UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of May 2024

Commission

file number 001-41313

BROOKFIELD

BUSINESS CORPORATION

(Exact name of Registrant as specified in its

charter)

250

Vesey Street, 15th Floor

New York, New York 10281

(Address of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Exhibit 99.1 included in this Form 6-K is incorporated by

reference into Brookfield Business Corporation’s registration statement on Form F-3 (File No: 333-273180).

EXHIBIT LIST

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

BROOKFIELD BUSINESS CORPORATION |

| |

|

| Date: May 17,

2024 |

By: |

/s/

A.J. Silber |

| |

|

Name: A.J. Silber |

| |

|

Title: Managing Director |

Exhibit 99.1

2024

MANAGEMENT

INFORMATION

CIRCULAR

Brookfield Business

Corporation

ANNUAL

GENERAL MEETING – JUNE 20, 2024

Notice

of Annual General Meeting of Shareholders

and

Availability of Investor Materials

An

Annual General Meeting of Shareholders of Brookfield Business Corporation (the “Corporation” or “BBUC”)

will be held on Thursday, June 20, 2024 at 9:00 a.m. Eastern Daylight Time (“EDT”)

in a virtual meeting format to:

| 1. | receive the

consolidated financial statements of the Corporation for the fiscal year ended December 31,

2023, including the external auditor’s report thereon; |

| 2. | elect the board

of directors of the Corporation; and |

| 3. | appoint the

external auditor of the Corporation and authorize the board of directors of the Corporation

to set its remuneration. |

We

will also consider any other business that may properly come before the meeting.

This

year’s meeting will be held in a virtual meeting format only. Shareholders will be able to listen to, participate in and vote at

the meeting in real time through a web-based platform instead of attending the meeting in person.

You

can attend and vote at the virtual meeting by visiting https://web.lumiagm.com/437273424

and entering your control number and password “BBUC2024” (case sensitive). See “Q&A on Voting” in

our management information circular dated May 8, 2024 (the “Circular”) for more information on how to listen,

register for and vote at the meeting.

You

have the right to vote at the meeting if you were a shareholder at the close of business on Wednesday, May 1,

2024. Before casting your vote, we encourage you to review the Circular, including the section entitled “Business of the Meeting”.

We

are posting electronic versions of the Circular, a form of proxy or voting instruction form, and our annual report on Form 20-F

(which includes our financial statements for the fiscal year ended December 31, 2023 and related

management’s discussion and analysis) (collectively, the “investor materials”) on our website for shareholder

review – a process known as “Notice and Access”. Electronic copies of the investor materials may be accessed at https://bbu.brookfield.com/bbuc/overview

under “Notice and Access 2024” and at www.sedarplus.ca and www.sec.gov/edgar.

If

you would like paper copies of any investor materials please contact us at 1-866-989-0311 or bbu.enquiries@brookfield.com

and we will mail materials free of charge within three business days of your request, provided the request is made before the date

of the meeting or any adjournment thereof. In order to receive investor materials in advance of the deadline to submit your vote, we

recommend that you contact us before 9:00 a.m. EDT on June 6, 2024.

Instructions

on Voting at the Virtual Meeting

Registered

shareholders and duly appointed proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholder)

will be able to attend the virtual meeting and vote in real time, provided they are connected to the internet and follow the instructions

in the Circular. See “Q&A on Voting” in the Circular. Non-registered shareholders who have not duly appointed themselves

as proxyholder will be able to attend the virtual meeting as guests but will not be able to ask questions or vote at the meeting.

If

you wish to appoint a person other than the Management Representatives identified in the form of proxy or voting instruction form (including

if you are a non-registered shareholder who wishes to appoint yourself as proxyholder in order to attend the virtual meeting) you must

carefully follow the instructions in the Circular and on the form of proxy or voting instruction

form. See “Q&A on Voting” in the Circular. These instructions include the additional step of registering your proxyholder

with our transfer agent, TSX Trust Company, after submitting the form of proxy or voting instruction form. Failure to register the

proxyholder (including, if you are a non-registered shareholder, failure to appoint yourself as proxyholder) with our transfer agent

will result in the proxyholder not receiving a user name to participate in the virtual meeting and only being able to attend as a guest.

Guests will be able to listen to the virtual meeting but will not be able to ask questions or vote.

Information for

Registered Shareholders

Registered

shareholders and duly appointed proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholder)

that attend the meeting online will be able to vote by completing a ballot online during the meeting through the live webcast platform.

If

you are not attending the virtual meeting and wish to vote by proxy, we must receive your vote by 12:00 p.m. EDT on June 18,

2024, or, in the event the virtual meeting is adjourned or postponed, not less than two business days prior to the time of the adjourned

or postponed meeting (the “Proxy Deadline”). You can cast your proxy vote in the following ways:

| · | On

the Internet at www.meeting-vote.com; or |

| · | Mail

your signed proxy using the business reply envelope accompanying your proxy; or |

| · | Email

your signed proxy to proxyvote@tmx.com; or |

| · | Fax

your signed proxy to 416-595-9593; or |

| · | By

telephone at 1-888-489-5760 (toll-free North America). |

Information for

Non-Registered Shareholders

Non-registered

shareholders will receive a voting instruction form with their physical copy of this notice. If you wish to vote, but not attend the

meeting, the voting instruction form must be completed, signed and returned in accordance with the directions on the form.

If

you wish to appoint a proxyholder, you must complete the additional step of registering the proxyholder with our transfer agent, TSX

Trust Company at 1-866-751-6315 (toll-free North America) or 416-682-3860 (outside North America)

or visiting www.tsxtrust.com/control-number-request by no later than the Proxy Deadline and provide TSX Trust Company with

the required information for your proxyholder so that TSX Trust Company may provide the proxyholder with a control number. This control

number will allow your proxyholder to log in to and vote at the meeting online. Without a control number, your proxyholder will not be

able to vote or ask questions at the meeting. They will only be able to attend the meeting online as a guest.

| |

By Order of the Board |

| |

|

| |

/s/

A.J. Silber |

| |

|

| |

A.J. Silber |

| |

General Counsel and Corporate Secretary |

| |

May 8, 2024 |

Letter

to Shareholders

To

our shareholders,

On

behalf of your Board of Directors, we are pleased to invite you to attend the 2024 annual meeting of Brookfield Business Corporation

(the “Corporation” or “BBUC”). The annual meeting will occur by webcast at 9:00 a.m. (Eastern

Daylight Time) on Thursday, June 20, 2024. You can read about the business of the meeting beginning on page 9 of the accompanying

Management Information Circular (the “Circular”). The Circular also provides important information on voting your

shares at the meeting, our ten (10) director nominees, our corporate governance practices, and director and executive compensation.

Additional details on how to access our live audio and participate in our annual meeting can be found in the “Q&A on Voting”

section of the Circular.

2023

Highlights

Our

business had a successful 2023. BBUC reported net income of $2.8 billion, inclusive of a $3.8 billion gain recognized on our nuclear

technology services operation which was reported as a discontinued operation as a result of the sale completed on November 7, 2023.

The

performance at our dealer software and technology services operation continues to be strong. Our value creation plan focused on optimizing

costs, enhancing service, and improving productivity is largely complete. The business is now focused on product and technology innovations

to accelerate growth, enhance customer retention and expand its addressable market.

Our

Brazilian water and wastewater operation generated solid results during the year with increased contribution driven by the ongoing growth

of its service network and higher billing rates that contributed to resilient margin performance. The business began another round of

operational improvements and has been progressing commercial and cost optimization plans to further enhance financial performance and

cashflow.

Performance

at our Australian healthcare services operation has been challenged. While the business is focused on initiatives to improve profitability,

broader industry challenges including cost escalation and reduced patient activity continue to impact the private hospital sector in

Australia. We are in the early stages of engaging with key stakeholders to address these challenges.

