Highlights:

- 1Q24 Reported EPS of $2.13, up 43%

- 1Q24 Adjusted EPS (non-GAAP) of $2.29, up 35%

- 1Q24 Net sales of $2.2 billion, up 4%

- Sales change ex. currency (non-GAAP) up 4%

- Organic sales change (non-GAAP) up 3%

- FY24 Reported EPS guidance of $8.60 to $9.10

- Adjusted EPS guidance of $9.00 to $9.50

Avery Dennison Corporation (NYSE:AVY) today announced

preliminary, unaudited results for its first quarter ended March

30, 2024. Non-GAAP financial measures referenced in this release

are reconciled from GAAP in the attached financial schedules.

Unless otherwise indicated, comparisons are to the same period in

the prior year.

“We are off to a strong start to the year. In the first quarter

we delivered significant earnings growth, driven by higher volume

and productivity gains,” said Deon Stander, president and CEO.

“Materials Group delivered significant volume growth and margin

expansion, as downstream inventory destocking subsided and volumes

continued to normalize. Solutions Group delivered strong top-line

growth, driven by high-value categories, despite apparel imports

continuing to be below demand.

“In Intelligent Labels, we are targeting to deliver another year

of significant growth in 2024, as the apparel industry normalizes

and we accelerate the adoption of our solutions that help address

key industry challenges, further advancing our leadership position

at the intersection of the physical and digital,” added

Stander.

“We continue to expect strong earnings growth in 2024 and remain

confident that the consistent execution of our strategies will

enable us to meet our long-term goals for superior value creation

through a balance of profitable growth and capital discipline.

“Once again, I want to thank our entire team for their continued

resilience, focus on excellence and commitment to addressing the

unique challenges at hand.”

First Quarter 2024 Results by

Segment

Materials Group

- Reported sales increased 2% to $1.5 billion. Sales were up 2%

ex. currency and on an organic basis.

- Label Materials sales were up mid-single digits on an organic

basis.

- Volume/mix was up low-double digits, partially offset by

deflation-related price reductions.

- Graphics and Reflectives, and Performance Tapes and Medical

were down mid-single digits organically

- Reported operating margin was 15.1%. Adjusted EBITDA margin

(non-GAAP) was 18.3%, up 410 basis points driven by productivity

initiatives and higher volume/mix, partially offset by higher

employee-related costs.

Solutions Group

- Reported sales increased 8% to $655 million. Sales were up 10%

ex. currency and 6% on an organic basis.

- Sales in high-value categories were up low double-digits on an

organic basis.

- Sales were up low-single digits organically in base

solutions.

- Apparel imports remain below demand; continue to anticipate the

apparel industry to normalize in mid-2024.

- Reported operating margin was 8.6%. Adjusted EBITDA margin was

16.1%, up 40 basis points, driven by productivity initiatives and

higher volume, partially offset by higher employee-related costs

and investments.

- Margin was down sequentially, driven by seasonality and the

add-back of 2023 temporary cost reductions; sequential margin

improvement is anticipated in the second quarter.

Other

Balance Sheet and Capital Deployment

During the first quarter of 2024, the company returned $81

million in cash to shareholders through a combination of dividends

and share repurchases. The company repurchased 0.1 million shares

at an aggregate cost of $16 million. Net of dilution from long-term

incentive awards, the company’s share count was down 0.3 million

compared to the same time last year.

The company continues to deploy capital in a disciplined manner,

executing its long-term capital allocation strategy. The company’s

balance sheet remains strong. Net debt to adjusted EBITDA

(non-GAAP) was 2.3x at the end of the first quarter.

Income Taxes

The company’s reported effective tax rate was 26.5% in the first

quarter. The adjusted tax rate (non-GAAP) for the quarter was

26.0%.

Cost Reduction Actions

In the first quarter, the company realized approximately $19

million in pre-tax savings from restructuring, net of transition

costs, and incurred approximately $6 million in pre-tax

restructuring charges.

Guidance

In its supplemental presentation materials, “First Quarter 2024

Financial Review and Analysis,” the company provides a list of

factors that it believes will contribute to its 2024 financial

results. Based on the factors listed and other assumptions, the

company has revised its guidance range for 2024 reported earnings

per share from $8.65 to $9.15 to $8.60 to $9.10.

