Net Sales Increased 9.5% Compared to the

Second Quarter of 2023, with U.S. Net Sales Up 19.3%

Active Customer Growth of 11.7% on a

Trailing Twelve-Month Basis Compared to the Second Quarter of

2023

On Track to Open Five Princess Polly Stores

in 2024

a.k.a. Brands Holding Corp. (NYSE: AKA), a

brand accelerator of next generation fashion brands, today

announced financial results for the quarter ended June 30,

2024.

Results for the Second Quarter

- Net sales increased 9.5% to $148.9 million, compared to

$136.0 million in the second quarter of 2023; up 10.1% on a

constant currency basis1.

- In the U.S., net sales increased 19.3% compared to the

second quarter of 2023.

- Net loss was $(2.3) million, or $(0.22) per share, in

the second quarter of 2024, compared to net loss of $(5.0) million,

or $(0.47) per share, in the second quarter of 2023.

- Adjusted EBITDA2 was $8.0 million in the second quarter

of 2024, compared to $5.6 million in the second quarter of

2023.

“Our second quarter results exceeded our expectations,

showcasing the strength of our brands and the power of our business

model. We delivered net sales growth of over 9%, driven by the

momentum in our U.S. region, where net sales grew more than 19%

year-over-year. Importantly, our strong top-line growth translated

into adjusted EBITDA of $8.0 million, an increase of 44% compared

to the same quarter last year. We continued to execute against our

strategic priorities with an emphasis on our customers, and I'm

very pleased that our active customer base increased by nearly 12%

on a trailing twelve-month basis. Our strong second quarter results

are a clear indication that demand for our brands is strong and

that we have tremendous growth opportunities ahead of us,” said

Ciaran Long, Interim Chief Executive Officer and Chief Financial

Officer.

“I am pleased to report that in addition to three planned new

Princess Polly store openings previously announced, we have signed

two new leases for additional locations in Irvine and Santa Clara,

California, which will bring the Princess Polly physical presence

to six locations. Petal & Pup’s expanded omni-channel presence,

now on Nordstrom.com, Target.com and Macys.com, far exceeded our

expectations, setting the stage for continued growth and brand

expansion. Leveraging Petal & Pup’s omni-channel success, our

streetwear brand mnml launched a test on Nordstrom.com, and our

Culture Kings U.S. business delivered another quarter of strong

double-digit net sales growth on top of strong results last

year.

“Executing at a high level while delivering innovative

strategies to meet our customers where and when they want to shop

our portfolio of brands strengthens my confidence in the many

profitable future growth opportunities we see for a.k.a. Brands,

particularly the tremendous whitespace we see in the U.S. to expand

our brand portfolio reach and total addressable market,” concluded

Long.

Brand Highlights

- Princess Polly is on track to open stores in the Scottsdale

Fashion Square and Fashion Valley Mall in San Diego in the third

quarter of 2024 and stores in Boston, Santa Clara and Irvine in the

fourth quarter of 2024.

- Culture Kings U.S. registered another quarter of strong

double-digit net sales growth and launched new licenses and

graphics including Pokemon, WWE, NHL and Halo, with more exclusive

collaborations to come in the latter half of the year.

- Petal & Pup’s expanded omni-channel presence has far

exceeded expectations, setting the stage for continued growth and

brand expansion.

- mnml continues to expand its omni-channel distribution with

successful tests on Nordstrom.com and other retailers.

Second Quarter Financial

Details

- Net sales increased 9.5% to $148.9 million, compared to

$136.0 million in the second quarter of 2023. The increase was

driven by a 16% increase in the number of orders, due to growth in

the U.S., partially offset by a decline in the average order value

compared to the prior quarter, driven by adverse macroeconomic

conditions in Australia and New Zealand and actions taken to

improve our inventory position at Culture Kings. On a constant

currency basis1, net sales increased 10%.

- Gross margin was 57.7%, compared to 56.9% in the second

quarter of 2023. The improvement was primarily driven by lower

inbound air freight costs and duties, partially offset by the

impact of growing wholesale initiatives, as well as growing

marketplace initiatives, which have a higher return rate.

- Selling expenses were $41.2 million, compared to $35.9

million in the second quarter of 2023. Selling expenses were 27.7%

of net sales, compared to 26.4% of net sales in the second quarter

of 2023. The increases were driven by the impact from growing

marketplace initiatives and additional stores.