The

quality of our operations and our hands-on approach to repositioning the businesses we own continues to be a key differentiator of our

performance. This provides a strong setup for continued value creation as we execute our plans to enhance our business performance and

cash flows.

Shareholder

Meeting

Please

take the time to read our Management Information Circular and determine how you will vote your shares.

The

Board wishes to express our appreciation for your continued faith in us and we look forward to meeting with you (virtually) on June 20th.

Yours

truly,

“Cyrus

Madon”

Cyrus

Madon

Brookfield

Business Corporation

Executive

Chairman

Table

of Contents

Management

Information Circular

Table

of Contents

| Part One – Voting Information |

1 |

| |

|

| |

Who Can Vote |

1 |

| |

Notice and Access |

2 |

| |

Q & A on Voting |

2 |

| |

Principal Holders of Voting Shares |

8 |

| |

|

|

| Part Two – Business of the Meeting |

9 |

| |

|

|

| |

1. Receiving the Consolidated Financial Statements |

9 |

| |

2. Election of Directors |

9 |

| |

3. Appointment of External Auditor |

18 |

| |

|

|

| Part Three – Statement of Corporate Governance

Practices |

20 |

| |

|

| |

Overview |

20 |

| |

Board of Directors |

20 |

| |

Management Diversity |

28 |

| |

Sustainability Management |

28 |

| |

Code of Business Conduct and Ethics |

30 |

| |

Personal Trading Policy |

31 |

| |

|

|

| Part Four – Director Compensation and Equity

Ownership |

32 |

| |

|

| |

Director Compensation |

32 |

| |

Equity Ownership of Directors |

33 |

| |

|

|

| Part Five – Report on Executive Compensation |

34 |

| |

|

| |

Executive Overview |

34 |

| |

Compensation Elements Paid by Brookfield |

35 |

| |

Base Salaries |

35 |

| |

Cash Bonus and Long-Term Incentive Plans |

35 |

| |

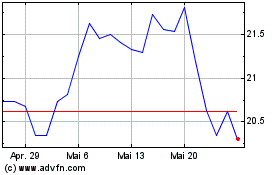

Performance Graph |

37 |

| |

Summary of Compensation |

38 |

| |

Pension and Retirement Benefits |

42 |

| |

Termination and Change of Control Benefits |

42 |

| |

|

|

| Part Six – Other Information |

44 |

| |

|

| |

Indebtedness of Directors, Officers and Employees |

44 |

| |

Audit Committee |

44 |

| |

Related Party Transactions |

44 |

| |

Management Contracts |

45 |

| |

Normal Course Issuer Bid |

45 |

| |

Availability of Disclosure Documents |

45 |

| |

Other Business |

46 |

| |

Directors’ Approval |

47 |

| |

|

|

| APPENDIX A – Charter of the Board |

1 |

2024 MANAGEMENT INFORMATION CIRCULAR / ii

Part One

– Voting Information

This

Management Information Circular (the “Circular”) is provided in connection with the solicitation by management of Brookfield

Business Corporation (the “Corporation” or “BBUC”) of proxies for the

Annual General Meeting of Shareholders of the Corporation (the “meeting”) referred to in the Corporation’s Notice

of Annual General Meeting of Shareholders and Availability of Investor Materials dated May 8, 2024 (the “Notice”)

to be held in a virtual meeting format only on Thursday, June 20, 2024 at 9:00 a.m. Eastern Daylight Time (“EDT”).

See “Q&A on Voting” on page 2 of this Circular for further information.

This

solicitation will be made primarily by sending proxy materials to shareholders by mail and email, and in relation to the delivery of

this Circular, by posting this Circular on our website at https://bbu.brookfield.com/bbuc/overview

under “Notice and Access 2024”, on our SEDAR+ profile at www.sedarplus.ca and on our Electronic Data

Gathering, Analysis, and Retrieval system (“EDGAR”) profile at www.sec.gov/edgar pursuant to Notice

and Access. See “Notice and Access” below for further information. The cost of solicitation will be borne by the

Corporation.

The information

in this Circular is given as at May 8, 2024, unless otherwise indicated. As the Corporation operates in U.S. dollars and reports

its financial results in U.S. dollars, all financial information in this Circular is denominated in U.S. dollars, unless otherwise indicated.

All references to C$ are to Canadian dollars. For comparability, all Canadian dollar amounts in this Circular have been converted to

U.S. dollars at the average exchange rate for 2023 as reported by Bloomberg of C$1.00 = US$0.7411, unless otherwise indicated.

Who

Can Vote

As

at May 1, 2024, the Corporation had 72,954,447 class A exchangeable subordinate voting shares (“exchangeable shares”),

1 class B multiple voting share (“class B shares”) and 25,934,120 class C non-voting shares (“class C shares”)

outstanding. The exchangeable shares are listed on the New York Stock Exchange (“NYSE”) and the Toronto Stock Exchange

(“TSX”) under the symbol “BBUC”. The class B shares and class C shares are all held indirectly by Brookfield

Business Partners L.P. (the “partnership” or “BBU”) (see “Principal Holders of Voting Shares”

on page 8 of this Circular for further information). Each registered holder of record of exchangeable shares or class B shares as

at the close of business on Wednesday, May 1, 2024 (the “Record Date”) is entitled to receive notice of and to

vote at the meeting. Except as otherwise provided in this Circular, each holder of an exchangeable share or a class B share on such date

is entitled to vote on all matters to come before the meeting or any adjournment thereof, either in person or by proxy. Except as otherwise

provided in the Corporation’s articles or as required by law, holders of class C shares are entitled to notice of, and to attend,

any meetings of shareholders of the Corporation, but are not entitled to vote at any such meetings.

The

share conditions for the exchangeable shares and class B shares provide that, subject to applicable law and in addition to any other

required shareholder approvals, (i) each holder of exchangeable shares is entitled to cast one vote for each exchangeable share

held at the Record Date for determination of shareholders entitled to vote on any matter and (ii) each holder of class B shares

is entitled to cast a number of votes for each class B share held at the Record Date for determination of shareholders entitled to vote

on any matter equal to: (A) the number that is three (3) times the number of exchangeable shares then issued and outstanding

divided by (B) the number of class B shares then issued and outstanding. The effect of the foregoing is that the holders of the

class B shares are entitled to cast, in the aggregate, a number of votes equal to three times the number of votes attached to the exchangeable

shares. Except as otherwise expressly provided in the Corporation’s articles or as required by law, the holders of exchangeable

shares and class B shares will vote together and not as separate classes.

Each

exchangeable share has been structured with the intention of providing an economic return equivalent to one non-voting limited partnership

unit of BBU (each, a “BBU Unit”). We therefore expect that the market price of our exchangeable shares will be significantly

impacted by the market price of the BBU Units and the combined business performance of our group (as defined below) as a whole. In addition

to carefully considering the disclosure made in this Circular, you should carefully consider the disclosure made by BBU in its continuous

disclosure filings. Copies of BBU’s continuous disclosure filings are available electronically on BBU’s SEDAR+ profile at

www.sedarplus.ca and on BBU’s EDGAR profile at www.sec.gov/edgar.

2024 MANAGEMENT INFORMATION CIRCULAR / 1

Notice

and Access

The

Corporation is using the Notice and Access provisions of National Instrument 54-101 — Communication with Beneficial Owners of

Securities of a Reporting Issuer and National Instrument 51-102 — Continuous Disclosure Obligations (“Notice

and Access”) to provide meeting materials electronically for both registered and non-registered shareholders. Instead of mailing

meeting materials to shareholders, we have posted this Circular and form of proxy on our website at https://bbu.brookfield.com/bbuc/overview

under “Notice and Access 2024”, in addition to posting it on SEDAR at www.sedarplus.ca and on EDGAR

at www.sec.gov/edgar. The Corporation has sent the Notice and a form of proxy or voting instruction form (collectively,

the “Notice Package”) to all shareholders informing them that this Circular is available online and explaining how

this Circular may be accessed. The Corporation will not directly send the Notice Package to non-registered shareholders. Instead, the

Corporation will pay Intermediaries (as defined on page 4 of this Circular) to forward the Notice Package to all non-registered

shareholders.