Excluding an estimated $0.40 per share impact of restructuring

charges and other items, the company continues to expect 2024

adjusted earnings per share of $9.00 to $9.50.

For more details on the company’s results, see the summary

tables accompanying this news release, as well as the supplemental

presentation materials, “First Quarter 2024 Financial Review and

Analysis,” posted on the company’s website at

www.investors.averydennison.com, and furnished to the SEC on Form

8-K.

Throughout this release and the supplemental presentation

materials, amounts on a per share basis reflect fully diluted

shares outstanding.

About Avery Dennison

Avery Dennison Corporation (NYSE: AVY) is a global materials

science and digital identification solutions company that provides

a wide range of branding and information solutions that optimize

labor and supply chain efficiency, reduce waste, advance

sustainability, circularity and transparency, and better connect

brands and consumers. Our products and solutions include labeling

and functional materials, radio frequency identification (RFID)

inlays and tags, software applications that connect the physical

and digital, and a variety of products and solutions that enhance

branded packaging and carry or display information that improves

the customer experience. Serving an array of industries worldwide —

including home and personal care, apparel, general retail,

e-commerce, logistics, food and grocery, pharmaceuticals and

automotive — we employ approximately 35,000 employees in more than

50 countries. Our reported sales in 2023 were $8.4 billion. Learn

more at www.averydennison.com.

“Safe Harbor” Statement under the Private

Securities Litigation Reform Act of 1995

Certain statements contained in this document are

"forward-looking statements" intended to qualify for the safe

harbor from liability established by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements,

and financial or other business targets, are subject to certain

risks and uncertainties.

We believe that the most significant risk factors that could

affect our financial performance in the near term include: (i) the

impacts to underlying demand for our products from global economic

conditions, political uncertainty, and changes in environmental

standards and governmental regulations; (ii) competitors’ actions,

including pricing, expansion in key markets, and product offerings;

(iii) the cost and availability of raw materials; (iv) the degree

to which higher costs can be offset with productivity measures

and/or passed on to customers through price increases, without a

significant loss of volume; (v) foreign currency fluctuations; and

(vi) the execution and integration of acquisitions.

Actual results and trends may differ materially from historical

or anticipated results depending on a variety of factors, including

but not limited to, risks and uncertainties related to the

following:

- International Operations – worldwide economic, social,

political and market conditions; changes in political conditions,

including those related to China, the Russia-Ukraine war, the

Israel-Hamas war and related hostilities in the Middle East;

fluctuations in foreign currency exchange rates; and other risks

associated with international operations, including in emerging

markets

- Our Business – fluctuations in demand affecting sales to

customers; fluctuations in the cost and availability of raw

materials and energy; changes in our markets due to competitive

conditions, technological developments, laws and regulations,

tariffs and customer preferences; increasing environmental

standards; the impact of competitive products and pricing;

execution and integration of acquisitions; selling prices; customer

and supplier concentrations or consolidations; financial condition

of distributors; outsourced manufacturers; product and service

quality; restructuring and other productivity actions; timely

development and market acceptance of new products, including

sustainable or sustainably-sourced products; investment in

development activities and new production facilities; successful

implementation of new manufacturing technologies and installation

of manufacturing equipment; our ability to generate sustained

productivity improvement; our ability to achieve and sustain

targeted cost reductions; collection of receivables from customers;

our sustainability and governance practices; and epidemics,

pandemics or other outbreaks of illness

- Information Technology – disruptions in information technology

systems, cyber attacks or other security breaches; and successful

installation of new or upgraded information technology systems

- Income Taxes – fluctuations in tax rates; changes in tax laws

and regulations, and uncertainties associated with interpretations

of such laws and regulations; retention of tax incentives; outcome

of tax audits; and the realization of deferred tax assets

- Human Capital – recruitment and retention of employees and

collective labor arrangements

- Our Indebtedness – credit risks; our ability to obtain adequate

financing arrangements and maintain access to capital; fluctuations

in interest rates; volatility in financial markets; and compliance

with our debt covenants

- Ownership of Our Stock – potential significant variability of

our stock price and amounts of future dividends and share

repurchases

- Legal and Regulatory Matters – protection and infringement of

intellectual property; impact of legal and regulatory proceedings,

including with respect to environmental, compliance and

anti-corruption, environmental, health and safety, and trade

compliance

- Other Financial Matters – fluctuations in pension costs and

goodwill impairment

For a more detailed discussion of these factors, see “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in our 2023 Form 10-K, filed

with the Securities and Exchange Commission on February 21,

2024.