- Marketing expenses were $18.3 million, compared to $18.4

million in the second quarter of 2023. Marketing expenses were

12.3% of net sales, compared to 13.5% of net sales in the second

quarter of 2023.

- General and administrative (“G&A”) expenses were

$25.9 million, compared to $24.2 million in the second quarter of

2023. G&A expenses were 17.4% of net sales, compared to 17.8%

of net sales in the second quarter of 2023. The decrease in G&A

expenses as a percent of net sales during the quarter was primarily

driven by higher net sales compared to the second quarter of

2023.

- Adjusted EBITDA2 was $8.0 million, or 5.4% of net sales,

compared to $5.6 million, or 4.1% of net sales, in the second

quarter of 2023.

Balance Sheet and Cash

Flow

- Cash and cash equivalents at the end of the second

quarter totaled $25.5 million.

- Inventory at the end of the second quarter totaled

$106.7 million, compared to $91.0 million at the end of fiscal year

2023, or compared to $106.7 million at the end of the second

quarter of 2023.

- Debt at the end of the second quarter totaled $106.9

million, compared to $93.4 million at the end of fiscal year 2023,

or compared to $120.0 million at the end of the second quarter of

2023.

- Cash flow used in operations for the six months ended

June 30, 2024 was $4.2 million, compared to cash flow from

operations of $7.3 million for the six months ended June 30,

2023.

Outlook

For the third quarter of 2024, the Company expects:

- Net sales between $141 million and $145 million

- Adjusted EBITDA3 between $6.0 million and $7.0 million

- Weighted average diluted share count of 10.6 million

For the full year fiscal 2024, the Company now

expects:

- Net sales between $560 million and $565 million

- Adjusted EBITDA3 between $20 million and $22 million

- Weighted average diluted share count of 10.6 million

The above outlook is based on several assumptions, including but

not limited to, foreign exchange rates remaining at the current

levels, the opening of four to five Princess Polly stores and

continued macroeconomic pressures, specifically in Australia and

New Zealand. See “Forward-Looking Statements” for additional

information.

Conference Call

A conference call to discuss the Company’s second quarter

results is scheduled for August 7, 2024, at 4:30 p.m. ET. Those who

wish to participate in the call may do so by dialing (877) 858-5495

or (201) 689-8853 for international callers. The conference call

will also be webcast live at https://ir.aka-brands.com in the

Events and Presentations section. A recording will be available

shortly after the conclusion of the call. To access the replay,

please dial (877) 660-6853 or (201) 612-7415 for international

callers, conference ID 13747420. An archive of the webcast will be

available on a.k.a. Brands’ investor relations website.

Use of Non-GAAP Financial Measures and Other Operating

Metrics

In addition to results determined in accordance with accounting

principles generally accepted in the United States of America

(GAAP), management utilizes certain non-GAAP financial measures

such as Adjusted EBITDA and Adjusted EBITDA margin for purposes of

evaluating ongoing operations and for internal planning and

forecasting purposes. We believe that these non-GAAP financial

measures, when reviewed collectively with our GAAP financial

information, provide useful supplemental information to investors

in assessing our operating performance. The non-GAAP financial

measures should not be considered in isolation or as a substitute

for the GAAP financial measures. The non-GAAP financial measures

used by the Company may be different from similarly-titled non-GAAP

financial measures used by other companies. See additional

information at the end of this release regarding non-GAAP financial

measures.

About a.k.a. Brands

a.k.a. Brands is a portfolio of next-generation fashion brands

for the next generation of consumers. Each brand in the a.k.a.

portfolio targets a distinct Gen Z and millennial audience, creates

authentic and inspiring social content and offers quality exclusive

merchandise. a.k.a. Brands leverages its next-generation retail

platform to help each brand accelerate its growth, scale in new

markets and enhance its profitability. Current brands in the a.k.a.

Brands portfolio include Princess Polly, Culture Kings, mnml and

Petal & Pup.

Forward-Looking Statements

Certain statements made in this release are “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995.

When used in this press release, the words “estimates,”

“projected,” “expects,” “anticipates,” “forecasts,” “plans,”

“intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,”

“propose” and variations of these words or similar expressions (or

the negative versions of such words or expressions) are intended to

identify forward-looking statements.

These forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the Company’s control, that

could cause actual results or outcomes to differ materially from

those discussed in the forward-looking statements.