The

Corporation has elected to utilize Notice and Access because it allows for a reduction in the use of printed paper materials, is consistent

with our focus on sustainability and results in significantly lower printing and mailing costs in connection with the meeting.

Registered

and non-registered shareholders who have signed up for electronic delivery of this Circular and our annual report on Form 20-F

(which includes our financial statements for the fiscal year ended December 31, 2023 and

related management’s discussion and analysis) (the “Annual Report on Form 20-F”) will continue to

receive them by email. No shareholders will receive a paper copy of this Circular unless they contact the Corporation at

1-866-989-0311 or bbu.enquiries@brookfield.com, in which case the Corporation will mail this Circular within three

business days of any request, provided the request is made before the date of the meeting or any adjournment

thereof. We must receive your request before 9:00 a.m. EDT on June 6, 2024 to ensure you will receive paper copies in

advance of the deadline to submit your vote. If your request is made after the meeting and within one year of this Circular being

filed, the Corporation will mail this Circular within 10 calendar days of such request.

The

deadline for shareholder proposals for the Corporation’s 2025 Annual General Meeting of Shareholders is March 20, 2025. Shareholder

proposals should be submitted to the Corporation’s registered office at 1055 West Georgia Street, 1500 Royal Centre, P.O. Box

11117, Vancouver, British Columbia, Canada, V6E 4N7.

Q &

A on Voting

What

am I voting on?

| Resolution |

Who

Votes |

Board

Recommendation |

| Election of the

Directors |

exchangeable shareholders; class B shareholders |

FOR each director

nominee |

| Appointment of

the External Auditor and authorizing Directors to set its remuneration |

exchangeable shareholders;

class B shareholders |

FOR the resolution |

Who

is entitled to vote?

Holders

of exchangeable shares at the close of business on Wednesday, May 1, 2024 are entitled to one vote per share on the items of business

as identified above. Holders of class B shares at the close of business on Wednesday, May 1, 2024 are collectively entitled to

cast, in the aggregate, a number of votes equal to three times the number of votes attached to the exchangeable shares issued and outstanding

on the items of business as identified above. Holders of class C shares are not entitled to vote on the items of business as identified

above.

Registered

shareholders and duly appointed proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholder)

will be able to attend the virtual meeting, submit questions and vote, provided they are connected to the internet, have a control number

and follow the instructions in the Circular. Non-registered shareholders who have not duly appointed themselves as proxyholder will be

able to attend the virtual meeting as guests but will not be able to ask questions or vote at the virtual meeting.

2024 MANAGEMENT INFORMATION CIRCULAR / 2

Shareholders

who wish to appoint a person other than the Management Representatives identified in the form of proxy or voting instruction form

(including a non-registered shareholder who wishes to appoint themselves to attend the virtual meeting) must carefully follow the

instructions in the Circular and on their form of proxy or voting instruction form. These instructions include the additional step

of registering such proxyholder with our transfer agent, TSX Trust Company (“TSX Trust”), after submitting the

form of proxy by calling 1-866-751-6315 (toll-free North America) or 416-682-3860 (outside North America) or visiting www.tsxtrust.com/control-number-request

no later than 12:00 p.m. EDT on June 18, 2024, or, in the event the virtual meeting is adjourned or postponed, not less

than two business days prior to the time of the adjourned or postponed meeting (the “Proxy Deadline”) and

providing TSX Trust with the name and email address of your appointee. TSX Trust will provide your appointee with a control number

which will allow your appointee to log in to and vote at the meeting. Failure to register the proxyholder (including, if you are

a non-registered shareholder, failing to appoint yourself as proxyholder) with our transfer agent will result in the proxyholder not

receiving a control number to participate in the virtual meeting and only being able to attend as a guest. Guests will be able to

listen to the virtual meeting but will not be able to ask questions or vote.

How

do I vote?

Shareholders

can vote in one of two ways, as follows:

| · | by

submitting your proxy or voting instruction form (by Internet, by mail or by telephone) prior

to the meeting; or |

| · | during

the meeting by online ballot through the live webcast platform. |

What

if I plan to attend the meeting and vote by online ballot?

If

you are a registered shareholder or a duly appointed proxyholder (including a non-registered shareholder who has duly appointed itself

as proxyholder), you can attend and vote during the meeting by completing an online ballot through the live webcast platform. Guests

(including non-registered shareholders who have not duly appointed themselves as proxyholder) can log into the meeting. Guests will be

able to listen to the meeting but will not be able to ask questions or vote during the virtual meeting.

In

order to attend the virtual meeting, you will need to complete the following steps:

Step

1: Log in online at: https://web.lumiagm.com/437273424

Step

2: Follow these instructions:

Registered

shareholders: Click “I have a Login” and then enter your 13-digit control number

found on your form of proxy and the password “BBUC2024” (case sensitive) and click the “Login” button.

You will be able to vote by online ballot during the meeting by clicking on the “Voting Icon” on the meeting centre site.

If you log in and vote on any matter at the meeting, you will be revoking any and all previously submitted proxies. If you voted by proxy

in advance of the meeting and do not wish to revoke all previously submitted proxies, do not vote by online ballot on any matter at the

meeting.

Duly

appointed proxyholders: Click “I have a Login” and then enter the control number

provided to you by TSX Trust and the password “BBUC2024” (case sensitive) and click the “Login” button.

You will be able to vote by online ballot during the meeting by clicking on the “Voting Icon” on the meeting centre site.

If you log in and vote on any matter at the meeting, you will be revoking any and all previously submitted proxies. If you voted by proxy

in advance of the meeting and do not wish to revoke all previously submitted proxies, do not vote by online ballot on any matter at the

meeting.

2024 MANAGEMENT INFORMATION CIRCULAR / 3

Guests:

Click “I am a guest” and then complete the online form.

It

is your responsibility to ensure internet connectivity for the duration of the meeting and you should allow ample time to log in to the

meeting online before it begins.

What

if I plan to vote by proxy in advance of the meeting?

You

can also vote by proxy prior to the Proxy Deadline as follows:

| · | by

internet: access www.meeting-vote.com and follow the instructions on

the screen. You will need your 13-digit control number, which is printed on the form of proxy

sent to you. |

| · | by

mail: complete, sign and date your form of proxy and return it in the envelope provided

or in one addressed to TSX Trust Company:

Attention: Proxy Department, P.O. Box 721, Agincourt, Ontario M1S 0A1 |

| · | by

telephone: call toll-free in North America at 1-888-489-5760. You will be prompted

to provide the 13-digit control number printed on the form of proxy sent to you. Please note

that you cannot appoint anyone other than the directors and officers named on your form of

proxy as your proxyholder if you vote by telephone. |

If

you vote by proxy, your proxy must be received no later than the Proxy Deadline, regardless of the method you choose. If you do not date

your proxy, we will assume the date to be the date it was received by TSX Trust. If you vote by telephone or via the Internet, do not

return your form of proxy.

You

can appoint the persons named in the form of proxy or some other person (who need not be a shareholder of the Corporation) to represent

you as proxyholder at the meeting by writing the name of this person in the blank space on the form of proxy. If you wish to appoint

a person other than the Management Representatives identified in the form of proxy you will need to complete the additional step of registering

your proxyholder with TSX Trust at 1-866-751-6315 (toll-free in North America) or 416-682-3860 (outside North America) or visiting www.tsxtrust.com/control-number-request

by no later than the Proxy Deadline and provide TSX Trust with the required information for your proxyholder so that TSX Trust may provide

the proxyholder with a control number. This control number will allow your proxyholder to log in to and vote at the meeting online. Without

a control number, your proxyholder will not be able to vote or ask questions at the meeting. They will only be able to attend the meeting

online as a guest.

