AXIS Advances Transition to Specialty Underwriter, Announces Loss Portfolio Transfer Reinsurance Agreement With Enstar on Reinsurance Segment Reserves

16 Dezember 2024 - 10:10PM

AXIS Capital Holdings Limited (“AXIS Capital” or “AXIS” or “the

Company”) (NYSE: AXS) and Enstar Group Limited (“Enstar”)

(Nasdaq: ESGR) today announced that they have entered into a

loss portfolio transfer (“LPT”) reinsurance agreement covering a

portfolio of reinsurance segment business. The closing of the

transaction is subject to regulatory approvals and other customary

conditions, and is expected to occur during the first half of 2025.

Under the LPT reinsurance agreement, which is structured as a

75% ground-up quota share, AXIS will retrocede to Enstar $2.3

billion of reinsurance segment reserves. This transaction is

predominantly attributable to casualty portfolios related to 2021

and prior underwriting years totaling $3.1 billion at September

30th. AXIS expects to recognize an approximate $60 million benefit

from the excess of reserves ceded over the consideration over the

next several years, according to the payment patterns of these

reserves. AXIS will maintain claims control for the covered

reserves subject to certain administrative rights of Enstar.

The LPT reinsurance agreement will be provided by Enstar’s

wholly owned subsidiary and S&P 'A' financial strength

rated reinsurance platform, Cavello Bay Reinsurance Limited.

“This transaction aligns our balance sheet with our previously

stated underwriting strategy of leaning into our specialty

insurance business,” said Vince Tizzio, President and CEO of AXIS.

“Furthermore, we continue to be focused on advancing the strategic

priorities laid out at our Investor Day in May of driving organic

growth, reinvesting in the business, and managing our capital for

the benefit of shareholders. We are pleased to be partnering with

Enstar in advancing our strategic priorities.”

Dominic Silvester, Enstar’s Chief Executive Officer

said, “This transaction showcases Enstar’s market-leading position

and, being the largest loss portfolio transfer announced in the

industry so far this year, it is another example of our ability to

deliver significant reinsurance solutions to our global

clients. We look forward to building a lasting partnership

with AXIS, a leading provider of specialty lines insurance and

reinsurance.”

About AXIS CapitalAXIS Capital, through its

operating subsidiaries, is a global specialty underwriter and

provider of insurance and reinsurance solutions. The Company has

shareholders' equity of $6.1 billion at September 30, 2024, and

locations in Bermuda, the United States, Europe, Singapore, and

Canada. Its operating subsidiaries have been assigned a financial

strength rating of "A+" ("Strong") by Standard & Poor's and "A"

("Excellent") by A.M. Best. For more information about AXIS

Capital, visit our website at www.axiscapital.com.

About EnstarEnstar is a NASDAQ-listed

leading global insurance group that offers innovative capital

release solutions through its network of group companies in

Bermuda, the United States, the United Kingdom, Continental Europe,

Australia, and other international locations. A market leader in

completing legacy acquisitions, Enstar has acquired more than 120

companies and portfolios since its formation in 2001. For further

information about Enstar, see www.enstargroup.com.

AXIS Cautionary Statement This press release

contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These statements include

statements regarding the intent, belief or current expectations of

AXIS and its management team. Investors can identify these

statements by the fact that they do not relate strictly to

historical or current facts. AXIS intends these forward-looking

statements to be covered by the safe harbor provisions for

forward-looking statements in the United States federal securities

laws. In some cases, these statements can be identified by the use

of forward-looking words such as "may", "should", "could",

"anticipate", "estimate", "expect", "plan", "believe", "predict",

"potential", "intend" or similar expressions. Forward-looking

statements contained in this press release, including statements

about expectations regarding the reserves ceded, speak only as of

the date they are made, are not guarantees of performance and

involve risks and uncertainties, and actual results may differ

materially from those projected forward-looking statements as a

result of various factors. In particular, AXIS may not be able to

complete the proposed transaction on the terms summarized above or

other acceptable terms, or at all, due to a number of factors,

including but not limited to the failure to obtain regulatory

approvals or to satisfy other closing conditions. Important risk

factors regarding AXIS can be found under Item 1A, 'Risk

Factors' in its most recent Annual Report on Form 10-K filed

with the Securities and Exchange Commission ("SEC"), as those

factors may be updated from time to time in its periodic and other

filings with the SEC, which are accessible on the SEC's website at

www.sec.gov, and are incorporated herein by reference. AXIS

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

Enstar Cautionary StatementThis press release

contains certain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements include statements regarding the intent, belief or

current expectations of Enstar and its management team. Investors

can identify these statements by the fact that they do not relate

strictly to historical or current facts. They use words such as

‘aim’, ‘ambition’, ‘anticipate’, ‘estimate’, ‘expect’, ‘intend’,

‘will’, ‘project’, ‘plan’, ‘believe’, ‘target’ and other words and

terms of similar meaning in connection with any discussion of

future events or performance. Investors are cautioned that any such

forward-looking statements, including statements about expectations

regarding the reserves ceded, speak only as of the date they are

made, are not guarantees of future performance and involve risks

and uncertainties, and that actual results may differ materially

from those projected in the forward-looking statements as a result

of various factors. In particular, Enstar may not be able to

complete the proposed transaction on the terms summarized above or

other acceptable terms, or at all, due to a number of factors,

including but not limited to the failure to obtain regulatory

approvals or to satisfy other closing conditions. Important risk

factors regarding Enstar can be found under the heading “Risk

Factors” in Enstar’s Form 10-K for the year ended December 31, 2023

and Enstar’s Form 10-Qs for the quarters ended June 30, 2024 and

September 30, 2024 and are incorporated herein by reference.

Furthermore, Enstar undertakes no obligation to update any written

or oral forward-looking statements or publicly announce any updates

or revisions to any of the forward-looking statements contained

herein, to reflect any change in its expectations with regard

thereto or any change in events, conditions, circumstances or

assumptions underlying such statements, except as required by

law.

|

|

|

|

AXIS Contacts: |

Enstar Contacts: |

|

|

|

|

For Investors: |

For Investors: |

|

Cliff Gallant |

Matthew Kirk |

|

+1 (415) 262-6843 |

+1 (201) 743-7734 |

|

investorrelations@axiscapital.com |

investor.relations@enstargroup.com |

|

|

|

|

For Media: |

For Media: |

|

Nichola Liboro |

Jenna Kerr |

|

+1 (917) 705-4579 |

+44 (0) 771-4487-187 |

|

nichola.liboro@axiscapital.com |

communications@enstargroup.com |

|

|

|

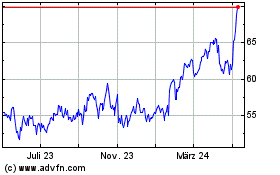

Axis Capital (NYSE:AXS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

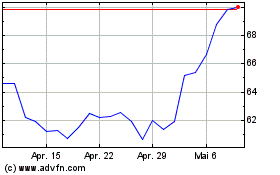

Axis Capital (NYSE:AXS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024