The forward-looking statements included in this document are

made only as of the date of this document, and we undertake no

obligation to update these statements to reflect subsequent events

or circumstances, other than as may be required by law.

For more information and to listen to a live broadcast or an

audio replay of the quarterly conference call with analysts, visit

the Avery Dennison website at

www.investors.averydennison.com.

First Quarter Financial

Summary - Preliminary, unaudited (In millions, except %

and per share amounts)

1Q

1Q

% Sales Change vs. PY

2024

2023

Reported Ex. Currency Organic Net sales, by

segment: Materials Group

$1,496.5

$1,460.5

2.5

%

1.9

%

1.9

%

Solutions Group

654.8

604.5

8.3

%

9.8

%

5.8

%

Total net sales

$2,151.3

$2,065.0

4.2

%

4.2

%

3.1

%

As

Reported (GAAP) Adjusted Non-GAAP

1Q

1Q

% % of Sales

1Q

1Q

% % of Sales

2024

2023

Change

2024

2023

2024

2023

Change

2024

2023

Operating income (loss)/operating margins before interest,

other non-operating expense

(income), and taxes, by segment:

Materials Group

$226.1

$160.5

15.1

%

11.0

%

$240.5

$174.8

16.1

%

12.0

%

Solutions Group

56.1

51.5

8.6

%

8.5

%

60.9

55.1

9.3

%

9.1

%

Corporate expense

(27.8

)

(21.9

)

(27.7

)

(22.0

)

Total operating income/operating margins before interest,

other non-operating expense

(income), and taxes

$254.4

$190.1

34

%

11.8

%

9.2

%

$273.7

$207.9

32

%

12.7

%

10.1

%

Interest expense

$28.6

$26.4

$28.6

$26.4

Other non-operating

expense (income), net

($8.6

)

($4.6

)

($5.0

)

($4.6

)

Income before taxes

$234.4

$168.3

39

%

10.9

%

8.2

%

$250.1

$186.1

34

%

11.6

%

9.0

%

Provision for income

taxes

$62.0

$47.1

$65.0

$47.5

Net income

$172.4

$121.2

42

%

8.0

%

5.9

%

$185.1

$138.6

34

%

8.6

%

6.7

%

Net income per common

share, assuming dilution

$2.13

$1.49

43

%

$2.29

$1.70

35

%

Adjusted free cash flow

$58.1

($71.2

)

Adjusted EBITDA:

Materials Group

$273.3

$207.5

18.3

%

14.2

%

Solutions Group

$105.4

$94.7

16.1

%

15.7

%

Corporate expense

($27.7

)

($22.0

)

Total Adjusted EBITDA

$351.0

$280.2

16.3

%

13.6

%

See

accompanying schedules A-4 to A-8 for reconciliations of non-GAAP

financial measures from GAAP.

A-1

AVERY DENNISON CORPORATION PRELIMINARY CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (In millions, except per

share amounts)

(UNAUDITED)

Three Months Ended

Mar. 30, 2024

Apr. 1, 2023

Net sales $

2,151.3

$

2,065.0

Cost of products sold

1,519.1

1,522.7

Gross profit

632.2

542.3

Marketing, general and administrative expense

365.2

334.4

Other expense (income), net(1)

12.6

17.8

Interest expense

28.6

26.4

Other non-operating expense (income), net(2)

(8.6

)

(4.6

)

Income before taxes

234.4

168.3

Provision for income taxes

62.0

47.1

Net income $

172.4

$

121.2

Per share amounts: Net income per common share, assuming

dilution $

2.13

$

1.49

Weighted average number of common shares outstanding,

assuming dilution

81.0

81.5

(1)

Refer to schedule A-5 for details

of "Other expense (income), net" and other items.

(2)

"Other non-operating expense

(income), net" for the first quarter of 2024 includes Argentine

interest income of $3.6.