If

you are a non-registered shareholder and your shares are held in the name of an intermediary such as a bank, trust company, securities

dealer, broker or other intermediary (each, an “Intermediary”), and you would like to know how to direct the votes

of shares beneficially owned, see “If my shares are not registered in my name but are held in the name of an Intermediary, how

do I vote my shares?” on page 6 of this Circular for voting instructions.

Who is soliciting

my proxy?

The

proxy is being solicited by management of the Corporation and the associated costs will be borne by the Corporation.

What happens

if I sign the proxy sent to me?

Signing

the proxy appoints Jaspreet Dehl, Chief Financial Officer of the Corporation, or in the alternative,

A.J. Silber, General Counsel and Corporate Secretary of the Corporation (collectively, the “Management Representatives”),

or another person you have appointed, to vote or withhold from voting your shares at the meeting in accordance with your instructions.

2024 MANAGEMENT INFORMATION CIRCULAR / 4

Can

I appoint someone other than the Management Representatives to vote my shares?

Yes,

you may appoint another person other than the Management Representatives named on the form

of proxy to be your proxyholder. Write the name of this person in the blank space on the form

of proxy. The person you appoint does not need to be a shareholder. Please make sure that such other person you appoint is attending

the meeting and knows he or she has been appointed to vote your shares. You will need to complete the additional step of registering

such proxyholder with our transfer agent, TSX Trust, after submitting the form of proxy or voting instruction form. See “If my

shares are not registered in my name but are held in the name of an Intermediary, how do I vote my shares?” on page 6 of this

Circular for instructions on registering your proxy with TSX Trust. Registered shareholders may not appoint another person or company

as proxyholder other than the Management Representatives named in the form of proxy when voting by telephone.

What

do I do with my completed form of proxy?

Return

it to TSX Trust in the envelope provided to you by mail to TSX Trust Company: Attention: Proxy Department,

P.O. Box 721, Agincourt, Ontario M1S 0A1; or by email to proxyvote@tmx.com; or by fax to 416-595-9593 by no later

than the Proxy Deadline. A completed form of proxy should only be returned if you are voting by mail, email, fax or appointing a proxyholder.

Can

I vote by Internet in advance of the meeting?

Yes.

If you are a registered shareholder, go to www.meeting-vote.com and follow the instructions

on the screen. You will need your 13-digit control number, which is printed on the form of proxy sent to you. You must submit your vote

by no later than the Proxy Deadline.

If

I change my mind, can I submit another proxy or take back my proxy once I have given it?

Yes.

If you are a registered shareholder, you may deliver another properly executed form of proxy with a later date to replace the original

proxy in the same way you delivered the original proxy. If you wish to revoke your proxy, prepare a written statement to this effect

signed by you (or your attorney as authorized in writing) or, if the shareholder is a corporation, under its corporate seal or by a duly

authorized officer or attorney of the corporation. This statement must be delivered to the Corporate Secretary of the Corporation

at the address below no later than 12:00 p.m. EDT on Tuesday, June 18, 2024, or,

in the event the virtual meeting is adjourned or postponed, not less than two business days prior to the time of the adjourned or postponed

meeting. You may also log in, accept the terms and conditions and vote by online ballot at the meeting. Voting by online ballot will

revoke your previous proxy.

Attention: Corporate

Secretary

Brookfield Business

Corporation c/o TSX Trust Company,

Attention: Proxy

Department, P.O. Box 721, Agincourt, Ontario M1S 0A1

If

you are a non-registered shareholder, you may revoke a voting instruction form previously given to an Intermediary at any time by written

notice to the Intermediary. An Intermediary is not required to act on a revocation of a voting instruction form unless they receive it

at least seven calendar days before the meeting. A non-registered shareholder may then submit a revised voting instruction form in accordance

with the directions on the form.

How will my shares

be voted if I give my proxy?

The

persons named on the form of proxy must vote your shares for or against or withhold from voting, in accordance with your directions,

or you can let your proxyholder decide for you. If you specify a choice with respect to any matter to be acted upon, your shares will

be voted accordingly. In the absence of voting directions, proxies received by management will be voted in favour of all resolutions

put before shareholders at the meeting. See “Business of the Meeting” on page 9 of this Circular for further information.

2024 MANAGEMENT INFORMATION CIRCULAR / 5

What if amendments

are made to these matters or if other matters are brought before the meeting?

The

persons named on the proxy will have discretionary authority with respect to amendments or variations to matters identified in the Notice

and with respect to other matters which may properly come before the meeting.

As

at the date of this Circular, management of the Corporation is not aware of any amendment, variation or other matter expected to come

before the meeting. If any other matters properly come before the meeting, the persons named on the form of proxy will vote on them in

accordance with their best judgment.

Who

counts the votes?

The

Corporation’s transfer agent, TSX Trust Company, counts and tabulates the proxies.

How

do I contact the transfer agent?

For

general shareholder enquiries, you can contact TSX Trust Company as follows:

| Mail |

Telephone |

Online |

| |

|

|

TSX

Trust Company

301

– 100 Adelaide Street West

Toronto,

Ontario M5H 4H1 |

Direct dial outside

North America at 1-800-387-0825 (toll-free North America) and 416-682-3860 (outside North America) |

Email:

shareholderinquiries@tmx.com

Website:

www.tsxtrust.com |

If

my shares are not registered in my name but are held in the name of an Intermediary, how do I vote my shares?

In

many cases, exchangeable shares that are beneficially owned by a non-registered shareholder are registered either:

| · | in

the name of an Intermediary or a trustee or administrator of self-administered RRSPs, RRIFs,

RESPs and similar plans; or |

| · | in

the name of a depository such as CDS Clearing and Depository Services Inc. or the Depository

Trust Company, of which the Intermediary is a participant. |

Your

Intermediary is required to send you a voting instruction form for the number of shares you beneficially own.

Since

the Corporation has limited access to the names of its non-registered shareholders, if you attend the virtual meeting, the Corporation

may have no record of your shareholdings or of your entitlement to vote unless your Intermediary has appointed you as proxyholder. Therefore,

if you wish to vote by online ballot at the meeting, you will need to complete the following steps:

Step

1: Insert your name in the space provided on the voting instruction form and return it by following

the instructions provided therein.

Step

2: You must complete the additional step of registering yourself (or your appointees other than

if your appointees are the Management Representatives) as the proxyholder with TSX Trust at 1-866-751-6315 (toll-free North America)

or 416-682-3860 (outside North America) or www.tsxtrust.com/control-number-request no later than the Proxy Deadline and

providing TSX Trust with your name and email address or the name and email address of your appointee. TSX Trust will provide you or your

appointee with a control number which will allow you or your appointee to log in to and vote at the meeting.

2024 MANAGEMENT INFORMATION CIRCULAR / 6

If you are a non-registered

shareholder located in the United States and you wish to appoint yourself as a proxyholder, in addition to the steps above, you must

first obtain a valid legal proxy from your Intermediary. To do so, please follow these steps:

Step

1: Follow the instructions from your Intermediary included with the legal proxy form and the

voting information form sent to you or contact your Intermediary to request a legal proxy form or a legal proxy if you have not received

one.

Step

2: After you receive a valid legal proxy from your Intermediary, you must then submit the legal

proxy to TSX Trust. You can send the legal proxy by email or by courier to: proxyvote@tmx.com (if by email), or TSX Trust

Company, Attention: Proxy Dept., P.O. Box 721, Agincourt, Ontario M1S 0A1 (if by mail). The legal proxy in both cases must be labeled

“Legal Proxy” and received no later than the Proxy Deadline.