Important factors, among others, that may affect actual results

or outcomes include the effects of economic downturns and unstable

market conditions; our ability in the future to continue to comply

with the New York Stock Exchange’s (NYSE) listing standards and

maintain the listing of our common stock on the NYSE; risks related

to doing business in China; our ability to anticipate

rapidly-changing consumer preferences in the apparel, footwear and

accessories industries; our ability to execute our strategic

initiatives, including transitioning Culture Kings to a

data-driven, short lead time merchandising cycle; our ability to

acquire new customers, retain existing customers or maintain

average order value levels; the effectiveness of our marketing and

our level of customer traffic; merchandise return rates; our

ability to manage our inventory effectively; our success in

identifying brands to acquire, integrate and manage on our

platform; our ability to expand into new markets; the global nature

of our business, including international economic, geopolitical

instability (including the ongoing Russia-Ukraine and

Israel-Palestine wars), legal, compliance and supply chain risks;

interruptions in or increased costs of shipping and distribution,

which could affect our ability to deliver our products to the

market; our use of social media platforms and influencer

sponsorship initiatives, which could adversely affect our

reputation or subject us to fines or other penalties; fluctuating

operating results; the inherent challenges in measuring certain of

our key operating metrics, and the risk that real or perceived

inaccuracies in such metrics may harm our reputation and negatively

affect our business; the potential for tax liabilities that may

increase the costs to our consumers; our ability to attract and

retain highly qualified personnel, including key members of our

leadership team; fluctuations in wage rates and the price,

availability and quality of raw materials and finished goods, which

could increase costs; foreign currency fluctuations; and other

risks and uncertainties set forth in the sections entitled “Risk

Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and “Forward-Looking

Statements” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023, quarterly reports on Form 10-Q and

any other periodic reports that the Company may file with the

Securities and Exchange Commission (the SEC). a.k.a. Brands does

not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

a.k.a. BRANDS HOLDING

CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except share

and per share data)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net sales

$

148,931

$

136,028

$

265,771

$

256,513

Cost of sales

62,962

58,672

114,128

110,657

Gross profit

85,969

77,356

151,643

145,856

Operating expenses:

Selling

41,191

35,932

75,406

70,338

Marketing

18,275

18,354

33,154

33,131

General and administrative

25,867

24,191

48,540

50,059

Total operating expenses

85,333

78,477

157,100

153,528

Income (loss) from operations

636

(1,121

)

(5,457

)

(7,672

)

Other expense, net:

Interest expense

(2,676

)

(2,841

)

(4,954

)

(5,692

)

Other income (expense)

245

(750

)

(298

)

(1,784

)

Total other expense, net

(2,431

)

(3,591

)

(5,252

)

(7,476

)

Loss before income taxes

(1,795

)

(4,712

)

(10,709

)

(15,148

)

(Provision for) benefit from income

tax

(466

)

(328

)

(485

)

555

Net loss

$

(2,261

)

$

(5,040

)

$

(11,194

)

$

(14,593

)

Net loss per share:

Basic and diluted*

$

(0.22

)

$

(0.47

)

$

(1.07

)

$

(1.36

)

Weighted average shares outstanding:

Basic and diluted*

10,501,057

10,761,511

10,509,810

10,757,470

* Adjusted for the one-for-12 reverse

stock split, effective as of September 29, 2023.

a.k.a. BRANDS HOLDING

CORP.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(unaudited)

June 30, 2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

25,466

$

21,859

Accounts receivable, net

5,778

4,796

Inventory

106,687

91,024

Prepaid income taxes

1,274

—

Prepaid expenses and other current

assets

15,862

18,016

Total current assets

155,067

135,695

Property and equipment, net

25,754

27,154

Operating lease right-of-use assets

52,033

37,465

Intangible assets, net

58,521

64,322

Goodwill

93,604

94,898

Deferred tax assets

1,555

1,569

Other assets

2,270

618

Total assets

$

388,804

$

361,721

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

32,773

$

28,279

Accrued liabilities

29,671

25,223

Sales returns reserve

7,930

9,610

Deferred revenue

15,911

11,782

Income taxes payable

—

257

Operating lease liabilities, current

7,258

7,510

Current portion of long-term debt

6,300

3,300

Total current liabilities

99,843

85,961

Long-term debt

100,607

90,094

Operating lease liabilities

50,195

35,344

Other long-term liabilities

1,588

1,704

Total liabilities

252,233

213,103

Stockholders’ equity:

Preferred stock

—

—

Common stock

128

128

Additional paid-in capital

468,726

466,172

Accumulated other comprehensive loss

(53,676

)

(50,269

)

Accumulated deficit

(278,607

)

(267,413

)

Total stockholders’ equity

136,571

148,618

Total liabilities and stockholders’

equity

$

388,804

$

361,721

a.k.a. BRANDS HOLDING

CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Six Months Ended June

30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(11,194

)

$

(14,593

)

Adjustments to reconcile net loss to net

cash (used in) provided by operating activities:

Depreciation expense

3,041

4,230

Amortization expense

5,527

5,931

Amortization of debt issuance costs

303

315

Lease incentives

—

1,186

Loss on disposal of businesses

673

1,533

Non-cash operating lease expense

4,085

3,760

Equity-based compensation

3,851

3,760

Deferred income taxes, net

—

3

Changes in operating assets and

liabilities:

Accounts receivable

(914

)

896

Inventory

(18,954

)

15,511

Prepaid expenses and other current

assets

2,757

(3,793

)

Accounts payable

4,874

350

Income taxes payable

(1,533

)

(1,179

)

Accrued liabilities

4,593

(9,117

)

Returns reserve

(1,568

)

2,214

Deferred revenue

4,253

98

Lease liabilities

(3,992

)

(3,815

)

Net cash (used in) provided by operating

activities

(4,198

)

7,290

Cash flows from investing

activities:

Purchases of intangible assets

(5

)

(62

)

Purchases of property and equipment

(2,726

)

(3,618

)

Net cash used in investing activities

(2,731

)

(3,680

)

Cash flows from financing

activities:

Proceeds from line of credit, net of

issuance costs

24,500

—

Repayment of line of credit

(10,000

)

(21,100

)

Repayment of debt

(1,200

)

(2,800

)

Taxes paid related to net share settlement

of equity awards

(202

)

(66

)

Proceeds from issuances under equity-based

compensation plans

93

90

Repurchase of shares

(1,189

)

(299

)

Net cash provided by (used in) financing

activities

12,002

(24,175

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(1,310

)

69

Net increase (decrease) in cash, cash

equivalents and restricted cash

3,763

(20,496

)

Cash, cash equivalents and restricted cash

at beginning of period

24,029

48,373

Cash, cash equivalents and restricted cash

at end of period

$

27,792

$

27,877

Reconciliation of cash, cash

equivalents and restricted cash:

Cash and cash equivalents

$

25,466

$

25,876

Restricted cash, included in prepaid

expenses and other current assets

582

2,001

Restricted cash, included in other

assets

1,744

—

Total cash, cash equivalents and

restricted cash

$

27,792

$

27,877

a.k.a. BRANDS HOLDING

CORP.

KEY FINANCIAL AND OPERATING

METRICS AND NON-GAAP MEASURES

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

(dollars in thousands)

2024

2023

2024

2023

Gross margin

58

%

57

%

57

%

57

%

Net loss

$

(2,261

)

$

(5,040

)

$

(11,194

)

$

(14,593

)

Net loss margin

(2

)%

(4

)%

(4

)%

(6

)%

Adjusted EBITDA2

$

8,012

$

5,568

$

8,885

$

7,754

Adjusted EBITDA margin2

5

%

4

%

3

%

3

%

Key Operational Metrics and Regional Sales

Three Months Ended June

30,

Six Months Ended June

30,

(metrics in millions, except AOV; sales

in thousands)

2024

2023

% Change

2024

2023

% Change

Key Operational

Metrics

Active customers4

4.01

3.59

11.7

%

4.01

3.59

11.7

%

Average order value

$

78

$

82

(4.9

)%

$

77

$

81

(4.9

)%

Number of orders

1.92

1.65

16.4

%

3.44

3.15

9.2

%

Sales by

Region

U.S.

$

95,375

$

79,967

19.3

%

$

172,513

$

152,593

13.1

%

Australia/New Zealand

45,650

48,037

(5.0

)%

79,165

89,483

(11.5

)%

Rest of world

7,906

8,024

(1.5

)%

14,093

14,437

(2.4

)%

Total

$

148,931

$

136,028

9.5

%

$

265,771

$

256,513

3.6

%

Year-over-year growth on a constant

currency basis1

10.1

%

4.7

%

Active Customers

We view the number of active customers as a key indicator of our

growth, our value proposition and consumer awareness of our brand,

and their desire to purchase our products. In any particular

period, we determine our number of active customers by counting the

total number of unique customer accounts who have made at least one

purchase in the preceding 12-month period, measured from the last

date of such period.