A-2

AVERY DENNISON CORPORATION PRELIMINARY CONDENSED

CONSOLIDATED BALANCE SHEETS (In millions)

(UNAUDITED)

ASSETS

Mar. 30, 2024

Apr. 1, 2023

Current assets: Cash and cash equivalents $

185.7

$

351.3

Trade accounts receivable, net

1,478.0

1,369.1

Inventories

972.5

1,050.6

Other current assets

250.6

218.2

Total current assets

2,886.8

2,989.2

Property, plant and equipment, net

1,598.2

1,565.6

Goodwill and other intangibles resulting from business

acquisitions, net

2,817.5

2,720.6

Deferred tax assets

115.5

118.3

Other assets

837.2

828.6

$

8,255.2

$

8,222.3

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities: Short-term borrowings and current

portion of long-term debt and finance leases $

1,170.5

$

648.3

Accounts payable

1,301.5

1,236.2

Other current liabilities

836.2

759.2

Total current liabilities

3,308.2

2,643.7

Long-term debt and finance leases

2,069.9

2,910.8

Other long-term liabilities

673.1

624.9

Shareholders' equity: Common stock

124.1

124.1

Capital in excess of par value

834.0

850.8

Retained earnings

4,809.1

4,486.4

Treasury stock at cost

(3,141.2

)

(3,057.4

)

Accumulated other comprehensive loss

(422.0

)

(361.0

)

Total shareholders' equity

2,204.0

2,042.9

$

8,255.2

$

8,222.3

A-3

AVERY DENNISON CORPORATION PRELIMINARY CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions)

(UNAUDITED)

Three Months Ended

Mar. 30, 2024

Apr. 1, 2023

Operating Activities Net income $

172.4

$

121.2

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation

49.0

44.8

Amortization

28.3

27.5

Provision for credit losses and sales returns

11.8

10.6

Stock-based compensation

7.5

10.5

Deferred taxes and other non-cash taxes

(3.0

)

(4.5

)

Other non-cash expense and loss (income and gain), net

18.1

10.1

Changes in assets and liabilities and other adjustments

(164.3

)

(218.3

)

Net cash provided by operating activities

119.8

1.9

Investing Activities Purchases of property, plant and

equipment

(48.8

)

(64.5

)

Purchases of software and other deferred charges

(6.9

)

(5.3

)

Purchases of Argentine Blue Chip Swap securities

(20.2

)

---

Proceeds from sales of Argentine Blue Chip Swap securities

14.0

---

Proceeds from sales of property, plant and equipment

0.1

0.2

Proceeds from insurance and sales (purchases) of investments, net

0.1

(3.5

)

Payments for acquisitions, net of cash acquired, and venture

investments

(0.3

)

(43.5

)

Net cash used in investing activities

(62.0

)

(116.6

)

Financing Activities Net increase (decrease) in

borrowings with maturities of three months or less

15.9

42.9

Additional long-term borrowings

---

394.9

Repayments of long-term debt and finance leases

(1.7

)

(1.4

)

Dividends paid

(65.3

)

(60.8

)

Share repurchases

(15.6

)

(50.7

)

Net (tax withholding) proceeds related to stock-based compensation

(18.3

)

(23.6

)

Other

---

(1.5

)

Net cash (used in) provided by financing activities

(85.0

)

299.8

Effect of foreign currency translation on cash balances

(2.1

)

(1.0

)

Increase (decrease) in cash and cash equivalents

(29.3

)

184.1

Cash and cash equivalents, beginning of year

215.0

167.2

Cash and cash equivalents, end of period $

185.7

$

351.3

A-4

Reconciliation of Non-GAAP Financial

Measures from GAAP

We report our financial results in conformity with accounting

principles generally accepted in the United States of America, or

GAAP, and also communicate with investors using certain non-GAAP

financial measures. These non-GAAP financial measures are not in

accordance with, nor are they a substitute for or superior to, the

comparable GAAP financial measures. These non-GAAP financial

measures are intended to supplement the presentation of our

financial results prepared in accordance with GAAP. We use these

non-GAAP financial measures internally to evaluate trends in our

underlying performance, as well as to facilitate comparison to the

results of competitors for quarters and year-to-date periods, as

applicable. Based on feedback from investors and financial

analysts, we believe that the supplemental non-GAAP financial

measures we provide are also useful to their assessments of our

performance and operating trends, as well as liquidity.

Reconciliations of our non-GAAP financial measures from the most

directly comparable GAAP financial measures are provided in

accordance with Regulations G and S-K.