Step

3: TSX Trust will provide duly appointed proxyholders with a control number by email after the

voting deadline has passed. Please note that you are also required to register your appointment as a proxyholder at 1-866-751-6315 (toll-free

North America) or 416-682-3860 (outside North America) or www.tsxtrust.com/control-number-request as noted above.

Failing

to register online as a proxyholder will result in the proxyholder not receiving a control number, which is required to vote at the meeting.

Non-registered shareholders who have not duly appointed themselves as proxyholder will not be able to vote at the meeting but will be

able to participate as a guest.

A

non-registered shareholder who does not wish to attend and vote at the meeting and wishes to vote prior to the meeting must complete

and sign the voting instruction form and return it in accordance with the directions on the form.

The

Corporation has distributed copies of the Notice Package to Intermediaries for onward distribution to non-registered shareholders. Intermediaries

are required to forward the Notice Package to non-registered shareholders.

Non-registered

shareholders who have not opted for electronic delivery will receive a voting instruction form to permit them to direct the voting of

the shares they beneficially own. Non-registered shareholders should follow the instructions on the forms they receive and contact

their Intermediaries promptly if they need assistance.

2024 MANAGEMENT INFORMATION CIRCULAR / 7

Principal

Holders of Voting Shares

On

March 15, 2022, the partnership completed a special distribution whereby unitholders received one exchangeable share for every two

BBU Units held (the “special distribution”). The following table presents information regarding the beneficial ownership

of the exchangeable shares by each person or entity that beneficially owns 10% or more of the exchangeable shares. The exchangeable shares

held by the principal shareholders do not entitle such shareholders to different voting rights than those of other holders of the exchangeable

shares. However, the exchangeable shares and the class B shares have different voting rights. Holders of exchangeable shares hold a 25%

voting interest in the Corporation and holders of the class B shares hold a 75% voting interest in the Corporation.

| | |

Exchangeable

Shares | |

| Name | |

Number

Owned | | |

Percentage | |

| Brookfield

Corporation((a)(b)) | |

| 47,244,876 | | |

| 64.8 | % |

Notes:

| (a) | Brookfield

Corporation (formerly Brookfield Asset Management Inc.) (together with any affiliate thereof

other than our group, including Brookfield Asset Management Ltd. (“Brookfield Asset

Management”), unless the context requires otherwise, “Brookfield”)

holds the exchangeable shares it beneficially owns through wholly-owned subsidiaries. In

addition, BAM Partners Trust (the “BN Partnership”) may be deemed a beneficial

owner of such exchangeable shares. BN Partnership is a trust established under the laws of

Ontario and is the sole owner of the Class B limited voting shares of Brookfield Corporation.

The BN Partnership has the ability to appoint one half of the board of directors of Brookfield

Corporation and approve all other matters requiring shareholder approval of Brookfield Corporation

with no single individual or entity controlling the BN Partnership. As such, the BN Partnership

may be deemed to have indirect beneficial ownership of 47,244,876 exchangeable shares. The

business address of Brookfield Corporation and the BN Partnership is Brookfield Place, 181

Bay Street, Suite 100, Toronto, Ontario M5J 2T3. |

| (b) | Brookfield

acquired the exchangeable shares set forth above in connection with completion of the special

distribution. Immediately prior to the special distribution, the partnership held all of

the exchangeable shares. |

Brookfield Business

L.P. (“Holding LP”), which is controlled by BBU (together with Holding LP, certain subsidiaries of Holding LP and

the entities which directly or indirectly hold the partnership’s operating businesses and any other direct or indirect subsidiary

of such entities (other than the Corporation), “Brookfield Business Partners”), which itself is controlled by Brookfield,

holds all of the issued and outstanding class B shares, having a 75% voting interest in the Corporation, and all of the issued and outstanding

class C shares, which entitle the partnership to all of the residual value in the Corporation after payment in full of the amount due

to holders of exchangeable shares and class B shares and subject to the prior rights of holders of preferred shares. Together, Brookfield

and Brookfield Business Partners hold an approximate 91% voting interest in the Corporation. In this Circular, references to “our

group” mean, collectively, the Corporation and Brookfield Business Partners and references to “we” or “our”

means the Corporation together with all of its subsidiaries.

To

the knowledge of the directors and officers of the Corporation, there are no other persons or corporations that beneficially own, exercise

control or direction over, have contractual arrangements such as options to acquire, or otherwise hold voting securities of the Corporation

carrying more than 10% of the votes attached to any class of outstanding voting securities of the Corporation.

2024 MANAGEMENT INFORMATION CIRCULAR / 8

Part Two

– Business of the Meeting

We will address

three items at the meeting:

| 1. | receive

the consolidated financial statements of the Corporation for the fiscal year ended December 31,

2023, including the external auditor’s report thereon; |

| 2. | elect directors

who will serve until the next annual meeting of shareholders or until their successors are

elected or appointed; and |

| 3. | appoint

the external auditor who will serve until the next annual meeting of shareholders and authorize

the directors to set its remuneration. |

We will also consider

other business that may properly come before the meeting.

As

at the date of this Circular, management is not aware of any changes to these items and does not expect any other items to be brought

forward at the meeting. If there are changes or new items, you or your proxyholder can vote your shares on these items as you, he or

she sees fit. The persons named on the form of proxy will have discretionary authority with respect to any changes or new items which

may properly come before the meeting and will vote on them in accordance with their best judgment.

1.

Receiving the Consolidated Financial Statements

The

Corporation’s consolidated financial statements for the fiscal year ended December 31, 2023 and related management’s

discussion and analysis are included in our Annual Report on Form 20-F. Our Annual Report on Form 20-F is available on our

website https://bbu.brookfield.com/bbuc/overview, under “Notice and Access 2024”

and on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov/edgar, and is being mailed to registered and

non-registered shareholders of the Corporation who have contacted the Corporation to request a paper copy of the Annual Report on Form 20-F.

Shareholders who have signed up for electronic delivery of the Annual Report on Form 20-F will receive it by email.

2.

Election of Directors

The

board of directors of the Corporation (the “Board”) is comprised of ten (10) members, all of whom are to be elected

at the meeting. The Board mirrors the board of directors of the general partner of BBU, except that David Court and Michael Warren are

the non-overlapping directors of the Board who assist the Corporation with, among other things, resolving any conflicts of interest that

may arise from its relationship with the partnership. If you own exchangeable shares or class B

shares, you can vote on the election of all ten (10) directors. The following persons are proposed as nominees for election:

| · |

Cyrus Madon |

|

· |

Jeffrey Blidner |

|

· |

David Court |

|

· |

Stephen Girsky |

|

· |

David Hamill |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| · |

Anne Ruth Herkes |

|

· |

John Lacey |

|

· |

Don Mackenzie |

|

· |

Michael Warren |

|

· |

Patricia Zuccotti |

The appointment

of the directors must be approved by a majority of the votes cast by holders of exchangeable shares and class B shares, voting together

as a single class.

| 2024 MANAGEMENT INFORMATION CIRCULAR / 9 |

Voting by Proxy

The

Management Representatives designated on the proxy to be completed by shareholders intend to cast the votes represented by such proxy

FOR each of the proposed nominees for election by the shareholders as set forth under “Election of Directors” in Part Two

of this Circular, unless the shareholder who has given such proxy has directed that such shares be otherwise voted or withheld from voting

in the election of directors.

Director Nominees

The

Board recommends that the ten (10) director nominees be elected at the meeting to serve as directors of the Corporation until the

next annual meeting of shareholders or until their successors are elected or appointed.

The

Board believes that the collective qualifications, skills and experiences of the director nominees allow for the Corporation to continue

to maintain a well-functioning Board with a diversity of perspectives. The Board’s view is that, individually and as a whole, the

director nominees have the necessary qualifications to be effective at overseeing the business and strategy of the Corporation.

