addition, cost inflation on

grain and energy costs outpaced the rate of price increases resulting in lower

growth in gross profit.

Our overall gross margin as a percent of net sales declined in the quarter due

in part to the non-cash agave inventory write-down. In addition, an excise tax

increase in Australia on ready-to-drink products impacting sales of Jack

Daniel's & Cola in this market and higher cost of grain and fuel suppressed

margins in the period.

Advertising investments increased 3% over the prior year first quarter,

reflecting the impact of a weaker U.S. dollar and the absence of spending behind

agency brands that we have ceased selling. Underlying advertising investments

were flat for the quarter, as we have shifted the seasonality of some

investments to later in the year and have reallocated spending to those brands,

markets, and channels where we believe the consumer and trade are more

responsive to the investments.

Selling, general, and administrative expenses increased 1% over the first

quarter last year, as the effect of a weaker U.S. dollar was nearly offset by

lower transition costs related to the fiscal 2007 Casa Herradura acquisition,

tight management of discretionary expenses, and the leveraging of investments

made in prior years.

Operating income declined $14.8 million, or 10% from the first quarter of last

year. Operating income was impacted by the $22.4 million pre-tax non-cash charge

related to an abnormal number of agave plants identified during the quarter as

dead or dying, as described above. The following table summarizes the major

factors influencing the change in operating income for the quarter:

Growth vs.

Prior Period

Non-cash agave inventory write-down (15%)

Estimated net change in trade inventories (3%)

Discontinued agency brands (1%)

Reduced transition expenses from acquisitions 2%

Foreign exchange 4%

Underlying operating income growth 3%

-----

Reported operating income growth (10%)

=====

|

Net interest expense decreased by $3.6 million, reflecting a shift in total debt

from higher rate fixed debt to lower rate variable debt. Additionally, an

overall reduction in debt levels also contributed to this reduction in net

interest expense.

16

The effective tax rate in the quarter was 33.8% compared to 33.9% reported in

the first quarter of fiscal 2008. Our effective tax rate was negatively affected

by the $6.7 million tax benefit on the provision for agave losses recorded in

the quarter. Adjusting for this item, our effective tax rate for the quarter was

33.2%. A shift in the mix of our income from higher tax jurisdictions to lower

tax jurisdictions when compared to last year is driving this lower rate.

Reported earnings per share of $0.73 for the quarter declined 5% from the $0.77

earned in the same prior year period. Excluding the impact of the $0.13 per

share non-cash write-down of agave inventory, underlying growth in operating

income, a reduction of net interest expense, a lower effective tax rate

(excluding the tax effect of the write-down of agave), and fewer shares

outstanding following the fiscal 2008 share repurchase contributed to the growth

in earnings for the quarter.

FULL-YEAR OUTLOOK

Due to the non-cash agave charge in the quarter, we have reduced our fiscal 2009

full year earnings per share guidance to a range of $3.60 to $3.85, representing

growth of 1% to 8% over prior-year earnings. Excluding the charge, fiscal 2009

guidance remains unchanged. The guidance incorporates expectations of improving

volumetric global trends for Jack Daniel's, benefits of price increases,

continued cost pressures, continued control of discretionary operating expenses,

lower net interest expense, and additional benefits from the fiscal 2008 share

repurchase.

LIQUIDITY AND FINANCIAL CONDITION

Cash and cash equivalents increased $41.3 million during the three months ended

July 31, 2008, compared to a decrease of $103.0 million during the same period

last year. Cash provided by operations was $104.7 million, down from $128.4

million for the same three-month period last year. The decline primarily

reflects a higher seasonal increase in inventory related to value (gift) packs

in preparation of the upcoming holiday season and the absence of a refund of

taxes related to the acquisition of Casa Herradura received in the first quarter

of last year. Cash provided by investing activities declined from last year by

$74.6 million, largely reflecting last year's liquidation of $85.6 million of

short-term investments and the $12.0 million acquisition of the Don Eduardo

brand name. Cash used for financing activities decreased by $239.9 million from

last year, primarily reflecting the $203.7 million special distribution to

shareholders in May 2007 and a $48.6 million reduction in net debt repayments.

On July 24, 2008, our Board of Directors approved a regular quarterly cash

dividend of $0.34 per share on Class A and Class B Common Stock. Stockholders of

record on September 8, 2008 will receive the cash dividend on October 1, 2008.

17

RECENT ACCOUNTING PRONOUNCEMENTS

In December 2007, the FASB issued Statement No. 141(R), "Business Combinations"

(FAS 141(R)), which establishes accounting principles and disclosure

requirements for all transactions in which a company obtains control over

another business.

In December 2007, the FASB issued Statement No. 160, "Noncontrolling Interests

in Consolidated Financial Statements" (FAS 160), which prescribes the accounting

by a parent company for minority interests held by other parties in a subsidiary

of the parent company.