Our non-GAAP financial measures exclude the impact of certain

events, activities or strategic decisions. The accounting effects

of these events, activities or decisions, which are included in the

GAAP financial measures, may make it more difficult to assess our

underlying performance in a single period. By excluding the

accounting effects, positive or negative, of certain items (e.g.,

restructuring charges, outcomes of certain legal matters and

settlements, certain effects of strategic transactions and related

costs, losses from debt extinguishments, gains or losses from

curtailment or settlement of pension obligations, gains or losses

on sales of certain assets, gains or losses on venture investments,

currency adjustments due to highly inflationary economies, and

other items), we believe that we are providing meaningful

supplemental information that facilitates an understanding of our

core operating results and liquidity measures. While some of the

items we exclude from GAAP financial measures recur, they tend to

be disparate in amount, frequency or timing.

We use the non-GAAP financial measures described below in the

accompanying news release.

Sales change ex. currency refers to the increase or decrease in

net sales, excluding the estimated impact of foreign currency

translation, and, where applicable, an extra week in our fiscal

year and the calendar shift resulting from the extra week in the

prior fiscal year, currency adjustments for transitional reporting

of highly inflationary economies, and the reclassification of sales

between segments. The estimated impact of foreign currency

translation is calculated on a constant currency basis, with

prior-period results translated at current period average exchange

rates to exclude the effect of foreign currency fluctuations.

Organic sales change refers to sales change ex. currency,

excluding the estimated impact of acquisitions and product line

divestitures.

We believe that sales change ex. currency and organic sales

change assist investors in evaluating the sales change from the

ongoing activities of our businesses and enhance their ability to

evaluate our results from period to period.

Adjusted operating income refers to net income adjusted for

taxes; other expense (income), net; interest expense; other

non-operating expense (income), net; and other items.

Adjusted EBITDA refers to adjusted operating income before

depreciation and amortization.

Adjusted operating margin refers to adjusted operating income as

a percentage of net sales.

Adjusted EBITDA margin refers to adjusted EBITDA as a percentage

of net sales.

Adjusted tax rate refers to the projected full-year GAAP tax

rate, adjusted to exclude certain unusual or infrequent events that

are expected to significantly impact that rate, such as effects of

certain discrete tax planning actions, impacts related to

enactments of comprehensive tax law changes, and other items.

Adjusted net income refers to income before taxes, tax-effected

at the adjusted tax rate, and adjusted for tax-effected

restructuring charges, and other items.

Adjusted net income per common share, assuming dilution

(adjusted EPS) refers to adjusted net income divided by the

weighted average number of common shares outstanding, assuming

dilution.

We believe that adjusted operating margin, adjusted EBITDA

margin, adjusted net income, and adjusted EPS assist investors in

understanding our core operating trends and comparing our results

with those of our competitors.

Net debt to adjusted EBITDA ratio refers to total debt

(including finance leases) less cash and cash equivalents, divided

by adjusted EBITDA for the last twelve months. We believe that the

net debt to adjusted EBITDA ratio assists investors in assessing

our leverage position.

Adjusted free cash flow refers to cash flow provided by

operating activities, less payments for property, plant and

equipment, software and other deferred charges, plus proceeds from

company-owned life insurance policies, plus proceeds from sales of

property, plant and equipment, plus (minus) net proceeds from

insurance and sales (purchases) of investments, less net cash used

for Argentine Blue Chip Swap securities. Where applicable, adjusted

free cash flow is also adjusted for certain acquisition-related

transaction costs. We believe that adjusted free cash flow assists

investors by showing the amount of cash we have available for debt

reductions, dividends, share repurchases, and acquisitions.