Jeffrey

Blidner and John Lacey were appointed to the Board on February 23, 2022 and David Court, Stephen Girsky, David Hamill, Anne Ruth

Herkes, Don Mackenzie, Michael Warren and Patricia Zuccotti were appointed to the Board on March 3, 2022. Cyrus Madon was appointed

to the Board on February 1, 2024.

We

expect that each of the director nominees will be able to serve as a director. If a director nominee tells us before the meeting that

he or she will not be able to serve as a director, the Management Representatives designated on the form of proxy, unless directed to

withhold from voting in the election of directors, reserve the right to vote for other director nominees at their discretion.

Each

director’s biography contains information about the director, including his or her background and experience, holdings of exchangeable

shares and other public company board positions held, as at May 8, 2024. See “Director

Share Ownership Requirements” in Part Three of this Circular for further information on director share ownership requirements.

| 2024 MANAGEMENT INFORMATION CIRCULAR / 10 |

The

following ten (10) individuals are nominated for election as directors of the Corporation:

Cyrus

Madon(a)

Age: 59

Director

since:

February 1, 2024

Director

of the general

partner of BBU since:

2024

(Affiliated)(d)

Areas

of Expertise:

CEO experience,

Private

Equity, Real Estate,

Infrastructure, Energy and Power |

Mr. Madon

is the Executive Chairman of the Corporation and of the general partner of the partnership. Mr. Madon is also a Managing Partner

of Brookfield Asset Management and the Executive Chairman of Brookfield Asset Management’s Private Equity Group. Mr. Madon

previously served as the Chief Executive Officer of the Corporation. Mr. Madon joined Brookfield in 1998 as Chief Financial

Officer of Brookfield’s real estate brokerage business. During his tenure, Mr. Madon has held a number of senior roles

across the organization, including head of Brookfield’s corporate lending business. Mr. Madon began his career at PricewaterhouseCoopers

where he worked in Corporate Finance and Recovery, both in Canada and the United Kingdom. Mr. Madon holds a Bachelor of Commerce

degree from Queen’s University and is on the board of the C.D. Howe Institute. |

| Board/Committee

Membership |

Public

Board Membership During Last Five Years |

| Board |

Brookfield Business Partners

L.P. /

Brookfield Business Corporation

Brookfield Asset Management

Ltd. |

2024

– Present

2024 – Present

2022 – Present |

| Number

of Exchangeable Shares and BBU Units Beneficially Owned, Controlled or Directed |

| Exchangeable

Shares |

BBU

Units(e) |

Total

Number of Exchangeable Shares and BBU Units |

| 45,815 |

91,630 |

137,445 |

| |

|

|

|

|

Jeffrey

Blidner(a)

Age: 75

Director

since:

February 23, 2022

Director

of the general

partner of BBU since:

2016

(Affiliated)(d)

Areas

of Expertise:

Growth Initiatives,

Governance,

Legal Expertise,

International Experience,

Strategic Planning Acumen,

Infrastructure, Power, Private Equity, Real Estate |

Mr. Blidner

is a Vice Chair of Brookfield Corporation and is the former Chief Executive Officer of Brookfield’s Private Funds Group. Mr. Blidner

currently serves as the Chair of the general partner of Brookfield Renewable Partners L.P. (and of Brookfield Renewable Corporation).

He also serves as a director of the general partner of BBU, Brookfield Corporation, the general

partner of Brookfield Infrastructure Partners L.P. (and of Brookfield Infrastructure Corporation) and is Chair of the general partner

of Brookfield Property Partners L.P. Prior to joining Brookfield in 2000, Mr. Blidner was a senior partner at a Canadian law

firm where his practice focused on merchant banking transactions, public offerings, mergers and acquisitions, management buy-outs

and private equity transactions. Mr. Blidner received his LLB from Osgoode Hall Law School and was called to the Bar in Ontario

as a Gold Medalist. Mr. Blidner is not considered an independent director because of his role at Brookfield. |

| Board/Committee

Membership |

Public

Board Membership During Last Five Years |

| Board |

Brookfield

Infrastructure Partners L.P. / Brookfield Infrastructure Corporation

Brookfield Renewable Partners L.P. / Brookfield Renewable Corporation

Brookfield Business Partners L.P. / Brookfield Business Corporation

Brookfield Corporation

Brookfield Property Partners L.P. |

2008/2020 – Present

2011/2020 – Present

2016/2022 – Present

2013 – Present

2013– Present |

| Number

of Exchangeable Shares and BBU Units Beneficially Owned, Controlled or Directed |

| Exchangeable

Shares |

BBU

Units(e) |

Total

Number of Exchangeable Shares and BBU Units |

| 17,594 |

35,189 |

52,783 |

| |

|

|

|

|

| 2024 MANAGEMENT INFORMATION CIRCULAR / 11 |

David

Court(a)

Age:

67

Director

since:

March 3, 2022

(Independent)(b)

Areas of Expertise:

Corporate Strategy, Human

Resource Management,

Leadership of a Large

Organization, Marketing,

Customer Management, Data

Analytics and Artificial

Intelligence |

Mr. Court

is a Director Emeritus at McKinsey & Company. Mr. Court was previously McKinsey’s Global Director of Technology,

Digitization and Communications, led McKinsey’s global practice in harnessing digital data and advanced analytics from 2011

to 2015, and was a member of the firm’s board of directors and its Global Operating Committee. Mr. Court is a director

of PSP Investments, a member of the National Geographic International Council of Advisors, a trustee of the Queen’s University

Board of Trustees and chair of the advisory board of Georgian Partners. Mr. Court was previously a director of Canadian Tire

Corporation between 2015 and 2023. Mr. Court holds a Bachelor of Commerce from Queen’s University and a Master of Business

Administration from Harvard Business School where he was a Baker Scholar. |

| Board/Committee

Membership |

Public

Board Membership During Last Five Years |

Board

Governance and Nominating

Committee |

Brookfield Business Corporation

/

Brookfield

Business Partners L.P.

Canadian Tire Corporation, Limited |

2022 – Present

2017 – 2022

2015 – 2023 |

| Number

of Exchangeable Shares and BBU Units Beneficially Owned, Controlled or Directed |

| Exchangeable

Shares |

BBU

Units(e) |

Total

Number of Exchangeable Shares and BBU Units |

| 8,302 |

16,605 |

24,907 |

| |

|

|

|

|

Stephen

Girsky(a)

Age: 62

Director

since:

March 3, 2022

Director

of the general partner of BBU since:

2016

(Affiliated)(d)

Areas

of Expertise:

Corporate Strategy, M&A,

Finance and Capital Allocation,

Leadership of a Large

Organization, Sustainability,

Automotive Sector, Electric

Vehicles |

Mr. Girsky

is president and CEO of Nikola Corporation, a publicly traded company that designs zero-emissions transportation and energy supply

and infrastructure solutions. Mr. Girsky served as managing director of VectoIQ, LLC, an independent advisory firm based in

New York. He served as president and CEO of VectoIQ Acquisition Corp. from January 2018 until the consummation of its business

combination with Nikola Corporation. Mr. Girsky served in a number of capacities at General Motors Co., including Vice Chairman,

and was previously the president of Centerbridge Industrial Partners and a Managing Director at Morgan Stanley. He is on the board

of directors at Nikola Corporation, BBUC, and Clarios. Mr. Girsky previously served on the board of directors of U.S. Steel

and General Motors. He also served as the lead director of Dana Holdings Corp. Mr. Girsky received a Bachelor of Science degree

in mathematics from the University of California at Los Angeles and a Master of Business Administration from the Harvard Business

School. Mr. Girsky is not considered an independent director because of his role consulting for Brookfield on its acquisition

of Clarios. |

| Board/Committee

Membership |

Public

Board Membership During Last Five Years |

| Board |

Brookfield

Business Partners L.P. / Brookfield Business Corporation

Clarios International

Inc.