Average Order Value

We define average order value (“AOV”) as net sales in a given

period divided by the total orders placed in that period. AOV may

fluctuate as we expand into new categories or geographies or as our

assortment changes.

a.k.a. BRANDS HOLDING CORP.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (in

thousands, except per share data) (unaudited)

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP

financial measures that management uses to assess our operating

performance. Because Adjusted EBITDA and Adjusted EBITDA margin

facilitate internal comparisons of our historical operating

performance on a more consistent basis, we use these measures for

business planning purposes.

We also believe this information will be useful for investors to

facilitate comparisons of our operating performance and better

identify trends in our business. We expect Adjusted EBITDA margin

to increase over the long-term as we continue to scale our business

and achieve greater leverage in our operating expenses.

We calculate Adjusted EBITDA as net income (loss) adjusted to

exclude: interest and other expense; provision for income (benefit

from) taxes; depreciation and amortization expense; equity-based

compensation expense; costs to establish or relocate distribution

centers; transaction costs; costs related to severance from

headcount reductions; goodwill and intangible asset impairment;

sales tax penalties; insured losses, net of any recoveries; and

one-time or non-recurring items. We calculate Adjusted EBITDA

margin as Adjusted EBITDA as a percentage of net sales. Adjusted

EBITDA and Adjusted EBITDA margin are considered non-GAAP financial

measures under the SEC’s rules because they exclude certain amounts

included in net income (loss) and net income (loss) margin, the

most directly comparable financial measures calculated in

accordance with GAAP.

A reconciliation of non-GAAP Adjusted EBITDA to net loss for the

three and six months ended June 30, 2024 and 2023 is as

follows:

Three Months Ended June

30,

Six Months Ended June

30,

(dollars in thousands)

2024

2023

2024

2023

Net loss

$

(2,261

)

$

(5,040

)

$

(11,194

)

$

(14,593

)

Add (deduct):

Total other expense, net

2,431

3,591

5,252

7,476

Provision for (benefit from) income

tax

466

328

485

(555

)

Depreciation and amortization expense

4,270

4,720

8,568

10,161

Equity-based compensation expense

1,895

1,824

3,851

3,760

Non-routine items5

1,211

145

1,923

1,505

Adjusted EBITDA

$

8,012

$

5,568

$

8,885

$

7,754

Net loss margin

(2

)%

(4

)%

(4

)%

(6

)%

Adjusted EBITDA margin

5

%

4

%

3

%

3

%

1 In order to provide a framework for assessing the performance

of our underlying business, excluding the effects of foreign

currency rate fluctuations, we compare the percent change in the

results from one period to another period using a constant currency

methodology wherein current and comparative prior period results

for our operations reporting in currencies other than U.S. dollars

are converted into U.S. dollars at constant exchange rates (i.e.,

the rates in effect on December 31, 2023, which was the last day of

our prior fiscal year) rather than the actual exchange rates in

effect during the respective periods. 2 See additional information

at the end of this release regarding non-GAAP financial measures. 3

The Company has not provided a quantitative reconciliation of its

Adjusted EBITDA outlook to a GAAP net income outlook because it is

unable, without making unreasonable efforts, to project certain

reconciling items. These items include, but are not limited to,

future equity-based compensation expense, income taxes, interest

expense and transaction costs. These items are inherently variable

and uncertain and depend on various factors, some of which are

outside of the Company’s control or ability to predict. See

additional information at the end of this release regarding

non-GAAP financial measures. 4 Trailing twelve months. 5

Non-routine items include severance from headcount reductions;

sales tax penalties; insured losses, net of recoveries; and

non-routine legal matters.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807148636/en/

Investor Contact investors@aka-brands.com Media

Contact media@aka-brands.com

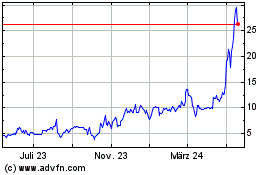

aka Brands (NYSE:AKA)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

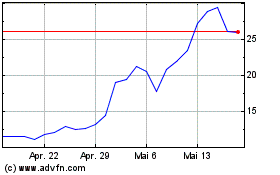

aka Brands (NYSE:AKA)

Historical Stock Chart

Von Dez 2023 bis Dez 2024