A-5

AVERY DENNISON CORPORATION PRELIMINARY RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES FROM GAAP (In millions, except %

and per share amounts)

(UNAUDITED)

Three Months Ended

Mar. 30, 2024

Apr. 1, 2023

Reconciliation of non-GAAP operating and EBITDA

margins from GAAP: Net sales $

2,151.3

$

2,065.0

Income before taxes $

234.4

$

168.3

Income before taxes as a percentage of net sales

10.9

%

8.2

%

Adjustments: Interest expense $

28.6

$

26.4

Other non-operating expense (income), net

(8.6

)

(4.6

)

Operating income before interest expense, other non-operating

expense (income) and taxes $

254.4

$

190.1

Operating margins

11.8

%

9.2

%

As reported net income $

172.4

$

121.2

Adjustments: Restructuring charges, net of reversals: Severance and

related costs, net of reversals

4.9

17.1

Asset impairment and lease cancellation charges

1.1

0.5

Losses from Argentine peso remeasurement and Blue Chip Swap

transactions(1)

11.3

---

(Gain) loss on venture investment

2.2

---

Outcomes of legal matters and settlements, net

(0.2

)

---

Transaction and related costs

---

0.2

Interest expense

28.6

26.4

Other non-operating expense (income), net(2)

(8.6

)

(4.6

)

Provision for income taxes

62.0

47.1

Adjusted operating income (non-GAAP) $

273.7

$

207.9

Adjusted operating margins (non-GAAP)

12.7

%

10.1

%

Depreciation and amortization $

77.3

$

72.3

Adjusted EBITDA (non-GAAP) $

351.0

$

280.2

Adjusted EBITDA margins (non-GAAP)

16.3

%

13.6

%

Reconciliation of non-GAAP net income from GAAP: As

reported net income $

172.4

$

121.2

Adjustments: Restructuring charges and other items

19.3

17.8

Argentine interest income(1)

(3.6

)

---

Tax effect on restructuring charges and other items and impact of

adjusted tax rate

(3.0

)

(0.4

)

Adjusted net income (non-GAAP) $

185.1

$

138.6

(1)

The total pretax net loss from the above-referenced Argentine

peso-related items was $7.7.

(2)

"Other non-operating expense (income), net" for the first quarter

of 2024 includes Argentine interest income of $3.6.

A-5 (continued)

AVERY DENNISON CORPORATION PRELIMINARY RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES FROM GAAP (In millions, except %

and per share amounts)

(UNAUDITED)

Three Months Ended

Mar. 30, 2024

Apr. 1, 2023

Reconciliation of non-GAAP net income per common

share from GAAP: As reported net income per common share,

assuming dilution $

2.13

$

1.49

Adjustments per common share, net of tax: Restructuring charges and

other items

0.24

0.22

Argentine interest income

(0.04

)

---

Tax effect on restructuring charges and other items and impact of

adjusted tax rate

(0.04

)

(0.01

)

Adjusted net income per common share, assuming dilution

(non-GAAP) $

2.29

$

1.70

Weighted average number of common shares outstanding,

assuming dilution

81.0

81.5

Our adjusted tax rate was 26% and 25.5% for the three months ended

March 30, 2024 and April 1, 2023, respectively.

(UNAUDITED) Three Months Ended Mar. 30,

2024 Apr. 1, 2023 Reconciliation of

adjusted free cash flow: Net cash provided by operating

activities $

119.8

$

1.9

Purchases of property, plant and equipment

(48.8

)

(64.5

)

Purchases of software and other deferred charges

(6.9

)

(5.3

)

Purchases of Argentine Blue Chip Swap securities

(20.2

)

---

Proceeds from sales of Argentine Blue Chip Swap securities

14.0

---

Proceeds from sales of property, plant and equipment

0.1

0.2

Proceeds from insurance and sales (purchases) of investments, net

0.1

(3.5

)

Adjusted free cash flow (non-GAAP) $

58.1

$

(71.2

)

A-6

AVERY DENNISON CORPORATION PRELIMINARY SUPPLEMENTARY

INFORMATION (In millions, except %) (UNAUDITED)

First Quarter Ended

NET SALES

OPERATING INCOME (LOSS)

OPERATING MARGINS

2024

2023

2024

2023

2024

2023

Materials Group

$

1,496.5

$

1,460.5

$

226.1

$

160.5

15.1

%

11.0

%

Solutions Group

654.8

604.5

56.1

51.5

8.6

%

8.5

%

Corporate Expense

N/A

N/A

(27.8

)

(21.9

)