Nikola Corporation |

2016/2022

– Present

2019 – Present

2020 – Present |

| Number

of Exchangeable Shares and BBU Units Beneficially Owned, Controlled or Directed |

| Exchangeable

Shares |

BBU

Units(e) |

Total

Number of Exchangeable Shares and BBU Units |

| 6,700 |

13,400 |

20,100 |

| |

|

|

|

|

| 2024 MANAGEMENT INFORMATION CIRCULAR / 12 |

David

Hamill(a)

Age:

66

Director

since:

March 3, 2022

Director

of the general partner of BBU since:

2016

(Independent)(b)

Areas

of Expertise:

Leadership of a Large

Organization,

Government and

Public Policy, Education

Sector, Social Services, Infrastructure |

Dr. Hamill

is a professional director and was Treasurer of the State of Queensland in Australia from 1998 to 2001, Minister for Education from

1995 to 1996 and Minister for Transport and Minister Assisting the Premier on Economic and Trade Development from 1989 to 1995. Dr. Hamill

also serves on the board of directors of the general partner of the partnership. Dr. Hamill retired from the Queensland Parliament

in February 2001 and since that time has served as a non-executive director or chairman of a range of listed and private companies

as well as not-for-profit and public sector entities. Dr. Hamill also serves on the board of directors of Dalrymple Bay Infrastructure

Limited. Dr. Hamill holds a Bachelor of Arts (Honors) from the University of Queensland, a Master of Arts from Oxford University

and a Doctorate of Philosophy from University of Queensland, and is a fellow of the Chartered Institute of Transport and the Australian

Institute of Company Directors. |

| Board/Committee

Membership |

Public

Board Membership During Last Five Years |

Board

Audit Committee

Governance and Nominating

Committee

Compliance Risk and Sustainability

Committee |

Brookfield

Business Partners L.P. / Brookfield Business Corporation

Dalrymple Bay Infrastructure Limited |

2016/2022

– Present

2020 – Present |

| Number

of Exchangeable Shares and BBU Units Beneficially Owned, Controlled or Directed |

| Exchangeable

Shares |

BBU

Units(e) |

Total

Number of Exchangeable Shares and BBU Units |

| 3,795 |

12,441 |

16,236 |

| |

|

|

|

|

Anne

Ruth Herkes(a)

Age:

67

Director

since:

March 3, 2022

Director

of the general

partner of BBU since:

2020

(Independent)(b)

Areas

of Expertise:

Leadership of a Large

Organization,

Risk

Management, Government and

Public Policy, International

Affairs, Sustainability, Energy

and Power, Space and Satellites |

Ms. Herkes

is a senior Advisor at ELC-Euringer Leadership Consulting, an executive search firm and leadership consulting company. She previously

was Deputy Chair of the board of directors of Merck Finck Privatbankiers AG, an asset and wealth management bank based in Munich.

She serves on the board of directors of Quintet (S.A.) Europe Private Bank in Luxembourg, where she is also a member of the remuneration

and nomination and audit committees, and the asset management forum. Previously she served on the board of Kreditanstalt fuer Wiederaufbau,

Germany’s third largest bank. She is a member of the International Advisory Board of Asia House, an independent think tank

and advisory service in London. Ms. Herkes in her former career served as State Secretary at the German Federal Ministry for

Economic Affairs and as Ambassador to Qatar. Ms. Herkes also serves on the board of directors of the partnership.

|

| Board/Committee

Membership |

Public

Board Membership During Last Five Years |

Board

Governance and Nominating

Committee |

Brookfield Business Partners

L.P. / Brookfield Business Corporation

|

2020/2022 – Present

|

| Number

of Shares and BBU Units Beneficially Owned, Controlled or Directed |

| Exchangeable

Shares |

BBU

Units(e) |

Total

Number of Exchangeable Shares and BBU Units |

| 8,081 |

1,106 |

9,187 |

| |

|

|

|

|

| 2024 MANAGEMENT INFORMATION CIRCULAR / 13 |

John

Lacey(a)

Age:

81

Director

since:

February 23, 2022

Director

of the general

partner of BBU since:

2016

(Independent)(b)

Areas

of Expertise:

Corporate Strategy, M&A,

Leadership of a Large

Organization, Asset

Management, International

Affairs, Private Equity, Human

Resource Management,

Restructurings,

Governance |

Mr. Lacey

is Chairman of Doncaster Consolidated Ltd., Doncaster Foundation and a director of Whittington Investments Ltd. Mr. Lacey also

serves on the board of directors of the general partner of the partnership. Mr. Lacey was previously the Chairman of the board

of directors of Alderwoods Group, Inc., an organization operating funeral cemeteries within North America, until 2006. Mr. Lacey

is the former President and Chief Executive Officer of The Oshawa Group (now part of Sobeys Inc.) and a former director of Loblaw

Companies Limited, George Weston Ltd., and TELUS Corporation. |

| Board/Committee

Membership |

Public

Board Membership During Last Five Years |

Board

Governance and Nominating

Committee (Chair) |

Brookfield

Business Partners L.P. / Brookfield Business Corporation |

2016/2022

– Present |

| Number

of Exchangeable Shares and BBU Units Beneficially Owned, Controlled or Directed |

| Exchangeable

Shares |

BBU

Units(e) |

Total

Number of Exchangeable Shares and BBU Units |

| 9,350 |

18,700 |

28,050 |

| |

|

|

|

|

Don

Mackenzie(a)

Age:

64

Director

since:

March 3, 2022

Director

of the general

partner of BBU since:

2016

(Independent)(b)

Areas

of Expertise:

Corporate Strategy, Marketing,

Technology, Entrepreneurship,

Retail, Construction,

Sustainability, Real Estate |

Mr. Mackenzie

is the Chairman and Owner of New Venture Holdings, a well-established privately-owned holding company with operating company and

real estate investments in Bermuda and Canada. Mr. Mackenzie also serves on the board of directors of the general partner of

the partnership. Prior to moving to Bermuda in 1990, Mr. Mackenzie worked in the software and sales sector. Mr. Mackenzie

acquired his first business in 1995, and New Venture Holdings was formed in 2000 to consolidate a number of operating investments

under a holding company umbrella. Mr. Mackenzie has a Bachelor of Commerce from Queen’s University and a Master of Business

Administration from Schulich School of Business of York University. |

| Board/Committee

Membership |

Public

Board Membership During Last Five Years |

Board (Chair)

Audit Committee |

Brookfield

Business Partners L.P. / Brookfield Business Corporation |

2016/2022

– Present |

| Number

of Exchangeable Shares and BBU Units Beneficially Owned, Controlled or Directed |

| Exchangeable

Shares |

BBU

Units(e) |

Total

Number of Exchangeable Shares and BBU Units |

| 6,715 |

13,430 |

20,145 |

| |

|

|

|

|

| 2024 MANAGEMENT INFORMATION CIRCULAR / 14 |

Michael

Warren(a)

Age:

56

Director

since:

March 3, 2022

(Independent)(b)

Areas

of Expertise:

Corporate

Strategy, M&A,

Finance and Capital

Allocation, CEO Experience,

Risk Management,

Sustainability, Asset

Management, Government

and

Public Policy, Financial

Services, Healthcare |

Mr. Warren

is the Managing Director of the Global Innovation and Growth Group of Albright Stonebridge Group (“ASG”), part

of the Dentons Global Advisor. He served as ASG’s Managing Principal from 2013 to 2017 and as Principal from 2009 to 2013.

Prior to ASG, Mr. Warren served as the Chief Operating Officer and Chief Financial Officer of Stonebridge International from

2004 to 2009, where he managed operations, business development, finance, and personnel portfolios. Mr. Warren served in various

capacities in the Obama Administration, including as senior advisor in the White House Presidential Personnel Office and as co-lead

for the Treasury and Federal Reserve agency review teams of the Obama-Biden Presidential Transition. Mr. Warren serves on the

board of the general partner of the partnership, the Board of Trustees, and the risk & audit committees at Commonfund, board

of directors of Walker & Dunlop, Inc., the board of directors of MAXIMUS, and the board of directors of Ripple Labs.