In March 2008, the FASB issued Statement No. 161, "Disclosures about Derivative

Instruments and Hedging Activities" (FAS 161), which requires qualitative

disclosures about objectives and strategies for using derivatives, quantitative

disclosures about fair value amounts of and gains and losses on derivative

instruments, and disclosures about credit-risk-related contingent features in

derivative agreements.

FAS 141(R) and FAS 160 become effective as of the beginning of our 2010 fiscal

year, while FAS 161 becomes effective as of the end of our 2009 fiscal year. We

do not expect our adoption of these pronouncements will have a material impact

on our financial statements.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

We hold debt obligations, foreign currency forward and option contracts, and

commodity futures contracts that are exposed to risk from changes in interest

rates, foreign currency exchange rates, and commodity prices, respectively.

Established procedures and internal processes govern the management of these

market risks. As of July 31, 2008, we do not consider the exposure to these

market risks to be material.

Item 4. Controls and Procedures

The Chief Executive Officer ("CEO") and the Chief Financial Officer ("CFO") of

Brown-Forman (its principal executive and principal financial officers) have

evaluated the effectiveness of the company's "disclosure controls and

procedures" (as defined in Rule 13a-15(e) under the Securities Exchange Act of

1934 (the "Exchange Act")) as of the end of the period covered by this report.

Based on that evaluation, the CEO and CFO concluded that the company's

disclosure controls and procedures: are effective to ensure that information

required to be disclosed by the company in the reports filed or submitted by it

under the Exchange Act is recorded, processed, summarized, and reported within

the time periods specified in the SEC's rules and forms; and include controls

and procedures designed to ensure that information required to be disclosed by

the company in such reports is accumulated and communicated to the company's

management, including the CEO and the CFO, as appropriate, to allow timely

decisions regarding required disclosure. There has been no change in the

company's internal control over financial reporting during the most recent

fiscal quarter that has materially affected, or is reasonably likely to

materially affect, the company's internal control over financial reporting.

18

PART II - OTHER INFORMATION

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

The following table provides information about shares of our common stock that

we repurchased during the quarter ended July 31, 2008:

Total Number of Maximum Number

Total Shares Purchased of Shares that May

Number of Average as Part of Yet Be Purchased

Shares Price Paid Publicly Announced Under the Plans or

Period Purchased per Share Plans or Programs Programs

May 1, 2008 - May 31, 2008 3,892 $68.62 -- --

Total 3,892 $68.62 -- --

|

These shares were received from an employee to satisfy income tax withholding

obligations triggered by the employee's retirement from the Company.

Item 4. Submission of Matters to a Vote of Security Holders

At the Annual Meeting of Stockholders of the Company held July 24, 2008, the

persons named below were elected to serve as directors until the next annual

election of directors, or until a successor has been elected and qualified. Each

director received the votes of at least 90.4% of the Class A shares present for

the meeting.

For Withheld

---------- ---------

Patrick Bousquet-Chavanne 54,132,551 7,792

Barry D. Bramley 49,457,201 4,683,142

Geo. Garvin Brown IV 53,179,662 960,681

Martin S. Brown, Jr. 53,258,955 881,388

Donald G. Calder 54,021,501 118,842

Sandra A. Frazier 53,138,045 1,002,298

Richard P. Mayer 49,526,641 4,613,702

William E. Mitchell 54,125,964 14,379

Matthew R. Simmons 54,134,490 5,853

William M. Street 48,982,742 5,157,601

Dace Brown Stubbs 53,205,687 934,656

Paul C. Varga 53,207,932 932,411

James S. Welch, Jr. 53,140,264 1,000,079

|

Item 6. Exhibits

31.1 CEO Certification pursuant to Section 302 of Sarbanes-Oxley Act

of 2002.

31.2 CFO Certification pursuant to Section 302 of Sarbanes-Oxley Act

of 2002.

32 CEO and CFO Certification pursuant to 18 U.S.C. Section 1350, as

adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

(not considered to be filed).

19

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

BROWN-FORMAN CORPORATION

(Registrant)

Date: September 5, 2008 By: /s/ Donald C. Berg

Donald C. Berg

Executive Vice President

and Chief Financial Officer

(On behalf of the Registrant and

as Principal Financial Officer)

|

20

Exhibit 31.1

CERTIFICATION PURSUANT TO SECTION 302 OF SARBANES-OXLEY ACT OF 2002

I, Paul C. Varga, certify that:

1. I have reviewed this Quarterly report on Form 10-Q of Brown-Forman

Corporation;

2. Based on my knowledge, this report does not contain any untrue statement of

a material fact or omit to state a material fact necessary to make the

statements made, in light of the circumstances under which such statements

were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial

information included in this report, fairly present in all material respects

the financial condition, results of operations and cash flows of the

registrant as of, and for, the periods presented in this report;

