UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of August, 2023

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant's name into English)

1, rue Hildegard Von Bingen, 1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F: x Form 40-F: o

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

Atento S.A. ("Atento"

or the "Company"), one of the world's largest customer relationship management and business process outsourcing (CRM / BPO)

service providers and an industry leader in Latin America, today announced that it has successfully received tranche 3 funding under its

interim financing arrangements announced on 23 June 2023, through the issuance of additional new money notes due 2025. This brings the

total amount received under that financing to $37 million, exceeding the initial target by $7 million.

The interim financing provides

enhanced liquidity and financial runway to Atento to support the implementation of the comprehensive restructuring of the business through

an English restructuring plan (the "Restructuring").

The Restructuring is expected

to deleverage Atento’s balance sheet significantly and allow the business to raise substantial new funding to facilitate the execution

of its transformation plan, in line with the Restructuring Support Agreement (the “RSA”) agreed with an ad hoc group of supportive

holders of Atento’s senior secured notes, announced on 3 July 2023. The $37 million of additional capital invested by members of

the ad hoc group demonstrates their commitment to supporting the Company through the Restructuring. Atento continues to collaborate with

its key financial stakeholders, including the ad hoc group, with a view to completing the Restructuring by the end of October 2023.

The Company is making good

progress towards implementing the Restructuring, and it remains on track to fulfilling the key milestones under the RSA towards doing

so. Atento also remains focused on executing its transformation plan, including geographical expansion and the development of new Artificial

Intelligence capabilities, which it believes will be facilitated by the successful implementation of the Restructuring.

A copy of the press release

in relation to the tranche 3 funding is also filed herewith as Exhibit 99.1.

Forward-Looking Statements

This report contains forward-looking statements. Forward-looking

statements can be identified by the use of words such as "may," "should," "expects," "plans,"

"anticipates," "believes," "estimates," "predicts," "intends," "continue"

or similar terminology. These statements reflect only Atento’s current expectations and are not guarantees of future events. These

statements are subject to risks and uncertainties that could cause actual results and events to differ materially from those contained

in the forward-looking statements. Such risks and uncertainties include, but are not limited to: Atento's ability to negotiate and execute

any further definitive documentation with respect to the restructuring transaction and to satisfy all the conditions of the restructuring

support agreement; ultimate outcome of the restructuring proceedings; actions by Atento’s lenders and other financing sources,

including any creditor actions that could impact Atento’s operations; Atento’s ability to improve its capital structure and

to address its debt service obligations through the proposed restructuring transaction, including potential adverse effects of any potential

bankruptcy proceedings on Atento's liquidity and results of operations; Atento’s future cash requirements; competition in Atento’s

highly competitive industries; increases in the cost of voice and data services or significant interruptions in these services; Atento’s

ability to keep pace with its clients’ needs for rapid technological change and systems availability; the continued deployment and

adoption of emerging technologies; the loss, financial difficulties or bankruptcy of any key clients; the effects of global economic trends

on the businesses of Atento’s clients; the non-exclusive nature of Atento’s client contracts and the absence of revenue commitments;

security and privacy breaches of the systems Atento uses to protect personal data; the cost of pending and future litigation; the cost

of defending Atento against intellectual property infringement claims; extensive regulation affecting many of Atento’s businesses;

Atento’s ability to protect its proprietary information or technology; service interruptions to Atento’s data and operation

centers; Atento’s ability to retain key personnel and attract a sufficient number of qualified employees; increases in labor costs

and turnover rates; the political, economic and other conditions in the countries where Atento operates; changes in foreign exchange rates;

Atento’s ability to complete future acquisitions and integrate or achieve the objectives of its recent and future acquisitions;

future impairments of Atento’s substantial goodwill, intangible assets, or other long-lived assets; and Atento’s ability to

recover consumer receivables on behalf of its clients. Atento is also subject to other risk factors described in documents filed by the

Company with the United States Securities and Exchange Commission. These forward-looking statements speak only as of the date on which

the statements were made. Atento undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: August 31, 2023 |

ATENTO S.A.

By: /s/ Dimitrius Oliveira

Name: Dimitrius Oliveira

Title: Chief Executive Officer |

Exhibit 99.1

Press release dated August 31 2023

Atento announces the

completion of the third tranche of funding under its new interim financing, bringing the total amount invested to $37 million.

| · | Atento announces the drawdown of ~$3M in tranche 3 funding under its new interim financing. |

| · | Tranche 3 brings the total interim financing received to $37 million, exceeding the initial target

by $7 million. |

| · | Tranche 3 funding to provide enhanced financial runway to support Atento’s restructuring. |

New York, August 31, 2023 - Atento

S.A. ("Atento" or the "Company"), one of the world's largest providers of customer relationship and business process

outsourcing (CRM/BPO) services and an industry leader in Latin America, today announced that it has successfully received tranche 3 funding

under its interim financing arrangements announced on 23 June 2023, through the issuance of additional new money notes due 2025. This

brings the total amount received under that financing to $37 million, exceeding the initial target by $7 million.