He serves as a Trustee of Yale University and is a member of the Yale Corporation Investment Committee. Mr. Warren formerly

served as a Trustee of the District of Columbia Retirement Board and as a member of the board of directors of the United States Overseas

Private Investment Corporation. Mr. Warren received degrees from Yale University and Balliol College at Oxford University where

he was a Rhodes Scholar. |

| Board/Committee

Membership |

Public

Board Membership During Last Five Years |

| Board |

Brookfield Business Corporation

Walker & Dunlop, Inc.

Maximus Inc. |

2022 – Present

2017 – Present

2019 – Present |

| Number

of Exchangeable Shares and BBU Units Beneficially Owned, Controlled or Directed |

| Exchangeable

Shares |

BBU

Units(e) |

Total

Number of Exchangeable Shares and BBU Units |

| 6,805 |

-- |

6,805 |

| |

|

|

|

|

| 2024 MANAGEMENT INFORMATION CIRCULAR / 15 |

Patricia

Zuccotti(a)

Age:

76

Director

since:

March 3, 2022

Director

of the general

partner of BBU since:

2016

(Independent)(b)

Areas

of Expertise:

Leadership of a Large

Organization,

Accounting,

Auditing, Risk Management |

Ms. Zuccotti

is a director of the general partner of Brookfield Renewable Partners L.P. (and of Brookfield Renewable Corporation), where she is

the Chair of the Audit Committee. Ms. Zuccotti also serves on the board of directors of the general partner of the partnership,

where she is the Chair of the Audit Committee. She served as Senior Vice President, Chief Accounting Officer and Controller of Expedia, Inc.

from October 2005 to September 2011. Prior to joining Expedia, Ms. Zuccotti was the Director, Enterprise Risk Services

of Deloitte & Touche LLP from June 2003 until October 2005. Ms. Zuccotti is a Certified Public Accountant

(inactive) and received her Master of Business Administration, majoring in accounting and finance, from the University of Washington

and a Bachelor of Arts, majoring in political science, from Trinity College. |

| Board/Committee

Membership |

Public

Board Membership During Last Five Years |

Board

Audit Committee (Chair)(c) |

Brookfield

Business Partners L.P. / Brookfield Business Corporation

Brookfield Renewable Partners L.P. / Brookfield Renewable Corporation |

2016/2022

– Present

2011/2020 – Present |

| Number

of Exchangeable Shares and BBU Units Beneficially Owned, Controlled or Directed |

| Exchangeable

Shares |

BBU

Units(e) |

Total

Number of Exchangeable Shares and BBU Units |

| 3,235 |

4,961 |

8,196 |

| |

|

|

|

|

Notes:

| (a) | Cyrus

Madon, Jeffrey Blidner, David Court and John Lacey principally live in Ontario, Canada. Stephen

Girsky principally lives in New York, United States of America. David Hamill principally

lives in Queensland, Australia. Anne Ruth Herkes principally lives in Munich, Germany. Don

Mackenzie principally lives in Pembroke Parish, Bermuda. Michael Warren principally lives

in Washington, DC, United States of America. Patricia Zuccotti principally lives in Washington

State, United States of America. |

| (b) | “Independent”

refers to the Board’s determination of whether a director nominee is “independent”

under Section 1.2 of National Instrument 58-101 — Disclosure of Corporate Governance

Practices. David Court and Michael Warren are the non-overlapping board members of BBUC

who assist BBUC with, among other things, resolving any conflicts of interest that may arise

from its relationship with BBU. David Court served on the board of directors of the general

partner of BBU from February 2017 until he resigned from such board of directors in

March 2022. |

| (c) | Patricia

Zuccotti is the chair of the Audit Committee of the Board and is our Audit Committee financial

expert. The Audit Committee of the Board consists solely of independent directors, each of

whom are persons determined by the Corporation to be financially literate within the meaning

of National Instrument 52-110 – Audit Committees. Each of the members of the

Audit Committee of the Board has the ability to read and understand a set of financial statements

that present a breadth and level of complexity of accounting issues that are generally comparable

to the breadth and complexity of the issues that can reasonably be expected to be raised

by the Corporation’s financial statements. |

| (d) | “Affiliated”

refers to a director nominee who (i) owns greater than a de minimis interest

in the Corporation (exclusive of any securities compensation earned as a director) or (ii) within

the last two years has directly or indirectly (a) been an officer of or employed by

the Corporation or any of its affiliates, (b) performed more than a de minimis amount

of services for the Corporation or any of its affiliates, or (c) had any material business

or professional relationship with the Corporation other than as a director of the Corporation.

“De minimis” for the purpose of this test includes factors such as the relevance

of a director’s interest in the Corporation to themselves and to the Corporation. |

| (e) | The

Corporation requires its directors who are not affiliated with Brookfield to hold sufficient

exchangeable shares and/or BBU Units such that the acquisition cost of the exchangeable shares

and/or BBU Units held by such directors is equal to at least two times their annual retainer

for serving as directors of the Corporation and the general partner of BBU, as applicable,

as determined by the Board from time to time (the “Director Share Ownership Requirement”).

Independent directors of the Corporation are required to meet the Director Share Ownership

Requirement within five years of joining the Board. The value of two times the annual retainer

for each such director is $330,000. For more information, see “Director Share Ownership

Requirements” in Part Three of this Circular. Each of the directors individually

and collectively beneficially own less than 1% of the exchangeable shares. |

| 2024 MANAGEMENT INFORMATION CIRCULAR / 16 |

Summary of 2024

Nominees for Director

The following summarizes

the qualifications of the 2024 director nominees that led the Board to conclude that each director nominee is qualified to serve on the

Board.

All Director Nominees Exhibit:

|

·

High personal and professional integrity and ethics

·

A proven record of success

· Experience

relevant to the Corporation’s global activities |

·

A commitment to sustainability and social issues

·

An inquisitive and objective perspective

· An

appreciation of the value of good corporate governance |

The Board is comprised

of ten (10) directors, which the Corporation considers an appropriate number given the diversity of its operations and the need

for a variety of experiences and backgrounds to effectively oversee the governance of the Corporation and provide strategic advice to

management. The Corporation reviews the expertise of incumbent and proposed directors in numerous areas, including those listed in the

chart below.

Director

Nominees |

Business

Development |

Corporate

Strategy /

M&A |

Leadership

of

a Large /

Complex

Organization |

Risk

Management |

Legal &

Regulatory |

Sustainability |

Industry

Experience |

| Cyrus

Madon |

✓ |

✓ |

✓ |

✓ |

|

✓ |

Infrastructure,

Power, Private Equity, Real Estate |

| Jeffrey

Blidner |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

Infrastructure,

Power, Private Equity, Real Estate |

| David

Court |

✓ |

✓ |

✓ |

|

|

|

Financial

Services, Manufacturing, Private Equity, Data Analytics, Artificial Intelligence |

| Stephen

Girsky |

✓ |

✓ |

✓ |

|

|

✓ |

Automotive,

Electric Vehicles, Manufacturing, Private Equity |

| David

Hamill |

✓ |

|

✓ |

|

|

✓ |

Government

and Public Policy, Education, Social Services, Infrastructure |

| Anne

Ruth Herkes |

✓ |

|

✓ |

|

✓ |

✓ |

Government

and Public Policy, International Affairs, Energy and Power, Space and Satellites |

| John

Lacey |

✓ |

✓ |

✓ |

✓ |

|

✓ |

Asset

Management, Retail, Grocery, Private Equity, Restructurings |

| Don

Mackenzie |

✓ |

✓ |

|

|

|

✓ |

Real