4. The registrant's other certifying officer and I are responsible for

establishing and maintaining disclosure controls and procedures (as defined

in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over

financial reporting (as defined in Exchange Act Rules 13a-15(f) and

15d-15(f)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such

disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the registrant,

including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this

report is being prepared;

b) Designed such internal control over financial reporting, or caused such

internal control over financial reporting to be designed under our

supervision, to provide reasonable assurance regarding the reliability

of financial reporting and the preparation of financial statements for

external purposes in accordance with generally accepted accounting

principles;

c) Evaluated the effectiveness of the registrant's disclosure controls and

procedures and presented in this report our conclusions about the

effectiveness of the disclosure controls and procedures, as of the end

of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the registrant's internal control

over financial reporting that occurred during the registrant's most

recent fiscal quarter (the registrant's fourth fiscal quarter in the

case of an annual report) that has materially affected, or is reasonably

likely to materially affect, the registrant's internal control over

financial reporting; and

5. The registrant's other certifying officer and I have disclosed, based on our

most recent evaluation of internal control over financial reporting, to the

registrant's auditors and the audit committee of the registrant's board of

directors (or persons performing the equivalent function):

a) All significant deficiencies and material weaknesses in the design or

operation of internal control over financial reporting which are

reasonably likely to adversely affect the registrant's ability to

record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other

employees who have a significant role in the registrant's internal

control over financial reporting.

Date: September 5, 2008 By: /s/ Paul C. Varga

Paul C. Varga

Chief Executive Officer

|

Exhibit 31.2

CERTIFICATION PURSUANT TO SECTION 302 OF SARBANES-OXLEY ACT OF 2002

I, Donald C. Berg, certify that:

1. I have reviewed this Quarterly report on Form 10-Q of Brown-Forman

Corporation;

2. Based on my knowledge, this report does not contain any untrue statement of

a material fact or omit to state a material fact necessary to make the

statements made, in light of the circumstances under which such statements

were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial

information included in this report, fairly present in all material respects

the financial condition, results of operations and cash flows of the

registrant as of, and for, the periods presented in this report;

4. The registrant's other certifying officer and I are responsible for

establishing and maintaining disclosure controls and procedures (as defined

in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over

financial reporting (as defined in Exchange Act Rules 13a-15(f) and

15d-15(f)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such

disclosure controls and procedures to be designed under our supervision,

to ensure that material information relating to the registrant,

including its consolidated subsidiaries, is made known to us by others

within those entities, particularly during the period in which this

report is being prepared;

b) Designed such internal control over financial reporting, or caused such

internal control over financial reporting to be designed under our

supervision, to provide reasonable assurance regarding the reliability

of financial reporting and the preparation of financial statements for

external purposes in accordance with generally accepted accounting

principles;

c) Evaluated the effectiveness of the registrant's disclosure controls and

procedures and presented in this report our conclusions about the

effectiveness of the disclosure controls and procedures, as of the end

of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the registrant's internal control

over financial reporting that occurred during the registrant's most

recent fiscal quarter (the registrant's fourth fiscal quarter in the

case of an annual report) that has materially affected, or is reasonably

likely to materially affect, the registrant's internal control over

financial reporting; and

5. The registrant's other certifying officer and I have disclosed, based on our

most recent evaluation of internal control over financial reporting, to the

registrant's auditors and the audit committee of the registrant's board of

directors (or persons performing the equivalent function):

a) All significant deficiencies and material weaknesses in the design or

operation of internal control over financial reporting which are

reasonably likely to adversely affect the registrant's ability to

record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other

employees who have a significant role in the registrant's internal

control over financial reporting.

Date: September 5, 2008 By: /s/ Donald C. Berg

Donald C. Berg

Chief Financial Officer

|

Exhibit 32

CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of Brown-Forman Corporation ("the

Company") on Form 10-Q for the period ended July 31, 2008, as filed with the

Securities and Exchange Commission on the date hereof (the "Report"), each of

the undersigned hereby certifies, pursuant to 18 U.S.C. Section 1350, as adopted

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, in the capacity as an

officer of the Company, that:

(1) The Report fully complies with the requirements of Section 13(a) of the

Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in all material

respects, the financial condition and results of operations of the Company.

Date: September 5, 2008 By: /s/ Paul C. Varga

Paul C. Varga

Chairman and Chief Executive Officer

By: /s/ Donald C. Berg

Donald C. Berg

Executive Vice President

and Chief Financial Officer

|

A signed original of this written statement required by Section 906 has been

provided to the Company and will be retained by the Company and furnished to the

Securities and Exchange Commission or its staff upon request.

This certificate is being furnished solely for purposes of Section 906 and is

not being filed as part of the Periodic Report.

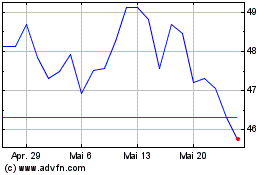

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Brown Forman (NYSE:BF.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024