The interim financing provides enhanced

liquidity and financial runway to Atento to support the implementation of the comprehensive restructuring of the business through an English

restructuring plan (the "Restructuring").

The Restructuring is expected to deleverage

Atento’s balance sheet significantly and allow the business to raise substantial new funding to facilitate the execution of its

transformation plan, in line with the Restructuring Support Agreement (the “RSA”) agreed with an ad hoc group of supportive

holders of Atento’s senior secured notes, announced on 3 July 2023. The $37 million of additional capital invested by members of

the ad hoc group demonstrates their commitment to supporting the Company through the Restructuring. Atento continues to collaborate with

its key financial stakeholders, including the ad hoc group, with a view to completing the Restructuring by the end of October 2023.

The Company is making good progress towards

implementing the Restructuring, and it remains on track to fulfilling the key milestones under the RSA towards doing so. Atento also remains

focused on executing its transformation plan, including geographical expansion and the development of new Artificial Intelligence capabilities,

which it believes will be facilitated by the successful implementation of the Restructuring.

About Atento

Atento is the largest provider of customer relationship

management and business process outsourcing (“CRM BPO”) services in Latin America and one of the leading providers worldwide.

Atento is also one of the leading providers of nearshoring CRM BPO services for companies operating in the United States. Since 1999,

the Company has developed its business model in 16 countries, employing approximately 135,000 people. Atento has more than 400 clients, offering

a wide range of CRM BPO services through multiple channels. Atento’s clients are mostly leading multinational companies in telecommunications,

banking and financial services, healthcare, retail and public administration sectors. In 2019, Atento was named one of the 25 best multinational

companies in the world and one of the best multinationals to work for in Latin America by Great Place to Work®. In addition, in 2021,

Everest named Atento as a “star performer”. Gartner has named the Company two consecutive years a leader in its Magic Quadrant

since 2021. For more information visit www.atento.com

Media Contact

press@atento.compress@atento.com

Forward-Looking Statements

This press release contains forward-looking

statements. Forward-looking statements can be identified by the use of words such as "may," "should," "expects,"

"plans," "anticipates," "believes," "estimates," "predicts," "intends," "continue"

or similar terminology. These statements reflect only Atento’s current expectations and are not guarantees of future events. These

statements are subject to risks and uncertainties that could cause actual results and events to differ materially from those contained

in the forward-looking statements. Such risks and uncertainties include, but are not limited to: Atento's ability to negotiate and execute

any further definitive documentation with respect to the restructuring transaction and to satisfy all the conditions of the restructuring

support agreement; ultimate outcome of the restructuring proceedings; actions by Atento’s lenders and other financing sources,

including any creditor actions that could impact Atento’s operations; Atento’s ability to improve its capital structure and

to address its debt service obligations through the proposed restructuring transaction, including potential adverse effects of any potential

bankruptcy proceedings on Atento's liquidity and results of operations; Atento’s future cash requirements; competition in Atento’s

highly competitive industries; increases in the cost of voice and data services or significant interruptions in these services; Atento’s

ability to keep pace with its clients’ needs for rapid technological change and systems availability; the continued deployment and

adoption of emerging technologies; the loss, financial difficulties or bankruptcy of any key clients; the effects of global economic trends

on the businesses of Atento’s clients; the non-exclusive nature of Atento’s client contracts and the absence of revenue commitments;

security and privacy breaches of the systems Atento uses to protect personal data; the cost of pending and future litigation; the cost

of defending Atento against intellectual property infringement claims; extensive regulation affecting many of Atento’s businesses;

Atento’s ability to protect its proprietary information or technology; service interruptions to Atento’s data and operation

centers; Atento’s ability to retain key personnel and attract a sufficient number of qualified employees; increases in labor costs

and turnover rates; the political, economic and other conditions in the countries where Atento operates; changes in foreign exchange rates;

Atento’s ability to complete future acquisitions and integrate or achieve the objectives of its recent and future acquisitions;

future impairments of Atento’s substantial goodwill, intangible assets, or other long-lived assets; and Atento’s ability to

recover consumer receivables on behalf of its clients. Atento is also subject to other risk factors described in documents filed by the

Company with the United States Securities and Exchange Commission. These forward-looking statements speak only as of the date on which

the statements were made. Atento undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise.

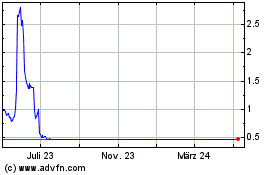

Atento (NYSE:ATTO)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Atento (NYSE:ATTO)

Historical Stock Chart

Von Jan 2024 bis Jan 2025