Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

19 April 2023 - 10:59PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549 |

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of April 2023

Commission File Number 001-36671

|

|

Atento S.A.

(Translation of Registrant’s name into

English)

Société anonyme

1 rue Hildegard Von Bingen, L-1282 Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive and registered

office)

|

|

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F: ☒ Form 40-F: ☐

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: ☐ No: ☒

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: ☐ No: ☒

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR. |

Atento Receives NYSE Notice Regarding

Continued Listing Criteria

New York, April

19, 2023 - Atento S.A. (NYSE: ATTO, “Atento” or the “Company”), one of the largest providers worldwide

and the leading company in customer relationship services and business process outsourcing (CRM / BPO) in Latin America, reports that,

on March 20, 2023 it received written notice (the “NYSE Notification”) from the New York Stock Exchange (the “NYSE”)

that the Company’s total market capitalization was less than US$50 million over a 30 trading-day period while its stockholders’

equity was less than US$50 million, below NYSE’s continued listing criteria.

The Company aims to notify the NYSE of its intent

to submit a plan to the NYSE that would bring the Company into conformity with the NYSE continued listing criteria. In accordance with

applicable NYSE procedures, the Company intends to submit a plan within 90 days of the Company’s receipt of the NYSE Notification

advising the NYSE of the definitive actions the Company has taken, and is taking, to bring the Company into compliance with NYSE continued

listing criteria within 18 months of receipt of the NYSE Notification (the “Cure Period”). The NYSE will review the plan and,

within 45 days of receipt, determine whether the Company has made a reasonable demonstration of an ability to conform to the relevant

criteria in the Cure Period.

If the plan is accepted by the NYSE, the Company’s

common stock will continue to be listed and traded on the NYSE during the Cure Period, subject to the Company’s compliance with

other continued listing criteria and semi-annual reviews by the NYSE of the Company’s compliance with the plan.

The NYSE Notification does not affect the Company’s

business operations or its SEC reporting requirements, nor does it conflict with or cause an event of default under any of the Company’s

material debt or other agreements.

About Atento

Atento is the largest provider of customer

relationship management and business process outsourcing (“CRM BPO”) services in Latin America, and among the top providers

globally. Atento is also a leading provider of nearshoring CRM BPO services to companies that carry out their activities in the United

States. Since 1999, the company has developed its business model in 14 countries where it employs approximately 150,000 people. Atento

has over 400 clients to whom it offers a wide range of CRM BPO services through multiple channels. Atento’s clients are mostly leading

multinational corporations in industries such as telecommunications, banking and financial services, health, retail and public administrations,

among others. Atento’s shares trade under the symbol ATTO on the New York Stock Exchange (NYSE). In 2019, Atento was named one of

the World’s 25 Best Multinational Workplaces and one of the Best Multinationals to Work for in Latin America by Great Place to Work®.

Also, in 2021 Everest named Atento as a star performer. Gartner named the company as a leader for two years in a row, since 2021 in the

Gartner Magic Quadrant. For more information visit www.atento.com

Media

Relations

press@atento.com

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include statements related to the Company’s intention to submit a plan to regain compliance with

the NYSE continued listing criteria and the on-going listing of the Company’s shares on the NYSE, and other statements identified

by words such as “could,” “may,” “might,” “will,” “likely,” “anticipates,”

“intends,” “potential,” “plans,” “seeks,” “believes,” “estimates,”

“expects,” “continues,” “projects” and similar references to future periods.

These

statements reflect only Atento’s current expectations and are not guarantees of future events, performance or results. These statements

are subject to risks and uncertainties that could cause actual results to differ materially from those contained in the forward-looking

statements. Risks and uncertainties include, but are not limited to, the Company’s continued assessment of the suitability and viability

of maintaining a listing on the NYSE, any plan submitted by the Company being accepted by the NYSE, and the Company’s assessment

of any plan to bring the Company into conformity with the NYSE continued listing criteria. The Company’s ability to regain conformity

with the NYSE continued listing criteria would affected by factors including, but not limited to, competition in Atento’s highly

competitive industries; increases in the cost of voice and data services or significant interruptions in these services; Atento’s

ability to keep pace with its clients’ needs for rapid technological change and systems availability; the continued deployment and

adoption of emerging technologies; the loss, financial difficulties or bankruptcy of any key clients; the effects of global economic trends

on the businesses of Atento’s clients; the non-exclusive nature of Atento’s client contracts and the absence of revenue commitments;

security and privacy breaches of the systems Atento uses to protect personal data; the cost of pending and future litigation; the cost

of defending Atento against intellectual property infringement claims; extensive regulation affecting many of Atento’s businesses;

Atento’s ability to protect its proprietary information or technology; service interruptions to Atento’s data and operation

centers; Atento’s ability to retain key personnel and attract a sufficient number of qualified employees; increases in labor costs

and turnover rates; the political, economic and other conditions in the countries where Atento operates; changes in foreign exchange rates;

Atento’s ability to complete future acquisitions and integrate or achieve the objectives of its recent and future acquisitions;

future impairments of our substantial goodwill, intangible assets, or other long-lived assets; and Atento’s ability to recover consumer

receivables on behalf of its clients. Atento is also subject to other risk factors described in documents filed by the company with the

United States Securities and Exchange Commission. These forward-looking statements speak only as of the date on which the statements were

made. Atento undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information,

future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ATENTO S.A. |

| Date: April 19, 2023. |

|

|

| |

By: |

/s/

Dimitrius Oliveira |

| |

Name: Dimitrius Oliveira |

| |

Title: Chief Executive Officer

|

| |

|

|

Atento (NYSE:ATTO)

Historical Stock Chart

Von Mai 2024 bis Jun 2024

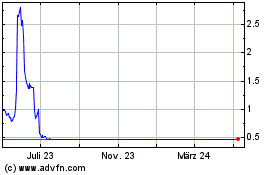

Atento (NYSE:ATTO)

Historical Stock Chart

Von Jun 2023 bis Jun 2024