N/A

N/A

TOTAL FROM OPERATIONS

$

2,151.3

$

2,065.0

$

254.4

$

190.1

11.8

%

9.2

%

RECONCILIATION OF NON-GAAP SUPPLEMENTARY

INFORMATION FROM GAAP

First Quarter Ended

2024

2023

2024

2023

Materials Group Operating

income and margins, as reported

$

226.1

$

160.5

15.1

%

11.0

%

Adjustments: Restructuring charges, net of reversals: Severance and

related costs, net of reversals

2.4

14.3

0.2

%

1.0

%

Asset impairment charges

0.1

---

---

---

Losses from Argentine peso remeasurement and Blue Chip Swap

transactions

11.3

---

0.8

%

---

Outcomes of legal matters and settlements, net

0.6

---

---

---

Adjusted operating income and margins (non-GAAP)

$

240.5

$

174.8

16.1

%

12.0

%

Depreciation and amortization

32.8

32.7

2.2

%

2.2

%

Adjusted EBITDA and margins (non-GAAP)

$

273.3

$

207.5

18.3

%

14.2

%

Solutions Group

Operating income and margins, as reported

$

56.1

$

51.5

8.6

%

8.5

%

Adjustments: Restructuring charges, net of reversals: Severance and

related costs, net of reversals

2.4

2.9

0.4

%

0.5

%

Asset impairment and lease cancellation charges

1.0

0.5

0.1

%

0.1

%

(Gain) loss on venture investment

2.2

---

0.3

%

---

Outcomes of legal matters and settlements, net

(0.8

)

---

(0.1

%)

---

Transaction and related costs

---

0.2

---

---

Adjusted operating income and margins (non-GAAP)

$

60.9

$

55.1

9.3

%

9.1

%

Depreciation and amortization

44.5

39.6

6.8

%

6.6

%

Adjusted EBITDA and margins (non-GAAP)

$

105.4

$

94.7

16.1

%

15.7

%

A-7

AVERY DENNISON CORPORATION PRELIMINARY SUPPLEMENTARY

INFORMATION (In millions, except ratios)

(UNAUDITED)

QTD

2Q23

3Q23

4Q23

1Q24

Reconciliation of adjusted EBITDA from GAAP: As

reported net income

$

100.4

$

138.3

$

143.1

$

172.4

Adjustments(1)(2)

68.3

54.1

40.7

19.3

Interest expense

31.9

31.0

29.7

28.6

Other non-operating expense (income), net

(6.6

)

(8.7

)

(10.9

)

(8.6

)

Provision for income taxes

39.8

46.3

58.5

62.0

Depreciation and amortization

74.0

75.1

77.0

77.3

Adjusted EBITDA (non-GAAP)

$

307.8

$

336.1

$

338.1

$

351.0

Total Debt

$

3,240.4

Less: Cash and cash equivalents

185.7

Net Debt

$

3,054.7

Net Debt to Adjusted EBITDA LTM* (non-GAAP)

2.3

*LTM = Last twelve months (2Q23 to 1Q24)

(1)

Includes "Other expense (income), net" and other items. Refer to

schedule A-5 for details of the adjustments.

(2)

Includes loss from Argentine peso remeasurement in the third and

fourth quarters of 2023 and first quarter of 2024.

A-8

AVERY DENNISON CORPORATION PRELIMINARY SUPPLEMENTARY

INFORMATION (UNAUDITED) First Quarter

2024 TotalCompany MaterialsGroup SolutionsGroup

Reconciliation of organic sales change from GAAP: Reported

net sales change

4.2%

2.5%

8.3%

Foreign currency translation

---

(0.5%)

1.5%

Sales change ex. currency (non-GAAP)(1)

4.2%

1.9%

9.8%

Acquisitions

(1.1%)

---

(4.0%)

Organic sales change (non-GAAP)(1)

3.1%

1.9%

5.8%

(1) Totals may not sum due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424348830/en/

John Eble Vice President, Finance and Investor Relations

investorcom@averydennison.com

Kristin Robinson Vice President, Global Communications

kristin.robinson@averydennison.com

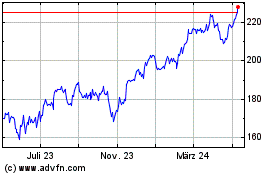

Avery Dennison (NYSE:AVY)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

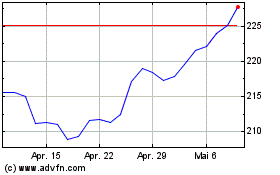

Avery Dennison (NYSE:AVY)

Historical Stock Chart

Von Jan 2024 bis Jan 2025